Ranking The Us Treasury Etfs

The variety of ETF choices makes distinguishing the best from the rest a little challenging. You’ve probably heard most financial pundits talk about focusing on funds with low expense ratios. That can certainly be a big factor in deciding which ETF to go with , but there are a lot of things that could go into making the right choice.

That’s where I’m going to try to make things easier for you. Using a methodology that I’ve developed, which takes into account many of the factors that should be considered and weighting them according to their perceived level of importance, we can rank the universe of available ETFs in order to help identify the best of the best for your portfolio.

Now, this certainly won’t be a perfect ranking. The data, of course, will be objective, but judging what’s more important is very subjective. I’m simply going off of my years of experience in the ETF space in helping investors craft smart, cost-efficient portfolios.

Best Us Treasury Etfs

- Publish date: Sep 12, 2022

For anyone who’s banked on Treasuries to help protect their portfolio from the bear market in equities this year, they’ve probably been mighty disappointed. We haven’t seen an inflationary environment like this since the 1970s and that’s completely broken the traditional relationship between stocks and bonds. Treasuries should be inversely correlated to stocks in most normal circumstances. Instead, we’ve seen the S& P 500 and long-term Treasuries both decline by more than 20% at the same time. That’s left investors with precious few places to seek safety.

The damage has taken place all along the yield curve. To give a sense of how unusual this environment has been, the iShares 1-3 Year Treasury Bond ETF experienced a maximum loss of 2% over its lifetime prior to this year and that was during the financial crisis. In 2022, it fell nearly 5% from peak to valley. The iShares 20+ Year Treasury Bond ETF fell as much as 24% during the financial crisis, but was down as much as 34% earlier this year. There has never truly been a Treasury market quite like the one we’re in right now.

U.S. Treasuries

Flia Ishg And Bwz Are The Best European Treasury Bond Etfs For Q2 2022

European treasury bond exchange-traded funds provide investors with exposure to debt securities issued by governments of European countries. The European GDP is now back to its pre-pandemic level after the COVID-19 pandemic sent it into its worst-ever recession.

The EU economy grew by 5.3% in 2021 as the gradual lifting of COVID-19 containment measures triggered robust economic activity. A continuously improving labor market, high household savings, and favorable financing conditions are expected to continue supporting the expansion. The EU economy is projected to grow by 4.0% in 2022 and 2.8% in 2023.

Fundamentals of the euro area economy remain strong but there’s great uncertainty following Russia’s recent invasion of Ukraine. EU countries buy 41.1% of their gas and 27% of their oil from Russia and energy prices could rocket if the Russia-Ukraine conflict interrupts this supply. The European Commission is yet to assess the economic impact of the conflict and there are added risks due to inflation, higher energy prices, and ongoing supply chain bottlenecks.

Amid the Ukraine war, European Commission has agreed to ease its financial support of the euro zone economy in 2023. However, the commission acknowledges there’s a high level of uncertainty and it is ready to provide cash should the war necessitate it.

You May Like: Us Government Senate And House Of Representatives

How To Work Out The Value Of A Bond

Yield to maturity is a useful measure of the value of a bond. It is also a good way to compare what you’ll get by investing in different bonds.

YTM calculates the average annual return of a bond from when you buy it until maturity. It assumes that you reinvest coupon payments in the bond at the same interest rate the bond is earning.

Make sure you always balance the return against any risks before investing.

Shm Spdr Barclays Short Term Municipal Bond

Municipal bonds offer tax-free interest. Those seeking short-term municipal bonds can use the SPDR Barclays Short Term Municipal Bond . This ETF seeks to track the Barclays Capital Managed Money Municipal Short Term Index. It has over $4 billion in assets, a weighted average maturity of 2.9 years, and an expense ratio of 0.20%.

Also Check: Federal Government Grant Award Program

How Do Bond Etfs Work

Bond ETFs are passively managed, which means that theres no financial manager whos picking which bonds will be brought into the fund. That means that the costs associated with bond EFTs are very low, much lower than mutual funds .

If theres no financial manager, then how are fixed income ETFs created?

Bond ETFs are created in the same way that other types of ETFs are created. A fund provider purchases all of the bonds that will be included in the bond ETF. The fund provider owns the bonds, but investors can buy shares of the ETF on the stock market.

When you purchase shares of a bond ETF youll essentially become a shareholder. Just like if you were a shareholder in a corporation, youll receive monthly dividends, interest payments, and capital gains .

Unlike individual bonds, bond ETFs have no maturity date. The bonds within the ETF will mature, but the proceeds are simply reinvested in new bonds. You wont get back your principal unless you sell your shares. If you do decide to sell your shares, you may receive more or less than what you paid for them depending upon the market conditions .

