Section 184 Indian Home Loan

A loan offering for Native Americans, Alaska Natives and members of other designated villages and tribes allows low down payments and relaxed credit standards. Mortgage purposes can include new construction, existing homes, improvements and loan refinancing.

The Department of Housing and Urban Development’s Section 184 program offers the same benefits to Native Hawaiians. Find complete details and participating lenders at the HUD Section 184 page.

United States Department Of Agriculture Loans

Although USDA loans used to be strictly for farmland, many rural and suburban areas are now eligible for their no money down, 100% financing. USDA guaranteed mortgage loans generally have more lenient credit standards and a very competitive interest rate. USDA loans have an up-front insurance premium that can be financed in the loan in addition to a monthly mortgage insurance premium which will be included in the monthly payment for the life of the loan.

What Is The Home Stimulus Program

Better known as the Homeowners Assistance Fund , this program is part of the American Rescue Plan for providing relief to Americans amid the COVID-19 pandemic. The purpose of the HAF is to prevent Americans from losing their homes, utilities or insurance during a time of economic hardship. More information about the HAF can be found on the U.S. Treasury website.

Recommended Reading: Government Programs For Mental Illness

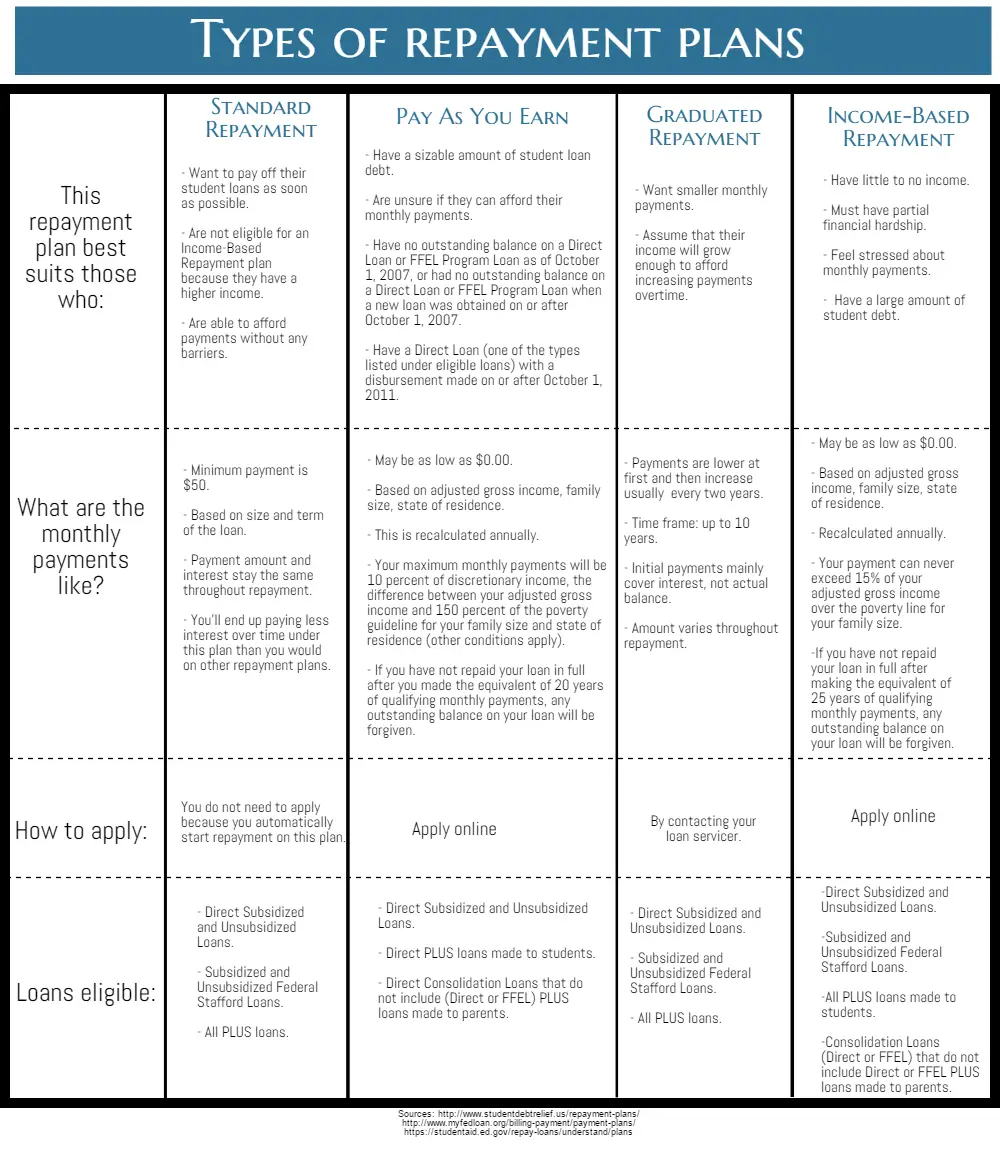

If You Want To Get Rid Of Your Loans For Good Make The Following: Repayment

There are no grace periods or grace periods once a student loan defaults. Alternatively, you might choose to pay that sum and be out of debt.

Negotiating a lower student debt settlement may also be possible, but dont expect to save much money. Typical federal student loan settlements reduce collection costs and save you around 10% of the outstanding sum.

Types Of Mortgage Loans For Home Buyers And Refinancers

Topwww.nerdwallet.com

386 People Used

Also Check: Government Grants For Low Income Homeowners

Economic Injury Disaster Loans

If you own a small business or non-profit thats in a declared disaster zone, an Economic Injury Disaster loan can help you rebuild. An Economic Injury Disaster loan can give you up to $2 million to repair your business. Similar to a home and property disaster loan, you cant use an Economic Injury Disaster loan for renovations or upgrades.

Fha Funding Controls For 2021 Personal Loans A Form Of Mortgage Ensured By Government Property

FHA funding controls For 2021 personal loans, a form of mortgage ensured by government property

