Deduct The Interest On Your Mortgage During Tax Time

Did you know that you can deduct the interest you pay on your home’s mortgage? Yes, you can trim your taxable income by doing this simple step when you fill out your taxes.

Remember to deduct interest payments. This could mean you pay less to the government and get a bigger refund check. While this isn’t a perk specific to government employees, it can help you save money as a homeowner.

How Can I Get Free Money From The Government

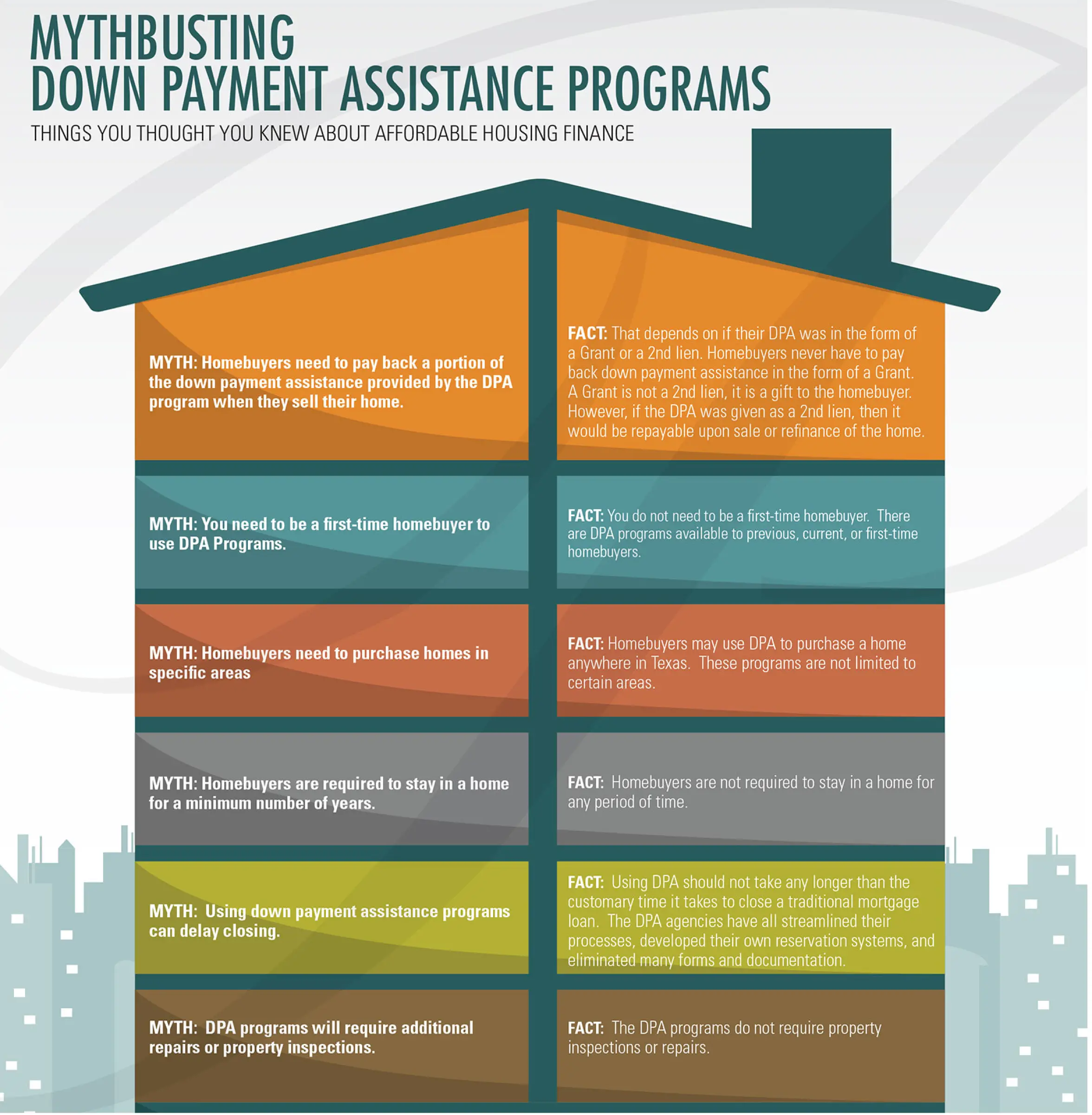

The idea that the federal government has so much money that it hands it out for free is part myth and part fact. The myth is that anyone can apply for and receive a cash grant from the government that they dont need to pay back. Thats false.

