Solar Government Incentives In The Us And Canada

The United States offers great incentives for its citizens to go solar. The NL Clean Energy Technology Center created a comprehensive database to summarize applicable incentives and policies by state. Interestingly, the Golden State of California is doing impressive work on solar incentives making them a true leader for solar power generation in the US. Here are some of the renewable energy incentives implemented in California:

- The Solar Investment Tax Credit is a federal incentive that offers a whopping 26% tax credit. When you file your taxes, the Solar ITC provides a cashback on the annual taxes and is usually computed as a percentage of the aggregate cost

- Moreover, California also has the Net Energy Metering which transfers all unutilized solar energy back to the utility company. In return, solar PV users are paid in a form of credit for all excess solar energy sent to their system. This setup ensures that no energy is wasted and ordinary homeowners that generate excess solar energy have the power to sell it – truly an amazing deal!

In the case of Canada, they provide solar incentives at the provincial level in the form of cashback, discounts, insurance, tax credits and more. Specific government incentives and programs are likewise found on the digital platform at Natural Resources Canada.

Fossil Fuel And Nuclear Subsidies

In contrast to what weve gotten from our renewables investment, from fossil fuel and nuclear subsidies weve only gained more pollution and higher costs.

U.S. costs from the climate crisis caused by the burning of coal, oil and natural gas will soon climb to $360 billion a year, according to the Universal Ecological Fund. The International Monetary Fund estimates that in the U.S., public health costs from air pollution caused by fossil fuel emissions were $300 billion in 2015. And Oil Change International notes:

The cost of federal fossil fuel subsidies to American taxpayers is equivalent to the projected 2018 budget cuts from proposals to slash 10 public programs and services, including supports for Americas most vulnerable children and families. Misplaced priorities, not a scarcity of resources, are driving this administrations efforts to balance the national budget at the expense of the most vulnerable.

The Congressional Research Services estimate of $100 billion in federal nuclear subsidies goes back more than 70 years. But its still mounting.

The research service says that since 2010, nuclear power has received in excess of $4 billion more in taxpayer support for technology development than renewables have. Taxpayers for Common Sense reports that the new units at Georgia Powers Vogtle nuclear plant, under construction since 2013, have received more than $12 billion in loan guarantees but now are projected to cost twice as much as initially estimated.

How Is The Home Battery Scheme Different To South Australias Virtual Power Plant Announced In February 2018

South Australiaâs Virtual Power Plant was announced prior to the launch of the Home Battery Scheme, and was designed in phases to demonstrate the viability of a virtual power plant to reduce energy costs for households and support the energy grid in ways that could reduce energy costs for all South Australians.

The trial phases involved 1,100 Housing SA properties being fitted with solar and battery storage systems. All installations under the trial phases were completed in 2019. Tesla is now rolling out Phase 3 of South Australiaâs Virtual Power Plant to another 3,000 Housing SA properties, and plans to have up to 50,000 South Australian homes connected over time.

With the Home Battery Scheme subsidy, private households can purchase a Tesla Powerwall and enrol their home energy system in South Australiaâs Virtual Power Plant. To find out more about the Tesla Energy Plan visit .

To learn more about a range of virtual power plant programs available in South Australia, you can read summaries of current programs on the âJoin a VPPâ page of this website.

