Lawyers And Upfront Fees

Under the MARS Rule, lawyers can ask you to pay an upfront fee, but only if they

- are licensed to practice law in the state where you live or your home is located

- are supplying you with real legal services

- are complying with state ethics requirements for lawyers

- place the money you pay them in a client trust account, withdraw fees only as they complete actual legal services, and notify you of each withdrawal

Who Qualifies For Fha Cash

An FHA cash-out loan allows homeowners with lower credit scores or a less than impressive debt-to-income ratio to access the equity of their home at a current low rate.

The basic requirements to qualify for an FHA cash-out refinance are:

- The home mustve been refinanced but be your primary residence, and you must have lived in the home for at least 12 months prior to applying for the loan

- You must have made on-time mortgage payments for the past 12 months prior to applying for the loan

These are the basic requirements, but there might be additional requirements depending on your circumstances, such as your credit score.

FHA loans usually require a debt-to-income ratio of 43% or less, but different factors may affect this, such as a high credit score or high home equity.

As mentioned, your current mortgage does not have to be an FHA loan to qualify for an FHA cash-out refinance.

What Happens At The End Of My Trial

If you do nothing, you will be auto-enrolled in our premium digital monthly subscription plan and retain complete access for CA$95 per month.

For cost savings, you can change your plan at any time online in the Settings & Account section. If youd like to retain your premium access and save 20%, you can opt to pay annually at the end of the trial.

You may also opt to downgrade to Standard Digital, a robust journalistic offering that fulfils many users needs. Compare Standard and Premium Digital here.

Any changes made can be done at any time and will become effective at the end of the trial period, allowing you to retain full access for 4 weeks, even if you downgrade or cancel.

You May Like: Government 1st Time Home Buyer Programs

Make More Frequent Payments

Without increasing your total payment amount, you could increase the number of payments you make in a month.

For example, you could go from monthly payments of $1,500 to:

- Bimonthly payments of $750, or

- Weekly payments of $375

By accelerating your payments, you could shorten the length of your loan and save money by paying less interest. You could pay every two weeks or every week instead of once a month, thereby paying the equivalent of up to one extra month each year. See how much you could save with our online tool:

Pro tipBe sure to pick a payment frequency thats aligned with your schedule. If you get paid every two weeks, for example, you could line up your payments with your payday.

Mortgage Grants For The Disabled

There are lots o housing grant programs for disabled people that help them to buy a house. Disabled people can also buy a house with the help of the housing choice homeownership voucher program. Their disability does not stop them to become a homeowner. One just needs to look for the grants that are available for disabled people and help them to buy a home.

Those grants programs are helpful for people who are low-income and disabled. But these grants also help the families and individuals who belong to moderate-income as well. One needs to visit their local public housing office and know about the grant programs that are available for them and helpful for them to buy the home and get help to pay for the mortgage. However, those grants have eligibility requirements and some necessities. If you fulfill them then you will get help from them. You have needed to apply for the grant and get help.

Don’t Miss: How To Get Government Subsidy For Home Loan

Refinance To Lower Your Payments

Refinancing can offer homeowners relief by reducing their monthly payments. Most of the time, a refinance will lower your interest rate and extend your loan term both of which result in a more affordable monthly mortgage payment. Borrowers who cant lower their rate may still save money by spreading their remaining loan balance over a longer loan term.

Thanks to rising home values, even homeowners who made a very small down payment or refinanced recently could be eligible for a refi.

Even if you dont think youd qualify for a refinance, its worth talking to a lender. Many homeowners are eligible but dont know it yet.

Whats more, not everyone needs great credit or perfect finances to qualify for a refinance. Select programs, like the government-backed Streamline Refinance, can help borrowers refinance with little, no, or negative home equity.

Even if you dont think youd qualify for a refinance, its worth talking to a lender. Homeowners might be surprised at the amount of equity they gained as housing prices shot up nationwide. This could put refinancing within reach even if you had no home equity quite recently.

