Exhibit : The Proportion Of Government Bonds That Offered No Income Has Finally Receded

Global government bond yields% of BofA/Merrill Lynch Global Government Bond Index

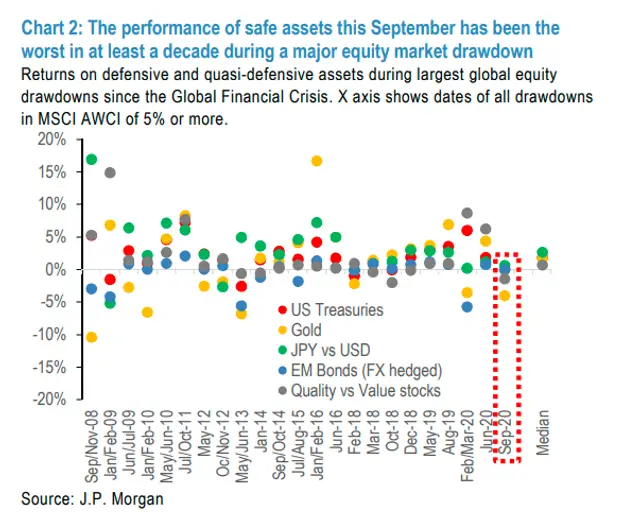

This years record-breaking drawdown has added to fixed income investors woes. Surging inflation, central banks desperately trying to play catch-up and governments that had seemingly lost their fear of debt, have all combined to trigger a brutal repricing. Markets have had to totally rethink the outlook for monetary policy rates and the risk premium that should exist in a world in which central banks cannot backstop the market. The drawdown in the Bloomberg Barclays Global Bond Aggregate in the first 10 months of 2022 was around -20%, four times as bad as the previous worst year since records began in 1992.

Crucially, while the correction in global bond markets has been incredibly painful, we believe that it is nearing completion. Further hikes from the central banks are likely in 2023 as policymakers continue to battle inflation. Yet with the market now pricing a terminal rate close to 5% in the US, around 4.5% in the UK and near 3% in the eurozone, the scope for further upside surprises is significantly diminished provided that inflation starts to cool. This is a key difference versus the start of 2022: this years problem has not only been that the central banks have been hiking rates aggressively, but that they have been hiking by far more than the market expected.

Jp Morgan Global Aggregate Bond Index

JPM GABI consists of the JPM GABI US, a U.S. dollar denominated, investment-grade index spanning asset classes from developed to emerging markets, and the JPM GABI extends the U.S. index to also include multi-currency, investment-grade instruments.

Launched in November 2008, the JPM GABI represents nine distinct asset classes: Developed Market Treasuries, Emerging Market Local Treasuries, Emerging Markets External Debt, Emerging Markets Credit, US Credit, Euro Credit, US Agencies, US MBS, Pfandbriefe represented by well-established J.P. Morgan indices.

The JPM GABI US is constructed from over 3,200 instruments issued from over 50 countries, and collectively represents US$8.6 trillion in market value. The JPM GABI is constructed from over 5,500 instruments issued from over 60 countries and denominated in over 25 currencies, collectively representing US$20 trillion in market value.

What Is Included In My Trial

During your trial you will have complete digital access to FT.com with everything in both of our Standard Digital and Premium Digital packages.

Standard Digital includes access to a wealth of global news, analysis and expert opinion. Premium Digital includes access to our premier business column, Lex, as well as 15 curated newsletters covering key business themes with original, in-depth reporting. For a full comparison of Standard and Premium Digital, .

Change the plan you will roll onto at any time during your trial by visiting the Settings & Account section.

You May Like: Government Small Business Start Up Loans

Exhibit : The Reset In Yields Has Boosted The Diversification Potential Of Bonds

Total return scenarios by change in US Treasury yields%, return at end-2023

Within credit markets, we believe that an up-in-quality approach is warranted. The yields now available on lower quality credit are certainly eye-catching, yet a large part of the repricing year to date has been driven by the increase in government bond yields. Take US HY credit as an example, where yields increased by around 500 bps in the first 10 months of 2022, but wider spreads only accounted for around 40% of that move. HY credit spreads still sit at or below long-term averages both in the US and Europe. It is possible that spreads widen moderately further as the economic backdrop weakens over the course of 2023.

