When Do I Pay Stamp Duty

You pay stamp duty when real property used for residential or primary production purposes is transferred into your name. The transfer of real property into your name is commonly referred to as when you acquire real property.

Stamp duty must be paid before you can be registered as the owner on the Certificate of Title.

If you are using a taxpayer representative, for example, a conveyancer, to assist you with your property settlement including organising to transfer the real property into your name, they will arrange for stamp duty to be paid using your funds.

It doesn’t matter if you purchase the real property or if it gifted to you, you will still need to pay stamp duty when the real property is transferred into your name, or acquired by you, unless an exemption applies.

If you are purchasing a replacement home for one that was destroyed by bushfire, relief may be available. For more information see our Bushfire Relief page.

Federal Home Loan Bank Down Payment Assistance Program

The Federal Home Loan Bank Down Payment Assistance Program offers up to $ 10,000 in down payment and closing cost assistance to applicants who meet the program’s income requirements. This money is given as a 0% interest loan with a five-year forgiveness period. To be eligible for this program, you must be a first-time home buyer with a low or moderate income. Additionally, you must intend to make the house your primary residence.

Are There Restrictions On How I Use My First

Yes, you may use grant funds for down payment on a home, paying closing costs, reducing your mortgage interest rate, and other home purchase-related expenses.

Get pre-approved for a mortgage today.

Dan Green

Dan Green is a former mortgage loan officer and an industry expert. He’s appeared on NPR and CNBC, and in The Wall Street Journal, Bloomberg, and dozens of local newspapers. Dan has helped millions of first-time home buyers get educated on mortgages, real estate, and personal finance. Have mortgage questions? Ask Dan in the chat.

You May Like: Can You Still Buy Government Bonds

Charitable Or Nonprofit First

You might qualify for charitable or nonprofit assistance if you have low to moderate income. Charities and nonprofits are non-government organizations that can offer you educational and financial resources when you buy a home. Nonprofits usually have income qualifications that dictate who can get help.

Letting For Longer Than 2 Years

You may be able to let out your First Home for longer than 2 years if:

- the location of your job changes

- a marriage or long-term relationship ends

- youre moving to get away from a situation that involves domestic abuse

- youve been made redundant

- youre caring for a relative or friend

You can ask the local council. You may also need to ask your mortgage lender.

Also Check: Us Government Medicare Supplemental Insurance

What If The Property Is Not Used For Residential Or Primary Production Purposes

No stamp duty is liable where real property that is not used for residential or primary production purposes is transferred into your name. This includes transfer of real property used for:

- Mining and Quarrying

*where the land is within a zone established by a Development Plan under the Planning, Development and Infrastructure Act 2016 that envisages the use, or potential use, of the land as non-residential and non-primary production.

For more information on when stamp duty doesn’t need to be paid on the transfer of one of the above real property types, refer to the explanation of qualifying land on the Real Property page.

Free Iphone Under Ebb Program Free Government Iphone

Government Programs for Low-Income Families To help low-income people and protect families from poverty, the federal government administers security programs, or welfare programs. Among the benefits offered through these welfare programs are subsidies under the Affordable Care Act. Check out these government programs for low-income families for more information on all the benefits available to them.

Read Also: How To Write A Statement Of Work Government

Don’t Miss: Government Employee Discounts On New Cars

Hud Good Neighbor Next Door Program

Public servants can buy affordable homes through the Good Neighbor Next Door Program run by HUD. It is possible for them to finance properties for as little as $100 down and get them for 50% off retail. Federal Housing Administration-insured mortgages finance the foreclosed properties that are available for purchase. The HUD sells foreclosed properties once the government takes them over.

The program may be available to law enforcement officers, teachers, firefighters, and emergency medical technicians working for agencies, schools, or departments in the area where the home is located. When bidding on a Good Neighbor Next Door property, you or your spouse should have never bought a Good Neighbor Next Door home or owned a home in the past year.

After the purchase, you must certify that you will continue working as an officer of the law, a teacher, a firefighter, or an EMT, you agree to own the home and live there as your residence for three years, and that you will be there every year. A copy of the HUD certification is mailed to the homeowner annually, which they must sign and return.

First Home Owner Grant

A $10,000 First Home Owner Grant is available to those 18 years and over when you buy or build your first new home. Your first new home can be a house, townhouse, apartment, unit or similar that is newly built, purchased off the plan or substantially renovated.

For new properties the value must not exceed $600,000. For land that you plan to build on, the total must not exceed $750,000.

You also get the First Home Buyer Assistance Scheme benefits .