Read Also: How To Hook Up Multiple Solar Panels

Read Also: What Is The Us Government Debt

Why Government Gives Solar Subsidy

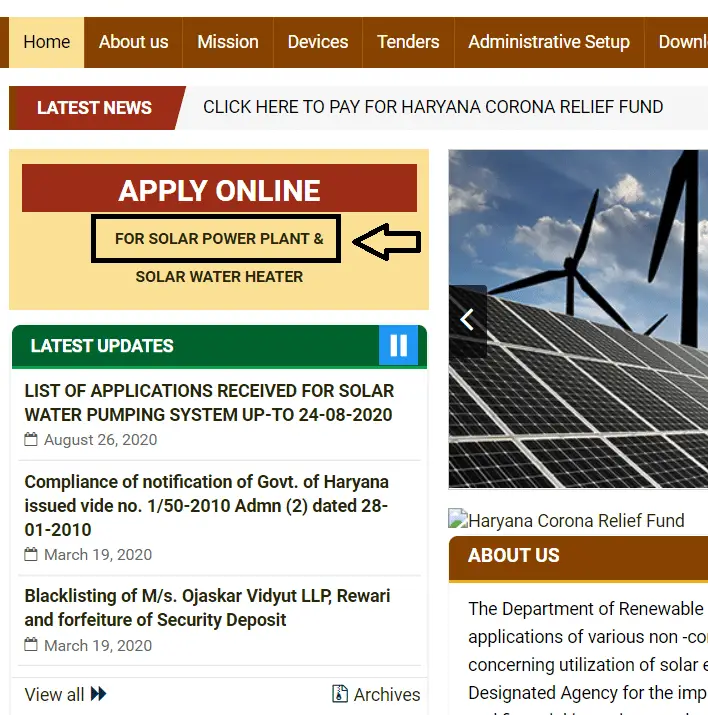

India had target to install 40GW solar panels at residentail home buildings, but India has achived only 5GW till 2021. Indian Goverment sets target 280GW solar panels by 2030 that means, every year should be install 10GW every year. Government has taken new intitives to install solar panels at homes, such as any customers can install solar panels by any solar dealer / distributors / company, installers and after installing they will send solar panel installation photo to the nearest electricity board.

Who Can Qualify For Solar Incentives

Whether you can qualify for a solar incentive program depends on a few factors, including:

- Incentive availability in your state

- Whether you have tax liability

- Your annual income

Yes, its true: some states dont offer incentives for solar. In these places,solar can still make financial sense, but not because of anything the statelegislature is doing to help homeowners go solar.

The good news is everyone can qualify for the federal tax credit – as long as they have enough income to owe taxes.Tax liability is a fancy way of saying the amount that you pay in taxes.

Your annual income determines how much you owe, and if you make enough, youll be able to claim bothfederal and state solar tax credits. In many cases, you can claim thesecredits over multiple years if your tax liability is less than the totalamount of the credits.

Low-income solar incentives

Your annual income can also help you qualify for incentives in theopposite direction. If you make below the area median income inseveral states, you may qualify for low-income grants and rebatesthat can greatly reduce the cost to go solar – even making solarbasically free in some places.

Learn more:Low-income solar incentives by state

Do solar leases and PPAs qualify you for incentives?

The good news is that people who choose a solar lease or PPA in a statethat offers incentives will likely find the per-kWh electricity pricefrom the solar installer lower than people in states without incentives.

Recommended Reading: Grant From Government For House

How To Get Solar Subsidy In Jharkhand

The government announced a 40% subsidy for up to 3 kW system but it was difficult to get funds due to the pandemic. The subsidy is available for residential homeowners who install on-grid solar systems. It is provided by the state discom company after submitting the complete installation documents on their portal.

Homeowners Guide To Going Solar

Since 2008, hundreds of thousands of solar panels have popped up across the country as an increasing number of Americans choose to power their daily lives with the suns energy. Thanks in part to Solar Energy Technologies Office investments, the cost of going solar goes down every year. You may be considering the option of adding a solar energy system to your homes roof or finding another way to harness the suns energy. While theres no one-size-fits-all solar solution, here are some resources that can help you figure out whats best for you. Consider these questions before you go solar.

See the Spanish version here. Vea la versión en español aquí.

How does solar work?

There are two primary technologies that can harness the suns power and turn it into electricity. The first is the one youre likely most familiar with photovoltaics, or PV. These are the panels youve seen on rooftops or in fields. When the sun shines onto a solar panel, photons from the sunlight are absorbed by the cells in the panel, which creates an electric field across the layers and causes electricity to flow. Learn more about how PV works.

Is my home suitable for solar panels?

How do I start the process of going solar?

Can I install solar myself?

How much power can I generate with solar?

Will I save money by going solar?

Can I get financing for solar?

How can I find state incentives and tax breaks that will help me go solar?

Is solar safe?

What does mean?

