Should I Take Out Federal Or Private Student Loans

As you consider how to pay for college, its wise to take advantage of any grant or scholarship opportunities available to you before you start to look at financing options. If you do have to borrow money, its almost always best to start with federal loans. These loans come with many benefits unique to the federal government, like income-driven repayment plans, long forbearance and deferment periods and loan forgiveness options.

If grants, scholarships and federal loans dont cover your costs, you may need to stack on private student loans to finance the remaining balance. While these should typically be a last resort, you may qualify for low interest rates if you have good credit.

Federal Direct Subsidized Student Loan

A Federal Direct Subsidized Student Loan is awarded based on your demonstrated financial need. The federal government pays interest on a subsidized loan while you are enrolled in school in at least half-time. The interest rate for Federal Direct Subsidized loans disbursed on or after July 1, 2019, for undergraduate students will have a fixed interest rate of 4.53%, while in repayment status.

Subsidized And Unsubsidized Federal Student Loans: Whats The Difference

5-minute readSeptember 21, 2020

Like many students working through college, you need to borrow money to pay for your tuition, room and board, books and other supplies. You have several loan choices, ranging from federal student loans provided by the federal government to student loans offered by private lenders.

Loans offered by the federal government tend to come with lower interest rates and better terms. Most students focus on obtaining these loans first, only turning to private loans after exhausting their federal options.

The tricky part is that federal student loans come in two main flavors: direct subsidized and direct unsubsidized loans. And while these loans are both offered by the U.S. federal government, theyre not quite the same.

It’s a bit complicated, but direct subsidized student loans are generally regarded as the best student loan you can get. The terms that come with direct unsubsidized student loans aren’t quite as good. But these loans still tend to come with lower interest rates than do private student loans.

Of course, the best way to qualify for the lowest interest rates on both federal and private student loans is to build a strong credit score. Visit Rocket HQSM to find out how to do this.

Heres a cheat sheet explaining the differences between these two federal student loans, who can qualify for them and how the repayment process for each works.

Also Check: Government Grants For Minority Startup Businesses

What Is The Borrowing Process For Subsidized Loans

For students who wish to be considered for subsidized loans, the first step is to complete the FAFSA. The schools financial aid office may then determine the eligibility for the program. Students typically receive an award letter outlining their financial aid information. They also state the amount a student may borrow.

Students may not borrow more than they need to pay for their education. They may not borrow more than the maximum loan amount allowed for the type of study the student is receiving either. These loans typically have a fixed interest rate. It does not change from the first day until the final payment is made. No payment is typically made by the borrower during their time in school. Students may choose to make payments during this time.

The students award letter may also outline how much direct unsubsidized funds the student qualifies. It is possible to use both types of loans to cover the cost of education. The loan limits apply to the total amount of both direct student loan options.

How Do Subsidized Student Loans Work

Despite what people might tell you, a loan subsidy is never provided on the actual borrowed amount, but only on the interest.

When you borrow money, the borrowed amount is the principal amount, and you are charged interest on it. The amount of interest is calculated based on factors like the number of payments, loan longevity, loan amount, and the lenders own demand, among other things.

When you make a loan payment, a percentage of it goes to pay off your interest, and the rest goes to the principal amount. If you default on a payment, the interest charges are usually added to the principal amount, which increases the amount you owe, as well as, the subsequent interest payments.

With a subsidized student loan, defaulting on a payment does not increase your total loan amount, and each successful payment reduces your principal amount. Institutions may offer this as part of a flexible benefits plan, while the government offers it to anyone who requires tuition assistance.

Also Check: Can I Sue The United States Government

Federal Supplemental Educational Opportunity Grant

Undergraduates with exceptional financial need can qualify for between $100 and $4,000 a year. While the government provides enough Pell Grant money for each participating school to cover all its eligible students, that might not be the case with the FSEOG.

Check for other grants, including those for future teachers or for the children of fallen U.S. service members, to see what you might qualify for.

Accept And Receive Your Federal Direct Loans

Temple University students must accept offered Federal Direct loans online in the Financial Aid section of Self-Service Banner in the TUportal after receiving email notification that the financial aid award is ready for review.

New Federal Direct loan borrowers must complete a Master Promissory Note and Entrance Interview.

