Federal Lead Plus Financing

Unlike other government financing, And Financing try provided centered on monetary reputation. Individuals, whether they are children or moms and dads, need certainly to proceed through a credit check in order to be eligible for a good Together with Mortgage. Good credit is actually a prerequisite for Plus Loan borrowing, but people that have poor credit may be eligible when they satisfy particular almost every other rigid requirements.

Grad And funds are available to scholar children, and additionally postgraduate and you will elite group people. Having Grad Plus financing paid for the 2021-twenty two academic 12 months, the new -21, Grad Along with Loans had a cuatro.30% APR this is a great 22.8% YoY improve.

Mother or father And additionally fund are around for mothers away from centered youngsters. To possess Father or mother And additionally Loans paid into the 2021-22 informative year, brand new -21, Father or mother Also Fund had an excellent 5.30% APR it is an 18.5% YoY increase.

Bank Student Loans Or Personal Loans

You can apply for a personal loan through a bank or online lender. A personal loan will advance you a lump sum amount, and youll need to start making payments right away, so its important that you factor your monthly payments into your budget.

Personal loans interest rates can vary widely depending on your financial situation, so its important to carefully evaluate whether youll be able to afford your monthly payments while in school. Make sure to shop around for a lender and compare interest rates! A good place to start is an online search platform like Loans Canada the largest lender network in Canada. With a single search, youll be able to compare rates offered by the countrys top lenders.

Recommended Reading: Dispensary Silver City Nm

Timeline Of Federal Relief

The federal government has taken several steps to assist federal student loan borrowers impacted by COVID-19, described above. The following is a review of the actions and announcement made by the White House and U.S. Department of Education.

This section will be updated to reflect any additional updates or changes.

Read Also: Governmentjobs Com Las Vegas

What Happens After I Get A Federal Loan

The government first disburses the funds to your schools financial aid office. After the school collects your tuition and fees, the financial aid office typically contacts you with instructions for picking up any remaining funds.

The grace period

Federal loans come with a six-month grace period before you need to start making full repayments according to your repayment plan. This grace period goes into effect as soon as you drop below half time. So if you take a semester off or lighten your course load, youll need to start paying off your student loans earlier.

If you have a direct subsidized loan, you dont need to worry about paying it off until your grace period is up. Students with direct unsubsidized or PLUS Loans might want to consider making at least interest-only repayments while in school to avoid something called interest capitalization.

Interest capitalization

Repayment plans

After your grace period expires, its time to choose a repayment plan. Typically, your loan servicer helps you decide which is right for you, showing you how to sign up.

Federal student loans come with a wide range of repayment plans:

Federal loan deferment

When it comes to federal loans, deferment generally refers to pausing your repayments when youve hit a temporary financial roadblock. Interest continues to add up on most federal loans, with the exception of direct unsubsidized loans.

