How Much Can You Get

The amount you can receive depends on several factors, including:

- your province or territory of residence

- your family income

- your tuition fees and living expenses

- if you have a disability

The amount you can receive in grants and loans is calculated when you apply with your province or territory.

To find out if you can receive Canada Student Grants or Loans, use the federal student aid estimator. Note that this estimator doesn’t take into account the provincial and territorial student grants and loans.

What Is The Fafsa

The Free Application for Federal Student Aid is used to determine how much a student and their family is expected to contribute for the student’s education. The difference between the total cost of attendance and the family contribution is your financial need.

NOTE: Undocumented students don’t qualify for federal financial aid and are not able to submit a federal FAFSA. However, these students can submit a MN Dream Act application to be considered for state financial aid. Learn more about the MN Dream Act and how to apply for these benefits.

After your need is determined you will receive a “financial aid package” from the colleges you have applied to for you to review. This package consists of any Federal Pell Grants, Minnesota State Grants and any other financial aid offered by colleges and universities you are eligible to receive. Your financial aid may also be supplemented with loan and work study funds.

- Your eligibility to receive a Minnesota State Grant is determined by completing a FAFSA. Results are automatically sent to Minnesota colleges. When you submit your FAFSA on the Web, be sure to click on the link to Minnesota state financial aid on the FAFSA confirmation page to complete the online eligibility questionnaire for a Minnesota State Grant.

Student Loans: Next Steps

Most likely, Congress will reach a short-term funding deal to keep the federal government operational, or there will be a short-term shut down of the federal government. The important thing to remember is that your student loan payments are still due, regardless of a government shut down. Private loans arent impacted by a government shut down. While federal loans are temporarily in forbearance, you would still owe federal student loans beginning February 1 if there is no extension. The best thing you can do for your student loans now is to know your options for student loan repayment. With temporary student loan relief ending, its more important than ever to get wise on your student loans. Here are some smart ways to pay off student loans faster:

Recommended Reading: Government Grants To Start Trucking Business

Create Your Student Loan Accounts

The best way to stay on top of your student loan is to create accounts for your student loan portals. It is important to turn on your notifications so you are alerted when there is information in your inbox. Please be sure to register for the portal specific to your province / territory of residence. Do not ignore notifications that you receive from these portals. You will only receive communications in your inboxes when there is important information or information that needs your attention. Feel free to contact the Student Service Centre if you have questions about any communications you receive.

This account will be used to apply for full-time Canada and Alberta student loans, upload required documents needed for your application , complete your Alberta Master Student Financial Aid Agreements , and view past applications. You will need to log in to this portal everytime you would like to apply for a new student loan.

If you have trouble logging into this account, please contact Alberta Student Aid directly.

While you do not apply for loans through this portal, it will have lots of important information about your Canada Student Loans, including the current status of your loan . You will also be able to determine how much federal funding you have received over your lifetime, repayment details, make payments towards your Canada Student Loans, and submit your federal MSFAA as well as applications for the Repayment Assistance Plan .

Quick links

How To Maintain Interest Free Status While You’re A Student

If you have taken out a government student loan in the past and do not have a current year’s loan, you are responsible for notifying the government of your full-time, in-school status. Otherwise, your loan may start accumulating interest.

You can request a confirmation of enrolment form from the Financial Aid and Awards, 422 University Centre . You must submit this form to the required government loan office within the current study period. Forms expire as of the last day of study for each term/school year and cannot be released after the study period has ended.

Recommended Reading: City Jobs In Las Vegas

Grants And Loans For Full

The Canada Student Financial Assistance Program offers student grants and loans to full-time and part-time students. Grants and loans help students pay for their post-secondary education.

