How Student Loan Interest Works

When you take out a student loan, youre required to repay the original amount you borrowed, plus an additional interest payment. The interest payment is based on a percentage of the loan balance, and the percentage is based on the interest rate. You can think of interest as a fee that the lender charges to loan you money.

The interest rate for federal student loans is set every year and is the same for all undergraduate borrowers, regardless of credit history. Interest rates for federal loans are always fixed, which means they will stay the same for the total life of the loan.

The interest rate for private student loans differs per borrower. The interest rate depends on the current rate offered as well as your credit history . The interest rate on private loans can be fixed or variable .

If youre applying for a private student loan and you dont have stable income or good credit, youll probably need a cosigner. Your cosigner should also have a good understanding of how student loans work and their obligation.

Because private student loan interest rates can vary, its important to explore options from different lenders before you apply.

Recommended Reading: Government Help For New Business

How To Apply For The Federal Student Loan Repayment Program

There isnt a formal application for this federal employee repayment program. Instead, ask your employer or potential manager for more information if you are employed by a federal agency or are interviewing with one for a job.

Your employer will consider your request. Whether it issues the funds to you is decided on a case-by-case basis.

If the agency does decide to move forward, it must prepare a plan that describes how the agency will implement the program and disburse the money.

Public Service Loan Forgiveness: What It Is How It Works

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

Public Service Loan Forgiveness is a federal program designed to encourage students to enter relatively low-paying careers like firefighting, teaching, government, nursing, public interest law, the military and religious work.

You must make 10 years worth of payments, for a total of 120 payments, while working for the government or a nonprofit before qualifying for tax-free forgiveness.

You can use the PSLF Help Tool on the federal student aid website to find out your eligibility based on the types of loans you have and your employer.

Public Service Loan Forgiveness has undergone temporary changes in the face of the COVID-19 pandemic.

-

First, all federal student loans were put into forbearance with no payments due through May 1, 2022.

-

Second, the Education Department has issued a limited waiver through October 2022 of sometimes-onerous provisions for PSLF qualification.

The waivers for PSLF qualification mean that a broader range of past payments on federal loans will count toward forgiveness, as long as you were working for a qualified employer at the time.

Read Also: Government Jobs In Las Vegas

Student Loan Borrowers Who Earn A High Salary Wont Get Student Loan Cancellation

Student loan cancellation wont be for student loan borrowers who earn a high salary. The corporate lawyer, doctor, dentist or MBA who earns $3oo,000 a year wont get student loan cancellation. Again, not everyone will qualify for student loan forgiveness. The main proposal on wide-scale student loan forgiveness from Senate Majority Leader Chuck Schumer and Sen. Elizabeth Warren proposes to limit student loan forgiveness to federal student loan borrowers who earn up to $125,000 annually. . If Congress passes any legislation on student loan forgiveness, that income cap could be lowered. The stimulus checks in response to the Covid-19 pandemic were targeted at individuals who earned up to $75,000 annually. It may be a hard sell to justify wide-scale student loan forgiveness at an income threshold that is higher than the income threshold for stimulus checks. .

Who May Qualify For Federal Student Loan Forgiveness

There are several federal programs that offer student loan forgiveness based on certain criteria, such as employment.

If you have a parent PLUS loan, you should explore discharge options in the event of the death of the student, if you become permanently and totally disabled, if the loan gets discharged in bankruptcy, or if the school engages in activities like falsely certifying for the loan or closing while the student is studying. If one of these events occurs, you can apply for a discharge. Upon acceptance, youd no longer be responsible for the loan.

Also Check: Free Dental Implants Grants

Can You Use Debt Consolidation To Repair Bad Credit

Debt Consolidation Loan. While negative reports cannot be removed from your credit report, there are things you can do to correct your credit score. First, you can get a debt consolidation loan and pay off all your other debts. You will probably have to pay a much higher interest rate, but your monthly payment will be less than the total payments you are currently making.

