General Sales Tax Exemption Certificates

Please note that this chart provides a brief description of the various exemption documents. Additional requirements may apply. See the individual forms and instructions for details.

General sales tax exemption certificates

| Exemption certificate | ||

|---|---|---|

| No, but must be an agency, or instrumentality of the United States | Purchase of any taxable tangible personal property or service by a United States governmental entity | Not a Tax Department form. A copy of a contract signed by an authorized United States government official is also sufficient to show exemption. Form ST-119.1 is not valid to show exemption for governmental entities |

Note: A Tax Bulletin is an informational document designed to provide general guidance in simplified language on a topic of interest to taxpayers. It is accurate as of the date issued. However, taxpayers should be aware that subsequent changes in the Tax Law or its interpretation may affect the accuracy of a Tax Bulletin. The information provided in this document does not cover every situation and is not intended to replace the law or change its meaning.

Branches Or Divisions Filing Separate Returns

Although you have to register your business as a single entity, you can apply to have your branches or divisions file their own returns. To do this, use Form GST10, Application or Revocation of the Authorization to File Separate GST/HST Returns and Rebate Applications for Branches or Divisions.

To qualify, your branches or divisions have to be separately identified either by their location or by the nature of their activities, and separate records must be kept. The branches and divisions have to keep the same reporting periods as the head office.

Note

If you make this application and you are required to file electronically or you are required to file using a specific method, all of the branches or divisions identified in the election also have to file electronically.

How Do I Start Using The Quick Method

Before you start using the quick method of accounting, file a quick method election. To do this, use our online services at My Business Account or Represent a Client, or complete and send Form GST74, Election and Revocation of an Election to Use the Quick Method of Accounting to your tax services office.

For more information and line-by-line instructions on how to complete your GST/HST return using the quick method, see Guide RC4058, Quick Method of Accounting for GST/HST.

Also Check: Polk County Fl Forclosure

How To Provide An Exemption

As a business, when you provide an exemption to a customer you may need to request information or documentation. For information about what exemptions require information or documentation, refer to the PST Exemptions and Documentation Requirements bulletin .

It’s the customer’s responsibility to ensure they qualify for an exemption. If the customer claims an exemption that they don’t qualify for, they are liable for any tax, interest and penalties associated with the purchase or lease. However, if you had reason to believe your customer wasn’t entitled to the exemption and provided the exemption, you may also be subject to an assessment.

If your customer isn’t able to provide the required information or documentation at or before the time of the sale or lease, you must charge and collect, and your customer must pay, PST on that sale or lease. However, if your customer is able to provide the required information or documentation within 180 days of the purchase or lease, your business may refund or credit the PST charged.

