Federal Employee Health Insurance

The Federal Employees Health Benefits program is designed to help protect federal employees and eligible family members from the expenses of illness and accident. Through FEHB, federal employees can get comprehensive health insurance coverage.

Unlike many private sector health benefit plans, FEHB provides coverage without physical examination, places no restrictions on age or physical condition, offers a wide range of health insurance plans to choose from and cannot be canceled by the plan in which you enroll.

It is a voluntary program open to nearly all employees of the federal government. The exceptions mainly involve temporary, seasonal and intermittent employees. They are eligible only under certain circumstances, primarily an expectation of employment averaging 130 hours per month for at least 90 days.

How Do I Get Health Insurance

You can get it through:

- your job or your spouse’s job, if the employer offers it.

- your parent’s plan until you turn 26.

- a government program like CHIP, Medicaid, or Medicare.

- your college if they offer a student plan.

- a membership association, union, or church.

- an insurance company or agent.

- the federal health insurance marketplace.

Annual Leave Accrual Rates

|

1 hour of annual leave for each 20 hours in a pay status |

1 hour of annual leave for each 13 hours in a pay status |

1 hour of annual leave for each 10 hours in a pay status |

* There is potential for a newly appointed or reappointed employee to receive service credit for prior non-Federal service or active duty uniformed service.

** Leave is prorated for part-time employees.

Recommended Reading: What Is A Governing Board

How To Get Health Coverage

You can get health care coverage through:

- A group coverage plan at your job or your spouse or partner’s job

- Your parents’ insurance plan, if you are under age 26

- A plan you purchase on your own directly from a health insurance company or through the Health Insurance Marketplace

- Government programs such as

Purchasing Health Care Coverage Through The Marketplace And Reporting Changes

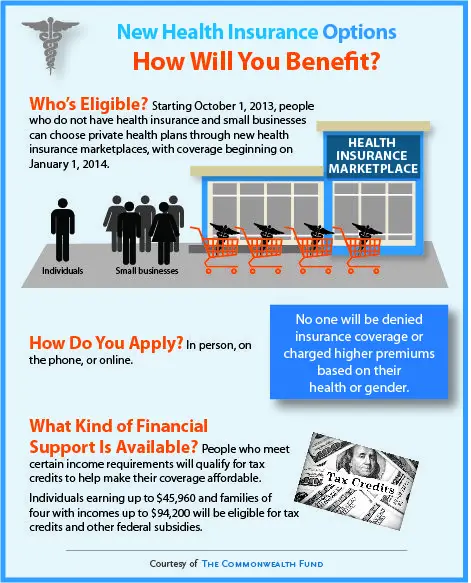

Each year the Health Insurance Marketplace has an open enrollment period and special enrollment periods for eligible taxpayers. For information about enrollment periods, visit HealthCare.gov or contact your state-based Marketplace.

If you enrolled in insurance coverage through the Marketplace, you should report any changes in your circumstances like changes to your household income or family size to the Marketplace when they happen. Changes in circumstances may affect your advance payments of the premium tax credit. When you report a change in circumstances, you may become eligible for a special enrollment period, which allows you to purchase health care insurance through the Marketplace outside of the open enrollment period. Visit the Marketplace at HealthCare.gov for more information about reporting changes in circumstances and special enrollment.

To estimate the effect that changes in circumstances may have upon the amount of premium tax credit that you can claim – see the Premium Tax Credit Change Estimator on our Affordable Care Act Estimator Tools page.

Find out more about the Premium Tax Credit and other tax provisions of the Affordable Care Act at IRS.gov

Recommended Reading: Government Funding For First Time Home Buyers

Your Options Depend On Your Household Income

When you apply for Marketplace coverage youll estimate your income for the current calendar year.

- How to estimate your income if youre unemployed

-

Its hard to predict your annual income if youre unemployed. Still, its important to make your best estimate based on all current or expected sources of income for the year.

-

Types of income to include on your application:

- Unemployment compensation that you receive from your state. Visit CareerOneStop’s Unemployment Benefits Finder for more information about unemployment in your state.

- All household members income

- Additional types of income, including interest income, capital gains, and alimony

- Most withdrawals from traditional IRAs and 401ks. for information on non-deductible contributions, and IRS Publication 590-B for information on Roth accounts.)

-

Note: Its very important to immediatelyupdate your income information with the Marketplace if your income changes during the year. This will ensure you get the right amount of savings based on your new annual income estimate.

Health Coverage For People With Disabilities

If you have a disability, you have three options for health coverage through the government.

-

Medicaid provides free or low-cost medical benefits to people with disabilities. Learn about eligibility and how to apply.

-

Medicare provides medical health insurance to people under 65 with certain disabilities and any age with end-stage renal disease . Learn about eligibility, how to apply and coverage.

-

Affordable Care Act Marketplace offers options to people who have a disability, dont qualify for disability benefits, and need health coverage. Learn about the .

