When Do Social Security Payments Begin

SSDI Cases

Social Security disability benefits begin five full months after your disability date, known as your Alleged Onset Date.

Your payment would begin on the 6th month after your Alleged Onset Date. However, the furthest SSA will pay back due benefits on SSDI cases is 12 months before the filing date.

SSI Cases

SSI payments begin the first full month after the Alleged Onset Date. However, the furthest SSA will pay back due benefits is to the first month after the protected filing date of the claimants SSI application.

Other Pensions Might Reduce Your Social Security Benefits

Your benefits will be affected if you have a pension from a job that didnt have Social Security taxes taken out of your paycheck. Common examples include people who worked for a public education system, railroad workers and Federal government employees hired before 1984 who are covered by the Civil Service Retirement System .

Two complicated provisions will affect your claiming strategy: the Windfall Elimination Provision and the Government Pension Offset . The WEP reduces your own benefits by a discounted factor based on how many years you worked in jobs that did not withhold Social Security taxes. The GPO reduces your spousal and survivor benefits by two-thirds of the amount of your noncovered pension.

How To Report Social Security Income On Your Federal Taxes

Every Social Security recipient receives a benefit statement, Form SSA-1099, in January showing the total dollar amount of benefits received during the previous year. This includes retirement, survivor’s, and disability benefits.

Take that total shown in Box 5 and report it on Line 6a of Form 1040 or Form 1040-SR The IRS provides a worksheet to help you calculate what portion of your benefits are taxable and add the amount to your other income. More simply, you can use online tax software or consult a tax professional to crunch the numbers.

You May Like: Government Jobs Hot Springs Ar

Determine Your Wages For Each Year You’ve Worked

The federal government keeps track of how much money you’ve paid Social Security taxes on each year in your earnings record. You can view this in your my Social Security account.

For most people, their actual income and the income they’ve paid Social Security taxes on are the same. But this isn’t always the case with high earners. In 2022, for example, you only pay Social Security taxes on the first $147,000 you earn. In 2023, this amount increases to $160,200. So if your earnings record shows $147,000 for 2022, that’s not a mistake, even if your actual income for the year was much higher.

How Are Social Security Benefits Calculated

You are nearing retirement age and wonder how much money you can expect from the federal government in Social Security benefits each month after leaving the workforce.

The short answer? The amount of money you earn while working determines your monthly benefits. Of course, it is not entirely that simple. The Social Security Administration also factors inflation and other formulas to determine your final monthly benefit.

The length of your working career and how early you retire will also impact your monthly benefits.

Here’s a closer look at what goes into determining the amount of money you will receive each month:

Read Also: La City Jobs Government Jobs

Fact #: Most Older Beneficiaries Rely On Social Security For The Majority Of Their Income

Social Security provides the majority of income to most older adults. For about half of this group, it provides at least 50 percent of their income, and for about 1 in 4 older adults, it provides at least 90 percent of their income, according to multiple surveys and the Census Bureau study.

Most retirees have modest incomes, save for some at the top of the income spectrum. Most low-income older Americans have very little pension income, if any, according to the U.S. Census Bureau study. Among retiree households in the bottom third of the income distribution, most received no pension income. About 1 in 4 of these households lived on less than $20,000 in 2015, and about half lived on $50,000 or less, according to an Social Security Administration study that also matches survey and administrative data.

How Do Benefits Work And How Can I Qualify

While you work, you pay Social Security taxes. This tax money goes into a trust fund that pays benefits to:

-

Those who are currently retired

-

People with disabilities

-

The surviving spouses and children of workers who have died

Each year you work, youll get credits to help you become eligible for benefits when its time for you to retire. Find all the benefits the Social Security Administration offers.

