How We Approach Editorial Content

Maintaining independence and editorial freedom is essential to our mission of empowering investor success. We provide a platform for our authors to report on investments fairly, accurately, and from the investors point of view. We also respect individual opinionsthey represent the unvarnished thinking of our people and exacting analysis of our research processes. Our authors can publish views that we may or may not agree with, but they show their work, distinguish facts from opinions, and make sure their analysis is clear and in no way misleading or deceptive.

To further protect the integrity of our editorial content, we keep a strict separation between our sales teams and authors to remove any pressure or influence on our analyses and research.

Read our editorial policy to learn more about our process.

How To Buy Ishares Etfs

There are many ways to access iShares ETFs. Learn how you can add them to your portfolio.

Discuss with your financial planner today

iShares funds are available through online brokerage firms.All iShares ETFs trade commission free online through Fidelity.

iShares unlocks opportunity across markets to meet the evolving needs of investors. With more than twenty years of experience and a global line-up of 900+ ETFs, iShares continues to drive progress for the financial industry. iShares funds are powered by the expert portfolio and risk management of BlackRock.

corporate

Transparency Is Our Policy Learn How It Impacts Everything We Do

Transparency is how we protect the integrity of our work and keep empowering investors to achieve their goals and dreams. And we have unwavering standards for how we keep that integrity intact, from our research and data to our policies on content and your personal data.

Wed like to share more about how we work and what drives our day-to-day business.

Recommended Reading: Safelink Free Phone Replacement

Our View On This Fund

TheWealth Shortlist features funds our analysts believe have the potential to outperform their peers over the long term. If a fund is not on the Shortlist, this is not a recommendation to sell however, if you are thinking of adding to your investments, we believe the Wealth Shortlist is a good place to start. View funds on the Wealth Shortlist »

Vanguard Total Bond Market Index Admiral Shares

VBTLX is the biggest bond fund in the world. When you own shares, you have insight to the entire sphere of the U.S. bond market. This includes more than 10,000 bonds.

The fund invests about 40% in corporate bonds and 60% in U.S. government bonds of all maturities. These include short-, intermediate-, and long-term issues.

