What Are The Benefits And Risks Of Bonds

Bonds can provide a means of preserving capital and earning a predictable return. Bond investments provide steady streams of income from interest payments prior to maturity.

The interest from municipal bonds generally is exempt from federal income tax and also may be exempt from state and local taxes for residents in the states where the bond is issued.

As with any investment, bonds have risks. These riskes include:

The issuer may fail to timely make interest or principal payments and thus default on its bonds.

Interest rate risk. Interest rate changes can affect a bonds value. If bonds are held to maturity the investor will receive the face value, plus interest. If sold before maturity, the bond may be worth more or less than the face value. Rising interest rates will make newly issued bonds more appealing to investors because the newer bonds will have a higher rate of interest than older ones. To sell an older bond with a lower interest rate, you might have to sell it at a discount.

Inflation risk. Inflation is a general upward movement in prices. Inflation reduces purchasing power, which is a risk for investors receiving a fixed rate of interest.

Liquidity risk. This refers to the risk that investors wont find a market for the bond, potentially preventing them from buying or selling when they want.

Risk Of Selling Before Maturity

If you buy a bond and hold it to maturity, you’ll get back the face value. But if you sell a bond before maturity, you’ll get market value. This can be more or less than the face value.

The market value of a bond depends on supply and demand. Market interest rates have the biggest impact on the price of bonds. The credit risk of the issuer and how long the bond is issued for can also have a big impact on the price of a bond.

The price of fixed rate bonds and indexed bonds moves in the opposite direction to market interest rates:

- If market interest rates rise, the price of these bonds falls.

- If market interest rates fall, the price of these bonds rises.

The price of floating rate bonds doesn’t move very much when interest rates change because their coupon payment rate adjusts.

Some bonds can be hard to sell. If you’re planning to sell before maturity, look for bonds with high liquidity, for example, AGBs.

What Are Government Bonds

Learn all about government bonds: including what they are, how they work, and why they move in price.

Interested in bods trading with IG?

A government bond is a type of debt-based investment, where you loan money to a government in return for an agreed rate of interest. Governments use them to raise funds that can be spent on new projects or infrastructure, and investors can use them to get a set return paid at regular intervals.

Don’t Miss: Polk Real Foreclosure

How To Buy Government And Rbi Bonds

Anything that comes from a government office is highly prized. Any job or investment opportunity tries to offer a compelling opportunity with a competitive payoff. Every time someone required a companion in the past, the first requirement was to check the Government Job off the list, as it guaranteed a lot of things. The most significant factors are job security and vacation time. It didnt matter what you did at work the approval stamp was enough to earn respect from friends and family. Everything else was frowned upon.

In comparison to the private sector, government employment has less competition and job pressure than private enterprises. Weve all heard stories of people who go to work and come home every day without complaining. Every day, you leave your work stress at your office desk, get paid on time, and bring home delights from every festival. People who work for the government soon have their own home, a four-wheel car, and are already arranging vacations. All of this is in addition to a gratuity and a retirement pension.

Government bonds are an outstanding investment because they are issued by the government to meet various development goals. They come with guaranteed profits and benefits.

There are a few things to keep in mind when investing in RBI bonds.

It cannot be used as a guarantee by investors when applying for loans.

The only way to transfer the bond is to give it to the candidate.

Some banks allow bond purchases to be made online.

Benefits

- TAGS

New To Bonds And Gilts

When you buy a bond you are, in effect, lending a company or government money. In return you receive interest and the issuer promises to pay back the loan on a specified date.

Gilts are UK government bonds, which are issued to help finance public spending. PIBS are issued by UK building societies and work in a similar way to bonds.

Don’t Miss: City Jobs In Las Vegas

Example Of A Uk Government Gilt

An example of a conventional UK government gilt is the 1½% Treasury Gilt 2047. The date of maturity on the bond is 2047, and the coupon rate is 1.5% per year. Here, youd receive two equal coupon payments, six months apart. If you held £1000 nominal of 1½% Treasury Gilt 2047, you would receive two coupon payments of £7.50 each on 22 January and 22 July.

