Get Broad Exposure To The Bond Markets

You can use just a few funds to complete the bond portion of your portfolio. Each of these ETFs and index funds gives you access to a wide variety of bonds in a single, diversified fund.

- View the Vanguard Total International Bond Index Fund, which holds about 6,427 non-U.S. bonds.

For more information about Vanguard funds and ETFs, visit vanguard.com to obtain a prospectus or, if available, a summary prospectus. Investment objectives, risks, charges, expenses, and other important information about a fund are contained in the prospectus read and consider it carefully before investing.

You must buy and sell Vanguard ETF Shares through Vanguard Brokerage Services or through another broker . See the Vanguard Brokerage Services commission and fee schedules for limits. Vanguard ETF Shares are not redeemable directly with the issuing fund other than in very large aggregations worth millions of dollars. ETFs are subject to market

All investing is subject to risk, including the possible loss of the money you invest. Diversification does not ensure a profit or protect against a loss.

Bond funds are subject to interest rate risk, which is the chance bond prices overall will decline because of rising interest rates, and credit risk, which is the chance a bond issuer will fail to pay interest and principal in a timely manner or that negative perceptions of the issuer’s ability to make such payments will cause the price of that bond to decline.

What Are The Risks Associated With Investing In Bonds

As with any investment, buying bonds also entails risks:

- Interest rate risk: When interest rates rise, bond prices fall, and the bonds that you currently hold can lose value. Interest rate movements are the major cause of price volatility in bond markets.

- Inflation risk: Inflation is the rate at which the price of goods and services rises over time. If the rate of inflation outpaces the fixed amount of income a bond provides, the investor loses purchasing power.

- Credit risk is the possibility that an issuer could default on its debt obligation.

- Liquidity risk: Liquidity risk is the possibility that an investor might wish to sell a bond but is unable to find a buyer.

- Stocks tend to earn more money than bonds. In the period 1928-2010, stocks averaged a return of 11.3% bonds returned on average 5.28%.

- Bonds freeze your investment for a fixed period of time. For example, if you buy a 10-year-bond, you cant redeem it for 10 years. This creates the potential for your initial investment to lose value. Stocks, on the other hand, can be sold at any time.

You can manage these risks by diversifying your investments within your portfolio.

Bonds With Call Or Put Option

The distinguishing feature of this type of bonds is the issuer enjoys the right to buy-back such bonds or the investor can exercise its right to sell them to such issuer. This transaction shall only take place on a date of interest disbursal.

Participating entities, i.e. the government and investor can only exercise their rights after the lapse of 5 years from its issuance date. This type of bonds might come with either

- Put option only

In any case, the government can buy back its bonds at face value. Similarly, investors can sell such bonds to the issuer at face value. This ensures the preservation of the corpus invested in case of any downturn of the stock market.

Read Also: Michigan Schools And Government Credit Union Customer Service

What Are The Benefits Of Investing In Bonds

Bonds offer a host of advantages:

- Capital preservation: Capital preservation means protecting the absolute value of your investment via assets that promise return of principal. Because bonds typically carry less risk than stocks, these assets can be a good choice for investors with less time to recoup losses.

- Income generation: Bonds provide a fixed amount of income at regular intervals in the form of coupon payments.

- Diversification: Investing in a balance of stocks, bonds and other asset classes can help you build a portfolio that seeks returns but is resilient through all market environments. Stocks and bonds typically have an inverse relationship, meaning that when the stock market is down, bonds become more appealing.

- Risk management: Fixed income is broadly understood to carry lower risk than stocks. This is because fixed income assets are generally less sensitive to macroeconomic risks, such as economic downturns and geopolitical events.

- Invest in a community: Municipal bonds allow you to give back to a community. While these bonds may not provide the higher yield of a corporate bond, they often are used to help build a hospital or school or that can improve the standard of living for many people.

Morningstar Fixed Income Style Box

Net Asset Value The NAV is a funds value or price per share. The NAV is calculated by dividing the market value of all a funds shares by the number of issued shares.

Daily NAV Change The daily NAV change is the difference between a funds current price per share and its price at the time of market close on the prior day.

ReturnsReturns are calculated on a year-to-date and trailing 12-month basis. These returns, also known as trailing returns, illustrate a fund’s performance over a specific time period, including capital appreciation as well as reinvested dividends and capital gains distributions.

