Guiding Principles Of Corporate Governance

Business Roundtable supports the following core guiding principles:

Business Ethics Case Study: Gen Y Manufacturing Company

ABSTRACT The long term success of the investors not only depends on the narrow financial performance of the companies of whom share they buy but also on their efficiency to manage the ethical questions that will result in image of the company. Many organizations and business investors take this responsible investment as an obligation but with the changing industry scenario and with many Gen Y employees and owners entering the market this responsible investment is actually becoming the core value of the company and also the key reason for the sustainability and brand building of the company. The purpose of this paper is to view the following points:Statistics on shareholders and investors preferring ethical/responsible investmentInstances of organizations who invested in unethical industries and there consequencesHow can ethical investment contribute to organizational sustainability

Corporate Governance And Directors

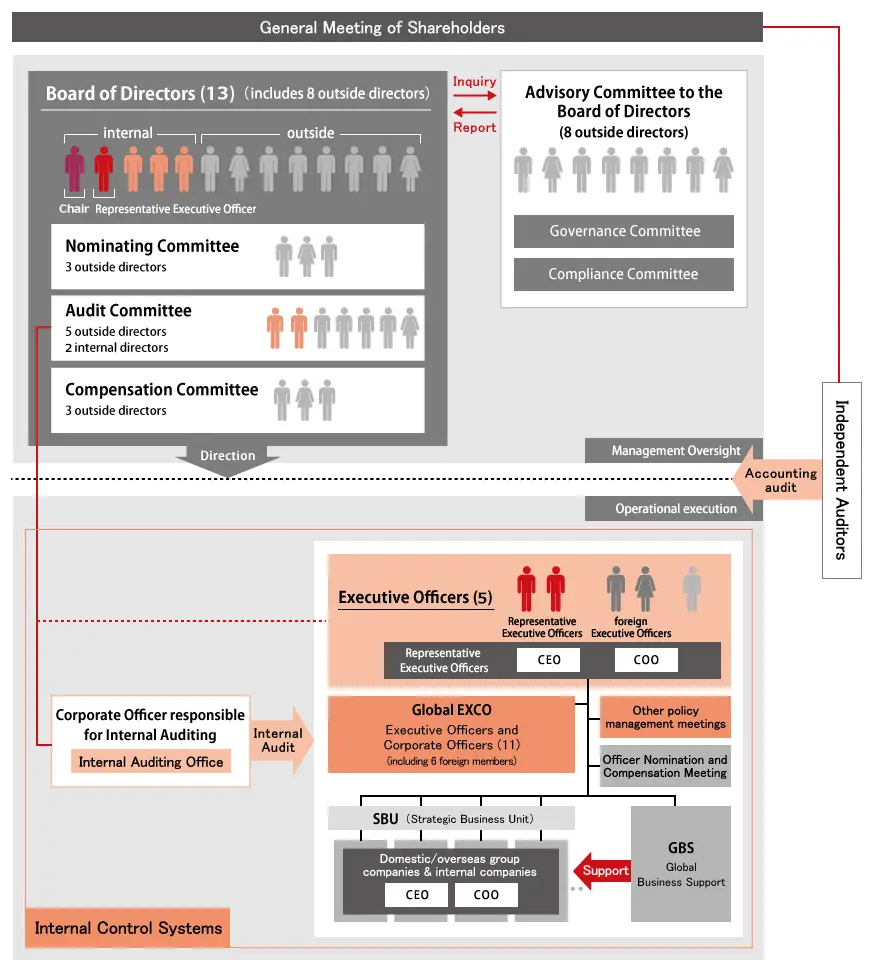

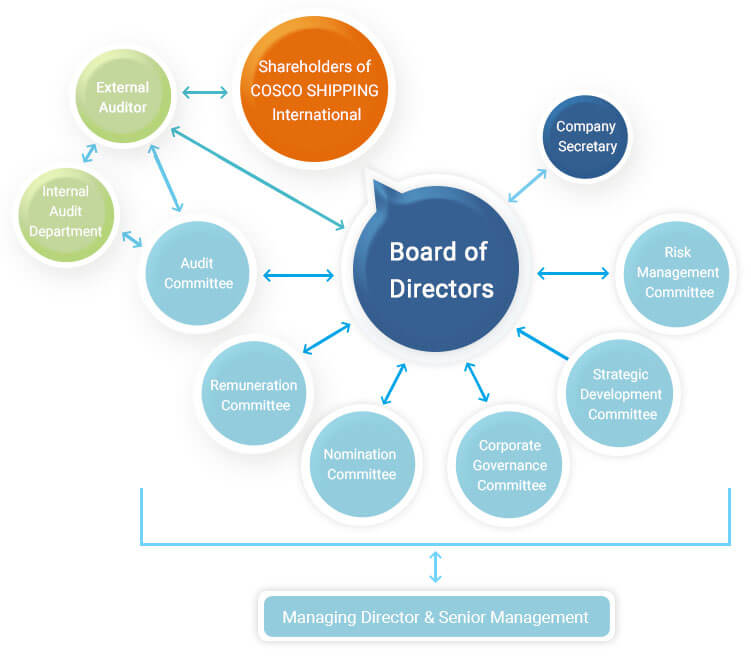

The Board of Directors being the heart and the soul of the corporation are accountable and play a major role in achieving good corporate governance. With the increasing issues in corporation in the late 1980s, the need for an external director was felt. The need for someone who would participate without any bias was brought forth. If the board of directors is of the right mix, with correct ratio of executive and non-executive directors, with Independent directors being Independent in true sense, then the whole idea of good corporate governance can be achieved.

Read Also: How Much Does Medicare Cost The Government

Should Ceos Also Serve As Chairmen Of The Board

In recent years, there has been considerable pressure from activist investors and corporate governance experts to split the two roles. Critics see an inherent conflict of interest when the person who runs the company day-to-day also heads the board tasked with supervising the company.

Even so, many CEOs still wear both hats. About 56 percent of S& P 500 companies have a combined chairman and CEO, roughly the same percentage as in 2012, according to an analysis by Mercer.

Companies where the CEO and chairman are one and the same, have increasingly added another role, lead director, to monitor such issues as CEO performance.

The Top 5 Responsibilities Of The Board Of Directors:

1. Organization strategic planning and monitoring

The board may be responsible for creating and reviewing the mission and purpose statements that articulates the organizations goals, means, and primary constituents served. Boards must actively participate in an overall strategic planning process and monitoring of the plans goals. As part of this, they may also monitor the organizations programs and services to determine which are consistent with the organizations mission and monitor their effectiveness.

