What Is United States Government Life Insurance

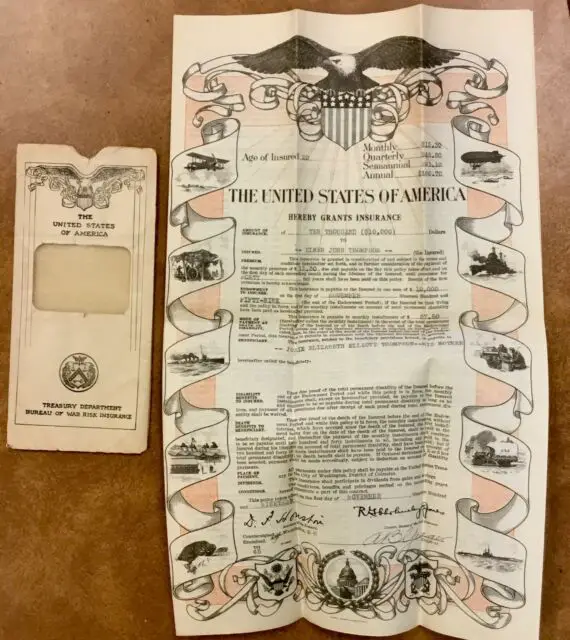

United States Government Life Insurance is a type of life insurance that was offered by the United States government between 1919 and 1951. This measure, which was originally intended to support veterans who served during World War I, formed part of a broader set of policies known as the War Risk Insurance program.

Naming A Beneficiary Who Is Under Legal Age

If the beneficiary you name is under the legal age when you die, you may want to set up a trust and designate a trustee or administrator. This person can hold the proceeds of the death benefit in trust on behalf of the minor.

If you don’t name a trustee or administrator, the death benefit, plus any interest it earns, will be held in trust by the province or territory. It will be paid out when your beneficiary reaches legal age. Consult with a lawyer or financial advisor for more details.

Real World Example Of United States Government Life Insurance

USGLI was introduced in 1919, as a response to the United States entering World War I. As of 2013, there were approximately 8,000 active policies remaining, with the policy holder’s average age of 88. Since Jan. 1, 1983, all USGLI policies have been paid-up, with no further premiums required.

The modern successor of the USGLI program is Service Member Group Life Insurance. Through this life insurance program, United States military personnel can receive insurance coverage for the duration of their service in the military, with the premium payments deducted from their regular pay. The term of the insurance varies depending on their length of service, with additional coverage granted for the 120 days following their departure from service.

You May Like: Las Vegas Rtc Jobs

Whole Life Insurance Might Be Right For You If:

- You want level-premium protection that will never expire.

- You want to build tax-deferred cash value that you can access in your lifetime.

- You want to be able to take a loan against your plan, usually on a tax-free basis2.

- You have estate-planning needs that might be met by a whole life insurance plan.

- You want to supplement the survivor benefit of your federal pension.

Who Should Use A Smaller Life Insurance Company

State insurance regulations mean small insurers generally offer the same types of life insurance coverage as larger ones and premiums can’t vary because of a companys size.

A smaller life insurance company is a better fit if you want:

-

More personalized service: Larger companies typically cannot offer the same one-on-one customer service as small shops. If knowing your agent or broker is important to you, go with a smaller company.

-

Potential for underwriting flexibility: It varies by company, but some smaller insurers may be more willing to accept an applicant with health concerns or risky hobbies.

-

Specialized coverage : Some smaller companies specialize in policies for particular jobs or avocations. Firefighters, for example, might be better served by a smaller specialty company.

Make sure to check the companys credit and customer service ratings if youre unfamiliar with the insurer.

Don’t Miss: City Of Los Lunas Jobs

Am I Eligible For Sgli

You may be eligible for full-time SGLI coverage if you meet at least one of these requirements.

