Are You And Your Child Repaying Student Loans Together

Some parents might view repaying student loans as a responsibility their child should share. If thats you, then cosigning a private student loan, rather than borrowing a parent loan, might make more sense. This way, both you and your student share equal legal responsibility for repaying the debt.

Many lenders offer cosigner release, meaning your child eventually could assume full responsibility for managing and repaying the cosigned loan. Between cosigning a student loan and taking our parent loans on your own, consider which is the better fit for your financial future.

Ultimately, student loans for parents allow borrowers to pay for college costs and control future repayment if necessary. By exploring your options for parent loans, youll know how to choose the borrowing option thats right for you and your family.

Canada Student Grant For Full

This grant is available to full-time students in financial need. You are automatically assessed when you apply for student aid with your province or territory.

If you are in school part-time, see grant for part-time students.

Note: This grant is not available to students from the Northwest Territories, Nunavut and Quebec. They have their own student aid programs.

Who Can Borrow From The Parent Plus Loan Program

| Biological or Adoptive Parent | |

| Yes, but only for as long as the stepparent is married to the students parent | |

| Grandparents, Aunts, Uncles, Other Relatives | No, unless they have legally adopted the student |

| Legal Guardians or Foster Parents | No |

Eligibility for the Parent PLUS Loan does not depend on demonstrated financial need.

Sallie MaeLearn More About Sallie Mae

Don’t Miss: Dental Lifeline Network Dental Implant Grant

Parent Plus Loans Come With An Origination Fee

On top of interest, you might also consider the added expense of an origination fee. As of Oct. 1, 2020, all Parent PLUS Loans come with an origination fee of 4.228%.

If you borrowed $30,000, youd pay an origination fee of $1,324.40. That extra fee is a considerable expense on top of all the interest youll be paying.

Since many private student loans dont come with an origination fee, its worth comparing your options so you can find a loan with the lowest borrowing costs.

Parent Plus Loans Are Federal Student Loans Issued Directly To Parents They Take A Look At Your Credit Offer Some Flexibility In Repayment Options And The Ability To Fill Funding Gaps After Exhausting Federal Student Loans To Students Grants And Scholarships For The 2019

1. How do Parent PLUS loans work?

When families fill out the FAFSA, one of the options offered for funding are Parent PLUS loans. These loans are meant to supplement school, state, and other federal financial aid offered. is the first step. A credit assessment is performed to determine any late payments and recent defaults.

Then, parents fill out a promissory note from the school itself. The form may be downloaded from the schools financial aid office webpage or given to parents another way. Youll want to contact the school for their individual procedure.