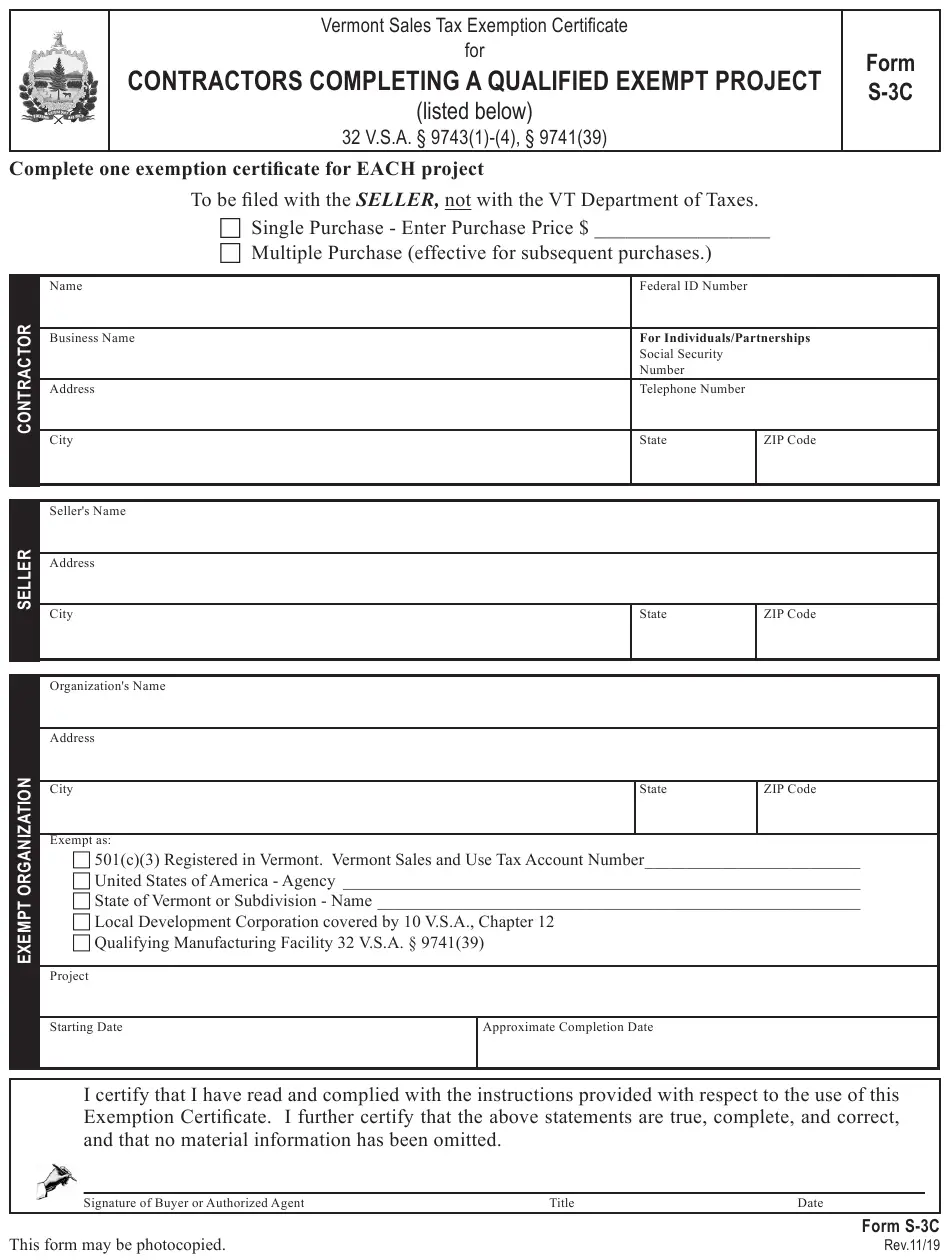

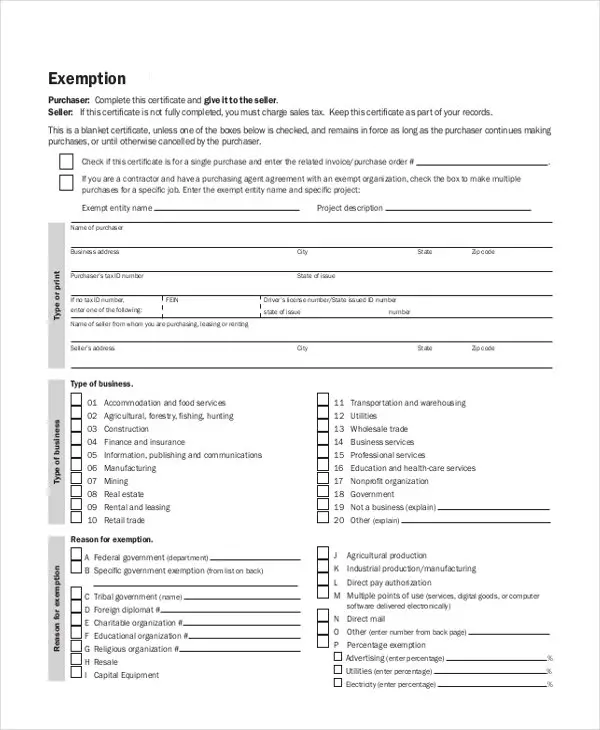

State Law Governs Exemption Certificate Requirements

In most cases, for a sales tax exemption to apply, the purchaser must present the seller with a written certificate that documents the exemption the purchaser is claiming. The seller will then be relieved from paying or collecting tax on the sale, provided the seller accepts the certificate in good faith and with a reasonable belief that the purchaser is entitled to the claimed exemption.

