Preparing For Student Loans Payments

Under normal circumstances, new graduates have six months before they have to begin making debt payments. Thats half a year to get the lay of the land.

There are several student loan repayment plans to choose from. Some are based on a percentage of discretionary income, run for 20-25 years, and may include loan forgiveness if all payments are made on time. Others start with low payments that increase over time as your income increases.

Regardless of which plan you choose, make sure you know who your loan-holder is, where to send payments, and how much to pay. You may also have questions about discharging your loans or the consequences of missed payments. Get answers to your concerns before you fall behind, and join the 7.5 million borrowers in default when the CARES Act provisions went into effect.

Tips to prepare for student loan payments:

- If you havent already you were busy weve been there use the grace period to research student loan repayment options.

- Avoid student loan default at all costs.

- Know the exact date when you expect to pay off the loan and shoot for that target.

Executive Director Marriner S Eccles Institute University Of Utah

Dont tell me what you value. Show me your budget, and Ill tell you what you value.

Joe Biden

Even modest student loan forgiveness proposals are staggeringly expensive and use federal spending that could advance other goals. The sums involved in loan-forgiveness proposals under discussion would exceed cumulative spending on many of the nations major antipoverty programs over the last several decades.

There are better ways to spend that money that would better achieve progressive goals. Increasing spending on more targeted policies would benefit families that are poorer, more disadvantaged, and more likely to be Black and Hispanic, compared to those who stand to benefit from broad student loan forgiveness. Indeed, shoring up spending on other safety net programs would be a far more effective way to help low-income people and people of color.

Student loan relief could be designed to aid those in greater need, advance economic opportunity, and reduce social inequities, but only if it is targeted to borrowers based on family income and post-college earnings. Those who borrowed to get college degrees that are paying off in good jobs with high incomes do not need and should not benefit from loan-forgiveness initiatives that are sold as a way to help truly struggling borrowers.

How Long Does It Take To Get Your Student Loans Forgiven

It varies significantly by program. Most federal loan forgiveness programs take years to dispense relief, and it could be as long as a decade, at least in the case of PSLF. Other non-federal forgiveness programs might award borrowers relief after two to three years of working in an underserved area or field. In addition, employers may offer to match or help make your monthly loan payments, in which case relief would be felt immediately and frequently.

You May Like: When Is Open Enrollment For Government Healthcare

Will Student Loan Relief Be Extended Again

Well, this latest extension just kicks the can down the road for several more months . But will student loan relief be extended again in the fall? No. Yes. Probably. Who knows. The U.S. Department of Education always says that the current student loan COVID relief extension will be the last .4 Student loans have been on pause since the CARES Act passed back in March 2020. This latest student loan extension is the sixth time its been extendedso who knows if this will be the last we see of it.

In March 2022, a group of Democratic lawmakers asked President Biden to cancel student loan debt completely and extend student loan relief through the rest of 2022.5 Still, dont bank on it being extended again or even totally canceled. Instead, just keep paying on your loan like usual.

Student Loan Forgiveness And Discharge Options

In some cases, federal student loans can be forgiven in full or in part. Conditions for loan forgiveness include:

- Becoming a teacher or other public service professional under specific guidelines.

- Service in the U.S. Armed Forces.

- Closure of a college before completion of studies.

- Fraud or malfeasance on the part of an educational institution.

- False certification as a result of crime or identity theft.

- Total and permanent disability.

Though it is extremely rare, another way in which a student loan can be completely discharged is through a declaration of bankruptcy, although a borrower must be able to prove undue financial hardship in a bankruptcy court.

Courts use different tests and may consider some or all of the following criteria:

- You cannot maintain, based on current income and expenses, a minimal standard of living, if forced to repay the student loans.

- Additional circumstances exist indicating that this state of affairs is likely to persist for a significant portion of the repayment period of the loan.

- You have made good-faith efforts to repay your loans.

7 Minute Read

Don’t Miss: I Need Help From The Government Financial

Thing To Do If You Cant Pay Student Loan

The easiest way to solve a problem is to start at the source and in this case, that means your loan servicing company if you have a federal student loan or a bank, if you took out a private student loan.

The loan servicers and banks make money if you simply follow the terms of your loan agreement and pay them back the money you borrowed. They lose money if they have to chase you all over to make those payments.

So, its in their best interests to be helpful. They should provide you with information on various repayment plans that will make it easier for you to afford monthly payments. You could ask them to have a portion of every paycheck deducted to help meet your obligations.

But be careful who you speak with and listen closely to what they say. Unfortunately, many loan servicers have come under fire for offering misleading or sometimes false information to borrowers that drives up the cost of repaying your student loan.

