With The Reserve Bank Of India Hiking Rates To Rein In Inflation Bond Yields Have Risen To Their Highest Levels In Three Years What Does That Mean For The Markets And Investors

With the Reserve Bank of India hiking rates to rein in inflation, which is expected to remain above 7% until at least September, bond yields have risen to their highest levels in three years. What does that mean for the markets and investors?

The big jump

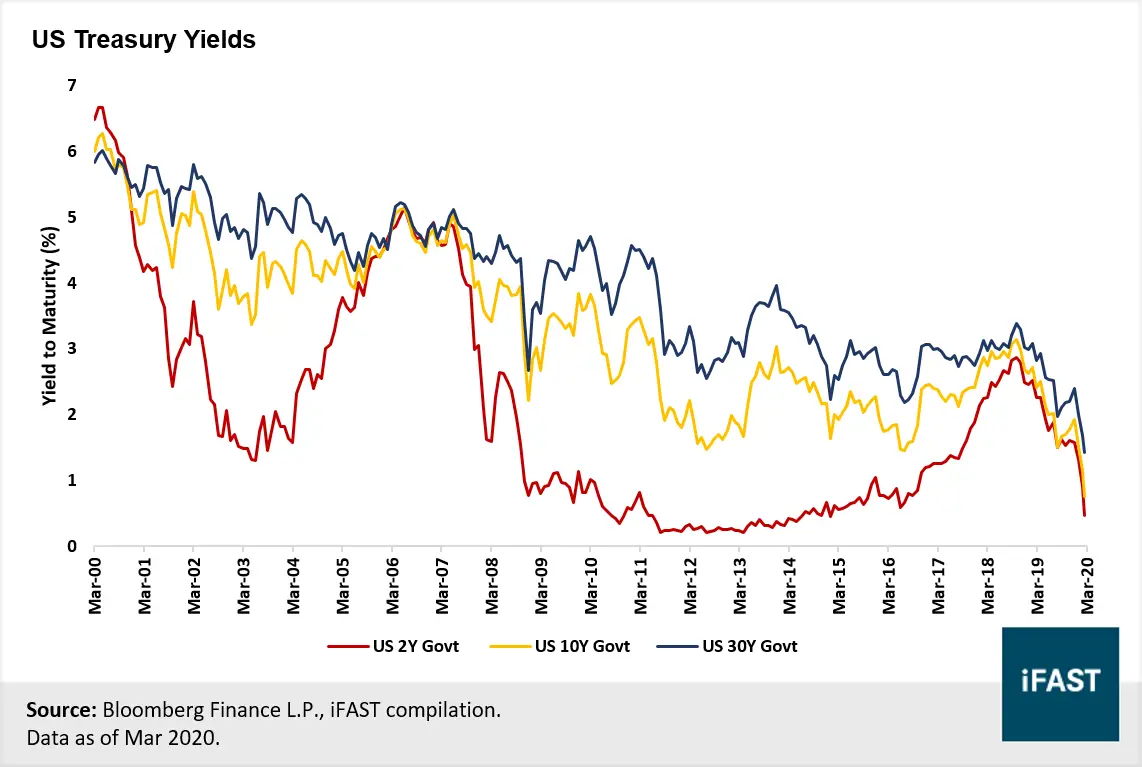

The yield on benchmark 10-year government bonds has shot up by 149 basis points to 7.50% in the last one year. Since the start of the year, long-term yields have risen by over 100 bps, and short-term yields by over 150 bps.

Bond yields have been rising across the world amid higher inflation and plans for policy normalisation. Seeing the writing on the wall, buyers of government bonds have been demanding higher yields. Data showing further increase in inflation leading to higher-for-longer inflation expectations may result in further increase in bond yields and correction in markets. We expect inflation in India to trend down sharply in the second half of FY23 on high base effects but note upside risks to inflation from higher-than-expected domestic food prices and global fuel prices, said a report from Kotak Securities.

What it means

The rise means the government will have to pay more as yield , leading to a rise in cost of borrowings. This will put upward pressure on general interest rates in the banking system. Further, if the RBI opts for normalisation of the monetary policy and intervenes less in the market, interest rates are bound to go up.

Bond investors

and equity investors

Global Fixed Income: Yields And Risks

This slide shows the risk-reward for different fixed income sectors. Risk is measured by the various sectors’ correlation with the MSCI AC World index. Moving towards the top right of the chart, one will find increasingly higher yielding fixed income instruments that are characterized by higher correlations with equity markets .

Us Investment Grade Bonds

This page illustrates a broad overview of the U.S. investment grade bond market. The left shows the spread over similar duration government bonds – a measure of how much investors get paid to take on the additional risk of investing in investment grade debt. The right shows the number of upgrades from high-yield to investment-grade and downgrades from investment-grade to high yield .