At least one of these must be true:

- Youre an active-duty member of the Army, Navy, Air Force, Marines, or Coast Guard, or

- Youre a commissioned member of the National Oceanic and Atmospheric Administration or the U.S. Public Health Service , or

- Youre a cadet or midshipman of the U.S. military academies, or

- Youre a member, cadet, or midshipman of the Reserve Officers Training Corps engaged in authorized training and practice cruises, or

- Youre a member of the Ready Reserve or National Guard, assigned to a unit, and scheduled to perform at least 12 periods of inactive training per year, or

- Youre a volunteer in an Individual Ready Reserve mobilization category

If youre in nonpay status with the Ready Reserve or National Guard

You may be eligible for full-time SGLI coverage if you meet both of these requirements.

Both of these must be true:

- Youre scheduled for 12 periods of inactive training for the year, and

- Youre drilling for points rather than pay

Note: You must pay your premiums directly.

Whole Life Insurance Pros

- It never expires. As long as you continue to pay your premiums, you can be confident that your beneficiaries will receive payment when you die.

- In most cases, the premium remains the same throughout your lifetime, making it a predictable expense in your long-term budget.

- The policys cash value accumulates tax-deferred each year. In addition, the value of the benefit may increase if your policy pays dividends1.

- The rate of return on the cash value is guaranteed by the insurance company.

- Many whole life policies allow you to take a loan against the value of the policy2.

- As with all life insurance, the death benefit generally passes to your heirs free of federal income tax.

- Whole life insurance can be an important tool in estate planning, potentially helping to reduce estate taxes and fund trusts.

Don’t Miss: Huntsville Al Government Jobs

Top Reasons For Buying Life Insurance In The Us

According to a 2020 report from trade research organization LIMRA and the non-profit organization Life Happens, these are the most common reasons Americans said they bought life insurance:

-

84% Burial/final expenses

Stats About The Cost Of Life Insurance

5x-15x ⢠How much more permanent life insurance costs vs. term life insuranceâ

4.5-9% ⢠Average percent increase in your insurance costs as you age, assuming your health stays the sameâ

30% ⢠The average cost difference between sequential health ratings â

2x to 3x ⢠How much rates for smokers cost vs. rates for nonsmokers (but a year after you quit smoking, most companies will offer you non-smoker ratesâ

35% ⢠The average difference between the least expensive and most expensive rate for the same person across insurance companiesâ

30% ⢠Percent difference between premiums for men and women â

â Policygenius data quoting data from December 2021. Data is based on quotes for 20-year terms from 10 life insurance carriers that offer policies through the Policygenius marketplace .

| $353.21 | $700.95 |

Methodology: Sample monthly premiums are for male and female non-smokers with a Preferred health rating Life insurance averages are based on a composite of policies offered by Policygenius from AIG, Banner, Brighthouse, Lincoln, Mutual of Omaha, Pacific Life, Protective, Prudential, SBLI, and Transamerica and may vary by insurer, term, coverage amount, health class, and state. Not all policies are available in all states. Rate illustration valid as of 10/11/2021.

Ready to shop for life insurance?

You May Like: Government Contractors Charleston Sc

Whole Life Insurance Cons

Initially, premiums can be significantly higher than the premiums for comparable amounts of term life and universal life insurance, especially when you are younger. However, the level premium feature means that when you are older, whole life premiums will be comparable to or even less than the premiums you would pay if you continued to renew your insurance.

The rate of return used to build your cash value might not be comparable to the rates of return of other savings alternatives.

Term Life Insurance Options For Couples

When considering buying life insurance as a couple, look at what coverage you may already have through your employer or that you may have bought when you were on your own.

If you decide to purchase insurance, make sure you consider all the options available to you as a couple. Make sure to consider the pros and cons of each.

