Correcting Your Credit Report

If there is incorrect information in your credit report, you may ask the credit reporting agency to investigate. For most items, you must do so in writing and can use a trackable method like certified mail to ensure that it is received. Certain items may be disputed directly online when viewing your credit report. If an item is available to be disputed online, all dispute options available will appear next to that item. The credit reporting agency must investigate your claim within 30 business days by asking the creditor in question to review its records, unless the agency believes that the dispute is “frivolous or irrelevant.” Within 5 business days of its receipt of your request, a credit reporting agency must notify the creditor that you are disputing the information.The credit reporting agency is required to correct, complete, or delete any information that is erroneous, incomplete, or unverified.

Most negative information that is more than 7 years old may not be included in your credit report. There are several exceptions to this rule the primary one is bankruptcy, which may be reported for up to 10 years. These rules do not apply if the credit transaction is for $50,000 or more, or if the report is being provided in connection with employment in a job that involves an annual salary of $20,000 or more.

Where To Get Your Free Fico Credit Scores

Other than the major issuers, some of the lesser-known issuers, such as HSBC, Sallie Mae and UnionBank, also offer access to free FICO credit scores. Several credit unions also provide FICO scores for free, including Navy Federal Credit Union, Hudson Valley Credit Union, DCU, America First Credit Union and more.

Unlike in the past, you may also order a free credit score from two of the three national credit bureaus. Equifax launched a free program called Equifax Core Credit to give you access to a monthly Equifax credit report and your monthly VantageScore 3.0. Experian also offers access to a FICO Score 8, though this credit bureau doesnt specify how often you can view your credit score. Unfortunately, TransUnion doesnt provide scores for free.

Nevertheless, keep in mind that your credit score may not be the same across each credit bureau as some lenders may report your credit information to each bureau at different times.

It’s Possible To Regularly Check On The State Of Your Credit At No Cost To You

is important in many facets of most of our lives. Having good credit increases the likelihood of qualifying to borrow money and receiving low interest rates, in addition to influencing decisions made by insurance companies, landlords, utilities, and employers. There’s no better way to monitor the state of your credit than by regularly reviewing your , and fortunately, federal law guarantees you the right to free annual credit reports.

Although the process itself is fairly straightforward, being unfamiliar with the official methods of requesting your credit report and/or how often you can receive a report from the same company may make the exercise seem more daunting than it actually is. If you follow these steps, you shouldn’t have any problems.

Read Also: Mortgage Loans For Federal Government Employees

It Can Affect Your Finances

Financial institutions look at your credit report and credit score to decide if they will lend you money. They also use them to determine how much interest they will charge you to borrow money.

If you have no credit history or a poor credit history, it could be harder for you to get a credit card, loan or mortgage. It could even affect your ability to rent a house or apartment or get hired for a job.

If you have good credit history, you may be able to get a lower interest rate on loans. This can save you a lot of money over time.

Other Situations Where You Are Eligible For A Free Credit Report

If you are a victim of identity theft, you are entitled to place a fraud alert on your file and to receive copies of your credit report from each of the three credit reporting companies free of charge, regardless whether you have previously ordered your free annual reports.

For more information on ID theft, including advice for victims and tips on prevention, review the Attorney Generals Consumer Alerts: Identity Theft Prevention and Identity Theft Recovery.

If a company takes adverse action against you, such as denying an application for credit, insurance, or employment, you are entitled to a free credit report if you ask for it within 60 days of receiving notice of the adverse action. The notice will give you the name, address, and phone number of the credit reporting company to contact.

You May Like: Government Jobs Palm Springs Ca

What To Do About Inaccurate Information

- Clearly identify the inaccurate information on your credit report and dispute it, in writing, to both the credit reporting agency that issued the report with inaccurate information and any creditors associated with the information.

- For more information, review the FTCs online Disputing Errors on Credit Reports article.

- If an investigation doesnt resolve your dispute with the credit reporting company, you can ask that a statement of the dispute be included in your file and future reports. If inaccurate information is not removed or reappears, you may wish to consult with a private attorney regarding possible legal actions.

