The Difference Between Government And Conventional Loans

Posted 3 years ago

When it comes time to obtain a new home mortgage, chances are that your new loan will either be a conventional or government loan.

Simply put,mortgages that are insured bythe FHA and the VA are government loans. Most other mortgages are considered to be conventional, or jumbo loans.

Joe The Gnome Collector: Fha Loan Benefits & Requirements

Joe has a low credit score due to his obsession with garden gnomes. He maxed out many credit cards buying garden gnomes, and traveling to see different gnomes throughout the world. Joe now needs a house to put all his gnomes. His parents offered to help him with the down payment, but he is still not sure how he will be approved for a loan.

An FHA loan may be the perfect loan for Joe, here’s why:

An FHA loan offers more flexible credit qualifying guidelines than other loan types. This is due to the fact that the Federal Housing Administration insures this type of loan. The FHA does not lend the money, rather they guarantee the loan. Since the government is backing the loan, a lender is able to offer a competitive interest rate, which can save borrowers money.

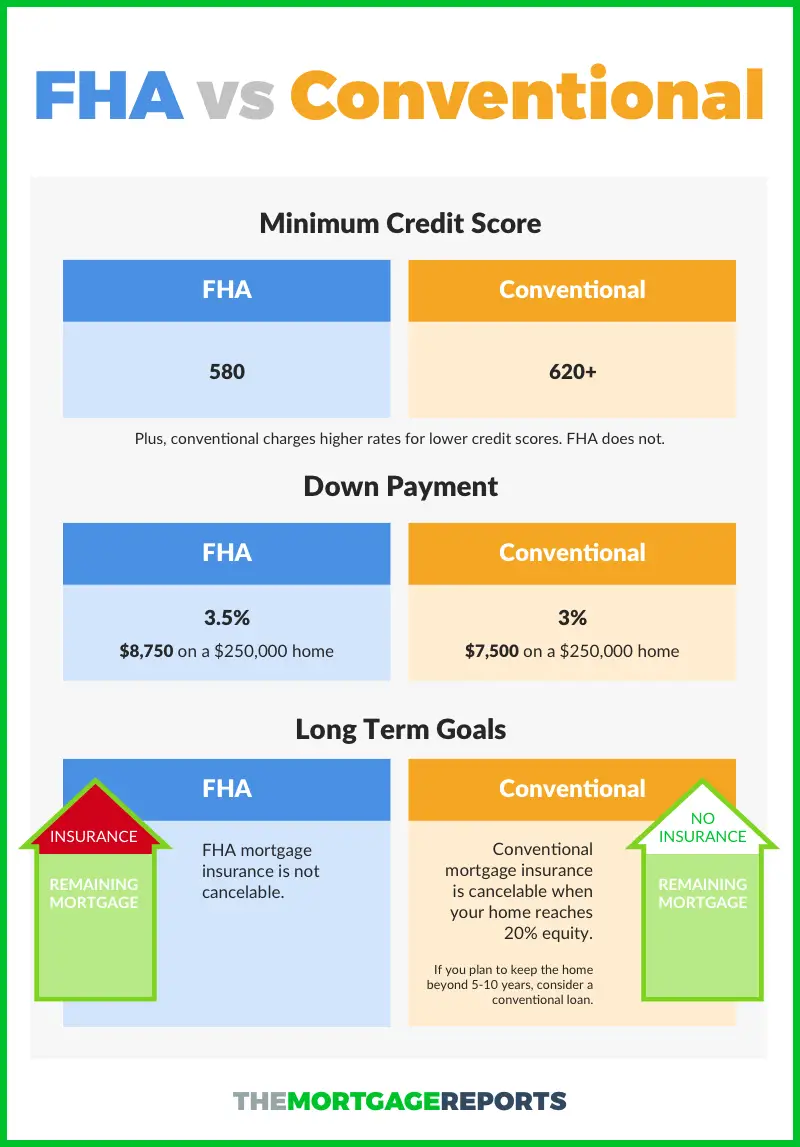

The requirements necessary for obtaining an FHA loan are relatively simple. Joe does not need to be worried about having the perfect credit score due to late payments, foreclosures, bankruptcies, tax liens, or legal judgments, in order to get an FHA loan. Currently, FHA guidelines state you only need a 580 credit score to qualify for maximum financing on an FHA loan, where a conventional loan will require at least a 620 credit score. However, this number may vary from lender to lender.