There are four main types of benefits that the SSA offers:

Read Also: Government Aid For Senior Citizens

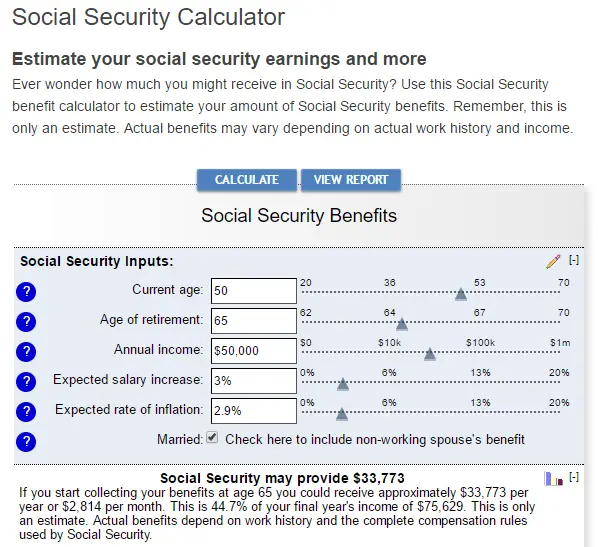

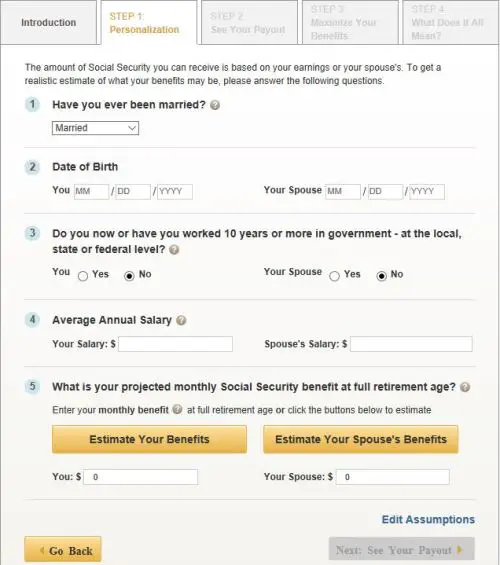

Calculate My Social Security Income

These days thereâs a lot of doom and gloom about Social Securityâs solvency – or lack thereof. And regardless of whether you think Social Securityâs future is secure, the fact remains that you shouldnât plan on living exclusively off your Social Security benefits. After all, Social Security wasnât designed to make up a retireeâs entire income.

Still, many people do find themselves in the position of having to live off their Social Security checks. And even if you have other income sources in retirement, Social Security can make up a significant part of your retirement income plan. That’s why itâs important to know all the rules surrounding eligibility, benefit amounts, taxation and more.

Do you need help managing your retirement savings? To find a financial advisor who serves your area, try our free online matching tool.

Disability Help Center Can Help You With Your Disability Claim

If you are currently in the process of applying for Social Security disability or SSI, you probably are already aware that it is a challenging and drawn out process.

Represent Myself offers you expert guidance, video tutorials, and support from knowledgeable professionals who understand how the application and appeals process works.

With our tools and knowledge, you will never need to hire a disability lawyer to obtain benefits which can save you a substantial amount of time and money.

We encourage you to apply for social security disability or SSI, even if you are not sure whether or not you will qualify. A representative at your local Social Security field office will be able to inform you about your eligibility based on your income and expenses.

Dont assume that you wont be eligible just because you earn a certain amount or arent sure about your eligibility. The SSA considers many factors when calculating your eligibility for SSDI or SSI and the amount that you can qualify for.

Company Information

You May Like: How To File For Medicare Benefits

You May Like: Government Credit For Electric Cars

Fact #: Social Security Is Especially Beneficial For Women

Social Security is especially important for women, because they tend to earn less than men, take more time out of the paid workforce, live longer, accumulate less savings, and receive smaller pensions. Women represent more than half of Social Security beneficiaries in their 60s and 7 in 10 beneficiaries in their 90s. In addition, women make up 96 percent of Social Security survivor beneficiaries.

Claim Of Discrimination Against The Poor And The Middle Class

Workers must pay 12.4 percent, including a 6.2 percent employer contribution, on their wages below the Social Security Wage Base , but no tax on income in excess of this amount. Therefore, high earners pay a lower percentage of their total income because of the income caps because of this, and the fact there is no tax on unearned income, social security taxes are often viewed as being regressive. However, benefits are adjusted to be significantly more progressive, even when accounting for differences in life expectancy. According to the non-partisan Congressional Budget Office, for people in the bottom fifth of the earnings distribution, the ratio of benefits to taxes is almost three times as high as it is for those in the top fifth.

