What Is A Treasury Bond

A Treasury bond, or “T-bond,” is debt issued by the U.S. government to raise money. When you buy a T-bond, you lend the federal government money, and it pays you a stated rate of interest until the loan comes due.

These types of securities are fully guaranteed by the U.S. government, so the probability that you won’t get your money back is extremely low.

A bond, more generally, is simply a loan that you make to a particular entity — it could be a corporation, a municipality, or, in the case of T-bonds, the federal government. You make an initial loan amount — called the principal — and receive interest payments until the loan comes due in the future or at its time of maturity. At maturity, you should receive your entire principal back plus the final payment of interest you’re owed.

Technically, all the securities discussed below are bonds, but the federal government uses the term “Treasury bonds” to refer specifically to its long-term basic security. Treasury bonds are always issued in 30-year terms and pay interest every six months. However, you don’t have to hold the bond for the full 30 years. You can sell it anytime after the first 45 days.

The related terms “note” and “bill” are reserved to describe bonds with shorter maturity lengths. Treasury bills have maturity dates of four weeks to one year. Treasury note maturity dates range from two to 10 years.

Types Of Government Bond

The terminology surrounding bonds can make things appear much more complicated that they actually are. Thats because each country that issues bonds uses different terms for them.

UK government bonds, for example, are referred to as gilts. The maturity of each gilt is listed in the name, so a UK government bond that matures in two years is called a two-year gilt.

In the US, meanwhile, bonds are referred to as treasuries. Treasuries come in three broad categories, according to their maturity:

- Treasury bills expire in less than one year

- Treasury notes expire in one to ten years

- Treasury bonds expire in expire in more than ten years

Other countries will use different names for their bonds so if you want to trade bonds from governments outside of the US or UK, its a good idea to research each market individually.

How To Buy Bond Funds

Another way to gain exposure in bonds would be to invest in a bond fund ) that exclusively holds bonds in its portfolio. These funds are convenient since they are usually low-cost and contain a broad base of diversified bonds so you don’t need to do your research to identify specific issues.

When buying and selling these funds , keep in mind that these are âsecondary marketâ transactions, meaning that you are buying from another investor and not directly from the issuer. One drawback of mutual funds and ETFs is that investors do not know the maturity of all the bonds in the fund portfolio since they are changing quite often, and therefore these investment vehicles are not appropriate for an investor who wishes to hold a bond until maturity.

Another drawback of mutual funds is that you will have to pay additional fees to the portfolio managers, though bond funds tend to have lower expense ratios than their equity counterparts. Passively managed bond ETFs, which track a bond index, tend to have the fewest expenses of all.

In addition to the Treasury, corporate, and municipal bonds described above, there are many other bonds that can be used strategically in a well-diversified, income-generating portfolio. Analyzing the yield of these bonds relative to U.S. Treasuries and relative to comparable bonds of the same type and maturity is key to understanding their risks.

Recommended Reading: Money Owed By The Federal Government

Can You Still Buy Bearer Bonds

A bearer bond is a fixed-income security that is owned by the holder, or bearer, rather than by a registered owner. Bearer bonds are virtually non-existent anymore as the lack of registration made them ideal for use in money laundering, tax evasion, and any number of other under-handed transactions. They also are vulnerable to theft.

How Do Government Bonds Work

When you buy a government bond, you lend the government an agreed amount of money for an agreed period of time. In return, the government will pay you back a set level of interest at regular periods, known as the coupon. This makes bonds a fixed-income asset.

Once the bond expires, you’ll get back to your original investment. The day on which you get your original investment back is called the maturity date. Different bonds will come with different maturity dates – you could buy a bond that matures in less than a year, or one that matures in 30 years or more.

Read Also: At& t Government Internet Program

How I Bonds Work

Think of I Bonds as flexible-term variable-rate CDs.

