The Basics: Understanding Federal Student Loans

College is an exciting time for you and your child. There are many unknowns, but one thing is certain: Paying for college can be easier with the right supportand thats what were here for.

Below, weve outlined some basics to keep in mind as your family prepares to pay for college.

A general rule for financing college is that you should never borrow more money than is necessary following this practice sets your child up for a more stable financial future.

Along with this basic rule, there are many other factors to think about: Which school does your child want to attend? What do they want to study? Do they know what kind of career they want, and what their expected earnings might be?

Its a lot to think about, but if your child takes a little time now to consider their future career and the potential return on investment from their education, it can plant the seed for a successful future!

The Guaranteed Student Loan Program

Under the guaranteed student loan program, private lenders like Sallie Mae and commercial banks issued student loans that the federal government guaranteed. Guaranteed loans are also called Federal Family Education Loans .

Here’s how the “guarantee” works: If a borrower defaults on a guaranteed loan, the federal government pays the bank and takes over the loan. The federal government pays approximately 97% of the principal balance to the lender. At that point, the federal government owns the loan and the right to collect payments on the loan.

Federal Student Loan Process

To apply for a federal student loan youll need to file the Free Application for Federal Student Aid . The information on the FAFSA will determine how much youll be able to borrow. Your college will send you a financial aid offer, which will include details on how to accept your loan. You will then need to sign a Master Promissory Note .

You May Like: Best Government Contracting Companies To Work For

How To Apply For Federal Student Loans For College

Applying for federal student loans is free. All you need to do is complete the . In addition to determining eligibility for federal student loans, the FAFSA also determines whether you may qualify for other federal student aid like grants and work-study. You need to submit the FAFSA every year youre enrolled in college to receive federal student aid.

The easiest and fastest way to file the FAFSA and check your eligibility for federal student loans is online. Your application will be processed within 3-5 days. You can also mail in a paper application, but processing it will take about 7-10 days.

Submitting the FAFSA is totally free. If youre asked to pay, that means youre in the wrong place.

How Does Interest On A Student Loan Work

Because youre not just paying back the amount you borrow, youre paying back interest as well, its important to understand how much that will add to the total amount you pay.

How much you pay in interest depends on a number of factors: whether your loan is subsidized or unsubsidized, the interest rate on your loan, the amount you borrow, and the loan term.

For example, you graduate with a $10,000 loan with a 5% interest rate and plan to pay it off over 10 years. You will pay $2,728 in interest over the 10 years that you repay the loan. Your monthly loan payment will include both payments to reduce the principal balance and interest payments. The total amount repaid will be $12,728 including both principal and interest.

Interest generally continues to accrue during forbearances and other periods of non-payment. So, if you take a break on repaying your loans or skip a loan payment, the total cost of the loan will increase, and not just because of late fees.

Loan payments are applied to the loan balance in a particular order. First, the payment is applied to late fees and collection charges. Second, the payment is applied to the interest that has accrued since the last payment. Finally, any remaining money is applied to the principal balance. So, if you pay more each month, you will make quicker progress in paying down the debt.

You can use a loan calculator to help you calculate exactly how much youll pay in interest.

Read Also: Government Jobs In Surprise Az

What Is A Federal Student Loan

Federal student loans are intended to help you pay for your college education. The federal government provides student loans through the Department of Educations William D. Ford Federal Direct Loan Program. This type of federal aid offers fixed interest rates and loans must be repaid once you leave school or drop below half-time enrollment.

There are four types of Direct loans available, including a loan option specifically for parents of dependent students. The federal loan program offers subsidized and unsubsidized loan options, as well, depending on your enrollment level.

The Federally Guaranteed Student Loan Program Ended June 30 2010 But Many People Are Still Paying On Guaranteed Loans Issued Before Then

Many former students have federally guaranteed student loans. These loans are different from private student loans that the government doesn’t guarantee, and from loans issued directly to the student by the federal government . As of June 30, 2010, Congress stopped the guaranteed student loan program for newly issued loans. But many people are still paying on their federally guaranteed student loans that were issued before June 30, 2010, so they’ll be around for a while.