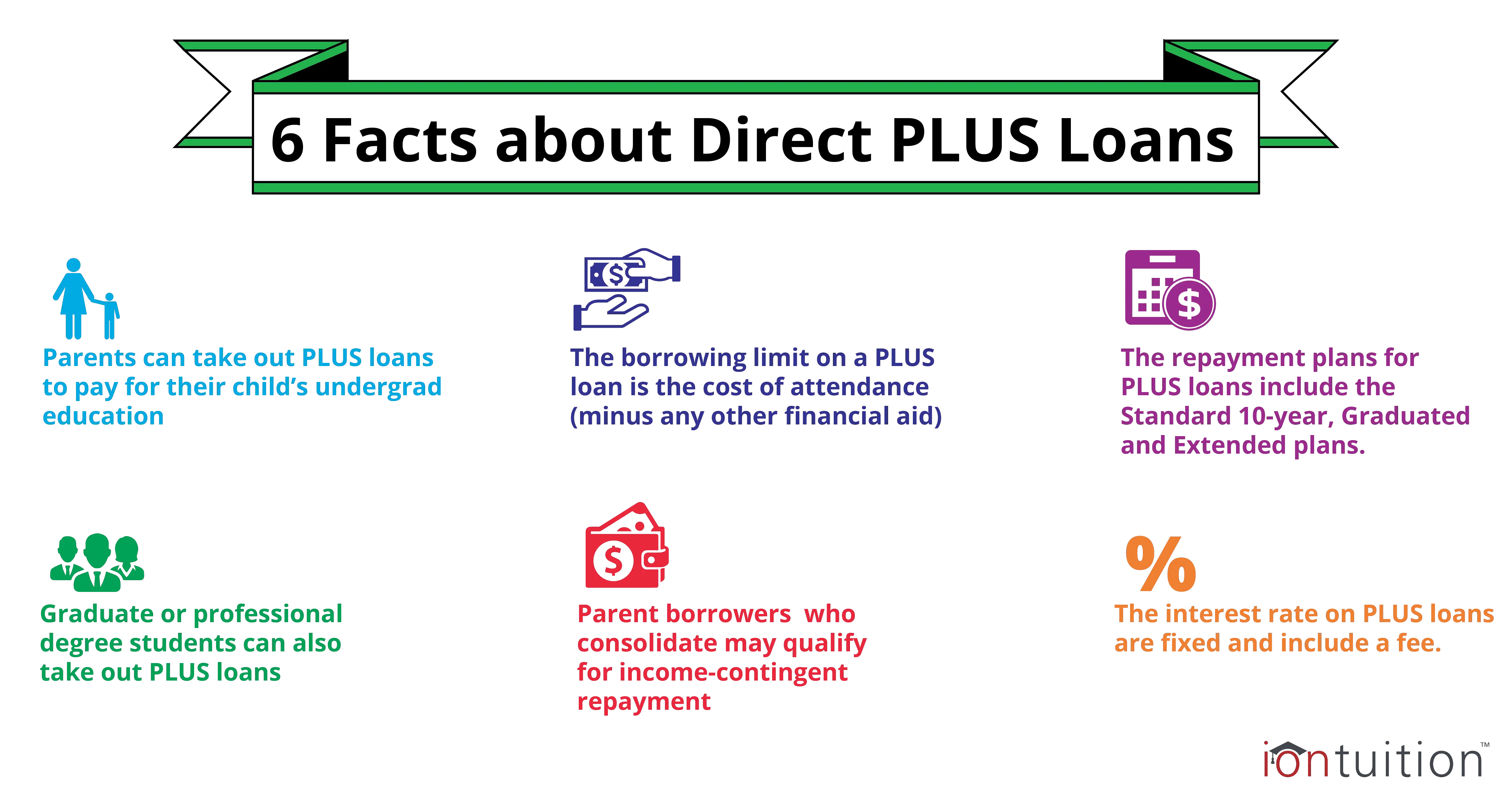

Parent Plus Loans are awarded for up to the full cost of attendance minus other financial aid students received. Funds are sent directly to the school. Refunds for amounts beyond what is owed to the school are sent to the parent or to the student with the parents permission.

Important note: Parents dont have to borrow the full amount offered. For instance, families may decide to pay some of the money offered in the form of PLUS loans with one or a combination of installment plans from the college, tax credits, student income, their own income, and .

You May Like: Congress Mortgage Stimulus Program For Middle Class 2021

How Can Parents Find Out Whether They Will Qualify For Loans

Whether a student is starting at a community college to later transfer to a four-year school, or he or she is trying to decide between a public or private college, the cost of school can be daunting, but most families do qualify for some form of aid.

- To supplement the aid the student receives, parents can apply for a Direct PLUS Loan, which is made to the parent to help cover costs for the parent’s dependent child. A parent can estimate how much in Direct PLUS Loan funds he or she will receive by using this formula: Cost of Attendance Other Financial Assistance Received = Eligibility for PLUS Loan.

- Although a student does not need a credit history in order to get a federal student loan, a parent’s credit record will be checked when he or she applies for a Direct PLUS Loan. If you find that a parent is concerned that he or she may not qualify, you can reassure him or her that a borrower with an adverse credit history can obtain an endorser or document extenuating circumstances.

- If a parent is unable to obtain a Direct PLUS Loan, the student may be able to get additional Direct Unsubsidized Loan funds. Tell the student to contact the college financial aid office to ask about this option.

Your Number One Student Loan Choice

Low cost student loans are the number one source of financial aid for college bound individuals. There are two types of student loans to consider. The Federal student loan and the private lender student loan. Both have their advantages but savvy students will turn to the Federal student loan first. With easier qualification standards and lower fixed interest rates Federal loans make a college education more accessible to students from all walks of life.

Don’t Miss: Government Contracts For Box Trucks

Best Parent Student Loans For Parents Who Dont Want To Cosign

Parent student loans are a viable option to help you pay for your childs higher education.

College students and graduates arent the only ones saddled with student loan debt.

More than 91% of private student loans for the 2020-2021 academic year were cosigned, according to data from MeasureOne, a data and analytics company. Additionally, 63.48% of graduate school loans included cosigners, the data showed.

If youre looking to help your children with student loans, you have two basic options: You can cosign a loan for your child or you can take out a student loan in your own name.

Either way, youre at least partially responsible for the debt. But if you take out student loans as the primary borrower, you may be able to help your child avoid graduating with a mountain of student loan debt.

Help Your Student Reduce Costs Or Find Other Funding

Student loans are a popular ways to pay for college, but there are other ways to bring down costs. Here are some ways to cut costs if youre not able to find any student loans for parents with bad credit.

