Pmay Loan Interest Rate Calculator

The Finance Minister under the Central Government of India has recently announced the Union Budget for this year 2022. Mrs. Nirmala Sitaraman has said that the scheme can be extended for people. /so, that they can apply under this affordable housing project. For migrant workers from any state, the government has also provided affordable rental housing in the Budget session.

Calculation of EMI under the Pradhan Mantri Awas Yojana

- At first, the total amount of the loan is in Rupees.

- Then the rate of interest is needed.

- After that, the total loan time period in months has been decided.

- All the following details applicant has to punch in the calculator given on the official page.

- At last click on the calculate button.

- And your details come onto your screen.

What Are The Benefits Of The Clss Scheme

Here are the benefits you get under the housing loan subsidy scheme:

- Subsidised interest rate up to a certain amount on your home loans.

- The subsidised amount under the scheme is directly transferred into your account. Thus, your outstanding principal gets reduced, and so does your EMI.

- You can extend your loan tenure up to 20 years.

- There is no maximum limit to the loan amount. If the amount crosses the specified limits, the interest will be at the standard rate provided by the lender.

- You can enjoy tax benefits under the subsidy on home loan by the Government as stated in the Income Tax Act of 1961.

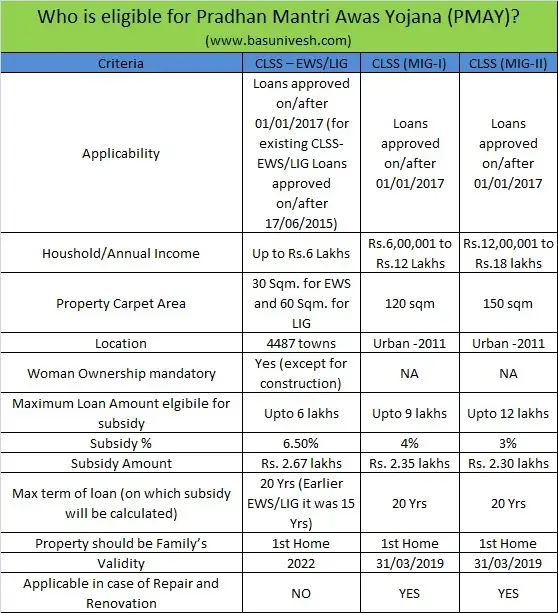

The key benefit of the CLSS is the subsidized interest rate. The subsidy is decided based on the income groups. For a better understanding, here is a complete table of the subsidy rates of the income groups along with the maximum loan limit.

| Annual Household Income |

|---|

| 3.00% |

Illustration:

Let’s assume, you have applied for a home loan of 12 Lakh at an interest rate of 8.5% and with a tenure of 20 years. In such a scenario, you pay an EMI of 10,414, and the total payable interest will be 12,99,331. Now suppose, you have availed a 3% subsidy on a home loan by Government under the MIG-ll group. Your EMI will be reduced to 8,418. The total payable interest will be 10,50,292. Under the subsidy scheme, you will save 1,996 on each EMI and total interest of 2,49,039.

Eligibility Criteria For The Lower Income Group

For applicants falling under the LIG or Lower Income Group

- Yearly income of the household from Rs. 3 lakh up to Rs. 6 lakh

- Home loan amount on which subsidy is calculated up to Rs. 6 lakh

- Rate of interest subsidy 6.50%.

- The houses carpet area up to 60 square metres

Applicants from the EWS and LIG categories can avail of a maximum home loan subsidy of up to Rs. 2.67 lakh.

You May Like: What Is Grant Money From The Government

How Does It Work

The ONE Mortgage has four features that make buying a home truly affordable:

- 3 percent minimum down-payment

- No Private Mortgage Insurance

- Extra assistance that lowers your monthly payments

With these features, ONE Mortgage can lower your monthly payments by hundreds of dollars every month compared to other 30-year mortgages. Use our ONE Mortgage calculator to see how ONE can boost your buying power.

