Your Annual Credit Report Is Now Available Weekly And Its Still Free

The three national credit reporting agenciesTransUnion, Experian and Equifaxare required by federal law to provide you with a free annual credit report. In fact, AnnualCreditReport.com was created by the credit reporting agencies as a one-stop-shop to provide you with your annual credit reports.

In response to the COVID-19 health crisis, TransUnion is pleased to offer you one free weekly credit report online through April 20, 2022 at AnnualCreditReport.com. Reviewing your credit reports regularly helps you ensure the information reported is accurate. It also gives you an opportunity to monitor your account history to combat identity theft.

How Do I Get A Copy Of My Credit Report

Right now, its easier than ever to check your credit report more often. Thats because everyone is eligible to get free weekly online credit reports from the three nationwide credit reporting agencies: Equifax, Experian, and Transunion. To get your free reports, go to AnnualCreditReport.com. The credit reporting agencies are making these reports free until April 20, 2022.

Each of the three nationwide credit reporting agencies Equifax, TransUnion, and Experian are already required to provide you, on your request, with a free credit report once every twelve months. Be sure to check your reports for errors and dispute any inaccurate information.

In addition to your free weekly online credit reports until April 20, 2022 and your free annual credit reports, all U.S. consumers are entitled to six free credit reports every 12 months from Equifax through December 2026. You can access these free reports online at AnnualCreditReport.com or get a “myEquifax” account at equifax.com/personal/credit-report-services/free-credit-reports/ or call Equifax at .

Why Trust Your Credit Score

The Experian credit score is derived from a credit bureau check, and includes your borrowing, charging and repayment activities. It summarises a number of positive and negative factors that aim to predict how likely you are to honour your credit commitments in the future.

A favourable credit report helps you reach your financial goals while poor credit reports and credit scores limit your financial opportunities. Since your credit report could influence whether you are able to buy a home or get any kind of credit, it is extremely important to protect your credit score by making loan and account payments on time and not taking on more debt than you can handle.

Key information used to calculate your credit score includes account information , public records, such as judgments and administration and sequestration orders. Information such as race, gender, where you live and marital status are not used in calculating credit scores.

Recommended Reading: Government Grants For Home Repairs

How To Get A Free Annual Credit Report From The Government

The Fair Credit Reporting Act entitles all Americans to a free credit report every 12 months. You can make this request via the official government-run website. The credit report contains information from the three major US credit reporting bureaus

This will take you to a page outlining the three-step process required to request your credit report.

This begins the three-step process.

How Things Work Now

Currently, Americans have multiple scores from each of the three major reporting bureaus. Scoring models vary in how which factors are weighted more heavily but all credit scores are used to evaluate a person’s ability to manage credit and debt. They’re used to decide who gets a car or home loan, credit cards, apartment.

These factors include:

- Payment history

- Length of credit history

- New credit

Read Also: Enhanced Relief Mortgage Program For The Middle Class

The Goal: Eliminate Errors Ensure Fair Practices End Confusion

Fixing mistakes on a credit report can be a byzantine system of filling out forms and phone calls.

“The fact that their customers are creditors and other users of information explains the unacceptable error rates and bias against consumers who complain about errors,” Wu argued, adding that, “if consumers are not able to obtain legal redress for FCRA violations, a key means of enforcement disappears, making the broken credit reporting system much, much harder to fix. A public credit registry would replace or provide an alternative to this broken system.”

Both Wu and Waters referenced a recent Supreme Court decision, which narrowed the case brought by an Arizona man who had successfully sued Transunion for relief after a car dealership’s credit check incorrectly flagged him as being on a terrorist watchlist.

But even smaller errors can cost you over the long haul in the form of higher interest rates on mortgages and car loans or possibly getting a mortgage or rent application denied, even if you satisfy the income requirements.

How The Fair Credit Reporting Act Works

The Fair Credit Reporting Act is the primary federal law that governs the collection and reporting of credit information about consumers. Its rules cover how a consumer’s credit information is obtained, how long it is kept, and how it is shared with othersincluding consumers themselves.

The Federal Trade Commission and the Consumer Financial Protection Bureau are the two federal agencies charged with overseeing and enforcing the provisions of the act. Many states also have their own laws relating to credit reporting. The act in its entirety can be found in United States Code Title 15, Section 1681.