Some states provide specific exemption certificate forms that purchasers should use in claiming different exemptions. Other states, while not issuing specific forms, specify what information must be included in an exemption certificate. At a minimum, the certificate should include the following information:

- the date, which should predate or be the date of the sale

- the signature of the purchaser or the purchaser’s agent or employee

- both the purchaser’s and the seller’s names and addresses

- the purchaser’s business license or tax registration number

- a description of the property being purchased

- the basis of the claimed exemption

Tom owns a tire shop. The owner of a restaurant across the street provides him with a resale certificate for the purchase of some tires. Tom should ask the customer to explain how the resale of tires applies to his restaurant business. That is, Tom should require some further evidence that the restaurant owner is engaged in the retail tire business.

Read Also: City Of Las Vegas Government Jobs

State Tax Exemption Rules And Regulations

Through the Department of States Diplomatic Tax Exemption Program, the U.S. Government meets its obligations under Article 34 of the Vienna Convention on Diplomatic Relations and Article 49 of the Vienna Convention on Consular Relations, as well as other similar treaties and agreements, to provide exemption from state and local sales, restaurant, lodging/occupancy and other similar taxes charged to customers.

Generally, states, territories, the District of Columbia and localities develop their own statutes, and regulations concerning the manner in which vendors may grant such tax exemptions to foreign missions and their members.

The information below is provided to better assist vendors with understanding the applicable state and local rules and regulations concerning this issue. This listing is not exhaustive of all such statutes/regulations. Therefore, if a vendor does not find information specific to their location, they are encouraged to contact the Department of States Office of Foreign Missions or the appropriate tax authority. OFMs Headquarters, located in Washington, DC, can be reached 8:00am to 5:00pm by telephone at 895-3500, option 2 or by electronic mail at .

Schedule B Calculation Of Recaptured Input Tax Credits

Complete Schedule B electronically if you are required to recapture ITCs for the provincial part of the HST on specified property or services. For more information on recaptured ITCs, see Recapture of ITCs, and the following publication:

Line 1400

Enter on line 1400 your gross ITCs and adjustments. This is the total of all your eligible ITCs and adjustments for the reporting period before accounting for the recaptured ITCs.

Line 1401

Enter on line 1401the total of your gross recaptured ITCs next to the applicable recapture rate for each province with a recapture requirement. The recapture rate that applies to a recaptured ITC in respect of a specified property or service is the rate that applied at the time the tax first became payable, or was paid without having become payable, in respect of that property or service.

For the province of Ontario, the recapture rate is 100% for tax that first became payable, or was paid without having become payable, before July 1, 2015. For tax that became payable, or was paid without having become payable, on or after July 1, 2015, and before July 1, 2016, the recapture rate is 75%.

For tax that becomes payable, or is paid without having become payable, on or after July 1, 2016, and before July 1, 2017, the recapture rate is 50%.

Line 1402

Line 1401 will automatically be multiplied by the applicable recapture rate and the result will be entered on line 1402.

You May Like: Government Jobs Las Vegas No Experience

Gst/hst Rulings And Interpretations

You can request a ruling or interpretation on how the GST/HST applies to a specific transaction for your operations. This service is provided free of charge. For the mailing address or fax number of the closest GST/HST Rulings centre, see GST/HST Memorandum 1-4, Excise and GST/HST Rulings and Interpretations Service, or call 1-800-959-8287.

New Registrants And Instalments

If you are a new registrant and an annual filer, you may have to make instalment payments during your next fiscal year even if your net tax is less than $3,000. This could happen if your first year of filing for GST/HST is less than a full fiscal year. To determine if you need to do this, estimate what your net tax will be for your next fiscal year by prorating your net tax from your short fiscal year.

Divide the net tax for the first short fiscal year by the number of days that you were registered in that fiscal year. Then multiply this amount by 365. If the estimated amount is $3,000 or more, and your net tax for the next fiscal year will be $3,000 or more, you will need to make instalment payments in the next year.

