Little Evidence Those Higher Payments Are Justified

Legal or not, the rise in Medicare Advantage coding means taxpayers pay much more for similar patients who join the health plans than for those in original Medicare, according to Kronick. He says there is “little evidence” that higher payments to Medicare Advantage are justified â there’s no evidence their enrollees are sicker than the average senior.

Kronick, who has studied the coding issue for years, both inside government and out, says that risk scores in 2019 were 19% higher across Medicare Advantage plans than in original Medicare. The Medicare Advantage scores rose by 4 percentage points between 2017 and 2019, he says â faster than the average in past years..

Kronick says that if CMS keeps the current coding adjustment in place, spending on Medicare Advantage will increase by $600 billion from 2023 through 2031. While some of that money would provide patients with extra health benefits, Kronick estimates that as much as two-thirds of it could be going toward profits for insurance companies.

AHIP, the industry trade group, did not respond to questions about the coding controversy. But a report prepared for AHIP warned in September that payments tied to risk scores are a “key component” in how health plans calculate benefits they provide and that even a slight increase in the coding adjustment would prompt plans to cut benefits or charge patients more.

Would Medicare For All Save Billions Or Cost Billions

current law

How much would a Medicare for all plan, like the kind endorsed by the Democratic presidential candidates Bernie Sanders and Elizabeth Warren, change health spending in the United States?

Some advocates have said costs would actually be lower because of gains in efficiency and scale, while critics have predictedhuge increases.

We asked a handful of economists and think tanks with a range of perspectives to estimate total American health care expenditures in 2019 under such a plan. The chart at the top of this page shows the estimates, both in composition and in total cost.

In all of these estimates, patients and private insurers would spend far less, and the federal government would pay far more. But the overall changes are also important, and theyre larger than they may look. Even the difference between the most expensive estimate and the second-most expensive estimate was larger than the budget of most federal agencies.

Estimates of U.S. health care expenditures under Medicare for all in 2019, as a share of G.D.P.

Other 2019 budget estimates as a share of G.D.P.

The big differences in the estimates of experts reflect the challenge of forecasting a change of this magnitude it would be the largest domestic policy change in a generation.

These estimates come from:

Analysts at the Urban Institute, a Washington policy research group that frequently estimates the effects of health policy changes.

What Does Medicare Part C Cover

A Medicare Part C plan will cover the same medical services as Original Medicare. That means plans will cover doctors, hospital care and many other types of health services. Coverage includes:

- Inpatient care

- Long-term care

- Lab tests, X-rays and diagnostics

Keep in mind that even though Part C coverage may be similar to Original Medicare, there are key differences that will affect your access to care and how much you pay for medical services.

You May Like: Government Jobs Las Vegas No Experience

Income Related Adjustment Amounts

The cost of your premium can be affected by your income level. The higher your income, the more youll be asked to pay in premiums. The income used to determine your premium payment is based on the income you reported on your IRS tax return from two years prior. See the table below.5

|

Annual 2019 Income |

2021 Medicare Part B Premium |

|

$88,000 or less |

|

|

$504.90 |

The Medicare Part D Donut Hole Coverage Gap

After 2020, Medicare Part D plans have a shrunken coverage gap, or donut hole, which represents a temporary limit on what the plan will cover for prescription drugs.

You enter the Part D donut hole once you and your plan have spent a combined $4,430 on covered drugs in 2022.

Once you reach the coverage gap, you will pay up to 25 percent of the cost of covered brand name and generic drugs until you reach total out-of-pocket spending of $7,050 for the year in 2022.

Once you reach $7,050 in out-of-pocket spending, you are out of the donut hole and enter catastrophic coverage, where you typically only pay a small copayment or coinsurance payment for the rest of the year.

Also Check: Entry Level Government Jobs Las Vegas

Gop Lawmakers Want To Change The Voting Process Here’s How

The federal government announced a large hike in Medicare premiums Friday night, blaming the pandemic but also what it called uncertainty over how much it may have to be forced to pay for a pricey and controversial new Alzheimer’s drug.

Nhe By Age Group And Gender Selected Years 2002 2004 2006 2008 2010 2012 And 201:

- Per person personal health care spending for the 65 and older population was $19,098 in 2014, over 5 times higher than spending per child and almost 3 times the spending per working-age person .

