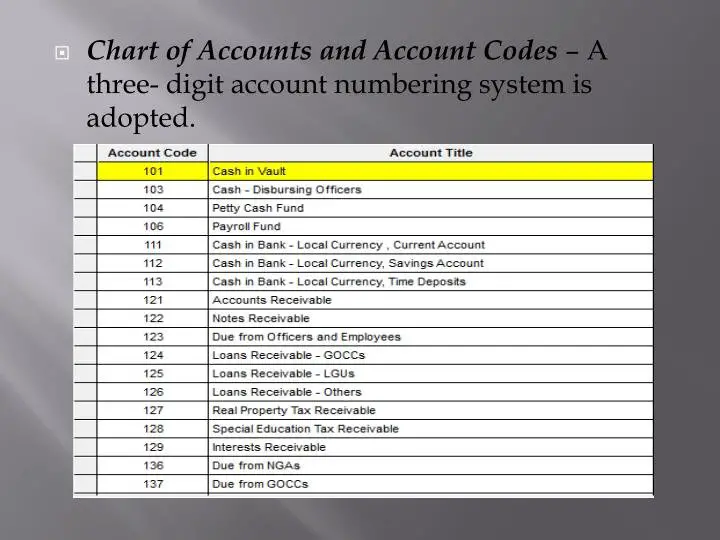

Adding Account Codes To The Chart Of Accounts

The DfE have designed the CoA to meet the reporting needs of most academy trusts and it is important to keep a standard format. We expect trusts will be able to use their own cost centre structure to meet local reporting requirements, but we will consider creating new ledger codes where one or more of the following criteria are met:

- there is a change in accounting standards

- we change the reporting requirements

- we receive enough requests for additional codes for clearly different cost classifications

If you require codes that do not meet the above criteria, we advise:

- using cost centres or analysis codes to create the internal breakdown you need

- creating a local ledger code in the CoA. The DfE have left the last digit free under each ledger code. This gives the option to create an additional nine account codes for each account code in the standard chart of accounts.

As an example, there is no specific CoA account code for maths hub funding. If a trust wished to record this separately, a trust could either

- allocate this income along with associated expenditure under a separate cost centre heading using account code 510950 Other DfE revenue grants, or

- set up a flexible account code within the range 510951 to 510959 for Maths Hub funding to report this grant separately. Any flexible codes set up by a trust for local reporting would roll up to the DfECoA account code level for the purposes of DfE reporting

Common Nonprofit Asset Accounts

- Cash

- Accounts receivable

- Inventory

- Fixed Assets

- Other

Asset accounts are numbered in the 1000 range, and their names will need to be descriptive. The number will be listed first, followed by a dash, then the account name. For example, 1000 Checking. This accounts number is 1000, and the name represents what it is, which is your checking account. This account will be used to track how much money is in your checking account. Below are a few more examples of other asset accounts:

- 1001 Savings

- Retained earnings

- Other equity

- Funds with donor restrictions and funds without donor restrictions

- Fund balances

Equity is the value of your assets, minus your liabilities. In other words, its the value of your organization after your expenses and debts are deducted. This information is reflected on a Balance Sheet report. Its where fund accounting emerges. If you need a recap of fund accounting, refer to our complete overview of What Is Fund Accounting?

A fund is a breakdown of your equity. The money you have and owe can be intended for a specific purpose . Therefore, you will need an equity balance to represent the funds overall worth. If you know what funds need to be created, you can set each up as its own equity account. Equity is numbered in the 3000 range:

- 3000 General Fund

- 3200 Building Fund

- 3300 Special Projects Fund

Cppm Policy Chapter : Planning Budgeting And Reporting

Planning, budgeting and reporting are inter-related elements and fundamental to an understanding of government’s performance management and accountability process. This comprehensive Core Policy and Procedures Manual chapter was created to cover previous disparate financial management content, such as accounting policy, account classification, financial planning, budgetary control and financial reporting.

Policy is included for direction on service plans, reports, capital plans and performance measures in support of the BTAA, and policy for ministerial accountability reports in support of the BBMAA. Government’s accounting policies are disclosed at the end of the reporting section. BTAA, BBMAA and FAA report requirements and responsibilities are summarized in the information and reference section.

