Whats The Difference Between Government Grants And Loans

Date:

Are you looking to get help paying for your education? Does your non-profit organization need financial assistance to complete a community project? The government offers financial help, but you may not know whats available and where to find it.

There are two main types of help offered by the government: grants and loans. Use this quick guide from USAGov to explore the difference between the two and find out how to apply.

Grants

Government grants fund projects that will benefit parts of the population or the community. Grants provide money for projects that help improve the economy or the public. Understand key information about grants:

- The federal government awards grants to state and local governments, universities, research labs, law enforcement, non-profit organizations, and businesses.

- People can’t use grants for personal benefits. Organizations receive this funding and dont have to repay it.

- To search or apply for grants, visit the federal governments free, official website, Grants.gov. There you can check your eligibility, find tips for the application process, learn how to write a successful grant proposal and more.

Loans

Government loans are borrowed money for an individual as a personal benefit or assistance. These loans are for specific purposes like help with student financial aid, housing situations, or utility bills. Understand key information about loans:

Want more information about government grants and loans? Learn more at USA.gov.

Pros And Cons Of Loans

Pros While its never fun to owe money, it does help you establish a credit history. This will help when you apply for credit cards and other types of loans in the future .

Cons In addition to paying back the amount you borrow, you will need to pay interest on that amount. Interest is essentially the cost of borrowing money and is calculated as a percentage.

Interest rates on student loans tend to be much lower than the interest rates on personal loans. that the average interest rate for private loans in the first quarter of 2018 was 10.22 percent. At College Ave, we offer .

Find Free Money For College With Federal Grants

What is a grant? A federal grant is a form of federal financial assistance where the U.S government redistributes its resources to eligible recipients who demonstrate financial need.

Below, weve got you covered for Federal grants, State Grants, College Grants, and other grants in special situations. Just follow these steps, and youll have a higher chance of uncovering grants that are the perfect fit for you.