You May Like: Can The Us Government Be Sued

Low Foreign Ownership Has Meant Low Correlation With G7 Yields

Low foreign ownership of Chinese financial assets has had important consequences for the profile of index returns and behavior of Chinese government bond yields. A direct consequence has been China’s limited exposure to the global financial cycle, and that the correlation of index returns between China and G7 bond markets is low, as Table 1 shows. Also note that the Chinese government bond market shows low correlation, overall, with both the US Treasury market, and the US equity market, so it is neither a definably risk-on or risk-off asset class, which in turn can provide portfolio diversification benefits for investors.

Table 1: Correlation of Chinese government bond returns with other asset classes

A related impact of low foreign ownership of Chinese government bonds is the limited connectivity between Chinese and G7 government bond yields, shown in Chart 2. There is some evidence of this connectivity increasing during periods of rising US Treasury yields, eg, 2017 – 18, and falling during periods of declining Treasury yields, eg, 2020, but overall the connectivity has been modest, and spreads between these markets variable.

Chinese bond yield spreads versus G4

Templeton Global Bond Fund

The Templeton Global Bond Fund seeks to provide current income and capital appreciation, and growth by investing at least 80% of assets in governmental and agency bonds around the world. The portfolio managers of Franklin Templeton Investments look for investment opportunities across currencies and interest rates for reasonable returns, as well as substantial portfolio diversification.

Below are some of the characteristics and costs to the fund:

- Expense Ratio: .99% as of May 01, 2020.

- 30-Day SEC Dividend Yield: 2.13% as of Dec. 31, 2020.

- Assets Under Management: $16 billion as of Nov. 30, 2020

- Inception Date: Sept. 18, 1986

Please note that funds with higher expense ratios can eat into performance over time. However, anything below 1.0% is generally appropriate for most investors.

The fund has an average weighted maturity of 2.42 years and contains 213 holdings as of Dec. 31, 2020. The fund has 91.94% of its assets invested in international fixed income securities, with the remaining amount held in cash.

The top five allocation weightings by country are as follows:

- United States: 24.30%

The fund has a $1,000 minimum investment amount.

Don’t Miss: How To Take Out Government Student Loans

But Several Factors Suggest Change Is Underway As Foreign Investors Re

Improved access after recent reforms, the sheer size of the Chinese govt bond market, the trend towards inclusion in global bond indexes, high relative yields, and portfolio diversification benefits may all be contributing to increasing foreign investor flows into Chinese govt. bonds, which reached $20bn in July alone. This would tend to increase the correlation of Chinese government bond yields with the G7, ceteris paribus, and reduce yield spreads, over time. Historically, it’s worth noting Chinese government bond yields were below US Treasury and German Bund yields, in the early 2000s, and as recently as 2007, as Chart 4 shows, so current spreads of 250-350 bp are high historically.

Chart 4: Chinese government bond yields v US, Japan and Germany since 2003

FTSE Russell® is a trading name of FTSE, Russell, FTSE Canada, MTSNext, Mergent, FTSE FI, YB and BR. “FTSE®”, “Russell®”, “FTSE Russell®”, “MTS®”, “FTSE4Good®”, “ICB®”, “Mergent®”, “The Yield Book®”, “Beyond Ratings®” and all other trademarks and service marks used herein are trademarks and/or service marks owned or licensed by the applicable member of the LSE Group or their respective licensors and are owned, or used under licence, by FTSE, Russell, MTSNext, FTSE Canada, Mergent, FTSE FI, YB or BR. FTSE International Limited is authorised and regulated by the Financial Conduct Authority as a benchmark administrator.

Holding Bonds Vs Trading Bonds

If you buy a bond, you can simply collect the interest payments while waiting for the bond to reach maturitythe date the issuer has agreed to pay back the bond’s face value.

However, you can also buy and sell bonds on the secondary market. After bonds are initially issued, their worth will fluctuate like a stock’s would. If you’re holding the bond to maturity, the fluctuations won’t matteryour interest payments and face value won’t change.

But if you buy and sell bonds, you’ll need to keep in mind that the price you’ll pay or receive is no longer the face value of the bond. The bond’s susceptibility to changes in value is an important consideration when choosing your bonds.

You May Like: Ibm Data Governance Maturity Model

Target To Capture Yield And Growth Opportunities In The Evolution Of Chinas Bond Market

China Bond Fund

The rise of Chinas bond market to become the worlds second largest1 has been driven primarily by local investors. The next stage of its growth should see more diverse ownership and a closer alignment with international standards, as Chinese securities are increasingly represented in flagship global benchmarks for stocks and bonds.

In this low for longer interest rate environment, income-seeking investors can consider China bonds to deliver potential diversification benefits and added resilience to a global portfolio. China bonds comparatively offer higher yields with muted volatility and have lower correlations to global risk assets. This is especially important during times of extreme market volatility.