The reset in fixed income this year has been brutal, but it was necessary. After the pain of 2022, the ability for investors to build diversified portfolios is now the strongest in over a decade. Fixed income deserves its place in the multi-asset toolkit once again.

Up next

The bull case for equities

We think equities in the developed markets will have positive returns in 2023. Our 2023 Investment Outlook details which types of stocks we think are most attractive.

09jy221811211216

Image Source: Shutterstock

Jpmorgan Other Banks Discuss Refunding Duped Zelle Customers: Report

-

JP Morgan Chase & Co , Wells Fargo & Co , and Bank Of America Corp are among the banks in advanced discussions to create a playbook for refunding customers and each other for illegitimate transfers.

-

The banks aimed to boost security and consumer trust in Zelle, the peer-to-peer payment system jointly owned by a consortium of banks, the Wall Street Journal reports.

-

Zelle recorded 1.8 billion transactions in 2021, totaling $490 billion, more than double pre-pandemic levels.

-

The report cited Zelle operator Early Warning Services LLC, saying fraud and scam claims comprised less than 0.1% of payments.

-

Zelles owners include Capital One Financial Corp , PNC Financial Services Group, Inc , Truist Financial Corp , and U.S. Bancorp .

-

The new rules under discussion would not extend to customers seeking refunds for goods or services they say they did not receive or for people whose errant payments resulted from typos.

-

The new refund rules could kick in as soon as early next year.

-

The banks ran tests to ensure the changes would not result in a fresh surge of scams.

-

If the new rules kick in, financial institutions participating in Zelle would have to agree to them or risk being kicked out of the network.

Don’t Miss: Quickbooks Government Approved Accounting System

What Happens At The End Of My Trial

If you do nothing, you will be auto-enrolled in our premium digital monthly subscription plan and retain complete access for CA$95 per month.

For cost savings, you can change your plan at any time online in the Settings & Account section. If youd like to retain your premium access and save 20%, you can opt to pay annually at the end of the trial.

You may also opt to downgrade to Standard Digital, a robust journalistic offering that fulfils many users needs. Compare Standard and Premium Digital here.

Any changes made can be done at any time and will become effective at the end of the trial period, allowing you to retain full access for 4 weeks, even if you downgrade or cancel.

Ishares Em Bond Etf To Cost 060%

BlackRock unit iShares filed stipulating for the first time that its planned iShares Emerging Markets Local Currency Bond Fund will trade under the symbol LEMB and have an annual expense ratio of 0.60 percent, making it more expensive than competing funds already on the market.

Although emerging market equities are reeling amid signs of slowing global growth, developing market debt is increasingly viewed as stable investment, and in the past year, sovereign debt denominated in local currencies has clearly revealed itself to be a hotspot in the world of ETFs.

WisdomTrees Emerging Markets Local Debt ETF had $1.11 billion in assets under management as of Oct. 12, while Van Ecks Market Vectors Emerging Markets Local Currency Bond ETF had $494 million, according to data compiled by IndexUniverse. Both were rolled out a bit more than a year ago.

An ETF Hotspot

iShares already has had great success with a first-generation, dollar-denominated, emerging market debt fund that it sponsors, the JP Morgan USD Emerging Markets Bond ETF . EMB, which iShares launched in December 2007, has $3.07 billion under management and is the biggest emerging markets debt ETF.

Its planned fund, LEMB, is a passive fund that will track a Barclays Capital benchmark of more than 270 bonds from sovereign and local currency bond markets such as Brazil, Chile, Egypt, and Hungary. The fund will use a representative sampling strategy rather than replicate the credits in the index.

Recommended Reading: Us Government Social Security Website

Wall Street Climbs As Oil Prices Slide Fed In Focus Dow Up 240 Points

Even though the government is yet to make up its mind on inclusion of G-Secs in global bond indices, brokerage expects indices major to make an announcement in this regard as early as next week.

On Monday finance minister Nirmala Sitharaman told an industry gathering that the 2020 budget proposal on allowing bond inclusion in indices could not move forward as the fund flows did not meet the desired levels, due to many reasons including the Covid pandemic.

Without offering any details like a timeline or the tax and stamp duty breaks that investors were demanding, Sitharaman said: “I don’t know whether we’re holding it back or not. I think global situation changed a lot since I made that statement in the 2020 budget.