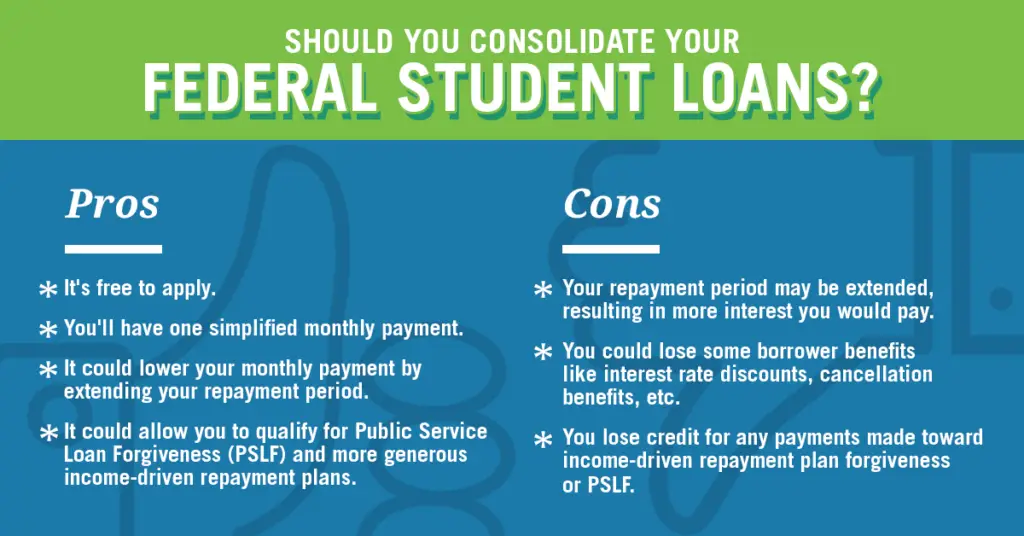

Direct consolidation loans

Student Loan Registration Requirements

Full-time loans

In most provinces youll need to be registered in at least 60% of a full course load. For students from Newfoundland and Labrador, registration in 80% is required for the provincial portion and 60% is required for the federal portion. Students who have been assessed as having a permanent disability are eligible for a full-time loan at 40%.

Please note: a typical full course load at Dalhousie is comprised of 15 credit hours.

Part-time loans

If youre registered for 20% to 40% of a full course load, complete the part-time loan application .

Please note: a typical full course load at Dalhousie is comprised of 15 credit hours.

Read Also: Las Vegas Federal Jobs

How Much Can You Get

The amount you can receive depends on several factors, including:

- your province or territory of residence

- your family income

- your tuition fees and living expenses

- if you have a disability

The amount you can receive in grants and loans is calculated when you apply with your province or territory.

To find out if you can receive Canada Student Grants or Loans, use the federal student aid estimator. Note that this estimator doesn’t take into account the provincial and territorial student grants and loans.

How Do I Apply For Federal Student Aid

Create an FSA ID account if youre going to submit your FAFSA online or track its status online. If youre going to submit a paper FAFSA by mail and wont be tracking its status, you wont need an FSA ID.

Complete and submit the FAFSA.

Know what happens after you submit the FAFSA. This includes:

Learning how to correct or update information on it.

Finding out how and when youll get your aid.

Know the Deadlines for Submitting the FAFSA

-

The federal deadline for submitting the FAFSA for the 2021-22 school year is June 30, 2022.

-

The federal deadline for submitting the FAFSA for the 202021 school year is June 30, 2021.

-

Many states and colleges use the FAFSA for their financial aid programs. See the state deadlines. Check with your college for its deadline.

Recommended Reading: Www.qlinkwireless.com/register

What It Would Take For The Government To Cancel Federal Student Loans

- The White House is looking at actions it might be able to take to forgive federal student loan debt.

- Here’s what the different moves would cost.

Under pressure from Democrats, advocates and borrowers, the White House is looking at actions it might be able to take to forgive federal student debt.

The country’s outstanding federal student loan balance exceeds $1.7 trillion, eclipsing credit card and auto debt. Average debt for a bachelor’s degree recipient has tripled over the last three decades, to $30,000 today from less than $10,000 in the early ’90s. A quarter or more of borrowers are estimated to be in delinquency or default.

There’s no precedent for sweeping loan forgiveness carried out by the government. Experts say the closest example may be when there was cancellation of the taxes due on forgiven mortgages in the aftermath of the 2008 financial crisis.

More from Personal Finance:How one guaranteed income experiment is helping the homeless

On the campaign trail, President Joe Biden promised to forgive $10,000 in federal student loans for all.

Such a move would cost around $377 billion, and would reduce the number of Americans with student debt to around 30 million from more than 40 million today, according to estimates by higher-education expert Mark Kantrowitz.

Long-term costs of broad cancellation would be the loss of $60 billion a year the government earns from the interest on federal student loans, Kantrowitz said.

Private Student Loan Interest Rates

Private loan terms, including interest rates and fees, vary by lender and usually are determined based on your credit history . Most lenders offer both variable and fixed interest rates.

