Buying Treasuries As Etfs

It is possible to buy Treasuries through ETFs at most brokerages. ETFs are bought and sold like stocks, and many qualify for commission-free trades. Investors can choose among government bond ETFs focused on short-term Treasuries, long-term Treasuries, TIPS, and FRNs.

Many Treasury ETFs have modest fees some of the largest funds offer expense ratios as low as 0.15% annually, making them a very affordable investment option.

Treasury ETFs can be held in IRAs and other tax-advantaged retirement accounts.

How Are Bonds Traded In The Market

Bonds can be bought and sold in the secondary market after they are issued. While some bonds are traded publicly through exchanges, most trade over-the-counter between large broker-dealers acting on their clients’ or their own behalf. … Yield is therefore based on the purchase price of the bond as well as the coupon.

Structure: Coupon Or No Coupon/discount

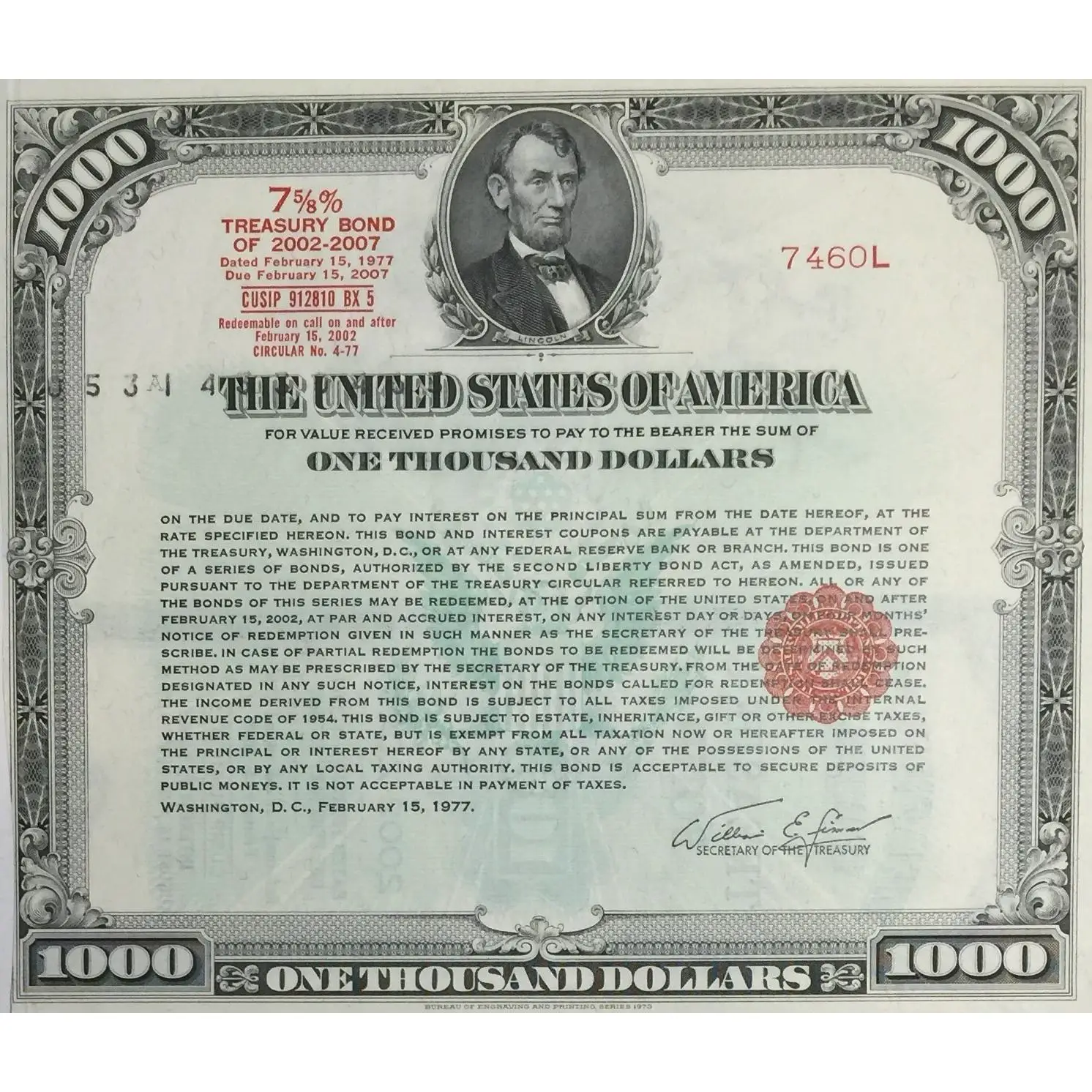

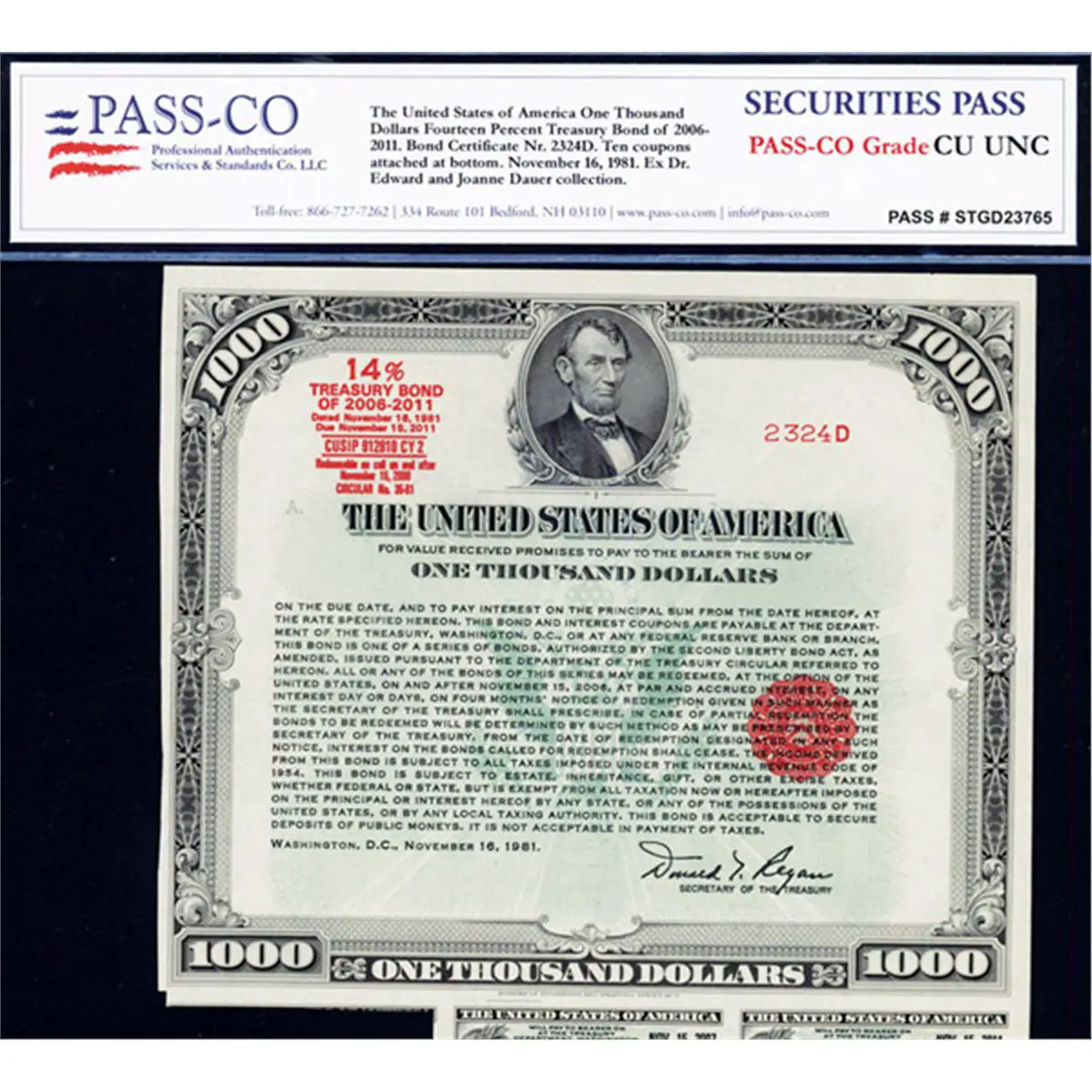

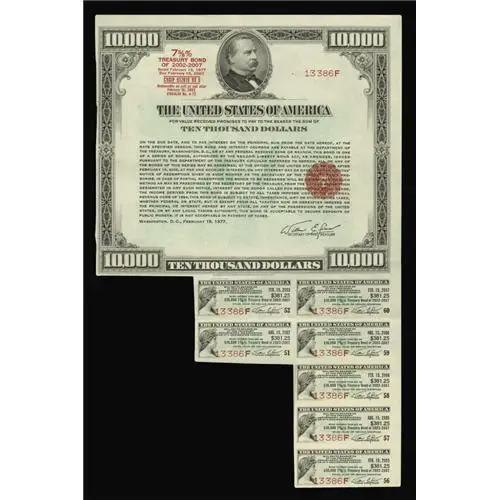

Investors in Treasury notes and Treasury bonds receive interest payments, known as coupons, on their investment. The coupon rate is fixed at the time of issuance and is paid every six months.

