Food Stamps And Meal Programs During The Covid

Because of the COVID-19 pandemic, it may be easier for you and your family to get food stamps and take part in meal programs. Contact your state’s social services agency to see if you’re eligible.

During the pandemic:

-

Food stamp recipients may receive additional funding. More people may be eligible to receive SNAP during the pandemic than normally.

-

Parents whose kids’ schools are closed can pick up school meals for their kids to eat at home.

-

People can enroll in food programs remotely rather than in person. This applies to programs for pregnancy, families, seniors, and people with disabilities.

What Has Been Done So Far Directly For Borrowers

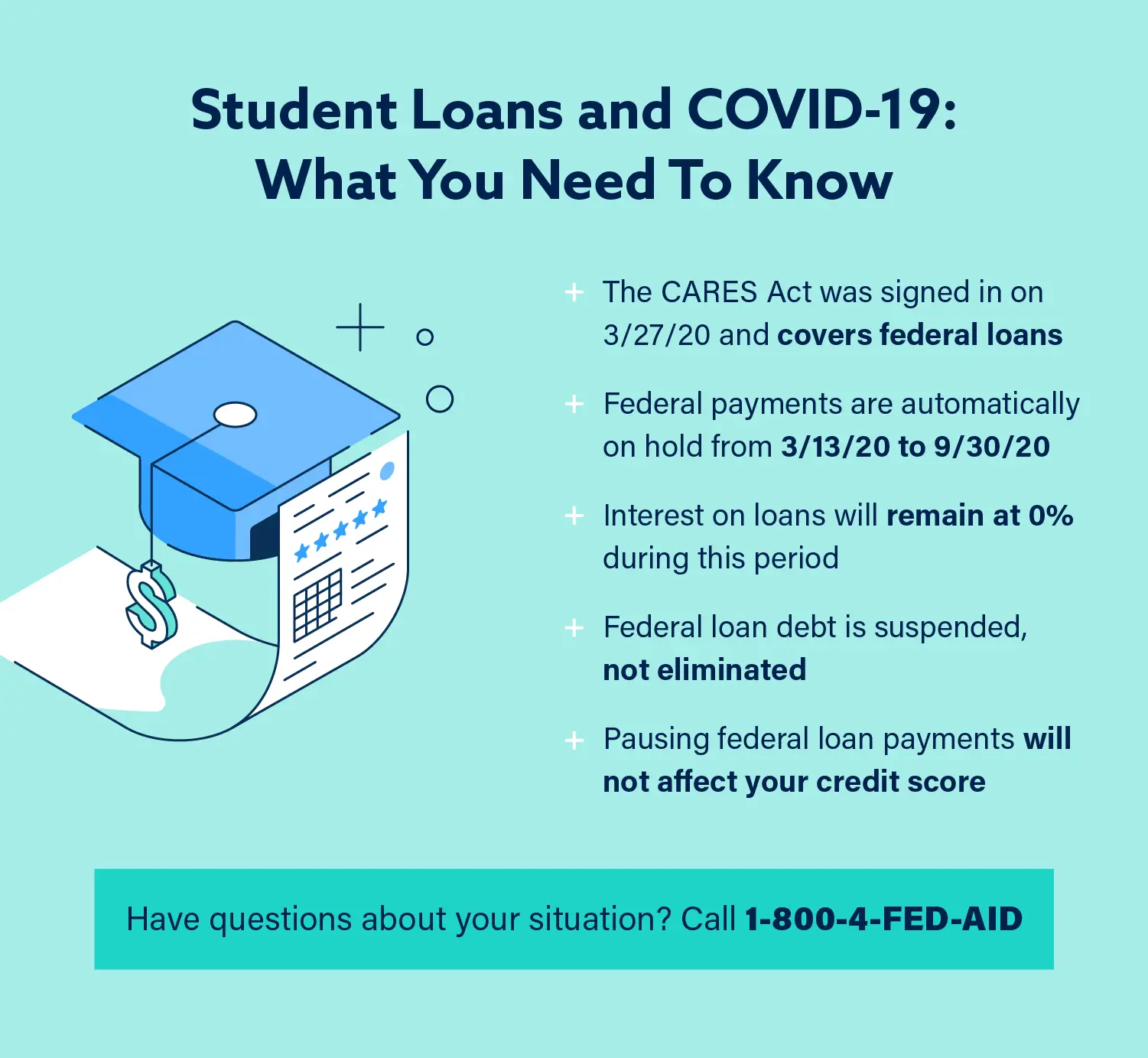

The Coronavirus Aid, Relief, and Economic Security Act temporarily suspends monthly payments on all loans held by the Department of Education, from March 13, 2020, through September 30, 2020. The suspension will be automatic borrowers do not have to apply for relief, although individuals can still choose to make monthly payments. For borrowers in default, the bill stops the involuntary collection of payments through wage garnishment and seizure of tax refunds until the end of September. The law also sets the interest rate at zero percent during this time period.

When Does Student Loan Interest Start Again

Student loan interest is on hold until the forbearance ends, which will be no later than June 30, 2023. Interest will begin to accrue the next day. You can find your interest rate by contacting the student loan servicer the company that handles your account.

The White House has said this latest extension will be the last for federal student loan debt.

Heres a list of federal student loan servicer companies:

-

American Education Services has Federal Family Education Loans only.

-

Default Resolution Group only handles federal student loans in default.

UPDATE: The Administration is extending the pause on federal student loan repayments to allow for the Supreme Court to rule in the case on the student debt relief program.The pause will end no later than June 30, 2023. Payments will resume 60 days after the pause ends.

The White House

