National Homebuyers Fund Down Payment Assistance

Grants are sometimes provided instead of mortgage assistance to first-time home buyers. An example is the Down Payment Assistance offered by the National Homebuyers Fund . They are provided to qualified borrowers, including first-time home buyers and repeat buyers, by the NHF as a nonprofit public benefit corporation.

There is a 5% loan assistance available for down payments and closing costs up to the mortgage loan amount. The assistance wont be one-size-fits-all, so the buyer may be able to forgive or repay the loan, depending on their situation.

The $25000 Downpayment Toward Equity Program Expected In 2022

In 2021, Congress introduced a bill titled The Downpayment Toward Equity Act, a home buyer grant for first-generation home buyers with extra grant money available to renters with socially or economically disadvantaged backgrounds.

The Downpayment Toward Equity Act awards up to $25,000 so renters can buy their first home. Grant monies can be used to make a down payment, pay for closing costs, lower your mortgage rate by using discount points, and cover other expenses, too.

Check your eligibility for the $25,000 Grant.

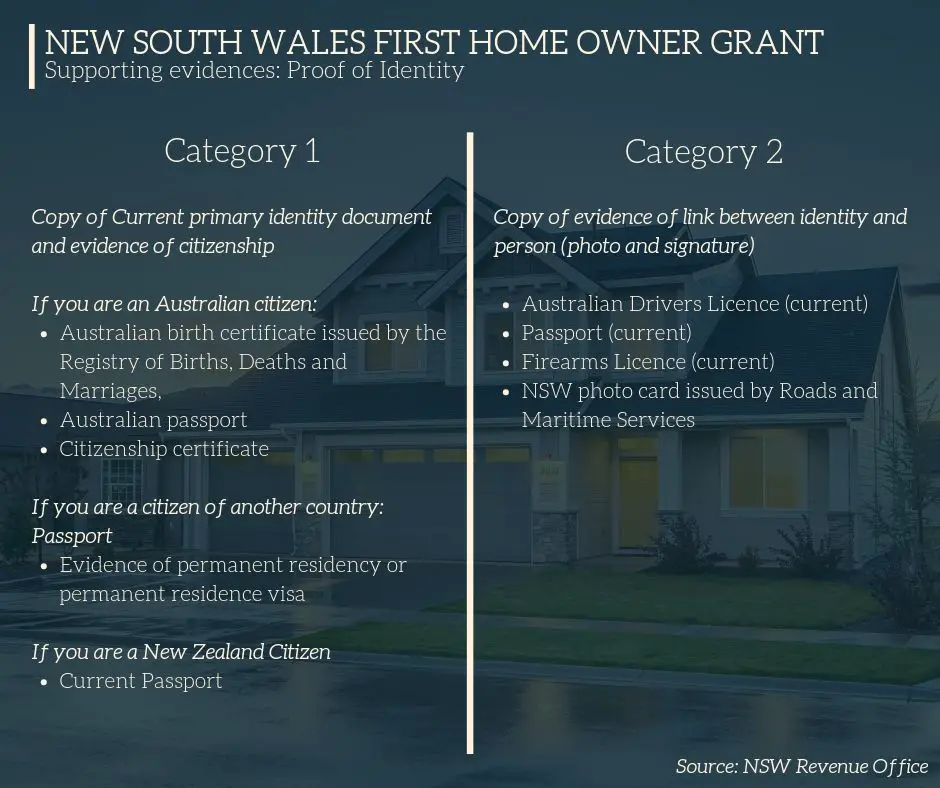

First Home Owners Grants And Concessions In Nsw

Is there a first home buyers grant?

Yes, the First Home Owner Grant scheme offers a $10,000 grant for the purchase or construction of new homes. The value of the property of a newly constructed property must be under $600,000. If buying land to build a property the combined land and dwelling valued must be less than $750,000.

Are stamp duty concessions available?

Yes, the First Home Buyers Assistance scheme provides first home buyers with exemptions from transfer duty on new and existing homes:

- New homes. If you are buying a new home worth less than $650,000 you pay no stamp duty . If the home is valued between $650,000 and $800,000 you can get a discount.