Other Treasury securities, such as Treasury bills or zero-coupon bonds, do not pay a regular coupon. Instead, they are sold at a discount to their face value investors receive the full face value at maturity. These securities are known as Original Issue Discount bonds, since the difference between the discounted price at issuance and the face value at maturity represents the total interest paid in one lump sum.

Also Check: Can You Add Minutes To A Government Phone

How To Invest In Government Bonds In India

The bond market has flourished rapidly over time. There are varieties of bonds in the market and one of the less risky ones is government bonds. Like corporations and individuals, even governments need funds to sort out the public issues in the society or economy. Also known as G-Secs, these bonds raise extra funds from the public in return for interest payments and full capital return on the date of maturity. Investors can buy government bonds offline and online as well.

All the funds received from the public can be used for building roads and schools, investing in public projects, and refurbishing purposes. But, how to invest in government securities? Before jumping into it, lets comprehend how you can buy government bonds.

Buying Government Bonds: Treasuries

Treasury bond yields will vary by maturity. As of December 2020, the U.S. Treasury bond market offered the following yields:

The U.S. Treasury has made buying Treasury bonds easy for U.S. investors by offering the bonds through their website, TreasuryDirect. Heres a step-by-step guide to using TreasuryDirect. TreasuryDirect account holders can also participate in Treasury auctions, which are conducted approximately 300 or more times per year.

The first step in the auction process is the announcement of upcoming auctions, which are generally declared four to five business days beforehand. This step discloses the number of bonds that the Treasury is selling, the date of the auction, maturity date, terms and conditions, eligible participants, and competitive and non-competitive bidding close times. Noncompetitive bids guarantee that investors will get the full purchase amount of the security at the yield determined during the auction by competitive bidding. Competitive bids specify the yield expected for security.

The second step of the auction process is the auction date when the Treasury reviews all bids received to ensure compliance with the full set of applicable rules. All compliant noncompetitive bids are accepted up until issue day, as long as they are appropriately postmarked.

The final step of the auction process is the issuance of the securities. Securities are deposited to accounts, and payment is delivered to the Treasury.

You May Like: How Do You Qualify For A Free Government Phone

Submit A Bid In Treasurydirect

The bid submission process in TreasuryDirect is completely online. Login to your account and click the BuyDirect® tab. Follow the prompts to specify the security you want, the purchase amount, and other requested information.

You also can set up reinvestments, using the proceeds from a maturing bond to buy another bond.

Introduction To Government Bonds

First, let us acquaint ourselves with some common terms to be aware of when looking at government bonds:

- Treasury bond: A security issued by the United States government.

- Municipal bond: A debt security issued by a local or state municipality.

- Maturity: The life of the bond.

- Yield: The yield offered as a return on the debt securitys investment. There are several different types of bond yield and methods for calculating them.

- Coupon: The amount of regular periodic interest payments.

- Bond rating: A rating that is provided by a rating agency based on creditworthiness qualities and characteristics.

Government bonds are essentially debt obligations of governments. Federal bonds are issued by the federal government with the federal governments single credit rating backing them all. As of July 2020, the U.S. federal government holds the highest AAA rating from Fitch, an Aaa from Moodys, with an AA+ rating from Standard and Poors.

Both federal Treasury bonds and municipal bonds use the revenues from the bonds for financing government projects or activities. These government bonds also come with some special tax advantages that make them unique in the bond world overall. The type of government bond you are looking for determines where you can purchase it, so you need to decide which type of bond you would like to buy first.

Also Check: Lost My Free Government Phone

How Does Buying Bonds Work In The Uk

Whether you want to buy and hold the bond directly, you can buy UK Government bonds through brokers, banks, and the DMO. However, another option is to invest in funds that specifically target government bonds to simplify your investment in bonds.

