How Long Will It Take To Pay Off My Student Loan

The standard repayment period for a federal student loan is 120 months . Repayment terms for a private student loan vary, depending on the lender. But, private lenders generally do not offer the same flexibility and repayment options that are available with federal student loans.

For example, borrowers with more than $30,000 in federal student loans may opt for an extended repayment period of up to 25 years. Federal borrowers may also qualify for an income-driven repayment plan, which could extend the loan term to 25 years.

Interest rates dont affect the length of your loan, as the term is based on the type of repayment plan you have, such as a standard repayment plan, an extended repayment plan or income-driven repayment plans.

Current Private Student Loan Interest Rates

Unlike federal loans, private student loan rates change much more than once a year. These rates are determined by each bank, credit union, or online lender and are based on current market conditions.

Private lenders review several factors, including your credit score, to determine eligibility. These factors are also used in determining what interest rate you receive within the range offered by the lender.

Below, you will find private student loan interest rates from several lenders in the industry.

Subsidized Vs Unsubsidized Loans

The Department of Education offers subsidized and unsubsidized loans for undergraduate students. Subsidized student loans are available to students based on financial need.

With subsidized loans, the government pays any accumulated interest on your behalf while youre still completing your education. In other words, you wont owe any interest on your student loan until after you graduate.

When a loan is unsubsidized, you as the borrower may have to start repaying interest on your principal amount immediately. However, if your unsubsidized loan qualifies for an in-school deferment you can delay your interest payments .

Don’t Miss: Free Government Flip Phones For Seniors

Fed Loan Rates For 21

While rates are increasing for new federal student loans, rates on existing student loans will likely remain the same unless you have an older variable-rate loan.

Edited byAshley HarrisonUpdated August 10, 2021

Our goal is to give you the tools and confidence you need to improve your finances. Although we receive compensation from our partner lenders, whom we will always identify, all opinions are our own. Credible Operations, Inc. NMLS # 1681276, is referred to here as “Credible.”

Your student loan interest rate is a percentage that represents how much youll pay in interest charges each year essentially the cost of borrowing money.

The interest rates on federal student loans are set by Congress and can change each year. For the 2021-22 academic year, the interest rates on federal Direct Loans will be rising.

Heres what you should know about student loan interest rate increases:

How Federal Student Loan Interest Rates Are Set

As noted above, federal student loan interest rates are based on Treasury yields, and Tuesdays auction was the final precursor to formal Congressional approval.

The 10-year Treasury notes closing yield was included in formulas to determine the final fixed interest rate for each federal loan type. These are:

- Direct unsubsidized loans for undergraduates: 10-year Treasury + 2.05%

- Direct unsubsidized loans for graduates: 10-year Treasury + 3.60%

- Direct PLUS loans: 10-year Treasury + 4.60%

Don’t Miss: How To Start A Business With Government Grants

How To Calculate How Much Interest You Will Owe

Every month, the interest amount you owe on your loan is recalculated using a daily interest formula based on your total outstanding loan amount:

Interest amount = Outstanding principal balance x Number of days since last payment x Interest rate factor

The interest rate factor is your annual interest rate divided by the number of days in the year. Your loan servicer is responsible for billing you monthly and explaining how your payments are applied to your principal balance.

You can use our student loan payment calculator to see how much your loan will cost in the long run after interest is accounted for.

Note that if you enter into forbearance or deferment on your loans, or sign up for an extended or income-driven repayment plan, your loans will accrue more interest over time making them more costly.

> > Read More: How Student Loan Interest Works

Impact Of The Rise In Interest Rates

Borrowing $5,500 in federal loans for 2021-22 the maximum loan amount for dependent first-year undergraduate students for a standard 10-year term will cost $1,098 in interest with monthly payments of $55. That is $3 more a month and $301 more in total interest compared with the same loan taken out at this years rates.

The increase in interest rates will have a bigger impact on borrowers who take out PLUS loans given the higher interest rates on such loans. There are also no specific limits on the amount of a loan rather, it is determined by the schools cost of attendance.

If a parent borrows around the average for a PLUS loan, or $16,500, for a 10-year term at next years rate of 6.28%, the cost would be $186 a month and $5,762 in total interest. Thats $9 more a month and $969 more in total interest for the same loan this year.

