Releasing Your Student Record

Temple University, Japan Campus follows both U.S. and Japanese regulations – the U.S. Family Educational Rights and Privacy Act and Japanese privacy law. Therefore, TUJ cannot disclose a student’s educational records without written consent. In order for TUJ to process a student’s financial aid application, it is important that students complete the procedures below.

Returning Of Federal Student Aid

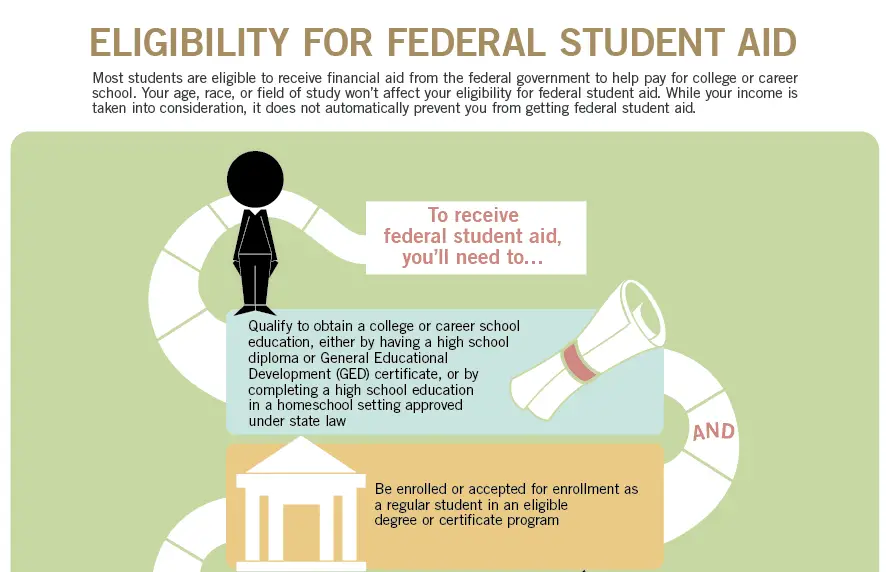

All Federal Student Aid programs are governed by the Higher Education Act . These are known as Title IV Programs.

FSA funds are given with the expectation that the recipient will complete 100% of the semester. In general, the law assumes that a student “earns” federal student aid awards in proportion to the number of days in the term the student completes. When a student fails to complete any course in a given semester, due to either withdrawing or failing, a school must determine how much aid the student is entitled to receive. Any funds determined to be unearned must be returned the FSA program. This may result in the student owing money to the college.For example: If a student completed 30% of the semester, then 30% of the federal aid originally awarded is “earned”. This means that 70% of the student’s scheduled or disbursed aid remains must be returned to the FSA programs. Federal aid that must be returned is referred to as “unearned”.

A student must complete more than 60% of the semester to earn 100% of the federal aid awarded. This does not mean the student will be entitle to all the federal aid awarded if the student withdraws before aid has been disbursed.

Overview Of Your Data Rights

Your data rights for personal data where we are the data controller.

You can review and enforce your personal data rights through your account, communications you receive from us, third party mechanisms, or with the assistance of our support team using the emails at the end of this Policy. For instance, you can:

Your data rights for personal data you submit to our Customers.

Upon making your personal data available to an employer , your personal data may be controlled by our Customer. In this regard, we are a data processor for personal data Customers maintain have us process, and your data rights are subject to our Customers internal policies. For these reasons, we are not in a position to directly handle data requests for personal data controlled by Customers. You should contact the Customer regarding personal data they may hold about you and to exercise any data rights you may have. We will cooperate with such inquiry in line with applicable law and our contractual obligations with the Customer.

You May Like: How Much Does Government Disability Pay

Prepare Yourself And Your Family

-

Make sure your state ID or drivers license is current and available. Shelters and assistance programs may have strict ID requirements.

-

If possible, store your belongings. Shelters have limits on how much you may bring.

-

Arrange for your mail to be delivered somewhere or talk to your local post office. Many have special services for people who are homeless. You may be able to get a free P.O. box or receive general delivery service.

-

Pack a bag for yourself and each member of your family.

-

Keep important documents and needed medications with you.

Your Nevada Privacy Rights

A sale under Nevada law is the exchange of personal data for monetary consideration. We do not currently sell personal data as defined under Nevada law. If you want to submit a request relating to our compliance with Nevada law, please contact us at the privacy support emails listed at the end of this Policy.

Recommended Reading: How Does The Government Monitor Social Media

How The Module Works

The interactive module contains short, self-study sections with information you must read before you start your OSAP or OSAP for Micro-credentials application. At the end of each section, you will be asked to answer a question about what youve just read.

Correct answers let you move to the next section of the module. When youve finished the information module, your OSAP or OSAP for Micro-credentials application will open.

You can log in and out of the module at any time, and your progress will be saved.

If you choose to complete the module in one sitting, it will take you approximately 15 minutes.

