Finding Your Loan Information

If you are unsure which agency is servicing your defaulted student loan, you may retrieve your loan information from the National Student Loan Data System . This system contains financial aid information collected from schools, agencies, and other educational institutions. You will need your Federal Student Aid ID information to access your account. Or, you may contact the Federal Student Aid Information Center .

Q Is College Worth The Money Even If One Has To Borrow For It Or Is Borrowing For College A Mistake

A. It depends. On average, an associate degree or a bachelors degree pays off handsomely in the job market borrowing to earn a degree can make economic sense. Over the course of a career, the typical worker with a bachelors degree earns nearly $1 million more than an otherwise similar worker with just a high school diploma if both work fulltime, year-round from age 25. A similar worker with an associate degree earns $360,000 more than a high school grad. And individuals with college degrees experience lower unemployment rates and increased odds of moving up the economic ladder. The payoff is not so great for students who borrow and dont get a degree or those who pay a lot for a certificate or degree that employers dont value, a problem that has been particularly acute among for-profit schools. Indeed, the variation in outcomes across colleges and across individual academic programs within a college can be enormousso students should choose carefully.

What Are The Consequences Of Missed Payments Defaulting

Student loans never disappear. Theres no statute of limitations, and student loans are rarely discharged even in bankruptcy a fact reaffirmed in March by the U.S. Second Circuit Court of Appeals.

With few exceptions and pending direct relief from Washington your student loans will follow you until you pay them off.

When payment schedules resume, if there are no changes and you make a late payment on a federal student loan, you may be responsible for a late fee equal to 6% of the payment.

Defaulting on federal student loans results in more severe penalties. Before the CARES Act forbearance, you were considered delinquent when you havent made a payment in 90 days. When you havent made a payment in 270 days , you go into default and suffer plenty of consequences for it.

The government can garnish up to 15% of your wages and Social Security benefits, as well as offset income tax refunds. The government may also deduct 25% of each payment for collections fees, making the loan cost significantly more.

Late or missed payments also show up on your credit report and can harm your score.

If you cannot afford your payments, it is much better to contact your loan servicer and review your repayment options rather than simply not paying. Not paying and remaining silent is never a good combination.

Read Also: Government Grants To Start Trucking Business

Select A Repayment Plan For Your Federal Student Loans

Within the grace period you may receive information about repayment from your lender. Youll have a choice of several repayment plans. Find the right one for you.

Most federal student loans are eligible for at least one income-driven or income-based repayment plan . These repayment plans are based on a percentage of your discretionary income. Theyre designed to make your student loan debt more manageable by reducing your monthly payment amount.

Timeline Of Federal Relief

The federal government has taken several steps to assist federal student loan borrowers impacted by COVID-19, described above. The following is a review of the actions and announcement made by the White House and U.S. Department of Education.

This section will be updated to reflect any additional updates or changes.

Recommended Reading: Polk Real Foreclosure

Rehabilitate Your Canada Student Loan

If your loan is in collection, Contact the CRA to:

- see if you qualify to have your federal student loan brought up to date

- make payments equal to 2 regular monthly payments and choose one of the following options:

- pay off all outstanding interest on your loan, or

- add all unpaid interest to the balance of your loan

Once you make your payments, contact the NSLSC. You should receive a new repayment schedule within 1 month.

Federal Student Loan Holders Seeking An Income

- Income-driven repayment plan options set your monthly loan payment at an amount that is based on your income and family size. Depending on your income, your payments could be as low as $0 a month. If you do not qualify for these options, you may qualify for a graduated repayment plan that allows you to make smaller initial payments that increase over time. This graduated repayment plan could extend your repayment period and increase the total amount you pay in loan interest.To see the various payment plans and your options, visit StudentLoans.gov and log in to the Repayment Estimator tool using your FSA ID.Important: You must contact your loan servicer to choose and enroll in a plan.