How Much Can I Borrow

You can borrow up to 90% of the market value of the property you arebuilding or buying. The maximum market value is different depending on whereyour home is located. The maximum market value is:

- 320,000 in Cork, Dublin, Galway, Kildare, Louth, Meath and Wicklow

- 250,000 in the rest of the country

You need to show that you can afford your monthly mortgage repayments, whichmust be less than one-third of your household income. You can use the Home Loan Calculatoron the Local Authority Home Loan website to get an estimate of how much you canborrow and what your repayments will be.

Read Also: How To Apply For A Government Phone

How Do I Get Government Help To Pay For My House

Related Articles

There are government programs available to help homeowners in financial distress make house payments or otherwise reduce some of the principal owed on their home loans. These programs review eligibility based on payment history, income verification and loan-to-value ratios. While not everyone meets the criteria to qualify for assistance, review your situation with your lender and a loan counselor to see if you do.

How To Pay Off Your Mortgage Early

If paying off your mortgage early is right for you, here are some strategies to do it:

- Make biweekly payments. One way to get started with making extra mortgage payments is to set up a biweekly schedule. This amounts to making a full extra monthly payment each year and can reduce the time spent with a mortgage. Starting with biweekly payments can help you get ahead on your mortgage while allowing you to keep working toward other financial goals.

- Make extra mortgage payments each year. Similar to making biweekly payments, you can simply make an extra mortgage payment once a year, or pay an additional amount each month on top of what you already pay.

- Make sure that your extra payments go towards principal and are not credited as future monthly payments by speaking with your lender and following their process for making principal payments.

- Refinance to a mortgage with a shorter term. If you stand to get a lower interest rate, refinancing to a 15-year mortgage means youll pay off the loan sooner. Keep in mind that even with a lower rate, you could be paying more each month, since your payments are now spread out over a shorter period of time.

You May Like: Government Jobs In Scranton Pa

Student Loan Forgiveness For Private Education Debt

The vast majority of student loan forgiveness programs apply toward federally-held education debt. With that said, some state-based LRAPs dont make a distinction between offering repayment assistance for federal or private loans, and employers are equally incentivized to match your federal or private loan payments.

The only kind of student loan forgiveness that some reputable private lenders offer is in the case of disability or death. Contact your private lender whether it be a bank, credit union or other financial institution to learn about its policy. You might also find this policy detailed in your loan closure documents.

Here are examples of lenders that do offer student loan forgiveness for disability:

| Lender |

|---|

| Parent loans are forgiven if the student beneficiary is dead or becomes disabled |

Q: Does The Insolvency Exclusion Apply To Amounts Discharged Under A Pra Principal Reduction

A5: The insolvency exclusion may apply to a discharge of indebtedness under a PRA principal reduction to the extent that the taxpayer is insolvent when the discharge occurs. For further discussion of the insolvency exclusion, see page 4 of Publication 4681, Canceled Debts, Foreclosures, Repossessions, and Abandonments PDF.

Also Check: Us Government Senate And House Of Representatives

Mortgage Trouble Due To Covid

If you’ve experienced a job loss or other financial hardship as a direct result of the Covid-19 pandemic and you are now unable to pay your mortgage because of that hardship, you may be eligible for relief.

Contact your mortgage servicer immediately, inform them of your situation and ask if there are any payment options available, such as a reduced monthly interest rate or halted interest payments. If your servicer is able to offer you a reduction on your mortgage payment or other accommodations, be sure to keep up with those agreed-upon terms.

If your mortgage is federally backed, you may be eligible for additional assistance. Federally backed mortgages are owned by the U.S. Department of Housing and Urban Development , the Federal Housing Administration, Fannie Mae, Freddie Mac or a similar federal institution. Go to FannieMae.com or Freddie Mac.com to figure out where you should apply for assistance. You will need to follow the instructions directly on those websites to get relief, and the process is being updated frequently.

For more information, visit the Consumer Financial Protection Bureau’s website for mortgage relief. However, if Covid-19 aid does not apply to you, there are still options available.

Where Mortgage Grants Are Available

The mortgage grants are given by various organizations, churches, charities, companies, as well as private agencies. All these sources may work on federal, state, county, or local levels. But they all have one motto to help people who need financial help to pay for mortgage payments and dont want to lose it. However, one can look for them at online websites, reach their local public housing office, or can get the help of their lenders as well.

