Help Paying For The Phone And Internet Bill

You can also get help paying for telephone service and even Internet in the United States. Many organizations provide services for free or very low costs. Lifeline is one of the best-known, since it has an alliance with the federal government. Other companies, such as Comcast, sell laptops and desktops for a few hundred dollars in addition to offering high-speed Internet at a low price.

Also Check: List Of Government Programs For Minorities

Personal Loans For Low Income Earners

Join millions of Canadians who have already trusted Loans Canada

Being a low income earner, having an unfortunate credit history or having to deal with financial issues doesnt mean that you need to settle when it comes to applying for a loan. Its common for people currently dealing with these situations to think that they only have one option and thats a high cost loan that doesnt even begin to cover their needs. We want you to know that you have many options and should not under any circumstances settle for less money or more fees than you are willing to take. Personal loans for low income earners are designed as alternatives to high cost low value credit products like high interest credit cards and payday loans. They are one of the best options for those who need access to fair and affordable credit.

Trying to get out of debt fast with a low income? Check this out.

Be Aware Of Predatory Lenders

Unfortunately there are countless predatory lenders out there willing to take advantage of people like you who are in need of help. Personal loans for low income individuals and families are available quickly and with reasonable rates but dont get fooled by too good to be true promises and over the top claims. You probably wont be able to find a legitimate private lender who can offer you the world but you will find one who can offer you an affordable loan with reasonable rates thats tailored to your specific low income lifestyle.

Don’t Miss: Government Scheme To Clear Debt

Advantages Of Mortgages For Low Income Earners

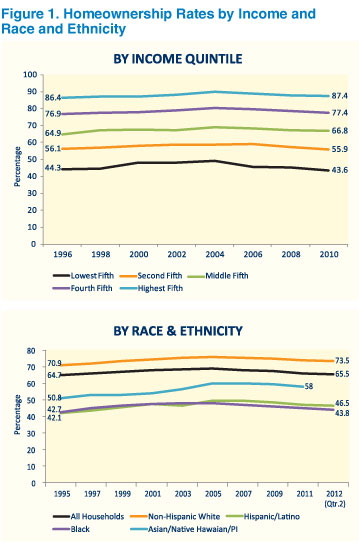

Home ownership is often referred to as the American Dream, and in many cases, it is. Sometimes, however, the achievement of owning a home may seem out of reach, particularly for low income earners and for those who have experienced homelessness. If you are living paycheck-to-paycheck, you may find it difficult to save money and plan for owning a home. There are however advantages to getting on the property ladder. They include:

EquityA mortgage allows you to purchase a home on credit. Since, over time, most properties increase in value, every dollar you pay into your home has the potential to grow. By the time you are done paying off a 30-year loan, your property’s value may grow by 50 to 100 percent, or even more. This is not a guarantee sometimes property values decrease, and there is no way to predict whether the homes in your area will increase or decrease in value. It is the general trend, however, for homes to increase in value over many years.Independence

Increased Self-EsteemIf you are buying your home after living in substandard rental housing or transitioning from homelessness, home ownership can give your self-esteem a large boost. Home ownership, particularly when it follows tough times, such as unemployment or homelessness, is something that you can take pride in.

Special Local And National Programs

Both the Federal government and local agencies have put in place programs to help both low income earners and the homeless pursue home ownership. Your housing or financial counselor can help you determine which of these and others you qualify for.HUDThe U.S. Department of Housing and Urban Development, also called HUD, helps people to find affordable housing. HUD offers several programs for people, generally those who earn a low income, to become homeowners. HUD also offers programs for those who need rental assistance. These programs help people who are not ready for home ownership to find affordable housing through subsidized or low-cost rental options.If you are currently renting your home through public housing, HUD may make it possible for you to own your current apartment or house. Your local public housing agency has more information on whether that is a feasible option for you. You also may qualify for HUD-sponsored vouchers to buy a home other than the one in which you live currently, particularly if you live in Section 8, or public, housing.

Recommended Reading: Federal Government Money Assistance Program

Payday Loans & Auto Title Loans

While a payday loan might seem like a good idea when you need money fast, high interest rates make it difficult for many people to pay off what they owe.

With an auto title loan, you use your car as collateral, and if you cant pay it back, you lose your card. We dont recommend payday loans or auto title loans.

Recommended Reading: Dental Grants For Seniors

Get Your Credit Score In Order First

Having a good credit score will massively increase your chances of getting approved for a good loan, as your credit score is a summary of your borrowing dependability. Based on the different credit agencies used, the credit score bands are as follows:

| Equifax |

|---|

- Not maxing out credit cards keep your spending to 30% of your

- Not applying for too many cards and loans

Don’t Miss: Government Funding For Home Improvements

Help Only Comes To Those Who Ask For It

Now that you know about these homeownership programs, be sure to ask your Realtor, real estate agent, or housing authority about those that might apply to you.

