Subsidized Federal Student Loans

On a subsidized loan, the federal government pays the interest while youre in school, during the six-month grace period after you graduate, and if you temporarily defer the loans. On a Federal Direct Unsubsidized Loan, you are responsible for paying all of the interest on the loan.

Since the interest is paid for you while you are in school on a subsidized loan, it doesnt accrue. So the amount you owe after the post-graduation grace period is the same as the amount you originally borrowed.

Recommended Reading: Regions Savings Account Interest Rate

Student Loan Interest To Be Eliminated On Nov 1

FREDERICTON â The provincial government is following through on its commitment to eliminate interest on the provincial portion of New Brunswick student loans as of Nov. 1. Interest accrued before this date remains payable.

âEliminating the interest on student loans is something student representatives have asked for, and it has always been our intention to do so,â said Post-Secondary Education, Training and Labour Minister Trevor Holder. âIn 2020, we began helping students by lowering the interest rate. Now I am proud to say that we are at a point where we can completely eliminate it. This will make post-secondary education more attractive by reducing the borrowing costs for students.â

The initiative will benefit 65,000 existing borrowers, as well as future post-secondary students in the province.

A borrower repaying a loan of $15,000 over 10 years will save about $4,500. These estimates are based on the latest interest rates set by the Bank of Canada.

There are several supports and services to help students with the costs of their post-secondary studies. These include federal and provincial grants, bursaries, loans and the Repayment Assistance Program.

Students in need of financial support can find more information online. With one application, they will be considered for all programs offered by the provincial and federal governments.

What If I Cant Repay My Student Loans

If youve had difficulty finding employment after graduation and you cant make your monthly student loan payment, you dont need to resort to a debt consolidation loan or a credit counsellor like Consolidated Credit just yet. You can apply for the repayment assistance plan . RAP is available in every province and, although some vary in detail, most of them are similar to the federal RAP. Here are the details:

When you apply for RAP, youll need to prove that your financial situation cant support your monthly payments. Youll need to provide details about your income, and, depending on those details, you may be assessed to make a payment that does not exceed 20% of your income.

You can apply for RAP when your student loans go into repayment or if your financial circumstances change. RAP requires you to re-apply every six months, but there is no limit on how long you can use RAP. If youve been eligible for 60 months, the federal government will begin to cover both the interest and principal amounts that exceed your monthly payments.

Also Check: Low Interest Government Loans For Debt Consolidation

Dollar Loan Center Locations

1. address 1386 E Flamingo Road, Las Vegas, NV 89119 This is Dollar Loan Center your Community Short-Term Loan provider with 56 locations throughout Nevada and Utah. Established in 1998, were the key provider location information. address 7345 S Durango Dr, Las Vegas, NV 89113. phone 251-1800. emails Dollar

Also Check: Ida Auto Finance

What Is The Interest Rate On Unsubsidized Student Loans

Unsubsidized student loans have low, fixed interest rates. Rates are set by Congress and are subject to change annually. However, this change only impacts those taking out loans for the first time. Those whove already taken out a loan will have the same rate throughout repayment.

Here are the current rates:

| Type of Borrower | |

| 6.54% | 1.057% |

Interest begins accruing on unsubsidized student loans as soon as the funds are disbursed to your school.

You dont have to make payments while in school, during the six-month grace period after graduation, or when loans are in deferment or forbearance. But the interest is always accruing during those times the government doesnt pay any of it on your behalf.

In that sense, unsubsidized student loans arent that different from private student loans. With private loans, interest begins to accrue as soon as funds are disbursed. One key difference, however, is that private student loans may offer a choice of fixed or variable rates while unsubsidized loans only have fixed rates.

You May Like: Paper Application For Free Government Phone

How Are Student Loan Interest Rates Set

Since 2013, federal student loan interest rates are set each year based on the 10-year Treasury note rate following the May auction .

There is a set margin of 2.05 percentage points for undergraduate student loans, 3.60 points for graduate student loans and 4.60 points for PLUS loans. Rates are fixed for the life of the loan, although rates for new loans are set each year.

Here are the calculations for 2017-18:

- Undergraduate student loans 40 rate plus 2.05 percentage points equals 4.45% interest rate.

- Graduate student loans 40 rate plus 3.60 percentage points equals 6.00% interest rate.