- Existing homes. If you are a first home buyer purchasing an existing home worth less than $650,000 you pay no stamp duty . If the home is valued between $650,000 and $800,000 you can get a discount.

- Vacant land. If you buy vacant land under $350,000 then you pay no stamp duty. Between $350,000 and $450,000 you can get a discount on the duty.

Read Also: How To Buy A Government House

Utah Down Payment Assistance Programs

The Utah Housing Corporation offers down payment assistance loans for repeat buyers as well as those purchasing for the first time. This PDF from UHCs website lays out the details.

You could get 4% or 6% of your primary loan amount depending on which down payment assistance loan you qualify for.

The loan is a 30-year second mortgage charging a fixed interest rate thats 2 percentage points higher than your primary mortgage rate. To qualify, youd first have to get approved for a FHA or VA loan through UHC.

Learn more about these loans at UHCs website. And explore HUDs list of other homeownership assistance programs in Utah.

How Does It Work

First home buyers need to submit an application to be considered for the FHSS scheme before signing the contract of sale for their first home or applying for a cash release from your super fund.

Though you can make multiple separate contributions, you are only allowed one release of funds under the FHSS scheme. Furthermore, the FHSS release will offset any existing debts owed to any Government institutions such as the ATO. However, your FHSS release won’t be used to pay down the account balance of your higher education or trade support loan unless you have outstanding income tax debt, which includes a compulsory repayment for your study loan.

You can read more about how the scheme is intended to help you save for your first home quicker in our detailed explanation of the First Home Super Saver Scheme.

Don’t Miss: Government Financial Aid For College

How To Receive Your Down Payment Grant

Home buyer dont have to take action to collect their down payment grants. Mortgage lenders will do it for you, automatically. All you have to do is buy a home, show up at closing, and the money will be there waiting for you.

Home buyers using the program are required to participate in home purchase counseling from a government-approved counselor.

Most programs can be completed in 2 hours.

Dont Miss: How To Start A Business With Government Grants

Using Super To Buy Your First Home

An individual can have a portion of their pre-tax income salary sacrificed into their superannuation, and this will be taxed at the regular superannuation rate of 15%.

Self-employed workers or those whose employer does not salary sacrifice can make their own contributions and claim a tax deduction.

Individuals can also make voluntary contributions as long as theyre within the current superannuation caps.

Under the scheme, first home buyers can only voluntarily contribute up to $15,000 per financial year, and $30,000 in total.

To be eligible, individuals must:

Eligibility is based on an individual, which means that if someone is buying a property with another eligible person, they can each contribute their own FHSS funds. For example, a couple buying a home together can contribute up to $60,000 for a purchase.

Individuals who have previously owned property in Australia may be eligible if they can prove they suffered a financial hardship that resulted in the loss of ownership of a property. They can apply for consideration from July 1.

Don’t Miss: Government Support For Single Mothers

Can I Use The First Home Owners Grant As A Deposit

Whether or not you can use the First Home Owners Grant as a deposit largely depends on your lender and the rules around how they consider a borrowers eligibility. While some lenders may allow you to use grants as part of a deposit, other lenders may require proof of genuine savings in their home loan application process. This typically means that you need to have saved about 5% of the purchase price as a minimum , according to financial adviser Stuart Wemyss.

Keep in mind, however, that your deposit is just one part of the equation in working out if its a suitable time for you to buy. Having a bigger deposit means that youll have more equity in your home, which could reduce your likelihood of experiencing negative equity and mortgage stress. Seeking professional financial advice may be helpful to support you in considering if it may be a good time for you to buy, based on your personal circumstances and needs.

Read Also: Colt 45 Automatic Government Model

The Downpayment Toward Equity Act

The Downpayment Toward Equity Act is a bill introduced by Congress in 2021. It’s a grant for first-generation home buyers. It offers extra grant money to renters who come from socially or economically disadvantaged backgrounds.

The Downpayment Toward Equity Act awards as much as $25,000 to eligible renters who have never purchased a home before.