Net Annual Fund Operating ExpensesThis figure represents the total percentage of a mutual funds assets used to maintain a fund, including operating expenses and management fees. Its calculated by dividing a funds annual net operating expenses by the average dollar value of its assets, and includes the impact of any fee waivers or expense reimbursements that may have been in effect during the time period.

Sales Charges The commission paid by an investor upon investment in a fund.

Net Asset Value The NAV is a funds value or price per share. The NAV is calculated by dividing the market value of all a funds shares by the number of issued shares.

Daily NAV Change The daily NAV change is the difference between a funds current price per share and its price at the time of market close on the prior day.

Sales Charges

Fund management

Recommended Reading: Government Grants For Commercial Real Estate

How To Work Out The Value Of A Bond

Yield to maturity is a useful measure of the value of a bond. It is also a good way to compare what you’ll get by investing in different bonds.

YTM calculates the average annual return of a bond from when you buy it until maturity. It assumes that you reinvest coupon payments in the bond at the same interest rate the bond is earning.

Make sure you always balance the return against any risks before investing.

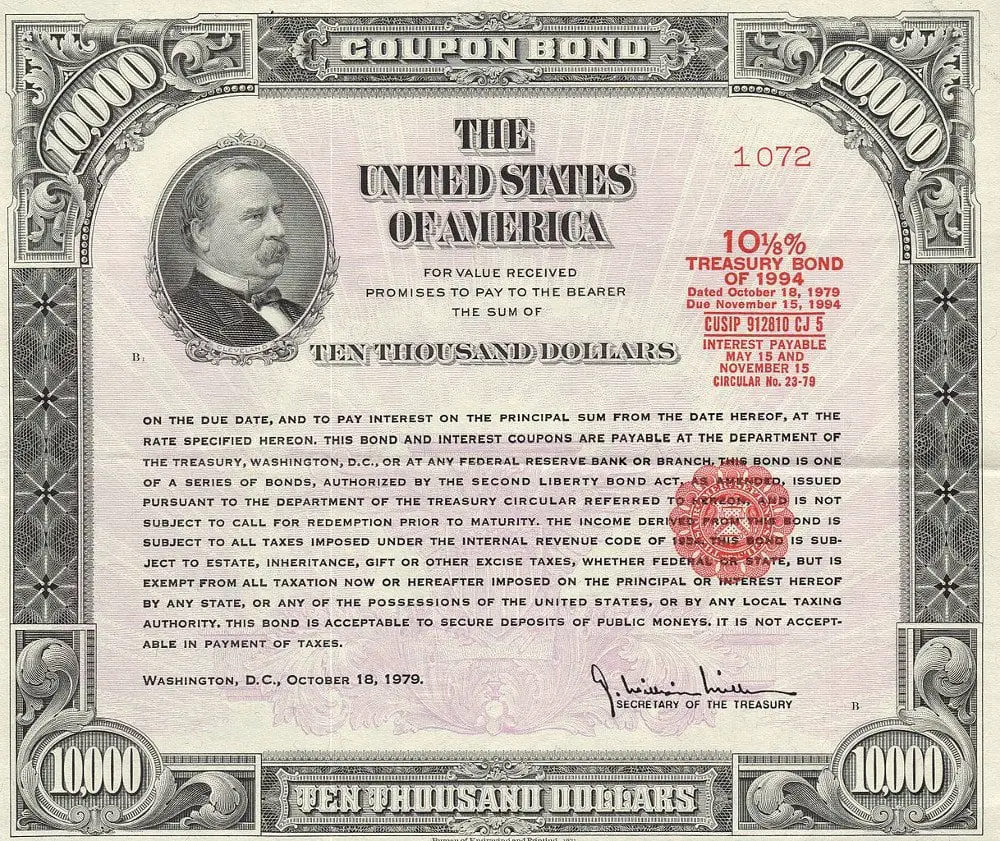

Where Can I Buy Government Bonds

In general there are two broad categories investors can consider when looking to invest in government government bonds: Treasury bonds and municipal bonds. Both are options for investors seeking to build out the low-risk portion of their portfolio or just save money at higher, low-risk rates.

Government bonds can also be a great place to start if you are new to bond investing overall. Treasuries and municipals and are usually top low-risk bond options also considered alongside money market accounts, certificates of deposit, and high yield savings accounts.