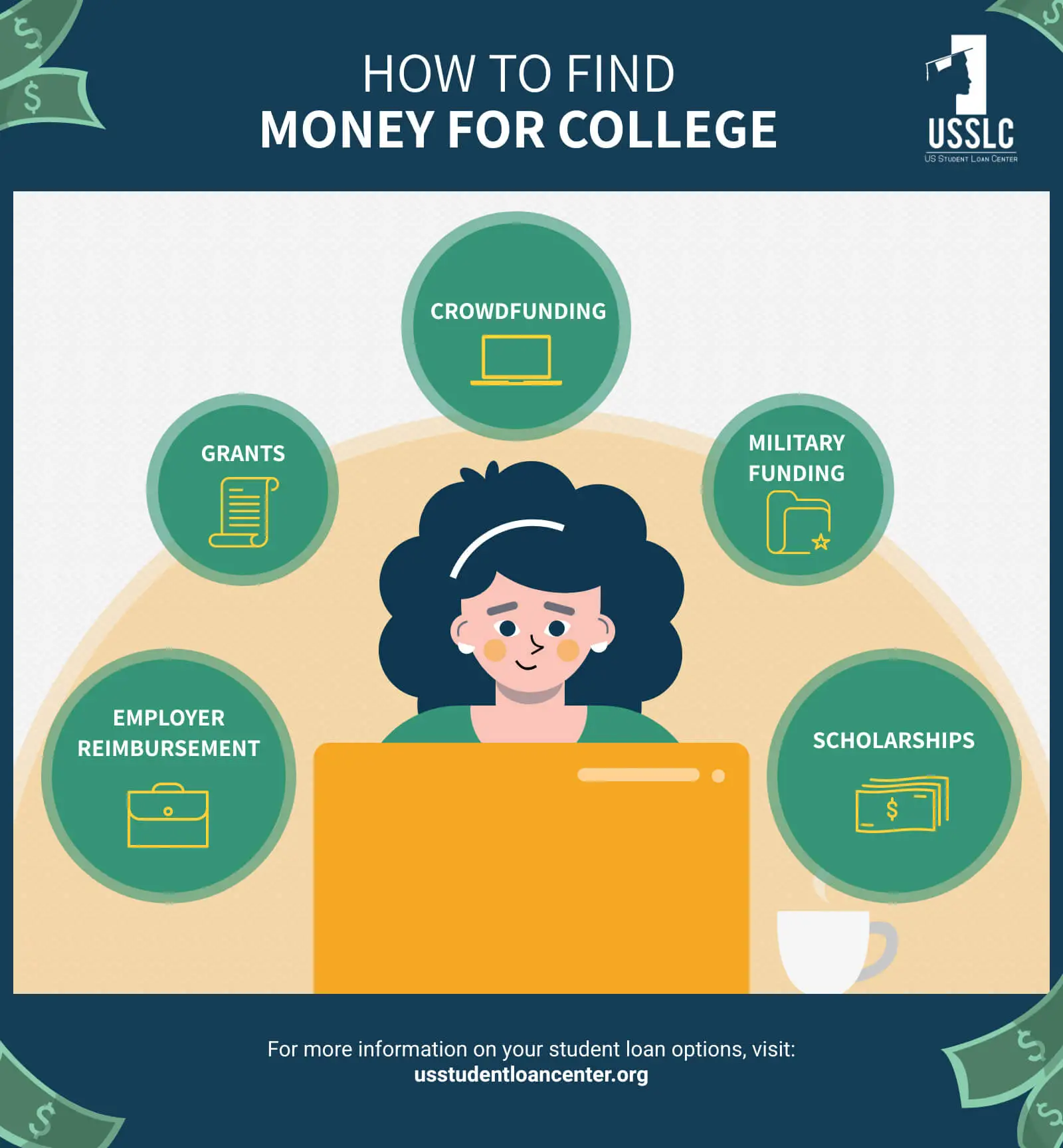

Find this infographic useful? You can download the full version here.

Recommended Reading: Data Governance Security And Privacy

How To Apply For Student Loans

When applying for student loans, you . To apply for a federal student loan, youll be required to fill out the FAFSA.

Students are generally eligible to borrow up to a capped amount of federal aid each semester. While many students benefit from federal student loans, some students may find the amount of aid they are offered doesnt always cover what they need. To bridge the gap, taking out a private student loan could be an option to cover costs.

If youre at College Ave, youll need a few things to get started:

You can start a right here!

How Fafsa Works

The primary purpose of the FAFSA is to determine how much financial aid a student qualifies for, including both need-based and non-need-based aid. It determines eligibility for federal need-based grants including the Pell Grant and Federal Supplemental Educational Opportunity Grants subsidized federal student loans, which are based on need unsubsidized federal student loans, which most students qualify for regardless of need federal work-study state-based financial aid, including grants, scholarships, and loans school-based financial aid, including need-based grants and scholarships, and school-based merit aid .

To determine a family’s financial need, the FAFSA asks a series of questions about the parents’ and student’s income and assets as well as other factors, such as how many children there are in the family. It then comes up with an Expected Family Contribution .

The confusingly named Expected Family Contribution will be renamed the Student Aid Index in July 2023 to clarify its meaning. It does not indicate how much the student must pay the college. It is used by the school to calculate how much student aid the applicant is eligible to receive.

The FAFSA is the official form that students or their families use to apply for financial assistance for college from the federal government. States, individual colleges and universities, and private scholarship programs rely on the information provided in the application as well.

Read Also: How To Apply For Government Student Loans

What Is A Loan

A loan is money that you borrow with the expectation that you will pay it back, within a deadline laid out by your lender.

Students can borrow money through , which are issued by the government, or , which are issued by non-government entitles like banks and credit unions. To qualify for a private student loan, youll need to demonstrate your ability to pay the loan back, usually with a .

Health Professional In Military

The Health Professions Loan Repayment Program can help medical professionals tackle student loan debt while on active duty or in the Army Reserve. If eligible, you can receive up to $40,000 per year for a specified term, which is typically three years. Thats a potential total of $120,000 of student loan forgiveness.

Recommended Reading: Government Assistance Paying Utility Bills

Consider State Grants To Pay For College

After you have gone through all of your federal grant options, consider state grants by contacting one of the state grant agencies provided by the Department of Education.

We also have put together this ultimate guide of Financial Aid and Student Loans By State, which includes any grants offered by your state. Just click your state and see what’s available.

I Need Financial Help Immediately What To Do

If you are in financial hardship situation, To overcome from financial hardship situation there are various Government financial assistance, Private financial assistance, Charities and organizations Financial assistance, you just need to know are you Eligible for Free Grants money from government Hardship Grants.

