Getting A Private Student Loan

Not just anybody can get a private student loan. Because lenders are most often dealing with borrowers who have little to no established credit, theyll require a cosigner .

Heres what theyre looking for from borrowers and cosigners:

- Debt-to-income ratio

- Length of employment with current employer

But cosigners, beware. Almost 11% of student loans are delinquent or in default , so get ready to pony up if your borrower falls behind.3

Private student loans dont require the Free Application for Federal Student Aid , which helps you find financial aid you might not have known you could get. So, make sure you fill one out.

Almost all lenders will do whats called a school certification. This means the school will need to confirm the students enrollment status and their loan eligibility, plus show that the amount of the loan doesnt exceed the cost of the school, including any help from federal aid, grants or scholarships.

What To Watch For

When choosing the best option for you, free is always better, and interest rates shouldnt be the only consideration. Its always better to start by exploring trade school grants and scholarships.

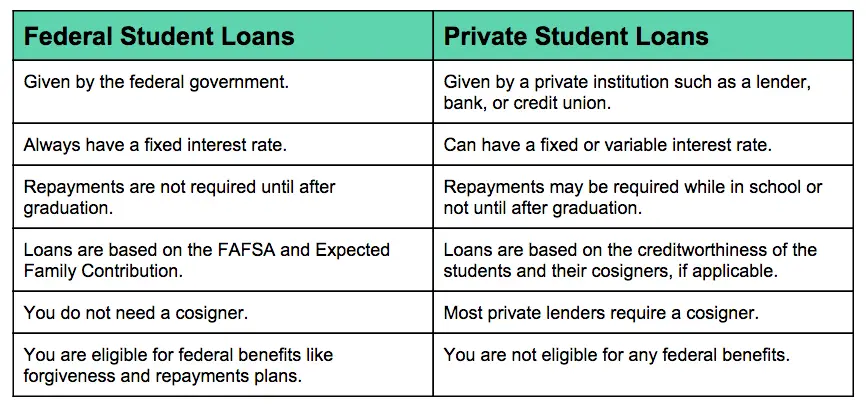

Once you move into getting loans, try federal loans first. Theyre better rates than private loans, but they also come with a wide variety of repayment plans and other perks that make them easier to manage than private loans, especially if youre still in school. Compare terms, grace periods, and the total amount youll pay over time.

The bottom line is that you can get a number of financial aid options to help pay for trade school whether you want to be a chef, a mechanic, or another profession.

Other student loan options:

Ascent Student Loans Disclosures

Ascent loans are funded by Bank of Lake Mills, Member FDIC. Loan products may not be available in certain jurisdictions. Certain restrictions, limitations and terms and conditions may apply. For Ascent Terms and Conditions please visit: AscentFunding.com/Ts& Cs Rates are effective as of 03/01/2022 and reflect an automatic payment discount of either 0.25% OR 1.00% . Automatic Payment Discount is available if the borrower is enrolled in automatic payments from their personal checking account and the amount is successfully withdrawn from the authorized bank account each month. For Ascent rates and repayment examples please visit: AscentFunding.com/Rates. 1% Cash Back Graduation Reward subject to terms and conditions, please visit AscentFunding.com/Cashback. Cosigned Credit-Based Loan student borrowers must meet certain minimum credit criteria. The minimum score required is subject to change and may depend on the credit score of your cosigner. Lowest APRs are available for the most creditworthy applicants and may require a cosigner.

Also Check: State Government Jobs Ohio

Provincial And Territorial Governments Of Canada

If youve been denied a federal loan or maxed out all your federal benefits, provincial and territorial loans provide support for students in their respective provinces. Depending on where you reside, you can receive financial support for post-secondary education purposes. Keep in mind there are different regulations and options for students depending on which province they live in.

- Firstly, Students from Ontario, British Columbia, Saskatchewan, New Brunswick, and Newfoundland and Labrador can only receive one single integrated loan or bursary from the government. The government of Canada works with these provincial governments to provide financial assistance.

- Secondly, students from Alberta, Manitoba, Nova Scotia, and Prince Edward Island are allowed to apply for federal student loans, along with provincial/territorial loans, depending on where they reside. This implies they can possibly receive more than one loan at a time.

