Know About Native American Options

Native American first-time homebuyers can apply for a Section 184 loan . “Next to the no-money-down VA loan, this is the best federal-subsidized loan offered,” says Ferraro. This loan requires a 1.5% loan upfront guarantee fee and only a 2.25% down payment on loans over $50,000 .

Unlike a traditional loan’s interest rate, which is often based on the borrower’s credit score, this loan’s rate is based on the prevailing market rate. Section 184 loans can only be used for single-family homes and primary residences.

How To Calculate The Toronto Land Transfer Tax Refund Amount

BothToronto land transfer taxand Ontario land transfer tax applies to homes purchased within the City of Toronto.Land transfer tax rebatesare incentives offered to first-time home buyers, but the municipal tax rebate is calculated separately from the provincial tax rebate.

If you’re a first-time home buyer in Toronto, you can receive a rebate of up to $4,475 off your municipal land transfer tax and a rebate of up to $4,000 off your provincial land transfer tax. Currently, Toronto land transfer tax rates are the same as Ontario land transfer tax rates. This means that a home buyer in Toronto will be paying double the land transfer tax compared to a home buyer for the same home purchase price in another municipality. First-time buyers are eligible to receive a rebate for both portions.

Lets say that youre purchasing a $300,000 home in Toronto. The tax rates for both the municipal portion and the provincial portion are the same. First, lets calculate the municipal portion using Toronto land transfer tax rates.

| Purchase Price of Home | |

|---|---|

| Total Ontario Land Transfer Tax | $0 |

The municipal land transfer tax for a first-time Toronto home buyer would be $0. Since the provincial portion is the same calculation, the total land transfer tax would be $0.

| Purchase Price of Home | |

|---|---|

| Combined Land Transfer Tax | $175 |

How Can We Help

As mortgage brokers, we can:

- Apply for all the grants youre eligible for

- Make the entire end-to-end process simpler for you

- Help you get a on your home loan

- Make finding a property easier with suburb reports, and property reports of your choosing

- Help you through settlement and beyond.

Please speak with one of our specialist mortgage brokers by giving us a call on 1300 889 743 or by filling in our to buy your first home.

Recommended Reading: Harford County Government Job Listings

How Do Mortgages Work

In the simplest terms, mortgages are basically large loans from banks or financial institutions. Its just another way to borrow money.

For example, if you borrow $200,000 at 3.00% APR, you will pay approximately $6,000 per year for the ability to have $200,000 to purchase a house to live in. This is why mortgage rates are so important, because the higher your mortgage rate, the more money you will pay in the long-run.

Two Home Buyer Programs: Which Is Right For You

TSAHCs mortgage loans with down payment assistance are offered through the following programs. You dont have to be a first-time home buyer to use either program!

Homes for Texas Heroes Program

If youre in a hero profession, this is the home loan program for you. Hero professions include:

- Professional educators, which includes the following full-time positions in a public school district: school teachers, teacher aides, school librarians, school counselors, and school nurses

- Police officers and public security officers

- Firefighters and EMS personnel

- Correction officers and juvenile corrections officers

- Nursing faculty and allied health faculty

Home Sweet Texas Home Loan Program

If you dont qualify under one of the professions listed above, this is the best program for you.

You May Like: How Do You Get A Free Government Cell Phone

American Dream Downpayment Act Or 529

- Status: Introduced to the House

- Originally Introduced: February 25, 2021

- Latest Action Taken: August 2, 2022 Introduced in the U.S. Senate

The American Dream Downpayment Act authorizes a tax-advantaged downpayment savings account. Its based on Internal Revenue Code Section 529, which permits tax-advantaged tuition savings accounts. The American Dream Downpayment Act would occupy section 529 of the tax code and creates savings accounts for buying a home.

Cash added to a 529 down payment savings account can be withdrawn with no taxes due on gains.

Withdrawals from a 529 are allowed at any time so long as proceeds are used toward the purchase of a home. This includes, but is not limited to, making a down payment, paying for mortgage and real estate closing costs, paying state and local taxes, and paying other home-buying expenses due at closing.