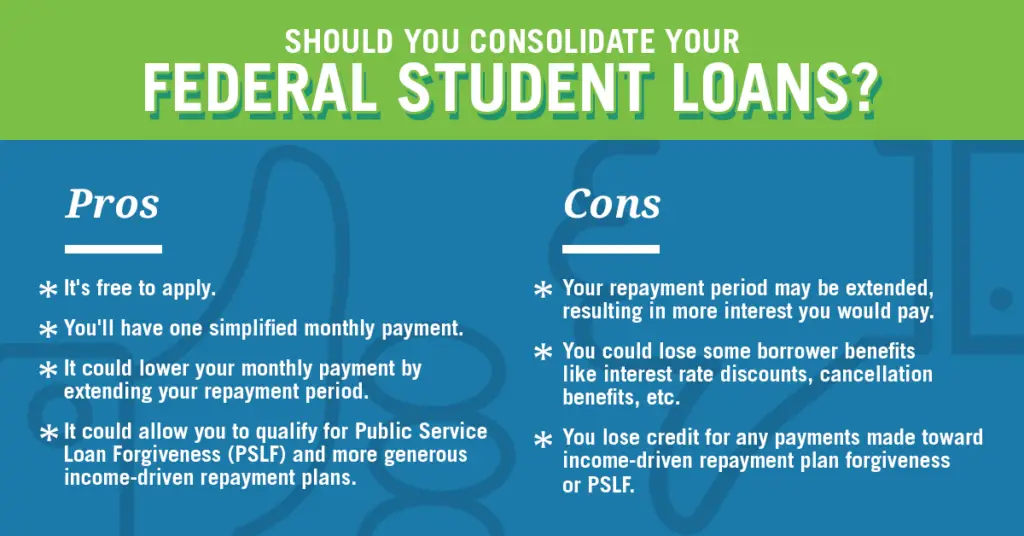

- You may be able to consolidate your Perkins and Federal Family Education Loan loans to qualify for an income-driven repayment plan such as Pay As You Earn or Revised Pay As You Earn .Important: Be careful which loans you include in consolidation and avoid consolidating Parent PLUS loans with student loans you took out for your own education because you could lose access to favorable repayment plans.

If you are considering refinancing your federal student loan into a private student loan:

- Understand that you will lose access to the forbearance, deferment, income-driven repayment, rehabilitation, and consolidation options described in this sheet, as well as the forgiveness and discharge options available for federal student loans only.

Don’t Miss: City Of Las Vegas Government Jobs

Help With Lower Payments

Borrowers who’ve been negatively impacted by the coronavirus pandemic may want to enroll in one of the government’s income-driven repayment plans when bills resume.

Under these plans, people’s payments are capped at a portion of their income and some monthly obligations wind up being as little as $0.

Usually, borrowers have to provide documentation to prove their household earnings and size, however the Education Department is considering allowing them to temporarily self-certify this information.

How Do I Pay Off My Student Loan Debt Fast

Home \ Debt \ How Do I Pay Off My Student Loan Debt Fast?

Join millions of Canadians who have already trusted Loans Canada

While there are many ways to get a well-paying job, the vast majority require some form of higher education and education costs money. The cost of living continues to rise, and many opt for post-secondary education to improve their chances of economic success. There are available measures to reduce your expenses, such as using savings and applying for scholarships and grants. However, many Canadians still require student loans to afford tuition. Student loans are accessible, and often the only way some individuals can access higher education.

Since the average individual with a degree makes roughly 1.7 times more than those without one, it truly is an investment in your future. Of course, that increased salary doesnt show up overnight. In the meantime, you must address your student loans, lest you damage your credit. The good news is that you can pay them down surprisingly quickly if you are diligent and savvy.

Recommended Reading: Las Vegas Government Jobs

Private Student Loan Holders

- Private student loans are issued by private lenders such as banks, an online lender, or credit unions. Private student loans will not be in your NSLDS report but might be available on your credit report, which you can get for free at annualcreditreport.com.