Don’t Miss: What Is Data Governance Framework

Solar Net Metering Benefit

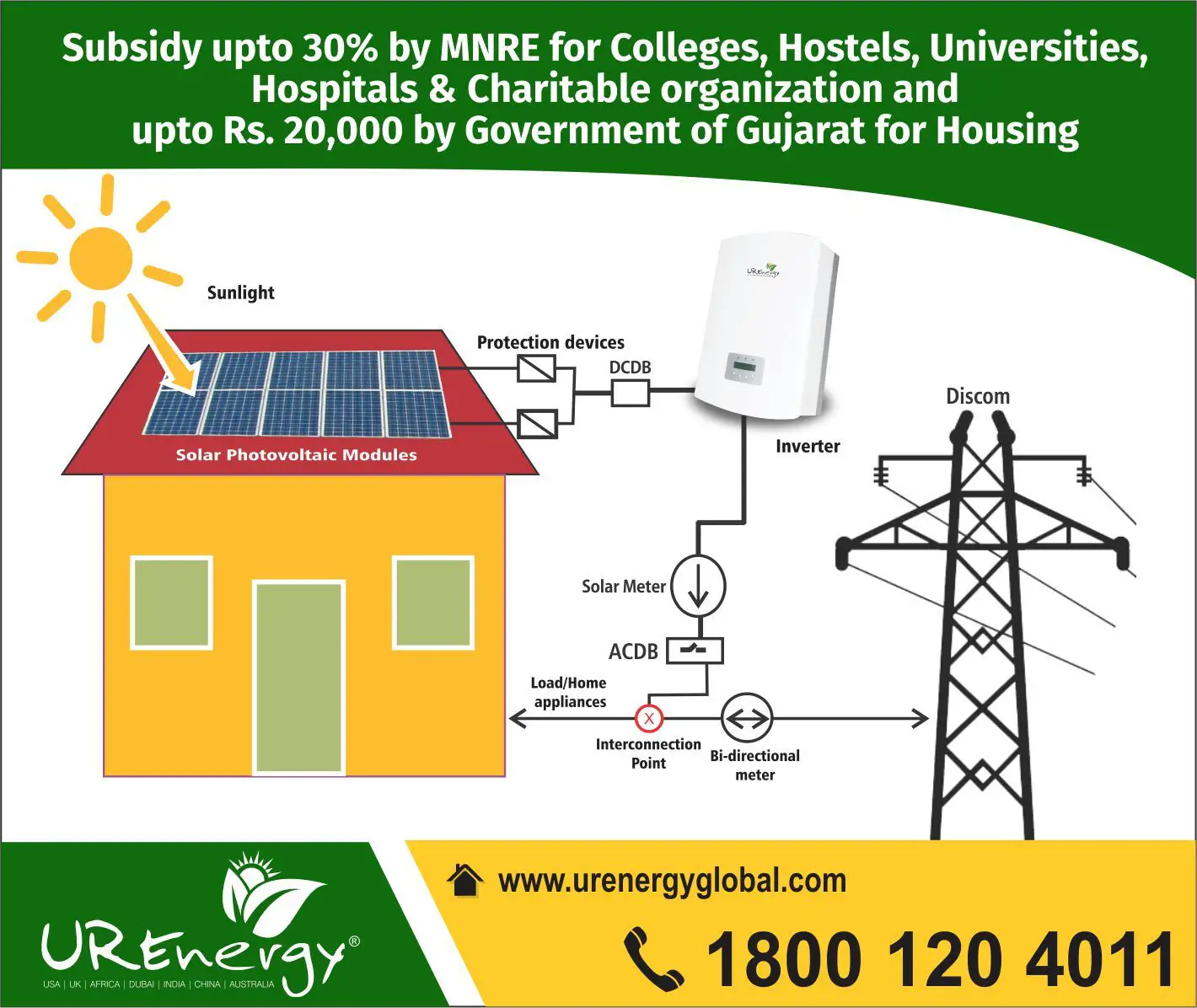

An on-grid solar system gives you subsidy benefits as well as net metering benefits. You can run all your appliances in the daytime by using solar power. Keep in mind that at this time you are not using grid electricity and hence your electricity bill is not increasing during the day.