FHA financial loans, a type of financial confirmed from the national casing Administration, posses limitations on how a great deal of residence can acquire. When you need to get your dream house making use of an FHA finance, you wont manage to buy a turnkey estate: FHA funding limitations are based on a percentage with the typical home price tag in each county Montana auto title loans reviews.

The federal government assurance on these loans is built to allow low- to moderate-income applicants just who might if not become shut-out of housing industry, but itsnt supposed to place citizens on the connect for flamboyant buys. This warranty makes FHA money pricey: customers pay upfront mortgage loan insurance policies, and every month loan insurance rates premiumspotentially for the lifetime of the mortgage.

You May Like: How To Get Financial Help From Government

Finding The Right Mortgage For You

As you can see, there is no one-size-fits-all mortgage solution. You have to do your research to figure out which has the best terms for your financial situation, including the monthly affordability of the loan, your down payment savings, and how long you anticipate living in your home.

Better Mortgage offers both fixed and adjustable rates for conventional and jumbo loans. We can also finance a whole range of properties, including single-family homes, multi-family homes, townhouses, and more. Get pre-approved today, and well help you find the perfect mortgage for your needs.

Conforming Vs Nonconforming Loans

Both conforming and nonconforming mortgages are types of conventional mortgages.

Mortgages that conform to the dollar limits set by the Federal Housing Finance Agency are called conforming loans. The limit changes annually, based on federal guidelines. Loans that exceed those guidelines are considered jumbo loans.

As of 2021, the conforming loan limit is $548,250 for a single-family home in most of the US and goes up to $822,375 in certain higher-cost areas.

Pros: Conforming loans may have lower interest rates and fees than nonconforming loans.

Cons: The amount that can be borrowed is limited.

You May Like: Government Subsidized Housing For Elderly

Get Your Credit Mortgage

Regardless of which type of mortgage loan you end up getting, it’s crucial to learn if you need to make some improvements at least three to six months before you apply. Check your to get an idea of where you stand and also view areas you may need to address.

Also, consider using Experian Boost to potentially help increase your credit score. The program connects to your bank account and gives you credit for your on-time utility, phone and certain video streaming payments.