A fixed rate remains unchanged for the life of the loan. This can be helpful when making financial plans, as your monthly payments will be known. Variable interest rates can fluctuate, which makes monthly payments harder to predict. However, depending upon your credit history, you might obtain a rate that stays relatively low, even with fluctuations.

Federal loans offer fixed interest rates, which is just one reason they are frequently considered beneficial over private student loans.

To see how interest rates affect the cost of your loan, check out our .

Don’t Miss: State Jobs In Las Vegas

Things You Need To Know

Federal Direct Plus Loan For Parents

The Federal Direct PLUS Loan for Parents is a credit-based alternative loan program specifically designed to provide low cost loans to parents of dependent college bound students. Parents can secure a loan up to the value of the cost of their student’s attendance less any other financial aid their child has been awarded. Repayment of the PLUS Loan begins as soon as the loan is fully disbursed and students must sign a promissory note guaranteeing repayment if the parent or guardian defaults at any time.

Also Check: Entry Level Government Jobs San Diego

Use Your Student Loans To Build Credit

Making regular on-time payments on your student loans can help you establish a good credit history over time. If you can afford it, making interest-only payments while you’re in school can help you avoid capitalized interest and also build your credit history.

But even if you wait until after you leave school, those payments can help you achieve your credit goals. As you work to build your credit history using your student loans and other credit options, use Experian’s free credit monitoring service to track your progress with access to your FICO® Score and Experian credit report.

Student Loans In The United States

Student loans are a form of financial aid intended to help students access higher education. Student loan debt in the United States has grown rapidly since 2006. The total debt was $1.73 trillion by July 2021, with almost half of that being graduate school loans the average Bachelor’s degree borrower has about $30,000 of debt upon graduation.:1

With a number of notable exceptions, student loans must be repaid, in contrast to other forms of financial aid such as scholarships, which never have to be repaid, and grants, which rarely have to be repaid. For example, student loans may be discharged through bankruptcy, by proving “undue hardship” but the bar for discharge is high.

Research indicates the increased usage of student loans has been a significant factor in college cost increases.

Some US leaders have acknowledged the student loan debt crisis. Former Secretary of Education Betsy DeVos said that Federal Student Aid’s portfolio “is nearly 10 percent of our nation’s debt.” However, Goldman Sachs has argued that student loan relief would have negligible benefit to the Gross Domestic Product.

You May Like: Congress Mortgage Stimulus Middle Class

Federal Student Loan Forgiveness Programs

In addition to flexible repayment programs and extensive deferment options, you might be eligible to have your federal loan forgiven. Aside from forgiveness built into income-based repayment plans, several forgiveness programs are available to federal borrowers:

- Public service loan forgiveness. People who work in a qualifying nonprofit or government job while making at least 120 repayments can potentially have their loan forgiven after 10 years.

- Teacher loan forgiveness. Teachers who work at low-income schools or educational service agencies for at least five years in a row might be able to get up to $17,500 of their student debt forgiven.

- Federal Perkins Loan cancellation. This program offers loan forgiveness programs on Perkins Loans by profession a former federal loans program. Teachers, public service workers, librarians and some volunteers are eligible to get up to 100% of their debt forgiven. The federal government stopped its Perkins loan program as of June 30, 2018.

Figure Out The Net Cost Of College

Start by calculating the cost of attendance at the school of your choice.

A good rule of thumb is to determine the net college cost and the amount of income and savings currently on hand, then subtract whats available from the net price.

For most students and parents, borrowing 125 percent of this difference is a good gauge of what is needed from student loans. Its easier to determine the net cost of college because all colleges and universities eligible to receive federal financial aid are required to provide an online calculator through their websites.

Part of the calculation also comes from figures in your federal student aid package. After the FAFSA is complete, a financial aid package is generated for each applicant.

Within that package, you are provided details regarding the type of aid offered, including all federal student loans you may be eligible for, federal work-study programs, supplemental educational opportunity grants, scholarships, and Pell Grants.

Based on the unmet need, you can determine what you may need to borrow to fund your education.