Money awarded by this grant can be used for a down payment, closing costs, and other expenses. Recipients can even use the grant money to lower their mortgage rates by using discount points.

You can learn more about the Downpayment Toward Equity Act on the U. S. Congress website.

You May Like: Government Grants For Nonprofit Organizations

How Do I Apply For These First

First off, you want to make sure that youre eligible for the government scheme/grant for which youre applying. Each program has slightly different eligibility requirements so you want to check off all the boxes prior to submitting your application.

Generally, you can apply for these government schemes and grants at the same time you apply for a home loan.However, if youre planning on using any of the aforementioned grants or schemes, please have a discussion with your bank or mortgage broker prior to submitting your application.

Most lenders will apply for the grant on your behalf once a formal home loan approval is granted, and you have signed any relevant applications/declaration.

For the stamp duty waiver, your solicitor will handle the paperwork for you on settlement day.There can be different eligibility requirements so its best to consult with your mortgage broker or directly with your lender up front.

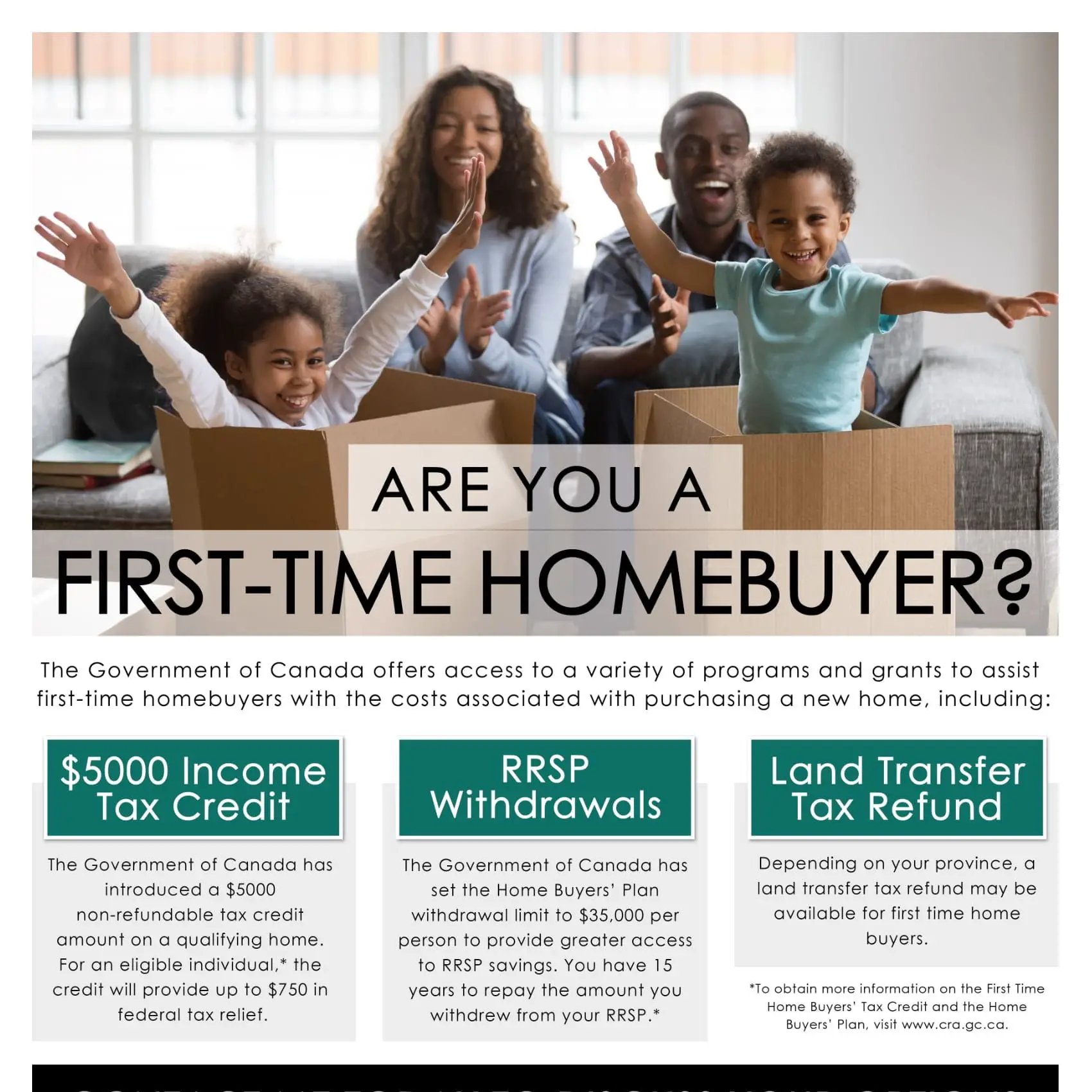

Are You A Resident Of Canada

You have to be a resident of Canada when you receive funds from your RRSPs under the HBP and up to the time you buy or build a qualifying home. For more information about residency status, see Residency status or call 1-800-959-8281, or 613-940-8495 . We accept collect calls by automated response. You may hear a beep and experience a normal connection delay.

If you become a non-resident after a qualifying home is bought or built, you cannot cancel your participation in the HBP. However, special rules will apply to the repayment of your HBP balance. For more information, see the HBP participant becomes a non-resident.

Read Also: Am I On A Government Watchlist

Regional Home Guarantee Scheme

With the announcement of the 2022 Federal Budget, the government has indicated their plans to roll out the Regional Home Guarantee scheme in response to the growing concerns of population density in capital cities.

The RHG scheme looks to incentivise property purchase and construction in regional areas of Australia by reducing the amount of deposit required to purchase in these underpopulated regions.

How Can I Apply For The First Home Owner Grant

Applying for the First Home Owner Grant is easy, and your Mortgage Choice broker can guide you through the paperwork. Heres a form you can fill out to start the application process.