- Contributions must be cash

- Contribution total limit is $129,400

- Contribution limits adjust with inflation

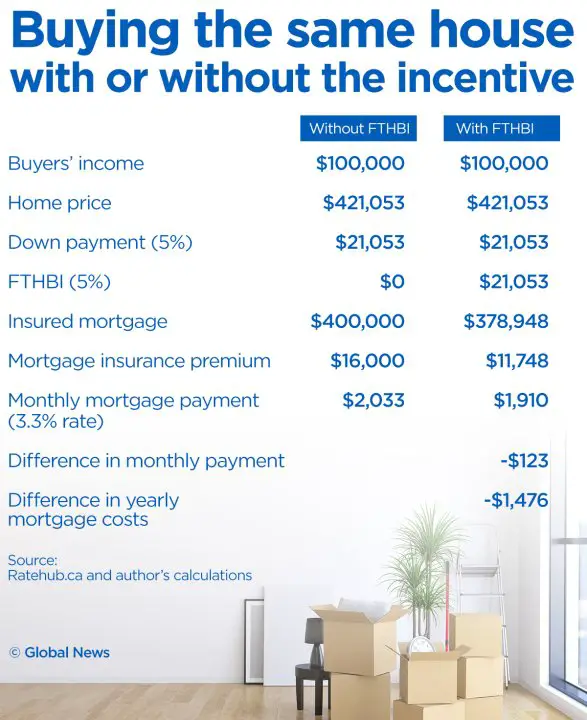

How Does It Work

Suppose you have met all the requirements and have received a 5% incentive. If your home is valued at, say, $200,000, then the 5% incentive would equate to $10,000. If the value of your home rises to $300,000, your payback would work out to 5% of the present value .

On the other hand, if you receive a 10% incentive of the homes buying price of $200,000, and the value of the home decreases by $50,000, the repayment value would work out to 10% of the present value .

Also Check: Blue Cross And Blue Shield Government

Get Help With Your Home Purchase

Buying your first home can be challenging, especially when it comes to getting approved for a mortgage and coming up with the down payment.

Thankfully, Uncle Sam has first-time home buyer government programs that can make it easier to get into your new home.

Dig deeper and find out about various loan options, state-run mortgage programs, down payment assistance, and other resources available to eligible buyers.

In this article

Down Payment Assistance : What Is It

If you qualify for our programs, TSAHC will provide you with a mortgage loan and funding to use for your down payment. You can choose to receive the assistance as a grant or a deferred forgivable second lien loan . If youre eligible, you can essentially receive free money to help you buy a home. To qualify, you must have a credit score of 620 and meet certain income requirements.

Don’t Miss: Government Grant Programs For Small Business

So What Government Programs Are Available For First Time Home Buyers

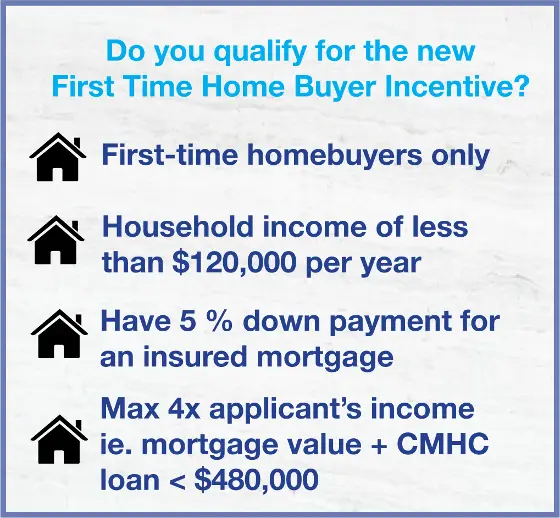

Fortunately, there are many government programs that are designed to help make home ownership more within the reach of First Time Home Buyers. These programs aim to help you with both your down payment, and your monthly cash flow. Heres a summary:

| Government Programs | Canadas First Time Home Buyer Incentive | Land Transfer Tax Rebate | Home Buyers Plan |

| What is it? | Refund on Tax Payable to the Province and the City | Tax-free RRSP withdrawal | |

| How does it help you? | It helps with your down payment and on-going cash flow | It reduces closing costs | It helps you with your down payment by making it tax-free |

Although all three programs aim to help First Time Home Buyers, the definition of a First Time Home Buyer is different for each program. And so is the eligibility criteria. Lets look at how you use those programs to super charge your first home purchase.

Right To Buy And Right To Acquire

Right to Buy is only available if you live in England or Northern Ireland. If youre a council house or housing association tenant, it allows you to buy the property at a discount.