For example, the federal government filed suit in January of 2017 against Navient, the largest servicer of student loans in the U.S. with 12 million customers who owe $300 billion. The suit alleged that Navient made serious mistakes in the collections process that cost consumers millions of dollars.

Private Student Loan Repayment Plans

Unlike federal student loans, private student loans dont have a standard student loan repayment process. However, they may have unique student loan repayment plans that other lenders dont offer.

For instance, some private lenders require you to start repayment as soon as funds are disbursed, while others let you make interest-only payments while in school or defer any payments until you leave school. Others may give you the option to pay interest plus a small monthly payment like $25 while youre in school in order to begin chipping away at your balance early.

In many cases, private student loans will offer repayment terms of anywhere between seven and 15 years, although its possible to find lenders with terms as short as five years or as long as 20 years. Your available term lengths will depend on your lender and what type of degree youre funding.

Also Check: How To Report Government Fraud

Debt Avalanche Or Debt Snowball Method

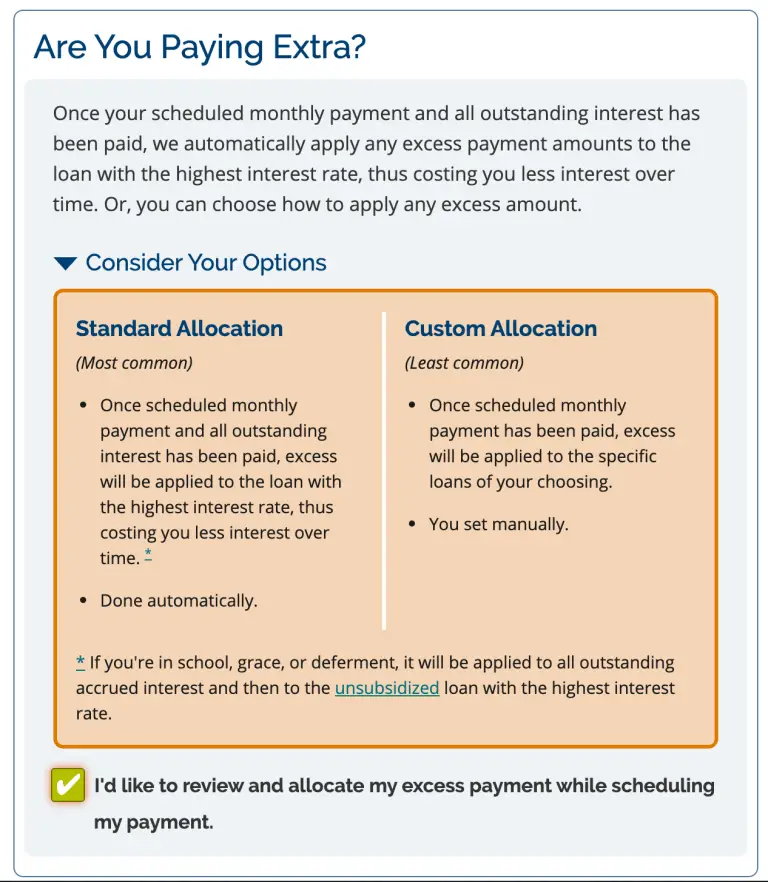

The debt avalanche method is a tried-and-true approach to paying off debts. Youll start by paying the minimum required on all of your debts, then put additional monthly payments toward the loan with the highest interest rate.

Once that debt has been paid in full, youll take the amount you were putting toward that loan and add it to your minimum payment on the loan with the next-highest interest rate. Youll continue this process until all of your loans have been paid in full.

The debt snowball method uses the same approach, but instead of targeting the loans with the highest interest rates first, youll focus on the accounts with the lowest balances. You wont save as much in interest with this strategy, but it can help you gain some wins early on as you pay off lower-balance loans.

Obviously, these approaches work only if you have multiple loans, so you cant use them if you refinance or consolidate your loans into one new one.

But if you can afford extra payments and youre fine with keeping multiple loans and monthly payments, this can be a great way to accelerate your debt repayment and save money on interest.

Dont Qualify For Student Loan Forgiveness Alternatives For Conquering Your Debt

Not everyone qualifies for student loan forgiveness or repayment assistance. If youre ineligible and struggling to pay your loans, consider other strategies for managing your debt.

One approach is accessing the income-driven repayment programs mentioned above, since you can reduce your monthly payments significantly. But if you dont have qualifying federal loans, or need a complete pause from making payments, consider putting your loans in deferment or forbearance.

You could qualify if you return to school, encounter financial hardship or have another eligible reason. Some private lenders will also put your loans into forbearance temporarily, so speak with your lender about your options.

