Where To Find Home Buying Help In Dc

The organizations weve listed above should provide advice freely to any first-time home buyer in Washington D.C.

The U.S. Department of Housing and Urban Development also provides a list of city-specific programs across the District. These are as follows:

- District of Columbia Housing Finance Agency: Homebuyer programs, including down payment and closing cost assistance

- Habitat for Humanity: Through volunteer labor, builds houses for families in need

Size Up State Programs

Many statesfor example, Illinois, Ohio, and Washingtonoffer down payment assistance for first-time homebuyers who qualify. Typically, eligibility in these programs is based on income and may also limit the price of the property purchased. Those who are eligible may be able to receive financial assistance with down payments and closing fees as well as costs to rehab or improve a property.

Dont Worry New Homeowners Can Still Get Federal Tax Breaks

The good news is that there are some other federal tax credits new homeowners can take advantage of. The only downside is that theyre a bit more specific and perhaps less generous than the First-Time Home Buyer Tax Credit. That doesnt mean theyre not worth it, youll probably just have to meet certain requirements beyond being a first-time home owner within a certain income range.

Mortgage Interest Credit. The mortgage interest credit is a federal tax credit available to homeowners who were issued a Mortgage Credit Certificate from their local government.4 MCCs are made to help first-time homebuyers with lower income afford home ownership.

The credit lets new homeowners convert up to $2,000 of the mortgage interest they paid in a given year into a nonrefundable tax credit. If you paid more than $2,000 in mortgage interest in your tax year, whatever remains can still be itemized and deducted from your taxable income but youll have to be sure to reduce your deduction by the amount you were credited.

To be eligible for the mortgage interest credit, you must be a first-time home buyer, use the home as your primary residence, and meet certain purchase price and income restrictions. Figuring out the amount of your credit requires some math, which is detailed on the website of the National Council of State Housing Agencies .

Also Check: How To Write A Statement Of Work Government

Good Neighbor Next Door

- A U.S. Department of Housing and Urban Development program that provides housing aid for law enforcement officers, firefighters, emergency medical technicians and teachers

- Best for: People employed in one of the qualifying professions

The Good Neighbor Next Door program, sponsored by the U.S. Department of Housing and Urban Development , provides housing aid for law enforcement officers, firefighters, emergency medical technicians and pre-kindergarten through 12th-grade teachers.

Qualified participants can receive a discount of 50 percent on a homes listed price in revitalization areas. You can search for properties available in your state using the programs website. You must commit to living in the home for at least 36 months.