Yield To Maturity On Government Bonds

Yield to Maturity is the rate of return on a bond if purchased at the current market price and held until the maturity date. The calculation of the yield assumes all coupon interest payments are reinvested at the same rate. Yield To Maturity will vary through time with changes in the price and the remaining term to maturity of the bond.

To explain this in further detail, suppose interest rates fall. New bonds that are issued will now offer lower interest payments. This makes existing bonds that were issued before the fall in interest rates more valuable because they offer higher interest payments compared to new bonds. As a result, the price of existing bonds will increase. However, if a bond’s price increases, it is now more expensive for a new investor to buy. The bond’s yield will then fall because the return an investor expects from purchasing this bond is now lower.

|

Bond |

|---|

|

Australia Bond 15 Year Yield |

3.75% p.a. |

Investing $100 into a hypothetical government bond with a 2.75% p.a. coupon interest rate would pay you $1.375 every six months, before paying your $100 back at the end of the bond’s term.

There are some bonds that have a floating rate – that is, the rate changes with fluctuations in benchmark interest rates. If interest rates drop the value of your bonds will increase, and vice versa. These types of bonds have the potential for greater highs but also significant lows.

Recommended Reading: City Jobs Las Vegas Nevada

Open A Cds Account Kenya

A CDS account is simply an account that the Central Bank of Kenya uses to record the ownership of your securities and your transaction history.

The first step is usually opening a CDS account Kenya which the CBK uses to track investment in government securities. To open a CDS account Kenya, you must have a bank account with a commercial bank. Once you have an account with a commercial bank, you can collect a mandate card from the CBK or its branches. Fill the mandate card in block letters. With the CDS account, you can invest in multiple treasury bills and bonds.

Some of the details that you need to fill in the mandate card include your bank account details and contact details. You will need signatories from your commercial bank to ascertain that the information you provided is true. You can access the service by sending an SMS with the word Register to CDS code Kenya 22372. Once you have the CDS account, you can start using the CBK USSD code *866# to access the account.

Requirements for CBK CDS Account Opening

To open Central Bank of Kenya CDS account, you need to provide:

- An original and copy of your ID card

- Recent colored passport size photograph

- Specimen signature on the mandate card

- The mandate card should be filled in block letters

- Names on the mandate car should appear in the same order as on the ID card

- The applicant must be 18 years old or above

Option : Buy Bonds From Hargreaves Lansdown

When it comes to buying bonds in the traditional sense one of the very few UK platforms that you will have at your disposal is Hargreaves Lansdown. In fact, the bond coupon rate examples that we discussed earlier were taken from the Hargreaves Lansdown website.

You will have a good select of bonds to choose from which includes both corporate and government bonds. You will need to check what the running yield on the bonds is, as this gives you a clear indication of the value of your investment.

In simple terms, the running yield looks at the difference between the coupon rate and the current price of bonds, so that you know how much money you are making on the investment.

To buy bonds from Hargreaves Lansdown you will need to:

- Open an account

- Deposit some funds with a UK debit card or bank account

- Make sure the meet the minimum investment amount

- In most cases, you then need to call Hargeaves Lansdown to place your bond order

Once you buy the bonds, your coupon payments will be reflected in your Hargreaves Lansdown account. When the bonds mature, your original investment will also be paid into your brokerage account.

Don’t Miss: Rtc Careers Las Vegas

What Are Corporate Bonds

A corporate bond is a debt instrument issued by a business to raise money. Unlike a stock offering, with which investors buy a stake in the company itself, a bond is a loan with a fixed term and an interest yield that investors will earn. When it matures, or reaches the end of the term, the company repays the bond holder.

You might like:

Risks Of Investing In Bonds

Bonds are considered safer than shares, but still have some risks.