You May Like: Government Accounting Problems And Solutions

How Do I Get This Loan

You apply using the FAFSA or Renewal FAFSA, just the way you would for other federal student aid. Then you complete a promissory note provided by the school or the U.S. Department of Education. The promissory note is a binding legal document when you sign it youre agreeing to repay the loan under certain terms. Read the note carefully and save it.

Private Loan Interest Rates

Private lenders have started to implement strategies similar to federal relief in order to keep default rates at historic lows the current private loan default rate is 2%.

- Official report estimates for the overall average private student loan interest rate generally range from 6% to 7%.

- Among major private lenders, 12.99% is the highest annual percentage rate .

- The lowest available APR among private lenders is 1.04% *.

- 93% of private undergraduate loans have a co-signer, which typically lowers a borrowers interest rate.

- 60% of graduate loans are co-signed.

*Both of these rates are from CollegeAve.

Recommended Reading: Is There Government Funding For Solar Panels

If Youre Having Trouble Repaying

If you need help with repaying your Canada Student Loan, you may qualify for the Repayment Assistance Plan .

If youre having trouble repaying a provincial student loan, contact your student aid office. For repayment assistance with a loan or line of credit provided by your financial institution, contact your branch to determine what your options are.

Understand that by making your payments smaller, it will take you longer to pay back your loan. Youll end up paying more interest on your loan.

If you consider refinancing or consolidating your student loan, note that there are important disadvantages.

If you transfer your federal or provincial student loan to a private lender, you will lose any tax deductions on your student loan interest. You wont qualify for the interest free period while you’re in school and will end up paying more interest over time.

Interest Rates For Federal Plus And Perkins Loans

Both Federal PLUS and Perkins Loans are no longer available. They held the same rates until the end of their programs:

- Federal PLUS Loan rate 8.5%

- Perkins Loan rate 5%

Federal PLUS Loans were part of the FFEL Loan Program that ended in 2010. Perkins Loans were designed as a low-interest option for low-income undergraduate and graduate students and included a forgiveness program. These havent been available since 2017.

Also Check: Bucks County Pa Government Jobs

How Student Debt Affects Your Credit Score

Student loans and lines of credit form part of your credit history. If you miss or are late with your payments, it can affect your credit score.

Your credit score shows future lenders how risky it can be for them to lend you money. A poor credit score can also affect your ability to get a job, rent an apartment or get credit.

Federal Student Loan Rates: 2020 To 2021

- Undergraduate Direct Subsidized and Unsubsidized loans – 2.75%

- Graduate or Professional Unsubsidized loans – 4.3%

- Direct PLUS loans – 5.3%

Compared to last year, students will be paying 1.78% less on interest, which could save you hundreds to thousands of dollars over the life of the loan. For example, if you took an undergraduate loan last year for $7,500 with a 4.53% interest rate, and a standard 10-year repayment plan, you will be paying around $1,840 worth of interest. If you take out that same loan this year, with the same repayment plan, but with the 2.75% interest rate, youll only be paying $1,087 worth of interest.

Recommended Reading: Government Benefits For Legally Blind

How To Calculate Student Loan Interest

Calculating your student loan interest can help you determine your monthly budget. To calculate how much interest you pay each month, use the following steps:

Let’s say you’re charged 5 percent interest on your $10,000 loan every month. Here’s what those steps look like:

In this scenario, you’ll pay $41.10 in interest each month.

Keep in mind that some private loans do carry a variable rate, so the daily interest rate may fluctuate over the life of the loan, typically on a monthly, quarterly or annual basis. You can also use a student loan calculator to calculate your monthly interest charge.

Learn more:How to calculate student loan interest

How Do I Refinance My Student Loans

To refinance your student loans, shop around and compare a few lenders to see which one offers the best rate and repayment terms for your situation, getting prequalified where possible. When you’re ready to apply, you can typically apply online, over the phone or in person. Once you’re approved and have submitted the necessary documentation, the lender will pay off your existing loans, and you’ll begin making your new payments.

Read Also: Government Grants For Minority Startup Businesses

Fees For Federal Student Loans

Federal Student Loans also charge fees that are a percentage of the total loan amount. Similar to the fixed interest rate, these depend on the loan type and are set annually. The fee is deducted from each loan disbursement you receive while enrolled in school.

For example, a 4.228% fee means if you want your school to receive $10,000 in disbursement, you need to effectively borrow $10,441.5 ) in principal for that student loan to cover the fee, so that your school will receive $10,000. Or if you borrow for $10,000 in principal, your school will then only receive $9,577.2 ) actual disbursement.