The fact is the federal government does not offer free money or grants to individuals. Offers and statements to the contrary usually mean someone is trying to sell you something, or is an outright scam. The confusion often stems from us hearing or reading about government grant programs designed to help stimulate the economy in certain regions or sectors.

Programs of this type are almost always aimed at entities like state and local governments or agencies that spend the grant money on public projects. Grants are also available for researchers and nonprofits, but even these are limited.

The best way to learn about government grants and eligibility requirements is to check out the official Grants.gov website. There youll find information about government grant policies, the agencies offering grants, their eligibility and qualification requirements, and how to recognize grant scams.

As Americans, we trust our government to spend our tax dollars wisely. The federal programs that administer loans, grants, emergency relief, and other socially-minded programs are there to benefit all of us when and if we need it. But free money to individuals would hardly serve the greater good.

Dont Miss: Dental Grants For Implants

Downpayment Toward Equity Act Of 2021

- Status: Introduced to the House, awaiting a vote

- Originally Introduced: April 14, 2021

- Latest Action Taken: June 22, 2022 Hearings held by the Committee on Banking, Housing, and Urban Affairs.

The Downpayment Toward Equity Act, also known as the $25,000 First-Time Home Buyer Downpayment Grant, gives first-time buyers a cash grant up to $25,000 toward the purchase of a home. The bill states that cash can be applied to any purchase-related line-item including down payment, interest rate reduction, mortgage and real estate closing costs, and other general expenses.

The programs minimum eligibility standards include:

- Must be a first-time home buyer

- Must meet income and purchase price limitations

- Must be purchasing a primary residence second homes and rental homes are not allowed

- Must use a government-backed mortgage such as a conventional loan, FHA loan, or USDA loan

- Must have parents or legal guardians who have not owned a home in your lifetime unless they lost their home to foreclosure or short sale, or you lived in foster care at any point into your lifetime

You May Like: Writing A Government Grant Proposal

How Federal Employees Can Get Approved For A Mortgage

Getting approved for a mortgage as a federal employee is really no different than what someone who works in the private sector would have to do.

As with all individuals wanting to purchase a new home, there are steps you need to take to ensure that you are in the best possible place to be approved.

Check your credit score! Although there are programs that will allow/work with a lower credit score, it is still important to work towards better credit.

Review your score and credit report for errors. If there are errors, you may need to dispute them which can take months. This should be done at the direction of a good loan officer.

Many lenders will want to see a credit score of at least 620. With some of the specialized loan programs, the rate is acceptable at 580 or even at a 500 score. However, the lender will base some of their approval decision upon what is actually on your report, not just the score.

Read more about

Debt to Income

Another factor that lenders will look at is your Debt to Income ratio. The debt that you owe, such as credit card payments, loans, and other bills should be about 30% or less than what your monthly income is. The reason that lenders look at this is because they want to ensure that you can actually pay back the loan.

Work History

Documentation

These are some of the steps every borrower needs to consider, and it is no different for federal employees looking at special programs.

Va Loans For Federal Employees

The VA loan is the only mortgage that is available only to Federal Employees. The loan is offered by lenders, not offered by the Federal government, but the loan is backed by the government insuring it against default.

VA loans are available to veterans, active military and their spouses. Read more

Read Also: Free Government Money For Veterans

Set Aside Money For Repair Costs

What if the furnace stops working in the dead of winter? That represents a significant cost that you’ll need to address right away. Would you have the funds to cover it?

When you’re buying a home, it’s critical to budget for unknown costs. Make sure that you have money in the bank for new appliances, flooded basements, windows, or other costly repairs. You don’t want to be in a situation where you have an urgent problem without the financial means to tackle it.

How Do You Qualify For Hud Programs

Most HUD programs target low-income people. If you meet the requirements, you can take advantage of these programs. Many of them cover rental assistance or public housing.

Otherwise, look to the Federal Housing Administration . It is an arm of HUD that can assist those who dont meet qualifications for some of HUDs programs. If youre a teacher, firefighter, or another government employee, you may qualify for these programs instead.

You May Like: Data Governance Vs Data Privacy

Finding The Right Home Buyer Grants

The above list is by no means complete rather, its a start. New assistance programs are forming all the time while others have expired or run their course after meeting a short-term need.

At the same time, while conducting your search for assistance, keep your guard up for websites or for-profit companies that promise to help you find any kind of funding you need for a small fee. Many of these organizations have names that imply an association or direct relationship with the U.S. government, when theres no connection whatsoever. So, steer clear!

