How Does An Individual Claim A Check

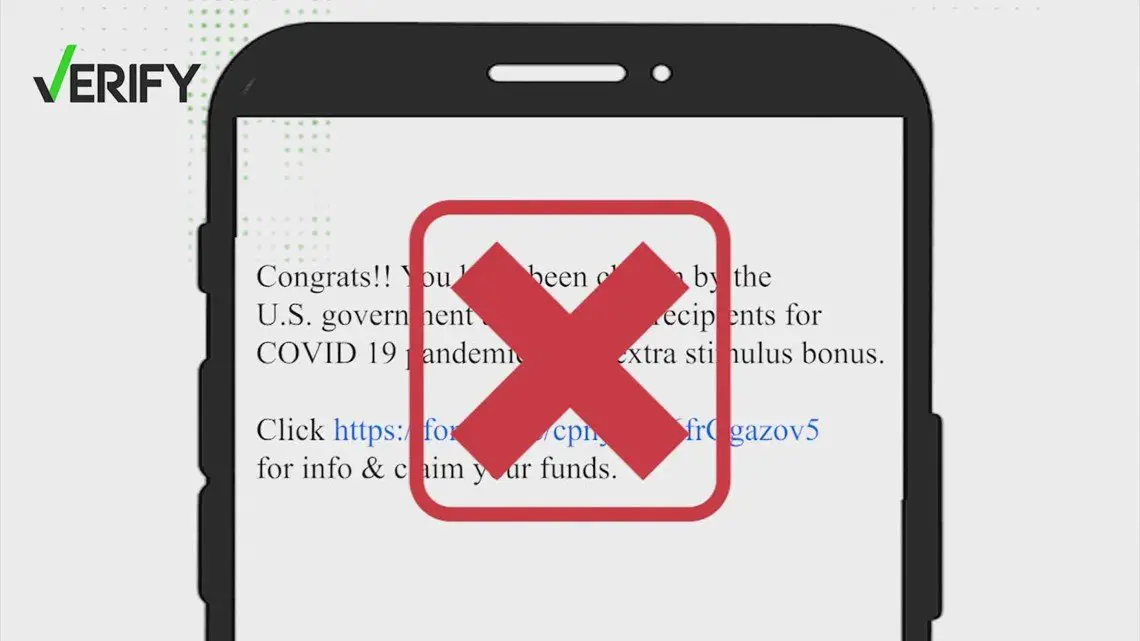

You do not need to claim the check . These will be automatic payments sent out by the IRS directly to you based on the direct deposit or address provided in your tax returns or Social Security Benefits statement.

The Treasury and IRS have a new web tool allowing quick registration for Economic Impact Payments for those who dont typically file a tax return.

This Story Is Part Of A Group Of Stories Called

Finding the best ways to do good.

