Missing Money From Employers

Many people out there may find unclaimed money from previous employers. This could be from unpaid wages due to payroll checks never being cashed, overtime work that didnt get included in your wages, pensions or retirement plans that were never cashed out, or a refund of overpaid benefits.

To aid in helping connect former employees with missing funds, the Department of Labor has issued new guidelines to businesses to help them be more proactive in contacting past employees. This is due to a recent finding that most businesses werent in compliance with the Employee Retirement Income Security Act of 1974 , which mandates that plan fiduciaries must make every effort to locate missing plan participants.

If you feel youre still owed money from a former employer, the first step is to search for your employer through the Wage and Hour Division website. This resource, called Workers Owed Wages , is a free service run through the DOL that holds onto wages of former employees for up to three years.

If you are unsuccessful in locating your employer or having your earnings returned to you, you can file a complaint with the DOL for help reclaiming your benefits. To do this youll need to enter basic personal information about you and your employer. In some cases, youll also need to provide information about your past wages and how you were paid.

Actions The Cra Initiates

The CRA takes various actions to collect tax debts when taxpayers dont make voluntary payments. The collections limitation period will restart when the CRA:

- issues a garnishment or statutory set-off to collect an outstanding tax debt when you dont make voluntary payments

- applies a refundable credit to your tax debt and notifies you by sending you a letter or statement of account

- issues a notice of assessment or reassessment against a third party for amounts you owe

- certifies your tax debt in the Federal Court of Canada

- initiates seizure and sale action to collect your outstanding tax debt

How To Find Unclaimed Money That May Be Owed To You

With more than 26 million people out of work in the past month, a lot of Americans are looking for any extra cash they can find right now. Fortunately, theres an easy way to search for any unclaimed money thats owed to you.

What does it mean to have unclaimed money? When a business or government office owes you money for example, when you have credit at a store that closes, or youre owed a utility deposit that money eventually goes to state-run unclaimed property offices. The money goes unclaimed because no one tells you its there thats why you should periodically search for it. Heres how to check if theres free money you can put back in your pocket.

You May Like: Can I Cash A Government Check At Any Bank

Ev Tax Credits: Biden’s Bill Passes House Wants To Put $12500 In Your Pocket

The House’s version of the Build Back Better bill includes massive changes to the EV tax credit system. It passed the House and now it heads to the Senate.

How does $8,000 back on your taxes for buying a Tesla sound? It could happen.

Following huge changes to better incentivize electric car purchases, the US House of Representatives on Friday passed President Joe Biden’s Build Back Better bill. The legislation includes a refundable EV tax credit for up to $12,500 — a huge shift away from the currently nonrefundable amount. Now, the bill heads to the Senate where it needs to pass before the changes become official. Read on for the latest.

Does The State Owe Me Money California

stateowecashCaliforniafundsstateowedmoneymoney

How do i find out if the state of california owes me money?

To find potential money, visit the State Controllers Office and search the Unclaimed Property Database for money that the state may owe you!

what happens when money is escheated to the state?Unclaimedstatestateescheatedstate funds

Contents

Don’t Miss: Federal Government Jobs Nashville Tn

What Makes Federal Revenue Increase Or Decrease

The majority of federal revenue comes from individual and corporate income taxes as well as social insurance taxes. When individuals and corporations earn more money, they pay more in taxes, and thus federal revenue increases. Alternatively, if they make the same amount, but tax rates increase, the federal revenue will also increase. Decreases in federal revenue are largely due to either individuals or corporations making less money or a decrease in tax rates.

The federal government funds a variety of programs and services that support the American public. The federal government also spends money on interest it has incurred on outstanding federal debt, including Treasury notes and bonds.

What Happens If The Us Defaults

If Congress doesnt suspend or raise the debt ceiling, the government would not be able to borrow additional funds to meet its obligations, including interest payments to bondholders. That would most likely trigger a default.

The knock-on effect of the U.S. defaulting would be catastrophic.

Investors such as pension funds and banks holding U.S. debt could fail. Tens of millions of Americans and thousands of companies that depend on government support could suffer. The dollars value could collapse, and the U.S. economy would most likely sink back into recession.

And thats just the start. The U.S. dollar could also lose its unique place in the world as its primary unit of account, which means that it is widely used in global finance and trade. Without this status, Americans simply wouldnt be able to maintain their current standard of living.

A U.S. default would set off a series of events, including a depreciating dollar and surging inflation, that I believe would likely lead to the abandonment of the U.S. dollar as a global unit of account.

The combination of all this would make it a lot harder for the U.S. to afford all the stuff it imports from abroad, and with it Americans standard of living would fall.