- Apply for grants and loans in one application, directly with your province of residence

- You don’t need to repay grants you receive

- You need to repay loans after finishing school, with interest

- You may be eligible for more than 1 type of grant – when you apply with your province, they will assess your eligibility for all available grants

How A Government Shutdown Effects Student Loans

If there is a short-term government shut down, expect little impact to your student loans. Specifically, a government shutdown only affects the federal government. There is no impact to private student loans, for example, and state and local governments will continue to operate. Currently, for your federal student loans, there is temporary student loan forbearance through January 31, 2022. . This means that there are no mandatory federal student loan payments and interest rates on federal student loans temporarily are set at 0%. Even with a longer-term government shut down, you should still be able to:

The question is whether processing these various requests could be delayed while the federal government is shut down. . The good news is that you can contact your student loan servicer, which is a private company that works with the federal government to manage your student loans but isnt part of the federal government.

You May Like: Government Programs To Help Homeowners Avoid Foreclosure

Recommended: Usa Visa Australia & Canada Visa Lottery Process

- Successful candidates may be eligible for staff housing and the reimbursement of relocation costs.

- Isolated Post Allowances range from $19,000 to $31,000, which is based on if the employee has dependents or is occupying staff housing.

- Vacation Travel Assistance is provided twice a year for each eligible member of the household.