- PLUS loans 40 rate plus 4.60 points equals 7% interest rate.

The current interest rate system was established in 2013, when President Barack Obama signed the Bipartisan Student Loan Certainty Act. After July 1, 2013, all annual percentage rates were linked to the 10-year U.S. Treasury Rate. The law also capped all Stafford loan rates at 8.25% and 9.50% .

U.S. Sen. Richard Burr said the law has saved borrowers about $58-million in student loan interest since it was enacted.

How Do You Apply For Unsubsidized Student Loans

To apply for an unsubsidized student loan, you may need to fill out a Free Application for Federal Student Aid. Once its submitted, schools use the information from the FAFSA to make any financial aid package that they send you. To be eligible to fill out the FAFSA, you must be a U.S. citizen or eligible non citizen with a valid Social Security number. You also must meet other requirements:

- Registered with the Selective Service if youre a male student

- Be enrolled or accepted for enrollment as a regular student in an eligible degree or certificate program

- For Direct Loan Program funds, be enrolled at least half time

- Maintain satisfactory academic progress

Recommended Reading: How To Get A Us Government Job

Why You Can Trust Bankrate

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. Weve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate follows a strict editorial policy, so you can trust that were putting your interests first. All of our content is authored by highly qualified professionals and edited by subject matter experts, who ensure everything we publish is objective, accurate and trustworthy.

Our loans reporters and editors focus on the points consumers care about most the different types of lending options, the best rates, the best lenders, how to pay off debt and more so you can feel confident when investing your money.

You May Like: What Is The Lowest Interest Rate

Federal Direct Subsidized & Unsubsidized Loans

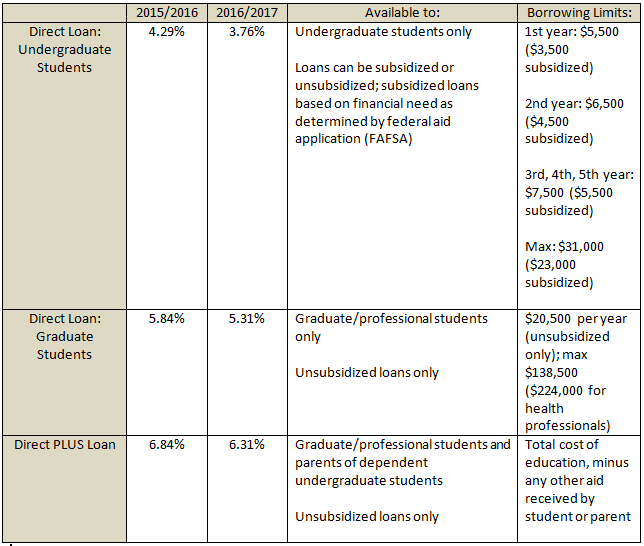

Tulane participates in the Direct Loan Program. The federal government through the U.S. Department of Education is your lender for the Direct Loan Program. Federal Direct Subsidized and Unsubsidized Loans are offered to eligible students who are enrolled at least half-time and who meet all other eligibility criteria.

Eligible undergraduate students who have financial need may be offered a Direct Subsidized Loan, on which no interest will be charged before repayment begins or during authorized periods of deferment. Interest is charged during the repayment period on a Direct Subsidized Loan.

Regardless of financial need, eligible students may qualify for a Direct Unsubsidized Loan. Interest on the Direct Unsubsidized Stafford Loan will begin to accrue when the loan is disbursed and be capitalized to the principal balance when the repayment period begins.

Also Check: Student Loan Relief Programs Government

Direct Unsubsidized Loan Eligibility

To qualify for a Direct Unsubsidized Loan, you must:

- Be enrolled at least half-time in college

- Be enrolled in a program that will award you with a degree or certificate upon completion

- Be either an undergraduate, graduate, or professional student

You do not need to demonstrate financial need to qualify.

Direct Subsidized Or Unsubsidized Loan Interest Rates

Interest rates for Direct Subsidized or Unsubsidized Loans vary depending on loan type, when the loan was first disbursed, and your degree status .

| Period loans first disbursed |

|---|

| Contact your loan holder to determine the interest rate |

Military service members may be eligible for reduced interest rates.

If you need more information about the interest rate for your student loans, contact your loan holder. If you aren’t sure which institution or servicer holds your loans, locate your loan holder.