Also Check: How Do I Sign Up For Government Health Insurance

Specialized Loan Forgiveness Programs

If you work or volunteer for certain organizations, you may be eligible for additional programs that will forgive or reduce your student debt. Here are some examples:

- AmeriCorps VISTA, AmeriCorps NCCC, or AmeriCorps State and National programs: Volunteers for these programs can receive up to the maximum Pell Grant award toward repaying qualified student loans through the Segal AmeriCorps Education Award. For the 20212022 school year, this amounts to $6,495.

- Army National Guard: The Army National Guards Student Loan Repayment Program can help you earn up to $50,000 toward loans. Covered loans include Federal Direct, Perkins, and Stafford loans.

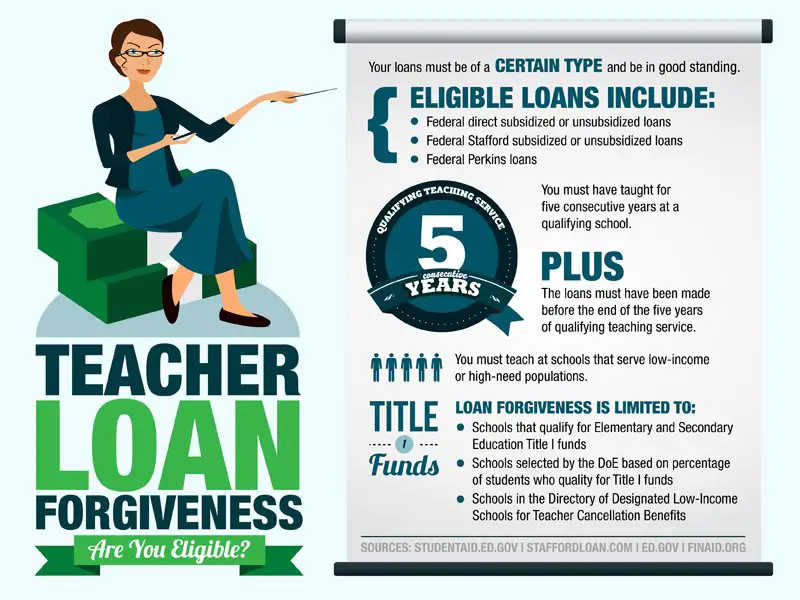

- Full-time teachers in low-income schools or educational service agencies: Through the Teacher Loan Forgiveness Program, teachers may be eligible for forgiveness of up to either $5,000 or $17,500 on their Federal Direct and Stafford loans after five consecutive years of service. The higher amount is for certain math, science, and special education teachers. The Education Department has further details on its website.

- Medical and nursing school graduates: Working in underserved areas can qualify doctors and nurses for student loan forgiveness under some state programs.

During the time that your monthly loan payments are suspended, those suspended payments will count toward PSLF, just as if you had continued to make them, as long as you meet the programs other requirements.

Also Check: Capabilities Statement Template

Can You Get A Real Car Loan With Bad Credit

- Check your creditworthiness. Check your credit score before you start shopping for a car loan.

- Save for the deposit. Building up a deposit can have several advantages.

- Think about how much you can afford. Donât just think about your monthly loan payment, but how much you can afford.

- Buy from different lenders.

How To Apply For Federal Student Loans For College

Applying for a federal student loan is free. All you need to do is complete the . In addition to federal student loans, the FAFSA also determines your eligibility for other federal student aid like grants and work-study. You need to submit the FAFSA every year youre enrolled in college to receive federal student aid.

Also Check: Federal Government Day Care Centers

You May Like: Assurance Wireless Virginia

Forms Of Public Student Loan Forgiveness

Relief from payment of loans particularly by students comes in two main forms. Students do not just get loan forgiveness but actually have to earn the forgiveness. As a student, there are fundamentally two known ways you can earn forgiveness for your loan. Each of the ways has its own condition attached to it.

The two ways you can get loan forgiveness are:

- Repayment plans

Is There More Student Loan Forgiveness Coming

Part of President Joe Bidens campaign pitch was that he was going to offer some sort of forgiveness to student loan borrowers, but as of April 2021, Biden hasnt sorted that question out.

He told a February CNN Town Hall meeting that Im prepared to write off a $10,000 debt, but not $50,000, but has not followed up on that with any legislative proposal.