Read Also: Government Jobs In Titusville Fl

How To Get A First Time Home Buyers Grants

There are a number of things you have to do for you to be able to qualify for first time home buyers grants. We are going to break down some of these factors that can go a long way to determine what grants you can get, how much grants you qualify for, and how you can actually apply to get these grants for your home.

First and foremost, we have to understand who a first time buyer is. To qualify for grants meant for first time home buyers, you would have to show that you are actually a first time home buyer, and have some hard time being able to come up with the amount that you are required to have for you to be eligible to apply for these loans.

Here are some of the things you should check before you proceed:

You May Like: Can I Get A Replacement Safelink Phone

The Bottom Line: Help Is Available For Those Buying A Home For The First Time

First-time home buyers have access to many grants, loans and financial help that can make buying a home easier. First-time buying assistance can include help with down payments and closing costs, tax credits or education. You might be able to get help from your local, state or federal government if you meet income standards.

Charities, nonprofits and employer programs are also available. These programs vary by state, but you can easily find programs you qualify for through HUDs website. As a first-time buyer, you cannot have owned property in the last 3 years.

Ready to explore your options? Get preapproved now to start.

Get approved to see what you can afford.

Rocket Mortgage® lets you do it all online.

Don’t Miss: Government Grants For Handicap Vans

Homepath Ready Buyer Program

With this program, you can get up to 3% of the purchase price in closing cost assistance toward the purchase of a HomePath property. To qualify, youll need to complete a homebuyer education course.

Youre also limited in what you can buy. This program is only for HomePath properties, which are foreclosed homes owned by Fannie Mae.

First Home Super Saver Scheme

The First Home Super Saver Scheme allows first home buyers to save a deposit for their first home inside their super.

This can help first home buyers save faster with the concessional tax treatment of superannuation.

Tip: Youll need a determination letter from the ATO specifying the amount that can be released from your super to use as a deposit for a home loan.

You May Like: Can You File A Class Action Lawsuit Against The Government

Calhfa Zero Interest Program

CalHFA Zero Interest Program, also known as ZIP, is a second mortgage that can work with certain CalPLUS loans. The program makes homeownership more affordable for low-income buyers by providing borrowers with a zero-interest loan amounting to 3% of a borrowers first mortgage.

And since this is a junior loan, payments for the loan can be deferred as long as you live in your house. However, keep in mind youll have to pay for the loan if you ever default on your mortgage, sell, refinance, or transfer the title to someone else.