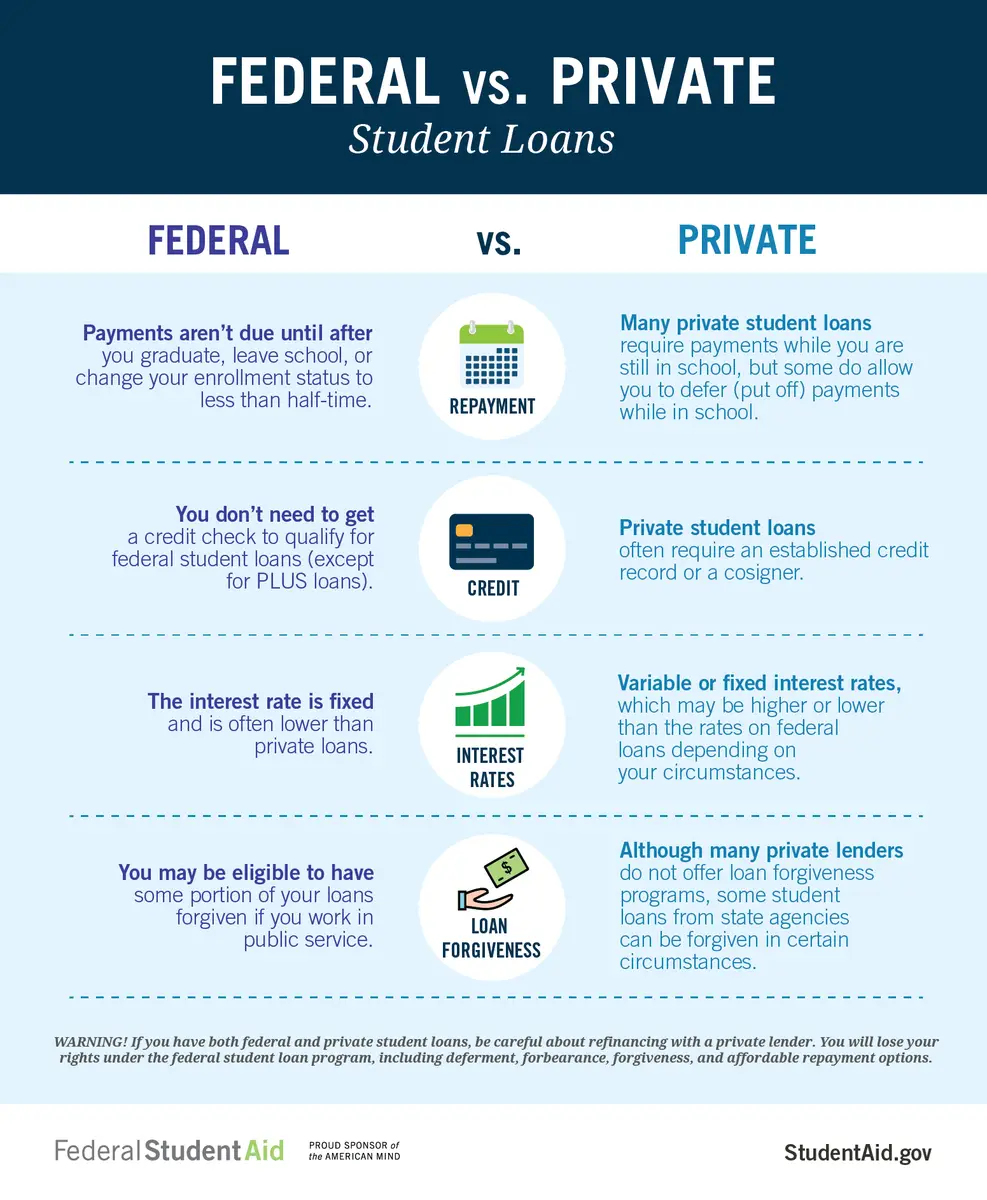

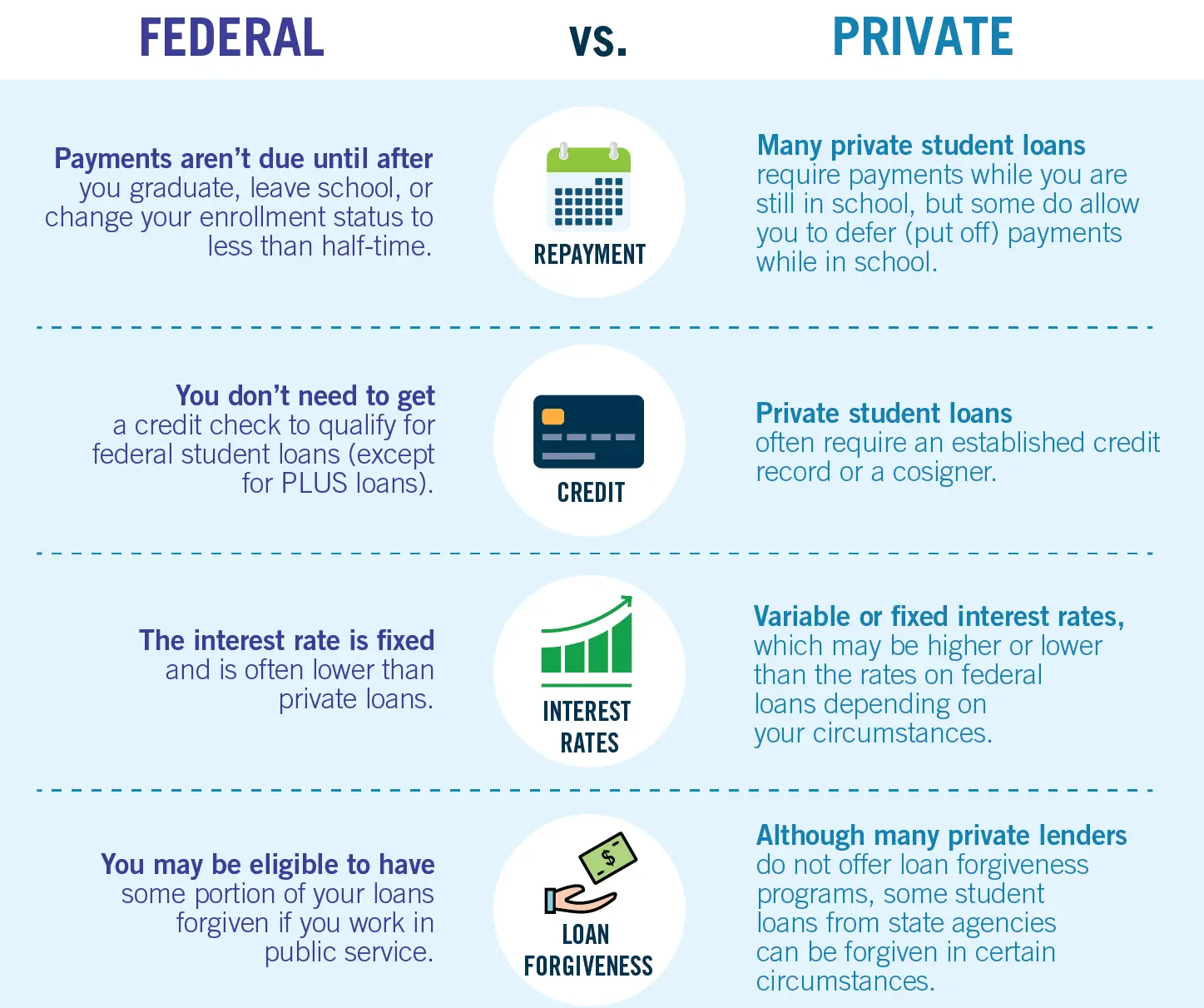

How Student Loan Interest Works

When you take out a student loan, youre required to repay the original amount you borrowed, plus an additional interest payment. The interest payment is based on a percentage of the loan balance, and the percentage is based on the interest rate. You can think of interest as a fee that the lender charges to loan you money.

The interest rate for federal student loans is set every year and is the same for all undergraduate borrowers, regardless of credit history. Interest rates for federal loans are always fixed, which means they will stay the same for the total life of the loan.

The interest rate for private student loans differs per borrower. The interest rate depends on the current rate offered as well as your credit history . The interest rate on private loans can be fixed or variable .

If youre applying for a private student loan and you dont have stable income or good credit, youll probably need a cosigner. Your cosigner should also have a good understanding of how student loans work and their obligation.

Because private student loan interest rates can vary, its important to explore options from different lenders before you apply.

Also Check: Start A Trucking Company Grant

Will Student Loan Relief Expire Or Get Extended

Temporary student loan forbearance due to the Covid-19 pandemic will have provided student loan borrowers with 22 months of student loan relief. . This student loan relief, in aggregate, will give student loan borrowers $110 billion of student loan cancellation. . The Biden administration has extended student loan relief twice: once in January 2021 for 8 months, and then another four months through January 31, 2022. If there is an extended government shut down, its