Basically, there are two ways to apply for the First Home Owner Grant. You can apply through your lender at the same time you apply for your home loan this is where your Mortgage Choice broker can help. Or you can apply directly to the state government body that handles the First Home Owner Grant in your area.

You May Like: Will The Government Forgive Student Loans

How Do I Know If Im Eligible For The First Home Owners Grant

If you want to apply for the FHOG, you need to:

- Be over 18 years of age

- Be an Australian citizen or permanent resident of Australia

- Buy the property as a person, not as a trust or company

- Have not owned a home before 1 July 2000

- Occupy the home as your principal place of residence within 12 months of its purchase or construction, for a continuous period of at least six months.

If youre younger than 18, you can apply for an age exemption, and there are other requirements that can be waived in certain circumstances, such as if youre an Australian Defence Force member. Its best to seek advice on which criteria do and dont apply to your situation.

Your new home needs to meet certain criteria, too. For example, the grant cannot be used to buy an investment property. The property you purchase must be your first home in Australia and its value can be no more than $1 million.

Provided you meet the above criteria, the grant can be used to help you buy a residential property that fits one of the following descriptions:

- A newly-built property

- A land and building package

- Vacant land that you will build a new home on

- An established home thats gone through significant renovations, with most or all of the house having been replaced or refitted, and this being the first time its been on the market since the renovations have been completed.

Rrsp Home Buyers Plan

Normally, any amount you withdraw from your RRSP is considered taxable income However, the government allows you to borrow up to $35,000 from your RRSP to help pay for your home as long as you qualify as a first-time buyer. In order to meet this requirement, you must not have purchased a home within the last four years or also not have lived in a home owned by your spouse during this time.

Importantly, any funds borrowed from your RRSP for your down payment must be repaid. These repayments must begin two years after your purchase and you have up to 15 years to make these payments.

Don’t Miss: Federal Government Compensation Financial Aid

Applying For The First Home Owners Grant

On this page:

The Queensland First Home Owners’ Grant is a state government initiative to help you get your first home.

If youre eligible for the grant, you can get $15,000 towards buying or building a new house, unit or townhouse that you will live in.

- Anyone who is or will be an owner of the new home must be included on the application as an applicant.

- If you have a spouse, they must be included on the applicationeither as an applicant spouse or non-applicant spouse.