Pimco Global Bond Fund Unhedged

Pimco Global Bond Fund Unhedged focuses on investing in high-quality, developed countries around the world. The fund is managed by the Pacific Investment Management Company LLC . It’s important to note that the PIGLX is designed for the more affluent investor since it has a $1 million initial investment requirement.

The primary benchmark that the funds holdings are based on is the Bloomberg Global Aggregate Index, which has exposure in the U.S., Pan-European, and the Asian-Pacific markets.

The fund seeks to provide exposure to multiple economies, including developing countries denominated in global currencies. The fund is designed to provide exposure to global bond markets while allowing for currency exchange rate appreciation. In other words, the fund does not hedge currency exposure. Although exchange rates can move and add to the fund’s return, the currency volatility can also reduce returns.

Below are some of the characteristics and costs to the fund:

- Expense Ratio: .67% as of July 31, 2020

- 30-Day SEC Dividend Yield: 1.34% as of Nov. 30, 2020

- Assets Under Management: $195 billion as of Sept. 30, 2020

- Inception Date: Nov. 23, 1993

The top five allocation weightings by country are as follows:

- Italy: 19.24%

- Spain: 13.19%

- Denmark: 9.42%

The fund has over 665 bond holdings with an effective maturity of 6.21 years as of Sept. 30, 2020. Over 49% of the bonds in the fund have maturities of five to 7 years.

Also Check: Free Debt Relief Programs Government

Global Fixed Income: Interest Rate Sensitivity

This page looks at the sensitivity of the price return and total return of a fixed income investment to interest rate changes. An illustration of 1% fall in interest rates is used to analyze the impact across major fixed income assets including U.S. treasuries, corporate credit and various Asian and emerging market credit assets. Falling interest rates mean rising bond prices, while rising interest rates mean falling bond prices.

Should You Invest In A Total Bond Market Index Fund

Index fund investing benefits from lower fees than buying actively managed mutual funds. Lower costs result in better after-fee returns over the long term. Thats true with fixed income investments as well as equities.

SP Global tracks the relative performance of actively managed funds compared to their respective benchmark across a number of asset classes. Its latest report shows that actively managed funds were more likely to underperform their respective index over one-, three- and five-year periods. Morningstar has reported similar results.

There are at least two important considerations beyond performance that investors should keep in mind. First, the duration of the funds in our list hover around six years. Duration helps us understand how much the value of a fund will rise or fall with interest rates. Generally, for each 1% rise or fall in interest rates, a funds value will rise or fall by a percentage equal to its duration.

Assuming a fund with a six-year duration, an increase in rates of 1% will cause the funds value to decline by about 6%. A decrease of 1% in the prevailing rates will cause the funds value to increase by about 6%. Given the historically low interest rate environment and the recent rise in yields, you need to consider the interest rate risk associated with a total bond index fund.

Read Also: St Bernard Parish Government Jobs

United States Government Bonds

The United States 10Y Government Bond has a 2.654% yield.

10 Years vs 2 Years bond spread is -23.4 bp. Yield Curve is inverted in Long-Term vs Short-Term Maturities.

Central Bank Rate is 2.50% .

The United States credit rating is AA+, according to Standard & Poor’s agency.

Current 5-Years Credit Default Swap quotation is 20.20 and implied probability of default is 0.34%.

| Residual |

|---|

Leaving Chinese Government Bonds Modestly Rated

PBOC caution on monetary easing, and concerns about a hard landing from the post-GFC Chinese credit boom, may explain the relatively modest valuation of the Chinese government bond market, versus its global peers, shown in Table 2. The table shows that despite the short market index duration of 6.14 , overall yields are considerably higher than US Treasuries, JGBs and Bunds, even if the market has the same credit rating as Japan at A+. Default risks in local currency government bond markets are also very low, since the issuing authority has the option to print money to redeem debt, in extremis.

Table 2: Chinese government bonds vs. global peers – size, duration, & credit ratings

Also Check: Federal Government Grant Program World Bank

Pay Attention To Performance

Attention, at maturity it means that to be sure of the 1.5% net yield, the bond must be held until its redemption date. This will happen in March 2067, in 47 years. If the bond is sold first, the yield changes depending on the sale price.

In case of sale of the BTP before maturity, if the sale price is higher than the purchase value, the yield will be higher. Vice versa in case of sale at a lower price.

Here lies the first risk. The price of 131.7 cents is a step away from an all-time high of 132 cents. Prices had never gone so high. But how long can they still appreciate? The stock recovered all the losses of the collapse of late February and early March. It is currently well above the levels of January 2020, then already at an all-time high.