The three major credit reporting bureausEquifax, Experian, and TransUnionas well as other, more specialized companies, collect and sell information on individual consumers’ financial history. The information in their reports is also used to compute consumers’ credit scores, which can affect, for example, the interest rate they’ll have to pay to borrow money.

Don’t Miss: Rtc Las Vegas Jobs

Submit Your Request By Phone:

To request your credit report free of charge by phone, use our Interactive Voice Response system: . Interactive Voice Response is an automated tool that gathers the required information to process your request through voice response or key pad selection. It is important to note that when requesting your free credit report by phone, you will be required to enter your Social Insurance Number . If you do not wish to provide your S.I.N., you will need to select a different option to submit your request such as mail or in person. If/when you complete the identity validation process, your credit report will be sent to your home address via Canada Post within 5-10 days.

Request Your Free Medical History Report

You have the right to get one free copy of your medical history report each year. You can request a copy for:

- Yourself

- Someone else, as a legal guardian

- Someone else, as an agent under power of attorney

Request a medical history report online from MIB or by phone at 1-866-692-6901.

Not everyone has a medical history report. Even if you currently have an insurance plan, you won’t have a report if:

- You haven’t applied for insurance within the last seven years

- Your insurance policy is through a group or employer policy

- The insurance company isnt a member of MIB

- You didnt give an insurer permission to submit your medical reports to MIB

Don’t Miss: Free Government Phones In Virginia

Errors On Your Credit Report

If you find errors on your credit report, write a letter disputing the error and include any supporting documentation. Then, send it to:

Find a sample dispute letter and get detailed instructions on how to report errors.

The credit reporting agency and the information provider are liable for correcting your credit report. This includes any inaccuracies or incomplete information. The responsibility to fix any errors falls under the Fair Credit Reporting Act.

If your written dispute does not get the error fixed, you can file a complaint with the Consumer Financial Protection Bureau .

Here Are Some Key Questions To Ask:

- If I cant make my payment as a result of the coronavirus, what are the hardship or relief programs available?

- Are there fees associated with any of these programs?

- Will I have the option of deferring the repayment of any amounts owed to the end of my loan?

- If Im able to defer or lower my monthly payments, will interest continue to accrue during this hardship or relief period?

- How long does the hardship or relief period last and when will I need to start repaying?

- If my financial situation hasnt changed once the hardship or relief period ends, what will be the options?

- How will this agreement or relief be reported to the credit reporting agencies? Note: that the recently passed CARES Act places special requirements on companies that report to credit reporting agencies if they provide payment relief due to coronavirus.

- For credit cardswill I lose the ability to use my card if I enroll or request relief?

There are special forbearance or relief programs for some types of mortgages. To learn more, go to the Mortgage and housing assistance page.

Recommended Reading: Free Government Grants For Dental Implants

Specialty Consumer Reporting Agencies

Specialty consumer reporting agencies prepare reports on consumers’ histories for specific purposes. The reports cover employment, insurance claims, residential rentals, check writing, and medical records. Think about ordering a specialty report if you are ready to buy homeowners or automobile insurance, open a checking account, apply for private health or life insurance, or rent a home or apartment.

Property Insurance Claim Reports: Insurance companies often check reports of this kind when you apply for homeowners or automobile insurance. One of these reports is the CLUE report .2 CLUE reports contain information on property loss claims against homeowner’s insurance and automobile insurance policies. A CLUE report contains personal information, such as your name, birth date, and Social Security number. It also contains a record of any auto or homeowner property loss claims you submitted to an insurance company. It includes the type of loss, date of the loss, and amount paid by the insurance company. It lists inquiries, or companies that have checked your claim history.

Another property loss report is called A-PLUS . The A-PLUS database is compiled by a smaller company and is less commonly used than the CLUE database. You may order a CLUE report and an A-PLUS for free once every 12 months.

Tenant History Reports: Landlords sometimes check your tenant history as well as your credit history. You may order a free copy of your tenant history report once every 12 months.

How To Access Your Free Credit Reports

To access your free credit reports, visit AnnualCreditReport.com. Youll need to answer some questions to prove your identity in order to see your reports. If you have difficulty accessing your report online, you can also request it by phone or postal mail. You can choose to access your report for any of the three credit bureaus or all three at once.