Also Check: Ethics Training For Government Contractors

How To Get The Maximum Social Security Benefit

The maximum Social Security benefit in 2022 is $4,194 per month or $50,328 for the year. Most people do not get that much, though. To get the maximum you would have had to postpone benefits until age 70. You also would need to have earned the maximum taxable amount for at least 35 years. For people who start receiving benefits at full retirement age , the maximum amount in 2022 is $3,345. That said, the average Social Security check as of July 2022 is $1,670.95. To make sure you have enough in retirement to maintain your current lifestyle, consider talking to a financial advisor.

How Are Social Security Disability Benefits Calculated

Mathematically speaking, Social Security Disability Insurance is calculated in the same way as Social Security retirement benefits. Both are based on your record of covered earnings work income on which you paid Social Security taxes.

The Social Security Administration starts by figuring your average monthly income across your working life, adjusted for historical wage growth. It then plugs that figure into a formula to determine your primary insurance amount , also known as your full retirement benefit.

The PIA formula is progressive weighted to provide proportionally higher benefits to lower earners and its the same whether youre claiming retirement or disability benefits. What differs is how much income data goes into determining your full benefit and when you can collect it.

For retirees, the SSA uses the 35 highest-earning years to calculate the monthly average income and PIA. You become eligible to claim that full amount at full retirement age, which is 66 and 4 months for people born in 1956 and is gradually rising to 67. Benefits are reduced if you claim earlier by as much as 30 percent if you start taking them at the minimum age of 62.

Exactly how much of your earnings history is included depends on arcane Social Security terms like elapsed years and computation years, but basically, heres how it works.

Regardless of your age, if your SSDI claim is approved, youll be awarded your full benefit 100 percent of your PIA.

Keep in mind

Also Check: Credit Card For Government Employees

Your May Have To Pay Taxes On Social Security Benefits

Most people know that Social Security is funded by a tax on earnings, currently 6.2% for the employee . But some retirees dont realize that you may well have to pay income tax on Social Security benefits when it comes time to claim them. Benefits lost their tax-free status in 1984, and the income thresholds for triggering tax on benefits havent been increased since then.

It doesnt take a lot of income for your Social Security benefits to be taxed. Your benefits wont be taxed if your provisional income is less than $25,000 if youre single or $32,000 if youre married. If youre single and your provisional income is between $25,000 and $34,000, or married filing jointly with provisional income between $32,000 and $44,000, up to 50% of your Social Security benefits may be taxable. If your provisional income is more than $34,000 on a single return or $44,000 on a joint return, up to 85% of your benefits may be taxable.

The Social Security Administration says about 40% of beneficiaries pay taxes on their benefits. Since the thresholds arent adjusted for inflation, the number of beneficiaries who pay taxes on Social Security benefits increases every year. The Social Security Trustees annual report estimates that taxes on Social Security will total $45.1 billion in 2022, up from $34.5 billion in 2021.

You may also have to paystateincome taxes on your Social Security benefits. See our list of the 12 States That Tax Social Security Benefits.

Demographic And Revenue Projections

| This section’s factual accuracy may be compromised due to out-of-date information. The reason given is: Several of these projected dates have passed, and some language referring to data as ‘current’, ‘latest’, ‘most recent’, etc. is as old as 2005, or undated. Please help update this article to reflect recent events or newly available information. |

In 2005, this exhaustion of the OASDI Trust Fund was projected to occur in 2041 by the Social Security Administration or by 2052 by the Congressional Budget Office, CBO. Thereafter, however, the projection for the exhaustion date of this event was moved up slightly after the recession worsened the U.S. economy’s financial picture. The 2011 OASDI Trustees Report stated:

Annual cost exceeded non-interest income in 2010 and is projected to continue to be larger throughout the remainder of the 75-year valuation period. Nevertheless, from 2010 through 2022, total trust fund income, including interest income, is more than is necessary to cover costs, so trust fund assets will continue to grow during that time. Beginning in 2023, trust fund assets will diminish until they become exhausted in 2036. Non-interest income is projected to be sufficient to support expenditures at a level of 77 percent of scheduled benefits after trust fund exhaustion in 2036, and then to decline to 74 percent of scheduled benefits in 2085.