Don’t Miss: Government Surplus Pickup Trucks For Sale

What Happens If You Don’t Pay Support

Federal, provincial and territorial laws set out a variety of tools to enforce support. The following pages explain how federal laws help to enforce the support that you owe.

If any of these tools are being used to enforce your support order or agreement, see the Resolve Enforcement Issues section for information that may help you resolve issues.

What Are The State Ev Credits And Incentives

Many states and even local governments looking to speed up EV adoption rates offer their own incentives. California is a leader in incentivizing EV purchases with a direct consumer rebate up to $4,500, for example, through the Clean Vehicle Rebate Project. There is currently a waitlist for applications, however. Colorado, Washington and New England states also offer some generous state incentives that you can combine with the federal EV tax credit. Even your local utility company may subsidize an EV purchase.

Read Also: How To Become A Federal Government Contractor

Increased Costs To Borrow Money

As the yield offered on Treasury securities increases, the cost of borrowing money to purchase a home will also increase because the cost of money in the mortgage lending market is directly tied to the short-term interest rates set by the Federal Reserve and the yield offered on Treasury securities issued by the Treasury Department.

Given this established interrelationship, an increase in interest rates will push home prices down because prospective homebuyers will no longer qualify for as large a mortgage loan. The result will be more downward pressure on the value of homes, which in turn will reduce the net worth of all homeowners.

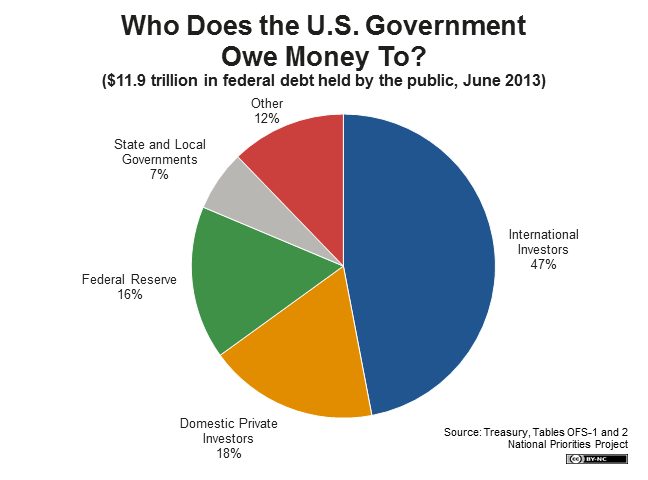

Us Debt: How Big Is It And Who Owns It

US federal debt is still a record high. This week it passed a milestone: the fourth straight year the deficit has passed the $1tn mark. As of today, the national debt stands at $16,066,241,407,385.80 .

It’s an issue that’s sure to come up in the first presidential debate this Wednesday.

So, how does the US borrow money? Treasury bonds are how the US – and all governments for that matter – borrow hard cash: they issue government securities, which other countries and institutions buy. So, the US national debt is owned mostly in the US – but the $5.4tn foreign-owned debt is owned predominantly by Asian economies.

Under President Obama’s first term, that figure has gone up from $3tn, a rise of 74.1%. Under George W Bush, it went up too – by 85% over the whole two terms – and 64% in his second term alone.

Holders of US Treasury bonds, $bn

The US Treasury releases the figures on this every quarter – we have made them more useable. So, who has the most?

It reflects a US national debt which has grown starkly, from $7.8tn in 2005 to busting through the US debt ceiling of $14.294tn last year – according to these day by day figures.

The full data is below. What can you do with it?

Also Check: How To Cash Government Check Without Id

California Judge Rejects Water Deal For Major Farm Supplier

Kathleen Ronayne

FILE – In this June 25, 2013, photo, workers move irrigation pipes from a field in the Westlands Water District near Five Points, Calif. A California judge has rejected a controversial contract between the federal government and the Westlands Water District, the nation’s largest agricultural water supplier, ruling the district failed to provide key information about the deal to permanently lock in its water access.

SACRAMENTO, Calif. A California judge has rejected a federal contract granting permanent access to U.S. government-controlled water for the nations largest agricultural water supplier, saying it lacked details on costs and appropriate public notice.

Environmentalists had blasted the contract with Westlands Water District as a sweetheart arrangement designed to benefit corporate agricultural interests over environmental needs and taxpayers. It was crafted during the Trump administration under then-Interior Secretary David Bernhardt, a former lobbyist for Westlands, a public entity based in Fresno that supplies water to private farmers.

This was an effort to basically steal public resources and put them into private pockets, said Stephan Volker, an attorney for the Winnemem Wintu Tribe, the North Coast Rivers Alliance and several other groups.

