All Spaxx Fidelity Investment Platforms In More Detail

You can compare SPAXX Fidelity Investment Platforms ratings, min deposits what the the broker offers, funding methods, platforms, spread types, customer support options,regulation and account types side by side.

We also have an indepth Top SPAXX Fidelity Investment Platforms for 2022 article further below.

We have listed top SPAXX Fidelity Investment Platforms below.

How Is My Account Protected

Protecting your account assetsFidelitys brokerage businesses are members of the Securities Investor Protection Corporation , and brokerage accounts maintained with Fidelity are covered by SIPC, which protects brokerage accounts of each customer when a brokerage firm is closed due to bankruptcy or other financial difficulties and customer assets are missing from accounts.

SIPC protects brokerage accounts of each customer up to $500,000 in securities, including a limit of $250,000 on claims for cash awaiting reinvestment. Money market funds held in a brokerage account are considered securities.

In addition to SIPC protection, Fidelity, through NFS, provides its brokerage customers with additional excess of SIPC coverage from Lloyds of London together with Axis Specialty Europe Ltd. and Munich Reinsurance Co. The excess of SIPC coverage would only be used when SIPC coverage is exhausted. As with SIPC, excess of SIPC protection does not cover investment losses in customer accounts due to market fluctuation. It also does not cover other claims for losses incurred while broker-dealers remain in business. Total aggregate excess of SIPC coverage available through Fidelitys excess of SIPC policy is $1 billion.

Furthermore, we also offer protection for your assets in the case of unauthorized activity in your account. For more information, please see our Customer Protection Guarantee.

What Are Money Market Funds

Money market funds are fixed income mutual funds that invest in debt securities characterized by short maturities and minimal credit risk. Money market mutual funds are among the lowest-volatility types of investments. Income generated by a money market fund is either taxable or tax-exempt, depending on the types of securities the fund invests in.

- Mutual funds

- Treasury bonds

A money market mutual fund is a type of fixed income mutual fund that invests in debt securities characterized by their short maturities and minimal credit risk. Money market mutual funds are among the lowest-volatility types of investments. Income generated by a money market fund can be either taxable or tax-exempt, depending on the types of securities in which the fund invests.

Regulations from the U.S. Securities and Exchange Commission define 3 categories of money market funds based on investments of the fundgovernment, prime, and municipal. SEC rules further classify prime and municipal funds as either retail or institutional based on investors in the fund.

You May Like: City Jobs Las Vegas Nevada

Risks Of Money Market Funds

- Unlike typical bank certificates of deposit or savings accounts, money market mutual funds are not insured by the Federal Deposit Insurance Corporation although money market mutual funds invest in high-quality securities and seek to preserve the value of your investment, there is the risk that you could lose money, and there is no guarantee that you will receive $1 per share when you redeem your shares

- Inflation risk Because of the safety and short-term nature of the underlying investments, money market mutual fund returns tend to be lower than those of more volatile investments such as typical stock and bond mutual funds, creating the risk that the rate of return may not keep pace with inflation

Prime money market funds:

- Foreign exposure Entities located in foreign countries can be affected by adverse political, regulatory, market, or economic developments in those countries

- Financial services exposure Changes in government regulations, interest rates, and economic downturns can have a significant negative effect on issuers in the financial services sector, including the price of their securities or their ability to meet their payment obligations

All prime and municipal money market funds:

- Liquidity risk The fund may impose a fee upon the sale of your shares, or may temporarily suspend your ability to sell shares, if the funds liquidity falls below required minimums because of market conditions or other factors

Fidelity Government Money Market Fund

Fidelity launched the Fidelity Government Money Market Fund in 1990, and boasts $219.95 billion in total assets as of May 2021, making it one of the most widely held funds in this category. Similar to the American Century Capital Preservation Fund, SPAXX strives to usher in high-yield returns, with high liquidity, and an emphasis on capital preservation.