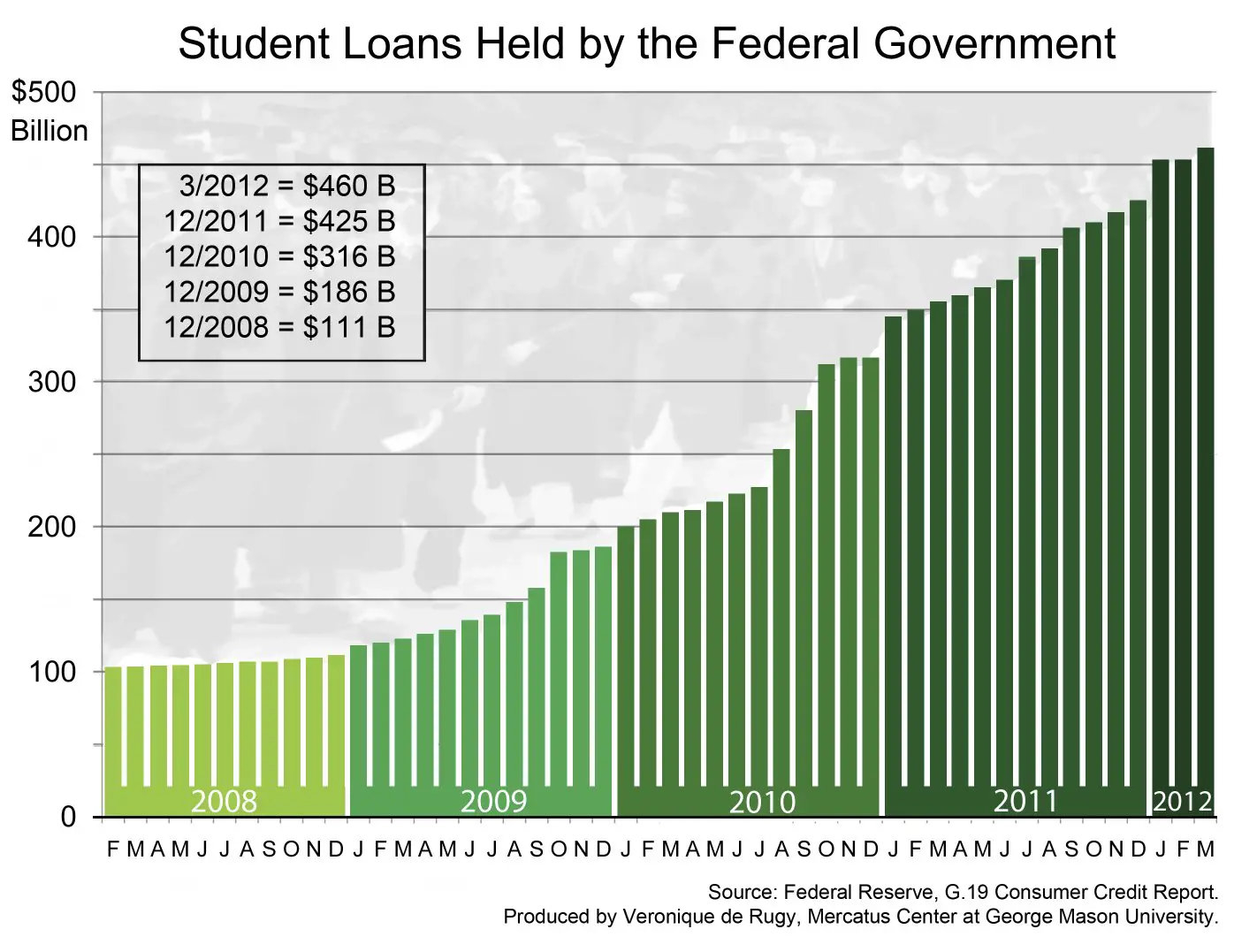

How Has The Coronavirus Affected Student Loan Interest Rates

With the U.S. economy in a state of upheaval due to the coronavirus pandemic, interest rates have fallen to near-record lows for many financial products. Student loans are no exception when the Fed cut interest rates in spring 2020, many private student loan companies lowered their interest rates on both fixed and variable products. Federal student loan rates for the 2020-21 and 2021-22 school years are some of the lowest rates in over a decade.