- In 2014, children accounted for approximately 24 percent of the population and about 11 percent of all PHC spending.

- The working-age group comprised the majority of spending and population in 2014, almost 54 percent and over 61 percent respectively.

- The elderly were the smallest population group, nearly 15 percent of the population, and accounted for approximately 34 percent of all spending in 2014.

- Per person spending for females was 21 percent more than males in 2014.

- In 2014, per person spending for male children was 9 percent more than females. However, for the working age and elderly groups, per person spending for females was 26 and 7 percent more than for males.

For further detail see health expenditures by age in downloads below.

Also Check: Government Programs To Stop Foreclosure

Reimbursement For Part A Services

For institutional care, such as hospital and nursing home care, Medicare uses prospective payment systems. In a prospective payment system, the health care institution receives a set amount of money for each episode of care provided to a patient, regardless of the actual amount of care. The actual allotment of funds is based on a list of diagnosis-related groups . The actual amount depends on the primary diagnosis that is actually made at the hospital. There are some issues surrounding Medicare’s use of DRGs because if the patient uses less care, the hospital gets to keep the remainder. This, in theory, should balance the costs for the hospital. However, if the patient uses more care, then the hospital has to cover its own losses. This results in the issue of “upcoding”, when a physician makes a more severe diagnosis to hedge against accidental costs.

Comparison With Private Insurance

Medicare differs from private insurance available to working Americans in that it is a social insurance program. Social insurance programs provide statutorily guaranteed benefits to the entire population . These benefits are financed in significant part through universal taxes. In effect, Medicare is a mechanism by which the state takes a portion of its citizens’ resources to provide health and financial security to its citizens in old age or in case of disability, helping them cope with the enormous, unpredictable cost of health care. In its universality, Medicare differs substantially from private insurers, which must decide whom to cover and what benefits to offer to manage their risk pools and ensure that their costs do not exceed premiums.

Medicare also has an important role in driving changes in the entire health care system. Because Medicare pays for a huge share of health care in every region of the country, it has a great deal of power to set delivery and payment policies. For example, Medicare promoted the adaptation of prospective payments based on DRG’s, which prevents unscrupulous providers from setting their own exorbitant prices. Meanwhile, the Patient Protection and Affordable Care Act has given Medicare the mandate to promote cost-containment throughout the health care system, for example, by promoting the creation of accountable care organizations or by replacing fee-for-service payments with bundled payments.

Also Check: Governmentjobs Com Las Vegas

Medicare Advantage Money Grab

Industry executives dont dispute that billing errors occur. But they deny that they charge too much, arguing they only want to be paid fairly for their services.

Clare Krusing, director of communications for Americas Health Insurance Plans, said that the industry trade group is working together with federal health officials to improve reporting of risk score data.

In the South Florida case, government lawyers have been investigating Humana, Inc. for several years as they try to determine if the company and some of its medical clinics manipulated the complex Medicare Advantage billing system. Humana says it is cooperating with the investigation.

In a separate civil case, a former Bush administration health official alleges in a whistleblower lawsuit unsealed earlier this year that two Puerto Rico health plans cheated Medicare out of as much as $1 billion by inflating patient risk scores. The plans, which at the time were owned by a subsidiary of New-Jersey based Aveta, Inc., denied the allegations.

Government audits and research reports have warned for years that Medicares risk scoring formula breeds overbilling, but efforts to hold the industry accountable have met with little success. Federal officials have yet to recoup hundreds of millions of dollars in suspected overpayments to health plans that date back as far as 2007.

We very intentionally tried to overpay them a little bit.

Thomas Scully, Medicare administrator under President George W. Bush

The Costs Of Medicare Premiums

Medicare Part B premiums average $148.50 per month in 2021.

Those with higher incomes may have to pay more. They will get a notice from Medicare about adjusted Part B premium payments.

Medicare refers to these premium increases as the Income Related Monthly Adjustment Amount . These IRMAA payments follow declared income on IRS tax returns from 2 years ago.

Read Also: Government Benefits For Legally Blind

Medicare Supplement Insurance :

- Monthly premiums vary based on which policy you buy, where you live, and other factors. The amount can change each year.