You May Like: Government Dental Grants For Seniors

Student Loan Discharge For Special Circumstances

While student loan discharge isnt the same as forgiveness, it could leave you debt-free. In rare circumstances, borrowers can get their student loans completely canceled.

There are several situations when you could qualify for federal student loan discharge, including:

| Reason | |

|---|---|

| If you borrowed under false pretenses through no fault of your own | |

| Unpaid refund | If your school didnt issue a refund to the Education Department |

If you think you could qualify or want to learn more, speak with your loan servicer.

Faqs Related To Mortgage Payments Grant

Here are various questions and their answers are mentioned below. These questions are mostly asked by people who need to pay for the mortgage payments but they did not have more money or struggling with the financial crisis. So, if you are one of those people then you can look for those questions and answers and get help with the answers.

Read Also: Sam’s Club Government Employee Discount

The Latest On Biden Administrations Mass Student Loan Cancellation

Note: As of Nov. 10, 2022, the government has temporarily stopped taking applications for this student loan forgiveness program until legal challenges to it have been resolved. Currently, the U.S. Supreme Court is expected to hear the challenges in late February 2023. See Federal Student Aids statement for more information.

As announced on Aug. 24, 2022, the federal government is offering nationwide forgiveness of up to $20,000 per borrower for federally held student loans.

The eligibility requirements are pretty straightforward:

- Income limits: If your annual income during the pandemic was under $125,000 or $250,000 , you might be eligible for up to

- $20,000 in federal student loan cancellation if you previously received a Pell Grant

- $10,000 in federal student loan cancellation if you didnt have a Pell Grant.

The application for this student debt cancellation is available online at the Federal Student Aid website. You wont need to document your income, just provide your name, Social Security number, date of birth, email and phone number.

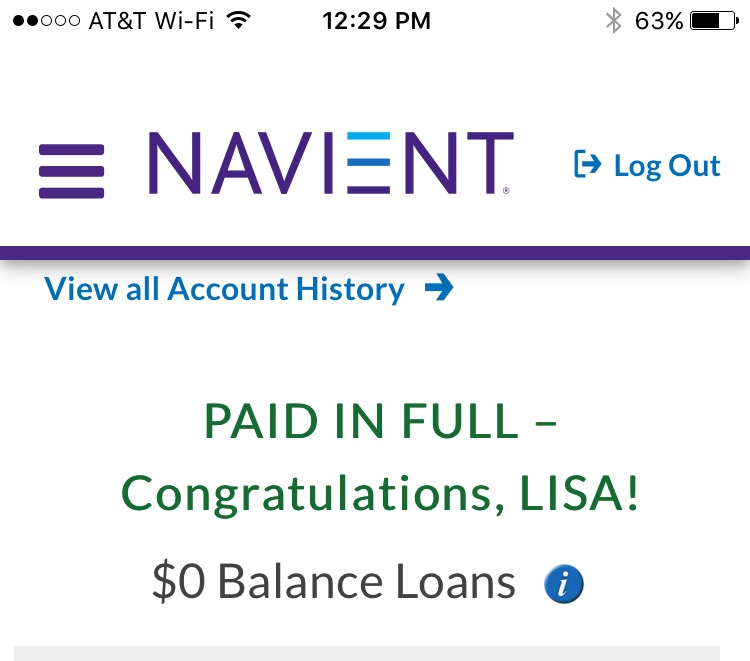

At the same time, approximately 8 million borrowers may receive automatic relief since their income data is already in the system. If in doubt, you can check your student loan balance to track any progress.

What Is A Mortgage Discharge

A mortgage is a loan secured by property, such as a home. When you take out a mortgage, the lender registers an interest in, or a charge on, your property. This means the lender has a legal right to take your property. They can take your property if you dont respect the terms and conditions of your mortgage contract. This includes paying on time and maintaining your home.

When you pay off your mortgage and meet the terms and conditions of your mortgage contract, the lender doesnt automatically give up the rights to your property. There are steps you need to take. This process is called discharging a mortgage.