Not sure who your servicer is? Visit StudentAid.gov, go to your account dashboard, and scroll down to the My Loan Servicers section. Keep in mind that more than one company may have your loans. Be sure to locate all of your loans before the resumption of payments so you dont risk delinquency and harming your credit score. You can also call the Federal Student Aid Information Center at 1-800-433-3243.

You May Like: Government Student Loan Repayment Calculator

Bring Your Contact Information Up

If you’ve moved or changed your email address or phone number since March 2020, update your contact information onyour account. Visit your Welcome page and select the Manage Profile sectionto confirm your address, email address, and phone number are correct. If your name has changed, pleasegive us a call.

Student Loan Discharge Programs

You may also be able to find student help assistance through student loan discharge programs. Loan discharge is very similar to loan forgiveness and cancellation but generally occurs when you no longer need to make payments on your loans due to a change in circumstances.

The most common reasons you may be eligible for student loan discharge include:

- Total and permanent disability discharge: You may be eligible to have your remaining student loan debt canceled if you are totally and permanently disabled and unable to work. If you are a veteran, the loan discharge is usually automatic.

- Closed school discharge: If the school where you received your loans closes while youre still enrolled or within 120 days of you leaving, without you receiving a degree, you may qualify for loan discharge.

- Borrower defense to repayment discharge: You could also be eligible for loan discharge if you were defrauded by your school as part of widespread fraud or misrepresentation.

- Loan discharge after death: If you die, any federal loans of parent PLUS loans will be eligible for discharge. If your parent dies while holding a PLUS loan, this will also be eligible for discharge.

You May Like: Collection Account Student Loan Permanently Assigned To Government

Federal Student Loan Servicers

Although the Department of Education funds federal student loans, it does not act as a direct servicer once loans are dispersed or begin repayment.

Instead, the government has selected several different private companies to collect your payments and provide you with any help you may need along the way.

Note that no matter who your servicer is, you should be able to access your loan information in the National Student Loan Data System .