- You must keep paying your Part B premium to keep your supplement insurance.

- Helps lower your share of costs for Part A and Part B services in Original Medicare.

- Some Medigap policies include extra benefits to lower your costs, like coverage when you travel out of the country.

Is End Stage Renal Disease Covered By Medicare

End Stage Renal Disease occurs when your kidneys can no longer function enough to meet your bodys needs. With ESRD, toxins and fluids can build up in your kidneys and cause serious medical issues. Due to its serious nature, Medicare does cover End Stage Renal Disease even if youre not old enough to enroll in Medicare.

If youre on Medicare because of ESRD, your coverage begins on the first day of your fourth month of coverage. You may be able to get your Medicare dialysis coverage to begin with the first month of dialysis if you meet the following criteria:

- Take part in home dialysis training during the first three months of your regular dialysis. A Medicare-certified training facility must offer the training.

- Your doctor expects that you can finish your training and perform home dialysis treatments.

Beneficiaries receiving Medicare only because of ESRD will stop receiving benefits either:

- 12 months after the month you end dialysis treatments

- 36 months after the month you have a kidney transplant

Don’t Miss: Dental Implant Grants For Seniors

Projected Impact Of Medicare Premium Growth On Social Security Benefits

Medicare per capita cost growth is expected to continue to increase at a faster rate than inflation measured by the CPI-W, thus increasing Medicare premiums at a faster rate than Social Security COLAs. The Medicare Trustees project that Medicare beneficiaries will use a larger portion of their Social Security benefits to pay Medicare Part B and Part D premiums in the future. For example, in 2018, the Medicare Part B and Part D premiums account for 12.4% of the average Social Security benefit 68 the Medicare Trustees project that this will increase to approximately 14.0% in 2028 and to 16.8% in 2092.69 Out-of-pocket costs are also expected to continue to absorb an increasing amount of the average Social Security benefit the Medicare Trustees project that out-of-pocket costs as a percentage of the average Social Security benefit will increase from approximately 23.6% in 2018 to approximately 26.9% in 2028 and to approximately 34.5% in 2092.70

The historical and estimated increases in average Social Security benefits, the average Medicare Part B and Part D benefits, average Medicare Part B and Part D premiums, and average out-of-pocket costs as indicated by the Medicare Trustees long-range projections are shown in Figure 2.

Acknowledgments

This report was originally authored by Kristanna H. Peris, National Academy of Social Insurance Intern.

How Much Does Medicare Cost

The amount of money youll need to spend on Medicare depends on several factors, including the type of coverage you choose, when you enroll, your annual income, the amount of medical services you need, and whether you have other health insurance. Your costs include your premiums , deductible , and coinsurance or copayments .

- Late-enrollment penalty.

Recommended Reading: Goverment Jobs In Las Vegas

How Much Does Dialysis Cost Out Of Pocket

Still asking, How much does Medicare pay for dialysis? Its best to know how Medicare calculates your costs because it will help you make sense of your Medicare Summary Notice when you get it.

- Deductible: This is the annual amount you need to pay out of pocket before Medicare begins to pay its portion of your approved costs. In 2021, the Part B deductible is $203.

- Premium: This is the monthly cost of Part B. You must pay your monthly Part B premium to have active Part B coverage. In 2021, the Part B premium is $148.50 per month, though some individuals with high income may have to pay a higher premium.

- Coinsurance: Once youve paid your deductible, coinsurance is the portion youll pay out of pocket for a service or home dialysis supplies.

Again, Medicare Advantage beneficiaries often have different costs theyre responsible for paying. For example, many Part C plans offer no-cost monthly premiums or flat-rate copayments instead of coinsurance. If youre on Original Medicare and want more info on Part C, give GoHealth a call. Well explain the difference and shop for plans in your area that fit your needs.

What extra benefits and savings do you qualify for?

How Does Medicare Work

Although we often use the name “Medicare” as a blanket term, there are actually several distinct Medicare programs. While there are some similarities, such as all falling under the umbrella of the Centers for Medicare & Medicaid Services , there are a number of important differences, including funding.

Please note that, while CMS also manages Medicaid, this state-based program is funded differently than Medicare.