Read Also: City Of Las Vegas Job Openings

You Dont Need Good Credit

Private loans require credit history to show youre likely to repay the loan on time. Theyll also use your credit score to determine what interest rate youll get. But most undergrads will have short credit histories and low credit scores, if they have scores at all.

Federal loans, on the other hand, are available to any enrolled undergraduate. The only type of federal loans that require a credit check are direct PLUS loans, available to graduate students and parents.

» MORE:What credit score do you need for a student loan?

Before turning to private loans, take out the maximum amount of federal loans. Start by submitting the Free Application for Federal Student Aid, or FAFSA.

If you need a private loan to cover a funding gap for school but dont have good credit, a handful of lenders may work with you.

» COMPARE:Student loans for bad or no credit

How To Apply For Student Loans

The application process for federal and private student loans is different. Here’s what you need to know:

- Federal student loans: If you don’t already have one, you’ll need to create a Federal Student Aid ID. Then, you’ll be able to fill out the Free Application for Federal Student Aid . You’ll provide information about yourself, the schools you want to receive your application, details about your parents’ finances , as well as your own financial situation. Your school will use this information to determine your eligibility for federal loans and other forms of financial aid.

- Private student loans: Most private lenders allow you to get prequalified without a hard credit inquiry. Do this with a handful of lenders so you can compare interest rates, repayment terms and other features. Then you’ll apply directly with the lender of your choice online. You may need to provide some documentation, such as pay stubs, tax returns, a government-issued ID and more. The lender will underwrite the application and give you an offer based on your creditworthiness, which you can accept or decline.

Remember, if you get approved for student loans, the lender will send the money to the school first, then you’ll receive anything that’s left over to use for other approved expenses.

Don’t Miss: Federal Jobs In Las Vegas Nevada

Federal Direct Unsubsidized Money

Head Unsubsidized Financing or unsubsidized Stafford Fund are available to undergraduate and you can scholar students, and additionally postgraduate and you will elite group youngsters. Monetary require is not a necessity students have to submit the newest FAFSA so you can meet the requirements.

Pupil borrowers are responsible for paying rates of interest on the Lead Unsubsidized Loans since out of disbursement if or not they have been in school otherwise maybe not. Into the 2021-twenty-two informative year, the latest Apr to own student college student borrowers is actually 3.73% when youre scholar college students -21 informative year, these fund had a two.75% and you can cuatro.30% Annual percentage rate, respectively.

Are All Student Loans Issued By The Federal Government

An overwhelming majority of the outstanding student loans held by Americans–92%, or 43 million borrowers–are federal loans of some type. The US Department of Education holds $1.4 trillion of the $1.6 trillion of total outstanding student debt collectively held by Americans.

As for the remaining borrowers, private loans comprise 7.63% of the total outstanding student debt at $119.3 billion.

State government-issued student loans are far rarer in terms of both offerings and eligible borrowers, so they only comprise 0.37% of the student debt held by Americans.

Also Check: Funding For Dental Implants

Q Who Is Doing All This Borrowing For College

A. About 75% of student loan borrowers took loans to go to two- or four-year colleges they account for about half of all student loan debt outstanding. The remaining 25% of borrowers went to graduate school they account for the other half of the debt outstanding.

Most undergrads finish college with little or modest debt: About 30% of undergrads graduate with no debt and about 25% with less than $20,000. Despite horror stories about college grads with six-figure debt loads,only 6% of borrowers owe more than $100,000and they owe about one-third of all the student debt. The government limits federal borrowing by undergrads to $31,000 and $57,500 . Those who owe more than that almost always have borrowed for graduate school.

Where onegoes to school makes a big difference. Among public four-year schools, 12% ofbachelors degree graduates owe more than $40,000. Among private non-profitfour-year schools, its 20%. But among those who went to for-profit schools,nearly half have loans exceeding $40,000.

Among two-year schools, about two-thirds of community college students graduate without any debt. Among for-profit schools, only 17% graduate without debt .