Don’t Miss: Government Job Openings In Atlanta Ga

What Is The Interest Rate On These Loans

For both Undergraduate Direct Subsidized and Unsubsidized Loans:

- 2.75% for loans first disbursed between 7/1/20 – 6/30/21

- 4.53% for loans first disbursed between 7/1/19 – 6/30/20

- 5.05% for loans first disbursed between 7/1/18 – 6/30/19

- 4.45% for loans first disbursed between 7/1/17 – 6/30/18

The interest rate for Direct Unsubsidized Graduate and Professional PLUS Loans:

- 4.30% for loans first disbursed between 7/1/20 – 6/30/21

- 6.08% for loans first disbursed between 7/1/19 – 6/30/20

- 6.60% for loans first disbursed between 7/1/18 – 6/30/19

- 6.00% for loans first disbursed between 7/1/17 – 6/30/18

The interest rate for Parent PLUS and Graduate or Professional Loans:

- 5.30% for loans first disbursed between 7/1/20 – 6/30/21

- 7.08% for loans first disbursed between 7/1/19 – 6/30/20

- 7.60% for loans first disbursed between 7/1/18 – 6/30/19

- 7.00% for loans first disbursed between 7/1/17 – 6/30/18

Each loan also carries an origination fee which varies based on the loan type. For loans where the first disbursement is made on or after October 1, 2019 and before October 1, 2020, the loan fees are as follows:

- Direct Subsidized Loans and Direct Unsubsidized Loans: 1.059%.

- Graduate and Professional PLUS and Parent PLUS Loans: 4.236%.