Youre required to hold them for at least one year. After that, you can cash out at any time youd like, or you can choose to hold them for up to 30 years from the original time of purchase. If you cash out within five years, you forfeit interest earned in the previous three months, whereas the early withdrawal penalty on a typical commercial CD is often six months or 12 months of interest. The flexibility to cash out after one year with a low early withdrawal penalty or to hang on for as long as 30 years makes I Bonds good for both short-term and long-term investing.

Similar to a CD, the value of I Bonds never goes down. Unlike a typical CD with a fixed interest rate for the entire term, the interest rate on your I Bonds changes in six-month cycles. You stay on the current rate for the full six months and then you go on a new rate for another six months, and a new rate after that for another six months, and so on.

The interest rate is guaranteed to at least match inflation. If inflation goes up, the interest rate on your I Bonds automatically goes up. Some older I Bonds earn a positive rate above inflation. The I Bonds you buy now only match inflation. Even merely matching inflation makes I Bonds attractive when other CDs and bonds dont keep up with inflation.

How To Earn 7% On Safe Bonds Your Broker Cant Sell You

I-bonds issued between now and April 30th, 2022, will earn interest at an annual rate of 7.12% over … the first 6 months after purchase.

At a time when investors worried about inflation are considering putting money into everything from bitcoin to commodities, theres an old fashionedand uber safe and simpleway to keep at least some of your cash from losing value: U.S. Savings Bonds.

The U.S. Treasury announced yesterday that I bonds issued between now and the end of next April will earn interest at an annual rate of 7.12% over the first 6 months after purchase. Thats the second-highest initial interest rate ever for these bonds.

You can purchase digital series I bonds on the U.S. Treasurys TreasuryDirect website, with a minimum investment of $25, and a maximum of $10,000 per calendar year, per Social Security number. You can cash your bonds after a year, but youll lose three months worth of interest if you cash out before youve held them for five years. Or, if inflation persists, you can choose to continue earning interest over the next 30 years, compounded semi-annually, with the rate reset every six months.

The 7.12% rate looks particularly attractive when compared with bank certificate of deposit rates, which have havent risen with inflation. Currently, the best annual interest rates offered on 1-year CDs top out at 0.65% to 0.75%, while even five-year CDs are paying at best around 1.2% a year.

Also Check: Ventura County Government Center Traffic Tickets

How To Buy Municipal Bonds As New Issues

Buying municipal bonds as new issues requires an investor to participate in an issuers retail order period. Youll need a brokerage account directly with the financial institution backing the bond issue and complete a request that indicates the quantity, coupon and maturity date of the bonds you want to purchase. You can find the available coupons and maturity dates in the bond prospectus, which is given to prospective investors.

What Type Of Bonds Are Best For Common Man

If common man decides to invest in bonds for income generation, best alternative will be tax free government bonds. Why? Because the interest income generated from such government bonds are free of income tax.

This becomes specially lucrative for those people who are in the maximum tax bracket .

Suppose there are two bonds available for investing. One is tax free bond, and the other is non-tax free bond. Generally the yield of tax free bonds is less than non-tax free bonds. Which one must select? The decision making should be done based on the following formula:

Net Yield = Bond yield *

Suppose there is a persons whose tax rate is 30%. For tax-free bonds, Net yield = bond yield. For non-tax free bonds, net yield = bond yield * = bond yield * 0.7. Example:

- Tax Free Bond

Recommended Reading: Paper Application For Free Government Phone

When Do I Get My Bond Payments

In the vast majority of cases, companies will distribute bond payments every 3 or 6 months. Once the frequency rate has been ascertained, it will never change. In theory, the value of your investment will grow at a slightly faster pace if the bonds pay out quarterly, as you will have the opportunity to reinvest the payments into other ventures.

However, the difference will be minute unless you are looking to invest a substantial amount!

Either way, the coupon payments will be transferred from the company to the broker that you bought the bonds from, and then reflected in your account. You can then reinvest them into other revenue streams like stock trading, ETFs, mutual funds, or investment trusts or simply withdraw them back to your UK bank account.