Government bonds are considered a safe investment in the UK and can provide a steady stream of income that can be especially beneficial when you are nearing retirement.

Youre Our First Priorityevery Time

NerdWallet, Inc. is an independent publisher and comparison service, not an investment advisor. Its articles, interactive tools and other content are provided to you for free, as self-help tools and for informational purposes only. They are not intended to provide investment advice. NerdWallet does not and cannot guarantee the accuracy or applicability of any information in regard to your individual circumstances. Examples are hypothetical, and we encourage you to seek personalized advice from qualified professionals regarding specific investment issues. Our estimates are based on past market performance, and past performance is not a guarantee of future performance.

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Recommended Reading: Government Jobs Grand Rapids Mi

Who May Own An I Bond

Individuals

|

Yes, if you have a Social Security Number and meet any one of these three conditions:

To buy and own an electronic I bond, you must first establish a TreasuryDirect account. |

|

|

Children under 18 |

Yes, if they meet one of the conditions above for individuals. Information concerning electronic and paper bonds:

|

|

Trust, estate, corporation, partnership and some other entities |

Electronic bonds : Yes Paper bonds:

|

NOTE: Tax questions? We have answers!

I Bonds Aren’t Right For All Investors

While the current I bond rate may be appealing, it’s important to consider whether these assets align with your goals before purchasing, experts say.

There are relatively low purchase limits, with a few exceptions, and no access to the funds for one year, making it suitable as a “supplement to your emergency fund,” Stephens said.

Recommended Reading: How Can I Sue The Government

Should I Buy A Government Bond

Government bonds can be a great option for the low-risk portion of an investors portfolio. They can also be a great way to begin investing in the bond market overall with little risk. Yields on government bonds range from approximately 2.20% to 3.00%. Many investors look to government bonds as options for consideration along with money market accounts, certificates of deposit, and high yield savings accounts. Ultimately the investment in a government bond is generally based on investment goals, risk tolerance, and return.

Competitive Vs Noncompetitive Auction Bidding

When you bid on Treasury securities, you have the option of submitting a noncompetitive bid or a competitive bid. Most individual investors opt for noncompetitive bidding. With a noncompetitive bid, you are essentially saying you will accept the rate/yield/discount margin at the conclusion of the auction. You are able to spend up to $5 million on a noncompetitive bid.

With a competitive bid, you specify a rate/yield/discount margin that you will accept. Once the auction is over, youll receive some, all or none of your bid depending on the rate/yield/discount margin that the Treasury ends up issuing. With a competitive bid, youre able to bid on a maximum of 35% of the securities being issued.

Once the deadline to submit bids has passed, the Treasury will issue securities to all noncompetitive bidders. Then, it will issue to the competitive bidder with the lowest rate/yield/discount margin and continue up until it runs out of securities. The rate/yield/discount margin at which it stops will be what all successful bidders receive.

Don’t Miss: Entry Level Government Jobs Hawaii

What Is A Government Bond And Where Are They Traded

Government bonds or gilts are an investment product in the UK that are positioned somewhere between shares and cash in terms of risk. Known to be less risky than the often-volatile share market, government bonds can be an attractive investment or trading opportunity for customers who are less risk-tolerant.

Is It A Good Time To Buy Government Bonds

Now is the best time to buy government bonds since 2015, fund manager says. … The market is now adapting to the possibility that bond yields will continue to rise. In a note Friday, Capital Economics upgraded its forecast for the U.S. 10-year yield to 2.25% by end-2021 and 2.5% by end-2022 from 1.5% & 1.75% previously.

Recommended Reading: How To Find If Government Owes You Money

Some Accounts Need Additional Identity Verification

Tommy Blackburn, a Richmond, Virginia-based CFP and senior financial planner at Mason and Associates who frequently helps clients purchase I bonds, said one of the main pain points is additional identity verification.

It can be very difficult obtaining the signature guarantee from major financial institutions and local ones.Tommy Blackburnsenior financial planner at Mason and Associates

In some cases, investors must fill out an account authorization form to prevent fraud, according to a Treasury official. This requires signing the form at a bank or credit union, notated with a “signature guarantee,” before mailing it back.

“In our experience, it can be very difficult obtaining the signature guarantee from major financial institutions and local ones,” Blackburn said. However, a Treasury official said they are working to expand certification to any notary public.

