Medicare Part D Donut Hole Coverage Gap Costs

Medicare Part D prescription drug plans and some Medicare Advantage plans have what is known as a donut hole or coverage gap, which is a temporary limit on how much a Prescription Drug Plan will pay for prescription drug costs.

As of 2020, Part D beneficiaries pay 25 percent of the cost of brand name and generic drugs during the coverage gap until reaching catastrophic coverage spending limit.

What Is The Average Cost Of Medicare Supplement Insurance

The average premium paid for a Medicare Supplement Insurance plan in 2019 was $125.93 per month.3

Its important to note that each type of Medigap plan offers a different combination of standardized benefits. Plans with fewer benefits may offer lower premiums.

Other factors such as age, gender, smoking status, health and where you live can also affect Medigap plan rates.

Medicare Supplement Insurance plans help pay for some of the out-of-pocket expenses youll face when you use Medicare Part A and Part B benefits. Medigap plans are sold by private insurance companies.

These costs can include certain Medicare deductibles, coinsurance, copayments and other charges.

There are 10 different Medigap plans available in most states. You can use the chart below to compare the costs that each type of Medigap plan may cover.

Medigap plans and Medicare Advantage plans are not the same thing. You cannot have a Medigap plan and Medicare Advantage plan at the same time.

| 80% | 80% |

Read additional medicare costs guides to learn more about Medicare costs and how they will affect you.

Comparison With Private Insurance

Medicare differs from private insurance available to working Americans in that it is a social insurance program. Social insurance programs provide statutorily guaranteed benefits to the entire population . These benefits are financed in significant part through universal taxes. In effect, Medicare is a mechanism by which the state takes a portion of its citizens resources to provide health and financial security to its citizens in old age or in case of disability, helping them cope with the enormous, unpredictable cost of health care. In its universality, Medicare differs substantially from private insurers, which must decide whom to cover and what benefits to offer to manage their risk pools and ensure that their costs do not exceed premiums.

Medicare also has an important role in driving changes in the entire health care system. Because Medicare pays for a huge share of health care in every region of the country, it has a great deal of power to set delivery and payment policies. For example, Medicare promoted the adaptation of prospective payments based on DRGs, which prevents unscrupulous providers from setting their own exorbitant prices. Meanwhile, the Patient Protection and Affordable Care Act has given Medicare the mandate to promote cost-containment throughout the health care system, for example, by promoting the creation of accountable care organizations or by replacing fee-for-service payments with bundled payments.

Don’t Miss: How Do I Get Government Housing

Fact: Medicare Advantage Maintains Lower Per

- An October 2021 actuarial analysis from Milliman found that per-member, per-month spending in Medicare Advantage is nearly $7 lower than per-member, per-month spending for beneficiaries of a similar health status in FFS Medicare .

- The research additionally showed that Medicare Advantage covers the same hospital and physician services at a 24% lower cost than FFS Medicare .

- All told, Millimans findings show that Medicare Advantage provides approximately $32.5 billion annually in added value to seniors through lower out-of-pocket costs and additional benefits unavailable in FFS Medicare, leading the researchers to conclude that the federal government pays less and gets more for its dollar in MA than in FFS, adding that findings suggest that overall MA offers significant value for the government.

How Are Medicare Supplements Funded

The federal government doesnt contribute financially to Medigap premiums.

If youd like more information on Medicare plans near you, complete an online rate comparison form to have an agent get in contact with you. Also, you can call the number above and speak with a Medicare expert today!

- Was this article helpful ?

You May Like: Government Grants For Start Up Businesses

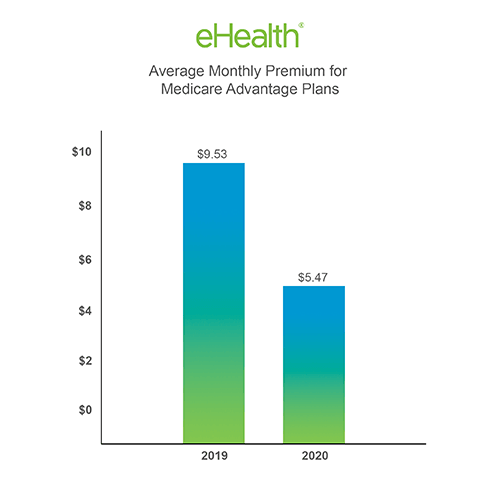

Comparing Medicare Advantage Costs By Insurance Company

While insurers typically offer a range of plans, Aetna is the cheapest Medicare Advantage provider with an average cost of $7 per month.