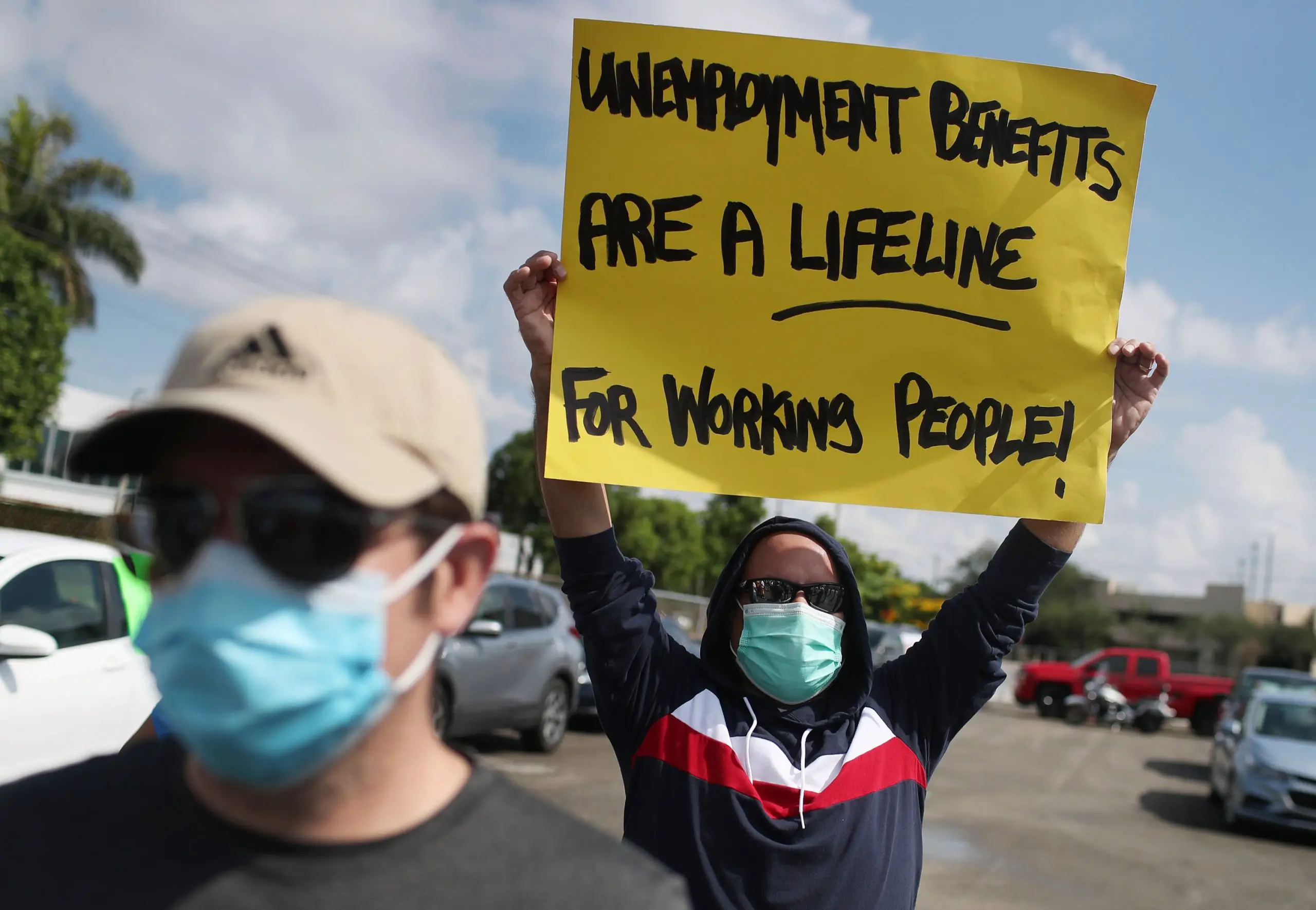

The CARES Act, the $2 trillion economic rescue legislation signed by President Trump on March 27 and scheduled to end in large part on July 31, was perhaps the most pleasant legislative surprise Ive seen in my decade of covering American politics.

The bill authorized hundreds of billions in spending on expanded unemployment benefits and stimulus checks to support the millions of workers who lost their jobs once pandemic lockdowns began. The result was that the lowest-income Americans barely saw their spending fall once federal support kicked in. Despite the crisis, poverty did not increase, and might even have fallen.

The legislation passed at the end of a decade that was marked by congressional stalemate and ineptitude. My basic model of federal politics going into the Covid-19 calamity was that presidents typically get two years to try to implement their agenda, which the opposition tries to block at every turn once the opposition wins back Congress in the midterms, the bulk of domestic affairs is handled in a series of bare-knuckle budget fights for the rest of the presidents term or terms in office.

The individual provisions of the CARES Act are widely known, but its worth dwelling a bit on the bill itself, its historic importance, and what it means that Congress was able to pass it.

What Is The Formula For Supporting Hospitals And Health Systems

No formula for allocating the full $178 billion fund to support health care providers is provided in statute. HHS will be able to disperse funding prospectively or retroactively following an application from an eligible entity that includes a statement justifying the need of the provider for the payment. HHS will review applications for and make payments from this funding on a rolling basis.