- 3.0 Planning, Budgeting and Reporting

- ensure that government and ministries plan for key services provided to the public

- provide for the economic, efficient and effective use of resources required to deliver services

- ensure that ministry planning processes are integrated with government’s overall strategic and financial planning, budget preparation and reporting processes

- ensure that ministry planning processes and activities are conducted in accordance with applicable legislation, regulations and Treasury Board policy

You May Like: Government Jobs In Las Vegas

A Service Plan Reports

At Least Two Accounts For Every Transaction

The chart of accounts lists the accounts that are available for recording transactions. In keeping with the double-entry system of accounting, a minimum of two accounts is needed for every transactionat least one account is debited and at least one account is credited.

When a transaction is entered into a company’s accounting software, it is common for the software to prompt for only one account namethis is because the software is programmed to automatically assign one of the accounts. For example, when using accounting software to write a check, the software automatically reduces the asset account Cash and prompts you to designate the other account such as Rent Expense, Advertising Expense, etc.

Some general rules about debiting and crediting the accounts are:

- Expense accounts are debited and have debit balances

- Revenue accounts are and have

- Asset accounts normally have debit balances

- To increase an asset account, debit the account

- To decrease an asset account, the account

- Liability accounts normally have

- To increase a liability account, the account

- To decrease a liability account, debit the account

To learn more about debits and credits, visit our Explanation of Debits and Credits and our Practice Quiz for Debits and Credits.

To learn more about the role of bookkeepers and accountants, visit our topic Accounting Careers.

Read Also: Mortgage Stimulus Program For Middle Class 2021

Best Practices For Creating Your Chart Of Accounts

1. Create only what you need

If you dont have any debt, dont worry about creating liability accounts. Likewise, if you dont own anything outside of the money in the bank, dont worry about fixed assets. Your nonprofits chart of accounts is completely unique, and should be tailored for your organization alone. You will always be able to make changes and adapt if needed.

2. Find the right amount of detail

The purpose of accounts is to accurately record transactions, which will allow you to generate accurate reports. Therefore, youll want to think through what information you are going to track. This will take some time, and you will most likely make changes down the road. Keep it detailed enough to give you the information you want without being so complicated that its impossible to use.

3. Dont be afraid to make changes

You will need to change things. For example, you may want to break an account into multiple items, or realize you dont need to track something like you originally thought. Again, your nonprofits chart of accounts is unique to your organization, so dont be afraid to make it exactly what you need.

French Gaap Chart Of Accounts Layout

The French generally accepted accounting principles chart of accounts layout is used in France, Belgium, Spain and many francophone countries. The use of the French GAAP chart of accounts layout is stated in French law.

In France Liabilities and Equity are seen as negative Assets and not account types of themselves, just balance accounts.

Profit and Loss Accounts

- Class 6 Costs Accounts

- Class 8 Expenses Recognised In Equity

- Class 9 Income Recognised In Equity

Also Check: How To Get A Replacement Government Phone

Updates To The 2022/23 Chart Of Accounts

This section includes:

- updated descriptions – table 4.3.1

Updates are highlighted in yellow on the CoA structures and mapping tab within the Academies chart of accounts 2021 spreadsheet and are also listed on the Change control tab within the same document. Summary tables of the updates are also shown below.

The tables below highlight updates to the Academies chart of accounts released 18 May 2021 from the previous version released in May 2021.

What Is The Purpose Of A Chart Of Accounts

In practice, the COA serves as the foundation for a company’s financial record-keeping system. It provides a logical structure that facilitates the addition of new accounts and the deletion of old accounts.

The organization of accounts within the COA varies from company to company. It usually consists of the accounts that a company has identified and made available for recording transactions in its general ledger. This can be done with accounting software.

For ease of use, a COA contains the list of accounts’ names, brief descriptions, account type, account balance and account codes for each sub-account.

Recommended Reading: Las Vegas Government Jobs

Why Is The Chart Of Accounts Important

Unless you have the name of every single account in your books memorized, you need to have all of them laid out in front of you, like a map.

The chart of accounts is designed to be a map of your business and its various financial parts.

A well-designed chart of accounts should separate out all the companyâs most important accounts, and make it easy to figure out which transactions get recorded in which account.

It should let you make better decisions, give you an accurate snapshot of your companyâs financial health, and make it easier to follow financial reporting standards.

The Income Statement Accounts

We use the income statement accounts to generate the other major kind of financial statement: the income statement.

Revenue accounts keep track of any income your business brings in from the sale of goods, services or rent.

Expense accounts are all of the money and resources you spend in the process of generating revenues, i.e. utilities, wages and rent.