Recommended Reading: American Government In Christian Perspective

Buying Vs Trading Bonds

If you buy government bonds and hold them until maturity, you will enjoy regular coupon payments and a return of your initial investment when they mature. During that time, however, the price of a government bond will fluctuate in the market. Bond prices have an inverse relationship with interest ratesâ âso when interest rates go up, government bond prices go down in the secondary market. Because of this, shorter-term investors who do not buy and hold bonds until maturity can experience gains or losses in the market. Bond traders can also look to profit from the relative differences in the yields of certain bonds, known as the spreadâ âfor instance, the spread between U.S. Treasuries and highly rated corporate bonds. Another bond trading strategy is to bet on changes in the spread between different maturities, known as the yield curve.

Government bonds can provide a combination of considerable safety and relatively high returns. However, investors need to be aware that governments sometimes lack the ability or willingness to pay back their debts.

Do You Need A Bond Fund

Investors rely on bonds for many reasons: funding short-term goals, diversifying a stock-heavy portfolio over the long term, or generating income during retirement, to name a few. Before getting down to choosing a bond ETF or mutual fund, step back and consider why you need one: What role is it playing for you?

Once you know what need its filling, figure out whether a taxable-bond fund or municipal-bond fund is a better choice for you. If youre investing via a tax-deferred account like an IRA or 401, a taxable-bond ETF or fund will be the better match. If youre investing in a taxable account, though, municipal bonds might be the better choice on an aftertax basis.

A good place to start your search for top bond ETFs and mutual fundsboth taxable and municipal alikeis with the Morningstar Analyst Rating. Mutual funds and ETFs that earn our highest rating of Gold are those that we think are most likely to outperform over a full market cycle.

Read Also: La City Jobs Government Jobs

Buying Government Bonds: Municipals

Municipal bonds are the second type of government bond option. They are issued by state governments or local municipalities for funding infrastructure and government activities in these areas.

While they fall in the same broad category as treasuries, municipal bonds are a class of their own. They are government-sponsored but they have their own credit rating system which is similar to the standards for corporate bond credit ratings. Municipal bond issuers and bonds are rated from high to low quality by credit rating agenciesnamely, Moodys, S& P, Fitch, and Kroll. Individual bonds may also come with their own individual credit rating.

Below is a ratings chart provided by MSRB:

Municipal bonds are also evaluated by maturity, ranging from 1-month to 30 years. Below is a look at the municipal bond yield curve for the AAA municipal market as of December 2020.

Finding comprehensive information on the full list of municipal bond investments can be somewhat more challenging than for treasuries. Beginning in 2008 the Municipal Securities Rulemaking Board introduced the website EMMA for providing investors with greater transparency on municipal bonds. EMMA provides full disclosure on all municipal bonds brought to market. It is not a platform for buying and selling municipals.

Portfolio Characteristicsas Of 9/30/22

Yields and Distributions A Shares| Current Distribution Yield |

|

Goals of the Fund, its role in an investors asset allocation strategy, its conservative investment approach, Portfolio characteristics, and long-term performance. |

This material must be accompanied or preceded by a current Davis Government Bond Fund Prospectus. You should carefully consider the Funds investment objective, risks, charges, and expenses before investing.The prospectus contains this and other information and can be obtained by clicking here or calling 800.279.0279. Read the prospectus carefully before you invest or send money.

The SEC Yield is computed in accordance with SEC standards measuring the net investment income per share over a specified 30 day period expressed as a percentage of the maximum offering price of the Funds shares at the end of the period. Current Distribution Yield is computed by multiplying the last dividend paid by 12 distributions per year and dividing that product by the current NAV per share.

The market value of an investment in the fund is not insured or guaranteed by the U.S. government or its agencies. CDs are insured by the FDIC for up to $100,000 and offer a fixed rate of return. Investment return and share price of the Davis Government Bond Fund fluctuate with market conditions, and you may have a gain or loss when you sell your shares.

Davis Distributors, LLC, 2949 East Elvira Road, Suite 101, Tucson, AZ 85756

Also Check: Government Assistance For Medical Bills

Low Risk Predictable Income

Most default superannuation funds will have a proportion of their members’ money invested in government bonds because of their low risk and predictable supply of income.

