Student Loan Discharge For Special Circumstances

While student loan discharge isnt the same as forgiveness, it could leave you debt-free. In rare circumstances, borrowers can get their student loans completely canceled.

There are several situations when you could qualify for student loan discharge, including:

- Closed school

If you think you could qualify or want to learn more, speak with your loan servicer.

Are You Eligible For Pslf As A Federal Employee

If you work for a federal, state, or local government andyou work full-time, you should be eligible for PSLF provided you have theright type of loans and are paying on them back on an income-driven repaymentplan.

You are considered to be working full-time if you eithermeet your employers definition of working full time or if you work at least 30hours weekly whichever is greater. If you have more than one qualifying job,the combined aggregate time you work for each employer can count towards determiningif you are full-time. This means youll qualify as long as you work a combinedaverage of 30 hours per week.

Pacific Leaders Bc Loan Forgiveness

If you’re a regular full- or part-time employee of the BC Public Service, have completed your probation, and have B.C. student loans in good standing, you may apply for this program.

If you plan on applying for the Pacific Leaders Loan Forgiveness program, any payments you make prior to your approval won’t be used in the calculation for eligibility.

In other words, you won’t be eligible for Pacific Leaders Loan Forgiveness on payments made prior to your loan forgiveness application being reviewed and approved.

If you direct a payment towards your Integrated student loan, the amount is applied against the federal and British Columbia portions.

Read Also: Safelink Phones Replacements

Changes To The Public Service Loan Forgiveness Under President Biden

On October 6, 2021, the Education Department announced a set of actions to increase eligibility for PSLF and forgive more student loan debt for federal employees.

One of the biggest changes to the program introduces a a time-limited waiver so that student borrowers can count payments from all federal loan programs or repayment plans toward forgiveness. Prior to this announcement, federal employees who had refinanced federal loans were not eligible for PSLF.

Other changes announced in October of 2021 include:

- Allowing more payments to count as qualified towards the 10 years of payment under PSLF

- Expanding eligibility for military service members regardless of loan payment status during active duty

- Automatically comparing the list of federal employees and military members against the list of federal student loans to help more people access PSLF

- Simplifying the application process to PSLF and re-examining previously denied PSLF applications.

More details of these changes can be found on the Department of Educations website.

Federal Student Loan Forgiveness Program Fulfills An Elusive Promise: To Erase Debts

The notice from the federal government took Lee Dossett, a doctor in Lexington, Kentucky, by surprise. “Congratulations!” it began.

After a couple of years of denials for a student loan forgiveness program designed for public servants, Dossett, who has worked in the nonprofit sector for 10 years, was told last week that not only was his application re-evaluated, but that the Department of Education had determined he should have his outstanding medical school loans erased altogether about $75,000 worth.

“I was completely shocked because I had honestly given up on getting it,” Dossett said.

But a record number of student borrowers are reaping the same benefit after the Biden administration in October began relaxing stringent rules around Public Service Loan Forgiveness, which launched in 2007 to help teachers, health care workers, military members and other public servants earn debt relief on their federal loans. As of last week, more than 70,000 borrowers qualified for debt forgiveness, amounting to about $5 billion in relief, the Department of Education said.

Before the overhaul, just 16,000 borrowers of about 1.3 million enrolled applicants had their loans’ remaining balances expunged through the program, according to federal data.

Don’t Miss: Safelink Free Replacement Phone

What Are The Requirements

Not everyone that works in public service qualifies for PSLF. Youll need to work full time at a qualifying organization and make 120 on-time loan payments. Those payments must be under a qualifying repayment plan, including:

For most borrowers, an income-driven repayment plan lowers your monthly payments and maximizes the amount youll have forgiven.

Next Steps For Public Service Borrowers Seeking Student Loan Forgiveness

The reconsideration program should go live in April. In the meantime, heres what borrowers seeking PSLF and TEPSLF can do:

- Read up on the requirements of PSLF and TEPSLF via the Education Departments website.

- Use the Departments PSLF Help Tool to get a preliminary assessment as to whether your employment qualifies for PSLF or TEPSLF.

- Review the criteria and rules governing the new Limited PSLF Waiver program.