Eligibility Criteria For The Medium Income Group I

For those falling under the Medium Income Group or MIG II

- Yearly income of the household from Rs. 12 lakh up to Rs. 18 lakh

- Home loan amount on which subsidy is calculated up to Rs. 12 lakh

- Rate of interest subsidy 3%

- The houses carpet area up to 200 square metres

Eligible candidates from MIG I & MIG II categories can avail a maximum subsidy on home loan interest of up to Rs. 2.35 lakh.

Note: The carpet area is the actual area within the walls where you can lay a carpet. It is excluding the inner walls thickness and common spaces like stairs or lobby.

Read Also: Government Mortgage Loans For Low Income

Other Types Of Help If Youre Homeless

Visit Benefits.gov to find out if youre eligible and how to apply for other types of help. This may include financial assistance, transportation, food, counseling, and more.

If you dont have medical insurance, you can use HRSA health centers. They give checkups, treatment when youre sick, pregnancy care, and immunizations for your children.

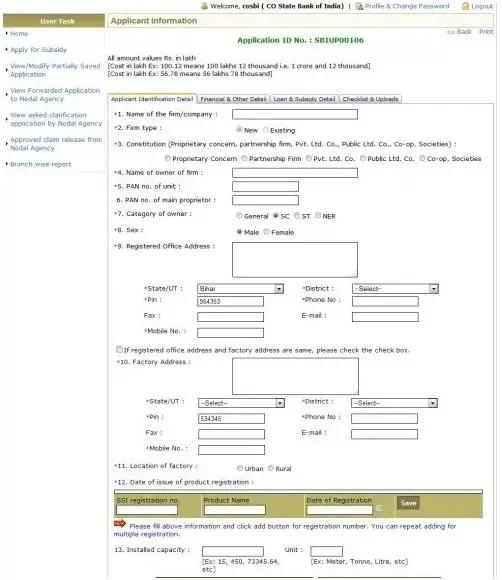

How To Apply For The Home Loan Subsidy

Eligible applicants can directly apply for a home loan under CLSS with PLIs or Prime Lending Institutions. PLIs are the financial institutions including NBFCs, cooperative banks, regional rural banks, and others who have partnered with the central nodal agencies to offer subsidised rates on housing loans. Close to 70 financing organisations have collaborated with NHB and HUDCO. Here are the steps to follow.

- Get in touchContact us and ensure that you meet the eligibility criteria for CLSS benefits.

- ApplyYou will receive a loan subsidy application form. Fill it with accurate details.

- Submit documentsSubmit the application form along with all the documents required. Make sure to submit updated papers.

- Get the loanThe loan amount is then disbursed to your account after the verification of documents and property.

- Reimbursement of subsidyBajaj Finserv will approach the nodal agencies to process your application and reimburse the subsided funds in your loan account.

Note: No lending institution can charge any additional fees to sanction a home loan under CLSS.

Disclaimer:

The validity of the PMAY scheme has not been extended.

- The EWS/ LIG schemes have been discontinued w.e.f. March 31, 2022

- The MIG schemes have been discontinued w.e.f. March 31, 2021

Read Also: Fpwa Federal Government Grant Program

Pmay Home Loan Subsidy Form 2022

PMAY home loan Eligibility Criteria =

- Firstly, applicants who applied under the scheme, must not have their own pucca house before this scheme.

- Then, the family income of the applicant should be 18 lakh per annum can apply under the yojana.

- Although the income of the spouse should also mention at the time of application submission.

- Also, those beneficiaries who already have one built house, can not take benefit of this scheme.

- As a result of this scheme, no assistance has been given from any other department under the government.

- Secondly, all the statutory towns notified in the Census 2011 survey can get coverage of this project for housing for all.

- Applicants can get also a subsidy either single or married, in both ways they can apply.

- Do follow us for more details related to this scheme.

| PMAY Interest Subsidy Details : |

Do I Have To Use The Total Grant Amount This Year

No. If youre eligible for an SAH or SHA grant, you can use money from your grant up to 6 different times over your lifetime. Depending on the adaptations you need, and the bid from your builder, you can use as much or as little of your grant as you need this year. If you dont use the full amount, you can use more money from the grant in future years.

We may adjust the total maximum amount each year based on the cost of construction. You may receive up to the current total maximum amount for the last year you use the grant.