- This includes interest rate risk, where market rates rise and we find that were earning less from a bond than we could with other investments.

- There is also inflation risk, where a high rate of inflation lowers the value of the interest we earn.

- Other risks include liquidity risk, meaning we cant find a buyer when we want to sell.

Read Also: Las Vegas Rtc Jobs

You Face The Risk Of A Default

Much of this guide has focused on the passive, regular, and clear-sighted nature of bonds. By this, we mean that once you make an investment, you know exactly how much you are going to receive in coupon payments. You also know the date in which you will receive your original investment back.

However, like all investment classes, there is never any guarantee that things will go to plan. After all, when companies issue bonds, they are borrowing money from outside investors. This money must be repaid, so if the company runs into financial difficulties, there is always the chance of a default. If this does happen you will lose money.

How I Bonds Work

Think of I Bonds as flexible-term variable-rate CDs.

Youre required to hold them for at least one year. After that, you can cash out at any time youd like, or you can choose to hold them for up to 30 years from the original time of purchase. If you cash out within five years, you forfeit interest earned in the previous three months, whereas the early withdrawal penalty on a typical commercial CD is often six months or 12 months of interest. The flexibility to cash out after one year with a low early withdrawal penalty or to hang on for as long as 30 years makes I Bonds good for both short-term and long-term investing.

Similar to a CD, the value of I Bonds never goes down. They are guaranteed by the U.S. government. Unlike a typical CD with a fixed interest rate for the entire term, the interest rate on your I Bonds changes in six-month cycles. You stay on the current rate for the full six months and then you go on a new rate for another six months, and a new rate after that for another six months, and so on.

The interest rate is guaranteed to at least match inflation. If inflation goes up, the interest rate on your I Bonds automatically goes up. Some older I Bonds earn a positive rate above inflation. The I Bonds you buy now only match inflation. Even merely matching inflation makes I Bonds attractive when other CDs and bonds dont keep up with inflation.

Also Check: Capabilities Statement Template

I Bonds The Ultimate Guide

Last Updated: 11min. read

I bonds are low-risk, inflation-linked savings bonds from the U.S. government. Here well look at why, when, where, and how to buy them.

Disclosure: Some of the links on this page are referral links. At no additional cost to you, if you choose to make a purchase or sign up for a service after clicking through those links, I may receive a small commission. This allows me to continue producing high-quality, ad-free content on this site and pays for the occasional cup of coffee. I have first-hand experience with every product or service I recommend, and I recommend them because I genuinely believe they are useful, not because of the commission I get if you decide to purchase through my links. Read more here.

Contents

What Type Of Bonds Are Best For Common Man

If common man decides to invest in bonds for income generation, best alternative will be tax free government bonds. Why? Because the interest income generated from such government bonds are free of income tax.

This becomes specially lucrative for those people who are in the maximum tax bracket .

Suppose there are two bonds available for investing. One is tax free bond, and the other is non-tax free bond. Generally the yield of tax free bonds is less than non-tax free bonds. Which one must select? The decision making should be done based on the following formula:

Net Yield = Bond yield *

Suppose there is a persons whose tax rate is 30%. For tax-free bonds, Net yield = bond yield. For non-tax free bonds, net yield = bond yield * = bond yield * 0.7. Example:

- Tax Free Bond

Also Check: Sacramento Federal Jobs

The Simple Guide To Buying Bonds

By Pat Bolland on January 30, 2014

Stocks get all the glory, but bonds are just as important. Heres a guide to the other side of a balanced portfolio.

Talk stocks with your friends and theyre all ears. Talk bonds and their eyes glaze over. Why? Because stocks are storiesabout exciting new products or projects and the people behind them. Contrast that with bonds, which are considered boring and even a little stodgy.

While bonds rarely make headlines, theyre an extremely important part of almost all portfolios. Yet many investors have only a vague understanding of how they work. Some of the ideas can be complicated, well admit. But when boiled down to their essence, bonds are relatively straightforward investments.