All You Need To Know About Government Bonds Purchase

3 min read.Neil Borate

- Bond yields fluctuate according to the size of the governments borrowing programme and the RBIs monetary policy outlook

The RBI, while announcing its policy statement on Friday, said it will allow retail investors to directly purchase government bonds by opening gilt accounts with it. Mint explains the current methods of buying these bonds, how they are taxed and what returns they give.

What kind of returns do government bonds give?

Aditya Birla Sun Life MF launches Nifty IT ETF all you …

The current yield on the 10-year government bond is 6.126%. In other words, if you hold the bond for 10 years, you will get a return of 6.126% per annum. The yield fluctuates according to the size of the governments borrowing programme and the RBIs monetary policy outlook.

Also Read | Vaccination drive picks up slowly

There are also government bonds of shorter tenors than 10 years such as treasury bills . These tend to have lower yields. Apart from these, you can also buy the Government of India Savings Bonds which pay a floating interest rate linked to the rate on National Savings Certificates . This rate is currently 7.15% and it is revised every six months based on the NSC rate. You can buy these Government of India Savings Bonds through certain designated banks such as SBI, HDFC Bank, ICICI Bank, Axis Bank and others.

How are returns on government bonds taxed?

What are the risks involved?

Can retail investors buy government bonds?

Don’t Miss: Government Jobs In Los Lunas Nm

How To Buy A Savings Bond

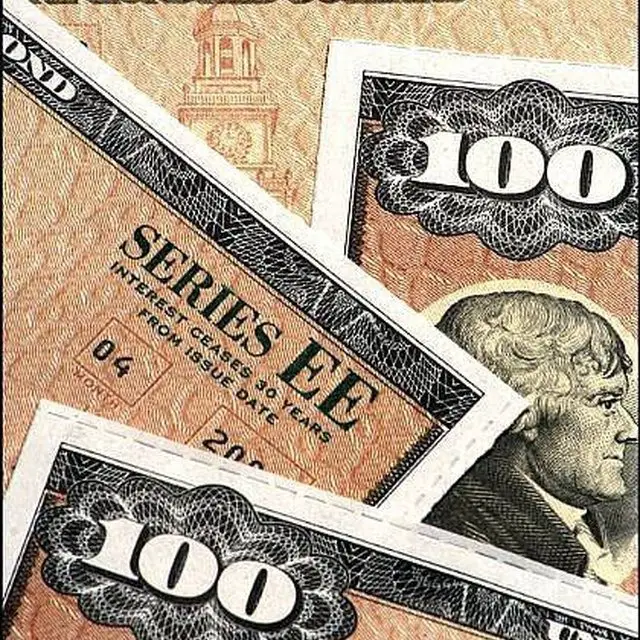

While savings bonds used to be issued on little pieces of paper, those days have come to an end. Savings bonds can now be purchased online from TreasuryDirect, the U.S. Treasurys electronic savings portfolio platform. If youre attached to paper bonds, Series I bonds can still be purchased in paper form using your IRS tax refund when you file your annual tax return.

Purchasing a savings bond is fairly straightforward. When you buy a savings bond, youll choose an amount between $25 and $10,000 and decide whether you want to buy a Series EE or Series I bond.

You will pay half the price of the face value of the bond. For example, youll pay $50 for a $100 bond. Once you have the bond, you choose how long to hold onto it foranywhere between one and 30 years. To get the full return of double your initial investment , youll need to wait the full term to the bonds maturity. While you can cash in a bond earlier, your return will be based on a maturation schedule that rises over the course of the bonds term.

The Treasury promises Series EE savings bonds will reach face value in 20 years, whereas the Series I savings bond has no guarantee of value in maturity. Keep in mind both reach full maximum value at 30 years.