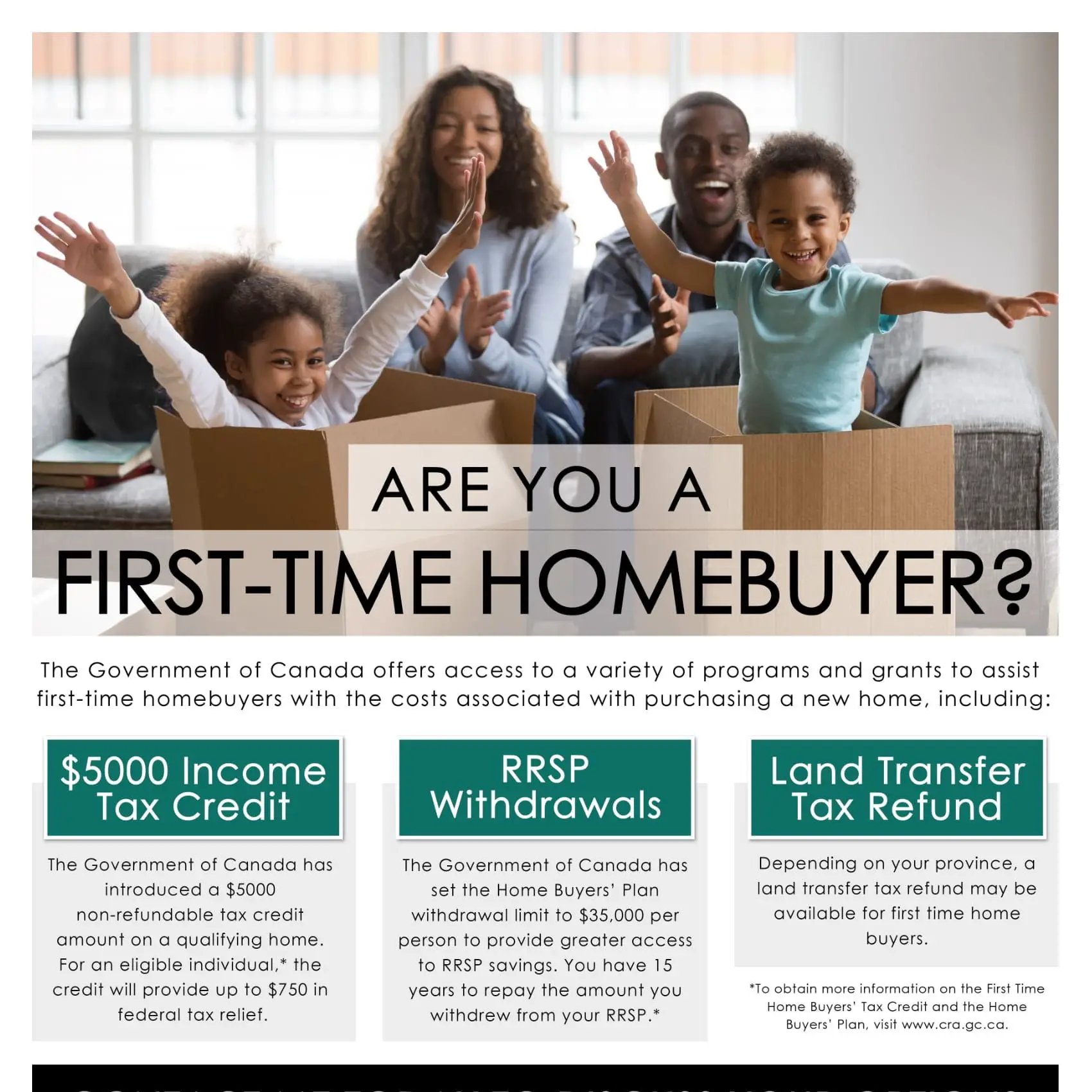

Government Of Canada Programs To Support Homebuyers In 2022

In a high-interest market, prospective buyers can use all the help they can get. Luckily, the Government of Canada offers a number of assistance programs that can make the financial pain of that big purchase a little easier to handle.

This article has been updated from a previous version.

Its no secret that Canadas housing market is feeling the effects of high inflation and interest, rebounding from low borrowing rates during the COVID-19 pandemic.

According to the Canadian Real Estate Association, by September of this year, the average home price had fallen to $640,479, a 6.6% drop from the year prior. National home sales also fell 3.9% between August and September, as many Canadians are on the fence about purchasing a home only to face high and rising interest on their mortgage.

In a high interest rate environment, prospective buyers can use all the help they can get. Luckily, the Government of Canada offers a number of homebuyer assistance programs that can make the financial pain of that big purchase a little easier to handle. Find out if youre eligible for any of the following home ownership incentive programs in Canada.

Read Also: Where Can I Cash A Government Check For Free

American Dream Downpayment Initiative

HUDs American Dream Downpayment Initiative helps first-time home buyers purchase a home with down payment assistance. Seniors with income at or below 80 percent of the areas median income can qualify for help. The senior can receive $10,000 or 6 percent of the purchase price of the home. The applicant must be a first-time home buyer or must not have purchased a home within three years of applying to the ADDI program. The grant can also be used toward paying for closing costs or home repairs. The repairs must be completed within one year of receiving the ADDI grant funds.

Video of the Day

State And Local First

Residents in every U.S. state can access first-time home buyer assistance programs through their state’s Housing Finance Agencies and other publicly and privately funded programs.

HFAs are federally funded agencies that help meet their state’s housing needs through affordable housing and community development programs. The types of assistance offered vary, but may include:

- Home purchase loan programs offering lower interest rates and low down payments to credit-worthy low-to-moderate income borrowers

- Grants and deferred-payment loans for down payment or closing cost assistance

- Mortgage credit certificates providing up to $2,000 off your tax bill for mortgage interest paid over the year

Additional sources of funding for first-time home buyers can be found through your local government and area nonprofits, so be sure to research your options.

Below are the HUD and HFA resource pages where you can learn about the homeownership assistance programs in your state and local community.

First-time buyer resources by state

| State |

|---|

You May Like: Blue Cross Blue Shield Government Providers

If You Move Within 5 Years Youll Pay Some Money Back

Real estate wealth is transformative and generational which is why the Downpayment Toward Equity Act promotes a long-term view on homeownership.

The bill requires homeowners to live in their homes for five years at minimum to maximize their grant. Buyers who change residence or sell within 60 months forfeit back a portion of their initial cash grant.