“For borrowers of all types, including student loans, we remain in an environment where rates remain remarkably low,” says Mark Hamrick, Washington Bureau Chief and senior economist for Bankrate. Student loan interest payments on federal student loans are also waived through Jan. 31, 2022.

Don’t Miss: Government Grants For Stroke Victims

The Difference Between Fixed And Variable Rates

Student loan interest rates can be either fixed or variable. Fixed interest rates dont change over your loan term, so youll know upfront how much your total cost to borrow will be and what your monthly payments will look like. Variable interest rates change based on market conditions, so your monthly payment may increase or decrease periodically.

Fixed Vs Floating Interest Rates

You can request to have a fixed interest rate. You can only make this change once. Contact the NSLSC or the Alberta Student Aid Service Centre for more information.

|

CIBC prime rate plus 2% |

Prime rate of Canadian banks plus 2% |

To compare the cost of choosing floating and fixed rates, use the Government of Canadas loan repayment estimator.

Read Also: Government Grants For Farm Fencing

Other Sources Of Funding

-

Registered Education Savings Plans

A Registered Education Savings Plan is a long-term investment account that lets people save up to $50,000.00 for a childs education. Money deposited into an RESP grows in 2 ways:

- Funds are put towards either fixed investments or equity investments . Interest earned on these investments is not taxed.

- Through the Canada Education Savings Grant , the federal government matches annual RESP contributions by 20% if the the future students receiving the funds are 17 or younger. The CESG applies on the first $2,500.00 of annual contributions up to a lifetime limit of $7,200.00.

- Through the Canada Learning Bond program, children from low-income families will get up to $2,000.00 in RESP contributions from the federal government. This is not a matching program no personal contributions are necessary to get the CLB.

Contributions to an RESP are not tax deductible. Withdrawals from an RESP for educational purposes are called educational assistance payments and count as part of the students annual taxable income. Should funds go unused and get returned to the contributor, he or she can receive the funds without paying additional tax.

What If I Cant Afford Repayments

When life happens and unexpected circumstance hurt your ability to pay back your loans, you have options especially if you have government student loans. Making payments on time and in full is key to maintaining a good credit score, which helps you in many areas of life like getting a car, buying a home, supporting a family and travelling.

1. Negotiate a better repayment plan with your lender

One surprisingly effective but easily overlooked solution to managing debt is to contact your lender, explain that youre struggling financially and ask if theyll agree to a new payment arrangement thatll help you meet your obligations. Be sure to explain any specific factors or circumstances affecting your ability to pay .

Lenders would rather work with you than risk losing money, so you may be offered an extended term with lower monthly payments, a different interest rate, permission to make a late payment without penalty, deferred payments or some other solution. By doing this, you could protect both your wallet and your credit score.

2. Refinance your student loans

One drawback is that student loans already tend to come with lower interest rates than most credit products, so it may be difficult to find a loan that lets you save money. However, if you have non-student debt such as credit cards, car loans, personal loans or mortgages, refinancing those could save you money on interest, which can then be applied to your student loans.

3. Government repayment assistance plans

Also Check: Is The Government Shutdown Again

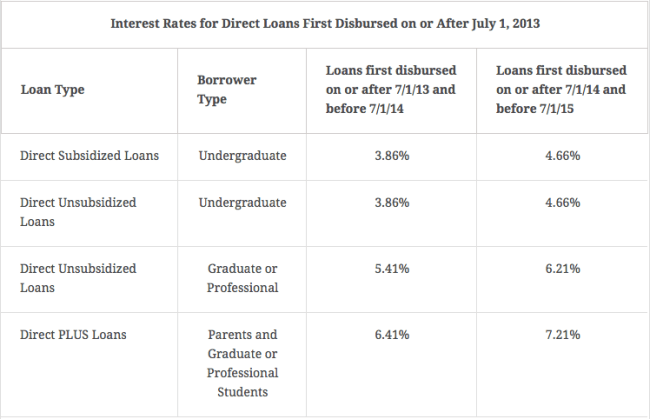

Federal Student Loan Interest Rates

Each spring, student loan interest rates are set by Congress based on the high yield of the last 10-year Treasury note auction in May. New rates apply to student loans disbursed from July 1 to June 30 of the following year. Federal loans are fixed, meaning that the rate will not fluctuate for the life of the loan. The interest rate you receive on a federal student loan is not determined by your credit score or financial history.