Some people with lower incomes can buy a home despite paying nothing out of pocket up front.

Between down payment assistance, concessions from sellers, and other programs like Community Seconds, you could buy a home with very little money saved up, as long as your income and credit fall within the program guidelines.

Government Health Care Assistance Programs

A number of state programs, pharmaceutical companies, local health clinics, and similar organizations offer assistance with paying medical bills. This is by no means the only option available. In addition, there are federal health programs, ranging from Medicaid to Childrens Health Insurance Program .

There are also many organizations that assist citizens in paying medical bills and in buying prescription drugs.

It is important to remember that several states have passed laws protecting consumers against abusive or aggressive medical debt collection practices. Clinics and offices must also charge patients for health care at fair prices, as determined by these regulatory bodies and current government regulations.

Medical consultations or procedures are not the only services eligible for grant funding. There are also state, federal, and local programs that provide prescription drug assistance. People can obtain their prescription drugs for free or at a large discount with these programs. As a result, the drug is delivered, coupons are exchanged for drugs, discount cards and financial assistance is provided.

Recommended Reading: Government Sponsored Hero Mortgage Program

What Is Considered Low Income In Australia

Theres no real definition for whats considered a low income, at least not in Australia. But you could go off the ATOs rules for tax offsets. It classes a taxable income of $37,500 or less as a low income eligible for a $700 tax offset, so if you earn less than this amount then you can probably consider yourself to be a low-income earner. This is considerably less than the nationwide median employee earnings of $62,400 a year, according to the ABS.

Obviously, earning $37,500 or less in a year can present issues with buying a home in todays property market. It doesnt make it impossible, but it does make it considerably harder.

Purpose Of This Guide

This guide aims to help persons of low income gain an understanding of the options available when it comes to finding affordable housing and getting a mortgage. By the end of this guide the reader should have a better grasp of the following:

- The advantages and disadvantages of home ownership for low income earners.

- How to determine whether the home you are interested in really is affordable.

- The process for finding, getting a contract on, and closing on your new home.

- The responsibility for budgeting for incidentals.

- Considerations regarding homelessness and home ownership.

- Programs that may help you achieve your dream of home ownership.

Read Also: Government Grants To Help With Bills

Homeready 3% Down Mortgage

The new HomeReady program from Fannie Mae is extremely flexible on sources of income. Applicants can use the income of household members who are not on the loan as a compensating factor. That means a family member who does not want to be on the loan can still help you qualify.

In addition, you can use boarder and roommate income, rental income from a basement apartment, and non-occupant co-borrower income to qualify.

The down payment requirement is just 3% and can come entirely from a gift or approved down payment assistance program.

Disadvantages Of Mortgages For Low Income Earners

Difficult RelocationOne of the main disadvantages of home ownership for low income earners is that you may not be able to easily relocate, should the need arise. If, for example, you receive a job offer in another city or state, you might not be able to simply sell your home, particularly if housing prices have dropped since you first took out your mortgage. Whether or not you are living in your home, you still must make your mortgage payments or risk losing your home, your equity and your hard-earned money.

It is possible that your home’s value will decrease over time. This is particularly true if you buy your home in what is called a “seller’s market,” which occurs when property values are high. If the trends change and you must sell your home during a “buyer’s market,” which means property values are low, then you might lose the equity that you have paid into your home. While this is frustrating for everyone, it may mean financial disaster for low income earners or those who have previously struggled with homelessness. If you plan on and are able to live in your house for many years, then this is less of a problem than if you need to or want to sell the house within a few years of purchase.

Also Check: 10000 Grant From The Government

Who Can Apply Am I Qualified For Grants For Home Improvement

You can apply if you meet the following conditions:

- Own and occupy the house

- Unable to get an affordable loan elsewhere

- Have a household income thats below the 50 percent median income in the area

- 62 years or older and unable to repair any loans for repair

This is also a program that grants help for seniors with home repairs. However, its not limited for the elderly as others who meet the other eligibility criteria can benefit from the programs loan.

The eligible areas for the loan are usually rural areas that have a population of not more than 35,000. You can check your home address online to determine if your area qualifies for the program

Essential Home Renovation Grant

The essential home renovation grand is also the residential Rehabilitation program. This grant is very helpful for those families who own and occupy an inadequate house. The main motive of this grant is to provide money to needy people so that they can make necessary repairs in their houses. The plant also ensures that all the necessary repairs comply with all minimum government health and safety standards. The main aim of this grant is to provide money so that they can get many facilities including structurally sound house structures such as waterproof, windproof, and weatherproof and proper drainage and proper electricity, proper ventilation, fire safety, heating facilities, and also include washroom facilities. So if you want to get help from this grant then you can apply for it.