Tax-Free Student Loan Forgiveness Through 2025

The American Rescue Plan Act of 2021, which President Joe Biden signed into law on March 11, 2021, includes a provision exempting all student loan forgiveness after December 31, 2020, and before January 1, 2026, from federal taxation.

Federal laws generally treat any forgiven student loan debt as a taxable event for the borrower unless they were forgiven for specific reasons, like the death or disability of the borrower . The American Rescue Plan Act makes student debt forgiveness tax-free until January 1, 2026. The tax exemption under this law applies to direct federal student loans, Federal Family Education Loans , and private student loans.

Don’t Miss: How Long Do You Have To Sue A Government Agency

Q How Many Student Loan Borrowers Are In Default

A. Thehighest default rates are among students who attended for-profit institutions. Thedefaultrate within five years of leaving school for undergrads who went to for-profitschools was 41% for two-year programs and 33% for four-year programs. Incomparison, the default rate at community colleges was 27% at public four-yearschools, 14%, and at private four-year schools, 13%.

Put differently, out of 100 students who ever attended a for-profit, 23 defaulted within 12 years of starting college in 1996 compared to 43 among those who started in 2004. In contrast, out of 100 students who attended a non-profit school, the number of defaulters rose from 8 to 11 in the same time period. In short, the government has been lending a lot of money to students who went to low-quality programs that they didnt complete, or that didnt help them get a well-paying job, or were outright frauds. One obvious solution: Stop lending money to encourage students to attend such schools.

Thepenalty for defaulting on a student loan is stiff. The loans generally cannotbe discharged in bankruptcy, and the government canand doesgarnish wages, taxrefunds, and Social Security benefits to get its money back.

Differences In Repayment Options For Guaranteed And Direct Loans

The most important difference between guaranteed and direct loans is the availability of repayment programs. The federal government offers several repayment plans for low-income borrowers like the:

- Income Based Repayment Plan

- Income Sensitive Repayment Plan

- Pay As You Earn , and

- Pay As You Earn Repayment Plan .

Some of these plans are available to certain FFEL borrowers. Generally, the repayment plan options are more generous for direct loans than for FFELs.

To determine whether you have FFEL guaranteed or direct loans, access the National Student Loan Data System.

You May Like: What Is A Government Issued Birth Certificate

Us Government Students Loans

Students who are Citizens or Permanent Residents of the U.S. may apply for a Direct Loan through the William D. Ford Federal Direct Loan Program. Students must be registered in a degree program. Students in any online or correspondence programs are not eligible for U.S. government loan funding. Contact the Financial Aid Coordinator to apply.

How The Funding Works

The Government of Canada works with most provincial or territorial governments to offer student grants and loans. In all situations, you apply with your province or territory of residence. The amount you can receive is calculated when you apply.

British Columbia, Manitoba, New Brunswick, Newfoundland and Labrador, Ontario, and Saskatchewan

The Government of Canada and the provincial governments work together to provide integrated student grants and loans.

Alberta, Nova Scotia and Prince Edward Island

Canada Student Grants and Loans are available alongside provincial or territorial student aid.

Yukon

Only Canada Student Grants and Loans and territorial grants are available.

Nunavut, the Northwest Territories and Quebec

Canada Student Grants and Loans are not available. These jurisdictions operate their own student aid programs.

You May Like: Colt 45 Series 80 Government Model

Q If So Many Students Are Struggling To Repay Their Loans How Much Are Taxpayers On The Hook For

A. For many years, federal budget forecasters expected the student loan program to earn a profituntil recently. In its latest estimates, the Congressional Budget Office expects the program to cost taxpayers $31 billion for new loans issued over the next decades. And that figure uses an arcane and unrealistic accounting method required by federal law. Using an accounting method that calculates the subsidy to borrowers from getting loans from the government at rates well below those theyd be charged in the private sector, the cost to taxpayers is $307 billion. And that largely excludes the cumulative losses already anticipated on loans issued prior to 2019.

Who Actually Owns Student Loan Debt

As of late 2021, American students are on the hook for approximately $1.75 trillion in student loans, according to data compiled by the Education Data Initiative. 43.2 million student borrowers owe an average of $39,351, up significantly from past decades. With that much money on the line, it’s reasonable to be curious about who might ultimately receive all those principal and interest payments. While $1.75 trillion may be a significant liability for the borrowers, it can be an even bigger asset for creditors.