The Department noted in its statement that under the Limited PSLF Waiver, many previous erroneous PSLF and TEPSLF determinations will be automatically corrected for Direct loan borrowers who already have certified their employment. Because the waiver addresses many issues borrowers experienced with program eligibility, we encourage you to wait to submit reconsideration requests until after the limited PSLF waiver has been applied to your loans, said the Department. Borrowers who nevertheless want to dispute a PSLF or TEPSLF determination, but dont want to wait for the new reconsideration process to go live, can submit a complaint via the Departments FSA Feedback division.

Also Check: Government Jobs In San Antonio Tx

Executive Director Marriner S Eccles Institute University Of Utah

Dont tell me what you value. Show me your budget, and Ill tell you what you value.

Joe Biden

Even modest student loan forgiveness proposals are staggeringly expensive and use federal spending that could advance other goals. The sums involved in loan-forgiveness proposals under discussion would exceed cumulative spending on many of the nations major antipoverty programs over the last several decades.

There are better ways to spend that money that would better achieve progressive goals. Increasing spending on more targeted policies would benefit families that are poorer, more disadvantaged, and more likely to be Black and Hispanic, compared to those who stand to benefit from broad student loan forgiveness. Indeed, shoring up spending on other safety net programs would be a far more effective way to help low-income people and people of color.

Student loan relief could be designed to aid those in greater need, advance economic opportunity, and reduce social inequities, but only if it is targeted to borrowers based on family income and post-college earnings. Those who borrowed to get college degrees that are paying off in good jobs with high incomes do not need and should not benefit from loan-forgiveness initiatives that are sold as a way to help truly struggling borrowers.

A Government That Delivers

The Department of Education isnt stopping there those at the department are working to make sure everyone knows about these new changes to encourage more public servants to apply. One significant change is the new limited waiver, which works to have all payments from borrowers count toward PSLF, regardless of payment plan or loan program type. In other words, under this limited PSLF waiver, you would get credit for periods of repayment that would not, outside of this waiver, qualify for PSLF . The Department of Education is working tirelessly to make sure that, from October 6, 2021 to October 31, 2022, anyone who is eligible is aware of the PSLF limited waiver.

In January 2022, Kate was able to successfully have her student loans forgiven and in February, she received a refund for her extra payments. This program, and especially the Administrations waiver, has changed her life. is being fixed, Kate said. Its been a long 12 years of paying loans and dealing with unexpected hurdles and conflicting information. I went to work in the government because I believe in its power to serve the people but in dealing with this process, its been hard to keep the faithnow my faith has been restored. Kate strongly encourages public servants to see how and if they can qualify. Now that Kate is no longer paying off her loans, shes seeing the impacts first-hand, by investing that money into her sons college fund as he grows.

Learn More

Read Also: Grb Platform

Obtaining A Federal Direct Consolidation Loan

To obtain a federal direct consolidation loan, contact the US Department of Education.

If you have not yet consolidated, you can seek a federal direct consolidation loan in order to obtain an income contingent repayment plan. Federal direct consolidation loans are available if you havent been able to obtain a FFEL consolidation loan, income sensitive repayment terms acceptable to you or if you have defaulted on your FFEL loans.

You can request income-contingent repayment or income-based repayment. The consolidation loan application does not currently include a checkbox for requesting these repayment plans, so you must ask for it separately.

Pslf Limited Waiver Opportunity

Under the regular PSLF rules, only payments made on Direct Loans counted toward the 120-payment minimum. Payments made towards FFEL and Perkins Loans didnât count. Nor did late payments or payments made under the wrong repayment plan.

On October 6, 2021, the Dept. of Education announced it was temporarily relaxing those eligibility requirements. For a limited period of timeâspecifically, until October 31, 2022âborrowers may receive credit for any past student loan payments, regardless if it was made for the wrong loan, under the wrong repayment plan, or was tardy, or was made for less than the full amount. The rule changes will also allow military members to count time on active duty toward the 10 years â even if they put a pause on making their payments during that time.

Don’t Miss: Government Grant For Dental Implants

Student Loan Repayment For Doctors And Health Care Professionals

The National Health Service Corps offers loan repayment assistance to qualifying health care profession. The program offers $50,000 in loan forgiveness to licensed doctors, dentists, and or clinicians who agree to work for at least two years in an eligible position.