- Sell or move within Year 1: Repay 100% or $25,000

- Sell or move within Year 2: Repay 80% or $20,000

- Sell or move within Year 3: Repay 60% or $15,000

- Sell or move within Year 4: Repay 40% or $10,000

- Sell or move within Year 5: Repay 20% or $5,000

There are exceptions to the repayment rule. No repayments are required for buyers who stay in their home for at least five years.

How Can I Move Forward

USAGrantApplication.org assists you in your search for housing grants. We offer a self-help reference tool: a grant-specialized website where the nations grants and grantors are researched and catalogued, creating one site that will significantly reduce your time and effort spent looking for grant information. Our research experts are always seeking new information to add to our site so you get the most updated research. With our help, you can find and apply for free government housing grants.

Also Check: Government Jobs Winston Salem Nc

First Time Home Buyer Grants For Canadians

Alan Harder

Buying your first home is a major financial undertaking. Luckily, the government of Canada offers a variety of grants and special programs to help ease the financial strain, as a way to encourage more Canadians to take the leap into home ownership.

In this article, youll find an overview of the programs available nationwide and by province, including a description of each, whom its for, and how to apply. We welcome you to reach out to us, and we can help you make sense of the resources available to first-time home buyers.

Bc Home Partnership Program

NOTE: Applications are no longer being accepted for the BC Home Owner Mortgage and Equity Partnership, as of April 1, 2018.

Home Owner Grant

B.C. is home to some of the most high-priced real estate markets in Canada, as well as some of the steepest property taxes. Under the Home Owner Grant, you may be eligible to lower the property taxes youre required to pay on an annual basis for your principal residence.

The amount of tax relief youre eligible for depends on where you live. For instance, those residing in the Capital Regional District, Greater Vancouver Regional District, and the Fraser Valley Regional District may be eligible for a grant of $570. Home owners residing in other parts of the province may be eligible for a grant of $770.

Availability: British ColumbiaValue: Between $570 and $770

Eligibility:

- Youre the registered owner of the home and you use it as your primary residence.

- Youre under 65 years old.

- You live in B.C. and are a Canadian citizen or permanent resident.

- You currently pay at least $350 annually in property taxes.

- The value of your home does not exceed the grant threshold. In 2018, this threshold is $1.65mil, but this number is reviewed and adjusted each year.

Things to note:

How to apply: You must apply for the Home Owner Grant each year in order to receive it. You can apply online by downloading and completing the Home Owner Grant application form. You can also apply by mail or in person.

Resource: Home Owner Grant

Don’t Miss: How Can I Sue The Government

Local Grants To First

There are many state or local government grants available for first-time homebuyers. And many of these dont require any repayment if you live in your home for a certain time frame. Contact a real estate agent and check with both your state and county to learn more about what options are available to you.

Read Also: Entry Level Government Jobs San Antonio Tx

What Is Bidens $25000 Downpayment Toward Equity Act

First-time home buyers may soon receive up to $25,000 in cash to purchase a new home.

On April 14, 2021, lawmakers introduced seventeen housing-related bills.

One of the bills, the Downpayment Toward Equity Act of 2021fulfills a campaign promise from the Biden administration: To give Americans direct financial assistance to purchase quality housing.

The grant proposal, known as the $25,000 First-Time Home Buyer Grant, is one of several first-time home buyer grants and credits moving through Congress.

This article simplifies the Downpayment Toward Equity Act. We show who qualifies for the grant, how to claim it, and when you can expect to the first-time home buyer grant to be available.

Get pre-approved for a mortgage today.

Recommended Reading: Government Bonds With Highest Interest Rate

Gst/hst New Housing Rebate

People buying a new build, or even building their own home in 2022, can take advantage of the GST/HST New Housing Rebate. The rebate will cover some of the GST or the federal part of the HST you paid.

You can apply for the rebate by filling out the New Housing Rebate Application for Houses Purchased from a Builder, and filing it with Revenue Canada. Those living in Ontario also need to fill out the Ontario Rebate Schedule . If you are building your own home, youll also need to submit a construction summary worksheet. And you have to include supporting documents if a vendor didnt charge you HST or GST on your invoice.

First Home Buyers Assistance Scheme

If youre a first home buyer in NSW, you may be eligible for a full or partial exemption on transfer duty.

Key features:

- For first home buyers only.

- Available for a new or existing home, or vacant land on which you intend to build a home.

- Property value must be less than $800,000.

Main criteria:

- You must be an individual, not a company or trust.

- You must be over 18.

- You, and your spouse/partner, must have never previously owned or co-owned a home in Australia.

- Australian citizens or permanent residents only.

- You must move into the new home within 12 months after buying the property and live there for at least six continuous months.

Also Check: Open Source Software Governance And Security Controls