Also Check: Government Early Childhood Education Programs

Disability Scholarships And Grants

Students with disabilities are advantaged when it comes to grants and scholarships. Since the IDEA made it illegal to segregate students with a disability, there has been a major push to offer grants for disabled students to pursue their educational goals. Not only are there grants for individual students, but the technological support that enables disabled students to participate in matters as well.

Disabled Students Allowances provide extra financial help if you have a disability or a specific learning difficulty like dyslexia. They are paid on top of the standard student finance package and dont have to be repaid. Full-time, part-time and postgraduate students can apply for Disabled Students Allowances.

Read Also: Are There Any Government Programs For First Time Home Buyers

Simplycash From American Express

With no annual fee and no minimum income requirement, the SimplyCash from American Express makes a great option. Youll earn 1.25% cash back in just about every spending category, making the card incredibly flexible in terms of earning potential.

There are also some additional perks that come with the card, including Front of the Line and American Express Experiences without the high annual fees that come with other Amex cards. Theres also travel accident insurance and purchase insurance when you charge these expenditures on your SimplyCash card.

Within the first 6 months, youll receive a welcome offer of 4% cash back, worth up to $200.

SimplyCash from American Express Main Features

- Minimum Income Requirement: None

Also Check: How To Become A Data Governance Expert

How Much Can I Borrow Towards My Home Loan With Pepper Money

Our home loan borrowing capacity calculator asks a few personal and financial questions to calculate an estimate of how much you may be able to borrow with Pepper Money. After finding out how much you could potentially borrow, you can then either speak to a lending specialist about your situation, or continue on to get an indicative interest rate online.

Find Affordable Rental Housing

People with low income Low Income: a total family income thats no more than the Section 8 low-income limit established by HUD. Individuals are considered one-person families., seniors Senior: for housing benefit eligibility purposes, a person who is 62 or older., and people with disabilities Person with a Disability: a person whose physical or mental impairment substantially limits one or more major life activities, such as eating or walking. may qualify for help from the U.S. Department of Housing and Urban Development to get affordable rental housing. HUD doesnât own rental property. It gives money to states and building owners, who in turn provide low-income housing opportunities.

Donât Miss: City Of Las Vegas Government Jobs

You May Like: Type 1 Diabetes Government Assistance

Good Neighbor Next Door

The Good Neighbor Next Door program offers unique benefits for nurses, first responders, and teachers. If youre eligible, you can buy HUD foreclosure homes at a 50% discount. Use an FHA mortgage, and you only need $100 for a down payment.

You can find the homes on the U.S. Department of Housing and Urban Development website, and you need a licensed real estate agent to put your offer in for you.

If your offer is accepted, and you qualify for financing, you get the home. The 50% discount makes homeownership a lot more affordable. The discount is actually a second mortgage. But it has no interest and requires no payments. Live in the home for three years, and the second mortgage is terminated.

What Kind Of Grants Can I Get

New construction and existing home purchases are both included in these housing grants, as are grants that cover closing costs and renovations. You can find homeowner education for free with grants that are designed to assist homeowners in managing their homes once purchased, including training you how to set up a household budget and manage your finances.

Government housing grants can be obtained for anywhere in the U.S., and in cities, suburban areas, or rural locations.

Specific types of grants can be found for:

- Mobile homes or parks

Recommended Reading: Buy Gold From Us Government

Are There Government Grants To Pay Off Debt

We all that every citizen of the country have some hopes from their government when they are in needy time and they are suffering from the financial crisis as well. Because when they have no money they have to face many life difficulties and along with them, their family also has to suffer. Even here are many situations of a persons life when he has to suffer much financial crisis and hence on a different level of their life. At that time, many people think about taking loans and debts, so that they can make some arrangements for their family, but these debts and loans are not easy to repay. So, people think about the government grants, so that they did not need to take loans from the lender. Because if they get the government grant then they did not need to repay it and they will be tension-free for returning the debt or loan.

Even the government have lots of grant programs on the various level and they help the people with their grant program. Maybe you listen about the government grants which help small businesses and subsidized healthcare centers. But the government not only has grant programs for them but also has many grants programs that help individuals with financial assistance. One just has to need to search about those grant programs or they can contact a government office in their local area and get proper information about the government grants which can help them to pay off debt.