You May Like: Free Government Phones With Data

The Alliance For Stabilizing Our Communities

The Alliance for Stabilizing our Communities is the combination of various organizations and development communities. This was created with the efforts of the National Council La Raza, the National Urban League, and the National Coalition of Asian Pacific American Community Development. All these make the ASC and provide help to people who need help with housing and come out from the mortgage payment and foreclosure risk. They make sure that people who are tucking in the odd situation of mortgage payments and risk of foreclosure will get help and stay in their house without any stress.

The ASC is funded with a more than $3.4 million grant from the Bank of America and it focused on the families who are at-multicultural. Not only this, but they also organize housing fairs throughout the country in the high foreclosure areas. But borrowers can also get help from them by contacting them and telling them about their condition. The borrowers can contact the Alliance for Stabilizing our Communities at 1-866-842-3391 and also ask queries if they have.

Things You Should Do Instead Of Paying Off Your Mortgage

In most cases, paying off debts early is a smart financial idea, as youll save money on interest owed. But when it comes to a mortgage, this isnt always the case in some cases, you may be penalized and end up paying more if you pay this debt off before the full mortgage term. Plus, there are other reasons why it may not make financial sense for you to pay off a mortgage early. Heres why it might not pay to pay off your mortgage early.

Important: 5 Things You Must Do When Your Savings Reach $50,000

Read Also: How Much Does Government Freight Pay

Dallas Home Connection Home Buyers Club

This is a non-profit agency that provides mortgage payment assistance for its members. Dallas Home Connection works with non-profit lending institutions and homebuilders. They work to provide mortgage payment assistance to the recipients. The recipients can get up to $2,500 for their mortgage payments from this agency.

How Does A Government

All government loans are secured, or insured, by the federal government. In some cases, applying for a government loan is as easy as filling out an application online and submitting it to the government. To apply for a student loan, you can simply fill out the Free Application for Federal Student Aid online.

In other cases, the government works with approved lenders and only insures the loan, rather than funding it. For instance, the government doesnt issue VA loans you must work with a mortgage lender to get this type of loan.

If a borrower defaults on a mortgage issued by a lender, like a private bank, but is secured by the government, the government ends up repaying the lender. Every lender has its own application process for taking out a government loan that youll need to follow.

Also Check: Does The Government Owe Me Any Money

Your Land Title Registry Offices Role

Land title registry offices are part of your provincial or territorial government. These offices register official property titles. They have processes to make changes to a propertys title.

You, your lawyer or your notary must provide your land registry office with all the required documents. Once it receives the documents, your land registry office removes the lenders rights to your property. They update the title of your property to reflect this change.

Do I Qualify For The Local Authority Homeloan

The Local Authority Home Loan is available to first-time buyers and freshstart applicants. Fresh start applicants include:

- People who are divorced, separated, or whose relationship has ended and who have no financial interest in the family home

- People who have gone through personal insolvency or bankruptcy

To qualify for a Local Authority Home Loan you must:

- Be a first-time buyer or a ‘fresh start’ applicant, see above.

- Be aged between 18 and 70.

- Provide evidence of insufficient offers of finance from two regulated financial providers, for example, a bank or building society.

- Have a gross annual income of less than 65,000 as a single applicant buying in Cork, Dublin, Galway, Kildare, Louth, Meath or Wicklow, or50,000 or less as a single applicant buying in other counties. Joint applicants must have a combined gross annual income of less than75,000.

- Have a satisfactory credit record

- Have a deposit of at least 10% of the propertys market price or purchase price, whichever is less.

- Have a legal right to live and work in Ireland and be able to show that you are habitually resident here.

- Occupy the property as your normal place of residence.

In general, secondary applicants must have been in continuous employment fora minimum of 1 year. However, secondary applicants on the following long-termsocial welfare payments may be considered:

- Widow’s, Widower’s or Surviving Civil Partner’s pensions,

- Invalidity Pension and Disability Allowance

Also Check: Governance Of Portfolios Programs And Projects A Practice Guide