Make A Final Decision: Fha Or Conventional Mortgage

Youve done your homework and learned the difference between FHA loans and conventional mortgages. Take the next step and work with a loan officer who asks the right questions like the knowledgeable, experienced ones at Capital Bank and can find the loan that fits you best. Then youll have everything you need to make your final decision!

Read Also: Government Grants For Homeschoolers

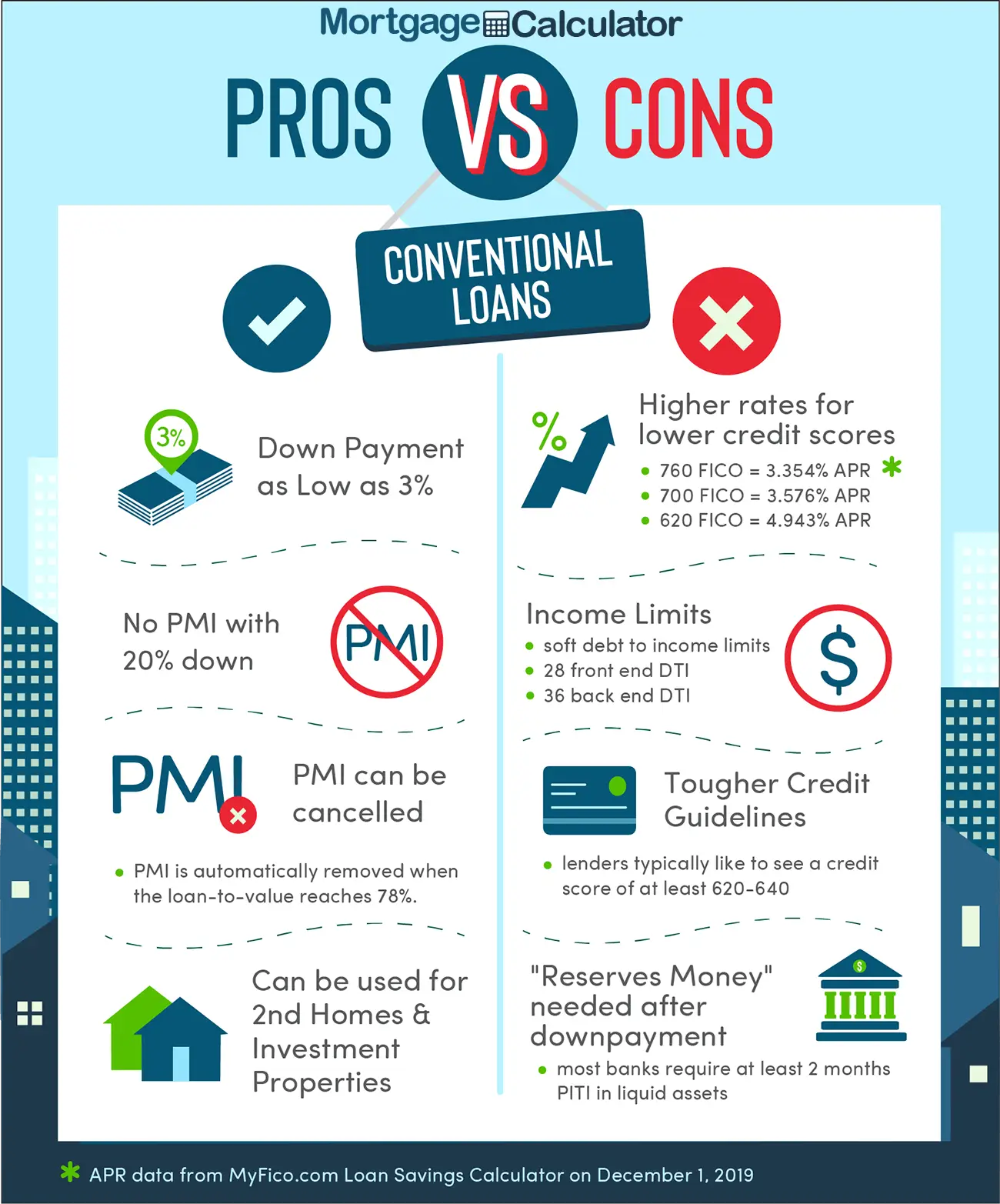

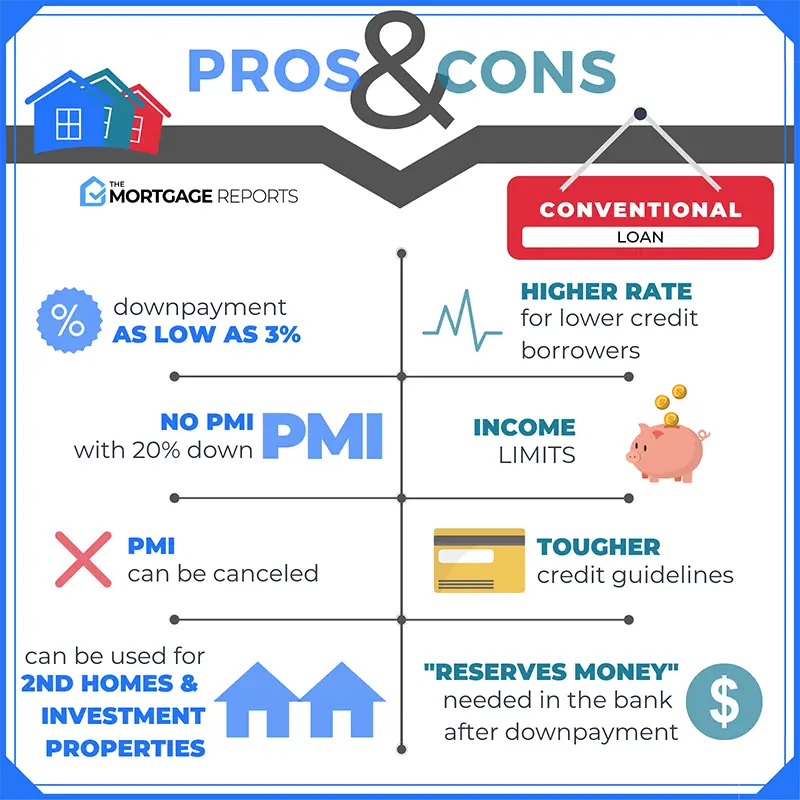

What Is A Conventional Loan

A conventional loan is a type of mortgage loan that is not insured or guaranteed by the government. Instead, the loan is backed by private lenders, and its insurance is usually paid by the borrower.

Conventional home loans are much more common than government-backed financing. In the second quarter of 2021, conventional loans were used for 76% of all new home sales, making them the most popular home financing optionby a long shot.1

Conventional loans offer buyers more flexibility, but theyre also riskier because theyre not insured by the federal government. This also means it can be harder for you to qualify for a conventional loanwhich actually helps protect you financially. But stay tunedwell get to that later.

When A Conventional Loan Makes Sense

Each situation is flexible, but your qualifications or preferences should be close to these if you want to try for a conventional loan:

- Your credit score is at least 620.

- You have a down payment equal to at least 3%, or 20% if you want to avoid PMI.

- You have a low debt-to-income ratio, or DTI, which compares your monthly debt payments to your monthly gross income.

- You want flexible repayment terms.

You May Like: Government Grants For Auto Repair Shops

The Fha Streamline Refinance Program

FHA loans have another advantage: the FHA Streamline program allows you to refinance an FHA loan without some of the costs or steps needed for other types of refinances.