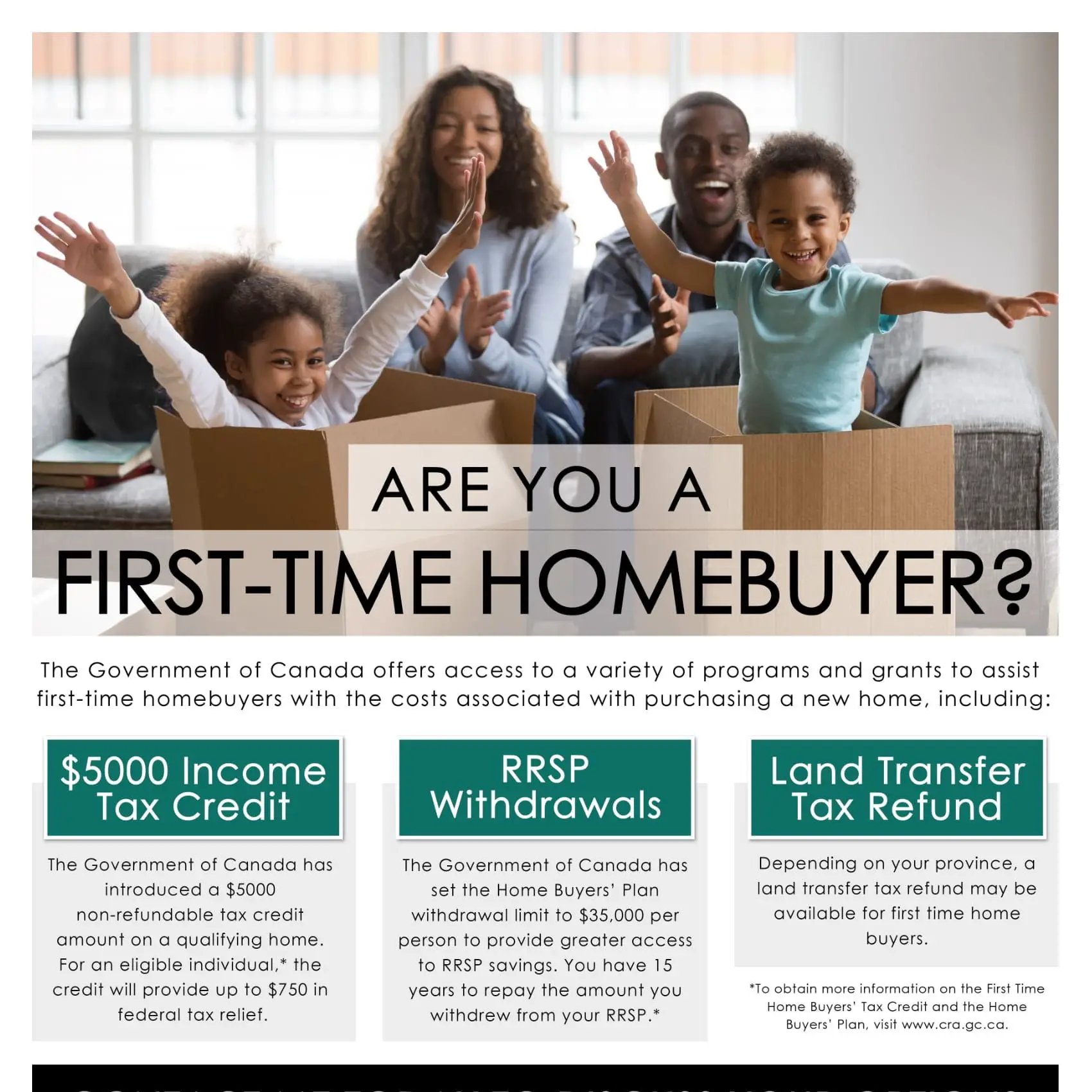

What Is $5000 First

The $5000 first time home buyer grant is a helpful grant to cover the cost of your down payment, but how this work? This grant is also known as matched saving program, that mean if you deposit the $5000 amount with your bank, community organization or with any of the government agency the government will additionally deposit $5000 in you account that will reduce the hurdle of your down payment as you can use now $10000.

Don’t Miss: Government Owned Homes For Sale

How Does The First

The First-Time Homebuyer Act or $15,000 First-Time Homebuyer Tax Credit of 2021 is not a loan to be repaid, and its not a cash grant like the Downpayment Toward Equity Act.

The tax credit is equal to 10% of your homes purchase price and may not exceed $15,000 in 2021 inflation-adjusted dollars.

Assuming a 2 percent inflation rate, the maximum first-time home buyer tax credit would increase as follows over the next five years:

- 2021: Maximum tax credit of $15,000

- 2022: Maximum tax credit of $15,300

- 2023: Maximum tax credit of $15,606

- 2024: Maximum tax credit of $15,918

- 2025: Maximum tax credit of $16,236

When you receive a tax credit, its applied to your federal tax bill, or refund, directly.

How Do You Qualify For The First Time Home Buyers’ Tax Credit

In order to be eligible for the First Time Home Buyers’ Tax Credit, your home must meet the following requirements:

- Be within Canada

- Be an existing or new home

- Be a single, semi, townhouse, mobile home, condo, or apartment

- Can include a share in a co-operative housing corporation that gives you possession of the home

- You must intend to occupy the home within one year of purchase

In order to be eligible for the First Time Home Buyers’ Tax Credit, your home must meet the following requirements:

- You or your spouse must purchase a qualifying home

- The home must be registered in either your name or your spouse’s name

- You cannot have owned a home in the previous four years

- You cannot have lived in a home owned by your spouse in the previous four years

- You must present documents supporting the purchase of the home

You May Like: Government Rebates For Heating And Cooling Systems

Louisiana Down Payment Assistance Programs

Louisiana has one of the most generous down payment assistance programs. Qualified borrowers could get 20% of a homes purchase price up to $55,000 as a silent second mortgage.