Instead, a month later, he asked Education Secretary Miguel Cardon to prepare a report that details a presidents authority to cancel $50,000 in student loan debt without approval from Congress.

According to student loan expert Mark Kantrowitz, the $10,000 cancellation would wipe out all student loan debt for about 14.5 million borrowers. The $50,000 cancellation would erase debt for about 36 million borrowers.

One thing to be aware of is that currently, whatever amount of loan is forgiven is counted as taxable income. That may change as new legislation comes out and possibly changes loan forgiveness programs.

Read Also: Car Repair Financial Help

Leaves And Change In Employment

Loan forgiveness is not pro-rated. If you leave government in the middle of the year, you’re not entitled to any portion of the loan forgiveness for that year and you must start making payments on the B.C. portion of your Canada-B.C. integrated student loan.

If you return to full-time studies, you’re not eligible as your loans will be in non-payment status during that time. You can re-apply when you return to work.

- For less than 3 months during the 12 month service period being reviewed, you’re eligible for loan forgiveness

- For 3 months or more during the 12 month service period being reviewed, you’re ineligible to receive loan forgiveness and will be removed from the program

Employees on general leave can’t apply while on leave, but are invited to apply or reapply to the program once they return to work.

Temporary Expanded Public Service Loan Forgiveness

Because you must work for 10 years in a qualifying job to get forgiveness and the program only started in late 2007, borrowers have only recently become eligible for relief. Unfortunately, the majority of borrowers so far who applied for loan forgiveness have been rejected.

In an effort to help borrowers who got bad advice about eligibility or experience other problems, Congress passed legislation in 2018 that provides limited, additional conditions under which a borrower may become eligible for public service loan forgiveness if some or all of the payments the borrower made on a Direct Loan were under a nonqualifying repayment plan. The Department is calling this new program the Temporary Expanded Public Service Loan Forgiveness opportunity. Note that this is not only a temporary opportunity, but there is also limited funding. This means that the funds will be provided on a first come, first served basis and unless there is new legislation, the opportunity will end once the funds are used up.

Due to a range of reported problems with the TEPSLF program, in January 2020, the Department posted a notice proposing to make at least one fix by consolidating the temporary and regular public service loan forgiveness programs into one application form so that borrowers applying for TEPSLF will no longer have to first file a separate application for PSLF.

Read Also: Governmentjobs.com Las Vegas

Limited Waivers For Pslf Applicants

Under the limited waiver, any payments made toward your federal loans, regardless of the payment plan youve been on, will count toward PSLF. Previously, only payments made on certain repayment plans would qualify.

If you made payments in the past that were rejected because they werent considered on time, those will now count toward PSLF.

Any payments made on Federal Family Education Loan or Perkins loans after 2007 will retroactively count toward PSLF. Previously, payments on these loans were not counted toward PSLF.

If you have consolidated your non-direct loans prior to the limited waiver period, the payments made prior to consolidation will also count toward PSLF.

For members of the military, any time spent in active duty will count toward PSLF, regardless of whether loan payments were paused or not during that time.

If you have applied to PSLF in the past and been denied, the Education Department said that it will be reviewing rejected applications. The Department will also be reaching out to borrowers who can now receive forgiveness under PSLF but havent applied to make sure theyre aware of the temporary rule changes.

Are Private Student Loans Eligible For Forgiveness

Public loans account for the vast amount of student loan debt, with private loans taking up a 100 billion slice of the $1.7 trillion pool. Still, obviously, an enormous amount of debt for people out there struggling to pay for their higher education.

Private lenders dont offer the same avenues for forgiving student loan debt, but there are possibilities for easing difficulties with payments. You can put a loan in deferment or forbearance, which essentially means putting a pause on payments if youre unable to make them at that time. And depending on your situation, you may be able to refinance your loan with your lender to get more favorable terms. In any case, you should always talk to your private lender when you have trouble making the necessary payments.

Also Check: Dental Lifeline Network Dental Implant Grant

What Is Student Loan Forgiveness

In short, student loan forgiveness is a way to get your lender to eliminate the whole balance you owe for your student loan, or at least part of that balance. It means you are no longer obligated to repay part of or the total of your loan debt.