The fund is typically 99.5% or more invested in cash or cash equivalents in the form of short-term U.S. government securities or repurchase agreements that are fully collateralized by cash or such securities. Some U.S. government securities are issued by duly authorized government agencies but are not directly issued nor guaranteed by the U.S. Treasury.

In selecting the fund’s investments, the funds management team focuses on maintaining a stable $1 net asset value share price. The weighted average maturity of the portfolio holdings is 54 days.

As of May 2021, the funds top holdings included the following:

- U.S. Treasury Bills

- Agency Fixed-Rate Securities

- U.S. Treasury Coupons

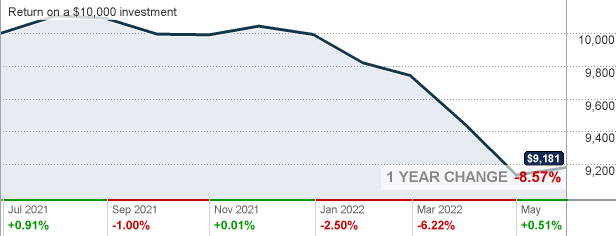

The fund has an annual expense ratio of 0.42% and a dividend yield of 0.01%. Its one-year total return is 0.00%. This fund is well suited for investors who prefer its broad range of investments.

Don’t Miss: Grb Platform

Surprisingly High Inflation Can Be A Challenge

Some inflation is normaland even good because it means the economy is growing. But inflation doesnât always behave the way itâs expected to. If itâs higher than expected or stays at an elevated level for a longer time than markets expect, managing investments can get tricky.

âSurprisingly high inflation can be a challenge for investment portfolios for 2 reasons: First, both bonds and stocks typically perform less well in a more inflationary environment. Second, stock-bond correlations tend to rise when inflation is higher. So bonds may provide less diversification benefits in that kind of environment,â Hofschire says.

Stock-bond diversification highest when inflation is tame

Past performance is no guarantee of future results.

Money Market Funds In A Low

As the Covid-19 pandemic stretches on, interest rates and yields have continued to fall. Rates on everything from CDs to money market funds have fallen to nearly zero. Today, some money market funds earn a yield of 0.00% while the highest paying funds yield no more than about 0.10%. Low yields have presented challenges to investors looking to earn income from cash.

For those who have cash balances below FDIC insurance limits, online savings accounts and money market accounts pay the highest rates. For those with cash balances well above FDIC limits, a money market fund is a relatively safe option. While yields are at historic lows, money market funds should react quickly when they begin to rise again.

Don’t Miss: Sacramento Jobs Government

Which Core Position Is Better Spaxx Or Fdic

The whole core position thing aims to have a place where you can hold your money till youre ready to invest it in securities or any other thing. Of course, some people will say, it doesnt matter just pick one randomly, which is not a bad idea.

However, this SPAXX vs FDIC analysis shows that each fund has its edge.

The FDIC-insured cash sweep program becomes a perfect match if your primary concern is to beat volatility and shield your money against possible risks.

On the flip side, if you care about return and yield, a government money market fund is the right pick.

But, as an investor, you want to seize every opportunity to make more profit, so, no lengthy analysis, go for SPAXX.

Although interest rates are extremely low currently, if it rises in the future, SPAXX will provide higher returns.

Ive Recently Moved Outside The United States What Does That Mean For Me

Regardless of where you move, the following applies:

Fidelity does not provide discretionary asset management services to customers who reside outside the United States. If you move outside the United States, your discretionary asset management relationships will be terminated, and certain mutual funds held in those accounts may be liquidated as part of that termination.

The services provided by our representatives are limited to those that are ministerial or administrative in nature. Among other things, this means that our representatives do not engage in discussions with customers about such topics as asset allocation, income planning, or portfolio composition.

Customers residing outside the United States will not be allowed to open new 529 Savings Plan Accounts or Health Savings Accounts , or to continue to contribute to existing 529s or HSAs.

Customers residing outside the United States will not be allowed to purchase shares of mutual funds.