Also Check: Government Assistance For Single Parents

Federal Employees Health Benefits Program

The IRS participates in the Federal Employees Health Benefits Program , one of the best health care insurance programs in the world. You can choose from a variety of health care plans and options, and your IRS health benefits cover you and your family members at reasonable rates. This program offers:

- One of the widest selections of plans in the country

- Annual open season

- Coverage that continues into retirement, at the same rate

- Pre-tax options

The FEHB Program can help you meet your health care needs. Federal employees, retirees and their survivors enjoy the widest selection of health plans in the country.

Here are even more important program features:

- No waiting periods. You can use your benefits as soon as your coverage becomes effective. There are no pre-existing condition limitations even if you change plans.

- A choice of coverage. You can choose self-only coverage for you, or self and family coverage for you, your spouse, and unmarried dependent children under age 22. Under certain circumstances, your FEHB enrollment may cover your disabled child 22 years old or older who is incapable of self-support.

- A choice of plans and options.

- Fee-for-Service plans

- Plans offering a Point of Service product

- Health Maintenance Organizations

You Usually Must Buy A Plan During The Open Enrollment Period

The open enrollment period for marketplace and individual plans is from November 1 to December 15 each year. You can buy at other times only if you lose your coverage or have a life change. Life changes include things like getting married or divorced, having a baby, or adopting a child.

You can sign up for a work health plan when youre first hired or have a major life change. You have 31 days to decide whether you want to join the plan. You might have to wait up to 90 days for your coverage to start. If you join your work plan, you must wait until the next open enrollment period if you decide to drop out or change your coverage. The open enrollment period for work plans might be different from the marketplace period.

Also Check: Are Student Loans Government Funded

You And Your Health Plan Share The Cost Of Your Care

All health plans require you to pay some of the cost of your health care. This is called cost-sharing. In addition to premiums, you usually must meet a deductible and pay copayments and coinsurance.

- A deductible is the amount you must pay before your plan will pay. For example, if your deductible is $1,000, your plan won’t pay anything until you’ve paid $1,000 yourself. You’ll have to meet a deductible each year. Some plans have more than one deductible. For instance, you might have one deductible for in-network care and another for out-of-network care. If your plan covers your family, youll have a separate deductible for each family member and a deductible for the family. Some plans dont have deductibles.

- Copayments are fees you pay each time you get a covered health service. For example, you might have to pay $25 when you go to the doctor and $15 when you fill a prescription. Youll also have a copayment if you go to the emergency room or see a specialist. The amounts vary by plan.

- Coinsurance is an amount you pay for a covered service after youve met your deductible. Its usually a percentage of the cost of the service. For example, your health plan might pay 80 % of the cost of a surgery or hospital stay. You pay the other 20%. The percentage you pay in coinsurance varies by plan. You usually dont have to pay coinsurance in an HMO.

Learn more: How to save money at the doctor | Care options and costs

What Health Plans Cover

Coverages vary by plan. Coverage requirements are different for plans you get at work and those you buy directly from an insurance company. Even among plans you get at work, the requirements are different depending on whether you work for a small employer or a large one. If you ask, your plan must give you a Summary of Benefits and Coverages.

Federal law requires individual and small-employer plans to cover 10 types of health care services, called essential health benefits. In addition, Texas requires some plans to include certain health benefits. Some plans might cover more services, like adult dental and vision care and weight management programs.

Learn more: How to get help with a mental health issue | Watch: How to get help with a mental health issue

Recommended Reading: Master Of Governance And Public Policy

Can I Change My Health Insurance Coverage

Yes. After you retire, you will still have the opportunity to change your enrollment from one plan to another during an annual open season. You cannot change to another plan simply because you retired. Each year, Open Season runs from the Monday of the second full workweek in November through the Monday of the second full workweek in December. The 2021 Federal Employees Health Benefits Open Season will run from November 8 through December 13, 2021.

How Do I Get Insurance For My Family

You can add your family to a work health plan. If you buy from an insurance company or the marketplace, you can buy a plan that also covers your family.

You can keep your dependent children on your plan until they turn 26. They don’t have to live at home, be enrolled in school, or be claimed as a dependent on your tax return. You can keep married children on your plan, but you cant add their spouses or children to it.

If you have dependent grandchildren, you can keep them on your plan until they turn 25.

You May Like: Free Government Cell Phones For Senior Citizens

Small Business Health Options Program Marketplace

The Small Business Health Options Program Marketplace – also known simply as SHOP – helps small businesses provide health coverage to their employees. While the SHOP Marketplace was previously only open to employers with 50 or fewer full-time equivalent employees, starting in 2016, some states may make the SHOP Marketplace available to businesses with up to 100 employees. If you have more than 50 employees and don’t know if you can use the SHOP Marketplace, contact your state Department of Insurance or the SHOP Call Center.

The SHOP Marketplace – which is also open to non-profit organizations – allows you to offer health and dental coverage that meets the needs of your business and your employees. SHOP offers flexibility, choice, and online application and account management. You can enroll in SHOP any time of year. Theres no restricted enrollment period when you can start offering a SHOP plan.

Businesses that offer health coverage through the SHOP Marketplace may be eligible for the small business health care tax credit.