Here is contact information for the three credit reporting agencies and links to their web pages informing consumers how to dispute inaccurate information:

What Is Credit Monitoring

Canadas credit bureaus, as well as many credit card issuers and financial institutions, offer credit monitoring services. These services will notify you after certain updates have been made to your credit report and credit score, such as a credit inquiry.

You could consider using this service if you think youve been the victim of fraud or if youve been affected by a data breach. This can help you see if somebody is trying to apply for credit in your name.

You usually need to pay for these services. Some institutions may offer it for free under certain conditions.

Recommended Reading: Government Help For Senior Citizens

What Is The Fair Credit Reporting Act Or Fcra

The Fair Credit Reporting Act is an important law that gives you the right to know the information that the credit bureaus keep on you and how that information informs your credit scores.

This law includes a number of consumer rights and protections. For example, under the FCRA you have the right to dispute incomplete or inaccurate information on your credit reports. In most cases, the credit bureau must investigate your case and correct or remove any inaccuracies within 30 days.

You Have More Than One Credit Report

When you order your free TransUnion credit report, youll also have the option to order your free Equifax and Experian credit reports. The information in these reports can differ, so its good practice to review all three. For example, some lenders choose to report account data to only one or two credit reporting agencies, not all three. Or, when you apply for a loan, a lender may only pull your credit report from one credit reporting agency, which would result in a hard inquiry on your credit report from that agency only.

You May Like: Us Government Mint Silver Coins

Increase The Length Of Your Credit History

The longer you have a credit account open and in use, the better it is for your score. Your credit score may be lower if you have credit accounts that are relatively new.

If you transfer an older account to a new account, the new account is considered new credit.

For example, some credit card offers come with a low introductory interest rate for balance transfers. This means you can transfer your current balance to this new product. The new product is considered new credit.

Consider keeping an older account open even if you don’t need it. Use it from time to time to keep it active. Make sure there is no fee if the account is open but you don’t use it. Check your credit agreement to find out if there is a fee.

Place A Credit Freeze

Contact each credit reporting agency to place a freeze on your credit report. Each agency accepts freeze requests online, by phone, or by postal mail.

Experian

PO Box 530086Atlanta, GA 30353-0086

Your credit freeze will go into effect the next business day if you place it online or by phone. If you place the freeze by postal mail, it will be in effect three business days after the credit agency receives your request. A credit freeze does not expire. Unless you lift the credit freeze, it stays in effect.

Also Check: American Government A Brief Introduction

Free Annual Credit Report Program

The Fair Credit Reporting Act promotes the accuracy and privacy of information contained in the files of credit reporting companies. This federal law allows you to request and obtain a free copy of your credit report once every 12 months from Equifax, Experian, and TransUnion.

The three nationwide credit reporting companies have set up one website, toll-free telephone number, and mailing address through which you can order your free report.

To order, visit annualcreditreport.com , call 1-877-322-8228, or complete the Annual Credit Report Request Form and mail it to:

Annual Credit Report Request ServiceP.O. Box 105281Atlanta, GA 30348-5281

Do not contact the three nationwide credit reporting companies directly.

You may order your report from each of the three nationwide companies at the same time, or you can order from only one or two. The FCRA allows you to order one free copy from each company every 12 months.

You will need to provide your name, address, Social Security number, and date of birth. If you have moved in the last two years, you may have to provide your previous address. To maintain the security of your file, each nationwide credit reporting company may ask you for some information that only you would know, like the name of the lender where you financed an automobile loan. Each company may ask you for different information because the information each has in your file may come from different sources.

Checking Your Credit Report For Free

Private companies called “credit reporting agencies” collect information related to your access to and use of credit. They make that information available to others under certain circumstances in the form of a “credit report.” Lending institutions, employers, insurance agencies, and future creditors make decisions about you from the information in your credit report. Your credit report is an important document, and the law gives you certain protections against the reporting of incorrect information. Knowing your legal rights and remedies is a first step to resolving any problems related to your credit report.