The Student to Service program is available to doctors in their final year of medical school. Youll commit to spending at least three years in a qualified position. In exchange, youll receive up to $120,000 of loan forgiveness.

The Indian Health Services Loan Repayment Program grants up to $40,000 in loan forgiveness. In exchange, doctors agree to work for two years in an American Indian or Alaskan native community. And once those two years are up, you have the option to renew your contract and receive additional loan forgiveness.

If you work primarily in a research position, you might want to look into the National Institutes of Healths loan repayment program. The military also offers loan forgiveness for doctors and health care professionals. And there are state programs available across the country.

A Change To Loan Forgiveness

In October 2021, the Department of Education announced an overhaul of the PSLF Program.

In a Department of Education press release, U.S. Education Secretary Miguel Cardona acknowledged the much needed change, saying, Borrowers who devote a decade of their lives to public service should be able to rely on the promise of Public Service Loan Forgiveness. The system has not delivered on that promise to date, but that is about to change for many borrowers who have served their communities and their country.

For Kate, that change happened in the form of a formal notification in her mailbox from her loan servicer in which she saw her loans were completely forgiven. However, shes not the only one whos been impacted by this change. More and more each day, public servants are getting their loans forgiven thanks to the recent revamp of the Department of Educations forgiveness program.

Also Check: State Of Nevada Unclassified Jobs

Who Is Eligible For Student Loan Forgiveness

The government previously restricted eligibility for the Public Service Loan Forgiveness program to only certain types of federal student loans and specific repayment plans.

However, through October 2022, borrowers who have made 10 years worth of payments while in a qualifying job such as positions in federal, state or local governments, a nonprofit organization or the U.S. military will now be eligible for loan relief no matter what kind of federal loan or repayment plan they have.

Past loan payments that were previously ineligible will now count, moving some borrowers closer to forgiveness. That is expected to especially help those borrowers with Federal Family Education Loans.

Among other changes, the department will allow military members to count time on active duty toward the 10 years, even if they put a pause on making their payments during that time.

How Student Debt Cancellation Could Impact Borrowers

Broad student loan forgiveness could affect 45.3 million borrowers with federal student loan debt who owe a total of $1.54 trillion to the government. Wiping out $10,000 each as Biden called for while campaigning would result in up to $429 billion canceled. Heres how that could affect borrowers based on their total debt owed:

For 15 million borrowers, a slate wiped clean. More than a third of federal borrowers could see their balances fall to zero with $10,000 in debt cancellation. Among those, 7.9 million owe less than $5,000 in student loans and 7.4 million owe between $5,000 and $10,000, according to federal data. Over half of those who default have less than $10,000 of federal undergraduate debt, according to a June 2019 analysis of federal data by The Institute for College Access and Success.

For 19 million borrowers, some breathing room. Nearly 19 million borrowers owe between $10,000 and $40,000 in federal student loans, according to federal data. Without a detailed execution plan, these borrowers face a number of possible outcomes from broad student loan forgiveness. For example, cancellation might not reduce the amount they pay each month, but it could draw their end date closer and lower the total amount theyd pay overall, due to interest. Or it might wipe out one loan completely but leave payments on others intact.

Also Check: Safelink Government Phone Replacement

Who Qualifies For Pslf

To qualify for PSLF you must be employed full-time by a US federal, state, local or tribal government agency — this includes the military — or a non-profit organization. You must have direct loans or other types of loans that have already been consolidated into direct loans, and you must make 120 qualifying payments . Examples of borrowers who qualify for PSLF are workers like teachers, nurses and firefighters who serve their local communities.

Howdoes Public Service Loan Forgiveness Work

The second type of student loan forgiveness available to federal employees is the Public Service Loan Forgiveness plan . While the federal government student loan repayment program is targeted at specific positions, PSLF is for all government employees . As the PSLF website states, The PSLF Program isnt about the specific job that you do for your employer. Instead, its about who your employer is.

The PSLF Program isnt about the specific job that you do for your employer. Instead, its about who your employer is.