The way that the balance sheet and income statement accounts interact with each other is complex, but one general rule to remember is this: revenues increase your companyâs equity and asset accounts, while expenses your assets and equity.

You May Like: Congress Mortgage Stimulus Program 2019

Carrying Out A Comprehensive Business Needs Assessment

The COA can only be properly configured after a comprehensive business needs analysis has been undertaken. The business needs analysis will define who the stakeholders/ users are,17 their tasks, goals, functions and what information they want from the system. The business needs analysis should draw from the countrys PFM framework and identify the stakeholders/users information requirements to be taken into account in designing the COA to ensure that the accounting and reporting system can record, control and report on the governments activities accordingly .

The three primary classifications that are essential for controlling, managing and reporting on the implementation of the governments budget are:

| Fiscal control, macroeconomic analysis, compliance control, internal management, and statistical reporting. | Revenue, expense, assets, and liabilities |

Business Needs Analysis Key Issues

Users of government financial information. They include policy makers, government managers, parliament/legislature, the broader public, supreme audit institution, credit rating agencies and international organizations. Each of these stakeholders may require data for different purposes.

Mapping requirements. The mapping requirements should be identified, e.g., to derive GFS and COFOG classification from other classifications. Mapping may consist of a one-to-many or many-to-one mapping methodology. In any case, the mapping process should be well documented and tested.

Configuring The Coa In An Ifmis

Governments are increasingly using IFMIS to modernize their accounting and reporting systems. An IFMIS can improve the PFM framework by providing real-time financial information that managers can use to formulate budgets, manage resources, and administer programs and supporting the preparation of financial reports and statements. A well implemented IFMIS can help governments achieve effective control over public finances and enhance transparency and accountability. Therefore, it must be designed to support the function of the public sector and handle the complex structure of budget organizations as well as to ensure compliance with budget laws and public finance rules.22

Configuration of the IFMIS is not limited to the GL module and the COA design should take account of the impact of using other IFMIS modules and subsidiary ledgers. The GL module is referred to as the backbone of an IFMIS and the COA provides the structure of the GL. An IFMIS usually includes the GL module and at least the accounts payable module. However, there are a number of other modules such as accounts receivable, cash management, procurement and payroll that are frequently used to enhance the system functionality. In any case, the linkage between the GL and subsidiary ledgers should be clearly established. Subsidiary ledger configuration combines with the COA in the GL to provide a comprehensive mechanism to record, control and report on the activities of the government to concerned stakeholders.

Also Check: Government Jobs Redstone Arsenal

Introduction To The Draft Trust Financial Statements

Trusts who send automated data to populate the accounts return, may also now use this data to produce draft trust financial statements for the trust. The template is now available to view on this page and trusts will able to populate it, using the automation functionality, from early September.

For more information, please click the following link to the Quick start guide to automating the accounts return and financial statements for more information.

Using The Chart Of Accounts With The Application Programme Interface Tool

This section includes

The API functionality is based on the DfEs chart of accounts and allows the DfE to understand your data and automatically match it to the right part of the online forms using the mappings identified in the CoA structure and mapping tab of the published chart of accounts. API also provides trusts with the opportunity to produce their draft financial statements.

For those using the API tool, the DfE has providing an automated mapping report which compares the trusts FMS data, at account code level, with the populated AR, enabling trusts to understand how their trial balance data has populated the AR.

Don’t Miss: Government Suburban

Make Separate Accounts For Important Month

A good chart of accounts makes sure financial reports are accurate with large non-cash entries, and separate accounts can be helpful in segregating these entries.

Related:

Stockholders’ Equity 27176 – Common Stock, No Par27876 – Retained Earnings

Operating Revenues 31010 Sales – Division #1, Product Line 01031722 Sales – Division #2, Product Line 02232819 Sales – Sales Returns and Allowances33410 Sales – Sales Discounts

Cost of Goods Sold 41430 COGS – Division #1, Product Line 01042342 COGS – Division #2, Product Line 02345469 COGS – Inventory Adjustments

Repair Dept. Expenses 59134 – Repair Dept. Salaries59151 – Repair Dept. Payroll Taxes59243 – Repair Dept. Supplies

Other 91845 – Gain on Sale of Assets96134 – Loss on Sale of Assets

What Is Chart Of Accounts

A chart of accounts is a financial, organizational tool that provides an index of every account in an accounting system.

This provides an insight into all the financial transactions of the company. Here, an account is a unique record for each type of asset, liability, equity, revenue and expense. A COA includes many subcategories for each account.