Only full-time students making their first OSAP application for the 2020-21 or 2021-22 school year need to complete this module. If you choose to reapply to OSAP for the 2020-21 or 2021-22 school year, you will not need to complete this module again.

Advance Child Tax Credit

Even if you dont pay any taxes, you may qualify for a refund of the CTC.

The CTC was expanded under the American Rescue Plan Act of 2021 for tax year 2021 only. If you are eligible, you will begin receiving advance Child Tax Credit payments on July 15. The payments will continue monthly through December 2021. Under ARPA, families are eligible to receive:

- Up to $3,000 per qualifying child between ages 6 and 17

- Up to $3,600 per qualifying child under age 6

The Internal Revenue Service began sending out letters in early June to more than 36 million families who may be eligible for the monthly payments. Most families do not need to do anything to get their payments, as long as theyve filed their 2020 or 2019 tax return. Learn more about the letter and how it can help you determine your eligibility.

You May Like: Can A Bank Put A Hold On A Government Check

Learn About The Types Of Food You Can Buy With Snap Benefits

If youre eligible, you can purchase food using benefits that are issued to you monthly. You can use your SNAP benefits to buy a variety of foods for your household, including:

-

Fruits and vegetables

-

Dairy products

-

Breads and cereals

See the United States Department of Agriculture’s list of foods and products you can buy using SNAP benefits.

Search For Financial Assistance From The Government

Benefits.gov is a free website that can help you determine which types of government assistance you might qualify for. You can also find out how and where to apply.

-

Using the Benefit Finder, answer questions about yourself and your needs. Afterwards, you can find out if youre eligible for programs to help you pay for:

-

Food

-

Housing

-

Utilities, and other necessities

Check back with Benefits.gov in the future to see if youre eligible for additional benefits. You can report major life events or see if new benefit programs have become available.

You May Like: Bucks County Pa Government Jobs

When Will You Know How Much You Will Receive

You will eventually receive a financial aid award letter from all colleges you applied to via your FAFSA or your CSS Profile. When the letter will arrive depends on the school, but generally, you can expect it at about the same time you receive your acceptance letter from that school.

The amount of aid offered can range from zero to the full cost of attending college. It will be broken down into three categories: free money you don’t have to pay back, earned money , and borrowed money .

How Is Financial Aid Awarded

Most of the details of obtaining financial aid take place at the college or university level. Importantly, while there are lots of similarities in the ways colleges award aid, each school has its unique process when it comes to open dates, deadlines, procedures, and the actual awards process.

It’s especially important to understand the differences between scholarships, grants, and loans when you read your financial award letter. Some schools, for example, promise to cover 100% of your financial aid needs but do so by including student loans.

Others package financial aid with no loans and some even raise your financial aid package each year to cover tuition increases. It pays to know not only what you will get but also how it will be packaged. A big part of the financial aid awards process has to do with you and your family’s ability to pay for collegethat is, your expected family contribution .

Keep in mind, however, that beginning in July 2023, the term “student aid index” will replace EFC on all FAFSA forms. In addition to some changes in the way the SAI is calculated, the change attempts to clarify what this figure actually isan eligibility index for student aid, not a reflection of what a family can or will pay for postsecondary expenses.

Also Check: Free Government Laptops Application Form 2021

Find Your Loan Servicer

If you don’t know whether your mortgage is federally backed, see a list of federal agencies that provide or insure mortgages. You can also check the Fannie Mae loan lookup and the Freddie Mac loan lookup to see if either one owns or backs your mortgage. Together, Fannie Mae and Freddie Mac own nearly half of all mortgages in the U.S.

Types Of Financial Aid

There are several types of financial aid availablesome are better than others. Here, I’ll go over all the major types of financial aid, their perks, and their drawbacks.

Grants

Grants are lovely little monetary awards that you don’t have to pay back. For this reason, they are awesomeif you get a grant, you are literally getting free money.

The catch? They’re usually based on your financial need. Free money is generally hard to come by, so eligibility criteria for grants tend to be stricter than for loans.

Student loans can be important financial assets, as long as you can support the monthly payments after graduation.

Loans

A loan is a sum of money that is given to you when you need it which you pay back after graduation. You also pay back an additional percentage of money, known as interest.

Loans can be really helpful, but also a burden post-graduation if you take on a lot of student debt. Some loans are better than others: for example, loans that are subsidized or have low-interest rates, subsidized loans are generally preferable because you end up paying less in the long run. To learn more about these types of loans, read our guides to the Perkins and Direct Subsidized loan programs.

Scholarships

Scholarships, like grants, are sums of money that are awarded to you to help pay for school. They’re a bit different from grants and loans in a few important ways, so I won’t spend much time addressing them in this post.

Read Also: Government Help Small Business Startup

What Happens After I Submit An Application

After you submit your application for funding, it is assessed. StudentAid BC assesses your financial need considering allowable costs and resources and determines whether or not you will receive funding.

You will receive a notification of assessment that tells you how much funding you will get. If you applied for assistance for full-time studies you can also check the status of your application online .

The receive your funding section describes the steps you need to take to use your funding to pay for school.