Again, your best route for seeking and finding grants to further your housing quest is to first work with professionals who have their feet firmly embedded on the ground in the areas where you want to live. Start with your local lender or your citys housing department. They should be knowledgeable about the current housing assistance programs for which you may be eligible.

Be persistent. While its true there are no free lunches, sometimes there is assistance with no obligation to pay back assuming certain requirements are met for those diligent and determined enough to go looking for it.

First Generation Down Payment Assistance

- Status: Introduced to the House

- Originally Introduced: July 16, 2021

- Latest Action Taken: July 22, 2021 The bills sponsor made introductory remarks on the measure

The First Generation Down Payment Assistance program is included within the Housing is Infrastructure Act of 2021. It awards $25,000 cash grants to first-time buyers toward the purchase of their home.

The First Generation Down Payment Assistance program is similar to the Downpayment Toward Equity Act, but with simpler qualification standards. Specifically, the program changes the definition of first-generation home buyer to include all first-time buyers whose parents or legal guardians dont own a home currently.

The programs minimum eligibility standards include:

- Must be a first-time home buyer

- Must meet income and purchase price limitations for the area

- Must be purchasing a primary residence second homes and rental properties are not allowed

- Must use a government-backed mortgage such as a conventional loan, FHA loan, or USDA loan

- Must have parents or legal guardians who dont currently own a home, unless you lived in foster care at any point in your lifetime

Also Check: Government Jobs In Waldorf Md

Warning: Do You Really Need A Loan Today*

It can be expensive to borrow small amounts of money and borrowing may not solve your money problems

Check your options before you borrow:

- For information about other options for managing bills and debts, ring 1800 007 007 from anywhere in Australia to talk to a free and Independent financial counsellor

- Talk to your electricity, gas, phone or water provider to see if you can work out a payment plan

- If you are on government benefits, ask if you can receive an advance from Centrelink: humanservices.gov.au/advancepayments

- The Governments MoneySmart website shows you how small amount loans work and suggests other options that may help you.

* This statement is an Australian Government requirement under the National Consumer Credit Protection Act 2009.

The Governments MoneySmart website shows you how small amount loans work and suggests other options that may help you.

*This statement is an Australian Government requirement under the National Consumer Credit Protection Act 2009.

Home Renovation Loan Programs

Here are a few programs that allow you to buy more home for your money.

-

The Energy Efficient Mortgage program extends your borrowing power when you buy a home with energy-saving improvements or upgrade a homes green features. If you qualify for a home loan, you can add the EEM benefit to your regular mortgage. It doesnt require a new appraisal or affect the amount of your down payment. The program simply allows your lender the flexibility to extend loan limits for energy efficiency improvements.

-

There are also FHA 203 loans, designed for buyers who want to tackle a fixer-upper. This special FHA-backed loan considers what the value of the property will be after improvements and allows you to borrow the funds to complete the project as part of your main mortgage.

These loan programs are designed for buyers who want to tackle a fixer-upper.

-

The CHOICERenovation loan is a conventional loan program through Freddie Mac that allows you to finance the purchase of a home and the cost of improvements, too, with low down payments.

-

HomeStyle from Fannie Mae is another conventional loan option for purchase-and-remodel projects. A 3% down payment is available to first-time home buyers.

» MORE: Use our mortgage calculator to find out your monthly mortgage payment.

Read Also: Government Issued Cell Phones For Seniors

When Special Programs Help You Get The Home Of Your Dreams

Home buying can be an exciting and frustrating process, especially for first-time borrowers. As a government employee, things like salary limitations or the need to move more frequently for your job can often make homeownership seem out of reach. The good news is there are many lending options and programs that are designed to make the process easier for you.

Giving Back To Those Who Support Our Nation

We believe that anyone who contributes to the progress of our nation deserves to be rewarded with a brighter tomorrow. Thats why our team at Hero Home Programs specializes in finding all the best financing options available to you, so you can get the best deal possible on your home purchase. In addition to helping you get the most savings possible in the present day, we also take your long term goals into account, setting you up for success years down the road.

Don’t Miss: Free Government Smartphones In Texas

What Is The Easiest Loan To Get Approved For As A Federal Employee

The good news is that you can get a payday loan, same day loan, and unsecured installment loans for federal employees. You dont even have to apply at each of the lenders yourself. Simply use the Heart Paydays loan-finder service online. Apply once, and youll be presented with ideal options for your financial situation.