There are additional restrictions that may apply, depending on the country where you now reside. Customers in certain countries may be limited to selling their existing holdings and withdrawing the proceeds from their accounts. They will not be able to make deposits in their accounts, or buy any additional securities. In most other countries, the restrictions will be less onerous, but customers may still experience certain limitations .

You May Like: City Of Los Lunas Jobs

American Century Capital Preservation Fund

The American Century Investments Capital Preservation Fund Investor Class was launched by American Century in 1972, and has over $2.22 billion in total assets under management , as of June 2021. The fund is primarily known for maximizing safety and liquidity. The fund aims to achieve the highest possible yield return consistent with its asset mix, which consists of Treasury bills, bonds, and notes. The fund ordinarily invests solely in short-term U.S. Treasury money market securities. The weighted average maturity of its portfolio holdings is 58.55 days.

The gross annual expense ratio for the Capital Preservation Fund was 0.48% as of May 2021. Its one-year total return as of December 2020 was 0.01%. This mutual fund is appropriate for investors whose current investment goals align with those of the strategy and who seek a pure-play government money market fund that invests exclusively in U.S. Treasury securities.

Money Market Funds With Low Costs And High Returns

We noticed a few patterns when comparing the best money market mutual funds on our list.

First, when it comes to expense ratios, many of the funds with the highest fees also require very significant minimum deposits. The one exception: Fidelity Money Market Fund , which is the only one on this listing with no minimum deposit requirement.

The reality of the current low-rate environment is that money market fund yields are minimal. When it comes to the funds on our list, few offer a seven-day yield that much above zeroall but one yield less than 0.10%.

Theres just one money market fund that stands out in terms of cost, yield and minimum investment: Invesco Premier Portfolio Fund . If you can meet the $1,000 minimum investment size, IMRXX offers a combination of relatively high returns with low expenses.

Read Also: Free Budget Phone

What Is The Difference Between Fidelity Government Money Market Fund Spaxx And Fdic Insured Deposit Sweep Program Fdic

Fidelity Government Money Market Fund SP AXX is a mutual fund that invests in government securities, fixed-income investments, and corporate debt.

FDIC insurance means the bank cannot lose money because of a default on your deposit. Fidelity Government Money Market Fund is a FDIC insured bank account whereas FDIC insured deposit sweep program is a money market fund that offers limited protection under the US government’s deposit insurance program.

Fidelity Government Money Market Fund offers higher rates and also has no minimum balance requirement. Fidelity Government Money Market Fund is an FDIC insured deposit sweep program.

Fidelity also offers a money market fund that is not FDIC insured, but it is called the Fidelity Government Money Market Fund SP AXX. With this product, your deposits are not FDIC insured, and therefore you cannot use them as cash to cover your everyday expenses or pay bills. Fidelity’s Government Money Market Fund is an FDIC insured deposit sweep program and has a variable-rate.

The Fidelity Deposit Sweep Program has a fixed rate of . 25%. Fidelity is a multinational financial services company headquartered in Boston, Massachusetts. The company was founded in 1946 and acquired by Edward Lambert in 200.

The FDIC insured program FDIC is not involved with the running of the fund.

Investment Bank Participation In Financial Markets

Investment banks have active participation in the money, bond, mortgage stock, and derivatives markets. Many investment banks through money market mutual funds invest in money market securities. Investment banks also underwrite commercial papers. Investment banks actively participate in the bond market through underwriting bond issues in the primary market and provide advisory services for clients for bond purchases and sales. Investment banks also play a role in the bond market by facilitating the raising of funds for corporate restructuring activities such as mergers and acquisitions, leveraged buyouts, and other activities. Investment or securities firms also play a role in the mortgage market by underwriting securities that are backed by mortgages for various financial institutions. In stock markets, the investment banks play the major roles of underwriters in the primary market, advisors and brokers in the secondary market. In derivatives markets of futures, options and swaps, investment banks act as financial intermediaries or brokers.