“Global fund flows have not been as big as we wanted it to be primarily due to other reasons. So it’ll come to its natural, logical conclusion soon.”According to the RBI data, G-Secs outstanding stood at Rs 84.7 lakh crore, or over USD 1 trillion, as of end-June 2022 and the corporate bonds outstanding at Rs 40.4 lakh crore.

In a note on Tuesday, strategists Min Dai, Madan Reddy and Gek Teng Khoo said that “now we believe that there is a very good chance that will announce the index inclusion of India’s in mid-September.”They also said they expect the inclusion to drive in as much as USD 30 billion into the country next fiscal alone, even though there is no clarity on the tax breaks, which is a necessary condition for inclusion.

India’s Inclusion Into Key Govt Bond Index Pushed Back To Next Year: Report

Indian government bonds will likely only be included in the JPMorgan emerging market global index early next year as New Delhi still needs to address various operational issues, four sources familiar with the matter said.

Investors had expected a decision on this could come as early as this month when operators meet to review the composition of the index and after Russia’s exit earlier this year. The latter led foreign investors to step up purchases of Indian government bonds with no investment cap.

West Bengal CM stops event mid way, raps district magis …

Local bond settlement rules, tax complexities and the way in which investors will repatriate dollars are among the operational issues that still need to be resolved, said a fund manager at a large global fund. Index investors tend to favour international settlement platforms such as Euroclear but India has said it wants to settle bonds onshore, like China.

“India is working to get its bonds included but operationally it is not ready,” one of the sources said.

The government and the Reserve Bank of India are expected to sort out some of these issues by the end of 2022, said two of the sources. If resolved, an announcement on India’s inclusion could come early next year, they said. The sources did not want to be named as they are not allowed to speak to the media.

India’s finance ministry and JPMorgan did not immediately respond to Reuters’ request for comment.

Don’t Miss: Government Refinance Loans For Homes

Jp Morgan Launches Fresh Consultation On India Bond Index Inclusion Report

Inclusion would drive $30bn of passive investor inflows

ByTheo Andrew,

JP Morgan has opened a fresh consultation with investors about the addition of India to its emerging market bond index, a move that could drive tens of billions of passive inflows.

The bank opened talks with fund managers this summer covering roughly 85% of the $240bn in assets under management tracking the GBI-EM Global Diversified index on whether to include Indian rupee-dominated bonds, the Financial Times reported.

Indias inclusion has long been touted for and would be a turning point for the indices, driving an estimated $30bn inflows, according to Goldman Sachs.

Previously, Morgan Stanley estimated inclusion in the indices would channel between $170bn and $250bn inflows into the countrys fixed income market over the next decade, compared to the $36.4bn added over the last 10 years.

Indian government bonds rallied following the news, with the yield on the 10-year debt falling 0.11% to 7.18%, as at 31 August.

The consultation is set to be completed next month with an announcement expected in October. JP Morgan declined to comment.

The countrys bond market is currently worth around $1trn and an estimated $270bn of fully accessible route sovereign bonds would be eligible for the index. It follows a decision in March 2020 by the Reserve Bank of India to allow foreign financial institutions to invest in Indian bonds without restrictions for the first time.

Related articles

You’re Now Leaving Jp Morgan

J.P. Morgans website and/or mobile terms, privacy and security policies dont apply to the site or app you’re about to visit. Please review its terms, privacy and security policies to see how they apply to you. J.P. Morgan isnt responsible for any products, services or content at this third-party site or app, except for products and services that explicitly carry the J.P. Morgan name.