Bond ETFs are ideal for investors because theyre traded on a centralized exchange throughout the day. The price of the bond ETF will change throughout the day as investors buy and sell shares. In other words, a bond ETF has high liquidity.

Get Up To $600 Or More 1 Learn How

For a limited time, receive a cash bonus when you open a new E*TRADE brokerage or retirement account with a qualifying deposit by October 31, 2022.

BONUS22

Check the background of E*TRADE Securities LLC on FINRA’s BrokerCheck seeE*TRADE Securities LLC and E*TRADE Capital Management, LLC Relationship Summary.

| Investment Products Not FDIC Insured No Bank Guarantee May Lose Value |

PLEASE READ THE IMPORTANT DISCLOSURES BELOW.

Banking products and services are provided by Morgan Stanley Private Bank, National Association, Member FDIC.

This Thematic Investing screener is an educational tool and should not be relied upon as the primary basis for investment, financial, tax-planning, or retirement decisions. This tool provides a sample of exchange-traded funds that may be of interest to investors and is provided to customers as a resource to learn more about different categories of ETFs and the use of screeners. This educational information neither is, nor should be construed as, investment advice, financial guidance, or an offer or a solicitation or recommendation to buy, sell, or hold any security, or to engage in any specific investment strategy. Additional ETFs available through E*TRADE Securities LLC may be found by using the ETF screener at .

How ETFs are selected for a theme:

For a definition of terms, please click on the Data Definitions link. Data and data definitions provided by Morningstar.

Recommended Reading: Us Government Benefits For Employees

What Are Fixed Income Etfs

A fixed income ETF is an exchange traded fund that only invests in bonds. While a regular ETF holds a collection of stocks or commodities, a bond ETF only holds a collection of bonds. A bond ETF may hold hundreds or even thousands of different bonds.

Most bond ETFs will include a specific subset of bonds. Here are some of the most common areas of focus:

-

Government bonds: These bond ETFs contain bonds that are issued by either the federal government or by local governments . U.S. Treasury bonds are often considered the most lucrative type of government bond.

-

Corporate bonds: Some bond ETFs will only contain corporate bonds that have been issued by large companies.

-

International bonds: These bond ETFs will contain bonds that are issued by foreign governments.

-

Maturity: Some bond ETFs contain only short-term bonds, while others include only long-term bonds.

So whys it called a fixed income ETF anyway?

Fixed income refers to any security that gives investors a fixed amount of interest or dividends until maturity is reachednamely, bonds.

Should You Invest In A Total Bond Market Index Fund

Index fund investing benefits from lower fees than buying actively managed mutual funds. Lower costs result in better after-fee returns over the long term. Thats true with fixed income investments as well as equities.

SP Global tracks the relative performance of actively managed funds compared to their respective benchmark across a number of asset classes. Its latest report shows that actively managed funds were more likely to underperform their respective index over one-, three- and five-year periods. Morningstar has reported similar results.

There are at least two important considerations beyond performance that investors should keep in mind. First, the duration of the funds in our list hover around six years. Duration helps us understand how much the value of a fund will rise or fall with interest rates. Generally, for each 1% rise or fall in interest rates, a funds value will rise or fall by a percentage equal to its duration.

Assuming a fund with a six-year duration, an increase in rates of 1% will cause the funds value to decline by about 6%. A decrease of 1% in the prevailing rates will cause the funds value to increase by about 6%. Given the historically low interest rate environment and the recent rise in yields, you need to consider the interest rate risk associated with a total bond index fund.

Also Check: What Are Government Student Loans

Note: Interested In Getting Periodic E

Out of 20 bond ETFs, all but three of them come with an expense ratio of 0.07% or less. Especially when it comes to retirement investing, lower expense ratios mean higher yields and that means more money in your pocket. Just as advantageous is the fact that all but 4 of the 20 have assets of at least $2 billion. In many cases, that means trading costs are also razor thin. I preach all the time about looking at the total cost of ownership of ETFs . No ETF issuer may offer a better cost advantage than Vanguard.

As I discuss with the Vanguard Stock ETF rankings, there are some disadvantages to dumping bond ETFs of all styles and target markets into one bucket. That’s less of an issue in the fixed income space since the vast majority of funds invest in hundreds, if not thousands, of individual bonds. If a low volatility stock ETF, for example, holds 50-100 names and a total stock market ETF has more than 1,000 stocks, the latter will hold a distinct diversification advantage. In the bond ETF world, diversification is less of an issue since most of them are highly diversified.

