Responsibilities Duties & Roles Of A Budget Analyst

Budget analysts can be expected to estimate future monetary needs, communicate available funds to different departments, keep track of spending and make sure its within the budget, help other staff to adjust plans to remain within their budget, process funding requests and present them in the best light to other staff and/or the public, consolidate budgets when appropriate, review budget proposals, develop future budgets, and more.

Job Outlook For Budget Analysts

Overall, job prospects are good, but competition may be fierce due to the number of people interested in this field. A bachelors degree or higher in accounting or another related field is necessary for these positions some employers prefer candidates with a masters degree in business administration . Individuals already in these occupations who want to advance and gain new skills should consider completing a masters program in accountancy.

Who Is A Budget Analyst

Budget analysts are professionals who have been trained to meet such expectations. Budget analysts provide financial advice to a variety of institutions, including governments, commercial enterprises, and colleges. They write yearly and special reports, as well as assess budget proposals. They examine data to assess the costs and advantages of different programs and then make financial recommendations based on their findings. Although government officials or senior executives in private companies often make budget decisions, they rely on the work of budget analysts to gather the data needed to make such decisions.

Budgeting, according to Dave Ramsey, is simply instructing your money where to go rather than wondering where it went. This quotation eloquently conveys the importance of budgeting to individuals, families, and organizations.

Budget analysts may utilize cost-benefit analyses to evaluate budgetary demands, evaluate program trade-offs, and look into other funding options. Budget analysts may also look at previous budgets and investigate economic and financial trends that affect the organizations revenue and expenses. Budget analysts may suggest reducing spending on specific programs or reallocating such funds.

Recommended Reading: Lost My Free Government Phone

The Budget Analyst Roadmap

The roadmap to becoming a budget analyst is relatively easy to follow. First, have a decent interest in numbers and how the finances of a business get allocated.

Second, get your Bachelors in Accounting, Finance, or a related field. Third, get one to three years of industry-related work under your belt. The smartest way to do so is to land a couple of relevant internships or part-time jobs during your time in school!

Third, do some fishing for budget analyst jobs in the location you want to work. Gain some intel as to whether theyll require you to be a CPA or get a Masters degree. If so, go back to school. If not, get out there and get hired!

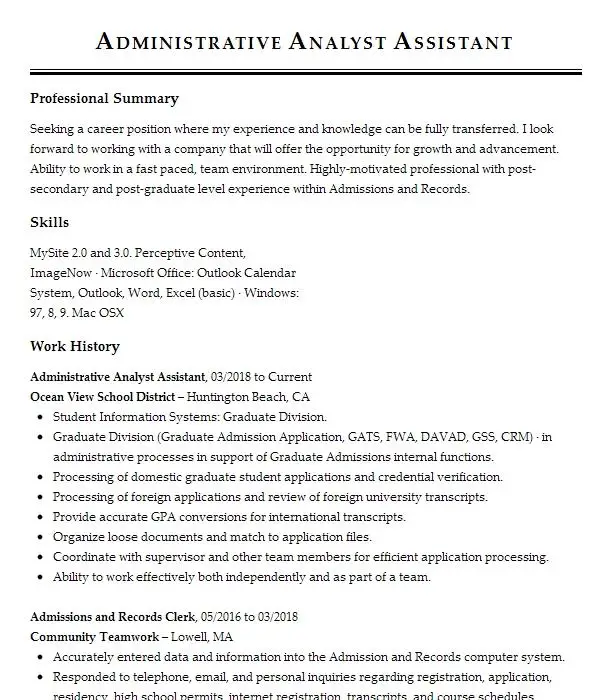

How Can I Become A Budget Analyst

The qualifications you need to work as a budget analyst include a bachelors degree in accounting, finance, or a related field. Senior analyst positions may require a masters degree in accounting. Some employers prefer applicants with CPA accreditation. In addition to accounting skills, you need to be able to communicate budget-related findings and suggestions to senior-level management and executives. You should also have strong attention to detail and written and verbal communication skills.