This refinance option allows you to lower your monthly payments or interest rate faster because it doesnt require a complete credit check or income verification. Often, an appraisal is not required.

The FHA Streamline refinance doesnt allow you to roll closing costs into the new mortgage amount.

Fha Fixed Rate Mortgages

- FHA 30 Year Fixed Rate Loan: A fixed rate loan that generally requires a small down payment. This loan may be obtained by buyers with low credit scores.

- FHA 15 Year Fixed Rate Loan: Similar to the 30 Year Fixed Rate Loan, it offers the benefits of a stable monthly mortgage payment, except that the interest you pay over the life of the loan is significantly less because the loan is expected to be paid in half the time.

- FHA 203k 30 Year Fixed Rate Loan: The 203k loan program provides borrowers special financing to buy a fixer-upper with enough extra money to complete necessary renovations.

Recommended Reading: Government Grants Dental Work

Fha Loans And Mortgage Insurance

To offset a lower required credit score, FHA loans will typically include mortgage insurance as part of the borrowers responsibility.

FHA loans require two types of mortgage insurance payments:

- An upfront mortgage insurance premium of 1.75% of the loan amount, either paid when you close on the loan or rolled into the loan amount.

- A monthly MIP as part of your regular mortgage payments.

If your down payment was less than 10%, youll continue to pay monthly mortgage insurance for the life of the loan.

If your down payment was 10% or more, youll only have to pay mortgage insurance for the first 11 years of the loan before you can remove it.

How To Get A Conventional Loan You Can Afford

We know all this technical mumbo jumbo can sound pretty overwhelming, but dont panic! Weve got some super simple tips to help you confidently buy a house with a conventional loan.

Tip #1: Commit to putting at least 10% down for your conventional mortgage. A down payment of 20% or more is even better because you can avoid PMI! A hefty down payment reduces your monthly payment and ensures you start off with equity in your home.

Tip #2: Stick with a 15-year fixed-rate mortgage. With a 15-year mortgage, your monthly payments will be a little higher, but youll save tens of thousands of dollars in interest compared to a 30-year mortgage. And choosing a fixed rate means you dont ever have to worry about your interest rate changing. Its fixed for the life of the conventional loan.

Tip #3: Make sure your mortgage payment is no more than 25% of your monthly take-home pay. When you have a house you can afford, youve got flexibility to save for other important financial goals like retirement and your kids college.

Also Check: Federal Jobs In Las Vegas Nevada

Need More Mortgage Help

That was a lot to take in, but heres the great news: Youre already ahead of the game. You know that the type of mortgage you choose can have a big impact on your financial future. Thats why its so important to learn about all your options so you can make the best decision for you and your family.

If youre looking for a lender who will help you understand mortgages so you can make a confident decision, we recommend our RamseyTrusted provider Churchill Mortgage. Theyve helped hundreds of thousands of people like you finance their home the smart way.

About the author

Ramsey Solutions

Ramsey Solutions has been committed to helping people regain control of their money, build wealth, grow their leadership skills, and enhance their lives through personal development since 1992. Millions of people have used our financial advice through 22 books published by Ramsey Press, as well as two syndicated radio shows and 10 podcasts, which have over 17 million weekly listeners.

Jumbo Loans Are Conventional Not Conforming

- Jumbo loans are typically considered conventional loans

- This is mainly due to their large loan amounts

- Which means they dont meet agency or government underwriting guidelines

- As such they will have their own unique underwriting criteria you must meet to get approved

Home loans over the conforming loan limit are considered jumbo mortgages and arent eligible for delivery to Fannie or Freddie as a result.

There are no conventional loan limits because they arent governed by any particular entity.

So any private sector mortgage lender can lend as much as they want to a borrower. And there is no set loan eligibility standard they must abide by.

But if the loans dont meet the guidelines of Fannie and Freddie, they will often come with a higher mortgage rate as a result.

This has to do with liquidity. Its easy to sell loans that adhere to Fannie/Freddie underwriting standards because investors know what to expect from the underlying mortgage securities.