- Your schools financial aid office may also have information about your private student loans.Note: Unlike federal student loans, private student loans lack many of the protections that are offered to federal student loan borrowers such as incomedriven repayment plans or loan forgiveness.

The White House Says New Tools And Processes Will Improve Service

President Joe Biden pledged Monday to make it easier for us to deal with the federal government, directing 17 agencies to improve how we will enroll for benefits, pay student loans, and contact the IRS.

An executive order from Biden commits to adding new processes and online tools to improve 36 different customer experiences across the federal agencies, the White House said in a release. The USA.gov website also will be revamped as a portal where people will be able to access, with just a few clicks of a mouse, all government benefits, services, and programs, without having to navigate duplicate and outdated federal websites.

The order is a continuation of the Presidents Management Agenda Vision, announced last month, to deliver better federal services. The White House said it should help alleviate frustrations people have when dealing with the government.

Too often, people have to navigate a tangled web of Government websites, offices, and phone numbers to access the services they depend on, the White House said.

People also will be able to change their addresses, names, and other personal information with the federal or state entities they choose without having to visit a physical office.

The White House said other promised improvements for specific groups include:

Have a question, comment, or story to share? You can reach Medora at .

Recommended Reading: City Of Las Vegas Government Jobs

Which Loans Are Eligible

The program allows for the payment of federally made, insured or guaranteed student loans only. You wont be able to get your private loans repaid by virtue of the program, but getting those federal loans paid will leave you with more money available to use towards the private loans.

Loans eligible for payment are those made, insured, or guaranteed under parts B, D, or E of title IV of the Higher Education Act of 1965 or a health education assistance loan made or insured under part A of title VII or part E of title VIII of the Public Health Service Act.

Loans made or insured under the Higher Education Act of 1965 include the following:

Federal Family Education Loans

- Subsidized Federal Stafford Loans

- National Defense Student Loans

- National Direct Student Loans

- Perkins Loans

Loans made or insured under the Public Health Service Act include the following:

- Loans for Disadvantaged Students

- Primary Care Loans

- Health Professions Student Loans

- Health Education Assistance Loans

Preparing For Payments To Resume

Most borrowers with federal student loans have not had to make any payments since March 2020. Direct Loans as well as PLUS loans, which are available to graduate school students and parents on behalf of their children, are eligible for the benefit. Some federal loans that are guaranteed by the government but not technically held by it, known as Federal Family Education Loans, or FFEL, did not qualify. Generally, those were disbursed prior to 2010.

The relief is even more significant for those who work in the public sector and may be eligible for federal student loan forgiveness after 10 years. They are still receiving credit toward those 10 years of required payments as if they had continued to make them during the pandemic, as long as they are still working full time for qualifying employers.

Borrowers will receive a billing statement or other notice at least 21 days before their payment is due, according to the Department of Education. Those who had set up auto payments may need to notify their loan servicing company they want those to continue.

If federal student loan borrowers can no longer afford their monthly payment, they may be eligible for an income-driven repayment plan. Under those plans, which are based on income and family size, a monthly payment can be as low as $0 a month. The Department of Education has more information online about the payment restart.

You May Like: Trucking Grants

What Is Loan Consolidation

Consolidation means your lender has given you a “repayment date.” It starts on the first day of the seventh month after you stopped attending full-time studies or withdrew from classes.

The National Student Loans Service Centre will automatically send you a consolidation agreement, approximately 45 days before you enter repayment.

Your consolidation agreement shows:

- The details of your current outstanding Canada-B.C. integrated student loans balance.

- Your monthly payment and when it is due. Please note that your payments will be prorated to your Canada and BC student loan debt, based on each loans portfolio outstanding balance.

- How long you have to repay.

- The interest rate charged on your loan.

- The bank account from which payments will be withdrawn.