Also Check: Free Government Help For Low Income Families

National Institute Of Health Loan Repayment Programs

The eight research programs within the NIHLP are divided between extramural research and intramural research. They are:

Eligibility

Q Whats With All These Proposals To Forgive Student Debt

A. Some Democratic candidates are proposing to forgive all or some student debt. Sen. Elizabeth Warren, for instance, proposes to forgive up to $50,000 in loans for households with less than $100,000 in annual income. Borrowers with incomes between $100,000 and $250,000 would get less relief, and those with incomes above $250,000 would get none. She says this would wipe out student loan debt altogether for more than 75% of Americans with outstanding student loans. Former Vice President Joe Biden would enroll everyone in income-related payment plans . Those making $25,000 or less wouldnt make any payments and interest on their loans wouldnt accrue. Others would pay 5% of their discretionary income over $25,000 toward their loan. After 20 years, any unpaid balance would be forgiven. Pete Buttigieg favors expansion of some existing loan forgiveness programs, but not widespread debt cancellation.

Forgivingstudent loans would, obviously, be a boon to those who owe moneyand wouldcertainly give them money to spend on other things.

But whoseloans should be forgiven? What we have in place and we need to improve is asystem that says, If you cannot afford your loan payments, we will forgivethem, Sandra Baum, a student loan scholar at the Urban Institute, said at aforum at the Hutchins Center at Brookings in October 2019. Thequestion of whether we should also have a program that says, Lets alsoforgive the loan payments even if you can afford them is another question.

Recommended Reading: Data Governance And Data Management

Forgiving All Debt Is A Hard Argument

Others believe that student borrowers willingly borrowed the money and are obliged to pay it back. They support proposals for streamlining forms and processes and providing information, but oppose debt forgiveness.

Arguing that forgiving student debt is justified because it will help the economy is a difficult argument. If the government forgave all credit card debt, which is about $1 trillion, that would help the economy, too. But is it fair to give benefit to those who use their credit cards more than others?

There are other concerns about canceling student debt. Should taxpayers cancel debt of those who are making high incomes? Should borrowers from families with millions of dollars of assets have student debt forgiven? When deciding whose debt to forgive, details matter.

The fairness issue also is apparent when talking to graduates and parents who sacrificed and struggled to avoid or minimize debt while the student was in school. Is it fair to not give a rebate on expenditures to a student who worked during school and vacations, and whose parents stopped taking vacations and deferred other expenditures to avoid student debt, when the government gives one to students who did not take the same measures?

The highest levels of debt are usually held by students who went to medical school, law school or graduate school. If a doctor has $200,000 in student debt but has very high earning potential, should he or she be given taxpayer funds to pay off debt early?

Frequently Asked Questions About Government Assistance

Here are some answers to common questions about student loans:

1. When is the best time to apply?

The online application usually becomes available in early June. We strongly encourage you to apply before the start of August to ensure you receive your funding in time for when tuition and fees are due.

2. Do I have to apply for a financial assistance each school year?

Yes, you will need to submit a new application at the start of each academic year. We encourage students to apply each year. Your financial situation can change each year, therefore, a new assessment is done based on the information you provide for that specific academic year.

3. Why would I apply for government student assistance as opposed to a bank loan?

Government student loans are interest and payment free as long as you are a full-time student. Also you do not need to have any collateral or a co-signor to secure your loan. As well, when you submit your application for funding you will also be assessed for government grants which is money you do not need to repay.

4. Is there a maximum amount of money my parents can earn before I am not eligible to receive financial assistance?

5. I live outside of Saskatchewan, can I apply for government financial assistance?

Yes, if you have not lived in Saskatchewan for 12 consecutive months prior to the start of your study period, you would apply for financial assistance in your home province or territory.

8. How do I apply for a financial assistance?

Graduate students

Recommended Reading: Government Land For Sale In Georgia

What To Do If You Have Private Student Loans

Even if there was new legislation or executive action that grants mass student loan cancellation, it would only apply to federal student loans not private student loans. Private student loan borrowers havent received much government relief throughout the COVID-19 pandemic, but there are still ways to make private student loans more manageable.

If you have private student loans, you can get ahead of any financial challenges by starting a dialogue with your lender and discussing your options to refinance or modify your loans. With rates at historic lows, now is a great time to refinance student loans and get an interest rate significantly lower than your current rate. Shop around and compare rates from several lenders to ensure youre getting the lowest rate possible.

Read Also: Polk County Fl Forclosure

Where Do I Find Student Loan Forgiveness Programs

Its wise to cast a wide net for student loan forgiveness. Contact your federal loan servicer to learn about federal loan forgiveness programs search far and wide for state-based programs, including by using our LRAPs database and talk to your employer about its assistance options or to hiring managers or job recruiters about companies that offer this benefit. You should also consider hiring a student loan or credit counselor to help you research these programs.