Don’t Miss: Car Insurance Government Employee Discount

When Did The Government Start Backing Student Loans

College degrees were not as common in the early-mid 20th century as they are today. There were only about 186,000 college graduates in America in 1940. Tuition at both public and private colleges was much lower, but colleges saw a boom in enrollment after the end of World War II when the number of American college graduates in 1950 tripled from what it was in 1940.

The GI bill in 1944 provided soldiers and war veterans with federal funding for their education, but the National Defense Education Act of 1958 that was signed into law by President Eisenhower created the first set of student loans backed by the federal government in an effort to encourage STEM degrees after Sputnik launched in Russia.

Until 2010, students could seek student loans from private lenders that were guaranteed, but not issued, by the federal government under the Federal Family Education Loan Program. Many people have confused this program for Federal Direct loans but FFELP loans were issued by banks and private financing companies. Federal Direct loans are actually issued by the US Department of Education.

Review Your Award Letter

Upon submitting the FAFSA, the information in the application is sent to the school of choice and its financial aid office determines the amount of federal student aid you may receive.

Information is also sent to the Department of Education, who in return sends the Student Aid Report . That is merely a summary of what was included in the FAFSA not a detailed report of how much aid you will receive. It does, however, allow you to review for any errors along the way.

Once the school calculates your federal student aid, it will send an award letter to you that details the amounts. Each school varies as far as timing of award letters so it may be some time between submitting the FAFSA and receiving the award information.

When you receive the award letter, determine the amount of aid you want to accept and from which school, and then inform the financial aid office at that school what you would like to do. They will set a deadline, typically detailed in the award letter, so be sure to respond in a timely fashion.

Once accepted, the school will let you know how and when the aid is paid out, and if any additional paperwork is required like entrance counseling or signing a promissory note.

Also Check: Standard Government Headstones And Markers

Q Are Student Loan Burdens Economically Handicapping An Entire Generation

A. More adults between 18 and 35 are living at home, and fewer of them own homes than was the case for their counterparts a decade or two ago. But these trends are mostly due to these folks entering the work force during the Great Recession rather than due to their student loans. Federal Reserve researchers estimate that 20% of the decline in homeownership can be attributed to their increased student loan debt the bulk of the decline reflects other factors.

Public Service Loan Forgiveness

This program forgives any remaining balance on your federal student loans after you have made 120 qualifying monthly payments under a qualifying repayment plan while working full-time for a qualifying employer.

Most public servants have qualifying employers, as those who work at government agencies or nonprofit organizations fall under this category. Qualifying repayment plan could mean making monthly payments on student loan debt as normal or any formal payment arrangement made with loan servicers.

So, if youve been making monthly payments on your loans for 10 years and you work for the government or a nonprofit organization, youre eligible for total debt cancellation on any remaining federal loans.

You May Like: Student Loans From Federal Government

How Federal Student Loans Work

If youre eligible for federal student loans, your school will provide you with a financial aid award letter. It outlines which loans you qualify for, if any, and the amount you can receive for the academic year.

Youll need to select which loans you want to accept and the amount. If this is your first time borrowing a federal loan, youll need to complete entrance counseling, which explains how loans work and how to pay them back. Youll also sign a master promissory note agreeing to the terms of your loan.

The school will then apply the federal loan funds toward your outstanding account charges, like tuition and fees. Whatever amount is left will be returned to you.

Once your enrollment drops below half-time or you graduate, a six-month grace period begins where you dont have to make payments. After the grace period is up, youll start making monthly payments based on the terms of your loan agreement.

Are Student Loans Funded By The Government

Some, but not all, student loans are funded by federal and state governments. Federal Direct loans are administered directly through the US Department of Education with subsidized loans for low-income students at a 3.4% interest rate and unsubsidized loans available to all borrowers with a 7.6% interest rate. Payment is deferred until the student graduates.

Federal Direct PLUS loans are available for graduate and professional students, as well as parents and guardians of dependent undergraduate students at an interest rate of 7.9%.