How Does A Government

All government loans are secured, or insured, by the federal government. In some cases, applying for a government loan is as easy as filling out an application online and submitting it to the government. To apply for a student loan, you can simply fill out the Free Application for Federal Student Aid online.

In other cases, the government works with approved lenders and only insures the loan, rather than funding it. For instance, the government doesnt issue VA loans you must work with a mortgage lender to get this type of loan.

If a borrower defaults on a mortgage issued by a lender, like a private bank, but is secured by the government, the government ends up repaying the lender. Every lender has its own application process for taking out a government loan that youll need to follow.

You May Like: Government Jobs In Sumter Sc

What Is The Home Stimulus Program

Better known as the Homeowners Assistance Fund , this program is part of the American Rescue Plan for providing relief to Americans amid the COVID-19 pandemic. The purpose of the HAF is to prevent Americans from losing their homes, utilities or insurance during a time of economic hardship. You can find more information about the HAF on the U.S. Treasury website.

Benefits Of Home Loans For Federal Employees

While buying a home may seem like a challenge for federal employees, the truth is, with various programs designed to help these employees, home ownership can provide many different benefits that can help in the long run. Benefits can include:

- The ability to build equity in your home

- No more worries about rent increases as your mortgage payment remains the same year after year

- Deduct your interest payments at tax time

- Sell your home for a profit when its time to move

Also Check: Where Can I Cash A Government Issued Check

State And Local First

Many states and municipalities offer first-time homebuyer grants and low-interest mortgage programs. Check your states housing finance authority website or contact a real estate agent or local HUD-approved housing counseling agency to learn more about first-time homebuyer loans in your area.

- Strengths: Down payment and closing cost assistance lower-interest mortgages

- Weaknesses: Income limits buyer education course usually required

What Are Some Federal Jobs

At the highest level, you have senior executive service jobs such as politicians, cabinet members or ambassadors. Next, you have the following branches where federal employees will work.

- Federal Judiciary

- Department of Health and Human Services

- Department of Homeland Security

- Department of Housing and Urban Development

- Department of the Interior

- Department of the Treasury

- Department of Veterans Affairs

The Department of Defense and the department of Veteran Affairs is the largest employer of all government branches. As you can imagine, there are many active military and those who support them and our veterans working every day.

Also Check: Dell Federal Government Employee Discount

Usda Loans For Federal Employees

USDA loan assists people in rural and suburban areas. This is a government backed loan that you can get 0% down with and possibly get lower interest rates.

You will need to intend to purchase a home in a rural area and there are income guidelines and the home most be located in a USDA designated rural area. Read more..

Although there might not be many federal employee geared home buying programs, that doesnt mean a federal employee should rule out some of the more common home loan options.

Other Government Resources For First

First-time home buyers often find it helpful to take a homebuyer education course before buying. And, if you use a government-run mortgage or down payment assistance program, homebuyer education is often required.

Many courses can be found online or through government housing agencies like Freddie Mac and Fannie Mae. Some are free, while others are available for a fee that typically ranges from $75 to $100, Gravelle says.

Even if you are not required to take this class, its worth your time and expense.

Homeownership is an important responsibility, and having a better understanding will ensure greater success, Anderson says.

You may even qualify for counseling through HUD for free.

There are HUD-approved housing counseling agencies in every state that can help borrowers navigate the process for no charge, adds Anderson.

You May Like: How To Check Government Watch List

Transforming Student Debt To Home Equity Act Of 2022

- Status: Introduced to the House

- Originally Introduced: April 1, 2022

- Latest Action Taken: April 1, 2022 Referred to the Committee on Financial Services

The Transforming Student Debt To Home Equity Act gives concessions to first-time buyers with monthly student loan payments to help them stop renting and start buying. The bill lowers mortgage rates for buyers, provides discounts on government-owned homes, and makes down payment assistance available.

The programs minimum eligibility standards are

- Must be a first-time home buyer

- Must be approved for a mortgage

- Must agree to own and live in the new home for 3 years

- Must have federal student loans not in default

- Must agree to take a homeownership class

Fannie Mae And Freddie Mac Loans

Fannie Mae and Freddie Mac are government-sponsored enterprises that buy loans from lenders, package them into mortgage-backed securities, and use the sale of the investment to offer lower interest rates for more Americans. A loan from either requires a minimum 3% down payment, a minimum 620 credit score , and a strong credit history.

Dont Miss: Missouri State Jobs In Kansas City

Recommended Reading: Is The Us Government Giving Out Grants