Subsidized And Unsubsidized Loans

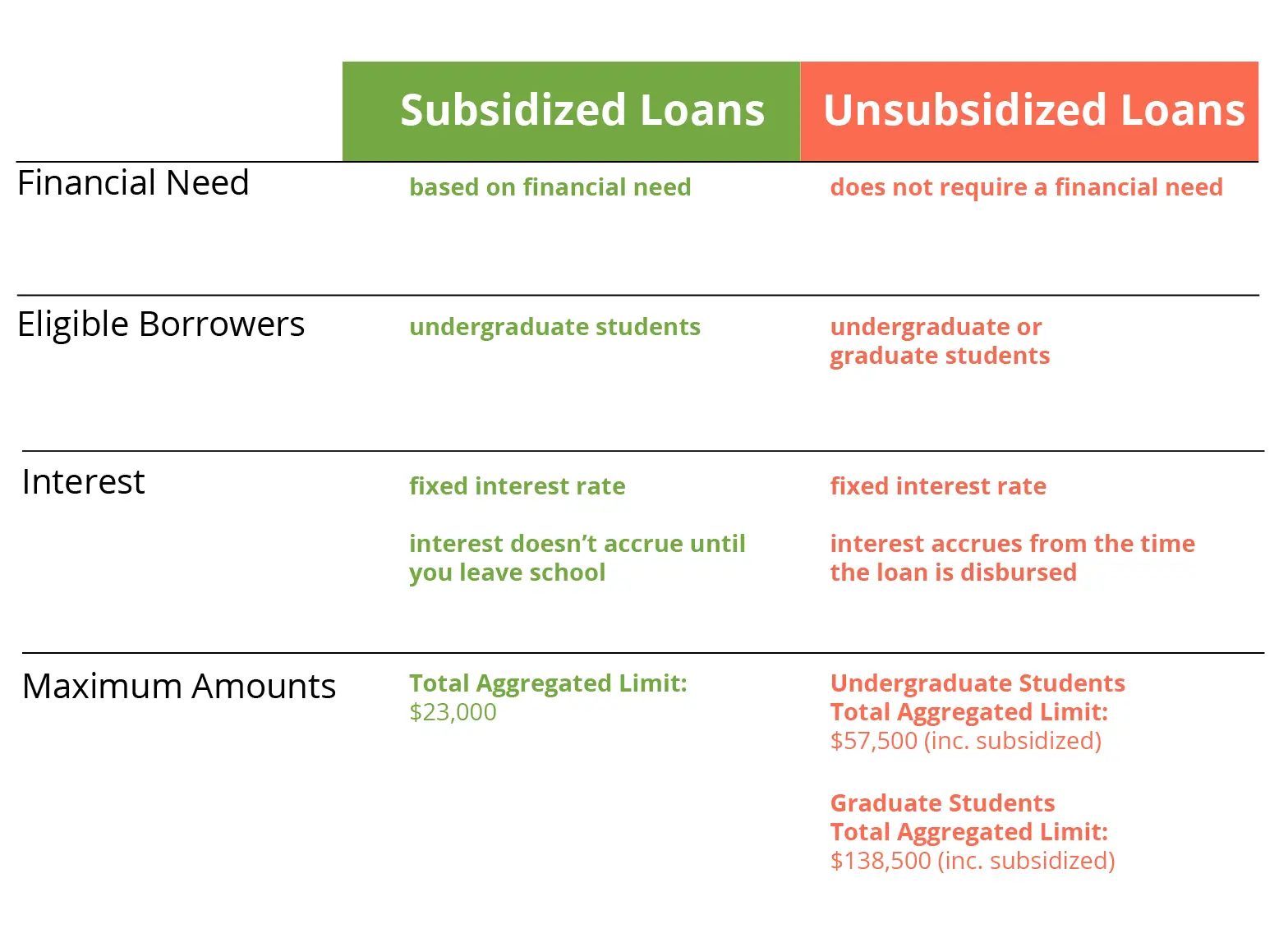

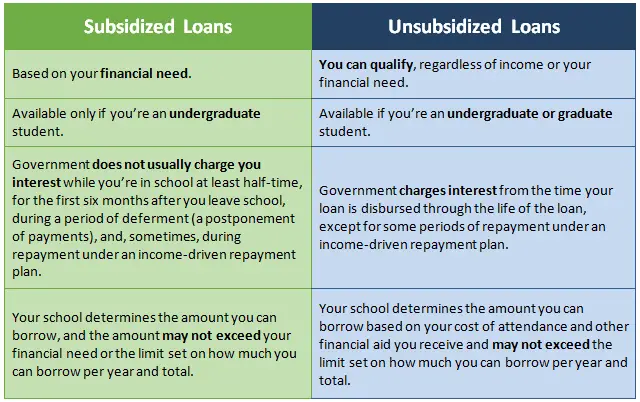

Subsidized Loans are loans for undergraduate students with financial need, as determined by your cost of attendance minus expected family contribution and other financial aid . Subsidized Loans do not accrue interest while you are in school at least half-time or during deferment periods.

Unsubsidized Loans are loans for both undergraduate and graduate students that are not based on financial need. Eligibility is determined by your cost of attendance minus other financial aid . Interest is charged during in-school, deferment, and grace periods. Unlike a subsidized loan, you are responsible for the interest from the time the unsubsidized loan is disbursed until its paid in full. You can choose to pay the interest or allow it to accrue and be capitalized . Capitalizing the interest will increase the amount you have to repay. See for more important information on the capitalization of interest.

| Loan Type |

|---|

| Requirement | |

|---|---|

| Deferment | You may receive a deferment if you are enrolled in school at least half-time or for unemployment or economic hardship |

| Repayment | There is a 6 month grace period that starts the day after you graduate, leave school, or drop below half-time enrollment. You do not have to begin making payments until your grace period ends. |

More information regarding student loans, program requirements, and managing repayment can be found at .

Read Also: How To Become A Federal Government Contractor

How Much Can You Borrow

Your school decides how much you can borrow based on the cost of attendance, your year in school and any other financial aid you receive.

However, there are annual and aggregate limits on how much you can borrow with both types of loans.

- Dependent students can borrow a total of $31,000 for undergraduate studies for both unsubsidized and subsidized loans. A maximum of $23,000 can come from Direct Subsidized Loans.

- Independent undergraduate students can borrow up to $57,500 total. A maximum of $23,000 can come from Direct Subsidized Loans.

- Graduate or professional students can borrow a total of $138,500 in Direct Unsubsidized Loans, including any undergraduate loans.

What Are Subsidized Student Loans

Subsidized student loans are any institution or government-supported loans that make it so you dont have to pay interest on your debt for some time. Basically, this reduces the overall cost of the loan and brings your total debt down.

However, despite the benefit they provide, and the fact that more students need financial aid, not everyone can get subsidized student loans. These types of loans come with certain conditions, the primary one being that you need to be in financial need, and provide proof of it.

Also Check: What Is Government Mortgage Relief Program

Federal Student Loans Vs Private Student Loans

There are differences between federal and private student loans that are important to remember. For example, federal student loans offer benefits that private student loans dont. Here are a few of them:

- Interest subsidies: Some federal student loans come with generous subsidies that cover the interest while youre in school. With private student loans, interest begins to accrue as soon as the loan is disbursed.

- Repayment plans: With federal student loans, you have access to income-driven repayment plans, which can lower your monthly payment depending on your household income. These arent available with private student loans

- Student loan forgiveness: If youre able to meet the requirements, you might qualify for federal student loan forgiveness after a period of time . Private student loans dont qualify for federal forgiveness programs.

Although federal student loans offer these protections, they might not fully cover your cost of college. In fact, many students end up with a combination of federal and private student loans to cover their tuition and other expenses.

If you decide that a private student loan is right for you, remember to consider as many lenders as possible to get the best deal. You can do this easily with Credible and you only have to fill out one application instead of multiple forms.

Compare student loan rates from top lenders

- Multiple lenders compete to get you the best rate

- Get actual rates, not estimated ones

- Finance almost any degree

How Much Can I Borrow With A Subsidized Loan

The amount you can borrow with a subsidized student loan is determined by your school, and the amount can’t exceed your financial need. The amount you can borrow each year also depends on your year in school and your dependency status. The following chart shows the annual and aggregate limits for subsidized loans as determined by the U.S. Department of Education.

| Borrowing Limits for Subsidized Loans |

|---|

| Year |

Don’t Miss: How To Apply For Government Subsidized Housing

What Else Should You Know About Subsidized Student Loans

If you are looking for a way to pay for your higher education costs, a direct subsidized loan are typically the first step. There is usually no need to apply with a credit history or a cosigner. These loans are typically never based on your credit history. Even first time borrowers can may obtain the funds they need. This is much unlike private loans that may require these loans. Also, note that these may be referred to as Stafford loans or direct Stafford loans. These terms are interchangeable.