Note: Your Credit Report is Free! Under state and federal law, you are entitled to one free copy of your credit report per calendar year from each of the three main credit reporting agencies noted above. Requesting a copy every year to ensure your report is without errors is worthwhile and recommended. If you ever apply for and are denied credit, you should immediately get a copy of your report to verify that all the information is correct. You have the right to know which credit reporting agency prepared the report that was used in the denial of your credit application. Under state law, you have the right to a free copy of your credit report within 60 days of being denied credit. Visit the annual credit report website or call 322-8228 to request your free annual credit report.

Don’t Miss: Government Sponsored Hero Mortgage Program

Read Your Reports And Fix Errors

-

Accounts that arent yours or you didnt authorize.

-

Incorrect, negative information.

-

Negative information thats too old to be included. Most negative information, other than one type of bankruptcy, should be excluded after seven years.

These errors have the potential to hurt your credit score, says Chi Chi Wu, a staff attorney with the National Consumer Law Center. You might see other types of errors, such as out-of-date employment information, she says, but those arent factored into your score.

If you find errors, dispute them. The credit bureaus will investigate and must remove information that they cant verify.

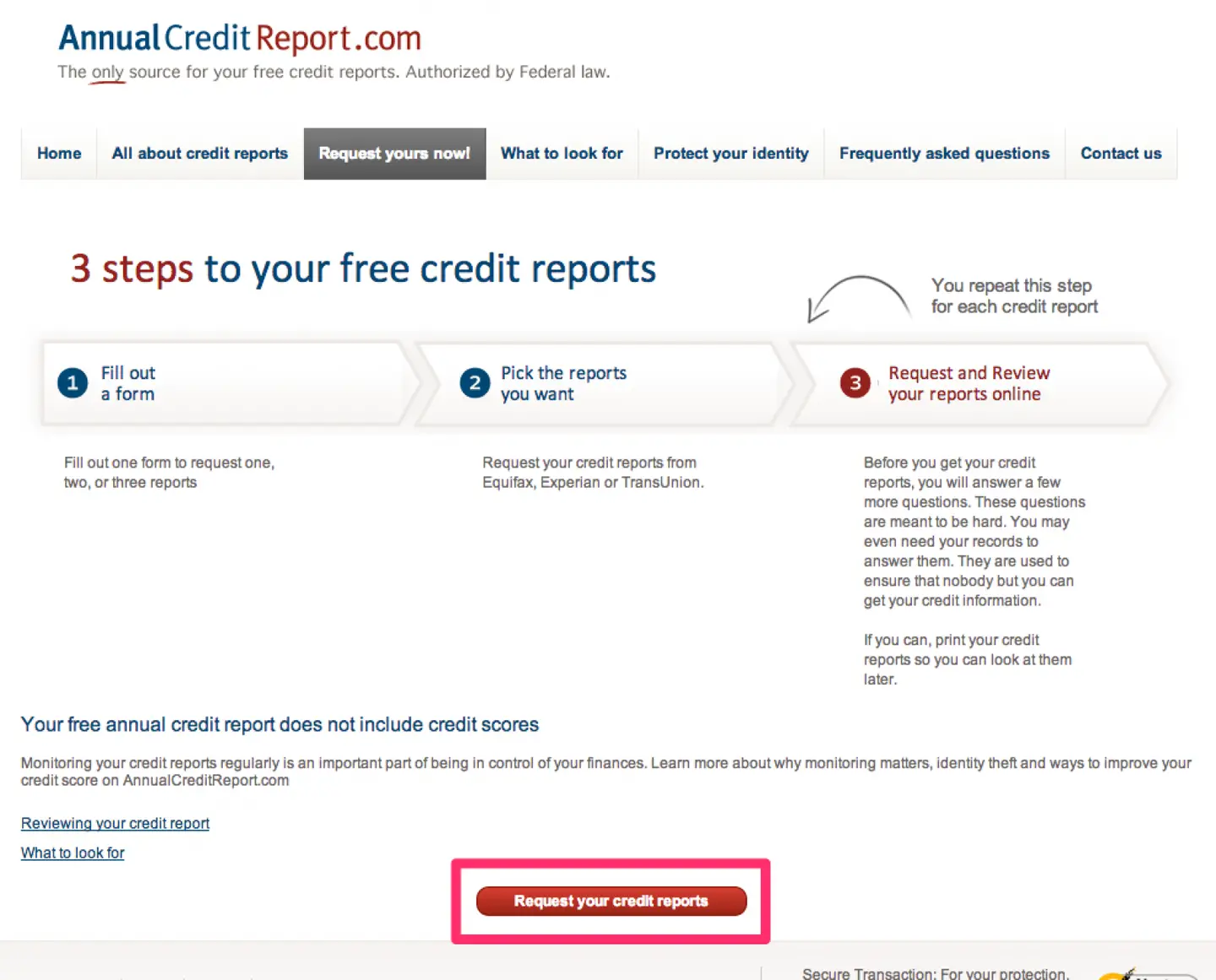

Pick The Reports You Want

There are three major US credit bureaus: Equifax, Experian and TransUnion. Each maintains a separate account of your “credit record”. Therefore, certain credit information might appear on one report but not on another.Choose the reports you’d like to receive. The Fair Credit Reporting Act permits you to receive one of each credit report every 12 months in other words, you could request an Equifax report today, an Experian report tomorrow, and a TransUnion report the next day.I like to receive all three reports at once, so I’m going to check all three boxes.

Read Also: Money Owed By The Federal Government

Have Your Personal Information Ready

In order to request a credit report, you will have to provide several pieces of personal information, specifically your full name, date of birth, mailing address, Social Security number , and your previous mailing address. Additional information may be required to process your request, in which case the consumer credit reporting company you requested your credit report from will contact you by mail. As this information is used to identify you for the request process, omission of any information when filing by mail may delay your request.

Although most of this information should be known to you, some details may be harder to recall. While you can simply pause when filling out a mailing request form or an online application, failing to have all of this information on hand while making a request by phone could result in a slower application process or having to start over at a later time.