What Are Treasury Bonds

U.S. Treasury bonds are fixed-income securities issued and backed by the full faith and credit of the federal government, which means the U.S. government must find a way to repay the debt. Treasury bonds are considered low-risk investments that are generally risk-free when held to maturity, given the status of the U.S. government and its economy. Relative to other higher-risk securities, Treasury bonds have lower returns. Regardless, U.S. Treasury bonds remain sought-after because of their perceived stability and liquidity, or ease of conversion into cash.

Although investors will owe federal taxes on Treasury bonds, one perk is that the interest generated from owning Treasurys is state and local income tax-free.

Don’t Miss: How To Work For The Government As A Spy

Buying Bonds Through A Brokerage

Most online brokerages sell Treasury bonds, corporate bonds and municipal bonds. Brokers like Fidelity, Charles Schwab, E*TRADE and Merrill Edge offer extensive bond listings. However, the purchasing process through an online brokerage is nowhere near as straightforward as through Treasury Direct. Bond prices vary from brokerage to brokerage, thanks to transaction fees and markups or markdowns.

Treasurydirect And Other Ways To Buy Treasuries

There are several ways to buy Treasuries. For many people, TreasuryDirect is a good option. However, retirement savers and investors who already have brokerage accounts are often better off buying bonds on the secondary market or with exchange-traded funds . Treasury money market accounts also offer more convenience and liquidity than TreasuryDirect.

Recommended Reading: Free Government Grants For First Time Home Buyers

How To Use Treasurydirect To Buy Government Bonds

Government bonds are one of the safest places to park cash. This is because they are backed by the full faith and credit of the U.S. government, so theres virtually no risk of default. The tradeoff for safety, of course, is low interest rates. But you can at least cut any fees or commissions by buying Treasury securities directly through TreasuryDirect, the U.S. Treasurys online platform. If you think you can handle more risk for a higher return, you may want to consider corporate bonds or even stocks. For help, speak with a financial advisor who serves your area.

How To Buy Individual Bonds

Investors can buy individual bonds through a broker or directly from an issuing government entity. One of the most popular cases for buying individual bonds is the ability for investors to lock in a specific yield for a set period of time. This strategy offers stability, whereas the yield on a bond mutual fund or fixed-income exchange traded fund fluctuates over time.

Its important to keep in mind that individual bonds must be purchased whole. Most bonds are issued in increments of $1,000, so you need to fund your brokerage account balance with at least that amount to get started. Note that while U.S. Treasury bonds have a face value of $1,000, the minimum bid is $100 and they are sold in $100 increments. U.S. Treasury bonds can be purchased through a broker or directly at Treasury Direct.

Whether youre exploring how to buy municipal bonds, corporate bonds or treasuries, the basics of buying an individual bond remain the same: You can purchase them as new issues or on the secondary market.

Featured Partner

Via TD Ameritrade’s Secure Website

Also Check: Government Loans To Build A House

Here Are The Main Ways To Purchase Bonds:

Directly from the Feds: U.S. Treasuries are sold by the federal government at regularly scheduled auctions. You can buy them through a bank or broker for a fee, but why pay for something you can get for nothing? The easiest and cheapest way to participate in this market is to buy them directly from the Treasury on the Treasury Direct website.

Through a broker: With the exception of Treasuries, buying individual bonds isn’t for the faint of heart. Most new bonds are issued through an investment bank, or “underwriter,” rather than directly to the public. The issuer swallows the sales commission, so you get the same price big investors pay.

That’s why, when buying individual bonds, you should buy new issues directly from the underwriter whenever possible — since you’re getting them at wholesale.

Older bonds are another matter. They are traded through brokers on the “secondary market,” usually over the counter rather than on an exchange, such as the New York Stock Exchange. Here, transaction costs can be much higher than with stocks because spreads — the difference between what a dealer paid for a bond and what he’ll sell it for — tend to be wider.

If you do plan to invest in individual bonds, you should probably have enough money to invest — say $25,000 to $50,000 at a minimum — to achieve some degree of diversification. If you have less, consider bond funds.

Exactly how you invest depends largely on your objective:

What Are The Risks Of Government Bonds

You might hear investors say that a government bond is a risk-free investment. Since a government can always print more money to meet its debts, the theory goes, youll always get your money back when the bond matures.

In reality, the picture is more complicated. Firstly, governments arent always able to produce more capital. And even when they can, it doesnt prevent them from defaulting on loan payments. But aside from credit risk, there are a few other potential pitfalls to watch out for with government bonds: including risk from interest rates, inflation and currencies.

Read Also: Best Free Government Cell Phone Service