One of the things that parents can do to help their children pay for college or save money is to let them live at home while taking classes. Room and board at school can be very expensive, so if a child is attending a school near home, living at home can save thousands of dollars each year.

The student can still get involved with campus life by joining clubs, attending sporting events, and hanging out around campus, but saving on room and board can save parents from having to get Parent PLUS Loans in the first place.

Parents can also work to help their children find other sources of funding for school. There are thousands of scholarships and grants that students can apply for. Parents should keep an eye out for these opportunities. Many local community organizations offer small scholarships to local students. Even if the award is a few hundred dollars, every bit helps.

Anything that parents can do to help their children make money to reduce college costs can help, even if they arent able to pay for tuition using a Parent PLUS Loan.

Recommended Reading: Government Jobs Las Vegas No Experience

Applying For Parent Loans For College

The process to apply for a parent college loan depends on the type of loan you choose. Parent PLUS loans are federal debt and have a slightly simpler application process. Theres more variety when it comes to private parental loans, however, so youll need to do some research before submitting your application.

Finding A Plus Loan Lender

All new federal education loans, including the PLUS loan, are made through the Direct Loan program. To obtain a Parent PLUS loan, contact the colleges financial aid office.

The PLUS loan borrower will need to sign a Master Promissory Note , which covers a period of continuous enrollment. Annual borrowing is capped at the cost of attendance minus other aid. The college will draw down the funds from the Common Origination and Disbursement system and deposit them into the students account. After the funds are applied to tuition and fees , any remaining funds will be disbursed to the student to pay for textbooks and other college-related costs.

Parents who are considering a PLUS loan also often consider a home equity loan or an alternative loan. Have questions? Learn more about qualifying for a Parent PLUS Loan: Questions about Qualifying for the Parent PLUS Loan

Don’t Miss: State Of Nevada Unclassified Jobs

Potential Consequences Of Student Loan Debt

While college grads earn about 70% more than people with only a high school degree, student loan debt has been associated with a number of social, economic, and psychological consequences including:

- having to choose work that pays more but might be less satisfying

- lower credit ratings from missed payments, just like any other loan

- disqualification from work opportunities if payment history is poor – any missed loan payments will appear negatively on the credit checks many employers do on potential job candidates

- reduced wealth accumulation compared to college grads without loans

- reduced housing access

Maximum Lifetime Limit For Student Aid

There are lifetime limits on the number of weeks you can receive student aid. This includes interest-free periods while you are in school. Once a lifetime limit has been reached, interest starts to accumulate. You will also have to start paying back the loan 6 months after you graduate or finish your studies.

Full-time students can receive student aid for no more than 340 weeks, except:

- students enrolled in doctoral studies can receive student aid for up to 400 weeks

- students with permanent disability can receive student aid for up to 520 weeks

Also Check: Good Jobs For History Majors

You Can Borrow As Much As You Need

Unlike other types of federal student loans, Parent PLUS Loans have virtually no limits when it comes to borrowing. You can borrow up to the cost of attendance minus any other financial aid received.

This can be helpful if your childs financial aid package falls short or you cant cover your Expected Family Contribution.

At the same time, you have to be careful to not take on too much debt. Since your borrowing is limited only by the cost of attendance, you run the risk of taking out more loans than you can afford to pay back.

Before finalizing your paperwork, crunch the numbers with our student loan calculators to ensure your budget can handle repayment.

Will President Biden Forgive Parent Plus Loans

So much for the low, slow payoff methods toward forgiveness of Parent PLUS Loans. How about a more unconditional form of forgiveness being hinted at by President Biden and other government leaders?

Theres been a lot of talk recently from lawmakers and consumer advocate groups pushing to have federal student loans forgivenincluding Parent PLUS Loans. But the legal details of how that would work are far from clear. And even President Biden himself hasnt stated for sure how he wants to address the issue.

Heres what we know right now about forgiveness proposals, including how theyd affect Parent PLUS borrowers:

- Democratic leaders in the House and Senate in February reintroduced a resolution calling on President Biden to use an executive order to forgive $50,000 in student loan debt for every borrower.

- Also in February, the White House said the administration is open to the idea of forgiveness and is looking into whether an executive action could work legally.

- Theres been a lot of debate about whether the forgiveness should apply for all borrowers, or whether it should be limited only to borrowers who fall below a defined maximum income.

- The Biden administration has said Parent PLUS Loan borrowers might be included in a possible forgiveness order.