If your solar system is generating more electricity than you consume, you can export it to the utility grid through a net meter. A net meter is a small device that allows you to inject electricity into the government grid. It measures the units of electricity that have been exported by you to the grid. At the end of the month, the government will adjust it in your electricity bill and pay you a certain amount as per your export.

In case your solar system is generating less solar energy than your consumption, then you can use grid electrified without any problem. Because the grid connection will already be connected to your home appliances.

How Much Subsidy Is Available On Solar

According to the latest notification by MNRE, 30% to 90% subsidy on benchmark capital cost is available for all consumers. But actually, how much subsidy you will get on solar panels depends on what capacity and type of solar system you are getting installed.

Lets know how much subsidy you will get for installing a solar system of which capacity.

- 4kW Solar System 10kW Solar System = 20% Subsidy

- More than 10kW Solar System = No Subsidy

Recommended Reading: Government Grants For Home Improvement

Thin Film Solar Panels

Despite being very thin and flexible, thin-film panels use very fine layers made of very thin layers. Solar panels made from thin-film materials use a thin layer of photovoltaic material applied to a solid surface like glass. Solar panels can be made from materials such as amorphous silicon, copper indium gallium selenide, and cadmium telluride. In order to ensure that people can outfit themselves according to their needs, thin-film solar panels are available in different sizes and forms. Utility companies and large-scale industries usually use thin-film panels.

Cost: surely the cost of solar panels depends on the number of panels and watts you need for your purpose. Solar panels tend to come in watts by watts. Thus, you can expect to pay between $1.00 and $1.50 per watt when you choose thin-film solar panels. Depending on the usage of watts, the amount may be higher the average cost from purchasing thin-film panels to installing them ranges from $6000 to $9000. Industrial purposes may require a lot of space and can be costly.

Also Check:

Homeowners Guide To The Federal Tax Credit For Solar Photovoltaics

This webpage was updated September 2022.

Disclaimer: This guide provides an overview of the federal investment tax credit for residential solar photovoltaics . It does not constitute professional tax advice or other professional financial guidance. And it should not be used as the only source of information when making purchasing decisions, investment decisions, tax decisions, or when executing other binding agreements.

You May Like: Government Jobs In Roseville Ca

Up To 90% Subsidy On Solar Pumps

For the overall development of India, the government is paying special attention to the agriculture sector. Therefore, the government of India is providing up to 90% subsidy to farmers and others who want to install solar water pump at their places.

But like subsidy on solar system, subsidy on solar water pump also depends on the policy of your state. There are some special provisions for some hilly states like J& K, Himachal Pradesh & UK. However, you can apply to install subsidized solar water pumps in any state. It definitely going to double your profits.

Read in detail: Solar Pump Yojana Subsidy on solar water pump in India.

Renewable Portfolio Standards And State Mandates Or Goals

A renewable portfolio standard typically requires that a percentage of electric power sales in a state comes from renewable energy sources. Some states have specific mandates for power generation from renewable energy, and some states have voluntary goals. Compliance with RPS policies will sometimes require or allow trading of Renewable Energy Certificates.

You May Like: Do Solar Panels Work With Snow On Them

Also Check: How To Get Off Government Watch List

Investment Tax Credit For Solar

The federal investment tax credit is far and away the best solar incentive. The ITC gives back 26 percent of what you paid for solar on your taxes. Instead of a deduction, which reduces your taxable income , a tax credit directly offsets what you would otherwise owe in taxes. In other words, instead of just being taxed on a lower income, the federal ITC offsets what you actually owe in taxes, and can even come back to you as a refund.

You May Like: What Is A Solid Surface Sink

State & Local Incentives

The other perk here is that you can apply the 26% discount costs of your solar system after also taking any state-level rebates or incentives, meaning you can benefit from both federal and state incentives to help offset the costs of going solar. On a state level, most have an incentive program in the form of a tax credit, but it varies state-to-state. Many local cities and counties also offer direct rebates to help with the costs of solar panel systems and installation.