Dr.Jeffrey R. Bohn, in, 2011

In , 2019

Don’t Miss: City Of Las Vegas Government Jobs

Types Of Money Market Funds

The types of debt securities held by money market mutual funds are required by federal regulation to be very short in maturity and high in credit quality. All money market funds comply with industry-standard regulatory requirements regarding the quality, maturity, liquidity, and diversification of the funds investments. Investments can include short-term U.S. Treasury securities, federal agency notes, Eurodollar deposits, repurchase agreements, certificates of deposit, corporate commercial paper, and obligations of states, cities, or other types of municipal agenciesdepending on the focus of the fund.

| Fund type | |

|---|---|

| known as tax-exempt) | |

| National municipal | Normally at least 80% of the funds assets are invested in municipal securities whose interest is exempt from federal income tax. |

| State municipal | Normally at least 80% of the funds assets are invested in municipal securities whose interest is exempt from federal and state personal income taxes. |

* A repurchase agreement is an agreement to buy a security at one price and a simultaneous agreement to sell it back at an agreed-upon price.

Their Holdings May Include Debt Issued By The Likes Of Bear Stearns Freddie Mac And Some Other Less

In stressful times, you may hear advisers and strategists recommend that investors raise their allocations to cash. There are two reasons for doing so. First, cash, which is presumably risk free, protects your portfolio from losses. Second, raising cash builds reserves you can use to buy stocks, junk bonds or other assets at lower prices once the backdrop brightens.

But just what is cash? And is it as safe as it appears to be?

In finance, cash is more than the green paper you carry in your wallet. The financial worlds definition of cash sometimes its referred to as cash equivalents is any investment with a fixed value that is easy to buy and sell.

This includes Lincolns and Hamiltons as well as savings and checking deposits and shares of money-market mutual funds. Short-term certificates of deposit and U.S. Treasury bills also count. The bedrock assumption is that if you invest $1 in any of these forms, your investment is worth $1 anytime, no questions asked.

But financial engineers have also invented all sorts of other cash equivalents. These are short-term interest-earning investments that are designed to maintain a stable value thats behind the comparison to cash but that are not necessarily liquid and not guaranteed by the government.

Read Also: Congress Mortgage Stimulus Middle Class

Investors Who Might Consider Money Market Funds

Money market funds may be appropriate for customers who:

- Have an investment goal with a short time horizon

- Have a low tolerance for volatility, or are looking to diversify with a more conservative investment

- Need the investment to be extremely liquid

While the returns on money market funds are generally not as high as those of other types of fixed income funds, such as bond funds, they do seek to provide stability, and can therefore play an important role in your portfolio. Investors can use money market funds in a few ways:

- To offset the typically greater volatility of bond and equity investments

- As short-duration investments for assets that may be needed in the near term

- As a holding place for assets while waiting for other investment opportunities to arise

Government And Treasury Money Funds

- 7-day yield as of 03/04/20224

- Minimum Initial Investment

- Schwab Government Money Fund Investor Shares

- 7-day yield as of 03/04/20224 0.01%

- Schwab Government Money Fund Ultra Shares

- 7-day yield as of 03/04/20224 0.01%

- Schwab Treasury Obligations Money Fund Investor Shares

- 7-day yield as of 03/04/20224 0.01%

- Schwab Treasury Obligations Money Fund Ultra Shares

- 7-day yield as of 03/04/20224 0.01%

- Schwab U.S. Treasury Money Fund Investor Shares

- 7-day yield as of 03/04/20224 0.01%

- Schwab U.S. Treasury Money Fund Ultra Shares

- 7-day yield as of 03/04/20224 0.01%

You May Like: Cash Out Refinance To Invest

Recommended Reading: Full Time Jobs In Warner Robins Ga

Investment Rationale For Government Money Market Funds

In case if you are wondering whether money market mutual funds are right for you at all, you should read this article.

The primary advantages of these funds outside of safety are that they offer daily liquidity and are free from liquidity fees imposed by the SEC. Since they invest in very short-term Treasury bills and repos, they provide easy tradability on a daily basis and you can quickly take advantage of rising rate environments. With the income from federally issued Treasury securities being state tax deductible, investors seeking to lower their tax bills may also favor government money funds.