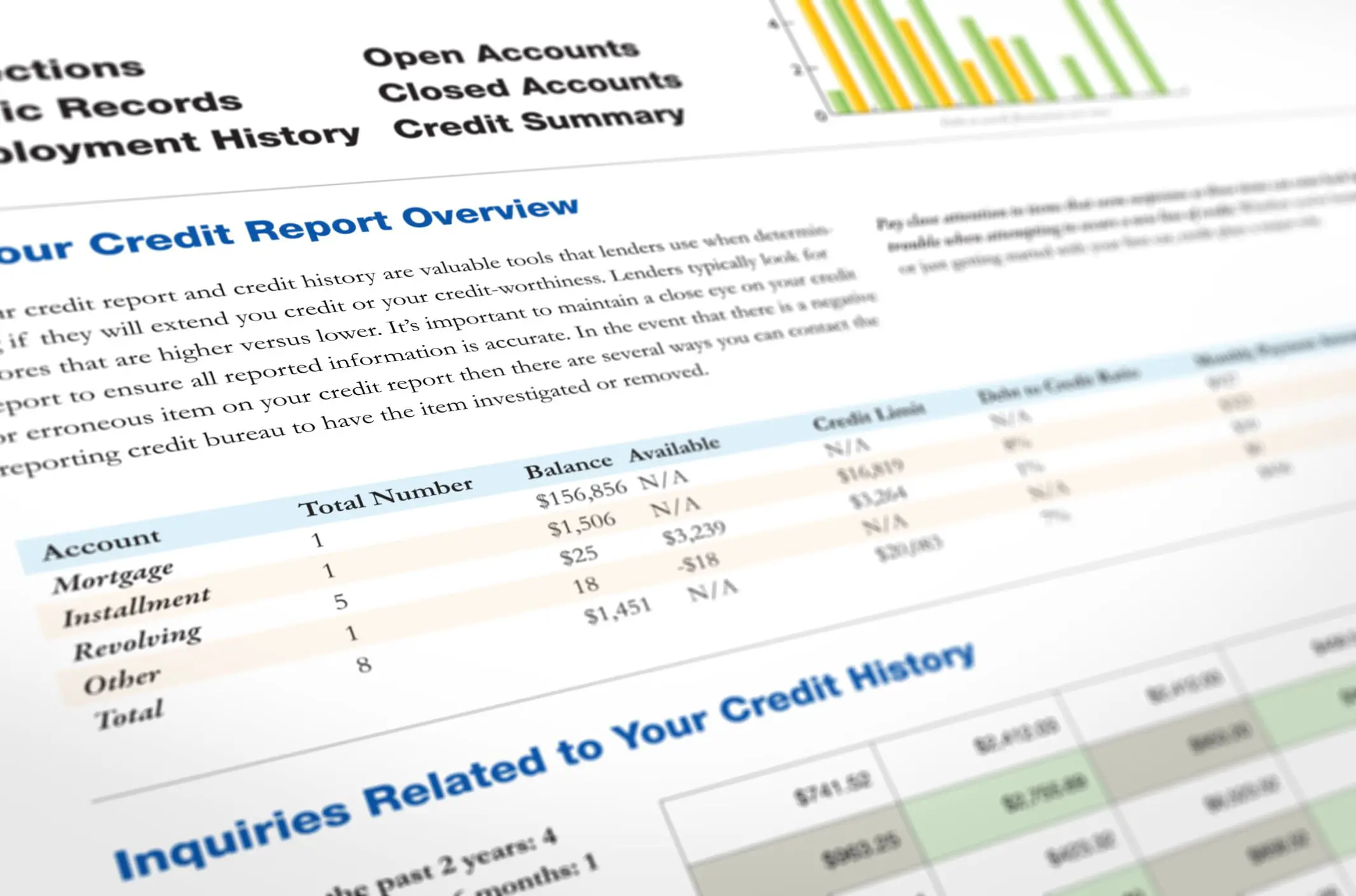

These reports dont show a credit score but instead provide a thorough history of your financial activities, including payments history and balances for credit cards, mortgages, and car, personal, or student loans.

When you access your report, make sure all the information is correct. If youve paid at least the minimum on time each month, your accounts should be listed as being in good standing. If you have past-due payments or an account in collections, this will also be noted on your report.