Don’t Miss: Government Contracts For Box Trucks

Premium Surcharge Is Based On 2020 Tax Return You Can Appeal It If Your Income Has Changed

The government determines whether you have to pay an income-related premium surcharge based on your income tax return from two years ago, since that is the most recent tax return they have on file at the start of the plan year. 2020 tax returns were filed in 2021, so those were the most current returns available when income-related premium adjustments are determined for 2022.

But if a life-change event has subsequently reduced your income, theres an appeals process you can use. In the appeal, you can request that the income-related premium adjustment be changed or eliminated without having to wait for it to reflect on a future tax return.

Premium Additions For Higher Incomes

Medicare Part D charges higher premiums for people with higher reported income. This means youll pay any premium that is mandated by your selected plan in addition to a flat fee based on your reported income.

Like Part B, the income used to determine your extra premium payment is based on the income you reported on your IRS tax return from two years prior. The table below breaks down what a 2021 Medicare Part D enrollee would have pay for a premium.1

| 2019 Reported Income | 2021 Medicare Part D premium cost |

| $88,000 or less | |

| Plan premium + $77.10 |

Read Also: Grants For Owner Operators

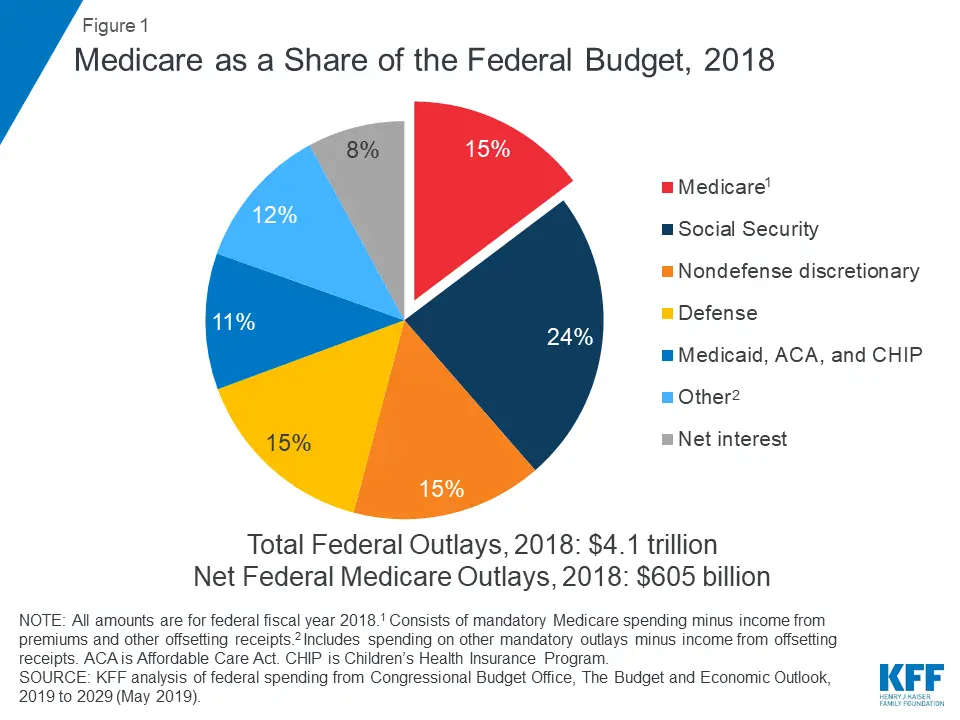

How Congress Really Spends Your Money

Kimberly Amadeo is an expert on U.S. and world economies and investing, with over 20 years of experience in economic analysis and business strategy. She is the President of the economic website World Money Watch. As a writer for The Balance, Kimberly provides insight on the state of the present-day economy, as well as past events that have had a lasting impact.

Eric is a duly licensed Independent Insurance Broker licensed in Life, Health, Property, and Casualty insurance. He has worked more than 13 years in both public and private accounting jobs and more than four years licensed as an insurance producer. His background in tax accounting has served as a solid base supporting his current book of business.

The Balance / Hilary Allison

Current U.S. government spending is $4.829 trillion. That’s the federal budget for the fiscal year 2021 covering October 1, 2020, through September 30, 2021. It’s 20.7% of gross domestic product according to the Office of Management and Budget Report for FY 2021.