Like shares, some government and corporate bonds can be traded on the ASX. Government bonds that can be traded on the ASX are known as Exchanged Traded Australian Government Bonds.

There are two main types of Australian Government Bonds that are listed on the Australian Securities Exchange :

- Treasury Bonds: These are medium to long-term debt securities that carry an annual rate of interest fixed over the life of the security. Interest is paid every six months, at a fixed rate, which is a percentage of the original face value of $100. The bonds are repayable at face value on maturity.

- Treasury Indexed Bonds: These are medium to long-term bonds. The capital value of the bonds is adjusted for movements in the Consumer Price Index , which measures inflation. Interest is paid quarterly, at a fixed rate, on the adjusted face value. At maturity, investors receive the capital value of the bond – the value adjusted for movement in the CPI over the life of the bond.

The Australian Government has never defaulted on the interest payments on the bonds that it has issued or on the repayment of the principal amount invested in them.

This is why government bonds are considered to be a highly secure investment product, second only to cash at the bottom of the risk spectrum.

Why Are Interest Rates On Government Bonds Usually Lower Than Other Bonds

Bonds issued by the federal government are considered to be essentially riskless. In the U.S., the federal government has never defaulted on its debt, and the government could theoretically create more money or raise taxes in order to pay for the interest on existing debts to avoid default. Therefore, Treasuries carry what is known as the risk-free rate of return. Corporate and other bonds must carry higher yields to compensate investors for the additional credit risk that are inherent to them.

You May Like: Government Center Parking Garage Boston

How Close The Bond Is To Maturity

Newly issued government bonds will always be priced with current interest rates in mind. This means that they usually trade at or near their par value. By the time a bond has reached maturity, its just a pay out of the original loan ie bonds move back towards their par values as they near this point.

The number of interest rate payments remaining before a bond matures will also have an impact on its price.

Next Steps To Consider

Before investing, consider the funds’ investment objectives, risks, charges, and expenses. Contact Fidelity for a prospectus or, if available, a summary prospectus containing this information. Read it carefully.

In general, the bond market is volatile, and fixed income securities carry interest rate risk. Fixed income securities also carry inflation risk, liquidity risk, call risk, and credit and default risks for both issuers and counterparties. Unlike individual bonds, most bond funds do not have a maturity date, so holding them until maturity to avoid losses caused by price volatility is not possible.

Read Also: How To Invest In Government Securities

What Is A Taxable

Taxable-bond ETFs and mutual funds invest in fixed-income securities issued by governments and corporations.

The right type of taxable-bond ETF or mutual fund for you comes down to personal preferences. Will you forgo the incremental yield and diversification benefits that high-quality long-term bond funds typically offer for some protection against rising interest rates? Do you want to stick with the highest-quality bonds you can find, or are you willing to delve into lower-quality bonds in exchange for higher yield? Will you dabble in world bonds for yield pickupand if yes, do you want currencies in the mix?

To help determine which types of taxable-bond ETFs and mutual funds may make sense in your situation, read A Checklist for Taxable-Bond-Fund Investors.

Holding Bonds Vs Trading Bonds

If you buy a bond, you can simply collect the interest payments while waiting for the bond to reach maturitythe date the issuer has agreed to pay back the bond’s face value.

However, you can also buy and sell bonds on the secondary market. After bonds are initially issued, their worth will fluctuate like a stock’s would. If you’re holding the bond to maturity, the fluctuations won’t matteryour interest payments and face value won’t change.

But if you buy and sell bonds, you’ll need to keep in mind that the price you’ll pay or receive is no longer the face value of the bond. The bond’s susceptibility to changes in value is an important consideration when choosing your bonds.

Recommended Reading: Government Grants For Personal Use

Benefits Of Government Mutual Bonds

There are still many unique benefits that come with government mutual bonds.

To start, they always pay a reliable return and are very low risk. If you want to diversify your portfolio even more, then mutual bonds are always a great option.

In addition, these types of bonds are exempt from both state and local taxes, which can save you a bit of hassle come tax season. Finally, you can resell government mutual bonds, allowing you to make the most of them.

You may want to resell your bonds if you notice they arent making worthwhile returns anymore or issues with the interest rates. Many people use the money from reselling their government mutual bonds to invest in more bonds with better interest rates.

This method allows you to keep up with inflation on long-term investments.