Recommended Reading: How Can I Get Financial Help From The Government

Requesting Extensions To The Period Of Performance Or The Closeout And Liquidation Periods

The LWA program Period of Performance extends 90 days beyond the Period of Assistance to allow states, territories, and the District of Columbia time to complete payments and investigate and recover improper payments. Following the end of the Period of Performance, states, territories, and the District of Columbia have 90 days to submit closeout reports and liquidate obligations. -.) The closeout and liquidation periods conclude unless extensions are granted 90 days after the Period of Performance ends. The initial Period of Performance for all states, territories, and the District of Columbia ended on March 27, 2021 therefore, the initial closeout and liquidation period ended on June 27, 2021.

Upon request, the Period of Performance and the closeout and liquidation periods may be extended. -.

To request an extension to the Period of Performance, the state, territory, or the District of Columbia must provide a written request to FEMA providing justification for the extension to include any specific data necessary for the request and the timeframe for the extension request.

Period of Performance extension request letters should be sent to no later than 15 days prior to the end of the Period of Performance. A standard template for requesting a Period of Performance extension is suggested.

I Think The Amount Of My Economic Impact Payment Is Incorrect What Can I Do

If you are missing all or part of your expected payment, you may qualify for the Recovery Rebate Credit and must file a 2020 tax return to claim the credit even if you normally do not file.If you have filed your 2020 tax returns and did not claim the credit on your original tax return, you will need to file an Amended U.S. Individual Income Tax Return, Form 1040-X. The IRS will not calculate the 2020 Recovery Rebate Credit for you if you did not enter any amount on your original tax return.

This is particularly important for individuals who may be entitled to payments for their qualifying dependents. For VA and SSI recipients who dont have a filing requirement and have a child, they may need to use the Non-Filer tool on IRS.gov in order to have the $1,400 for a dependent added automatically to their $1,400 Economic Impact payment. The IRS encourages people to review their How do I calculate my EIP Paymentquestion and answer.

You May Like: Government Grants For Small Businesses Owned By Minorities

Michigan Stages Survival Grant Program

Whos eligible: Live music and entertainment venues

How much money: Up to $40,000 per business

Wheres it from: Michigans COVID-19 aid package

Venues that make their money off of live entertainment and/or live music are eligible for grants as well although theyre not eligible for the Small Business Survival Grant Program.

The application period goes from 9 a.m. on Thursday, Jan. 21, to noon on Jan. 28.

For details on how to apply, .

RELATED STORIES

Other Reasons For Getting A Plus

The IRS says you also may be eligible for a plus-up payment if you:

-

Got married last year and have filed a joint return for the first time, as long as your income falls under the $150,000 limit.

-

Filed a 2020 tax return that includes a new child or dependent.

-

Are a veteran receiving disability compensation from the Department of Veterans Affairs and werent required to file a tax return for 2019 but have submitted one for 2020.

-

Were previously exempt from filing your taxes and used a nonfiler tool to claim your first stimulus check last year.

The plus-ups included in the latest batch of payments are just a small portion of the approximately 164 million checks and direct deposits that have gone out since March 12. Approximately $386 billion in aid has been distributed directly to Americans in the past eight weeks.

The IRS says it will continue sending out stimulus money in weekly batches.

If you dont normally file a tax return and have not yet received any stimulus cash from the government, the IRS is urging you to file your 2020 taxes so you can “get all the benefits entitled to under the law.”

Those include not only stimulus checks but also the upcoming monthly payments for families that are part of an expansion of the child tax credit.

Read Also: Government Aid For Student Loans

How Long Will It Take For This Check To Be Delivered

Rebates sent via direct deposit will take a few weeks. Rebates sent via checks may take a few months. For those eligible, Treasury will send notice by mail to the individuals last known address as soon as practicable. The notice will indicate the method by which the payment was made, the amount of the payment, and a phone number for a point of contact at the IRS to report any failure to receive your payment.

Does It Change How The Credit Works

Heres where it gets interesting: You could receive some of the credit as an advance on your 2021 taxes.