possible that this student loan payment restart date could be extended. Why? The U.S. Department of Education has a large task of contacting student loan borrowers to ensure they are prepared to restart federal student loan payments beginning February 1, 2022. . The Education Department is also transitioning approximately 16 million student loan borrowers to a new student loan servicer next year. If the government remains shut down for an extended period, these efforts could be delayed, and conceivably this could delay restarting federal loan payments. That said, this is a low likelihood.

How Student Loans Can Affect Your Credit

When you apply for a private student loan, lenders will review your credit worthiness before they loan you money. Your credit score will also determine your interest rate. In other words, borrowers with stable income and good credit history will pay less for their loans.

Undergraduate federal student loans dont require a cosigner or a credit check.

Having student loan debt affects your credit the same way your other loans do. This is important to know if youre planning to borrow money from another source. For example, student loan debt increases your debt-to-income ratio, which can hurt your chances of getting approved for a mortgage or other loan.

However, student loan debt can also help you build your credit. Making on-time regular payments could improve your credit score another measure lenders use to determine your ability to make payments.

And of course, the opposite is true if you miss a payment so be sure to stay on top of your loan payment every month.

Also Check: How Do I Get A Grant To Start A Trucking Company

Watch A Video About How Government Student Aid Works

The National Student Loan Service Centre offers the Government Student Loans and Grants Orientation Webinar.