How To Buy The Best Bond Etfs In Canada

The cheapest way to buy ETFs is from discount brokers. My top choices in Canada are:

- 105 commission-free ETFs to buy and sell

- Excellent customer service

- Stock and ETF buys and sells have $0 trading fees

- Desktop and mobile trading

- ETF buys have $0 trading fees

- Excellent market research tools

To learn more, check out my full breakdown of the best trading platforms in Canada.

Recommended Reading: Cheap Government Cars For Sale

The 10 Best Fixed Income Etfs To Invest In

What are the best fixed income ETFs to invest in? Heres a quick list of bond ETFs that are low-cost and which generate solid returns.

iShares Core U.S. Aggregate Bond ETF

Vanguard Total Bond Market ETF

iShares iBoxx $ Investment Grade Corporate Bond ETF

Vanguard Total International Bond ETF

SPDR Bloomberg Barclays 1-3 Month T-Bill ETF

Vanguard Intermediate-Term Corporate Bond ETF

Direxion Daily 20+ Year Treasury Bull

iShares 20+ Year Treasury Bond ETF

iShares Convertible Bond

FlexShares Credit-Scored U.S. Long Corporate Bond Index Fund

Municipal Bonds: Ishares National Muni Bond Etf

- 3-year return : 4.71%

- Expense ratio: 0.07%

- Assets under management : $24.5 billion

- Inception date: Sept. 7, 2007

Municipal bonds are issued by state and local governments. For example, a city might issue a municipal bond to pay for infrastructure improvements or other projects.

The advantage of municipal bonds is that investors returns are typically exempt from federal income tax, making them popular for investors looking to reduce their tax burden.

The iShares National Muni Bond ETF invests in more than 2,000 municipal bonds from state and local governments around the U.S., aiming to generate tax-free income for investors.

The fund has more than $24 billion in assets, so investors should have no issues buying or selling shares when they want to. Its also inexpensive to invest in, with an expense ratio of 0.07%equal to 70 cents for each $1,000 invested.

Recommended Reading: What Is Master Data Governance In Sap

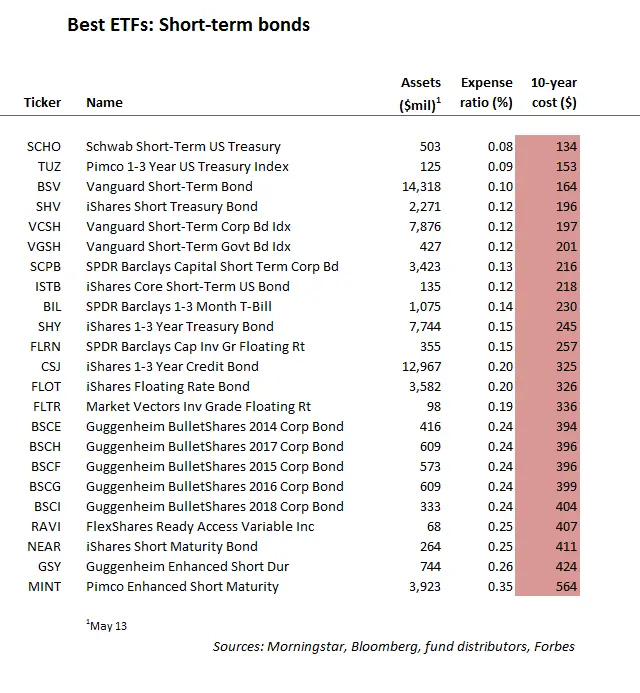

The Best Etfs And Mutual Funds

Expenses are an especially important factor to consider when investing in short-term bond fundsbut theyre key when evaluating other types of funds, too. For more tips about how to find good funds, read Morningstars Guide to Fund Investing. And check out our Best Funds lists across a variety of categories, including top core stock funds, the best small-company funds, highly rated growth stock funds and value stock funds, good international-stock funds, and even the best taxable-bond funds, which includes the funds featured here.

How To Buy Ishares Etfs

There are many ways to access iShares ETFs. Learn how you can add them to your portfolio.

Discuss with your financial planner today

iShares funds are available through online brokerage firms.All iShares ETFs trade commission free online through Fidelity.

iShares unlocks opportunity across markets to meet the evolving needs of investors. With more than twenty years of experience and a global line-up of 900+ ETFs, iShares continues to drive progress for the financial industry. iShares funds are powered by the expert portfolio and risk management of BlackRock.

corporate

Don’t Miss: New York State Government Assistance Programs

Vanguard Total Bond Market Index Fund Admiral Shares

As an Admiral Shares fund, the minimum investment requirement in this fund is $3,000. However, with a low expense ratio and industry-leading historic returns, it may be worth making the large initial investment.