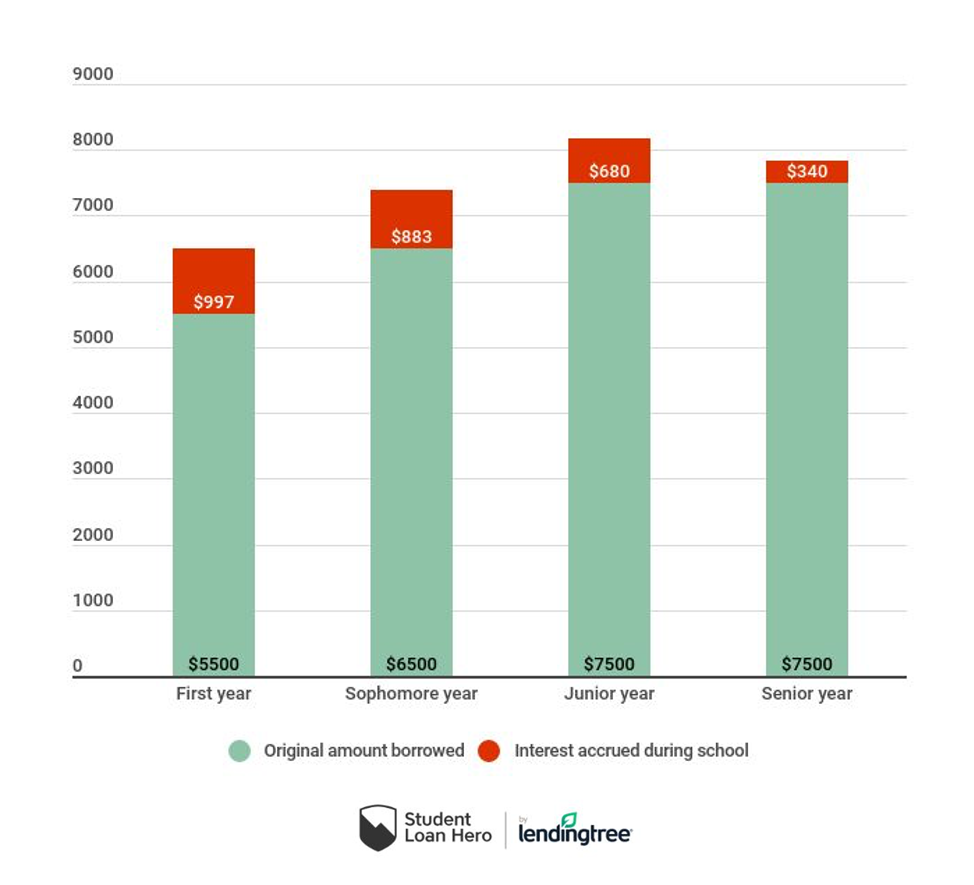

Interest charges differ between subsidized and unsubsidized loans. For federal subsidized loans, the government pays your interest charges for you while youre in school at least half time, during your grace period and while youre in deferment. The amount youll owe once your loan is in repayment will include only your original principal balance, loan fees and interest accrued moving forward.

With federal unsubsidized loans, interest charges start accruing immediately after funds are disbursed. If you choose to hold off on making loan payments until later, the accumulated student loan interest gets added to your principal balance when the loan enters repayment.

With that said, interest rates on federal student loans are temporarily set to zero through Jan. 31, 2022, due to impacts of the coronavirus pandemic.

Ascent Student Loans Disclosures

Ascent Student Loans Disclosures

*Ascent Student Loans are funded by Bank of Lake Mills, Member FDIC. Loan products may not be available in certain jurisdictions. Certain restrictions, limitations and terms and conditions may apply. For Ascent Terms and Conditions please visit: AscentStudentLoans.com/Ts& Cs

Rates are effective as of 09/01/2021 and reflect an automatic payment discount of 0.25% on the lowest offered rate and a 2.00% discount on the highest offered rate. Automatic Payment Discount is available if the borrower is enrolled in automatic payments from their personal checking account and the amount is successfully withdrawn from the authorized bank account each month. For Ascent rates and repayment examples please visit: AscentStudentLoans.com/Rates

1% Cash Back Graduation Reward subject to terms and conditions. for details.

Don’t Miss: How To Get Free Government Internet