Here is a list of federal student loan servicers and their information:

When Will Student Loan Payments Resume

After multiple extensions since they were first paused in March 2020, student loan payments and interest are now slated to restart 60 days after legal challenges have been resolved, according to the US Education Department. Should the courts not reach their final rulings by June 30, payments would still resume 60 days later — on Aug. 29, 2023.It’s always possible the moratorium will be extended again, but experts say that would only be a gambit to buy time, not a permanent solution to the student loan crisis.

The intent is “to make sure borrowers don’t have the rug pulled out from under them, rather than an indefinite replacement for loan forgiveness,” an unnamed White House aide told The Washington Post.

Read Also: Work From Home Government Jobs

How To Apply For Bidens Announced Student Loan Forgiveness

Nearly 8 million borrowers will automatically have their debt forgiven without applying because the government already has their income data. For those that the U.S. Department of Education does not have their income data for, the government will be introducing an online application system, said to be available in October 2022. You will not have to upload information or have an FSA ID to apply.

You can sign up to be notified of when the application is available on the studentaid.gov website. Most borrowers who apply should expect relief within 6 weeks of application. The government encourages everyone to apply, even if you think youre part of the 8 million that technically doesnt have to. You will need to apply by mid-November 2022 to make sure you get relief before student loan payments resume on January 1, 2023.

Restoration Of Total And Permanent Disability Discharges

Some disabled borrowers who qualified for a Total and Permanent Disability Discharge had their repayment obligation reinstated because they failed to submit the annual earnings paperwork during the pandemic. The U.S. Department of Education will reverse the reinstatements and provide other student loan debt relief for 230,000 borrowers with Total and Permanent Disability Discharges.

Recommended Reading: Government Land For Sale In Kansas

I’ve Been Making Payments During The Pause Can I Continue To Do So

Absolutely. Continuing to make payments during the payment pause could help you pay down your loan balance more quickly. The full amount of apayment will be applied to your principal balance once you’ve paid all interest that accrued beforeMarch 13, 2020. There is no penalty for paying less than your regular monthly payment amount during the payment pause.

Watch For Notices From Us

Great Lakes and Federal Student Aid have sent, and will continue to send, communications to help get you prepared forrepayment. Read these notices carefully, as they have important tips about what to expect.

As the end of the payment pause grows nearer, we will send you a billing statement about three weeks beforeyour due date. If you previously had a bill pay service set up with your bank, you may have to set that backup again. Refer to “I previously made monthly payments using a bill pay service. How do I continue usingthat payment method when repayment starts?” in theFAQs below.

In addition, if you were previously using Auto Pay to make your monthly payments before March 13, 2020, and you haven’t confirmed your enrollment, you’ll still need to confirm by logging in to your mygreatlakes.org account, selecting Payments, then selecting Auto Pay.

If you haven’t already, you must confirm that you want to remain in Auto Pay for your payments to be madeusing that method. If you do not elect to stay enrolled in Auto Pay, it willbe cancelled, you’ll lose the 0.25% reduction on your interest rate, and you’ll need to make other paymentarrangements when the COVID-19 payment pause ends. Log in to yourmygreatlakes.org account, and you’ll beprompted to confirm enrollment in Auto Pay.

Recommended Reading: Government Funding For Stroke Victims

Will Biden Extend This Student Loan Relief Beyond September 30 2021

There is no guarantee that Biden will extend student loan relief beyond September 30, 2021. Since the passage of the Cares Act last March, Bidens extension through executive order is the longest extension to date for this student loan relief. Rather than pause student loan payments for three-month increments, Biden chose a single eight-month extension. In determining whether to extend student loan relief any further , Biden will evaluate several factors, including the state of the Covid-19 pandemic and the associated economic recovery.

Many Federal Student Loan Servicer Contracts Due To Expire

In June 2020, the Department of Education announced that it had signed contracts with several new loan servicers, which would assume control of most of the federal student loan portfolio. Although this means your student loan servicer might change, you probably wont have to worry about it until the end of the student loan moratorium.