2. Protect assets and provide financial oversight

Boards need to ensure that theyre protecting the organizations assets and managing them responsibly, including carrying out its fiduciary responsibilities. For example, a board should work with the chief financial officer to establish a budget, ensure proper controls are in place for incoming and outgoing funds and review the organizations financial statements. This may also include establishing an audit committee and completing an internal audit every year.

3. Serve on committees or working groups

Board members should serve on committees or task forces and offer to take on special assignments, as this is where the bulk of board work gets done. Example committees include governance, finance, executive and audit committees. Boards can also create ad hoc committees or working groups to accomplish specific goals or tasks.

4. Select, support and review performance of the chief executive

Also Check: Government Grants For Struggling Families

Latest Corporate Governance Issues

Corporate governance issues and challenges are bound to arise. Within any organization, within any group of people, heads will clash on what is thought to be best for the goals they are trying to meet. This existed before the pandemic, and in some ways, the pandemic has shed light on the latest corporate governance issues.

One of the biggest governance issues examples is how the board of directors member salaries are perceived. According to a study at Harvard Business School, if a CEOs salary is perceived as being overinflated by the employees, the overall performance of the organization will take a hit. This is not a stretch to imagine. If any employee feels his contribution is ignored, they are not going to be the mental space to perform at their optimal level.

Another big challenge is accountability issues in corporate governance. Beyond an organizations direct financial objectives, organizations are expected to use their mass profit to better serve their employees and their communities. However, this does not always take place. Sometimes, decisions made by the board of directors have a negative impact on the employees, without impacting the board of directions. While conversation rises about social inequality, and equity, along with discussions of the great resignation, it is important for corporate directors to take part in their employees conversations to better serve them.

Explaining The Organizations Long

Another key function of the board of directors is to clearly explain the companys long-term trajectory to relevant parties. This includes shareholders and stakeholders.

Managing an organizations long-term goals also requires contingency planning. The board must account for actions that will occur when less-than-ideal situations arise.

A competent business strategy will help to reassure investors that their assets are being put to good use.