Joint first-to-die term insurance

- Insures two people under one joint policy

- Pays the death benefit when the first partner dies

- Gives each partner the same coverage

- Is usually less expensive than two identical single policies

- Is sometimes less flexible than single policies if the couple separates or gets divorced

- Usually can’t be divided

- Usually pays only one death benefit, so if one partner dies, the other needs to apply for a new policy to continue coverage

Single term insurance

- Provides each partner with their own policy

- Gives each partner their own coverage amount

- Is usually more expensive in total than a joint first-to-die policy

- Makes it relatively easy to change the beneficiary, if you separate or divorce

Recommended Reading: Free Government Flip Phones

How Policies Are Issued

Most insurers require that you undergo underwriting before a whole life policy is issued. Whole life insurance can be a good option if you have health issues that make you ineligible for group term coverage. And if you are younger and your health is good, you may be able to lock in lower premiums that will continue for the rest of your life and coverage that can never be canceled, as long as you keep your premiums up to date.

Insuranceopedia Explains United States Government Life Insurance

In 1917, Congress approved the issuance of life insurance policies to war veterans and other service members who would otherwise not be able to obtain insurance coverage from private insurers due to their increased risks, an existing disability, or prohibitive premium rates. Of those issued, some 8,000 policies have remained active. All of these policies have been paid up since 1983 and provide annual dividend benefits to their respective holders.

Read Also: Access Wireless Order Replacement Phone

Biggest Life Insurance Companies

The life insurance market in the United States is both massive and highly competitive. Though bigger may not mean better, either for consumers or for investors, it does imply a degree of longevity and financial stability in the life insurance business.

Life insurance is a policy or contract that guarantees the customer or the insured’s beneficiaries a sum of money outlined in the insurance policy. In exchange, the customer agrees to pay periodic premiums or payments to the life insurance company. Life insurance can be helpful since it can provide a measure of security for a policyholder’s loved ones by providing financial support to pay for funeral expenses and pay off debts.

Outlined in this article are the eight largest insurance companies in the United States. However, please remember that the precise ranking order of our group is based on the total volume of premiums written and may change frequently.

The Purpose Of Life Insurance

Your need for life insurance will vary with your age and responsibilities. The amount of insurance you buy should depend on the standard of living you wish to assure your dependents. You should consider the amount of assets and sources of income available to your dependents when you pass away. Social security benefits, available cash and other sources of income and investments may not provide the standard of living you have in mind. Life insurance helps bridge the gap between the financial needs of your dependents and the amount available from other sources, is the amount to be provided by life insurance. Your agent or other financial advisor can help you with these calculations. The Internet, as well as many financial magazines, books and articles are available to help you as well.

Recommended Reading: Best Entry Level Government Jobs

Life Insurance For Retirees

Last week, we looked at insurance coverage for current government employees. Now let’s explore options for retirees.

Under the Federal Employees Group Life Insurance program, the amount of Basic coverage you carry into retirement is based on your salary on the day you retire. You are eligible to continue Basic insurance if you meet all the following requirements:

- You are entitled to an immediate annuity, meaning youre eligible to begin receiving retirement benefits within 31 days of your separation. Those under the Federal Employees Retirement System can re-enroll in FEGLI when they file for their retirement benefit if they separate at their minimum retirement age with at least 10 years of creditable service, and choose to postpone their application to avoid the age penalty.

- You have been insured for the five years immediately preceding your retirement, or since your first opportunity to enroll.

- You have not converted your life insurance coverage to an individual policyor, if you have already converted the coverage, you cancel the converted policy.

When you retire, you will make your choices on form SF 2818, Continuation of Life Insurance Coverage. OPM deducts FEGLI premiums from your retirement benefit each month.

Here are your FEGLI options in retirement:

Basic:

Option A :

Option B and Option C :

You can choose full reduction for some multiples of Option B and Option C while you opting for no reduction of the rest of your Option B and Option C coverage.

United States Government Life Insurance Fund

All premiums paid on account of United States Government life insurance shall be deposited and covered into the Treasury to the credit of the United States Government Life Insurance Fund and shall be available for the payment of losses, dividends, refunds, and other benefits provided for under such insurance, including such liabilities as shall have been or shall hereafter be reduced to judgment in a district court of the United States or the United States District Court for the District of Columbia, and for the reimbursement of administrative costs under subsection . Payments from this fund shall be made upon and in accordance with awards by the Secretary.