- Lastly, those university students in Nunavut, the Northwest Territories, and Quebec, cannot obtain federal student loans and grants. These provinces manage their own student loan programs and work within their own province.

The following explains each province and their individual student loan options:

Alberta

The Student Aid Alberta Service Centre offers both federal and provincial student loan programs, which include scholarships, bursaries, and school loans along with financial planning resources.

British Columbia

Manitoba

New Brunswick

Nunavut

Key Highlights Of Isfcs Loan For Private Schools

- The lender offers secured loans up to Rs.2 crore and unsecured loans up to Rs.15 lakh.

- A wide range of collaterals is accepted for this role. Up to 80% of the collateral is offered as the Loan to Value .

- Loans can be repaid through NEFT or RTGS.

| Bank Name |

|---|

- PAN card of the applicants as well as the society/trust

- Copy of affiliation certificates of the school

- Copy of registration certificate of the society/trust

- Copy of other society/trust-related documents such as the updated list of members, by-laws, and so on

Also Check: Congress Mortgage Stimulus For Middle Class

Federal Student Loan Interest

Federal student loans almost always come with a lower interest rate than anything you can find from a private lender. Each year, the federal government sets the range of interest rates for student loans for the next academic year.

For 201920, the interest rate for Direct Subsidized Loans and Direct Unsubsidized Loans for undergraduates is 4.53%. Direct Unsubsidized Loans for graduate and professional students have an interest rate of 6.08%. And the interest rate for Direct PLUS Loans comes in at 7.08%.6

Pay As You Earn Repayment Plan

With the PAYE Plan, youll make monthly payments that equal 10% of your discretionary income, or what you can afford to pay based on the size of your family and your adjusted gross income. Your monthly payment cant be more than what it would be under the Standard Repayment Plan though. If youre married and file jointly, your spouses income will be factored in.

Also Check: How To Get A Safelink Replacement Phone

Types Of Federal Student Loans

There are a ton of federal student loan options out there, and they all fall under a few main categories. Again, to be eligible for any of these loans, you must fill out the FAFSA each year youre looking for aid.

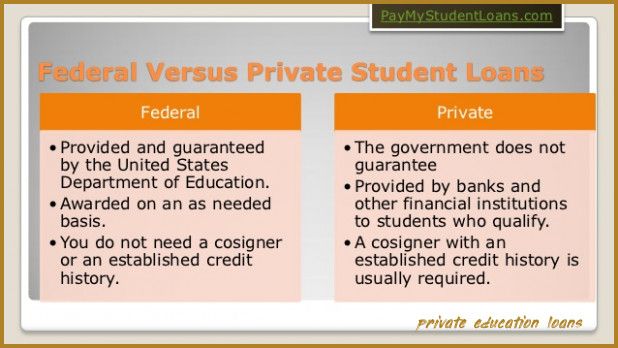

Whats The Difference Between A Federal And Private Student Loan

Not all loans are created equal. Heres an overview of some of the main differences in federal vs. private student loans.

| What are the repayment terms? | Standard terms are 10 years. | Terms vary by lender but could range anywhere from five years all the way up to 25 or more years. Talk about a nightmare! |

Recommended Reading: State Jobs In Las Vegas

Private Schools And The Cares Stimulus Package: What You Need To Know

School Heads//

On March 27, 2020, the House passed, and President Trump signed into law, the Coronavirus Aid, Relief, and Economic Security Act . This bill is an estimated $2 trillion economic stimulus package intended to provide immediate relief for individuals, nonprofits, businesses, and state and local governments.

Below is our current understanding of what this law means for independent schools.

Financial Aid From Private High Schools

Most independent high schools have well-managed financial aid programs from which students draw grant money and loans. Direct aid and tuition payment plans are used to craft workable solutions for private high school financing. The National Association of Independent Schools stands as a valuable resource for specific information about private education. A few examples of private high school financial aid successes:

Saint Thomas More High School – Through the Jennie Fund and other endowments, STM provides financial assistance for educational pursuits.