Ways to eliminate the projected shortfall

You May Like: Government Grants For Going Solar

Benefit Reduction If Taken Before Full Retirement Age

When calculating benefits for early retirement, there are one or two calculations, depending on how early benefits are taken. Assuming a normal retirement age of 67, the age of 62 is the earliest year a person can receive benefits or 60 months early.

The benefit is reduced by 5/9 of 1% for each month before the normal retirement age , up to 36 months. If the number of months exceeds 36, then the benefit is further reduced 5/12 of 1% per month.

For example, let’s say that a person wants to retire at 62, leading to a 60-month reduction from the normal retirement age of 67. The first 36 months would be calculated as 36 months times 5/9 of 1% plus 24 months times 5/12 of 1%.

- First 36 months: 5/9 = .5555 * 1% = .005555 * 36 months = .19999 or 20%*

- Remaining 24 months: 5/12 = .416666 * 1% = .00416666 * 24 months = .0999 or 10%

- In other words, benefits would be reduced by 30% if taken at age 62.

*The results were rounded and multiplied by 100 to create a percentage.

How Social Security Works

The Social Security Administration uses a multi-step formula to calculate just how much any given American gets in benefits. Factors include marriage, lifetime contributions, work history and more. But the purpose is always the same: to make sure that everyone who works has a safety net for retirement. To understand just how important that is we have to recall how senior citizens lived before President Franklin Roosevelt’s administration invented this program.

Although precise measurement hadn’t yet begun, most estimates suggest that in 1934 approximately half of all seniors lived in poverty. Most estimates suggest that this figure would have changed little over the past 84 years without the Social Security program. Instead, by 1959 this figure had fallen to 35%. By the year 2000 only 1-in-10 seniors lived in poverty, a number that has stayed largely consistent to this day. In many very real ways, Social Security created the concept of retirement.

Of course, there’s still far to go. Nearly a third of seniors still live within 200% of the poverty line, and many more still struggle to pay their bills.

You May Like: Can I Borrow Money From The Government

Social Security Calculation Step : Adjust For Filing Age

The easy way to look at it is to think about it in annual numbers.

Your benefit will be lower if you file at 62 and higher if you file at 70.

If you file after your full retirement age, your benefit will increase by 8% per year. If you file in the 3 year window immediately prior to your full retirement age your benefit will decrease by 6.66% per year of early filing. For anything more than 3 years before your full retirement age, your benefit will decrease by an additional 5%.

A lot of people dont want to retire on their birthday so its important to break this down by a monthly amount.

The Mechanics Of Social Securitys Trust Funds

Income is credited to the funds and disbursements for benefits and administration are counted against the funds balances. The Social Security Administration has the legal authority to spend any accumulated balances plus any incoming revenues. However, once a trust fund balance reaches zero, spending cannot exceed incoming revenues.

As with other trust funds, Social Securitys surpluses are credited with securities issued by the Treasury that excess income is used to reduce the amount of new federal borrowing necessary to finance governmental activities. The reverse happens when revenues for the trust funds fall short of their expenses.

The balance of the trust funds is a measure of the historical relationship between receipts dedicated to the programs and their expenditures. Therefore, it is important to understand that securities held by the funds are essentially bookkeeping mechanisms to track cash flows in and out of the accounts. However, trust funds have an important legal meaning in that a balance is required to permit spending from a fund.

Between 1984 and 2009, Social Security ran significant cash surpluses . Such surpluses were primarily the result of program reforms enacted in 1983. Those reforms slowly raised the retirement age and increased payroll taxes, which produced substantial trust fund reserves during the 1990s and early 2000s.

Read Also: Homes For Sale Government Hill San Antonio