Also Check: Safelink Stolen Phone Replacement

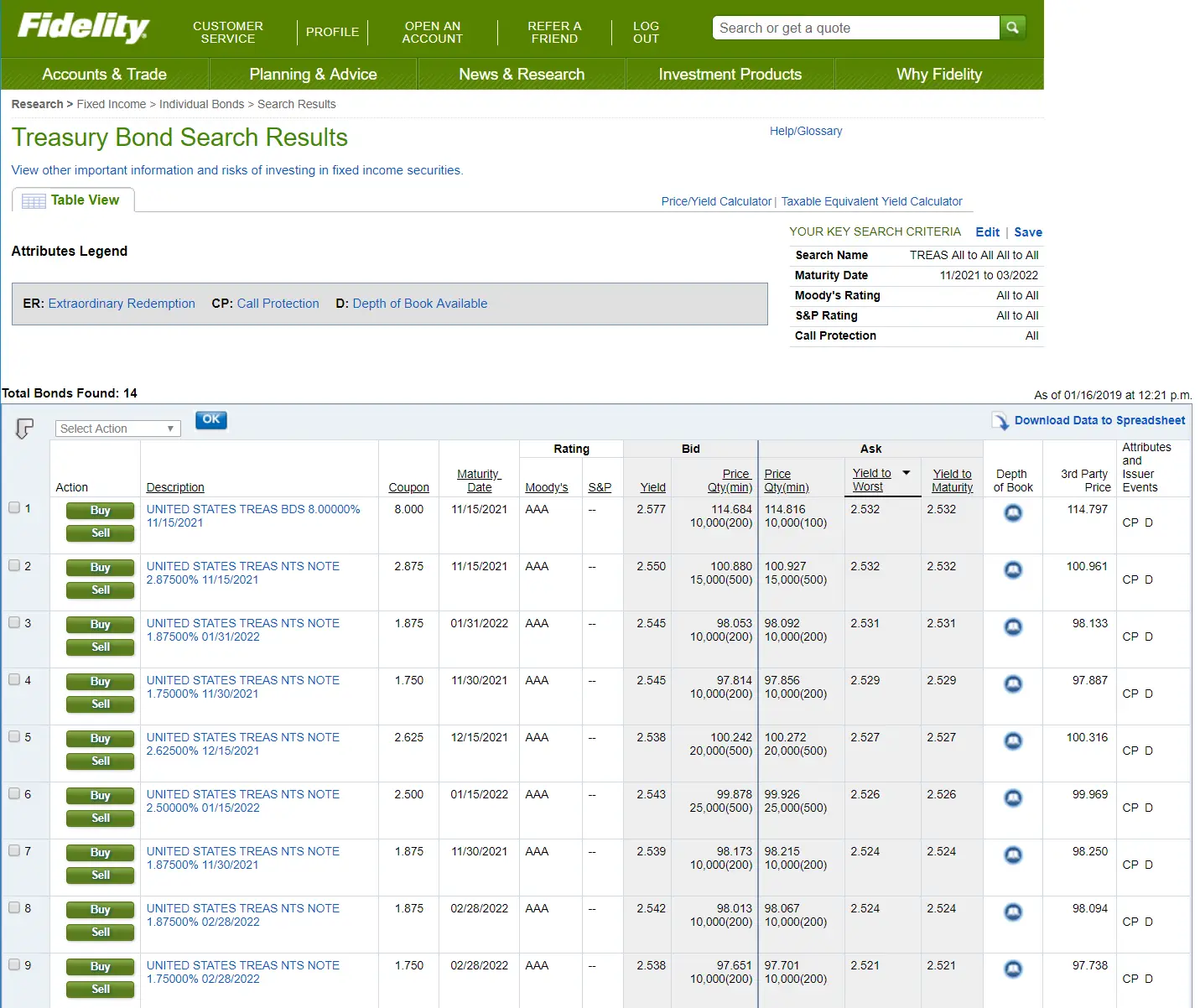

Ishares Us Treasury Bond Etf

You can trade this ETF now.

GOVT

- NAV as of Jan 07, 2022$26.0452 WK: 26.04 – 27.20

- 1 Day NAV Change as of Jan 07, 2022-0.06

- NAV Total Return as of Jan 06, 2022YTD: -1.25%

- Fees as stated in the prospectus Expense Ratio: 0.05%

1. Exposure to U.S. Treasuries ranging from 1-30 year maturities

2. Low cost access to the broad U.S. Treasury market in a single fund

3. Use at the core of your portfolio to seek stability in your portfolio and pursue income

Green Government Bonds: The Promise And The Pitfalls

Green sovereign debt issuance is on the rise and could dramatically improve liquidity and standards across the green bond market as a whole. Investor demand is high, but it is important both not to overpay for green sovereigns and to monitor what issuers do with green funds.

Green sovereign debt issuance is on the rise and could dramatically improve liquidity and standards across the green bond market as a whole. Investor demand is high, but it is important both not to overpay for green sovereigns and to monitor what issuers do with green funds.

According to OECD data, green government bonds were the fastest-growing sustainable bond segment in 20211. First-time issuers accounted for 40% of outstanding sovereign green bonds with the governments of Germany, Hungary and Thailand among those making green bond debuts. Further issues of debt to finance green initiatives have come from countries such as the U.K., and there have been further innovations in green bond structures.