Improving your credit for a mortgage can take some time, but the sooner you begin the process, the easier it will be to stop potentially damaging activities and make the changes you need to qualify for a mortgage loan.

Which Government Loan Is The Right Fit

- FHA loans: Homebuyers who may not qualify for conventional mortgages

- VA loans: Active or former service members as well as military spouses

- USDA loans: Individuals living in rural communities

Still not sure which government housing mortgage makes the most sense for your situation? Here are a few questions you can ask yourself to help narrow down your choices:

- Am I an active or former member of the armed forces? If not, right away you can remove VA loans from consideration.

- Is my home located in a rural area? People living in more urban and suburban neighborhoods wont qualify for a USDA loan, so you can scratch that one if thats the case.

- How much can I afford for a down payment? FHA loans offer plenty of flexibility with their down payment options, but you will need to put up some money up front. That may not be the case with either VA or USDA loans.

- How strong is my credit score? Youll need a 620 credit score at minimum to qualify for USDA loans. FHA and VA programs tend to be a bit more lenient on .

- Which loan offers the lowest interest rate? All three government loan programs tend to offer lower interest rates than conventional mortgages, but among them, VA might have a slight edge. Mortgage rates constantly fluctuate, no matter what type of home loan youre considering. So, be sure to take a look at the latest interest rates before making a decision.

You May Like: What Is Fund Accounting In Government

Understanding The Different Types Of Mortgage Loans

Were here to help! First and foremost, SoFi Learn strives to be a beneficial resource to you as you navigate your financial journey.Read moreWe develop content that covers a variety of financial topics. Sometimes, that content may include information about products, features, or services that SoFi does not provide.We aim to break down complicated concepts, loop you in on the latest trends, and keep you up-to-date on the stuff you can use to help get your money right.Read less

An important first step for aspiring homebuyers is to decide which type of home loan will best serve their needs. The interest rate, length, down payment, borrower qualifications, and extra fees all play a role in the decision.

To help make the choice a bit easier, lets talk about mortgage basics and compare the advantages and disadvantages of mortgage types.

Recommended: First-Time Home Buyers Guide

How We Make Money

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

At Bankrate we strive to help you make smarter financial decisions. While we adhere to stricteditorial integrity, this post may contain references to products from our partners. Heres an explanation forhow we make money.

Read Also: Government Jobs For Young Adults

State And Local Programs

Many states, local governments, and nonprofits offer programs to make homeownership more affordable. Many of these programs focus on low- and moderate-income families buying their first home, though some may be available to families who have previously owned a home. Other programs target teachers, firefighters, and other public service employees, or people interested in purchasing a home in a particular neighborhood.

Many programs offer down payment assistance that can be used with a regular FHA or conventional loan. Some programs lend money directly through subsidized loans.

or contact a local housing counselor to discuss your options. You can also ask local lenders whether they offer any special programs.

Mortgage insurance is required by many state and local programs. More on mortgage insurance.