If you live in England and dont qualify for Right to Buy, you might be able to get a smaller discount under the Right to Acquire scheme.

Find out more in our guide Right to Buy scheme: England, Wales and Northern Ireland

If you live in Northern Ireland and have been a Housing Executive or housing association tenant for five years or more, you might be able to buy the property at a discount. The amount of discount you’ll get increases depending on how long you’ve lived in the property.

The maximum discount available to Housing Executive or housing association tenants applying to buy their home is £24,000. Your discount will be 20% if youve lived in the property for five years. Youll get an extra 2% discount for every extra year, up to a maximum discount of 60% of the valuation or £24,000.

Don’t Miss: Government Help For First Time Buyers

Paying Off The Fthbi After 25 Years Of Ownership

Another example: You hit the 25-year mark in the same Vancouver condo and its time to pay back your FTHBI loan, so you get a home appraisal to determine the propertys fair market value.

If it appraises at $1,000,000, youd be required to pay back $50,000 instead of the $25,000 you originally borrowed through the FTHBI program.

Paying back more than what you borrow is bound to sound iffy to some people, but the program isnt intended to help home owners maximize their profits. Its about getting first-time buyers into a home when there are few other options. The FTHBI is really a second mortgage on your property, and mortgages arent free.

How To Apply For The First

After getting pre-approved for a mortgage and finding a home youd like to purchase, fill in the forms found on the FTHBI website. Give the forms to your lender, who will submit them on your behalf.

If your application is successful, youll then phone the closing service provider, FNF Canada, at 1 844-4535 to initiate your Incentive at least two weeks prior to the closing date of your home purchase, by giving them the contact information for your lawyer/notary.

You May Like: What Is The Relationship Between Corporate Governance And Social Responsibility

Fha Alternative: Homeready And Home Possible

Note that FHA isnt the only low-down-payment loan option available.

Fannie Mae and Freddie Mac two government-sponsored enterprises each offer a mortgage program with just 3% down. Fannie Maes low-down-payment option is called HomeReady and Freddie Macs is called Home Possible.

Though these arent technically government mortgage loans, they offer many similar benefits, such as flexible credit score and income guidelines. They also have reduced private mortgage insurance premiums, which means you might pay a lot less in mortgage insurance costs on a HomeReady or Home Possible loan than an FHA loan.

These programs are definitely worth exploring if youre considering an FHA mortgage.

Lifetime Individual Savings Account

You can use a LISA to buy your first home or save for later life. You must be aged between 18 and 39 to open a LISA.

You can put in up to £4,000 each year, until youre 50. You must make your first payment into your ISA before youre 40. The government will add a 25% bonus to your savings, up to a maximum of £1,000 a year.

If youre buying with another first-time buyer who also has a LISA, you can both use your LISA towards the same property.

Be aware that theres a penalty for taking money out of a LISA if youre not putting it towards a deposit or withdrawing after age 60.

Find out more in our guide Lifetime ISAs

Recommended Reading: How To Get A Us Government Job

Size Up State Programs

Many statesfor example, Illinois, Ohio, and Washingtonoffer down payment assistance for first-time homebuyers who qualify. Typically, eligibility in these programs is based on income and may also limit the price of the property purchased. Those who are eligible may be able to receive financial assistance with down payments and closing fees as well as costs to rehab or improve a property.

From Grants To Tax Breaks Incentives Abound To Help Achieve Ownership

A Tea Reader: Living Life One Cup at a Time

Homeownership remains a vital part of the American dream. Maybe that’s why there are a host of incentives designed to make it easier for first-time homebuyers to afford a place. These incentives include federal and state grants, tax credits, and other options. Even if you’ve owned a home in the past, you may qualify for these programs if you meet specific guidelines.

Don’t Miss: Government Housing In Phoenix Az

Government Of Canada Homebuyer Incentives And Rebates

Purchasing a home can be both exciting and overwhelming. The Government of Canada offers a number of financial incentives to help you throughout the homebuying journey. Incentives for first-time buyers, tax credits, rebates and other programs are available. Find out which incentives might be right for you.

Who Qualifies For First

You cant get first-time homeowner benefits if you own a rental or investment property, even if you dont live in it.

If you opt for a government-backed loan like a USDA loan, VA loan or an FHA loan, note that your home also has to meet certain higher safety standards before you qualify. Local and state government programs also tend to have income restrictions.