Don’t Miss: Governmentjobs Com Las Vegas

Chart Of Accounts Best Practices

Oftenthe simplest and most basic things within an organization are overlooked. It istime to get back to basics! The most basic of outputs from an accounting departmentis the chart of accounts.

Thechart of accounts enhances control, flexibility and reporting capacity whenused effectively. Unfortunately, many organizations become burdened with an overlydetailed chart of accounts, resulting in the inability or delayed ability toperform a timely analysis of data. Or, organizations with multiple subsidiariesor locations utilize different ledger reporting structures, making itchallenging to consolidate information for the parent company.

Whileindependent challenges, implementation of common chart of accounts practicescan streamline coding, data input and reporting capacities for organizations,regardless of size.

Problem1: Overly Detailed or Unorganized Chart of Accounts

Inan effort to add more detail to the ledger, many organizations become carriedaway with detailed inputs into their chart of accounts, while others dontoffer enough detail.

Overlyconsolidated codes make it challenging for an organization to budget, monitoror make decisions regarding expenditures. Lengthy ledgers make it difficult toinput numbers into the same accounts consistently, resulting in data overlapsand/or gaps. Lengthy ledgers are also expensive to audit annually, due to theextensive detail to reconcile.

Solution1: Condense the Chart of Accounts

Tags:

Examples Of A Nonprofit Chart Of Accounts

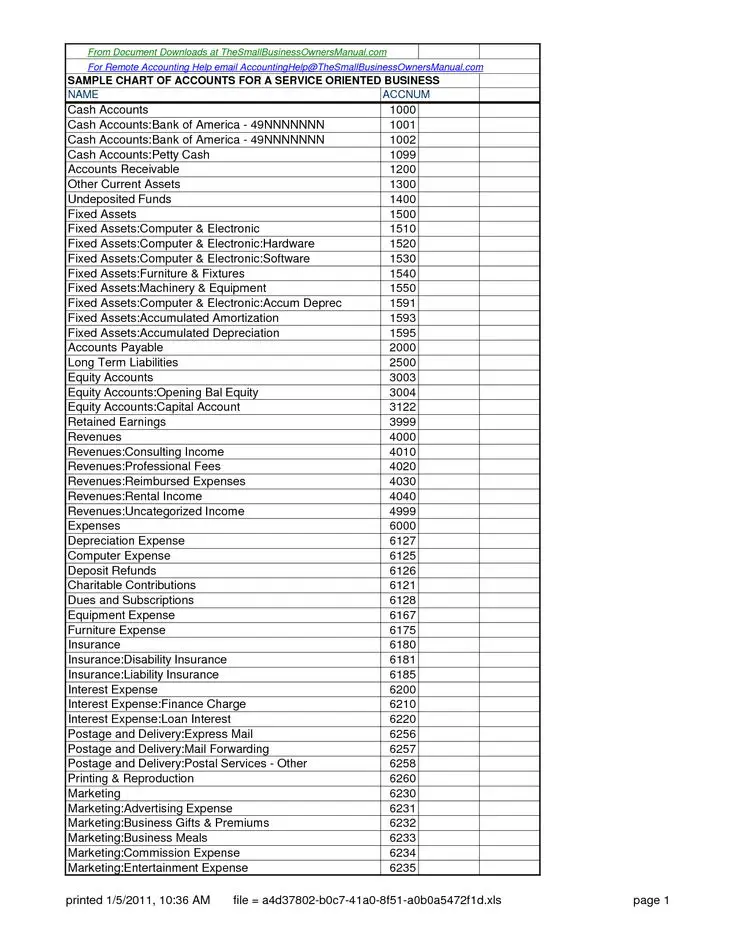

When accounts are created in an accounting system, they are organized using names and numbers. Account numbers are, for the most part, up to you and how you would like to organize them. However, the standard number ranges applied to each account is as followed:

A nonprofit chart of accounts may be similar to this:

In other words, accounts represent these five areas of your organizations finances that youre tracking:

- Asset = what you own = 1000 range

- Liability = what you owe = 2000 range

- Equity = overall worth = 3000 range

- Income = money you get = 4000 range

- Expense = money you spend = 5000 range

Also Check: Cash Grants For Single Moms

How To Use A Chart Of Accounts

The numbering of a chart of accounts involves assigning codes to the different accounts your company has and deciding on a structure for the accounts. To set up a chart of accounts:

Determine what type of accounts your company has

Determine your division, department and account codes

Choose a numbering system for each account type