The argument really is: Are we going to allocate that much water to Westlands Water District without conditions? she said.

Wars In Iraq Syria Pakistan And Afghanistan

Primarily within the defense budget, continued involvement in these engagements cost the U.S. massively, adding to the national debt:

- Around $5.9 trillion has been spent on these engagements since 2001.

- Additionally, the U.S. spends more on defense than the next 10 biggest spenders combined.

- While there has been no official accounting of the cost of the war in Afghanistan, researchers at Brown University estimate the cost of that conflict alone at $8 trillion over 20 years.

You May Like: Government Jobs In Mcdonough Ga

Data Sources And Methodology

This analysis was conducted using theMonthly Treasury Statement as the data source for federal government revenue and spending of the United States and theMonthly Statement of the Public Debt as the data source for federal debt.

U.S. Census Bureau data was used forpopulationandhouseholdestimates.Median home price estimatesare also provided by the U.S. Census Bureau. Rent estimates come from theDepartment of Housing and Urban Development . The Bureau of Labor Statistics Occupational Employment Statisticswas used for wage estimates. Information on the amount of credit card debt added by Americans comes from the Federal Reserve Bank of New YorkâsCenter for Microeconomic Data. The annual 10-K reports of the top S& P 500 companies were compiled in order to find the equivalent revenue from companies to match the federal governmentâs revenue for the year. TheAmerican Road and Transportation Builders Associationprovides information about the cost of building new roads derived from the cost models of different states.

Are Used Electric Cars Eligible For The Tax Credit

Like leasing an EV, buying a used electric car also does not allow you to claim the traditional EV tax credit in any way. But, the Build Back Better bill would change this. Right now, the bill includes a $2,000 credit for used EVs at least two years old that cost under $25,000. There’s an extra $2,000 available if the EV includes at least a 40 kilowatt-hour battery for a total of $4,000 available for qualifying EVs.

You May Like: Which Government Health Insurance Company Is Best

Concerns Over Chinese Holdings Of Us Debt

According to a 2013 Forbes article, many American and other economic analysts have expressed concerns on account of the People’s Republic of China’s “extensive” holdings of United States government debt as part of their reserves. The National Defense Authorization Act of FY2012 included a provision requiring the Secretary of Defense to conduct a “national security risk assessment of U.S. federal debt held by China.” The department issued its report in July 2012, stating that “attempting to use U.S. Treasury securities as a coercive tool would have limited effect and likely would do more harm to China than to the United States. An August 19, 2013 Congressional Research Service report said that the threat is not credible and the effect would be limited even if carried out. The report said that the threat would not offer “China deterrence options, whether in the diplomatic, military, or economic realms, and this would remain true both in peacetime and in scenarios of crisis or war.”

Forced Coupon Increase Of Corporate Debt Offerings

As the rate offered on Treasury securities increases, corporate operations in America will be viewed as riskier, also necessitating an increase in the yield on newly issued bonds. This, in turn, will require corporations to raise the price of their products and services in order to meet the increased cost of their debt service obligation. Over time, this will cause people to pay more for goods and services, resulting in inflation.

Read Also: How To Apply For Federal Government Jobs

Calculating And Projecting The Debt

In 20022003, Canada changed its calculation for net debt. Until then, net debt was defined as the total liabilities minus total assets. Now, it is the total liabilities minus financial assets. The government prefers the concept of “accumulated deficit,” which corresponds to the old definition of net debt.