Read Also: American Government Roots And Reform Online Textbook

Who Is More Powerful The Ceo Or The Board Of Directors

The CEO or executive director is the top senior executive over management and has a major impact on the success or failure of a company. But the board of directors arguably may have more power than the top chief executive. This is because the board is ultimately responsible for reviewing the performance of the CEO and if a new candidate is needed, they are responsible for vetting and selecting the candidate.

But each role has a unique impact on the organization. Think of it this way: the board of directors operate like the pilot of a jumbo jet at 30,000 feet level to oversee the big picture and make the adjustments as needed. The CEO operates like the pilot of a Cessna plane at the 2,000 feet level. Employees and volunteers of the organization operate on the ground, like the drivers of transport trucks completing the needed deliveries and pickups.

Fiduciary Duties Of The Board Of Directors

Aside from managerial duties, the board of directors also has fiduciary responsibilities. Board members are charged with protecting the financial interests of members and investors.

This fiduciary role involves making sure that the companys financial and material assets are kept in good order. But a fiduciary responsibility is not only about the money that the business holds. It also involves overseeing the companys facilities, equipment, and employees.

The board of directors should understand the status of all these assets and work to ensure that the companys best interests are always served.

Also Check: Government Help For Low Income

Building A Board Of Directorsand Its Role In Corporate Governance

As part of the terms of financing, the term sheet provided an outline of the size and composition of the board post-financing. A corporation requires directors, officers and shareholders to act. The directors comprise the board of directors. For early-stage companies prior to an outside investment, the board will likely have one or more founders of the business. As it grows, and especially once outside investors are involved in the company, the board will add outside directors who have increased influence on how the company is run.

Effective Governance: The Roles And Responsibilities Of Board Members

Corresponding author:Copyright

Running a health care organization is a team sport. It is very important that all members of the teamwhether on the medical staff, in management, or on the boardunderstand the role of governance and what constitutes effective governance. Many misunderstandings about the roles of boards exist. Many people think that board members are paid, for example, which is not true.

Don L. Arnwine

My interest in the subject of governance began when I became chief executive officer of an organization that was to establish a major health care and medical educational program in West Virginia. Five organizations merged to create the new organization 5 boards also merged to create 1 board of 56 members. Two years after the merger, we created a governance committee to study the subject, and that’s when my interest in governance began. While CEO of the Voluntary Hospitals of America, which grew from 30 to 850 hospitals during my tenure, I had the opportunity to visit with many boards. More recently, I have given 15 to 20 board retreats annually and have been an advisor to the Governance Institute. If I were allowed to focus on only one subject during the rest of my career, it would be governance.

In the sections that follow, I review the roles and responsibilities of boards, factors that increase board effectiveness, and the evolution of governance.

Read Also: Free Government Phones For Low Income

Vii Relationships With Shareholders And Other Stakeholders

Corporations are often said to have obligations to stakeholders other than their shareholders, including employees, customers, suppliers, the communities and environments in which they do business, and government. In some circumstances, the interests of these stakeholders are considered in the context of achieving long-term value.

Some Of The Most Significant Duties And Functions Of Independent Directors As Per Schedule Iv Of The Companies Act 2013 Are:

Don’t Miss: Charles County Md Government Jobs

Board Roles And Director Duties

Boards Role

The Boards role is to:

Scope of Director Duties

Directors should be aware of their duties at law, which includes acting in good faith and the best interests of the company exercising due care, skills and diligence and avoiding conflicts of interest. Directors should also put in place policies, structures and mechanisms to ensure compliance with legislative and regulatory requirements, establish appropriate tone-at-the-top, desired organisational culture and standards of ethical behaviour.

While the duties imposed by law are the same for all directors, a listed Board will generally have different classes of directors with different roles:

Conflicts of Interest

Director Competencies

Board Organisation and Support

Are Board Directors Paid

Typically, insider directors arent compensated for their board activity since they are often C-level executives or significant shareholders.

Directors outside the company are paid. NEDs are usually selected based on their expertise in related fields that will benefit the companys strategy and growth.

Pay varies according to the organisations size. In the UK, a non-executive director in the boardrooms of non-quoted firms typically earns between £15,000 and £20,000 a year.

Most non-executive directors of Listed PLCs receive pay of between £25,000 and £40,000 per year.

FTSE 100 NED positions usually pay between £40,000 and £100,000.

On Irish boards, the average non-executive directors remuneration is 63,000.

Also of note is the fact that many high-profile non-executive directors hold multiple directorships in addition to their full-time executive positions.