Conventional loans can be all over the map in terms of loan amount, down payment, credit score, and general risk. Still, both types of loans are considered conventional because they arent government loans.

Additionally, conforming loans have a minimum credit score requirement of 620 and tend to have a max loan-to-value ratio of 97%, whereas non-conforming conventional loans may allow lower credit scores and even higher LTVs.

Fannie Maes HomeReady is a popular conforming loan program that allows LTVs of up to 97%.

Also Check: Federal Grants For Dentures

When To Use A Conventional Loan

- Your credit score is fairly good

- Your DTI ratio is on the lower side

- You can afford a larger down payment

- You want flexibility with insurance and repaying your loan

Its important to thoroughly research your options before choosing a loan. A key takeaway when comparing FHA vs. conventional loans is that FHA loans are federally insured and conventional loans arent. This distinction results in different qualification and payment requirements for each loan.

Use the information in this post to carefully compare the differences in accepted credit scores, minimum down payments, loan limits, maximum debt-to-income ratios, mortgage insurance and property standards. In doing so, choose the loan that works for your circumstances and helps you best afford the home of your dreams.

Why You Can Trust Bankrate

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. Weve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate follows a strict editorial policy, so you can trust that were putting your interests first. All of our content is authored by highly qualified professionals and edited by subject matter experts, who ensure everything we publish is objective, accurate and trustworthy.

Our mortgage reporters and editors focus on the points consumers care about most the latest rates, the best lenders, navigating the homebuying process, refinancing your mortgage and more so you can feel confident when you make decisions as a homebuyer and a homeowner.

Read Also: Las Vegas Gov Jobs

What Is A Conventional Mortgage Or Loan

8 Min Read | Dec 30, 2021

Remember when you first started daydreaming about buying a home? You were probably imagining everything from freshly decorated rooms to a breathtakingly beautiful backyard. And you probably werent imagining the hours youd spend talking to your lender and researching different mortgage options.

To get you back to that sunny daydream, lets start by exploring the most popular mortgage option out there: the conventional loan. Because theyre so common, youve probably heard of conventional loans before. You may have even had a lender recommend them to you!

But what exactly are conventional loans? And how do they stack up against your other loan options? And why are they the only mortgage option we recommend? Heres the information you need to make a smart decision about whether or not a conventional loan is right for you.

Difference Between Fha And Conventional Loans

The main difference between FHA and conventional loans is the government insurance backing. Federal Housing Administration home loans are insured by the government, while conventional mortgages are not.

Additionally, borrowers tend to have an easier time qualifying for FHA-insured mortgage loans, compared to conventional. The closing process can take a bit longer as well, as explained here.

Did you know? The Federal Housing Administration falls under the Department of Housing and Urban Development , one of the 15 cabinet departments of the U.S. federal government.

You May Like: Las Vegas Government Jobs

Cost Of Mortgage Insurance

Be sure to consider the cost of mortgage insurance when comparing the two. An FHA loan will most likely cost you more in mortgage insurance premiums than a conventional loan.

For FHA loans, borrowers are required to pay a monthly mortgage insurance premium regardless of their down payment amount, and they must also pay a 1.75% upfront mortgage insurance fee when the loan closes. On a $300,000 loan that equates to $5,250.

Conventional loans only charge monthly mortgage insurance, but it can be dropped later on once youve earned enough equity in your home or have reached a certain loan to value . FHA mortgage insurance is required for the life of the loan.

Conventional Loan Down Payment

Contrary to popular belief, a 20% down payment is not a requirement to obtain a conventional loan. However, if you cant come up with a 20% down payment, youll have to pay private mortgage insurance , which is a lenders protection in case you default on your loan.

A smaller down payment equals more risk, so you mitigate that risk for the lender when you pay for mortgage insurance. PMI payments are built directly into your monthly mortgage payments.

Don’t Miss: Safelink Wireless Las Vegas

Fha Loans Vs Conventional Loans: An Overview

Consumers qualify for various types of mortgages based on their financial profiles. A lot of mortgages tend to be conventional loans. But there are others that are backed and insured by the Federal Housing Administration .