Read Also: Federal Government Free Credit Report

Covering College Costs With Grants

Generally, your school will pay out your grant money in at least two payments called disbursements. Typically, the college applies your grant money toward your tuition, fees, and room and board. Any money left over is paid to you for other expenses.2

Most college grants are not guaranteed for all years of college. For example, you may become ineligible for a need-based grant if your familys financial situation changes dramatically from one year to the next. Similarly, merit-based grants may not be guaranteed every year either. You might be required to maintain a certain GPA or meet other criteria to qualify for the grant.

If youre offered grants for school, make sure you understand all the requirements and how you can qualify in the futureand remember to fill out your FAFSA every year.

The Veterinary Medicine Loan Repayment Program

If youre a veterinarian looking for grants to pay off student loans, look no further than the National Institute of Food and Agriculture . Its loan repayment assistance program awards up to $25,000 per year $75,000 total in exchange for three years of paid work in an underserved area.

To be eligible, you must have an accredited degree in veterinary medicine and carry at least $15,000 in loan debt.

Also Check: Government Student Loans For Parents

New York State Young Farmers Loan Forgiveness Incentive Program

In New York, graduates who want to pursue a career in farming can receive up to $10,000 a year for up to five years to pay off their student loan debt. Requirements include having received your degree from a New York college or university, and residing in the state for the 12 months prior to applying.

You need to submit your application within two years after graduating from school. Funds can be applied to both federal and private student loans.

Volunteer Income Tax Assistance Program

Through the Volunteer Income Tax Assistance program , you can get free tax preparation. IRS offers this service as part of its compliance and outreach efforts. Tax preparation is free if you have a low income and do not exceed $54,000 in one year. VITA is free and open to everyone, but it is especially available to low-income individuals, to people with disabilities, and to people who speak English as a second language.

Don’t Miss: Types Of Government Mortgage Loans

Beginning Farmers And Ranchers

USDA, through the Farm Service Agency, provides direct and guaranteed loans to beginning farmers and ranchers who are unable to obtain financing from commercial credit sources. Each fiscal year, the Agency targets a portion of its direct and guaranteed farm ownership and operating loan funds to beginning farmers and ranchers.

Nurse Corps Repayment Program

The Health Resources and Services Administration offers student loan grants for the following nursing professionals:

- Licensed registered nurses

- Advanced practice registered nurses

- Nurse faculty members

Applicants who commit to two years service in either a health care facility with a critical shortage or at an accredited school of nursing will receive 60% of their outstanding student loan balance. You can earn an additional 25% by completing a third year of service.

Also Check: What Government Assistance Is Available For Single Mothers

Can I Get Any Financial Support From The Government

Yes, you can get financial support from the government in your emergency time, but you will get help only when you fulfill the requirements.

You may get help from the government too. Yes, there are various options available through which you can get help from the government easily. The best way is short-term benefit advances. You may be able to apply for short-term benefit advances. This means the benefits are paid early means before their due date. After making advances, they will be repaid by deductions from future payments. It usually contains 12 weeks.

There are some conditions for getting short-term benefit advances, so you have to fulfill these conditions. You can get a short-term benefit advance if:

- You need money before your first benefits payment is made

- You need money urgently before your benefits are increased

- Your benefit will not be paid on its due date, for example, because of technical problems

Most of the benefits are applied only through your local Jobcentre Plus. So, you have to keep this thing in your mind.

- Income-related Employment and Support Allowance

- Pension Credits

You can use these budgeting loans for several purposes and these loans will help you in paying for things like:

- Maternity expenses

- Universal Credit

- Employment and Support Allowance

Federal Supplemental Educational Opportunity Grant

FSEOG is a financial aid program that is administered directly by the admitting school. To apply for FSEOG, you must enroll in a school participating in these grant programs.

Once youve filled out your FAFSA form, your college determines your financial need. Your college will grant the FSEOG to students who have the most financial need.

You can get anywhere between $100 and $4,000 per year depending upon the following factors:

- Your financial need

- Other aids, grants, and scholarships that you are receiving

- Availability of funds at your school

The U.S Department of Education gives a certain amount as college grants to each school participating in the FSEOG program. Unlike Federal Pell that grants the amount direct to adult students, the financial aid office at your school grants FSEOG. You must visit the colleges website to check for application deadlines for campus-based funds.

Adult students returning to school can receive their grant in their student account through direct payment or a combination of both. You will receive the funds once per term .

If your school does not follow a term-based pattern, you will receive the funds at least twice a year.