If you do not receive funding, you can appeal your assessment.

Types Of Student Loans

Student loans are from the federal government or from private sources, such as a bank, credit union, state agency, or school. Learn the differences between federal and private loans before considering a loan.

Federal Student Loans

If you need to borrow money to pay for college or career school, start with federal student loans. Theyre more affordable than private loans.

Types of Federal Student Loan Programs – The William D. Ford Federal Direct Loan Program offers four types of Direct Loans:

- Direct Subsidized Loans are made to eligible undergraduate students based on financial need.

- Direct Unsubsidized Loans are made to eligible undergraduate, graduate, and professional students, and are not based on financial need.

- Direct PLUS Loans are made to graduate or professional students and parents of dependent undergraduate students.

- Direct Consolidation Loans allow you to combine all of your eligible federal student loans into a single loan with a single loan servicer.

Eligibility – You must be enrolled at a school that participates in the school loan program, and meet the general eligibility requirements.

How to apply – Complete the Free Application for Federal Student Aid or FAFSA. Watch this video to learn more about what happens after submitting your FAFSA.

Private Student Loans

Read Also: How To Join The Government

Learn About The Childrens Health Insurance Program

If your income is too high for Medicaid, your child may still qualify for the Childrens Health Insurance Program . It covers medical and dental care for uninsured children and teens up to age 19.

Is my child eligible for CHIP?

CHIP qualifications are different in every state. In most cases, they depend on income.

How do I apply for CHIP benefits?

You have two ways to apply for CHIP:

-

Fill out an application through the Health Insurance Marketplace.

What else do I need to know about CHIP?

-

You can apply for and enroll in Medicaid or CHIP anytime during the year.

How Will You Find Out What Financial Aid Youre Awarded

Shortly after you receive your college acceptance letter, youll receive a financial aid award letter outlining the federal grants, loans, and work-study youve been granted.

The letter will also include any aid youre eligible for directly from the school.

In the case of private aid, the timeline and means of communication will depend on the organization.

You May Like: Government Job Openings In Atlanta Ga

Check In With The Financial Aid Office

See if they can work with you on your financial aid package. Don’t treat it like a bidding warfor example, going to a school with another college’s financial aid package and demanding they match it won’t generally fly. Tell them that you’re grateful for the package, but as is, your family can’t afford it.

Take this opportunity to explain any extenuating circumstances or hardships that make paying for college difficult. Bring concrete numbers and calculations to back up your claims, and be prepared to discuss what you can afford.

The Financial Aid Application Process

The process is so much more manageable if we break it down step by step.

So you have a good idea of the financial aid basicsyou know all about the types of financial aid and their various sources. The next step? Actually learning how to apply for financial aid!

The process and timeline will be a bit different for everyone, but here I’ll focus on the process for first-time college freshmen who are proactive about applying for financial aid. It’s generally better to apply earlier rather than later for financial aid programs because some programs run out of funds. One notable example of a program with limited funds is the Perkins loan program.

You generally don’t have to worry about the financial aid application process until the bulk of your college application work is done. Here, I’ll outline a comprehensive financial aid process in chronological order of applications you should completethe CSS/Financial Aid Profile is listed first because you might have to complete it while working on some college apps .

Recommended Reading: How Much Does The Federal Government Spend

Look For Additional Aid

If there are any gaps to fill in financing your education, now is the time to seek out additional aid.

In many cases, that will mean applying for private student loans to help cover your remaining costs.

You can also research additional sources of grants and other funding for students with financial need.

Check out local resources as well, to see if any local businesses or nonprofits are offering aid you may qualify for.

Simple Guide: How To Apply For Financial Aid

You’ve taken the SAT or ACT . You’ve researched a list of safety, target, and reach schools. You’ve written what seems like 100 college essays, and nailed down several letters of recommendation. You think you finally have a minute to take a breather, and then you remember: you have to figure out how to pay for all of this!

Most students know that financial aid is an option, but the whole financial aid application process can be confusing. What counts as financial aid? Where do you get it? What’s the typical application process like? How much can you get? It’s enough to make your head spin, especially if you don’t have much guidance on the subject.

In this post, I’ll answer all those questions to start you off on the right foot. Heading off to college should be an exciting new adventure, not a stressful financial burdenthis guide will help you get all the financial aid you need to make this upcoming college transition a pleasant one.

Before we jump into that, though, I’ll talk more generally about college expenses and overarching financial aid strategy.

Recommended Reading: Solar Panels For Your Home Government Incentives

Gathering The Documents Needed To Apply

- Your Social Security Number

- Your Alien Registration Number

- Your federal income tax returns and W-2s from two years prior, and other records of money earned.

- Bank statements and records of investments

- Records of untaxed income

- An FSA ID to sign electronically.

Your on-line FAFSA is not complete until you submit it and view the confirmation page . You can also print out the confirmation page and keep for your records.

If you require help completing the FAFSA, you can sign up for a session at our office by clicking the button below, contact us at , or text 50056 with your questions and a LOSFA representative will assist you.