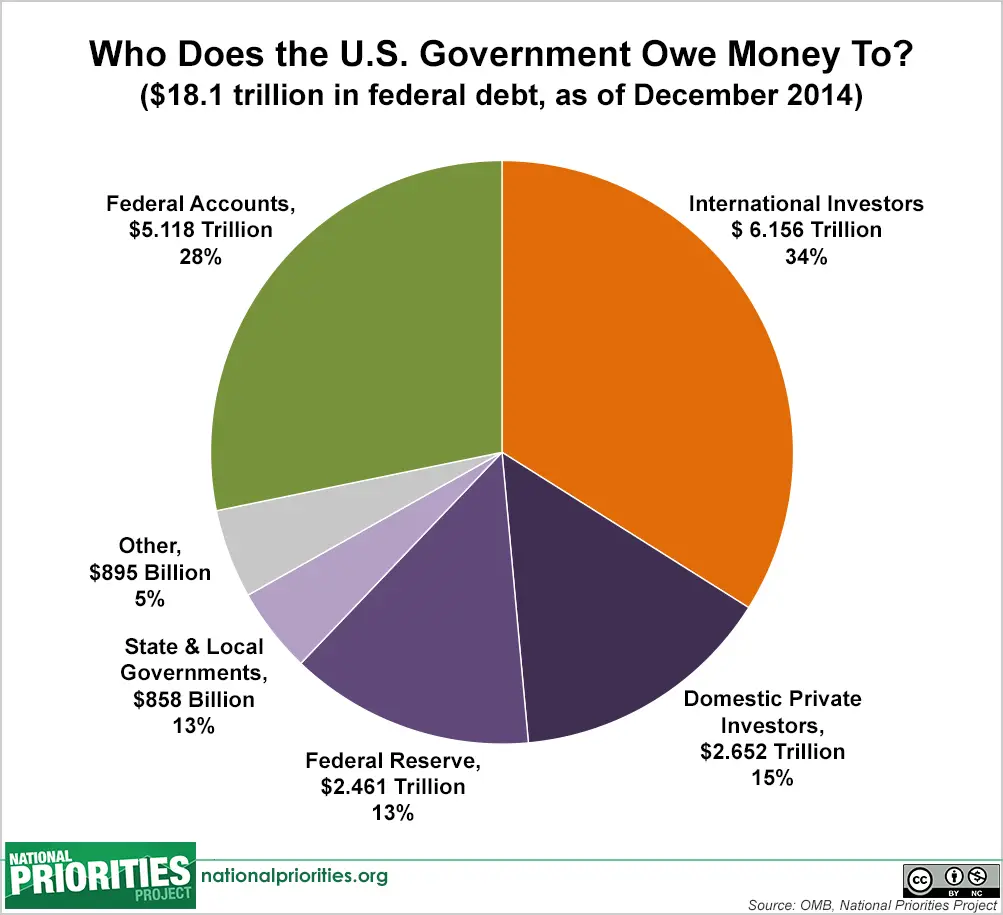

To Whom Does The Us Owe Money

From whom have we borrowed money to pay our yearly bills? Around a third of the debt, some $5.6 trillion, is owed to the countrys large institutional investors. That is:

- the Federal Reserve

- state and local governments

- and anyone else who holds U.S. Treasury bonds, bills or notes.

These investors have loaned us the money and in return, we have promised to pay them back with interest.

Another third, about $5.5 trillion, is owed to foreign governments. These countries, like our domestic investors, loaned us money in return for our promise to pay them back according to the binding agreements we made with them. China and Japan are the largest holders of American debt we owe each more than $1 trillion.

The final third, around $5 trillion, we actually owed to ourselves. Its money that the treasury has borrowed from various government trust funds Social Security, Medicare, retirement and pension funds, highway and airport accounts, unemployment and deposit insurance, etc. that have surpluses and are not part of the general revenue stream.

Also Check: Sell Solar Energy To Government

How To Find Out If You Have An Unclaimed Balance

Your financial institution must try to contact you in writing before transferring a product with an unclaimed balance to the Bank of Canada. The institution will try to contact you at the last address it has on file after the following times have gone by:

- after 2 years of inactivity

- after 5 years of inactivity

- after 9 years of inactivity

Notices will be sent in January after each period of inactivity mentioned above. For example, if you have a bank account that has been unused for 2 years as of July, then your first notice will be sent in January of the following year.

The notice you receive after 9 years of inactivity will let you know that your balance will be transferred to the Bank of Canada in January of the next year if you dont contact your financial institution or use the product by the end of the year. This notice will also tell you how to claim the balance once it is transferred.

The Bank of Canada will hold unclaimed balances of less than $1,000 for 30 years. It will hold unclaimed balances of $1,000 or more for 100 years.

What Is National Debt

Understanding those consequences begins with looking at how the U.S. government finances its spending. The Treasury Department has three sources.

It can use revenue from taxes and fees approved by Congress but collected by the Treasury.

It can also through the Federal Reserve.

But when the first two options dont supply enough cash to pay the bills, the Treasury can borrow the difference by issuing bonds and selling them on the worlds financial markets. Bondholders lend the government a set amount of money to be paid back with interest over a certain time frame. The amount owed is the national debt, which currently stands at US$28.43 trillion. That is above the debt ceiling of $28.4 trillion set by Congress earlier this year. The Treasury had been using extraordinary measures to finance government spending in lieu of an extension, but those measures were due to expire within weeks.

Although this includes money due to lenders and investors both overseas and in the U.S., a sizeble chunk is money that the federal government owes itself the U.S. Treasury owes money to other parts of the government as part of an accounting procedure. The Fed buys Treasury bonds when it wants to increase the supply of money in the economy and currently owns around one-fifth of the Treasury debt. The Social Security Administration holds around $2.9 trillion in national debt, which is financed with surplus revenue.

You May Like: Government Help With Private Student Loans