This loan would be completely forgiven after 10 years if you stay in the home that long, and you could also add $5,000 to the loan for closing costs.

This program is operated by the Louisiana Housing Corporation, and youd need to meet income limits. You cant earn more than 80% of your areas median income.

And, only first-time homebuyers can participate. Louisiana includes single parents who owned a home while married as first-time buyers.

Only homes in the following parishes qualify: Acadia, Allen, Ascension, Avoyelles, Beauregard, Bienville, Bossier, Caddo, Calcasieu, Caldwell, Catahoula, Claiborne, De Soto, East Carroll, East Baton Rouge, East Feliciana, Evangeline, Franklin, Grant, Iberia, Iberville, Jackson, Jefferson Davis, Lafayette, LaSalle, Lincoln, Livingston, Madison, Morehouse, Natchitoches, Ouachita, Pointe Coupee, Rapides, Red River, Richland, Sabine, St. Helena, St. James, St. Landry, St. Martin, St. Tammany, Tangipahoa, Union, Vermilion, Vernon, Washington, Webster, West Baton Rouge, West Carroll, West Feliciana, and Winn.

For more information on this program, visit LHCs website. And look at HUDs list of alternative homeownership assistance programs in Louisiana.

Also Check: Federal Government Social Security Card Replacement

Land Transfer Tax Rebate For First

Another tax credit available to first-time homebuyers in Ontario, British Columbia, and Prince Edward Island is the land transfer tax rebate. Each province has its own rules about who is eligible to claim the land transfer tax rebate. The amount of the rebate depends on which province you live in, the value of the home, and whether one or both buyers has owned a home before.

First-time homebuyers in the City of Toronto can also get a rebate of up to $3,725 on the municipal land transfer tax as long as they meet the necessary criteria. This rebate is applicable whether you’re buying a Toronto townhouse, condo or house.

You May Like: World Bank Federal Government Grant

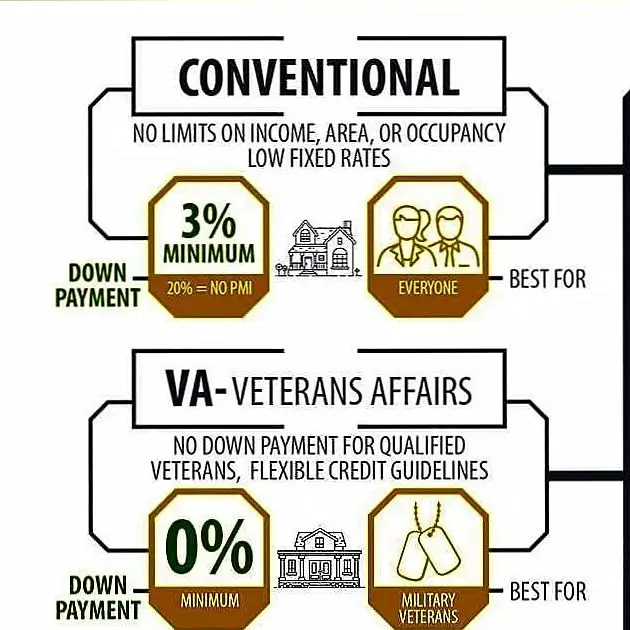

Which Loan Is Best For First

The majority of first-time home buyers use 30-year fixed-rate mortgages backed by Fannie Mae or Freddie Mac to purchase their first home but that doesnt make it the best loan for first-time buyers. Mortgages are not one-size-fits-all. Get pre-approved and let your lender advise you on which mortgage loan is best for you.

Read more of our other first-time home buyer tips.

Get pre-approved for a mortgage today.