Also Check: Government Loans For Low Income Families

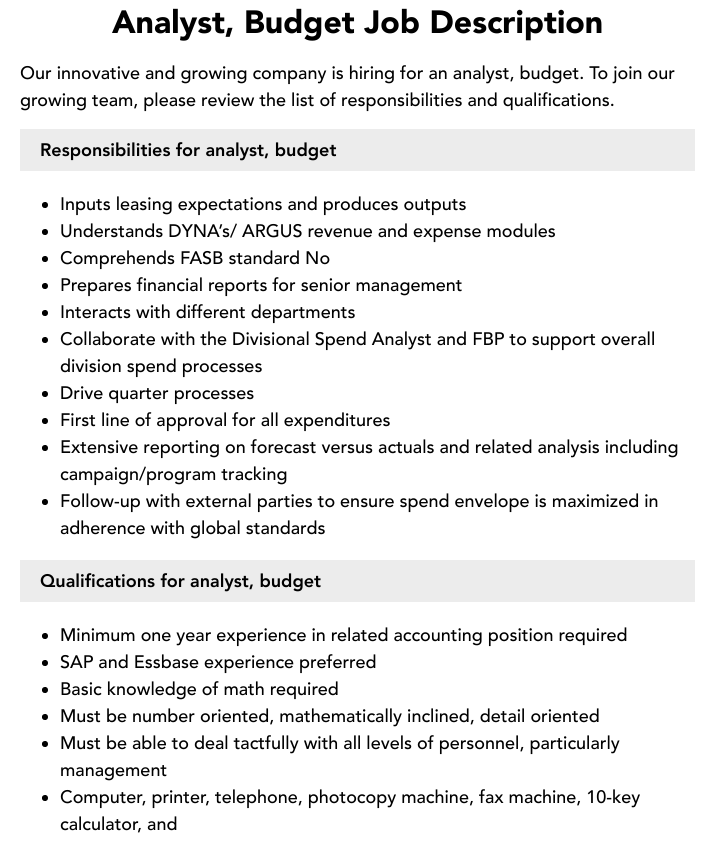

Budget Analyst Job Description Template

We are looking for a number-cruncher with attention to detail for the position of Budget Analyst. Budget Analysts are responsible for analyzing budget proposals, determining funding allocations, defending budget recommendations against various stakeholders, and forecasting future financial requirements.

Budget Analysts are well-versed in statistical modeling and are expert mathematicians. Beyond their quantitative skill set, they also need to petition and persuade management to approve their requests, requiring good communicative and interpersonal skills.

What Finance Planners Do

A financial planner is responsible for handling client accounts and providing financial advice to determine the best investment options according to the clients’ interests and risk appetite. Financial planners record the clients’ living expenses as a part of their portfolio, identifying their long-term goals and objectives, and giving tax advice. They also educate clients with investment options and opportunities to improve the clients’ account performance and sell financial products. A financial planner must have excellent analytical and communication skills to conduct data and statistical analysis, especially in researching financial instruments in the market.

In this section, we compare the average budget analyst annual salary with that of a finance planner. Typically, finance planners earn a $15,009 higher salary than budget analysts earn annually.

Even though budget analysts and finance planners have vast differences in their careers, a few of the skills required to do both jobs are similar. For example, both careers require financial reports, financial data, and financial analysis in the day-to-day roles.

Finance planners tend to make the most money in the insurance industry by averaging a salary of $71,594. In contrast, budget analysts make the biggest average salary of $60,887 in the government industry.

Recommended Reading: Spaxx Fidelity Government Money Market Fund

Budget Analyst Video Transcript

Capable of both developing and communicating a budget for a multimillion-dollar organization budget analysts help institutions organize their finances. Whether for public offices or private companies, budget analysts prepare budget reports and evaluate budget proposals. Budget analysts analyze data to determine the costs and benefits of various programs and recommend funding levels based on their findings.

The final decision on an organizations budget generally comes down to high-level executives or government officials, but they rely heavily on the competence of budget analysts when making those decisions. They also oversee spending throughout the year to keep spending within the budget, or revise it when changing circumstances demand it. They may recommend program cuts or evaluate the return on investment of particular efforts.