What Are The Current Federal Student Loan Interest Rates

The 2021-2022 student loan rates are:

- Direct Stafford Loans Subsidized: 3.73% interest + 1.057% one-time origination fee

- Direct Stafford Loans Unsubsidized: 3.73% interest or 5.28% interest , plus 1.057% one-time origination fee

- PLUS loans : 6.28% interest, plus 4.228% one-time origination fee.

For more information on how student loan fees work, check out this guide to understanding student loans.

Also remember that federal student loan interest rates get re-adjusted every year, so next years rate could be higher or lower than this ones. Just to give you an idea of how much it might fluctuate, here are the rates for the last five years, for undergraduate Direct Stafford loans:

- 2020-2021: 2.75%

| $31,000 |

However, remember that you can only borrow up to the amount actually offered to you by your college, in your financial aid award letter. If you need more than that, youll need to consider taking a private loan, from a company like Earnest.

Read Also: Why Data Governance Is Needed

Whats The Difference Between Direct Subsidized Loans Direct Unsubsidized Loans And Plus Loans Which One Is Best

These three types of federal loans are very different!

Direct subsidized loans are the most affordable ones.

They have the lowest interest rates. Interest also doesnt accrue during college. This means that if you borrow $3000 in Year 1 , then when you graduate, your loan balance will still be $3000 and youll only need to pay interest on that.

Direct UNsubsidized loans are slightly less affordable.

But they are still way better than private loans! They have the same interest rates as the federal subsidized loans, but interest DOES accrue while youre in college. This means that every month that you dont pay interest, that interest gets added to your loan balance. Then the next month, interest will get calculated based on your new loan balance. Note that if you accept this type of loan, youll have the option to make interest-only payments while in college. This way, your original borrowed amount will still be the same when you graduate. If you choose not to make any payments while in college, your borrowed amount will be much higher.

PLUS loans are the least affordable type of federal loanand are actually given to your parents.

PLUS loans have a higher interest rate than the Direct loans, and interest accrues while you are studying. Their rates may or may not be better than private loans, so compare your options! Also, if you are an undergraduate and your parent is unwilling to take on debt for you , then this option might not actually work.

How Do You Qualify For A Federal Student Loan

To apply for a federal student loan, you must submit a completed FAFSA between October 1 and June 30. For a Direct PLUS Loan, you will also be required to complete the Direct PLUS Loan Application and sign a promissory note. Many states and colleges set priority deadlines by which you must submit the FAFSA form to be considered for the aid programs they administer. Additionally, because some states and schools have limited funds, you should try and submit your completed FAFSA as soon as you can after October 1 to have the best chance to qualify for a federal student loan.

To qualify for a federal student loan, you must meet the following general eligibility requirements:

- Demonstrate financial need

- Be a U.S. citizen or eligible non-citizen

- Have a high school diploma or recognized equivalent, such as a General Education Development certificate, or have completed a high school education in a homeschool setting approved under state law

- Have a valid Social Security number

- Be enrolled or accepted for enrollment as a regular student in an eligible degree or certification program

- Be enrolled at least half-time to be eligible for Direct Loan Program funds

- Maintain satisfactory academic progress in college or career school

- Be registered with Selective Service, if male

Don’t Miss: Government Says Aliens Are Real

What Is A Subsidized Loan

Federal student loans come in two main types: subsidized and unsubsidized. A subsidized loan is a student loan for undergraduate students who demonstrate financial need. This type of loan doesn’t accrue interest the same way other loans do because the government temporarily covers interest costs. To qualify for a subsidized loan, also called a direct subsidized loan, you have to fill out the Free Application for Federal Student Aid .

How Are Direct Subsidized Loans Distributed

Applying for financial aid like these loans is usually an easy process. The first step is to complete the FAFSA. Then, you may work with your school to receive an award letter. Once you accept the subsidized or unsubsidized loans, the loans are distributed right to the school. Many schools are heavily involved in the process. They may help you determine your financial aid every step of the way.

All federal student loans are sent right to the school on your behalf. The funds may go to cover the costs you owe for the school. That includes your tuition and school fees. In some cases, this is may be done through multiple disbursements. You may receive direct subsidized and unsubsidized loans at different times. The two amounts together will typically equal the award you were provided.

The school may also set up the payment date. This is the date when the funds are applied to your account. Some schools may align this with the type of degree you are enrolled in. Most of the time, schools follow the rules set by the federal government on how this applies. You should be told this information when you enroll in the program as well.

You May Like: Practice Test For Government Jobs