Read Also: Low Interest Government Home Loans

Pmay Shahri Aka Pmay Urban

Launched on June 25, 2015, the PMAY Urban mission aims to end housing shortage in Indias urban areas, by ensuring a pucca house to all eligible households by 2022, when India completes 75 years of its independence. All in all, the government plans to build 20 million homes under the PMAY-U mission. As against the prior deadline of March 31, 2022, the urban scheme has now been extended till December 31, 2024, because only 61.77 lakh houses have been completed so far, as against the total of 12.26 million houses sanctioned under the scheme.

What Are Todays Mortgage Rates For Low

Many low-income mortgage programs have lower interest rates than standard mortgage loans. You might get a great deal.

Interest rates vary depending on the borrower, the loan program, and the lender.

To find out where you stand, youll need to compare loan offers from several lenders and then choose your best deal.

Recommended Reading: Fidelity Government Money Market Vs Treasury Money Market

Manufactured And Mobile Homes

A manufactured home usually costs less than a traditional, site-built home. When placed on approved foundations and taxed as real estate, manufactured homes can be financed with mainstream mortgage programs.

Many programs require slightly higher down payments or more restrictive terms for manufactured homes. HomeReady, for example, increases the minimum down payment from 3% to 5% if you finance a manufactured home. Other programs require the home to be brand new.

Additionally, there are often requirements regarding the year in which the home was built and the propertys foundation. These guidelines will vary between lenders.

Mobile homes that are not classified as real estate can be purchased with personal loans like FHAs Title 2 program. These are not mortgages, because the homes are not considered real estate.

What Is The Home Stimulus Program

Better known as the Homeowners Assistance Fund , this program is part of the American Rescue Plan for providing relief to Americans amid the COVID-19 pandemic. The purpose of the HAF is to prevent Americans from losing their homes, utilities or insurance during a time of economic hardship. You can find more information about the HAF on the U.S. Treasury website.

You May Like: Government Grants For Homeowners Improvements

Good Neighbor Next Door

The Good Neighbor Next Door program offers unique benefits for nurses, first responders, and teachers. If youre eligible, you can buy HUD foreclosure homes at a 50% discount. Use an FHA mortgage, and you only need $100 for a down payment.

You can find the homes on the U.S. Department of Housing and Urban Development website, and you need a licensed real estate agent to put your offer in for you.

If your offer is accepted, and you qualify for financing, you get the home. The 50% discount makes homeownership a lot more affordable. The discount is actually a second mortgage. But it has no interest and requires no payments. Live in the home for three years, and the second mortgage is terminated.

Pmay Interest Subsidy Under Clss

| Buyer category |

You May Like: Government Online Passport Application Form

Aponar Apon Ghar Home Loan Subsidy Scheme

Assam Government is inviting online applications for Aponar Apon Ghar Home Loan Subsidy Scheme 2020 at assamfinanceloans.in. Under this newAponar Apon Ghar Home Loan Subsidy Scheme, the state govt. will provide Rs. 2.5 lakh subsidy on home loans up to Rs. 40 lakh. This house loan subsidy is only for those who are purchasing their 1st house and have not availed of loans under the previous Apun Ghar Scheme. People can now apply online for Aponar Apon Ghar Scheme by fill a registration/application form, check the subsidy amount, and complete details.

Under Aponar Apon Ghar home loan subsidy scheme in Assam, all the applicants will get home loans at subsidized interest rates. This is an extension of the previous polar Apon Ghar Home Loan Subsidy Scheme 2016-17. Under the Apun Ghar home loan scheme, the state govt. was providing an interest subsidy of 3.5% for govt. employees on home loans up to Rs. 15 lakh taken for a 20 years duration.

The main objective of Assam Aponar Apon Ghar Home Loan Subsidy Scheme 2020 is to realize the vision of Housing For All by 2022 so that each poor people have their own house.

S To Take Before You Hire A Lawyer

A reputable lawyer doesnt guarantee results, no matter what your circumstances.