Budget analysts usually work in offices, but some may travel to gather information firsthand. They work in government agencies, universities, and private companies. Budget analysts generally work full time, and overtime is sometimes required during final reviews of budgets. The tight work schedules and pressure of deadlines can be stressful. Most budget analysts have at least a bachelors degree, though related work experience can sometimes suffice. Courses in accounting, economics, and statistics are helpful. Government positions may require certification.

Budget Analyst Careers In The Public Sector

Get great content like this and the hottest jobs delivered to your inbox.

Want to use your Excel skills for the good of all citizens? Consider a career in budget analysis. Although this job title conjures up images of accounting and auditing, budget analysis is policy work. Government budget analysts help elected officials divvy up trillions of tax dollars each year.

“You can really have a positive influence,” explains Scott Pattison, executive director of the National Association of State Budget Officers. “The ultimate decisions are made by elected officials, but if you’re doing good analysis of how things cost out, you have influence. For the right person — one who’s interested in public policy who’s comfortable with numbers — it’s a great way to be a contributor.”

As a budget analyst for a public agency, you’re in the thick of things. “You deal not only with the workers who actually manage the programs, but you deal all the way to the top of the department,” says Patrick Mullen, a senior analyst for the Government Accountability Office and past president of the American Association for Budget and Program Analysis. “You deal with the office of the president and appropriations committees, prepare testimony and answer questions that come up during the budget process. It can be quite exciting and challenging.”

The Time It Takes

Advance by Degrees

Search by Employer

You May Like: How To Buy Short Term Government Bonds

Qualifications For Budget Analyst

- bachelor’s in Accounting, Statistics or Finance

- Certified Personal Accountant

- Certified Government Financial Manager

- A background in a budgetary roll

- Strong computational and mathematical abilities

- Robust interpersonal skills – Must be a people person

- A good eye for detail

- Ability to pass a background check

Ready to Hire a Budget Analyst?

Other Skill Sets Requirements & Qualifications

If you desire to become a government employee budget analyst, you can pursue the certification of Certified Government Financial Manager , which is offered by the Association of Government Accountants. Gaining this certification could make you a stronger candidate for government jobs.

Other skills that could help you out in your pursuit of a career as a budget analyst are analytic and critical thinking skills, great communication skills, being extremely detail-oriented, having a deep understanding of math and finance, and have adequate writing skills.

Don’t Miss: What Government Is The Us

What Does A Budget Analyst Do

A budget analyst organizes the finances of private and public institutions by monitoring spending and preparing budget reports. They analyze data to determine the benefits and costs of recommended funding levels and other programs. Budget analysts then provide this information to top executives and elected officials of these institutions. These recommendations help to determine needs and guide management in making informed decisions.

Watch a video to learn what a budget analyst does:

Specialties In The Field Of Budget Analysts

- Fraud examiner: A fraud examiner specialist has the responsibility of investigating and discovering financial fraud.

- Financial analyst: Financial analysts carefully look at financial data and provide valuable insights to their management teams.

- Tax consultant: Tax consultants are the ones who work to ensure that taxes are filed correctly.

- Cost analysis specialist: A cost analysis specialist is a professional who analyzes costs and develops quality assessments.

Also Check: Costa Del Mar Sunglasses Government Discount

Where We Are A Service Provider

Our Customers are organizations such as federal, state, local, tribal, or other municipal government agencies , private businesses, and educational institutions , who use our Services to evaluate job applicants and manage their relationship with their personnel. When we provide our Services to our Customers, the Customer generally controls and manages the personal data, and we process personal data as a data processor or service provider. Our legal obligations as a processor and service provider are set out in our Customer contracts and policies.

For instance, if you apply to a job or your employer utilizes our Services to manage their relationship with you, the personal data collected about you is generally controlled by the employer . This Policy does not describe the processing of your personal data by our Customers, and we encourage you to visit the Customers privacy policy for information about their privacy practices. For example, if you applied to a job at a local state agency, you should contact that agency with any questions you may have relating to the personal data processing by that state agency within our Services.