The Vanguard Total Bond Market Index Fund Admiral Shares fund seeks to provide diversified exposure to the United States Market by investing in treasury bonds and mortgage-backed securities. The maturities on these investments range from short to intermediate and even long-term commitments.

With the fund being made up of investments across several segments, it was designed to be the core bond holding in your investment portfolio.

Key Stats

As is the case with just about any fund offered up by the firm, the VBTLX offers a compelling historic performance and comes with very low fees.

Read Also: Stay At Home Government Jobs

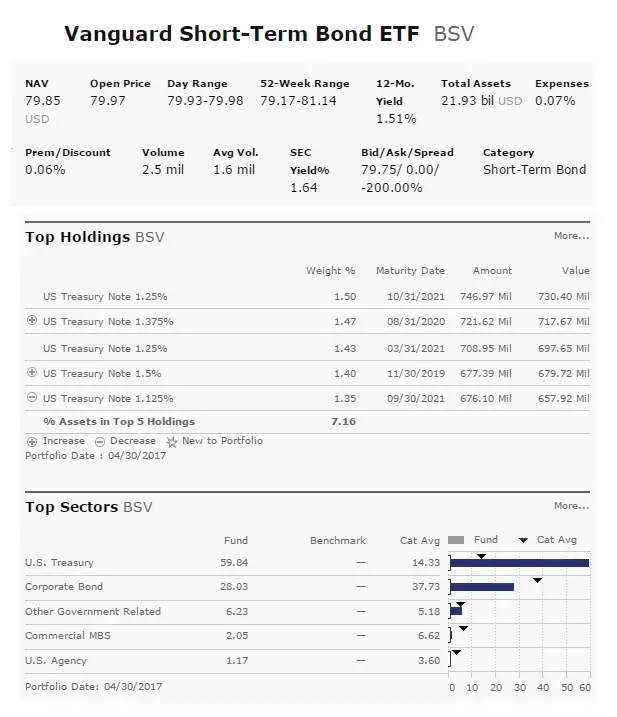

Vanguard Short Term Bond Etf List

Vanguard Short Term Bond ETFs are funds that focus on the shorter maturity and duration scale of the domestic fixed-income market. These are generally bonds with maturities of less than seven years and can include corporates, Treasuries, agencies as well as other bonds like TIPS.

As of 08/23/22

This is a list of all Vanguard Short Term Bond ETFs traded in the USA which are currently tagged by ETF Database. Please note that the list may not contain newly issued ETFs. If youre looking for a more simplified way to browse and compare ETFs, you may want to visit our ETF Database Categories, which categorize every ETF in a single best fit category.

This page includes historical return information for all Vanguard Short Term Bond ETFs listed on U.S. exchanges that are currently tracked by ETF Database.

The table below includes fund flow data for all U.S. listed Vanguard Short Term Bond ETFs. Total fund flow is the capital inflow into an ETF minus the capital outflow from the ETF for a particular time period. Fund Flows in millions of U.S. Dollars.

The following table includes expense data and other descriptive information for all Vanguard Short Term Bond ETFs listed on U.S. exchanges that are currently tracked by ETF Database. In addition to expense ratio and issuer information, this table displays platforms that offer commission-free trading for certain ETFs.

| Symbol |

|---|

Don’t Miss: Names Of Free Government Phones

A High Yield Etf Ahead Of The Curve

Horizons Active High Yield Bond ETF seeks to provide investors with high total return income and monthly distributions by primarily investing, directly or indirectly, in high-yield debt securities of North American companies. HYI may also invest, directly or indirectly, in convertible debentures, preferred shares and mortgage-backed securities.

International Bonds: Vanguard Total International Bond Etf

- 3-year return : 4.04%

- Expense ratio: 0.08%

- Assets under management : $119.2 billion

- Inception date: May 31, 2013

Governments and other organizations around the world issue bonds. If you want to buy bonds from countries outside of the U.S., the Vanguard Total International Bond ETF is an all-in-one fund that fits that bill.

This ETF focuses on highly rated bonds, primarily from Europe and the Pacific. It has relatively little exposure to emerging markets and other regions like the Middle East. The majority of the bonds in its portfolio are highly rated at A or above, meaning there is low default risk.

With almost $120 billion in assets, the fund is large enough that investors wont struggle to buy or sell shares. Its also inexpensive, with an expense ratio of 0.08%, equivalent to 80 cents for each $1,000 invested.

Also Check: Government Loans For Mobile Homes