The less common Perkins federal loan is for very low-income undergraduate and graduate students with an interest rate of 5%, and an annual limit of $5,500 for undergraduate students and $8,000 for graduate students.

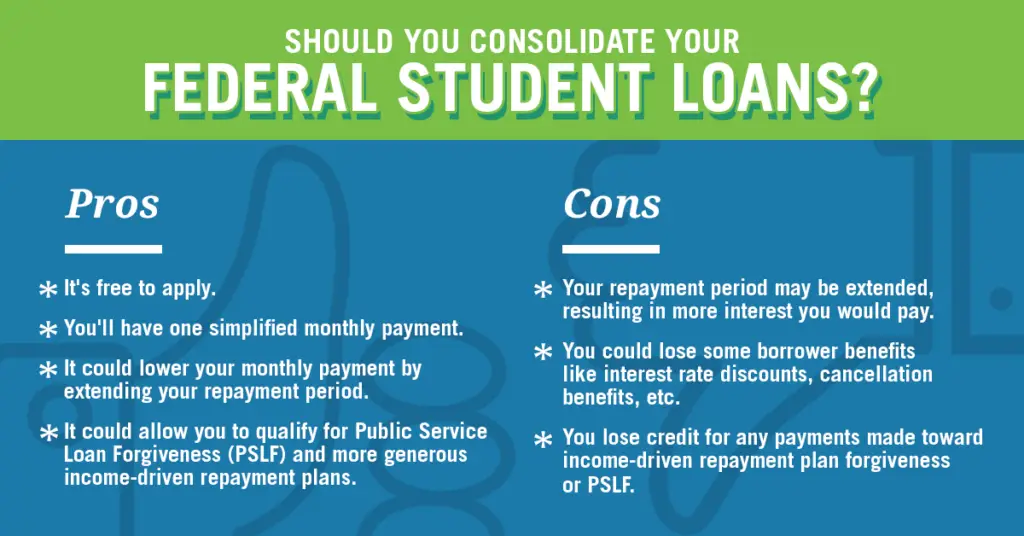

Federal consolidated loans are also available to borrowers who have multiple federal loans to combine all of your loans into one payment with the interest rate based on a weighted average of all the loans’ interest rates rounded to nearest one-eighth of a point.

The most well-known state student loan programs are administered by the governments of Alaska and Texas. Loans from the Alaska Commission on Post-Secondary Education are available to Alaska residents attending any out-of-state college and to any students attending Alaska State schools. Texas has an alternative loan program that administers college aid meant to supplement federal loans.

Read Also: How Are Governments Using Blockchain Technology

You Dont Need Good Credit To Consolidate

If you have multiple federal loans, you can easily consolidate student loans into one payment. Federal consolidation also makes some loans eligible for Public Service Loan Forgiveness and income-driven repayment plans. But it wont save you money, since its rate is determined by a weighted average of your prior loans interest rates.

You can also consolidate and refinance student loans through a private lender, which might lower your interest rates based on your credit and income. But refinancing means losing access to the benefits of federal students loans.

Repaying Your Canada Student Loans

If you have a government student loan, you have a six-month grace period when you graduate before you must start repaying your student loans. During that time, youll receive a letter in the mail outlining your loans interest rate and monthly payment. Your loan will usually default to a fixed interest rate, but if youd prefer your Canada student loan interest rate to be a variable interest rate, you can call your loan provider to make this change. If youd like to pay more toward your student loan to pay it off sooner, you can contact your provincial or federal student loan centre to change your payment terms.

Paying down your student loans is a long and arduous process, but there are ways to speed up your debt repayment progress. A tried-and-true method is to apply for student loan forgiveness . Many provinces offer student loan forgiveness to individuals working in specific professions.

For example, if you are a nurse and you are working in a rural area, you may be eligible to have some of your student loans forgiven. Another typical student loan forgiveness program is to forgive loans through non-refundable tax credits, as long as you live and work in your home province. These loan forgiveness programs can reduce your student loan debt by thousands and dramatically decrease the length of your loan, so its worthwhile to research loan forgiveness programs in your province.

Read Also: How To Email Government Officials