But that doesnt mean you should wait. Once repayment does resume, youll want to be ready so that you dont accidentally miss a payment on any of your student loans. This means contacting your server now so that youre aware of any changes.

And if youre not sure who your loan servicer is, consult our guide to finding student loan servicers.

Recommended Reading: Impact Of Poor Data Governance Kpmg

Why Was The Student Loan Payment Pause Extended

The payment pause has been extended a number of times, with the most recent extension announced in November 2022. In a press release, the administration made it clear an extension is necessary to prevent those who are eligible for forgiveness from being forced to pay due to ongoing litigation.

Borrowers can use the additional time to ensure their contact information is up to date with their loan servicers and consider enrolling in electronic debit and income-driven repayment plans to support a smooth transition to repayment, the press release states.

What Your Loan Servicer Must Do If You Request Forbearance

If you’re having trouble making payments on your federally backed mortgage because of the COVID-19 pandemic, contact your loan servicer. They must:

-

Defer or reduce your payments for six months if you contact them to make arrangements.

-

You can request an extension if you need it. For most loans, your forbearance can be extended up to 12 months.

Offer options for how you can make up the deferred or reduced payments. They will discuss these options with you at the end of your forbearance period.

Recommended Reading: What Is Governance Risk Management And Compliance

Advance Child Tax Credit

Because of the COVID-19 pandemic, the CTC was expanded under the American Rescue Plan of 2021. The IRS pre-paid half the total credit amount in monthly payments from July to December 2021. When you file your 2021 tax return, you can claim the other half of the total CTC.

Learn more about the Advance Child Tax Credit.

How To Lower Student Loan Payments When They Resume

Some borrowers wont have trouble making payments when those billing statements start arriving next summer. But for others recent graduates, parents, borrowers in student loan default, and so on the payment amount wont fit their budget, which could force them to make tough choices. Thankfully, the federal government unlike private lenders offers its borrowers flexible repayment options to accommodate most situations.

Heres how to lower student loan payments, depending on your situation.

Read Also: American Assistance Free Government Cell Phones

Ready To Start Your Journey

The most recent change, which was announced by the Department of Education on January 21, gives borrowers an additional eight months of financial relief.

“Borrowers of all ages are often faced with a tough tradeoff between making their student loan payments, investing in their long-term financial future, or paying their bills. The pandemic has only increased the economic hardship of the millions of Americans who have student debt,” said Biden in a statement.

As part of the coronavirus relief bill, the student loan forbearance period also suspends wage garnishment and tax refund reduction for anyone who defaulted on their federal student loans. While interest rates will remain at 0%, borrowers still have to opt in to forbearance.

A student with $25,000 in loan debt normally pays about $60 per month in interest. Now, students will pay no interest until at least October.

The federal student loan interest rate is set at 2.75% for the 2020-21 school year, down from last year’s 4.53%. A student with $25,000 in loan debt normally pays about $60 per month in interest. Now, students will pay no interest until at least October.

Unfortunately for some students, these measures do not apply to private student loans. About 90% of student debt is federal, meaning the suspended payments will impact the monthly statements of the vast majority of student loan borrowers.

Figure Out If Your College Of Choice Are Eligible For Federal Aid

An eligible school can be an institution of higher education or a postsecondary vocational institution that meets specific requirements.

The most significant component of an eligible school is that it offers an eligible degree or certificate program that leads to the gainful employment of the student.

Details about what is required from eligible schools to participate in the federal student aid program can be found here.

Recommended Reading: Does The Government Tax Cryptocurrency

What Else Can I Do To Get Ready For Repayment

Here are some other tips for getting prepared for repayment to begin after January 31, 2022:

- Learn about all the ways you can make a student loan payment.

- Download the Great Lakes Mobile app for another handy way to manage your loans.

- Follow us on social media .

- Check out our Knowledge Center for informative articles about federal student loans.

Great Lakes’ goal is to provide you with the best service possible. We’re in this together.