If your net tax for the current or previous year is less than $3,000, you do not need to make quarterly instalment payments in the current year. In this case, you need to file your GST/HST return and send us any GST/HST owing once a year.

Don’t Miss: Government Jobs In Las Vegas

Organizations Exempt From Sales Tax

G.L. c. 64H, § 6 and provide an exemption from sales tax for organizations that are:

Agencies of the United States

Agencies of the Commonwealth of Massachusetts or its political subdivisions or

Religious, scientific, charitable or educational organizations exempt from federal taxation under § 501 of the Internal Revenue Code and has obtained certification from the commissioner that it is entitled to such exemption.

For information regarding exemption from sales tax on purchases of tangible personal property by exempt government or 501 organizations, see TIR 99-4. These organizations are also exempt from tax on certain building materials purchased by hired contractors. G.L. c. 64H, § 6. This exemption only applies, however, to building materials and supplies purchased exclusively for use in the construction, remodeling or repair of buildings or other structures “owned by” or “held in trust” for the benefit of these organizations. For general guidance on the types of purchases that may qualify for exemption under § 6, see DD 02-16. In certain cases, the exemption may be available to agents of exempt entities. Also see G.L. c. 64H, § 6 and TIR 01-7, relating to contractor or subcontractor of a government body or agency providing qualified services in a public project.

Acceptance Of Uniform Sales Tax Certificates In California

California is a member of the Streamlined Sales and Use Tax Agreement, an interstate consortium with the goal of making compliance with sales taxes as simple as possible in member states.

when making qualifying sales-tax-exempt purchases from vendors in California.

The following guidelines are provided for the use of the MTC Uniform Sales Tax Certificate in California:

Simplify California sales tax compliance! We provide sales tax rate databases for businesses who manage their own sales taxes, and can also connect you with firms that can completely automate the sales tax calculation and filing process.

You May Like: City Of Las Vegas Government Jobs

Selling Goods Services And Rights For Others

Auctioneers

If you are a registrant auctioneer selling goods for a person , you are considered to have made a taxable sale of goods. This means that it does not matter if the vendor is, or is not, a GST/HST registrant, because it is the auctioneer who must charge and remit the GST/HST on the sale of the vendors goods, unless you made a zero-rated sale of goods.

There is no GST/HST charged on your commission or other services provided to the vendor that relate to the sale of the goods, such as short-term storage and advertising.

For more information, see GST/HST Info Sheet GI-010, Auctioneers.

Election

A vendor and an auctioneer can make a joint election to have the vendor account for the GST/HST on the sale of auctioned goods if the following conditions are met:

- both the vendor and auctioneer are GST/HST registrants

- the sale of the goods would be a sale of taxable goods if sold by the vendor

- the goods are prescribed in the Property Supplied by Auction Regulations for the purpose of the Excise Tax Act and

- at least 90% of the value of the goods sold at auction on a particular day on behalf of the vendor is for prescribed goods.

Prescribed goods include:

- motor vehicles designed for highway use

- cut flowers, potted plants, and plant bulbs

- horses and

- machinery and equipment designed for use in certain industries.

Agents

To help you determine whether you are acting as an agent of another person, see GST/HST Info Sheet GI-012, Agents.

When the vendor has to charge GST/HST

Simplified Method For Claiming Itcs

The simplified method for claiming ITCs is another way for eligible registrants to calculate their ITCs, when completing their GST/HST return using the regular method of filing.

When you use the simplified method for claiming ITCs, you do not have to show the GST/HST separately in your records. Instead, total the amount of your taxable purchases for which you can claim an ITC. You still have to keep the usual documents to support your ITC claims in case we ask to see them.

As of January 1, 2013, you are eligible to use the simplified method for claiming ITCs if you meet all of the following conditions:

- your annual worldwide revenues from taxable property and services are $1 million or less in your last fiscal year

- your total taxable supplies for all preceding fiscal quarters of the current fiscal year must also be $1 million or less. These limits do not include goodwill, zero-rated financial services, or sales of capital real property and

- you have $4 million or less in taxable purchases made in Canada in your last fiscal year. The $4 million purchase limit does not include zero-rated purchases, but it does include purchases imported into Canada or brought into a participating province.