Second Understand The Difference Between Government

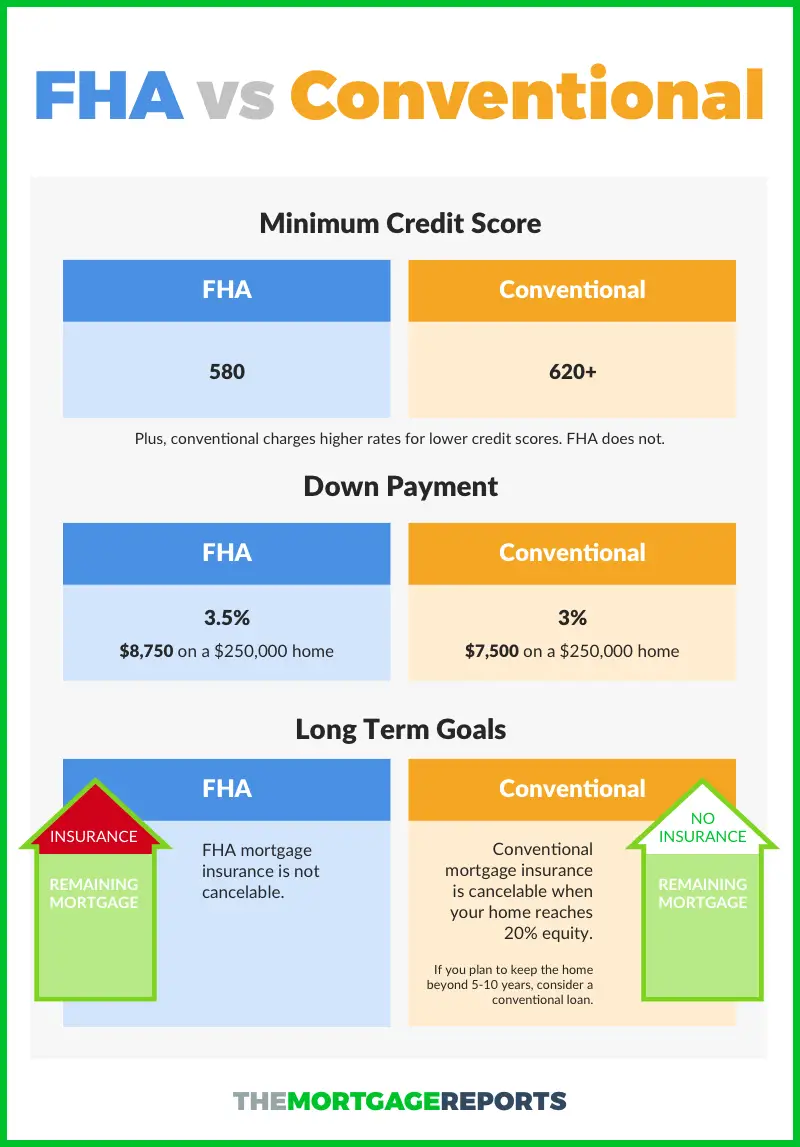

Now that you’ve decided whether you’re getting a fixed or adjustable-rate type of mortgage, you’ll want to decide whether you want a government-insured home loan or a conventional type of loan. Here’s the difference:

A conventional home loan is not insured or guaranteed by the federal government in any way. This makes it unique from government insured loans, which are divided into three main categories: FHA, VA, and USDA.

FHA loans come through the Federal Housing Administration mortgage insurance program, which is managed by the Department of Housing and Urban Development .

These loans are available to all types of borrowers. As part of this loan, the government insures the lender against losses that might result from borrower default. The upside to using an FHA loan is that you can make a down payment as low as 3.5%. The downside is that you’ll have to pay mortgage insurance, which will increase your monthly payments.

A VA loan comes through the U.S. Department of Veterans Affairs . This is offered to military service members and their families. These loans are also guaranteed by the federal government. The biggest advantage to this program is that borrowers can receive 100% financing for the purchase of a home. Thus, you won’t have to make any down payment whatsoever.

Also Check: Government Life Insurance For Seniors

Bottom Line: Home Improvement Loans

A renovation or home improvement project doesnt have to be put on hold because the out-of-pocket cost can be so high.

There are multiple financing options available for your situation and renovation needs. Figure out where you stand regarding credit, income, and equity in your home.

Then research these options for one that fits your needs! Make sure to speak with online mortgage lenders to understand your options.

Keep Reading:

Options For Students Homeowners And Businesses

When you need to borrow money, the U.S. government can be an appealing source of funding. Those loans typically have borrower-friendly featurestheyre relatively easy to qualify for and might have lower rates than you can find with private lenders. But it can be a challenge to find out about the many different government loan programs in order to take advantage of them.

Read Also: Ok Google Free Government Phones

Finding The Best Government Loan Lender For You

“When you talk about access to credit and people that might need the flexibility of these programs they may reach out to one lender and get one answer, and they might reach out to another lender and get a completely different answer,” Banfield says.

Borrowers should always shop multiple mortgage lenders to find the best terms and most suitable options for their personal situation.