Aetna stands out for having a large quantity of cheap plans, and many of its plans cost $0 per month. As a result, the company was named the cheapest Medicare Advantage provider.

An AARP Medicare Advantage plan costs an average of $21 per month, which is middle-of-the-road compared to other national insurance companies.

And the cost of a Humana Medicare Advantage plan averages $41 per month, indicating that the insurer offers a large number of expensive plans costing up to $200 per month. However, there are also many Humana plans that cost $0 per month, which are a popular option that’s widely available.

| Company |

|---|

Audits Reveal Millions In Medicare Advantage Overcharges

Newly released federal audits reveal widespread overcharges and other errors in payments to Medicare Advantage health plans for seniors, with some plans overbilling the government more than $1,000 per patient a year on average.

Summaries of the 90 audits, which examined billings from 2011 through 2013 and are the most recent reviews completed, were obtained exclusively by Kaiser Health News through a three-year Freedom of Information Act lawsuit, which was settled in late September.

The governments audits uncovered about $12 million in net overpayments for the care of 18,090 patients sampled, though the actual losses to taxpayers are likely much higher. Medicare Advantage, a fast-growing alternative to original Medicare, is run primarily by major insurance companies.

Officials at the Centers for Medicare & Medicaid Services have said they intend to extrapolate the payment error rates from those samples across the total membership of each plan and recoup an estimated $650 million as a result.

But after nearly a decade, that has yet to happen. CMS was set to unveil a final extrapolation rule Nov. 1 but put that decision off until February.

Ted Doolittle, a former deputy director of CMS Center for Program Integrity, which oversees Medicares efforts to fight fraud and billing abuse, said the agency has failed to hold Medicare Advantage plans accountable. I think CMS fell down on the job on this, said Doolittle, now the health care advocate for the state of Connecticut.

Read Also: Does The Government Sell Student Loans

Why Gao Did This Study

The Medicare program, which includes MA, is on GAO’s High Risk List, because of its size, complexity, and susceptibility to mismanagement and improper payments. Under MA, CMS pays MA organizations a fixed monthly amount per Medicare beneficiary to provide health care coverage no matter how many services are provided or how much those services cost. These organizations can retain savings if their costs to provide services are lower than their payments, but can incur losses if their costs exceed payments. In 2021, Medicare paid MA organizations about $350 billion to provide health care benefits to about 27 million beneficiaries.

This testimony is based on GAO’s prior work and focuses on, among other things, key findings and the status of CMS’s efforts to implement GAO recommendations related to monitoring disenrollments from MAOs by Medicare beneficiaries in the last year of life, and validating encounter data used to risk adjust MA organization payments. This testimony draws from GAO reports on Medicare Advantage issued from 2014 through 2021 . GAO also reviewed documents from CMS regarding steps taken to address GAO’s recommendations.

For more information, contact Leslie V. Gordon at 512-7114 or .

What Constitutes An Overpayment

Auditors flag overpayments when a patient’s records fail to document that the person had the medical condition the government paid the health plan to treat, or if medical reviewers judge the illness is less severe than claimed.

That happened on average for just over 20% of medical conditions examined over the three-year period rates of unconfirmed diseases were higher in some plans.

As Medicare Advantage’s popularity among seniors has grown, CMS has fought to keep its audit procedures, and the mounting losses to the government, largely under wraps.

From the outside, it seems pretty smelly.

That approach has frustrated both the industry, which has blasted the audit process as “fatally flawed” and hopes to torpedo it, and Medicare advocates, who worry some insurers are getting away with ripping off the government.

“At the end of the day, it’s taxpayer dollars that were spent,” said David Lipschutz, a senior policy attorney with the Center for Medicare Advocacy. “The public deserves more information about that.”

At least three parties, including KHN, have sued CMS under the Freedom of Information Act to shake loose details about the overpayment audits, which CMS calls Risk Adjustment Data Validation, or RADV.

Also Check: Government Grants For Small Towns

Medicare Advantage: Continued Monitoring And Implementing Gao Recommendations Could Improve Oversight

GAO-22-106026

We testified about our work on oversight of Medicare Advantage, a private plan option for Medicare coverage.