- On the other hand, in his presidential campaign, Bidens talk about loan forgiveness was focused primarily on helping undergraduates.6

You May Like: Sacramento Federal Jobs

Do You Qualify For Parent Plus Loans Complete The Fafsa

No matter what your financial situation, the first step for parents and college-bound students is completing the FAFSA, or the Free Application for Student Aid.

Graduate school students are typically considered independent students and do not need parents information to complete the FAFSA.

This form will ask for your family finances to determine how much your child is eligible to receive in financial aid and borrow based on the schools cost of attendance.

You also may be eligible to borrow through the federal governments Parent PLUS Loan program. However, do not automatically assume these federal loans are the best borrowing option for parents.

Stafford Loan Aggregate Limits

Students who borrow money for education through Stafford loans cannot exceed certain aggregate limits for subsidized and unsubsidized loans. For undergraduate dependent students, the maximum aggregate limit of subsidized and unsubsidized loans combined is $57,500, with subsidized loans limited to a maximum of $23,000 of the total loans. Students who have borrowed the maximum amount in subsidized loans may take out a loan of less than or equal to the amount they would have been eligible for in subsidized loans. Once both the subsidized and unsubsidized aggregate limits have been met for both subsidized and unsubsidized loans, the student is unable to borrow additional Stafford loans until they pay back a portion of the borrowed funds. A student who has paid back some of these amounts regains eligibility up to the aggregate limits as before.

Graduate students have a lifetime aggregate loan limit of $138,500.

Recommended Reading: Government Jobs In Las Vegas Nevada

Can You Afford To Repay Parent Student Loans

Some parents want to own a student loan to simplify the borrowing process and keep their child out of student debt.

Of parents who borrowed for their childs college, two-thirds say they dont regret it, according to our parent student loans survey, although over half of parents surveyed reported student debt balances of more than $40,000.

Still, you should borrow responsibly and take on parent student loans only if youre confident you can afford to repay them. Limit loan amounts as much as possible, and choose a student loan term that will result in affordable monthly payments.

Also, make sure you can continue to prioritize other important financial goals, such as saving for your retirement, alongside repaying student loans and covering college costs.

What Is A Direct Plus Loan

Direct PLUS loans are federal loans that graduate or professional degree students or parents of dependent undergraduate students can use to help pay for education expenses.

Direct PLUS loans have a fixed interest rate and are not subsidized, which means that interest accrues while the student is enrolled in school. You will be charged a fee to process a Direct PLUS Loan, called an origination fee. An origination fee is deducted from the loan disbursement before you or the school receives the funds. A credit check is performed on applicants to qualify for a Direct PLUS Loan.

There are two types of Direct PLUS loans: the Grad PLUS loan and the Parent PLUS loan.

Grad PLUS loans allow graduate and professional students to borrow money to pay for their own education. Graduate students can borrow Grad PLUS loans to cover any costs not already covered by other financial aid or grants, up to the full cost of attendance.

To qualify for a Grad PLUS loan you must meet three criteria:

Parent PLUS loans allow parents of dependent students to borrow money to cover any costs not already covered by the student’s financial aid package, up to the full cost of attendance. The program does not set a cumulative limit to how much parents may borrow. Parent PLUS loans are the financial responsibility of the parents, not the student and cannot be transferred to the student upon the students completion of school.

To qualify for a Parent PLUS loan, you must meet three criteria:

Recommended Reading: Highest Paying Jobs For History Majors

You Have A Few Different Options For Repayment

Although Parent PLUS Loans have the disadvantage of an origination fee , they win points for flexible repayment plans.

Parent PLUS Loans are eligible for the following plans:

- Standard Repayment Plan: Pay your loans off with fixed monthly payments over 10 years.

- Graduated Repayment Plan: Start with small payments that gradually increase over a term of 10 years.

- Extended Repayment Plan: Pay fixed or graduated payments over 25 years.

- Income-Contingent Repayment: If you consolidate first, youll pay 20% of your discretionary income or what youd pay on a 12-year plan, whichever is lower. If you still have a balance left after 25 years, you could be eligible for student loan forgiveness.

As you can see, you have several options for repayment. They can make your monthly bills go higher or lower. You might make extra payments to pay the loan off as fast as possible or extend your term to 20 or 25 years for some financial relief.

These flexible repayment plans can be a lifesaver in the event you lose your job or run into financial hardship. Note that private student loan companies typically dont offer these same protections, but some will allow you to pause payments through forbearance under certain circumstances.

If youre concerned about your ability to pay back a parent loan, a federal Parent PLUS Loan might be the most accommodating option. But if you dont anticipate trouble with repayment, you might prefer a private lender.