This 17-minute presentation will provide a thorough overview of the process and include such topics as how to apply, what loans and grants are, the stages of a student loan, repayment information and how to use your National Student Loan account.

We recommend that all first-time borrowers watch this video.

How Much To Borrow

Student loans must be repaid with interest. Because of this, youll want to keep the amount you borrow to a minimum. Before you start your loan application, determine how much you can really afford.

Experts recommend saving for at least one-third of future college costs, and covering the remaining two-thirds with current income and student loans.

If you dont have enough in savings, you might be tempted to fill the gap with student loans. But, remember to give yourself limits.

Aim to keep your total student loan debt below your expected starting salary after graduation. This will help keep your debt manageable so that you can realistically pay off the balance within a standard 10-year repayment plan.

Our loan calculator can help you estimate your monthly payment based on the loan amount, interest rate, loan fees and loan repayment term you input.

Recommended Reading: City Of Las Vegas Government Jobs

And Check If You Can Get Extra Help

You might be able to get extra money if you:

You’ll need to create a student finance account if you’re a new student or sign into an existing account if you’re a returning student.

It can take up to 6 weeks to process your application. You might have to provide extra evidence.

Federal Government To Cancel $2b More In Student Loans Us Military And Veterans Among Those To Benefit

The U.S. Department of Education announced a new round of student loan forgiveness as part of an overhaul of the Public Service Loan Forgiveness program.AP Photo/Seth Wenig, File

STATEN ISLAND, N.Y. — The U.S. Department of Education announced a new round of student loan forgiveness as part of an overhaul of the Public Service Loan Forgiveness program.

The PSLF program provides debt relief to public servants, including teachers, nurses, firefighters and others serving their communities in essential jobs by canceling their federal student loans after they have made payments for 10 years 120 separate monthly payments.

According to Education Secretary Miguel Cardona, an estimated $2 billion in student loans will be forgiven for more than 30,000 borrowers. Cardona noted in his tweet in mid-November that veterans and military service members will also benefit from this round of forgiveness.

Eligible borrowers will be automatically notified via email. The Education Dept. has also updated its application process to make it easier for borrowers to be approved for forgiveness, Syracuse.com, SILive.coms sister site, reported.

According to Fortune, since taking office, President Joe Biden has announced plans to cancel over $11 billion in student loan debt. However, $11 billion barely scratches the surface of the overall national student loan debt, which is currently almost $1.8 trillion with 43 million borrowers affected.

to learn more about the PSLF program and eligibility.

You May Like: Government Bank Owned Foreclosed Homes In Polk County

Financial Aid Suspension Appeal

Students who have their eligibility for US Financial Aid suspended may appeal the suspension if one or more of the following circumstances exist:

- Death of immediate family member.

- Extended illness of student, an illness that causes the student to be absent from class at least 15 days or more .

- Extended illness of a family member that places hardship on the student .

- Mitigating circumstances as determined by the university.

Download: Satisfactory Academic Progress Appeal US Financial Aid

* All appeals must be received in writing within 10 days of receipt of the Notice of Suspension.