Tax deductions and employer-sponsored programs are often more flexible. You can deduct your mortgage insurance on your personal home even if you have other properties up to the limits mentioned earlier.

Employer-sponsored programs are entirely up to the discretion of the employer and state sponsor if there is one. Many state-employer partnership programs also use the previously mentioned 3-year rule for deciding who is and who is not considered a first-time home buyer.

Some buyers believe that they might not qualify for first-time buyer programs. If you arent sure whether you qualify, the best thing to do is talk to a Home Loan Expert at Rocket Mortgage. They can take a look at your unique situation and point you in the right direction.

Also Check: State And Local Government Jobs

Down Payment Assistance Mortgages

Down payment assistance mortgages are loans that replace a home buyers typical cash down payment with borrowed money at favorable terms.

Access to down payment money at below-market mortgage rates is one form of down payment assistance. Instead of making a down payment using cash from a bank account, home buyers borrow money from a bank at 1 percent with ten years to pay it back.

Deferred mortgages are another form of home buyer down payment assistance.

A deferred mortgage is a loan that requires no repayment while you still live in the house that you bought. You repay the deferred mortgage only when you sell your home or refinance it.

For example, lets say you borrow $25,000 for a down payment using a deferred mortgage and choose to sell in five years because your homes value doubled. After your closing, you pay the $25,000 back to the lender and keep the rest of the profit for yourself.

Typically, down payment assistance mortgages are available through local foundations and municipal governments only. Theyre often limited to first-time buyers whose income falls below area averages and whose credit history shows a decent record of on-time payments. Learn more about down payment assistance programs.

Find out if youre eligible here.

Can I Apply For Multiple Government Grants And Schemes

Yes, you can if youre eligible.

For example, an eligible first-home buyer can technically apply for and qualify for the First Home Owners Grant and the First Home Guarantee, while paying no stamp duty.

Since each government grant/scheme has its own eligibility criteria and timelines, qualifying for them all is challenging, so, please speak with one of our specialist mortgage brokers to determine how best to proceed.

Call us on 1300 889 743 or fill in our.

You May Like: How To Get Government Cash Assistance

How Can One Apply For The Incentive

You can apply once you have been pre-approved for a mortgage, found the home to buy, and met the incentives qualifying criteria. Homevest can help advise you on finding a home that suits your needs. We can also help you get the best mortgage rates and negotiate on your behalf so you can have a great chance of qualifying for your dream home!

When it comes to applying for the first-time homebuyer incentive, youll need to simply fill out two application forms. That is, the FTHBI SEM information Package and the SEM Attestation and Consent Form. After youre done, theyre given to your preferred lender. The lender will then submit your application on your behalf. But dont worry, we can help you through this process!

Letting For Longer Than 2 Years

You may be able to let out your First Home for longer than 2 years if:

- the location of your job changes

- a marriage or long-term relationship ends

- youre moving to get away from a situation that involves domestic abuse

- youve been made redundant

- youre caring for a relative or friend

You can ask the local council. You may also need to ask your mortgage lender.

Don’t Miss: Gartner Data Governance Maturity Model

Down Payment Assistance Programs

The money you put “down” or the down payment on your home loan can be one of the largest hurdles for many first-time homebuyers. That’s why CalHFA offers several options for down payment and closing cost assistance. This type of assistance is often called a second or subordinate loan. CalHFA’s subordinate loans are “silent seconds”, meaning payments on this loan are deferred so you do not have to make a payment on this assistance until your home is sold, refinanced or paid in full. This helps to keep your monthly mortgage payment affordable.

MyHome Assistance Program CalHFA Government Loans : MyHome offers a deferred-payment junior loan of an amount up to the lesser of 3.5% of the purchase price or appraised value to assist with down payment and/or closing costs.

CalHFA Conventional Loans: MyHome offers a deferred-payment junior loan of an amount up to the lesser of 3% of the purchase price or appraised value to assist with down payment and/or closing costs.

Forgivable Equity Builder Loan Home equity has proven to be one of the strongest ways for families to build and pass on intergenerational wealth and CalHFA is committed to improving equitable access to homeownership for all Californians. The Forgivable Equity Builder Loan gives first-time homebuyers a head start on this with immediate equity in their homes via a loan that is forgivable if the borrower continuously occupies the home as their primary residence for five years.