The legislation makes the credit fully refundable, which means you can receive money from it as a tax refund even if your tax bill is reduced to zero. And half of that money can be advanced to households over the next six months . Its not clear how frequently payments would be made perhaps monthly but they should begin in July.

The changes are effective for 2021 only, though at least some Democrats would like to make it permanent.

Also Check: Check To See If Government Owes You Money

How Federal Pandemic Unemployment Compensation Works

To receive the FPUC extra $300 per week benefit, you had to file a claim for unemployment benefits, but you didn’t need to sign up expressly. The payments were automatic if you qualified for regular unemployment insurance payments. When FPUC payments ended on Sept. 6, 2021, those eligible for regular unemployment compensation from their state continued to receive it.

At least 26 states stopped making FPUC payments before the September deadline. One of the reasons governors cited was that the unemployment rate was low. For example, on Aug. 20, 2021, the national unemployment rate was 5.2%, down 0.2% over the month, and 3.2 points lower than in August 2020.

Recently Filed Taxes A Bonus Stimulus Check From The Irs May Be On Its Way

The IRS may have a little more cash for you as it continues to distribute the pandemic’s third round of stimulus checks, worth up to $1,400.

The tax agency says another batch of 1.1 million direct payments are on their way to Americans this week, mostly consisting of extra money for people who already received some relief cash in the latest go-round.

You might receive a bonus stimulus check which the IRS calls a “plus-up” payment if you haven’t gotten the full $1,400 so far, and you recently submitted your 2020 taxes.

Also Check: Government Programs For Solar Power

Thousands Of Americans To Get Free Cash For Gas & Transit From $125million Pot

In total, Americans have received three stimulus checks since 2020.

So far, the federal government has paid $3,200 to each eligible adult, with payments of $1,200 under former President Donald Trump’s Cares Act, $600 in a separate Trump relief measure, and $1,400 under Biden’s plan.

If you are still waiting on a check, you can track your third stimulus payment through the Get My Payment tool on the IRS website.

How Coronavirus Stimulus Payments Affect Your Household Income

The federal governments economic impact payments and the states new stimulus payment may have you wondering how to calculate your household income, whether you want to apply for health insurance right now during special enrollment or report a change to your income.

There are a few different types of stimulus payments: federal stimulus payments, Pandemic Unemployment Compensation , and the Golden State Stimulus payment. Its important to understand which payments you need to include while calculating your household income because this determines which programs you qualify for and how much financial help you get.

Don’t Miss: Government Assistance Paying Electric Bill

What Protections Do Borrowers Have With Respect To Federal Student Loans

The Department of Education and its loan servicers will suspend all payments on federally owned student loans through September 30, 2021. This includes all Direct Loans and Federal Family Education Loan program loans owned by the Department of Education . Interest will not accrue on loans during this period. Each of the months during the period of the suspension will be considered as if the borrower had made a payment for the purposes of the Public Service Loan Forgiveness program and for the rehabilitation of loans in default. During the suspension, the Department will report suspended payments to credit agencies as if they were regularly scheduled payments by the borrower. All involuntary collection activities, such as wage garnishments, on loans with suspended payments will stop for the duration of the suspension period.

In addition, borrowers will be able to receive up to $5,250 in employer assistance in repayment of student loans without incurring tax liability on that assistance through 2025. Finally, through 2025, any borrower who sees eligible student debt forgiven, such as at the end of an income-driven repayment plan, will not incur a tax obligation on the discharged amount.

Will The Recovery Rebates Be Taxed Or Reduce My Tax Refund In Any Way

No. The stimulus payment is a unique, fully refundable tax credit. You will not be taxed on the rebate. And the rebate will not affect your 2020 or 2021 taxes in any way. If you are expecting a refund for those tax years, not related to previous stimulus payments, the amount will not change because of recovery rebates.

Recommended Reading: Selling Old Car To Government

How Do I Get It

- The stimulus payments will be processed by the IRS.

- If you have already filed a 2019 tax return, you will get the stimulus payment automatically. You will receive it in the same form as your tax refund. If you requested direct deposit, then the stimulus will be direct deposited. If you requested a paper check, then the stimulus will be mailed to the same address on your 2019 tax return.