Read Also: Government Help For Single Fathers

Composition And Duties Of The Board Of Directors

The Board of Directors supervises and controls the management and operations of the company. The duty of the Board is to promote the interests of shareholders and the Group by overseeing the administration and proper organization of operations. The Board of Directors has two committees: the Audit Committee and the Human Resources Committee. The Board has ratified charter regarding its operation. Both committees also have charters ratified by Board of Directors. The Board of Directors is responsible for its operations to General Meeting, which discharges the members of the Board of Directors and the President from liability.

Duties

The Board of Directors is responsible for the administration and the proper organization of the operations of the company as well as for the appropriate arrangements of bookkeeping and financial administration. The Board of Directors has an approved charter, and it regularly assesses its validity. According to its charter, the Board of Directors controls and supervises the operations of the Company and the Group and approves the key operating principles, objectives and strategies. The Board of Directors oversees the operations, financials and risk management of the Group.

In particular, the following duties are handled and decided on by the Board of Directors

Composition

Independence

Meetings and decision-making

Whats The Difference Between An Inside Director An Outside Director And An Independent Director

Inside directors are company executives, while outside directors are non-employees. Outside directors, and sometimes inside directors, get paid for their services, sometimes in the form of stock in the company.

An independent director must meet an even higher standard. On top of being an outsider, he or she must have no material ties to the company. For instance, a close relative of a high-ranking executive, or an individual with substantial financial dealings with a company, would be seen as having material ties.

In the wake of the Enron Corp. accounting scandal of 2001, and the recent financial crisis, institutional investors, regulators, lawmakers and stock exchanges have pressed for stronger corporate governance and for more independent boards. As a result, in recent years, public companies have moved to increase their ranks of independent directors.

Since the early 2000s, a considerable number of substantive governance and related disclosure requirements have been imposed on boards and board committees through federal legislation, implementing rules and stock exchange listing standards, the law firm Weil, Gotshal & Manges wrote in a 2015 report.

In 2003, the Securities and Exchange Commission approved listing standards related to corporate boards, proposed by New York Stock Exchange and the Nasdaq. The rules mandate that that the majority of board members of companies listed on the exchanges be independent.

Don’t Miss: Government Surplus Pickup Trucks For Sale

Ford Leadership Style Analysis Essay

This brings us to the power structure of any organization. An organizational chart shows who reports to whom in a company. People in the top boxes of the chart are presumed to have the most power. Typically the top box is reserved for the president or CEO. However, the power structure of an organization can be very different from a company’s formal organizational structure.

Board Management Software Solutions Respond To The Evolution Of Corporate Governance

Environmental, social and governance issues have become more complex and multifaceted than ever before. At the same time, ESG continues to ascend on board and leadership agendas.

In this buyerâs guide, we explore what a market-leading ESG solution should look like and highlight the key areas organisations should be prioritising as they embark on their search.

You May Like: How To Get A Government Email Address

What Is A Board Of Directors

In a private company, a board of directors is a group of elected individuals representing the shareholders.

In a non-profit organisation, a board of directors is the governing body.

The members of a non-profit board focus on the organisations high-level strategy, oversight, and accountability.

The employees or managers oversee the day-to-day operations, not the board.

The primary job of a public companys board of directors is to look out for the shareholders interests. Legally, directors must put shareholders interests ahead of their own. Board members supervise the companys activities and evaluate its performance.

How Do Board Of Directors Influence A Business

The board of directors for a business usually has a lot of influence over the company. They are responsible for making sure that the company is run smoothly and efficiently. They also have the power to make decisions about the direction of the company and how it should be run.

Directors of a company are people who are appointed to serve as the companys representatives to its shareholders. As a board, we work together to maximize the success of our company in areas such as finance, legal, and ethical. Boards can benefit a company in a variety of ways by discussing company issues at board meetings, contributing funds, and voting on company decisions. Every year, the board of directors appoints a new chief executive officer and chief financial officer. They make recommendations based on their expertise and knowledge of your company in order to find a leader who will serve your company well. Board members are critical to CEOs decision-making on issues such as layoffs, bankruptcy, expansion, and rebrands. Check to see if your company is C or S, which are the most common corporate names.

The Board of Directors can be a valuable resource for your business, whether you run a small business or a large corporation. Always ensure that your company follows all laws and regulations in your state or territory. Certain state requirements do not typically necessitate a board for LLCs and sole proprietorships.

Read Also: What Is A Government Cage Code