You May Like: Government Jobs St Paul Mn

Direct Unsubsidized Loan Refinancing And Consolidation

There is no federal student loan refinancing program. In order to refinance your Direct Unsubsidized Loan, you would need to turn to a private lender who would essentially convert your loan into a private loan. While this may bring benefits such as a lower interest rate or lower monthly payments, it also means that you will be losing certain benefits carried by federal loans, such as the ability to place your loans in deferment or forbearance. Therefore, its important to weigh the pros and cons of refinancing before you make a decision.

Student loan consolidation is a process in which you combine multiple federal student loans into a single new loan, called a Direct Consolidation Loan. This new loans balance will be the total of all of its component loans, added up. The interest rate that it carries will be the weighted average of all of the loans that make it up.

Direct Unsubsidized Loans can be consolidated under this program.

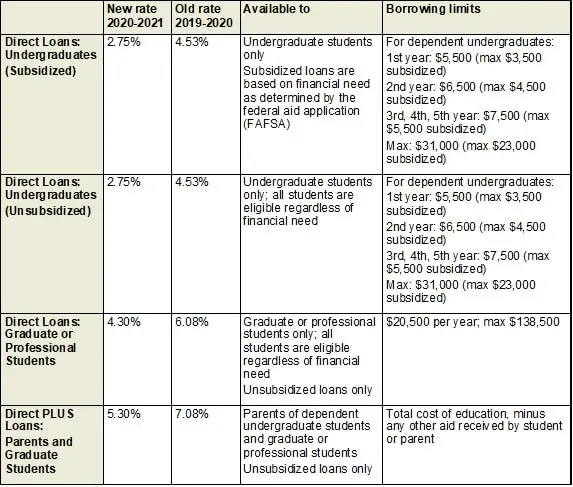

How Has The Coronavirus Affected Student Loan Interest Rates

When the coronavirus hit in March 2020 and the Federal Reserve Board cut interest rates, student loan rates plummeted. Federal student loan rates were at their lowest point in years, and borrowers could take out private student loans or refinance existing loans with rock-bottom rates as well. Also, federal student loan interest is waived until the ongoing litigation concerning student loan forgiveness is resolved or through June 30, 2023.

However, as the economy recovers from the pandemic, the Fed has been regularly raising rates five times so far in 2022. These rate increases drive higher interest rates across sectors. Federal student loan interest rates are up more than a percentage point for the 2022-23 school year, and private student loan rates are also starting to rise again. Rates will likely continue to rise as 2022 progresses.

Recommended Reading: Government Contracts For Disabled Veteran Owned Business

Interest Rates For Direct Loans First Disbursed Between July 1 2021 And June 30 2022

Direct Subsidized Loans, Direct Unsubsidized Loans, and Direct PLUS Loans first disbursed on or after July 1, 2013 have fixed interest rates that are determined in accordance with formulas specified in sections 455 through of the Higher Education Act of 1965, as amended .

The interest rate is determined annually for all loans first disbursed during any 12-month period beginning on July 1 and ending on June 30, and is equal to the high yield of the 10-year Treasury notes auctioned at the final auction held before June 1 of that 12-month period, plus a statutory add-on percentage that varies depending on the loan type and, for Direct Unsubsidized Loans, whether the loan was made to an undergraduate or graduate student. Loans first disbursed during different 12-month periods may have different interest rates, but the rate determined for any loan is a fixed interest rate for the life of the loan.

For each loan type, the calculated interest rate may not exceed a maximum rate specified in the HEA. The maximum interest rates are 8.25% for Direct Subsidized Loans and Direct Unsubsidized Loans made to undergraduate students, 9.50% for Direct Unsubsidized Loans made to graduate and professional students, and 10.50% for Direct PLUS Loans made to parents of dependent undergraduate students or to graduate or professional students.

Frequently Asked Questions :

How much money will I save?

The exact amount youll save will depend on how much you owe and your interest rate. If you owe the average balance of $5600 today, you will save approximately $800 in interest over the lifetime of your loan.

Will my monthly payments go down?

The 0% Interest change doesnt adjust your monthly payments. Once you apply and qualify, the zero interest calculation will be immediately applied to your account. That means all of the monthly payment youre making right now will go directly toward paying on the principal amount, and youll pay your loan down faster.