You May Like: Government And Public Sector Consulting

Government Subsidies For Solar Panels

Government Subsidies for Solar Panels Substitutes can help reduce the price of economic costs of some necessary telltales. Solar energy is a substitute and also an opportunity cost for the energy we use now, called fossil fuels. There are many benefits to switching from fossil fuels to solar energy. Solar energy can help lower the cost of the energy we use now by burning fossil fuels, changing the supply and demand of the product. Also, it can help the pollution that Is causing further health and economic problems.

Since there are many benefits to funding research about solar energy and knowing the benefits the alarm panels actually have, I believe government funding to keep prices low on this product is necessary. Subsidies given to producers of solar panels would mean money given to businesses would be used to keep prices low, and all the benefits currently about solar panels would still be in play. Also, if subsidies are given to businesses, there will be a lower chance of a monopoly because the prices will remain at a lower cost.

How Long Does It Take To Repay The Investment In A Solar System

Solar systems typically have a useful life of at least 25 years, and carry a warranty for 25 years. With all the incentives available, customers can typically recover their investment within 5-8 years, which means you get free electricity and extra credits for the remainder of the 25-year period. Its hard to beat that kind of return.

Since its so easy to offset the costs, why isnt everyone installing a solar energy system? If thats the question youre asking yourself, why not let us help you determine the best answer for your home and family?

You May Like: Social Security Government My Account

Solar Companies: Solar Photovoltaic Installers

The solar industry is constantly innovating, improving and growing. And while there are many solar installers out there, only a handful of them can offer real value for your solar panel investment.

At PADCON, our decades of experience in the solar industry guarantees energy-efficient, high-quality solar power systems and innovative technological advancements. Our anti-PID system is one of a kind – yielding the highest energy efficiency, making us a true market leader for this segment.

Contact us to get the best possible solar products and benefit from your state-subsidized solar power plants today!

Who Can Get Subsidy On Solar

Perhaps now you must be thinking that am I also eligible for subsidy on the solar system? This question bothers most people because no one gives a direct answer to it. Have a look below to know who is eligible for subsidy on solar in India.

- All residential homeowners are eligible to get govt. subsidy on a solar system.

- Registered societies, multi-store apartments, and cooperative group housing societies are eligible for subsidies.

- Institutes like schools, colleges, universities are eligible for solar subsidy schemes.

- NPOs , old age homes, orphanages, etc are also eligible.

- Farmers who want to install solar pumps in their fields can take advantage of the subsidy scheme.

Recommended Reading: Government Employee Car Rental Discount

Reap Solar Panel Grants

As the majority of Americans rely on small businesses for employment, they are the engine of the American economy. Small businesses can receive different grants and assistance to enable them to succeed and create jobs for the people.

You can think about solar panels through a grant program if you own a small business or farm. Certainly, the U.S. Agriculture Department offers grants of up to $20,000 to help small businesses operate and succeed.

This money is used by small businesses to buy solar panels that generate electricity for their businesses and farms. To qualify for this grant, there are specific eligibility criteria that need to be understood.

Wind And Solar Subsidies

The main drivers of wind and solar power among federal policies in the past decade have been the production tax credit for wind and the investment tax credit for solar.

The production tax credit is a per-kilowatt-hour subsidy for generating power that applies to any wind project. It phases out at the end of this year. The current investment tax credit, adopted by Congress in 2006, is a rebate of 30 percent on the cost of all solar projects. After 2021, it is eliminated for residential installations, and drops to 10 percent permanently for commercial projects.

The American Wind Energy Association says the production tax credit, passed by Congress in 1992, essentially created the wind industry as we know it. AWEA says that within the past decade, the credit has:

- Contributed more than $760 million in local and state taxes.

- Resulted in nearly $290 million in lease payments to farmers annually.

The Solar Energy Industries Association attributes the investment tax credit in the past 10 years to growing the industry by more than 10,000 percent and leveraging $140 billion in economic activity. The solar industry now employs more than 240,000 people.

The tax credits for wind and solar have contributed to a remarkable drop in the cost of renewables projects. In the past decade, wind costs have declined nearly 70 percent and utility-scale solar costs also fell by almost 90 percent. New solar and wind power are now cheaper than new coal, nuclear and natural gas technology.

Read Also: Parking Garages Near Government Center Boston