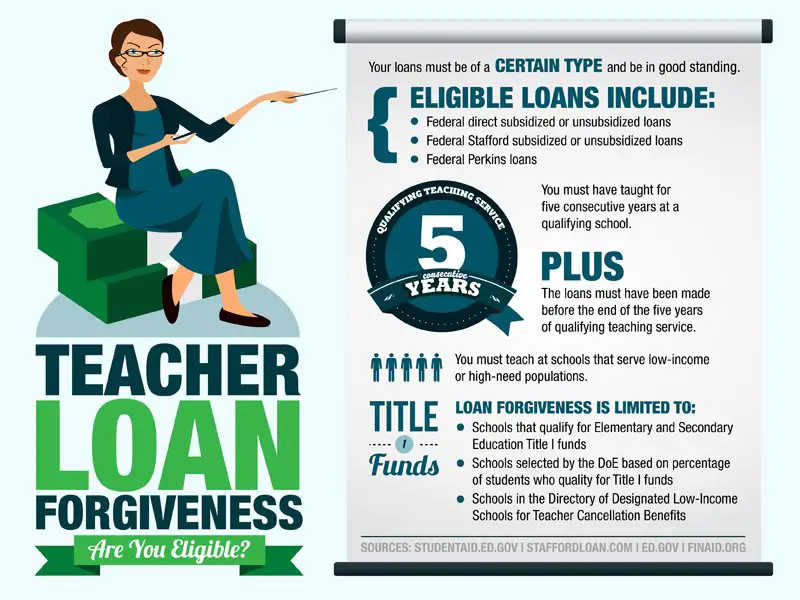

Public Service Loan Forgiveness allows eligible federal employees to have some of their federal student loans forgiven. Only certain types of loans are eligible for forgiveness. For example, eligible loans include loans received loans under the William D. Ford Federal Direct Loan Program, Federal Perkins Loans, and loans administered under the Federal Family Education Loan Program . Additionally, the PSLF can forgive Direct Consolidation Loans that you may have used to consolidate other types of federal student debt.

Eligible loans are forgiven only after you have made 120 qualifying payments on an income-driven repayment plan. Additionally, only payments made on an income-driven plan count towards earning loan forgiveness. You should also know that if you paid on your loan while it was deferred or in forbearance, the payment wont count towards the 120 qualifying payments.

Read Also: Harford County Careers

National Health Service Corps

The National Health Service Corps is a competitive program that recruits fully trained and licensed health professionals to provide primary health services in selected high-need communities. Professionals selected for this program may receive funds to be applied to the principal, interest, and related expenses of government loans and certain commercial loans.

Recommended Reading: Dental Implant Grants For Seniors

What Loans Are Eligible For The Government Employee Student Loan Forgiveness

The loan forgiveness program can forgive loans under the Direct Loan Program. Private loans are excluded. Also, other Education Department Loans such as Perkins, FFEL, etc. are not qualified.

If youre able to consolidate your non-Direct Loan Program into a Direct Consolidation Loan, the consolidated loan that resulted will be eligible for the government employee student loan forgiveness. But you have to remember that the forgiveness resulted is contingent on making the 120 payments.

You can find out the types of loans you have by finding out from the National Student Loan Data System. Visit the studentloans.gov to know more about the consolidation of your loans.

Recommended Reading: Federal Jobs In Las Vegas Nevada

What Is A Repayment Plan

There are qualifying repayment plans that the government employee student loan forgiveness counts are eligible. They are:

- 10-Year Standard Repayment Plan

- PAYE Plan

- Income Contingent Repayment Plan

- Repayment plans in which your monthly payment amount is more than or equals what youd pay under the 10-year plan

The Benefits Of Forgiving All Student Loans

Student loan borrowers know the burden imposed on their personal finances by student debt, but this burden is felt across the broader economy.

A federal reserve study found that student debt was a key contributor to the drop in homeownership rates.

Student loans have been shown to have a Disastrous Domino Effect on borrowers. This means borrowers find themselves unable to keep up with their loans, unprepared for any sort of financial emergency, and delaying major events like getting married and having kids.

Erasing student debt would produce a huge boost to millions of Americans and a boost to the economy.

Don’t Miss: Grants For Owner Operators