If you want to change your monthly payment, please call Resolve. They can help you with that at any time.

What happens if I move out of Nova scotia?

You must be a resident of Nova Scotia to remain eligible.

I just finished repaying my student loans, and/or I paid it off early. Do I qualify?

The zero interest benefit applies to qualifying students who are still in active repayment, and those who are starting repayment in the future.

1. The zero interest program applies to Nova Scotia Student Loans only, not to Canada Student Loans.

You May Like: Free Government Smartphones In Texas

How To Choose Between Subsidized And Unsubsidized Loans

Ultimately, subsidized loans are better for those with financial need, but they are also a wise choice simply to minimize the total amount of student debt you end up with after completing school. However, those who have larger borrowing needs than subsidized loans allow may find it necessary to supplement with unsubsidized loans.

Unsubsidized loans accrue interest from the day they are disbursed to the school and during all other periods regardless of loan status, says Betsy Mayotte, president and founder of the Institute of Student Loan Advisors , a 501 that offers advice and resources for students. For those reasons, subsidized loans are often less expensive over the long run for student loan borrowers, as they at least don’t have to contend with the interest that accrued while they are in school.

This story was originally featured on Fortune.com

Example Of Subsidized Loan Eligibility

Lets say you are a dependent student and in your 3rd year of college. Your total cost of attending college is $10,000, which includes: tuition, fees, books, supplies, transportation, lunch, and personal expenses. Your expected family contribution determined from your FAFSA is $3000 and your total financial aid from grants and scholarships totals $2,000. You have expenses not met of $5000 . You could get a subsidized loan for the portion of expenses that were not met which is $5000. If you still need additional money to cover costs, you could receive a maximum of $500 in an unsubsidized loan. You could not exceed $2,500 in an unsubsidized loan since the maximum a 3rd year student could borrow in federal direct loans is $7,500.

$10,000 Cost of Attendance $3,000 Expected Family Contribution $2,000 Financial Aid

Also Check: Free Government Grants For Cancer Patients

How To Pay Interest On Unsubsidized Loans

Most students donât start making payments until they leave school, but did you know you can start paying them before while youâre still at PCC? In fact, it is a really good idea to pay the interest on your loans while you are still taking classes. A small payment each month can keep that interest from stacking up and save you a lot of money.

For example: for a $5,000 loan, your monthly interest payments would be $28. If you paid this interest while in school, you would save $940!

Choose a loan by selecting a numbered box

Find contact info

Take Out Federal Student Loans

If you need to borrow for school, its usually best to rely on federal student loans first. This is mainly because youll have access to federal student loan benefits such as income-driven repayment plans and student loan forgiveness programs.

Once you complete the FAFSA, your school will send you a financial aid award letter detailing the federal student loans, federal financial aid, and school-based scholarships you qualify for. You can then choose which aid youd like to accept. Heres an example of how an award letter might look:

You May Like: Best Government Jobs Without Degree

The Difference Between Subsidized And Unsubsidized Student Loans

Federal student loans can be either subsidized or unsubsidized. The primary difference between the two options are the way you’ll pay the interest and your total debt after graduation. Unsubsidized loans start accruing interest immediately after they’re disbursed, while with subsidized loans, interest is not charged until you enter repayment.

Direct Unsubsidized Loans:

- Who pays interest costs? The borrower.

- What’s the lifetime maximum limit? $31,000 for dependent undergraduate students, $57,500 for independent undergraduate students and $138,500 for most graduate or professional students.

- Do you need to demonstrate financial need? No.

- Who can borrow? Undergraduate students, graduate students and professional degree students.

- Are there extra costs involved? 1.057 percent fee for loans disbursed on or after Oct. 1, 2020, and before Oct. 1, 2023.

Direct Subsidized Loans:

- Who pays interest costs? The U.S. Department of Education pays interest while the student is enrolled in school at least half time, during the six-month postgraduation grace period and during deferment. The borrower pays interest during regular repayment periods.

- What’s the lifetime maximum limit? $23,000.

- Do you need to demonstrate financial need? Yes.

- Who can borrow? Undergraduate students.

- Are there extra costs involved? 1.057 percent fee for loans disbursed on or after Oct. 1, 2020, and before Oct. 1, 2023.