Federal Student Loan Forbearance Extension: What It Means

The CARES Act did three things for federal student loans:

- Put loans into automatic administrative forbearance

- Set interest rates at 0%

- Suspended collections on defaulted loans

The original moratorium on interest and payments began on March 13, 2020, and was set to expire on Sept. 30, 2020.

There have been seven extensions since then. The most recent extension happened on Nov. 22, 2022, when the Biden administration announced the loan forbearance program will be in place until court cases are resolved in 2023.

You May Like: Entry Level Government Jobs Charlotte Nc

Existing Federal Student Loan Forgiveness Programs

If a borrower expects to receive loan forgiveness under President Biden, they can stop making federal student loan payments during the payment pause and interest waiver period, which was extended through December 31, 2022.

But, some borrowers may be eligible for an existing student loan forgiveness program. For example, Public Service Loan Forgiveness is available to borrowers who work full-time in a qualifying public service job. A borrower is eligible for loan forgiveness after making 120 qualifying payments.

During the payment pause, borrowers can still earn credit toward PSLF. As long as they continue to meet the eligibility requirements and submit the PSLF form, they will receive qualifying payment credit.

Borrowers who will not qualify for loan forgiveness when the relief period ends can also consider an income-driven repayment plan. With an income-driven repayment plan, monthly payments are adjusted based on the borrowers annual income. After a specified period of time the debt is forgiven.

When Will My Payments Restart And How

You should receive a billing statement at least three weeks before your first payment is due, but you can contact your loan servicer before then for specifics on what you owe and when payment is due. If you havent changed repayment plans, your due date should be the same as before the pause.

This is important: If you were on an automatic payment plan before the pandemic that is, before March 13, 2020 you must opt back in. Your servicer should reach out to you about this. If you dont respond, your payments will not automatically restart.

If you signed up after that date, automatic payments will indeed resume. Borrowers who have continued to make payments there are about 500,000 of them dont have to do anything at all.

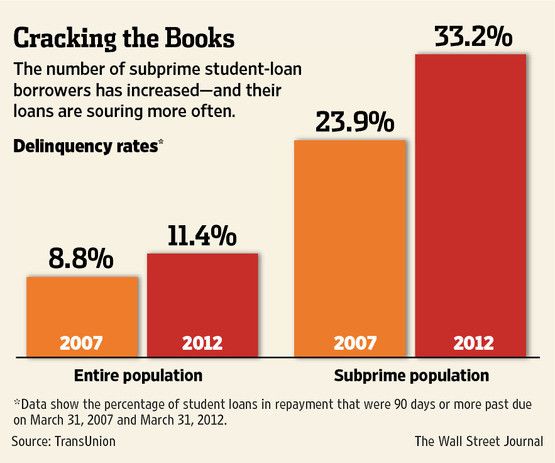

If you miss the first payment, dont panic. Just contact your servicer and make arrangements to become current. Once you are 90 days overdue, however, the servicer will report your delinquency to the major credit bureaus.

You May Like: How To Get A Free Computer From The Government

What Does The Payment Pause Do

During forbearance, first ordered by then-President Donald Trump in March 2020 as the COVID-19 pandemic took hold, federal student loan borrowers are allowed to skip payments. The interest rate on their loans has been set to 0%, and collections activities have been halted on defaulted loans.

Borrowers in standard repayment plans will find their previous loan balances waiting for them when payments resume, minus any debt cancellation that survives court challenges. Those in income-driven repayment plans, which cancel remaining debt once a certain number of payments has been made, are somewhat better off each month that passes in this payment pause still counts toward their totals.

The November announcement marked the eighth time the government has lengthened interest-free forbearance.

Roughly 40 million borrowers who were supposed to start paying their bills again in January 2023 now have additional time without them. After nearly three years without student loan bills and an uncertain future for cancellation, however, not everyone should continue the payment holiday.