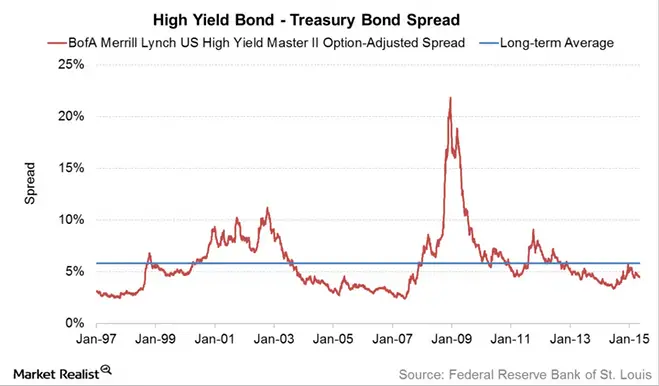

Global Fixed Income: Valuations

This page compares the spread of various fixed income instruments against treasuries with their long-term averages and historical ranges for a valuation comparison. Wide spreads indicate that the fixed income instrument is cheap, perhaps reflecting market concerns over credit risks. Narrow spreads shows the instrument is expensive, as investors expect lower risks of default.

Don’t Miss: Government Jobs In Lexington Sc

Why Almost Every Bond Fund Is Down This Year

The Index of Bonds on The Screen.

getty

If you own a bond fund, its probably down in recent months. Lets talk about why and walk through three popular fixed-income ideas from worst to first.

Well start with the iShares 20+ Year Treasury Bond ETF . TLT is the knee-jerk investment that many first-level investors buy when they are looking for bond exposure. Unfortunately, there are two big problems with TLT:

Any kid knows that 19 years is way too long to hold a bond when inflation is running a hot 7.5%.

Over short time periods, most fixed-rate bond funds trade opposite long-term Treasury rates. When rates take off, bond prices suffer. TLTwith its low yield and long durationhas especially suffered as the 10-year has run up to 2%.

The most popular high-yield bond fund in the world, the iShares iBoxx $ High Yield Corporate Bond ETF HYG , also broke down recently as long rates broke out. The 10-year rate is becoming competition for HYG.

We recently lamented that HYG never paid so little. When we last discussed the fund in December, its yield was crushed to 4%.

With the 10-year now at 2%, mainstream income investorsthe types that buy vanilla funds like HYGhave begun to question themselves.

Whats the point? they ask, two months after we posed them the same question.

First, DSLs bonds pay. Im talking about coupons that are cash flowing to the tune of 7%, 8% and even up to 10%.

Dont Put Your Portfolio On Autopilot

Still, with massive stimulus funds sloshing around the global economy, its prudent to be preparedand that means staying active.

It can be tempting to opt for a passive approach in fixed income. Passive strategies let investors sit back and enjoy the ride. But the ride may be more dangerous than many realize. In fact, pressing the autopilot button today could make you overly vulnerable to rising interest-rate and inflation risks. It also exposes you to volatility in risk assets as uncertainty persists around the path of recovery.

In contrast, active managers can control multiple levers and dials to navigate current and changing market winds. Below are three adjustments we think investors should consider today.

Also Check: Denied Parties List Us Government

Countries With The Highest 10

Which are the countries with the highest 10-year bond yields today? Any book or article on long-term investing will usually suggest diversifying a portfolio and allocating a certain portion of it towards bonds, particularly government bonds. Government bonds, similar to corporate bonds, allow governments to borrow money from markets. In turn, people or companies can buy these bonds, lending money to a government and expect to protect their money from inflation, and obtain some income through investing in a relatively less risky securities.

There are various types of government bonds, but usually most of them entitle the investor to periodic interest payments and the return of the principal amount once the maturity date of the bond expires. Governments that issue bonds usually specify the amount and the coupon and then auction them off. Once on the market, bonds change hands repeatedly and because the bond price fluctuates based on the market demand while the coupon stays the same, investors can get higher or lower profits from their bonds. For example, if an investor buys a bond that has a par value of $1,000 and an annual coupon rate of 5%, he gets $50 every year in interest and then the whole $1,000 amount once the bond reaches maturity. However, if the investor decides to sell the bond for $800, the person who bought the bond would receive the same $50 per year, but because he paid only $800 for his bond, his rate of return will be 6.25% instead of 5% .

Government Bonds With High Interest Rates

Before we get started, let me clarify that this article is not intended to provide any kind of investment advice. Any investment is potentially risky, and investing in government debt typically based in random foreign currencies can be especially risky even for experienced investors.

Basically, any decision you make with this information is yours alone and youre responsible for the consequences of your own investments.

With that said, here are the worlds highest yielding government bonds as of September 2018.

Argentinas peso appears to once again be headed for financial ruin

Also Check: Government Grants For Adults Going Back To School In Ontario