Before you hire someone who claims to be a lawyer , or someone who claims to work with lawyers, ask relatives, friends, and others you trust for the name of a lawyer with a proven record of helping homeowners facing foreclosure.

Get the name of each lawyer wholl be helping you, the state or states where each lawyer is licensed, and their license number in each state. Your state has a licensing organization or bar that monitors lawyers conduct. Call your state bar or check its website to see if a lawyer you’re thinking of hiring has gotten into trouble. The American Bar Association has links to your state bar or search online for the name of your state and the words state bar to find the site for your states bar association. Get in writing specific information about the work the lawyer or firm will do for you, including the cost, and the payment schedule

If you decide to hire a lawyer, stay in touch with them and keep a file with a record of your conversations, letters, emails, texts, and paperwork.

Read Also: Government Programs To Help The Elderly

Loan / Subsidy Amount In Assam Aponar Apon Ghar Scheme

The loan amount and the subsidy on it which can be availed under Assam Aponar Apon Ghar Scheme is given in the table below:-

Loan Amount Subsidy Amount

Rs. 5 lakh to Rs 10 lakhs Rs 1 lakh

Rs. 10 lakhs to Rs. 20 lakhs Rs. 1.5 lakh

Rs. 20 lakhs to Rs. 30 lakhs Rs. 2 lakh

Rs. 30 lakhs to Rs. 40 lakhs Rs. 2.5 lakhs

The mode of disbursement of the Subsidy amount is through DBT directly into the loan account of the loanee.

Where To Apply For A Flisp Subsidy

As FLISP is a government-backed initiative, the Department of Human Settlement administers and processes applications for a FLISP subsidy. Once youve been pre-approved for a home loan, apply for a FLISP subsidy at your local Department of Human Settlement office, or call the National Housing Finance Corporation on 0860 011 011.

Also Check: Federal Government Jobs San Antonio

Process To Claim Pmay Interest Subsidy Benefits

The process of claiming interest subsidy benefits under the PMAY scheme is straightforward.

-

After the lending institution has disbursed your loan amount, it will share all the necessary details with a central nodal agency. The two central agencies include National Housing Bank and Housing & Urban Development Corporation.

-

The agency will verify your application, and upon approval, the subsidy amount will be given to the lender.

-

The lender will credit this subsidy amount to your loan account, thus lowering your loan repayment amount.

What Home Loan Subsidy Does The Government Offer

The Pradhan Mantri Awas Yojana introduced by the Government of India, aims to provide housing for all by March 2022. The Credit Linked Subsidy Scheme is a significant part of PMAY, which offers a home loan interest subsidy to borrowers. The other three components of PMAY are In-Situ Slum Redevelopment, Beneficiary-Led Construction, and Affordable Housing in Partnership.

The Credit Linked Subsidy Scheme extends financial assistance to eligible individuals via various financial organisations in India. With this program, the government promotes the increase of credit flow in financial institutions towards housing requirements. The National Housing Board and the Housing and Urban Development Corporation are the central nodal agencies who have received the authorisation to take this project forward.

Borrowers who avail of a home loan from lenders such as Bajaj Finserv under the PMAY scheme can enjoy an interest subsidy of up to Rs. 2.67 lakh.

Recommended Reading: Do I Qualify For A Government Grant

Can I Get A Specially Adapted Housing Grant

You may be able to get an SAH grant if youre using the grant money to buy, build, or change your permanent home and you meet both of these requirements.

Both of these must be true:

- You own or will own the home, and

- You have a qualifying service-connected disability

Qualifying service-connected disabilities include:

- The loss or loss of use of more than one limb

- The loss or loss of use of a lower leg along with the residuals of an organic disease or injury

- Blindness in both eyes

- Certain severe burns

- The loss, or loss of use, of one lower extremity after September 11, 2001, which makes it so you cant balance or walk without the help of braces, crutches, canes, or a wheelchair

Note: Only 120 Veterans and service members each fiscal year can qualify for a grant based on the loss of one extremity after September 11, 2001, as set by Congress. A fiscal year runs from October 1 through September 30. If you qualify for, but dont receive, a grant in the current fiscal year because the cap has already been reached, you may be able to use this benefit in future years.