Recommended Reading: Free Government Smartphones In Tennessee

The Fixed Income Reset

24-11-2022

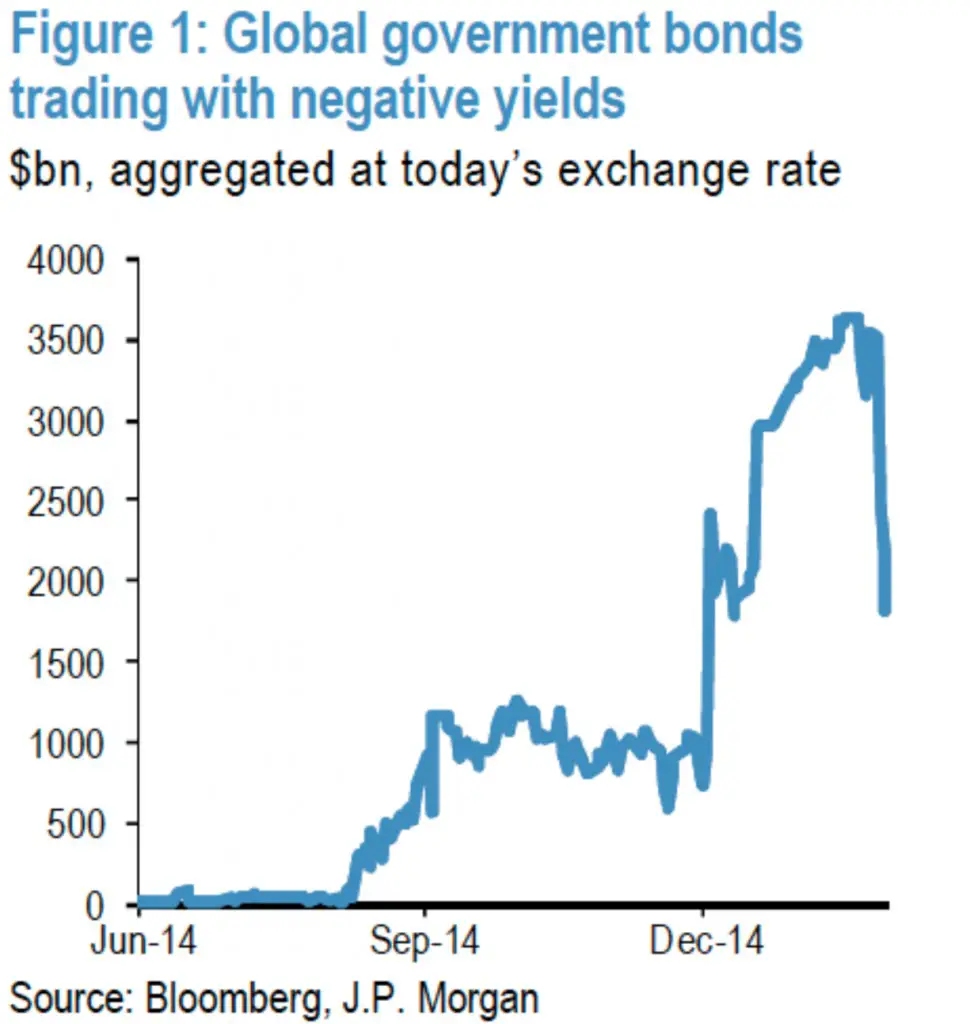

Allocating to fixed income has been a never-ending source of headaches for multi-asset investors in recent times. After a long bull market, yields had reached the point where government bonds could no longer offer either of the key characteristics that they are typically expected to deliver: 1) income, and 2) diversification against risky assets. At one point, a staggering 90% of the global government bond universe was offering a yield of less than 1%, forcing investors to take on ever greater risk in extended credit sectors that had much higher correlations to equities. Low starting yields had also diminished the ability of government bonds to deliver positive returns that could offset losses during equity bear markets .

Jpmorgan Says Russia Remains Part Of Its Emerging Debt Indexes New Bonds Excluded

LONDON, March 1 – JPMorgan said on Tuesday that Russian debt remained part of its emerging market bond indexes for now but that new debt issued by sanctioned Russian entities would not be included from March 1.

The U.S. bank, whose emerging market indexes are widely followed, has been assessing the impact of Western sanctions on Russia and the country’s inclusion in the local currency JPMorgan Government Bond Index-Emerging Markets and its hard currency Emerging Market Bond Index. ,

As of Feb. 28 there were no changes to the existing Russia bond compositions in those indexes, as well as the CEMBI index.

But it said Russia and Belarus were under review for exclusion from the environmental, social and governance versions of its indexes from March 31.

Specific corporate and quasi-sovereign issuers, such as VTB Bank and Russian state development bank VEB , are also under review for removal from the indexes on March 31, JPMorgan said.

Inclusion of Ukrainian local currency government bonds in the Government Bond Index-Emerging Markets indexes, which was due to happen on March 31, would now be put in hold “until further review due to the ongoing market disruption”, the bank added in a note sent to clients.

Read Also: Blue Cross Blue Shield Government Plans