Your credit rating stays in good standing with Canada-British Columbia integrated student loans and/or other BC and Canada student loans when you meet the terms of the consolidation agreement and repayment schedule by making your monthly payments on time.

The consolidation agreement lets you:

- Review your loan information.

- Review your bank account information.

- Establish your loan repayment options including:

- Setting up the pre-authorized payment plan

- Choose the fixed-rate interest option

- Review repayment assistance plans

Important:not

Extend Your Grace Period By Another Six Months If You:

You make loan payments to the National Student Loans Service Centre, not to OSAP.

Your payments are based on a 9 ½ year pay-back schedule. This pay-back schedule is the average amount of time it takes to pay back an OSAP loan.

You can make payments on your loan at any time to repay it faster.

Get repayment assistance:

If youre having trouble repaying your loan, you might be able to get repayment assistance.

If you have a severe permanent disability and you cant attend work or school, you can apply for the Severe Permanent Disability Benefit. Contact the National Student Loans Service Centre.

Extend your repayment period:

You can lower your monthly payments by extending your repayment period from 9 ½ up to 14 ½ years. Log in to your National Student Loans Service Centre account.

You May Like: City Jobs In Las Vegas

When Should I Start Repayment

Starting your repayment early will reduce your debt load after graduation because payments are applied directly to the outstanding principal balance.

Contact the lender holding your student loans to arrange repayment if you:

- have finished your program

- have transferred to part-time studies

- are taking time off for more than six months that is not an approved medical or parental leave

- have withdrawn from school completely

- want to make payments while still in school or

- have reached your lifetime limit for student financial assistance and you are still in full-time studies, but you did not apply for a payment referral via the NSLSC or by submitting a Schedule 2 Confirmation of Enrolment form

For Student Loans Received After August 1 2000

If you received loans after August 1, 2000 they are a joint federal-provincial student loan .

You will repay your student loans through the National Student Loans Service Centre .

- Around 45 days before you enter repayment, the NSLSC will send you a consolidation agreement combining all your loans you received after August 1, 2000 so you can make one payment.

- Make sure you understand the terms of the consolidation agreement and choose the repayment options that are best for you.

- Sign and return the consolidation agreement to NSLSC.

Read Also: Government Programs To Stop Foreclosure

Policy Options To Assist Existing Student Loan Borrowers

Rather than recommending a specific proposed option, this report offers a combination of both commonly proposed ideas and new ones generated by the Center for American Progress and Generation Progress staff.

It is also worth noting that these options are intended to be one-time solutions that could pair with a larger plan for tackling affordability going forward, such as CAPs Beyond Tuition. Combining a prospective affordability plan with this relief should cut down on the number of future loan borrowers and lessen the need for subsequent large-scale relief policies.

1. Forgive all federal student loan debt

Under this proposal, the federal government would forgive all outstanding federal student loans. This option would also require waiving taxation of any forgiven amounts.

Estimated cost: $1.5 trillion in cancellation plus an unknown amount of anticipated interest payments, both of which would be adjusted by whether Education Department already expected it to be repaid. For example, a $10,000 loan that the agency did not expect to be repaid at all would not cost $10,000 in forgiven principal. There would also be costs associated with not taxing forgiven amounts, which also must be part of the policy.

Estimated effects: It would eliminate debt for all 43 million federal student loan borrowers.27

Considerations

How simple is it from a borrower standpoint? This policy should be easy to implement for borrowers, since it should not require any opting in or paperwork.

Get A Loan Out Of Default

| Loan | ||

|---|---|---|

| The collection agency listed on your collection notice |

You can confirm which collection agency holds your account by calling: |

|

| Ontario Student Loans | The collection agency listed on your collection notice | You can confirm which collection agency holds your account by calling the Account Management and Collections Branch, Ministry of Finance: |

Learn how you could be eligible for financial relief and how the deferral may apply to your debt.

You May Like: How Do I Get A Grant To Start A Trucking Company