While both allow consumers to finance the purchase of a home, there are several key differences between FHA loans and conventional loans.

FHA loans make homeownership possible and easier for low- to moderate-income borrowers who may not otherwise be able to get financing because of a lack of or a poor , or because they have limited savings. Those who qualify for an FHA loan require a lower down payment. And the credit requirements arent nearly as strict as other mortgage loanseven those with credit scores below 580 may get financing. These loans are not granted by the FHA itself. Instead, they are advanced by FHA-approved lenders.

People with established credit and low levels of debt, on the other hand, usually qualify for conventional mortgages. These loans are generally offered by private mortgage lenders like banks, credit unions, and other private companies. Unlike FHA loans, conventional mortgages arent backed or secured by the government.

Understanding The Differences Between Conventional Loans Versus Government

In this blog, we will cover and discuss comparing conventional versus government loans. There are times when homebuyers need to use Conventional Versus Government loans. Government loans are for primary residence financing only. You cannot purchase a second home and/or investment property using an FHA, VA, USDA loan. Government-backed loans are for those homebuyers who intend in using their home purchase as an owner-occupant primary home. Conventional loans are often called conforming loans. This is because conventional loans need to conform to Fannie Mae and/or Freddie Mac Agency mortgage guidelines. Arent conventional loans private loans and not backed by a government agency? Why do private home loans need to conform to Fannie Mae and/or Freddie Mac Agency Mortgage Guidelines if they are not government-backed loans?

You May Like: Governmentjobs.com Las Vegas

Todays Fha And Conventional Mortgage Rates

For todays low down payment home buyers, there are scenarios in which the FHA loan is whats best for financing and there are scenarios in which the Conventional 97 is the clear winner. Rates for both products should be reviewed and evaluated.

Take a look at todays real mortgage rates now. Your social security number is not required to get started, and all quotes come with instant access to your live credit scores.

What Are The Roles Of Fannie Mae And Freddie Mac

MISHKANET.COM” alt=”Fha vs conventional loan calculator > MISHKANET.COM”>

MISHKANET.COM” alt=”Fha vs conventional loan calculator > MISHKANET.COM”> The reason for this is that Fannie Mae and Freddie Mac are the two giant mortgage companies that purchase mortgage bonds on the secondary market. Mortgage companies will use their warehouse line of credit obtained by banks to originate and fund conventional loans. After they fund home mortgages, lenders need to sell the loans they fund on the secondary mortgage bond market.

Recommended Reading: Government Dental Grants For Seniors

How Does Private Mortgage Insurance Work On Conventional Loans

Private mortgage insurance is required on all conventional loans if the loan to value is greater than 80% LTV. Mortgage Insurance on conventional loans is not a fixed rate like FHA loans. PMI rates depend on various factors such as the borrowers credit scores, the LTV, the property type, and other factors.

Va And Usda Loans Require Zero Down Payment On Home Purchase

VA and USDA loans are two specialty mortgage loan programs that do not require any down payment. VA loans are the best loan program in the nation. Zero down payment, no mortgage insurance, no maximum loan limit caps, and low mortgage rates than any other loan program. Only properties that are in a designated USDA Rural Development Area are eligible for USDA loans. USDA loans do not require any down payment. Plus, there are household income restrictions on USDA loans.

Recommended Reading: City Jobs In Las Vegas Nv

Features Of An Adjustable Conventional Loan

Many borrowers shy away from adjustable rate conventional loans. Instead, they prefer to stick with traditional amortized loans, so there are no surprises concerning mortgage payments due down the road. But an adjustable-rate mortgage might be just the ticket to help with the early years of payments for borrowers whose incomes are expected to increase.

The initial interest rate is typically lower than the rate for a fixed-rate loan, and there’s usually a maximum, known as a cap rate, on how much the loan can adjust over its lifetime. The interest rate is determined by adding a margin rate to the index rate. Adjustment periods can be monthly, quarterly, every six months, or yearly.