For example, we found that Medicare Advantage beneficiaries in the last year of life left the program to join traditional Medicare at twice the rate of other beneficiaries. This could indicate potential problems with their care.

The Medicare program, which includes Medicare Advantage, is on our High Risk List because of its size, complexity, and susceptibility to mismanagement and improper payments.

Why Do Medicare Advantage Plans Cost More And How Are They Paid

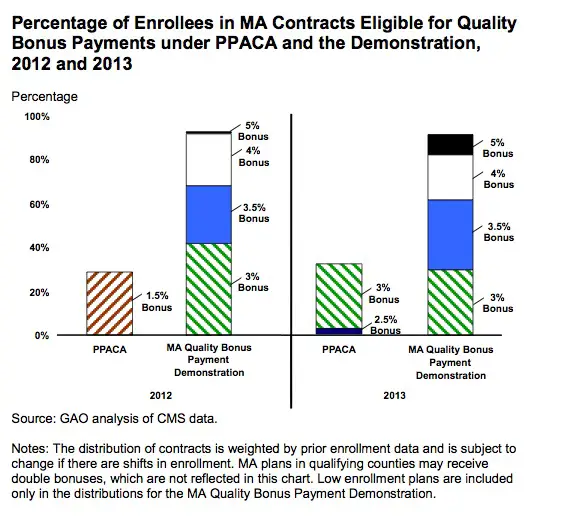

The government pays Medicare Advantage plans a set rate per person, per year under what is called a risk-based contract.12 That means that each plan agrees to assume the full risk of providing all care for that inclusive amount. This payment arrangement, called capitation, is also intended to provide plans with flexibility to innovate and improve the delivery of care.

But there are layers of complexity built into and on top of that set rate that allow for various adjustments and bonus payments. While those adjustments have proved useful in some ways, they can also be problematic and are the main reason for the extra cost of Medicare Advantage vis-à-vis traditional Medicare.

Benchmarks. Plan benchmarks are the maximum amount the federal government will pay a Medicare Advantage plan. Benchmarks are set in statute as a percentage of traditional Medicare spending in a given county, ranging from 115 percent to 95 percent. For counties with relatively low spending, benchmarks are set higher than average spending for traditional Medicare for counties with relatively high spending, benchmarks are set lower than average traditional Medicare spending . Special Needs Plans and other Medicare Advantage plans are paid in the same manner, with the same benchmarks.

Recommended Reading: What Is The Interest Rate On Government Student Loans

How Do Medicare Advantage Carriers Make Money

Bids that meet all qualifications receive approval. Benchmark amounts vary depending on the region. Benchmark amounts can range from 95% to 115% of Medicare costs. If bids come in higher than benchmark amounts, the enrollees must pay the cost difference in a monthly premium.

When bids are lower than benchmark amounts, Medicare and the health plan provide a rebate to enrollees after splitting the difference in cost. A new bonus system works to compensate for health plans that have high-quality ratings. Advantage plans that have four or more stars receive bonus payments for their quality ratings.

Can Medicare Savings Programs Provide A Medicare Subsidy

A Medicare Savings Program from the state may help subsidize your Medicare and Medicare Advantage premiums. If you meet certain conditions, a Medicare Savings Program may also pay hospital and medical insurance deductibles, copayments and coinsurance.

There are four types of Medicare Savings Programs. Each has an income and resource limit but these amounts may increase each year. You can still apply if your income and resources are slightly higher than the stated limits. Resources include checking and savings account balances, stocks and bonds.

The four types of Medicare Savings Programs are:

Don’t Miss: Data Governance Strategy And Framework

Saving Money With Medicare Advantage

After familiarizing yourself with the costs of Medicare Advantage, it may be helpful to learn more about a few ways to save on some potential plan costs.

- If you qualify for Medicaid, your Medicaid benefits can be used to help pay your Medicare Advantage premiums.

- A Medicare Savings Account is a type of Medicare Advantage plan that deposits money into a savings account that can be used to pay for out-of-pocket expenses prior to meeting your deductible.

- If your Medicare Advantage plan includes a doctor and/or pharmacy network, you can save a considerable amount of money by staying within that network when receiving services.