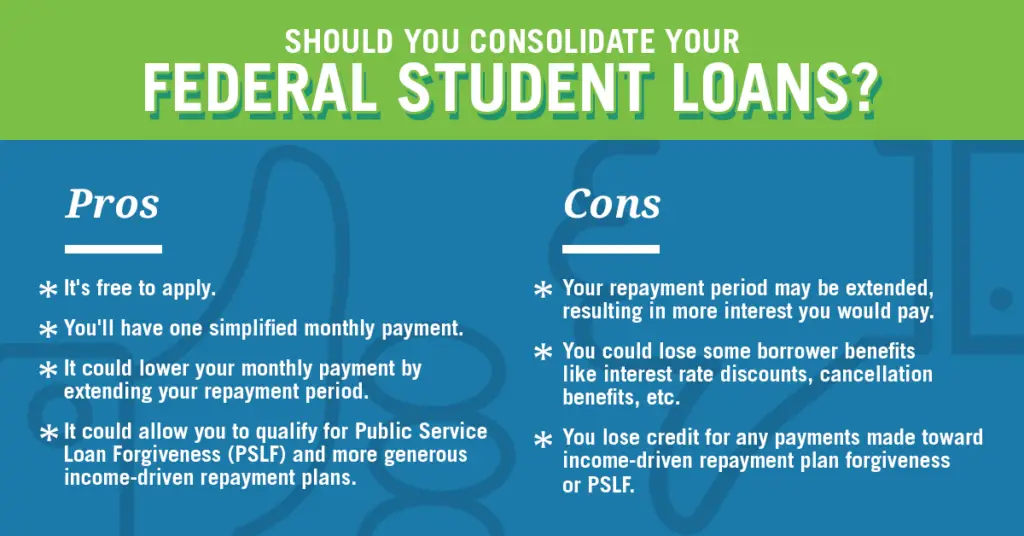

Federal Student Loans Versus Private Student Loans

Federal student loans are made by the U.S. government. A federal loan, such as federal direct loan, will have a lower interest rate than a private loan. Federal loans also typically offer more favorable terms, flexible repayment plans and loan forgiveness options.

When a borrower exhausts their college savings and they reach their federal student loan limits, they may turn to private student loans to help cover the remaining costs. Here are some key differences between a federal student loan and a private student loan:

Read Also: Government Jobs For History Majors

Need Assistance To Repay Your Loan

The Canada Repayment Assistance Plan can provide support.

When you apply for a Canada Student Loan, you are automatically assessed whether you qualify for a grant.

You dont need to take out a loan to get a grant. But, you need to apply and qualify for a loan to get a grant. If you qualify for a loan of at least $1, then you can choose:

A grant differs from a loan because:

- a student may qualify for 1 or more grants

- grants do not have to be paid back and

- a student may be eligible to get more than 1 grant at the same time.

What Happens After You Submit The Fafsa

After you submit the FAFSA, the government will send you a , which gives you basic information about your eligibility for federal student aid.

The colleges you included on your FAFSA will have access to this information, and theyll use it to determine the amount of federal grants, work-study, and loans you may qualify for.

The colleges youre accepted to will send you a detailing the financial aid you are eligible to receiveincluding federal student loans, grants, and work-study.

The amount of federal aid you receive from each school can vary, just as the cost of attending each school varies.

Don’t Miss: Polk Real Foreclosure

Apply Online For Student Finance

If youre a student from England you can apply online for the following academic years:

- 2021 to 2022

- Maintenance Loans

- Maintenance Grants

You can apply up to 9 months after the start of the academic year for your course.

If you need help with a further education course at a college or training provider you may be able to apply for an Advanced Learner Loan instead.

The application process is different for students from Scotland, Wales and Northern Ireland. Check how to:

on the Student Finance England website

Determine Whether Youre A Full

Student aid is calculated differently for full-time and part-time students. Also, the process of applying for student aid is different.

Your school determines whether youre full-time or part-time based on your course load, not Student Aid. At many schools, its possible to take fewer than the maximum amount of courses and still be considered a full-time student.

|

Dependent students, provide your parents or guardians name, Line 15000, family size, number of children in family attending post-secondary |

|

, provide your spouses or partners name, birthdate, Social Insurance Number, Line 15000, expected reduced yearly income |

|

|

Students with dependent children, provide your childs name, birthdate, monthly childcare costs |

|

|

Students enrolled at multiple schools or doing an exchange/field study, provide name of your primary school, name of your additional school, airfare costs |

|

|

Students with permanent disabilities, provide proof of your permanent disability, copies of a medical letter, a learning disability assessment or documentation proving you are receiving disability assistance such as AISH, an estimate of equipment costs and an assessment fee |

Don’t Miss: City Of Las Vegas Government Jobs