Dan Green

Dan Green is a former mortgage loan officer and an industry expert. He’s appeared on NPR and CNBC, and in The Wall Street Journal, Bloomberg, and dozens of local newspapers. Dan has helped millions of first-time home buyers get educated on mortgages, real estate, and personal finance. Have mortgage questions? Ask Dan in the chat.

Arkansas Down Payment Assistance Programs

The Arkansas Development Finance Authority has a couple of helpful programs. Its ADFA Move-Up Choice can provide a grant of 4% of the new mortgages opening balance.

You can use that for your down payment and other closing costs. Expect to pay a slightly higher mortgage rate than otherwise, because thats how your grant will be recouped.

If thats not what you need, the ADFA Down Payment Assistance Program offers between $1,000 and $10,000 in the form of a second mortgage, which is repayable over 10 years. Youll get cash back to cover the closing costs of that second mortgage.

To be eligible for assistance, your income must be within limits linked to the median income for the county where youre buying.

Visit the webpages of the ADFA Move-Up Choice and AFDA Down Payment Assistance programs to discover more including income limits for your county. And take a look atHUDs list of alternative programs for Arkansas.

Read Also: Entry Level Government Jobs Colorado

Read Also: Federal Government Department Of Compensation Financial Aid Program

Prepare The Move And Look For Home Insurance

Be sure to follow these steps before you move.

What Is $25000 First

The $25000 first-time home buyer grant, is a bill that still need to be passed by the congress, the bill is still pending and has not passed as a law, so we are still waiting for this update.

You should know about federal government programs if you are about to buy a home for the first time, especially if it is your first home. The first-time home buyer has access to grants, loans, and other financial assistance that can ease the process. In addition to down payment and closing costs, first-time purchaser assistance may offer tax credits or education assistance. You can achieve your dream of owning a home through two programs in the Department of Housing and Urban Development . Federal Housing Administration mortgage loans are the best known since they allow low-interest financing and low-cost fees with little down payment. The federal, state, or local government may be able to help if you meet the income requirements.

To qualify for the FHAs benefits, you must request credit from a financial institution that has been approved exactly by the agency. Credit scores of lower than 700 are not a problem in these cases. HUD sells homes whose owners cannot make their FHA mortgage payments under the other program. There are fewer costs associated with these types of properties, as well as low interest rates. The HUD voucher and bond programs allow home buyers to receive a supplement to their mortgage payments.

Read Also: Government Funding For Low Income Families

Qualifying For The First Time Home Buyers Tax Credit

Now for the tough part: How exactly do you qualify for this tax credit? Lets start with the basic requirements.

- Location: You must purchase the home inside Canada, and you must be someone who files an income tax return in Canada.

- Type of Home: Many types of homes qualify, including single-family dwellings, as well as townhomes, mobile homes, condos, or apartments.

- Moving in: You must plan to move into and occupy the home within one year of the purchase date.

- Names on the Registration: You or your spouse must have your names on the registration documents.

Most people will easily satisfy the first batch of requirements. Here are a few more stringent requirements that may eliminate some people from qualifying.

- Previous Homes: If you or your spouse or your common-law partner owned a home in the previous four years, you do not qualify for the tax credit.

- Living Arrangements: If you lived in a home that your spouse owned alone within the past four years, you cannot claim the credit on your own home or one you purchase with your spouse later.

- Co-Operative Housing: For those who live in co-operative housing, the qualification process can be confusing. If this is a co-operative where you have the ability to purchase an equity interest in the property, it qualifies for HBTC. If you only have a right to tenancy in the co-operative housing, however, it will not qualify.

The rules are slightly different for people who have disabilities.

Must Be Purchasing The Home From A Non

Eligible home buyers may not purchase their home from a relative, including a spouse, parent, child, aunt, uncle, cousin, or grandparent. Note that the bill provides no specific guidance regarding the purchase of a home from an entity controlled by a relative, such as a trust.

Important: The First-Time Homebuyer Tax Credit of 2021 is still a bill, and the above terms of a bill can change by the time they become a law.

Get pre-approved for a mortgage today.