The Three Types Of Government

- FHA: A lender must have approval from the Federal Housing Authority to offer FHA loans. The credit and down payment requirements for an FHA-backed mortgage are more forgiving than for conventional loans. In fact, FHA loans only require a 3.5% down payment making them ideal for first-time homebuyers.

- VA: The U.S. Department of Veterans Affairs backs VA loans and they are available to all active-duty military, reservists, and veterans. VA loans require no down payment, no private mortgage insurance, and flexibility on credit scores.

- USDA*: These types of loans are perfect for smaller, rural, or suburban homes. There are certain requirements that a neighborhood has to meet to be considered eligible, but USDA loans are more flexible on interest rates and down payments. Most USDA loans have no actual down payment requirements. Typically the only upfront payment is for closing costs and prepaid expenses. In fact, the seller can also pay up to 6% of the closing costs and prepaids, so its fairly common for USDA borrowers to need very little cash at closing.

Read Also: List Of Government Grants For Individuals In Usa

There Are Lenient Credit Requirements

Not everyone has a perfect credit score, thats why government-insured loans can be fitting for those individuals who may have less-than-desirable credit scores. A conventional loan typically requires a credit score above 620. But FHA and VA loans are available for homebuyers with credit scores of at least 580.

Fha Va And Usda Refinancing

Both the FHA and VA refinance mortgages including cash-out refinancing.

And there are “low-doc” versions, too.

“For a refinance, both FHA and VA offer a ‘streamlined’ version that reduces or eliminates the need for income-qualifying documentation. In most instances, there is no appraisal required,” Pataky says.

The USDA also offers streamlined and non-streamlined refinancing on its direct and guaranteed home loans.

Read Also: What Is The Return On Government Bonds

An Introduction To Mortgage

Before we learn about the different types of Mortgages, let us first discuss what is a Mortgage and what is its uses.

What is Mortgage?

When property, land or any other commodity is used as collateral to borrow money or to take a loan from a lender, it is known as Mortgage. In simpler terms, when a person borrows money from a lender and signs up an agreement where he/she gets cash in exchange for a real estate property as a guarantee with the bank until the entire amount is repaid is called a mortgage.

A few important pointers related to Mortgage have been given below:

- The borrower and lender both are uncertain about profit/loss in case of a mortgage. The lender is uncertain if the borrower will be able to pay the sum of money back or not and in case the borrower is unable to pay the lender back, he shall be in complete loss of the asset

- If the borrower is not able to pay back the loan amount, the lender has full authority over the mortgaged product

- The one who takes the loan is called a debtor and the one who lends money is called the creditor

- Loan is a contract between the lender and borrower when one lends money and the other borrows it at a certain rate of interest. Mortgage, on the other hand, is a type of loan in which the real estate or property element is added as a guarantee if the mount is not retired to the lender

Further below, we have discussed the different types of mortgages in detail for your reference.

Fha Funding Limitations By Residence Type

FHA money restrictions fluctuate by house kind. These are generally most affordable for one-unit hotels, rise for two-unit characteristics, boost again for three-unit properties and max look for four-unit properties.

If you want to use an FHA money purchasing a duplex, the reduce is raised above if you plan on using an FHA funding buying a single-family premises. And youll, in fact, need an FHA finance to buy a multi-unit residential property, over to four homes, provided that you live in one of many units while your principal household.

Also Check: How To See Government Contracts

Direct Subsidized And Unsubsidized Loans

Direct subsidized and unsubsidized loans are two different types of low-interest education loans offered through the Department of Education to help cover the cost of college or career school.

- Direct Subsidized loans are available for undergraduate students to attend a 4-year or 2-year college, technical school or trade school. They are only for students who demonstrate financial need. The U.S. Department of Education pays the interest while youre in school at least half-time, for the first 6 months after you leave school and during a period of deferment. Annual loan limits apply.

- Unlike direct subsidized loans, direct unsubsidized loans are not awarded based on need, but rather the cost of your tuition and other financial aid you need. Direct unsubsidized loans begin accruing interest as soon as you take out the loan. Annual loan limits apply.