Think of a bond as a kind of loan. When you buy a bond, you give a government or corporation a sum of money in exchange for the promise of interest payments for a specified period. At the end of that periodwhen the bond maturesthe interest payments stop and your initial investment is returned to you.

To understand the details, you need to learn bond market jargon. A federal government bond might be described as having a face value of $10,000, a coupon of 3% and a term to maturity of five years. If you purchase this bond for $10,000, youll receive $300 in interest every year for five years. When the bond matures in five years, youll get your original $10,000 back.

Some Helpful Things To Know About Bonds

- Some bonds are safer than others. A government or council bond may be safer than one issued by a company. The downside is that safer bonds tend to have lower interest rates than riskier ones.

- Some bonds are rated, which means they have a credit rating as a guide to how risky they are.

- If a bond is senior it means that if the company or government fails, we will have a higher priority in the queue of people trying to get their money back. If the bond is subordinated, we will be further down that queue.

- Subordinated bonds are more risky than senior bonds and will usually have a lower credit rating.

As with any investment, it pays to do homework and to get professional advice before investing in bonds particularly if there is a chance you will sell before maturity. The Financial Markets Authority has more information on how to protect yourself when you invest in bonds.

Recommended Reading: Polk County Fl Forclosure

How Common Men Can Buy Government Bonds

Small investors like me and you can buy government bonds in India using a mobile app or a web based app of National Stock Exchange . This app is called NSE goBID. Either of these two apps can be used to buy the following:

- Long-dated government bonds: holding time: 5 to 40 year.

- Treasury bills : holding time less than 1 year.

Before one can go ahead and buy the government bonds using NSE goBID, the process of registration must be completed. But do not worry, everything is online.

To get a better perspective of how/why a common man can invest in bonds, lets understand why rich and wealthy like bonds.

Gilts And Government Bonds

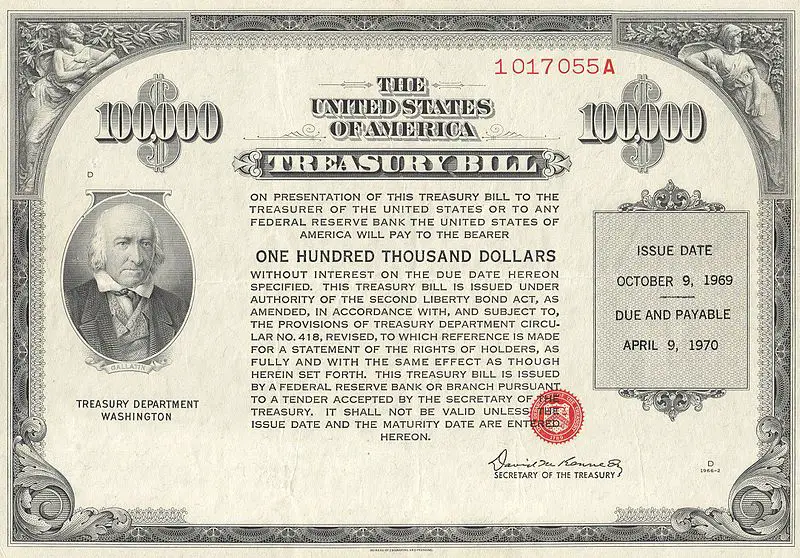

In the UK, government bonds are called Gilts, in the US government bonds are known as Treasury Bills, or T-Bills, while German federal bonds are referred to as Bunds. In the UK the government also issues Index-Linked Gilts and the interest they pay increases in tandem with the Retail Price Index, to keep in line with the pace of inflation.

Gilts are widely viewed as being among the safest type of bond. However the interest rate, or yield, available from Gilts is usually quite low as with all investments, to enjoy potentially higher returns, you need to take on more risk. But a loan to a stable government with a strong economy should help to keep your asset allocation reasonably well spread if you already hold other types of investment.

Also Check: Trucking Business Grants