- Some Medicare Advantage plans may include extra health perks such as gym memberships. There is even the possibility of Medicare Advantage plans soon covering expenses like the cost of air conditioners, home-delivered meals and transportation.

How Is Medicare Financed

Medicare is funded primarily from general revenues , payroll taxes , and beneficiary premiums .

Figure 7: Sources of Medicare Revenue, 2018

- Part A is financed primarily through a 2.9 percent tax on earnings paid by employers and employees . Higher-income taxpayers pay a higher payroll tax on earnings .

- Part B is financed through general revenues , beneficiary premiums , and interest and other sources . Beneficiaries with annual incomes over $85,000/individual or $170,000/couple pay a higher, income-related Part B premium reflecting a larger share of total Part B spending, ranging from 35 percent to 85 percent.

- Part D is financed by general revenues , beneficiary premiums , and state payments for beneficiaries dually eligible for Medicare and Medicaid . Higher-income enrollees pay a larger share of the cost of Part D coverage, as they do for Part B.

- The Medicare Advantage program is not separately financed. Medicare Advantage plans, such as HMOs and PPOs, cover Part A, Part B, and Part D benefits. Beneficiaries enrolled in Medicare Advantage plans pay the Part B premium, and may pay an additional premium if required by their plan about half of Medicare Advantage enrollees pay no additional premium.

Read Also: Federal Government Jobs No Experience

Also Check: Free Government Phones In Wv

How Can Medicare Advantage Plans Cost Nothing

When a Medicare Advantage plan costs $0, that means that the amount that the federal Medicare program pays to the insurance company is enough to cover the plan’s benefits. With these free Medicare Advantage plans, you don’t have any extra costs other than the typical payment for Medicare Part B, which is usually deducted from your Social Security payment.

Medicare Spends Its Way Out Of Trouble: 20032010

The 2003 Medicare Modernization and Improvement Act established a larger role for private health plans in Medicare largely based on a shift away from a focus on cost containment and regulation and toward the accommodation of private interests and an ideological preference for market-based solutions that stemmed from the Republican control of both the executive and legislative branches of government . The MMA enacted the most significant changes to the Medicare program since its inception, and the emphasis of these reforms was the use of private plansincluding, we note parenthetically, in Part D. The generosity afforded to private plans via the MMA was in large part an attempt by the Bush administration and Congress to increase the private sector’s role in Medicare.

The MMA also created two more Part C plans: regional PPO plans and Special Needs Plans . Regional PPOs are like local PPO plans except that they cover regions comprising a whole state or several states . Regional PPOs were created mainly to give rural beneficiaries better access to a broader set of private plans. SNPs were created for Medicare beneficiaries who also were eligible for Medicaid and other vulnerable populations and were intended to provide the focused, specialized care particularly suited to these populations.

Recommended Reading: Government Mortgages For First Time Buyers

Which To Choose: Medicare Or Medicare Advantage

Open enrollment for Medicare plans ends Dec. 7. Heres what you need to know about shopping for them.

- Give this articleGive this articleGive this article

Its open enrollment season again. From now through Dec. 7, about 65 million Americans are facing the annual question of which Medicare options will give them the best health coverage. An onslaught of television and radio ads, emailed promotions, texts and mailers serve as reminders, though not necessarily clarifying ones.

Its a very consequential decision, and the most important thing is to be informed, said Jeannie Fuglesten Biniek, a senior policy analyst at the Kaiser Family Foundation and a co-author of a recent literature review comparing Medicare Advantage and traditional Medicare.

If you are navigating this decision for yourself or for a loved one, here are some of the important factors to consider.

Is Social Security Government Funded

Social Security is funded with income from four sources. Social Security is primarily funded by payroll taxes assessed on wages in the United States. The employer pays 6.2% of income, and the employee chips in another 6.2%. The self-employed, being both employer and employee, pay 12.4% of income into the program.

You May Like: Short Term Disability Government Assistance

Per Enrollee Spending Growth Has Slowed In The Past Decade For All Major Payers

On a per enrollee basis, the average annual growth of Medicare spending was similar to that of private insurance over the course of the 1990s and 2000s. Average annual spending growth per enrollee in Medicaid was similar to growth for Medicare and private insurance in the 1990s, but slowed in the 2000s while spending growth accelerated for the other major payers. More recently, per enrollee spending in Medicare and Medicaid has grown somewhat slower than per enrollee spending in private insurance.