Also Check: Data Governance And Regulatory Compliance

Paying Off Federal Student Loans In 2022

Federal student loan payments are on pause until September 2022, so its time to start thinking about your plan for paying off your debt. Paying off federal student loans can be a daunting task, but knowing all of your options can help you narrow down which approach you want to take.

First, youll want to establish your goals, then take a look at each method individually. Depending on the situation, you may use just one or combine multiple approaches to make the most of your strategy.

If youre wondering how to pay off federal student loans, heres everything you need to know.

& nbspi Can Afford My Loans And Want To Save Money

Glad it’s going well!

You may have options to improve your strategy for paying off your loans. What type of student loans do you have?

Not sure? You can check on whether you have federal loans atwww.studentaid.gov. And your free credit report, which you can get atwww.annualcreditreport.com, should list all your loans.

Also Check: Blue Cross Blue Shield Government Basic Plan

Balance Increasers Frequently Missed And Paused Payments

Among Texas borrowers, 21 percent owed more after five years than their original loan principal. This was true of 14 percent of national borrowers.53 Texas balance increasers tended to have higher initial principal balances than other groups: 29 percent owed more than $20,000 when they began repayment, compared with 15 percent of defaulters.54

Sixty percent of defaulters had paused payments at least once, but among balance increasers, that number was 98 percent. Many had done so repeatedly, and most continued to have interest accrue while their payments were paused: 88 percent had at least one and 53 percent had three or more forbearances.

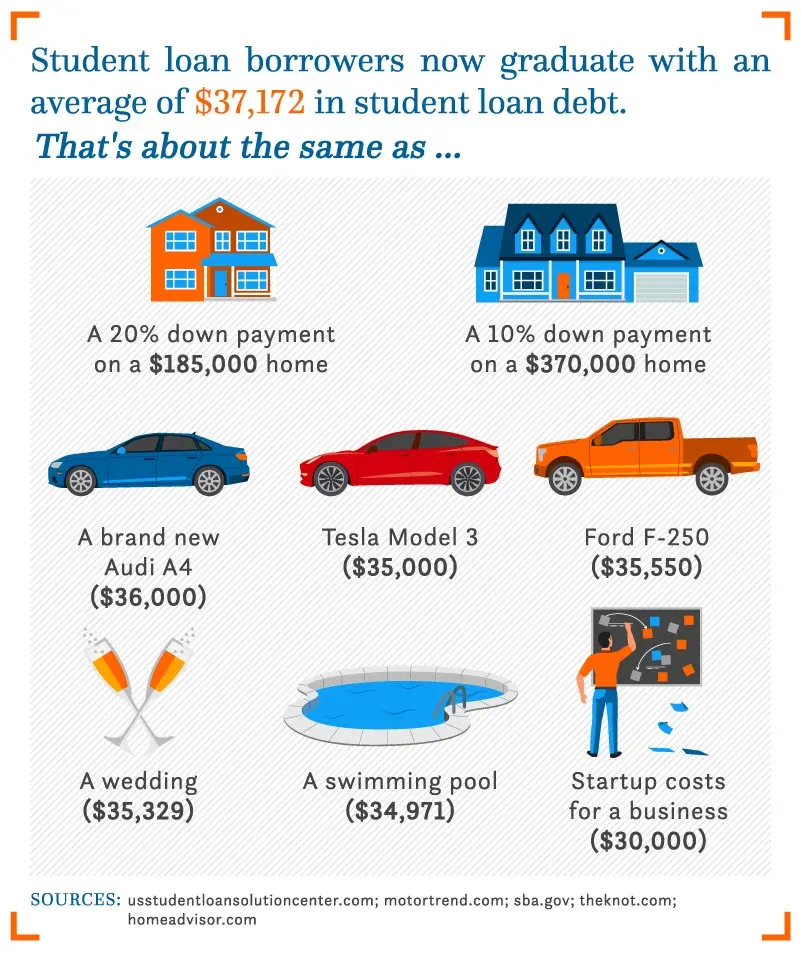

Balance increasers not only used forbearances multiple times, but also paused their payments for a median of 350 daysalmost a full yeartwice as long as the other groups that suspended payments. And those long pauseswhether borrowers request, are placed in, or retroactively use forbearancesadd up: A 2018 study by the U.S. Government Accountability Office estimated that using forbearances to suspend payments for all of the first three years of repayment would cost a typical borrower with $30,000 in student loans more than $6,000 in additional interest.55