You May Like: Grants To Start A Trucking Company

Consumer Rights Under The Fair Credit Reporting Act

Consumers also have a right to see their own credit reports. By law, they are entitled to one free credit report every 12 months from each of the three major bureaus. They can request their reports at the official, government-authorized website for that purpose, AnnualCreditReport.com. Under FCRA, consumers also have a right to:

- Verify the accuracy of their report when it’s required for employment purposes.

- Receive notification if information in their file has been used against them in applying for credit or other transactions.

- Disputeand have the bureau correctinformation in their report that is incomplete or inaccurate, in an effort to repair their credit.

- Remove outdated, negative information .

If the credit bureau fails to respond to their request in a satisfactory manner, a consumer can file a complaint with the Federal Consumer Financial Protection Bureau .

How To Obtain Your Free Credit Reports

The three major credit reporting agencies in the U.S. teamed up to provide where you can order your free credit reports: www.annualcreditreport.com.

Once there, answer a series of questions to verify your identity, and select which reports to view. You can also call 877-322-8228 to request a copy of your credit reports by phone.

Also Check: 8774182573

How To Get A Free Credit Report

Order a copy of your credit report from both Equifax Canada and TransUnion Canada. Each credit bureau may have different information about how you have used credit in the past. Ordering your own credit report has no effect on your credit score.

Equifax Canada refers to your credit report as credit file disclosure.

TransUnion Canada refers to your credit report as consumer disclosure.

Correct An Inaccuracy On Your Equifax Credit Report

If you find any information that you believe is inaccurate, incomplete or a result of fraud, you have the right to file a dispute with Equifax Canada. You will need to complete the enclosed with your package. You can also review how to dispute information on your credit report for additional details on the Equifax dispute process.

Don’t Miss: Government Contractors Charleston Sc

What Is A Credit Report

Your personal credit report contains details about your financial behavior and identification information. Experian® collects and organizes data about your credit history from your creditor’s and public records. We make your credit report available to current and prospective creditors, employers and others as permitted by law, which may speed up your ability to get credit. Getting a copy of your credit report makes it easy for you to understand what lenders see when they check your credit history. Learn more.

Pick The Reports You Want

There are three major US credit bureaus: Equifax, Experian and TransUnion. Each maintains a separate account of your “credit record”. Therefore, certain credit information might appear on one report but not on another.Choose the reports you’d like to receive. The Fair Credit Reporting Act permits you to receive one of each credit report every 12 months in other words, you could request an Equifax report today, an Experian report tomorrow, and a TransUnion report the next day.I like to receive all three reports at once, so I’m going to check all three boxes.

You May Like: Safelink Free Phone Replacement

How Do I Order My Free Annual Credit Reports

The three national credit bureaus have a centralized website, toll-free telephone number, and mailing address so you can order your free annual reports in one place. Do not contact the three national credit bureaus individually. These are the only ways to order your free credit reports:

- complete the Annual Credit Report Request Form and mail it to:

Annual Credit Report Request Service

P.O. Box 105281

Atlanta, GA 30348-5281

How To Review Your Credit Reports

To check your reports for errors or possible signs of identity theft, look especially at three areas.

You can view sample credit reports, with the different sections explained, on the Web sites of the three credit bureaus: experian.com, transunion.com, equifax.com/home/en_us.

Also Check: City Of Hot Springs Jobs

What Is Your Free Credit Score

Your credit score is the single most important financial score youll ever get. Yes, its even more important than matric aggregate, body fat count, or golf handicap, since credit providers use this credit score when deciding whether or not to extend credit to you. So be sure to maintain a good track record!

Your Experian credit score is calculated via a credit bureau check, using information from your full credit profile. Experian evaluates all of your accounts, your negative and positive information, and your payment history to assign you a credit score of 0999. The higher your credit score is, the better your credit profile, and the lower your risk will be of defaulting on an account or loan would be.

Can I Buy A Copy Of My Report

Yes, if you dont qualify for a free report, a credit bureau may charge you a reasonable amount for a copy of your report. But before you buy, always check to see if you can get a copy for free from AnnualCreditReport.com.

To buy a copy of your report, contact the national credit bureaus:

Federal law says who can get your credit report. If youre applying for a loan, credit card, insurance, car lease, or an apartment, those businesses can order a copy of your report, which helps in making credit decisions. A current or prospective employer can get a copy of your credit report but only if you agree to it in writing.

Don’t Miss: Data Governance Implementation Plan