- You only need 1 application for your new home, regardless of the number of applicants.

- The grant is paid per new home, not to each applicant.

- When determining eligibility, each applicant and their spouse must be considered.

Learn About The Home Repair Assistance Grant

In addition to the funding opportunities described above, individuals may qualify for house programs that offer financial support following a natural disaster.

The Federal Emergency Management Agency , for example, offers the Individuals and Households Program for families who are unable to afford their housing needs through any other means. The IHP provides help in the form of:

- Immediate housing assistance, which can cover the cost of temporary lodging, rental housing, home repairs or a replacement home.

- Assistance replacing personal property other than a home.

IHP assistance can come in the form of limited housing grants, as well as loans from the Small Business Administration . However, you do not need to own a business to qualify for assistance from the SBA.

Your home needs to be located within a designated disaster area and you must have no other means of recouping your losses in order to benefit from an IHP grant or loan. In other words, you cannot receive money from an insurance claim while also getting IHP assistance to cover the same loss.

For example, you may qualify for this program if your home has sustained damage from a flood but your homeowners insurance policy does not cover the damage.

As with any program, there are limitations to what you can receive under a home repair assistance grant such as this one. The goal of the IHP program is to secure a safe, sanitary and functioning living environment after a disaster.

Don’t Miss: Government Jobs That Pay For Graduate School

How Does The Downpayment Toward Equity Act Work

The Downpayment Toward Equity Act of 2021 is a cash grant for first-time home buyers. Its neither a loan nor a tax credit. Its a cash payment made to eligible buyers at closing to be applied to the purchase transaction directly.

The standard cash award for first-time home buyers is twenty-thousand dollars and an additional five thousand dollars is available, too.

To get the additional $5,000, home buyers must qualify as a socially disadvantaged individual, which includes all people who identify as Black, Hispanic, Asian American, Native American, or any combination thereof or, who have been subjected to racial or ethnic prejudice or cultural bias because of their identity as a member of a group without regard to their individual qualities.

Eligible home buyers can use the money as they please.

If you purchase a home for $100,000, the $25,000 cash grant can be split into a large down payment, a lump sum for your closing costs, and extra cash to buy down your mortgage interest rate.

On your settlement statement, you could apply:

- $20,000 to make a 20% down payment on your home

- $3,000 for your real estate and title closing costs

- $2,000 to buy a really low mortgage rate

You can also use the first-time buyer cash grant to make accessibility renovations to your home and for anything else home-purchase related.

Get pre-approved for a mortgage now.

Places From 1 July 2022

Beginning in financial year 2022-23, the government will provide a total of 60,000 places each year under the various schemes:

- 35,000 total places a year under the First Home Guarantee this is an increase from the 10,000 currently available

- 5,000 additional places a year under the Family Home Guarantee, from 1 July 2022 to 30 June 2025

- 10,000 places under the Help to Buy Scheme

- 10,000 places under a planned Regional First Home Buyer Support Scheme expected to start in January 2023.

Also Check: Jp Morgan Government Money Market Fund

About First Time Home Buyer Federal Grants

Buying your first home or moving someplace new is an expensive endeavor. You may face even more challenges financing a purchase if you have a disability, are low-income or are dealing with the after-effects of a natural disaster. Luckily, there are several house programs available through the federal government that you may qualify for.

Remember that most housing grants are reserved for organizations that plan on using the funds in order to improve the community or make services more accessible to its residents.

Rather than finding first time home buyer grants, you are far more likely to qualify for home loan opportunities from the government instead.

Loans, unlike grants, must be repaid. However, you can typically get great terms by utilizing loans such as those from the Department of Veterans Affairs or the Federal Housing Administration . The FHA is part of HUD, the Department of Housing and Urban Development.

For example, you can get down payment assistance by signing up for a loan backed by the FHA or the VA. Receiving first time home buyer down payment assistance allows you to put a minimum of 3.5 percent down with an FHA loan, in some circumstances.

When it comes to VA-backed loans, you can oftentimes qualify for first time home buyer loans with zero down.