Oak Hill Academy is an equestrian school for upper-class high school students. The school works with Sallie Mae and Your Tuition Solution to bring loans within reach for cash-strapped families. The school also provides need-based grants when appropriate, but funding limitations prevent every qualified student from receiving aid.

Choate Rosemary Hall in Connecticut is one of the Northeasts top private high schools. The school awards much of its campus-specific financial aid in the form of direct student grants that do not require repayment. For 11th and 12th grade students who require additional assistance, Choate administers its own Independence Foundation Loan. Loans are worth $2000 and $2500 for qualified students who choose to accept them.

Read Also: City Jobs In Las Vegas

How Do You Apply For A Tuition Assistance

Applying for a private school loan is very similar to applying for a car loan or a mortgage. You submit an application to a lender, be it an online lender or a bank, that has your pertinent financial information so they can evaluate your credit score, history, and current financial standing. You wont have to worry about putting up any of your assets as collateral, but your credit score, history, and financials are very important to whether or not youll qualify.

Because lenders arent being pressured by the government to fund these loans, theyll only approve the best candidates who meet their stringent criteria with the highest likelihood of paying the loan back in full. Typically, households that have a combined household income of $150,000 have no problem of being approved. Dont be discouraged if you make less than this. Apply regardless. You can still be approved.

Federal Student Loans For Flight School Financing

When applying to college, the first thing youre told to do is fill out the Free Application for Federal Student Aid . However, thats not typically the case when it comes to flight school.

Filling out the FAFSA unlocks federal financial aid, which is only available to accredited colleges. Unfortunately, most flight schools and training programs dont fall under this accreditation .

Its best to ask schools youre considering if they accept federal financial aid. Here are some types of federal student loans you could receive for flight school:

- Direct Subsidized Loan: This type of loan is available to students who prove they have financial need, and there are limits on how much you can borrow. The Department of Education pays the interest on subsidized loans while youre in school, during deferment and for the first six months after you leave.

- Direct Unsubsidized Loan: Here too, you can only borrow up to a certain amount, but you dont need to show financial need. Youre responsible for paying all interest, and the interest will accrue while youre in school.

- Direct PLUS Loan: This type of loan is available to parents of aviation school students. They can borrow up to the cost of tuition minus any financial aid, but theyll need to submit to a credit check to qualify.

Read Also: Good Jobs For History Majors

Variable Vs Fixed Loan Interest Rates

A variable interest rate can fluctuate over the life span of a loan. A fixed interest rate is just as it sounds fixed and unchanging for the life of a loan.

While all federal student loans come with a fixed interest rate, offer students the flexibility of a variable interest rate in addition to a fixed interest rate option. At the time of your loan disbursement, you might discover that variable interest rates are lower than the federal student loan fixed rate, but there are advantages to having a stabilized rate.

To learn more, see our resource page.

A Different Student Culture

Most students in Singapore do not live on campus. And Singapore does not have fraternities and sororities.

Olyvia Lim, a senior at the Nanyang Technological University, said reports about American college students partying amid a pandemic baffled her friends.

We all said, Why would they risk themselves to do such a thing? Lim said. Its a bit hard to believe because we are of similar ages, but I think its culture. They are all about freedom, but when the government here says, Wear a mask, we all do.

Read Also: Congress Mortgage Stimulus Middle Class

College Ave Graduate Student Loan

Min. Credit Score

Fixed APR

Variable APR

View details

Best for graduate students who’ll need extra time before starting repayment.

Pros

-

You can see if youll qualify and what rate youll get without a hard credit check.

-

International students can qualify with a co-signer.

-

Nine-month grace period is longer than other lenders offer.

Cons

-

You must be at least halfway through your repayment term before you can request a co-signer release.

Qualifications

-

Typical credit score of approved borrowers: Mid-700s.

-

Minimum income: $35,000 per year.

-

Loan amounts: $1,000 up to the total cost of attendance.

Available Term Lengths

5, 8, 10 or 15 years

Disclaimer

Min. Credit Score

Fixed APR

Variable APR

View details

Types Of Federal Loans

There are three main types of federal student loans: direct subsidized, direct unsubsidized, and direct PLUS loans.