Student debt has grown enormously, more than doubling over the past two decades. At the end of 2020, 43 million American borrowers owed a total of about $1.6 trillion in federal student loans, with private student loans bringing the sum to $1.7 trillion. While higher education can provide a significant socioeconomic boost to students who complete their degrees, the pile of debt is a serious problem for many student borrowers and potentially the United States economy itself.

Thankfully, the picture has shifted in a slightly more positive direction for those looking for help with their student loansand the situation may ease borrowers debt in the future based on political possibilities. The American Rescue Plan that President Biden recently signed into law makes all student loan forgiveness tax-free, meaning you pay no tax on that erased balance no matter what, a new development. Biden also touted the idea of canceling $10,000 of student loans for each borrower during his campaign. That still hasnt materialized, though his administration is reportedly still looking at paths to enact it.

Public Service Loan Forgiveness Requirements

Must work full-time for the government or eligible non-for-profit within a designated field, such as firefighting, teaching, government, nursing, public interest law, military, or religious work

Make 10 years worth of payments, totaling 120 payments , for the full amount within 15 days of your monthly payment due date.

Have loans in the federal direct loan program however, you can consolidate your federal loans for one payment under PSLF.

The Department of Education is taking steps over the coming months to help alleviate student loan debt for thousands of borrowers. They have outlined details in their October 6, 2021 Press Release announcing their Public Service Loan Forgiveness Fact Sheet.

Also Check: Government Jobs Vegas

Public Student Loan Forgiveness

A Public Student Loan Forgiveness is a program organized by the government for students with the sole purpose of offsetting the loan debt of the student in exchange for rendering services on behalf of the government.

Public student loan forgiveness is also called federal student loan forgiveness. This forgiveness or pardon is for only students that are currently on a loan program particularly the federal student loan. Therefore, this implies that only students that took a loan from the government can enjoy forgiveness.

Pei Debt Reduction Program

If youre a PEI resident and you have to borrow at least $6,000 in federal or provincial student loans each year, you could be eligible for a special grant to reduce the debt from your provincial student loan.

Eligible Academic Periods

If you started your schooling prior to August 1st, 2018, you could qualify for a debt reduction grant of up to $2,000 per year of your studies, which you can apply directly to your unpaid provincial student loan balance. To qualify, you must graduate from your program within one year of filing your application.

If you commenced your education after July 31st, 2018, you may be eligible for a debt reduction grant of up to $3,500 per year of study. Once again, you may use your grant funds to pay any provincial student loan balances. However, you must graduate within 3 years of sending your application .

Check out what happens to your student bank account when you graduate.

Eligibility Requirements For The PEI Debt Reduction Program

If you graduated during an academic year prior to, you must submit your application within one year of your graduation date. You also have to submit:

- A completed Debt Reduction Grant application

- A copy of your certificate, degree or diploma

- Your loan statement balances from National Student Loans Service Centre and Edulinx-PEI

Read Also: County Jobs In Las Vegas

How Student Loan Forgiveness Works

Loan forgiveness basically means a debt being retired early or forgiven in finance parlancerelieving the borrower of paying any more money back. Although theoretically, any student loan can be forgiven, the termand the issue ofstudent loan forgiveness generally applies to U.S. government-issued/backed loans . In other words, the widely publicized forgiveness programs do not apply to any privately issued loans, like those from a commercial bank or lenders like Sallie Maeeven if those loans are earmarked for students.

In some cases, borrowers may be able to get their loans forgiven or canceled. Individuals who want their loans forgiven must apply and may have to continue making payments until their application is approved.

The prospect of seeing that debt evaporate may seem like a dream come true. In reality, though, not that many people end up being eligible. Requirements vary depending on the type of loan, but most offer forgiveness only for those employed in certain public service occupations. These include teachers, government employees, and members of the military and AmeriCorps.

And not all federal loans are eligible . The eligibles that qualify for student loan forgiveness are primarily direct loans their predecessor, Stafford loans and Federal Family Education Loans . There are also repayment plans offered to student loan borrowers that include the discharge or forgiveness of some of their debt.