Buying Bonds: Where To Begin

Buying bonds can prove a little trickier than buying stocks, because of the initial amount required to begin investing. The face value of most bonds is $1,000, though theres a way around that. You have a few options on where to buy them:

-

From a broker: You can buy bonds from an online broker. Youll be buying from other investors looking to sell. You may also be able to receive a discount off the bonds face value by buying a bond directly from the underwriting investment bank in an initial bond offering.

-

Through an exchange-traded fund: An ETF typically buys bonds from many different companies, and some funds are focused on short-, medium-, and long-term bonds, or provide exposure to certain industries or markets. A fund is a great option for individual investors because it provides immediate diversification and you dont have to buy in large increments

|

when you open and fund an E*TRADE account with code: BONUS21 |

Read Also: Government Help With Home Down Payment

Giving Us Bonds As Gifts

Savings bonds commonly are given as gifts, and you still can purchase bonds for somebody else whether you buy online or with your tax return.

To buy a bond as a gift, use your own TreasuryDirect account, and the recipient needs her own account to receive the gift. If the recipient is younger than 18, the child’s parent or guardian needs to open an account as well . In addition, you’ll need the recipient’s Social Security number when you buy the savings bond.

If the child’s parents can’t or won’t open a TreasuryDirect account, you still can purchase the bonds, hold them in your own account’s “Gift Box,” and transfer them at a later date.

Because of these limitations, buying bonds with a tax refund might be a better option if the intent is to give the bonds as a gift.

How To Buy Corporate Bonds As New Issues

For everyday investors, it can be tricky to acquire new issue corporate bonds. Youll typically need a relationship with the bank or brokerage thats managing the primary bond offering. When considering corporate bonds, you should understand the bonds rating , maturity , interest rate and how the coupon is paid . To complete your purchase, youll need a brokerage account that will cover your purchase price and any commissions your broker might charge on the acquisition.

You May Like: Government Rebate For Hybrid Cars

Traditional Bank Bonds Are Now Online

Eric is a duly licensed Independent Insurance Broker licensed in Life, Health, Property, and Casualty insurance. He has worked more than 13 years in both public and private accounting jobs and more than four years licensed as an insurance producer. His background in tax accounting has served as a solid base supporting his current book of business.

Savings bonds, once a favorite savings offering at banks and credit unions, allow you to lend money to the U.S. government. They are securities issued by the U.S. Treasury Department that provide funding dollars for government operations, and the government pays interest in return for using your money. Those instruments are still available, but theyve evolved. You can buy savings bonds online or with your tax refund, and you can still hand out paper Series I bonds as gifts. However, the process is harder than it used to be.

Sensible Replacements For Canada Savings Bonds

The 2017 federal budget brought Canada Savings Bonds to an end after 71 years. Are ETFs such as the iShares Canadian Government Bond Index ETF the solution?

Its hard to believe, but the 1981 edition of the Canada Savings Bond paid 19.5% annual interest. By comparison, the TSX lost approximately 12% that year. Investors of all stripes were buying in sales of CSBs hit a peak in 1987 when $55 billion was bought by Canadians coast to coast.

And now theyre gone.

Well, not exactly. Approximately $5.5 billion are still outstanding, but those will soon mature, leaving nothing but memories for Canadian savers.

The 2016 edition of CSBs paid a paltry 0.70%, reducing demand to a trickle and, in the process, costing the Federal Government more to carry out the annual rite of passage than it was worth, so they cut it. Goodbye, old friend. You had a nice run.

Given the rate of interest, its hard to imagine anyone buying the 2016 edition, especially Foolish readers, but some of you are income investors and genuinely interested in conservative investments that provide a reasonable stream of income.

For most of you, dividend stocks are the vehicle of choice.

However, if you do have a portion of your wealth invested in the $5.5 billion outstanding and wonder what to do with the principal once they mature, here are three sensible replacements.

iShares

The ETFs 12-month trailing yield is 2.3%.

Bank of Montreal

Vanguard

Bottom line

Recommended Reading: How To Get Government Grant Money