Direct Subsidized Loans

With a direct subsidized loan, the government pays the interest on your loans while youre in school, during your grace period after graduation, and during any deferment periods.

Subsidized loans are available for students who demonstrate financial need. Your school will be able to tell you if you qualify after you fill out a Free Application for Federal Student Aid .

Because of their potential to save student borrowers a significant amount of money on interest, you should always accept subsidized loans before any others. Unfortunately for graduate students, subsidized loans are only available for undergraduates.

Direct Unsubsidized Loans

When you take on a direct unsubsidized loan, you are responsible for paying any and all interest that accrues. Interest begins to accrue the second your loan is disbursed, accrues the whole time youre enrolled, and continues accruing for the life of the loan until you pay it off. It also accrues through any grace periods or deferments.

After you graduate and your grace period has expired, all the interest that accrued on the loan while you were in school will capitalize. That means it will be added to the principal balance the original amount borrowed and youll start earning interest on the new balance.

Parent PLUS Loans

Grad PLUS Loans

Also Check: Access Wireless Replacement Phone

Applying For Private Student Loans

You can apply for private college loans directly from each lenders website. You should apply after youve made your school decision and once you know how much you need to borrow, so you wont have to submit separate student loan applications for schools youre considering.

How to get a private student loan

Theres no cost to apply for private student loans, but there are a few things you should know before you start:

- Youll fill out basic personal information and financial information.

- Youll be asked to choose the for your loan.

- You generally can apply with a during the application process. If you apply with a cosigner, theyll have to supply their financial information in the student loan application.

Our private student loan application process only takes about 15 minutes to receive a credit result.

No Campus Spread In Singapore

After outbreaks last fall, the city-state of Singapore has averaged less than one locally transmitted case each day. Since the pandemic began, our colleague Sui-Lee Wee reports, its three major universities have reported zero cases of community transmission.

From our perch here in the United States, that almost sounds like a fantasy. But the three factors that contribute to its success technology, restrictions and compliance may be a useful reference point for educators and officials across the world.

Read Also: Dispensary Silver City Nm

How Do You Borrow College Money Under Federal Loan Programs

Think FAFSAto qualify for a federal loan, you will need to complete and submit the Free Application for Federal Student Aid, aka FAFSA. Borrowers must answer questions about the student’s and parents’ income and investments, as well as other relevant matters, such as whether the family has other children in college. Using that information, the FAFSA determines Expected Family Contribution, which is being rebranded as the Student Aid Index . That figure is used to calculate how much assistance you’re eligible to receive.

Best Graduate Student Loan Options

All borrowers as a first option

Graduate students can take out up to $20,500 annually in unsubsidized federal student loans.

Min. Credit Score

Graduate school borrowers qualify for unsubsidized student loans only.

Pros

-

More flexible repayment options for struggling borrowers than other lenders.

-

Subsidized loans do not collect interest while in school or during deferment.

-

Lower interest rates compared with private lenders.

Cons

-

You pay an origination fee.

Qualifications

-

No credit check or minimum income is needed to borrow.

-

Loan amounts for undergraduates: $5,500 year one, $6,500 year two, $7,500 year three and thereafter, up to a total of $31,000

-

Independent students and graduate students have higher loan limits.

-

Undergraduate interest rate fixed at 3.73%, while grad students get higher 5.28% rate

Available Term Lengths

Our pick for

Borrowers without credit or a co-signer

Graduate PLUS loan interest rates aren’t based on your credit score: All eligible borrowers receive the same fixed rate.

Min. Credit Score

Best for graduate students who need to borrow beyond the federal unsubsidized loan limit.

Pros

-

More flexible repayment options for struggling borrowers compared with private lenders.

-

All borrowers who attend a school authorized to receive federal aid can qualify.

Cons

-

May have higher interest rates compared with private lenders.

-

You pay an origination fee.

-

You cant see if youll qualify without a hard credit check.

Qualifications

Available Term Lengths

Our picks for

Don’t Miss: Dell Government Employee Discount