In addition, if you are a public service body, you must be able to reasonably expect that your taxable purchases in the current fiscal year will not be more than $4 million.

Exception

Listed financial institutions cannot use the simplified method to calculate ITCs.

Step 1

Do not include:

Recommended Reading: Grants To Start A Trucking Business

Tax On Supplies Of Property And Services Made In Provinces Place Of Supply Rules

Specific rules apply to determine whether a supply that is made in Canada is made in or outside of a participating province. The province of supply then determines whether suppliers must charge the HST, and if so, at which rate. Unless otherwise indicated, the supplies referred to throughout the section are taxable supplies.

The following sections explain the place of supply rules and tax on property and services brought into a participating province. For more information on the place of supply rules, see Draft GST/HST Technical Information Bulletin B-103, Harmonized Sales Tax Place of supply rules for determining whether a supply is made in a province. For more information on tax on property and services brought into a participating province, see GST/HST Notice 266, Draft GST/HST Technical Information Bulletin, Harmonized Sales Tax Self-assessment of the provincial part of the HST in respect of property and services brought into a participating province.

Goods

Sales

You collect the HST if you sell goods and deliver or make them available to the customer in a participating province. Goods are also considered to be delivered in a province if you:

- ship the goods to a destination in the province that is specified in the contract for carriage of the goods

- transfer possession of the goods to a common carrier or consignee that you retain on behalf of the customer to ship the goods to such a destination or

- send the goods by courier or mail to an address in the province.

Note

District Of Columbia Federal Government Exemption Affidavit

A sales tax exemption certificate can be used by businesses who are making purchases that are exempt from the District Of Columbia sales tax. You can download a PDF of the District Of Columbia Federal Government Exemption Affidavit on this page. For other District Of Columbia sales tax exemption certificates, go here.

The federal government of the US is not subject to D.C. sales tax. However, for this exemption to apply, the cost of the purchase should be directly incurred and discharged by the federal government and not by an employee.

Recommended Reading: Government Jobs For History Majors

Calculating Your Net Tax

You have to calculate your net tax for each GST/HST reporting period and report this on your GST/HST return. To do so, calculate:

- the GST/HST collected or that became collectible by you on your taxable supplies made during the reporting period and

- the GST/HST paid and payable on your business purchases and expenses for which you can claim an ITC.

The difference between these two amounts, including any adjustments, is called your net tax. It is either your GST/HST remittance or your GST/HST refund. If you charged or collected more GST/HST than the amount paid or payable on your purchases, send us the difference. If the GST/HST paid or payable is more than the GST/HST you charged or collected, you can claim a refund of the difference.

For most businesses, this calculation is straightforward. However, to help reduce paperwork and bookkeeping costs, most small businesses can use the quick method of accounting to calculate their GST/HST remittance. For more information, see Quick method of accounting.

Supplies To Diplomats Governments And Indians

Diplomats

As a registrant, you must charge and collect the GST/HST on taxable supplies of property and services you provide to diplomatic missions, consular posts, international organizations, and foreign representatives and officials. Foreign representatives and officials include diplomatic agents, consular officers, members of administrative and technical staff of diplomatic missions, designated officials of international organizations, and their respective spouses.

If approved by Global Affairs Canada, diplomatic missions, consular posts, international organizations, and foreign representatives and officials and their spouses may obtain a rebate of GST/HST by filing Form GST498, GST/HST Rebate Application for Foreign Representatives, Diplomatic Missions, Consular Posts, International Organizations, or Visiting Forces Units.

Federal government

In general, we consider the federal government to be a single entity that includes all its departments, branches, agencies and some corporations. Federal Crown corporations are separate legal entities and are registered separately for GST/HST purposes.

The federal government pays the GST/HST on its taxable purchases. Therefore, as a registrant, you have to charge the GST/HST on the taxable supplies of property and services you make to the federal government. Special rules may apply to supplies of real property. For more information, see GST/HST Memoranda Series Chapter 19, Special Sectors: Real Property.

Municipalities

Indians

Notes

You May Like: Government Programs To Stop Foreclosure