The Secretary is authorized to set aside out of the funds so collected such reserve funds as may be required, under accepted actuarial principles, to meet all liabilities under such insurance and the Secretary of the Treasury is authorized to invest and reinvest the said United States Government Life Insurance Fund, or any part thereof, in interest-bearing obligations of the United States or bonds of the Federal farm-loan banks and to sell said obligations of the United States or the bonds of the Federal farm-loan banks for the purposes of such Fund.

The Secretary shall determine the administrative costs to the Department for a fiscal year for which this subsection is in effect which, in the judgment of the Secretary, are properly allocable to the provision of United States Government Life Insurance .

Read Also: State Government Jobs Ohio

How United States Government Life Insurance Works

The purpose of USGLI was to support American soldiers who may have been unable to obtain life insurance at affordable rates from private insurers. After all, insurance companies must set their insurance premiums based on the expected frequency and cost of the claims made by their policyholders. Since soldiers are exposed to a much higher risk of injury or death as compared to other occupations, the premiums charged to them under a private insurance plan would likely be very high.

To help support soldiers, the United States government created a series of policies called the War Risk Insurance program. One of the central pillars of this program was USGLI, which effectively subsidized the cost of life insurance for American soldiers. The premiums paid under this program were deposited to the United States Treasury and were used to cover the claims made by its policyholders.

The USGLI program entitled all active military personnel to a life insurance policy payable by the federal government in the case of death or disability caused by war. The maximum face amount of a USGLI policy was $10,000. The program was closed on April 25, 1951. War risk insurance proved to be extremely popular. During World War I, more than four million policies were issued.

Federal Regulation Of Insurance

Nevertheless, federal regulation has continued to encroach upon the state regulatory system. The idea of an optional federal charter was first raised after a spate of solvency and capacity issues plagued property and casualty insurers in the 1970s. This OFC concept was to establish an elective federal regulatory scheme that insurers could opt into from the traditional state system, somewhat analogous to the dual-charter regulation of banks. Although the optional federal chartering proposal was defeated in the 1970s, it became the precursor for a modern debate over optional federal chartering in the last decade.

In 1979 and the early 1980s the Federal Trade Commission attempted to regulate the insurance industry, but the Senate Commerce Committee voted unanimously to prohibit the FTC’s efforts. President Jimmy Carter attempted to create an “Office of Insurance Analysis” in the Treasury Department, but the idea was abandoned under industry pressure.

Over the past two decades, renewed calls for optional federal regulation of insurance companies have sounded, including the Gramm-Leach-Bliley Act in 1999, the proposed National Insurance Act in 2006 and the Patient Protection and Affordable Care Act in 2010.

You May Like: Government Phone Replacement

Before You Buy Insurance

The purchase of life insurance is an important decision for both you and your family. There are many reasons why life insurance is purchased, but these reasons should be based upon your needs or wants. Your marital status, number of dependents, family size, income, and wealth all play a role in determining the amount of life insurance that is right for you. The first step is to determine your current need for life insurance and how much you can afford to spend. It is a good idea to consider future needs too, because unlike most purchases, you can’t always buy life insurance when you need it you have to be in reasonably good health to purchase most types of life insurance products.

Remember if one kind of life insurance does not seem to fit your needs, ask about other plans. Be sure to read your new policy carefully, and ask the agent or company for an explanation of anything you do not understand. Take full advantage of the free look provisions that are provided on the policy cover page. New York requires a minimum free look period of 10 days and a maximum of 30 days. A 30-day free look period is required for any policy offered through the mail. “Free look” provisions allow you to cancel a policy without penalty within a set time period. Whatever you decide, it is important to review your life insurance program every few years to keep up with your changing financial and family circumstances and responsibilities.