Where we serve as a data processor, our Customer contracts and policies require us to either instruct you to contact our Customer, or redirect your inquiry to our Customer.

Budget Analyst Career Overview

Learn about our editorial process.

Accounting.com is an advertising-supported site. Featured or trusted partner programs and all school search, finder, or match results are for schools that compensate us. This compensation does not influence our school rankings, resource guides, or other editorially-independent information published on this site.

You May Like: How Do I Get Financial Help From The Government

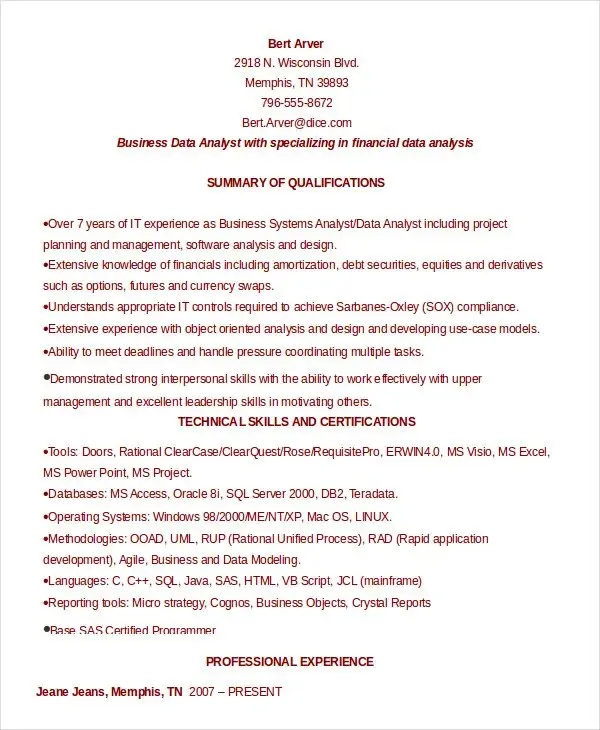

How To Become A Budget Analyst

A budget analyst typically needs a bachelors degree or a masters degree. Most earn a degree in business, accounting, public administration, finance, statistics, political science, sociology, or economics. These programs usually teach you how to analyze, work with numbers, create charts, develop budgets, allocate funds, and reading financial statements.

Additional skills are also needed to be a competent budget analyst. Some skills include the following: problem-solving and analytical skills to process a variety of data and evaluate costs and benefits communication skills to explain and defend recommendations in meetings and legislative committee hearings math skills to calculate or project budgets technology to able to use specific software, including spreadsheets and financial analysis programs and last but not least writing skills to present technical information in an understandable way to the intended audience.

Budget Analyst Skills And Personality Traits

We calculated that 8% of Budget Analysts are proficient in Financial Management, Budget Analysis, and Financial Reports.Theyâre also known for soft skills such as Writing skills,Analytical skills, and Communication skills.

We break down the percentage of Budget Analysts that have these skills listed on their resume here:

- Financial Management, 8%

Promoted through progressive budget analyst positions involving increasing levels of authority and responsibility in the Comptroller Department, Financial Management Division.

- Budget Analysis, 6%

- Financial Reports, 5%

Maintained financial operations of grants including budgeting, quarterly reconciliations, and submission of financial reports to state regulatory agencies.

- Financial Data, 4%

Managed six different financial data systems to ensuring timely and accurate reporting of expenditures and obligations for 3D Marine Aircraft Wing.

- PowerPoint, 4%

Provided budget forecasting and planning, allocated funding for multiple sub-tasks, and conducted One-on-One Project Review PowerPoint presentations with managers.

- Budget Estimates, 3%

Provided complete and final budget estimates by established deadlines, identified budget changes and demonstrated how those changes impacted agency operations.

Some of the skills we found on budget analyst resumes included “financial management,” “budget analysis,” and “financial reports.” We have detailed the most important budget analyst responsibilities below.

Read Also: How Do I Get A Free Government Phone In California

Key Hard Skills For Budget Analysts

- Mathematics: Budget analysts use math every day to evaluate funding requests and monitor spending and revenue. They often use complex equations and statistical formulas in their analysis.