Can The Eligibility Requirements For Continuing Health Benefits Coverage Be Waived

Yes. OPM has the authority to waive the 5-year participation requirement when it’s against equity and good conscience not to allow an individual to participate in the health care insurance program as a retiree. However, the law says that a person’s failure to meet the 5-year requirement must be due to exceptional circumstances. When someone is retiring voluntarily, a waiver may not be appropriate because he or she can continue working until the requirement is met. When circumstances under these conditions otherwise warrant a waiver, we will notify the individual’s employer.

Don’t Miss: How Do I Sign Up For Government Assistance

What Is The Affordable Care Act

The Affordable Care Act provides individuals and families greater access to affordable health insurance options including medical, dental, vision, and other types of health insurance that may not otherwise be available. Under the ACA:

-

You may be able to purchase health care coverage through a state or federal marketplace that offers a choice of plans.

-

Insurers can’t refuse coverage based on gender or a pre-existing condition.

-

There are no lifetime or annual limits on coverage.

-

Young adults can stay on their familys insurance plan until age 26.

-

Seniors who hit the Medicare Prescription Drug Plan coverage gap or “donut hole” can get a discount on medications.

Read the full text of the ACA and learn more about its provisions and relationship to patients, insurers, businesses, and families.

Dental And Vision Insurance

Most employees are also eligible for the Federal Employee Dental Vision Insurance Plan . FEDVIP is a separate insurance plan from FEHB. You can sign up for dental plan, a vision plan or both types of insurance. You can choose from several different plans to cover yourself, your spouse and your unmarried, dependent children up to the age of 22.

Learn more about the dental and vision insurance plans.

You May Like: State Of Texas Government Jobs

Medicaid Chip And Insurance Plans Through The Marketplace

When you fill out a Marketplace application, youll find out if you qualify for any of these types of coverage:

- A Marketplace insurance plan. You may qualify for premium tax credits and savings on deductibles, copayments, and other out-of-pocket costs based on your household size and income. Some people with low incomes may wind up paying very small premiums. Learn about getting lower costs on a Marketplace insurance plan.

- Medicaid. Medicaid provides coverage to millions of Americans with limited incomes or disabilities. Many states have expanded Medicaid to cover all people below certain income levels. Learn more about Medicaid and how to apply.

- Childrens Health Insurance Program . CHIP provides coverage for children, and in some states pregnant women, in families with incomes too high for Medicaid but too low to afford private insurance. Learn more about CHIP.

After you finish your Marketplace application, youll get an eligibility determination that tells you what kind of coverage you and others in your household qualify for.

Federal Employee Health Benefits

The Federal Employees Health Benefits program is the largest employer-sponsored health insurance program in the world, covering more than 8 million Federal employees, retirees, former employees, family members, and former spouses.

FEHB includes different types of plans: fee-for-service with a preferred provider organization health maintenance organizations point-of-service high deductible health plans and consumer-driven health plans. How you obtain coverage or services and pay for them differs depending on the plan. However, benefits available under all plans include hospital care, surgical care, inpatient and outpatient care, obstetrical care, mental health and substance abuse care, and prescription drug coverage. There are no waiting periods or pre-existing condition limitations under FEHB, even if you change plans.

FEHB New Employees:

The following resources will help you elect a health insurance plan:

Once you enroll in a health insurance plan, your enrollment automatically continues each year, as long as you remain eligible for the program. You do not have to reenroll each year. However, if you would like to make a change in your health insurance, you may do so during the Benefits Open Season or in conjunction with a qualifying life event.

To include a foster child as a family member, you must certify that:

For additional information or assistance click on:

Don’t Miss: Government Loan Programs For Mortgages

Family And Medical Leave/paid Parental Leave

Covered Federal employees are entitled to up to 12 weeks of paid time off for the birth, adoption, or foster, of a new child under the Family and Medical Leave Act/Paid Parental Leave . “Covered employees” are Interior Business Center employees who have completed 12 months of Federal service. FMLA eligibility does not normally extend to employees serving under a temporary appointment of 1 year or less or as an intermittent employee.

The Marketplace Is For People Who Dont Have Health Coverage

If you don’t have health insurance through a job, Medicare, Medicaid, the Children’s Health Insurance Program , or another source that provides qualifying health coverage, the Marketplace can help you get coverage.

- If you have job-based insurance: You can buy a plan through the Marketplace, but you’ll pay full price unless your employer’s insurance doesn’t meet certain standards. Most job-based plans do meet the standards.

- If you have Medicare: You can’t switch to Marketplace insurance, supplement your coverage with a Marketplace plan, or buy a Marketplace dental plan. Learn about Medicare and the Marketplace.

Recommended Reading: Best Western Government Camp Or

Premium Tax Credits Can Help You Pay For Coverage

Tax credits are amounts taken off what you owe in taxes. You can use this savings to pay your health insurance premiums. To get a tax credit, you must buy through the federal marketplace. Your income must be between 100% and 400% of the federal poverty level.

You can’t get a tax credit if your employer offers affordable health insurance or your income is below the poverty level.

For more information about tax credits, visit HealthCare.govs Saving Money on Health Insurance page.