When requesting your credit report online, you will be asked several security questions about your finances that only you should be capable of answering . As these questions will vary from person to person, it can be difficult to adequately prepare for them. Note that, should you request your credit report by mail or phone, you may not be required to answer any security questions.

Whats On My Credit Reports

Your credit reports contain personal information, as well as a record of your overall . Lenders and creditors report account information, such as your payment history, credit inquiries and credit account balances, to the three main consumer credit bureaus. All of that information can make its way into your credit reports.

Much of whats found in your credit reports can impact whether youre approved for a credit card, mortgage, auto loan or other type of loan, along with the rates youll get. Even landlords may look at your credit when deciding whether to rent to you.

Lets dig into some of the main components of your credit reports.

Personal InformationThe personal information you might find on your credit reports includes your name, address, date of birth, Social Security number and any jobs youve held.

The credit bureaus use this personally identifiable information to ensure youre really you, but it doesnt factor into your credit scores. In fact, federal law prohibits credit scores from factoring in personal information such as your race, color, gender, religion, marital status or national origin.

That being said, its not necessarily true that the American financial system is unbiased or that credit lending and credit scoring systems dont consider factors affected by bias. To learn more about racial justice in lending and initiatives seeking to create change, connect with organizations leading the fight, like the ACLU.

You May Like: Government Programs For Single Mothers To Buy A Home

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Read Your Credit Report Closely For Errors

Once you have received a credit report, it’s crucial to read it closely to verify that all of the following information is accurate:

- Personally identifiable information : Your name, address, SSN, date of birth, and employment information.

- Type of account , the date you opened the account, your or loan amount, the account balance, and your payment history .

- A list of everyone who has accessed your credit report within the last two years, including both soft and hard inquiries. When you apply for a loan, you’re giving the lender authorization to ask for a copy of your credit report.

- Public record and collections: can collect public record information from state and county courts, including bankruptcies. Additionally, if you have any overdue debt that was turned over to a collection agency, this will also appear on your credit report.

While it’s still a good idea to check for errors such as a variation of your name or an old address, personal information like this isn’t used to calculate your and, as such, isn’t as crucial to have corrected. However, if the name or address on your credit report don’t correspond to anything you go by or anywhere you’ve lived, respectively, then that could be a sign of some suspicious activity, such as identity theft.

Also Check: Blue Cross And Blue Shield Government