Recommended Reading: Hotel Deals For Government Employees

What Is Meant By Low Income For A Single Person In The United States Of America

According to the government, low-income are those men and women who earn less than double of the Federal Poverty Level . The federal poverty level for a single household is approximately $12,490 in a year. So, the single person who is earning less than $25,000 a year can be considered in the low income bracket.

Sa Government Financing Authority

- Show submenu for “About SAFA”About SAFA Menu

Don’t Miss: Sap Master Data Governance Best Practices

Is The Fafsa A Loan Or Free Money

The FAFSA application is not a loan. It is simply an application that you fill out in order to determine your eligibility for receiving a federal loan. There are three main types of financial aid that a student may be deemed eligible for after completing a FAFSA application. Some of this money is free money, some must be earned through work, and some must be repaid.

Help From Your Local Council

Getting financial help from the local councils is one of the best and easiest ways to get money quickly. There are various types of schemes available with the councils which are made according to the needs of the creditors. You may be able to apply to these local councils for councils local welfare assistance scheme. These schemes are generally available to people who are having low incomes and are facing financial difficulty.

Each local authority made its own rules and schemes mean every locality has its schemes with different rules. They help in the form of small cash loans or grants, food vouchers, and free used furniture.

- England: get in touch with your local council

- Scotland: you may be able to apply for a Scottish Welfare Fund

- Wales: you may be able to apply for the Discretionary Assistance Fund

- Northern Ireland: you may be able to apply for Finance Support

You May Like: Erp Software For Government Contractors

What Do You Know About The Hardship Loan Program

A hardship loan is quite similar to a personal loan. The borrower gets a huge amount of money but remember that there are a few restrictions and limitations. Hardship loans follow favorable terms and conditions. The interest that is charged in such kinds of loans is lower and also includes faster funding. These loans are very helpful for the borrowers as it helps them to resolve a difficult situation.

Pandemic Government Hardship Grants Covid 19

The coronavirus pandemic has forced the authorities to have a set of economic measures to attempt and handle a health crisis that has left Millions dead round the world, according to official statistics. The Government has approved a set of economic and social measures to decrease the effect of the crisis produced by the coronavirus, especially among the most vulnerable groups. The government has approved several decrees to confront the financial effect with help for the unemployed and loans to the self-employed and SMEs, although the announced plan to encourage the hospitality industry is long overdue. You an read more about $7000 Government Grants To get help instantly for your need

Here youll find out what helps by coronavirus are available for you, your loved ones or your company. Weve grouped them by home and household equipment, occupation -both if you work for someone else or if Youre self explanatory -, fiscal and economic issues, judicial processes, gender violence, prison and family environment.

Also Check: Grant Writing For Government Agencies

Disability Accommodations And Section 504

My child has a disability, but is not eligible for services under the Individuals with Disabilities Education Act . How can my child receive appropriate education services in the public school system?

If you find that your child does not qualify for services under the Individuals with Disabilities Education Act , then you should inquire about services under Section 504. Section 504 of the Rehabilitation Act of 1973 is designed to protect the rights of individuals with disabilities in programs and activities that receive federal funds from the U.S. Department of Education. Section 504 requires a school district to provide a “free appropriate public education” to each qualified student with a disability who is in the school district’s jurisdiction, regardless of the nature or severity of the disability. Your child does not have to qualify under IDEA in order to qualify for FAPE under Section 504. The U.S. Department of Education’s Office for Civil Rights enforces Section 504 in programs and activities that receive federal education funds. For more information, visit Protecting Students with Disabilities.

Government Hardship Grants For Single Mothers

The single mother can access Many Grants if she is the head of the family, with at least one economic dependent. This is because, being the department that protects and promotes prosperity in the population, they are responsible for offering a good amount of social assistance. Single mothers often face the challenge of managing household expenses alone for themselves and their children. Single mothers are usually overwhelmed by financial problems. Not only do they have to pay the bills for the family, but they generally have to make additional payments to the daycare centers and child caregivers while they go to work. All of them focus on improving the quality of life of each resident of the country equally. It is worth mentioning that, of all its initiatives, one of the most successful is the Emergency Grants for Single Mothers. Fortunately, many states have financial assistance options designed to help those families who encounter financial difficulties, and some areas may offer programs especially for single parents.

Government Hardship grants for single mothers

Also Check: Federal Government And Health Insurance