You May Like: Nj State Government Job Openings

How Can I Find First

Although homebuyers can no longer claim the federal first-time homebuyer credit, youll likely find similar programs locally. Some states also offer zero-interest loans and grant money to put toward the costs of buying a home, like a down payment.

Many first-time homebuyer programs offer tax benefits in the form of mortgage credit certificates , which convert some of the mortgage interest you pay into a federal tax credit. The tax credit is usually capped at $2,000, and its nonrefundable.

Tip:

Keep Reading: Programs for First-Time Homebuyers: Down Payment Assistance and More

Closing Cost Assistance Programs For Home Buyers

Closing cost assistance programs are home buyer stimulus plans that pay up to 100% of a buyers purchase closing costs, including title expenses, transfer taxes, and mortgage fees.

Typically, home buyers apply for closing cost assistance through their local housing agency, separate from their lender. You can look up your states housing agency on the National Council of State Housing Agencies website. The buyer and the home must meet the agencys minimum quality standards.

Closing cost assistance programs target lower-income home buyers with average credit scores, at least.

The first step towards getting closing cost assistance is getting pre-approved.

Don’t Miss: Does The Government Owe Me Any Money

First Homes Scheme: Discounts For First

If youre a first-time buyer, you may be able buy a home for 30% to 50% less than its market value. This offer is called the First Homes scheme.

The home can be:

- a new home built by a developer

- a home you buy from someone else who originally bought it as part of the scheme

The First Homes scheme is only available in England.

State And Local Programs For First Time Buyers

It is common for municipalities offer grants and programs to first-time homebuyers. It is your goal to attract new residents. This can be in the form either a grant or a loan that has low interest rates and flexibility. Be aware that not all programs are able to consider Limits on income Approve their beneficiaries. We recommend that your states website be consulted for further information. You should consult a professional real estate agent before you purchase your home. Agency HUD-approved Find out how to apply for a loan on your first home as a homeowner zone.

Don’t Miss: Where To Get Government Grants

Home Purchase Assistance Program

The Home Purchase Assistance program provides interest-free loans and closing cost assistance to qualified applicants to purchase single family houses, condominiums, or cooperative units in the District. The loan amount is based on a combination of factors, including income, household size, and the amount of assets that each applicant must commit toward a propertys purchase. The loan is subordinate to a private first trust mortgage.

Eligible applicants can receive a maximum of $80,000 in gap financing assistance and an additional $4,000 in closing cost assistance. The HPAP loan for borrowers with incomes below 80 percent of the area median income is deferred until the property is sold, refinanced to take out equity, or is no longer their primary residence. Moderate-income borrowers who earn between 80 percent and 110 percent AMI will have payments deferred for five years with a 40 year principal-only repayment period.

The maximum first trust loan amount cannot exceed the Federal Housing Administrations conventional conforming loan limit.

Areas of Interest:

Home Office Expense Deduction

A popular tax break with so many people working from home these days, the home office deduction is available to both homeowners and renters. Basically, if you work at home, you can deduct anything you use regularly and exclusively for work.

Calculating this deduction gets a little tricky since you have to multiply the expenses of operating your home by the percentage of your home devoted to business use. The âsimplifiedâ method deducts $5 for every square foot of space in your home used for qualified business purposes. Technically, though, youâre entitled to deduct part of your utility bills, insurance costs, materials, general repairs, and much more that will easily surpass $5 per square foot. Documentation and proof, however, is something of a nightmare.

Don’t Miss: Federal Government Health Insurance Options

Who Qualifies As A First

To qualify for the first-time homebuyer tax credit, you have to meet a few requirements. Despite its name, the credit isnt available only to people who have never purchased a home. Youre considered a first-time homebuyer if you havent owned a home or been cosigner on a mortgage at any point in the past three years.

To qualify as a first-time buyer, you must meet any of these requirements:

- Have not owned a home or been a cosigner on a mortgage in the previous three years

- Be a single parent who only co-owned a property with a former spouse while married

- Be a displaced homemaker who have only owned a home with a spouse

- Have only owned a home permanently affixed to a foundation

- Have only owned a home that is not in compliance with state or local building codes and that cannot be brought into compliance for less than the cost of building a permanent structure