- If you entered your information into the IRS non-filer portal earlier in 2020, you will get the stimulus payment automatically. You do not have to do anything.

- If you receive one of the following benefits, you will get the stimulus payment automatically. You do not have to do anything.

- Social Security

Is There Any Relief For Student Loan Repayments

The Department of Education and its loan servicers will suspend all payments on federally owned student loans through January 31, 2020. This includes all Direct Loans and Federal Family Education Loan program loans owned by the Department of Education . Interest will not accrue on amounts owed during this time. The CARES Act, passed March 2020, also encourages employers to implement loan repayment programs, allowing them to exclude up to $5,250 of student loan payments from their taxable income.

Recommended Reading: Government Jobs In Flagstaff Az

I Run A Nonprofit Organization And Am A Reimbursing Employer Under My States Unemployment Insurance Program Due To The Economic Impacts Of The Covid

Contact your state unemployment insurance office to learn what options may be available for delaying reimbursement payments. The CARES Act allows states to provide maximum flexibility to reimbursing employers as it relates to timely payments in lieu of contributions and assessment of penalties and interest. The U.S. Department of Labor will soon be issuing guidance on how states should implement this provision.

The 2021 Stimulus Payment

On March 11, 2021, the American Rescue Plan was signed into law. It called for sending a third round of stimulus checks to Americans. The American Rescue Plan authorized a $1,400 stimulus payment to eligible people. Learn more about it on the IRS website. Most people already received their payments, which were based on income reported on their 2019 or 2020 tax return.

If you believe you did not get all or part of the $1,400 stimulus from the American Rescue Plan of 2021, you should claim this as a recovery rebate credit on your 2021 tax returnLearn where to get help filing your taxes.

Don’t Miss: What Are Short Term Government Bonds

Are Eviction Moratoriums Extended

There is no extension of the national ban on evictions, which is set to expire on March 31. The bill doesnt extend the moratorium because it is being passed through a budget reconciliation in the Senate, which sets limits on what measures lawmakers can include.

In January, Biden issued an executive order extending eviction protections until the end of the month and called on Congress to keep the moratorium in effect through September. Advocates call on the president to extend the protection through another executive order.

Some states issued their own eviction bans.

When Can I Get The Child Tax Credit Payments

Starting in July, the Rescue Plan directs the Treasury Secretary to make periodic credit payments to taxpayers based on 2019 or 2020 tax return information. The frequency of the payments will depend on IRS administrative capacity and whether the taxpayer has direct deposit information on file with the IRS.

Recommended Reading: Government Help To Get Out Of Debt

Stimulus Update: More Pandemic Relief Money Is Headed To Residents Of These 5 States

by Angelica Leicht | Published on Oct. 5, 2021

A fourth stimulus check is looking more and more unlikely, but some states are stepping in to help residents in need of a financial boost. Here’s what you need to know.

A petition calling for Congress to support families with a $2,000 payment for adults and a $1,000 payment for kids through the end of the pandemic continues to gain popularity. As of early October, the petition had been signed by nearly 3,000,000 people — proof that millions of Americans want and need more financial help from the federal government.

But while the petition has drawn millions of signatures, it seems highly unlikely a fourth stimulus check will gain any traction with lawmakers. President Joe Biden has signaled time and again that he is not prioritizing another stimulus payment, and while some Democratic lawmakers have expressed support for recurring payments, it would almost certainly be an uphill battle to get another stimulus payment passed by Congress.

What Can I Do If I Have Not Received My Eip Money By Those Deadlines

If you have not received all or some portion of your Economic Impact Payments by the deadlines above, you will have to file a 2020 tax return and claim these amounts. You claim them on line 30 of the 2020 Form 1040 as a “Recovery Rebate Credit“. This is another name for the EIP stimulus payments. If you did not get all or a portion of the EIP payments in advance, then you can claim them on line 30 of your tax return for 2020.

Recommended Reading: What Hotels Give The Best Government Discount