- Forecasting: Forecasting is a multi-part process that allows analysts to plan for the future. Analysts apply methodologieslike extrapolation or regression analysisto statistical data to create forecasts.

- Enterprise Resource Planning Software: This software manages a company’s resources, including its financials, operations, reporting, and human resources. Analysts use ERP programs to understand how their budgets affect different aspects of their organizations.

- General Accounting: Because budget analysts monitor revenue and expenses, they usually need foundational accounting knowledge. Budget analysts do not have to be certified public accountants , but they should understand general accounting principles.

How Many Hours Does A Budget Analyst Work

Budget analysts put in, on average, 40 to 45 hours a week. Thats pretty normal, and a few extra hours each week is nothing to grip over. However, at the end of each quarter, the end of each fiscal year, and pretty much any other of the many hard deadlines budget analysts are held to, they can put in as much as 10 to 15 hours overtime each week, if not more.

Because budget analysts have so many strict deadlines, they can face some grueling hours for weeks on end. Not to mention that they can actually do quite a bit of traveling. This is why this career ranks below average for work-life balance. However, a couple of years of putting your nose to the grindstone to be paid back with a promotion could be well worth it.

Recommended Reading: Free Government Money For Small Business Startup

The Entry Level: Certification Training & Degree

Pretty much every company out there hiring a budget analyst is looking for someone with a Bachelors degree in Accounting, Finance, or a related field. Some employers may even require a Masters degree or an MBA in Finance and Accounting.

Some employers may allow relevant work experience to take place of some or all typically-required education, but many require this in addition to the appropriate degrees.

Occupational Employment And Wage Statistics

The Occupational Employment and Wage Statistics program produces employment and wage estimates annually for over 800 occupations. These estimates are available for the nation as a whole, for individual states, and for metropolitan and nonmetropolitan areas. The link below go to OEWS data maps for employment and wages by state and area.

Recommended Reading: Government Pandemic Extra Stimulus Bonus Program

Budget Analyst Job Description

Budget Analysts evaluate budget proposals to determine the optimal allocation of project funds. They are responsible for reviewing budget proposals and requests for funding, evaluating spending needs, and conducting cost-benefit analyses, among other duties.

- Completely free trial, no card required.

- Reach over 250 million candidates.

Description Of A Tax Accountant

A tax accountant is a professional who works with clients to produce tax return documents that follow tax laws and regulations while keeping them updated on their return information. Tax accountants must determine tax strategies for their clients that may minimize or eliminate tax payments while arranging audits with taxation authorities. They prepare tax documents for different clients, including private companies, non-profit organizations, and private individuals. Tax accountants are also required to obtain a bachelor’s degree in accounting and should understand business concepts.

The fourth career we look at typically earns higher pay than budget analysts. On average, tax accountants earn a difference of $5,544 higher per year.

While their salaries may vary, budget analysts and tax accountants both use similar skills to perform their jobs. Resumes from both professions include skills like “financial reports,” “financial data,” and “reconciliations. “

While some skills are shared by these professions, there are some differences to note. “financial management,” “budget analysis,” “powerpoint,” and “budget estimates” are skills that have shown up on budget analysts resumes. Additionally, tax accountant uses skills like cpa, tax audits, income tax returns, and tax research on their resumes.

Don’t Miss: Forsyth County Nc Government Jobs

Key Soft Skills For Budget Analysts

- Active Listening: Analysts must pay close attention to what others are saying. This helps them understand organizations’ financial goals and challenges to plan and forecast accurately.

- Critical Thinking and Problem-Solving: A budget analyst uses problem-solving skills to create possible solutions to tricky financial problems. Critical thinking skills help analysts evaluate multiple solutions to pick the best path forward for their organizations.

- Communication: An analyst has to explain their recommendations clearly for leaders to understand how budget decisions can affect their companies. This work requires strong .

- Time Management: Budget analysts have to manage their time and meet important deadlines. Strong time management skills also allow analysts to value their coworkers’ time, including executives and managers.