Don’t Miss: Freegovernmentcellphones.net

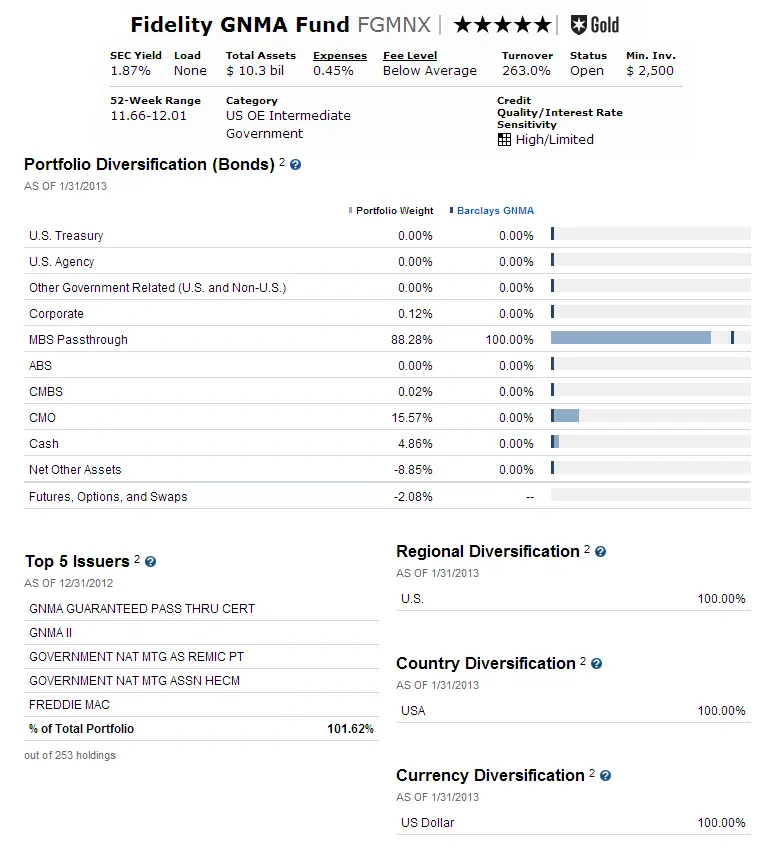

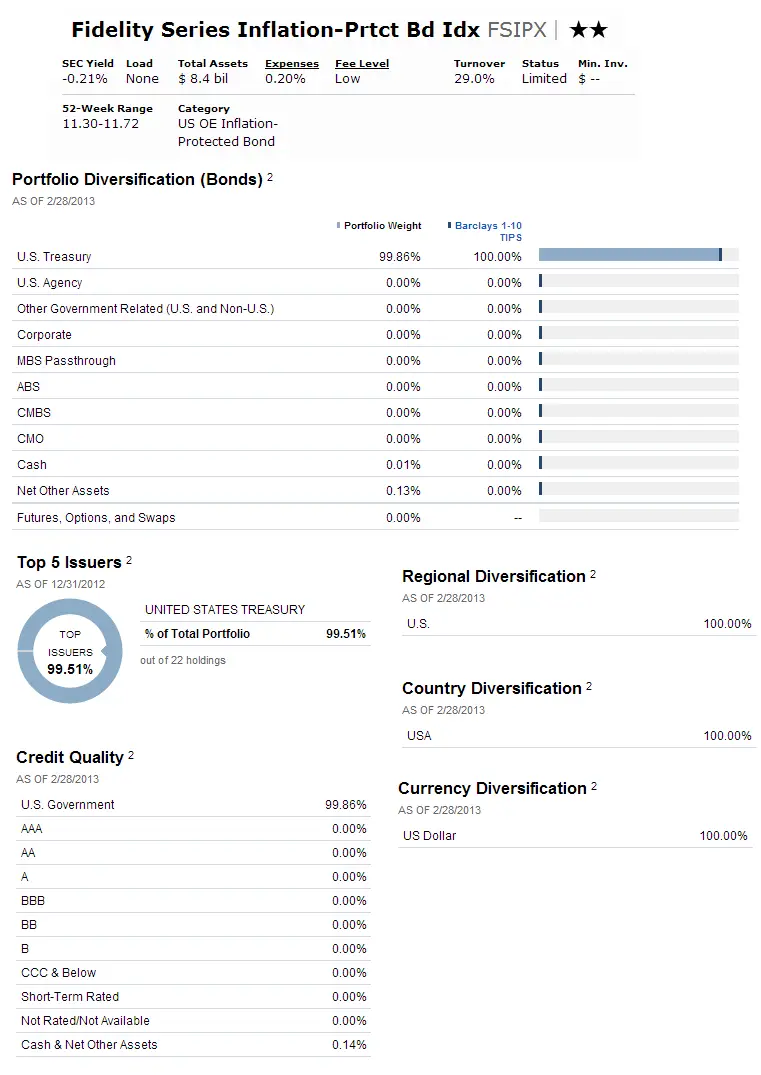

The Best Bond Index Funds To Buy From Vanguard And Fidelity

If you are looking for low-cost investing options, both Vanguard Investments and Fidelity are good options to consider. Both firms are well known and offer low fees. They allow you to invest in many of the best bond index funds covering all the major bond types.

Learn more about your options for investing with Vanguard and Fidelity.

Total Bond Market Funds

A total bond market fund can form the core of a fixed-income portfolio. These funds track the progress of the entire bond market. This allows you to have a broad investment with a single fund.

If you are looking for just one bond fund to invest in, total bond market funds are a wise choice. Let’s unpack two good choices to consider.

You May Like: City Jobs In Las Vegas

Still A Trust Me Exercise

However, without more robust certification, the green label still carries no guarantee as to the use of proceeds and remains largely a trust me exercise. Investors need to judge for themselves whether an issuer will actually use the funds for green investments and what impact that will have. Still, the lesson from corporates is that green investors will do just that. For example, several leading green investors declined to take part in Korea Electric Power Corp.s 2020 green bond issue, following concerns about the companys overseas investments in fossil fuels.

Some investors have turned to sustainability-linked bonds that have explicit green targets attached to their coupon payments, to ensure greater accountability regarding how their money is used. Governments may struggle to replicate this model, but we expect more green sovereigns to be issued with specific project and development targets over time.

These new kinds of vehicles can help finance the energy transition at scale, given the size of global bond markets. But it may take time for the green bond market to mature, for standards to improve and for the greenium to disappear. In this context, the maxim buyer beware remains as true as ever.

1 https://www.oecd.org/coronavirus/en/data-insights/increasing-sovereign-green-bond-issuance-helping-to-promote-green-growth, May 20, 2021

2 https://www.ft.com/content/94d604a9-50b9-49f1-b377-a7b6e4083d01, September 21, 2021

What Are Bond Funds

A bond fund is when funds from many investors are pooled together to invest in a variety of bonds. Bond funds don’t have a maturity date, and interest payments are made monthly to the investors. Bond funds typically focus on one type of bond, like corporate or government bonds.

The Balance does not provide tax or investment advice or financial services. The information is being presented without consideration of the investment objectives, risk tolerance, or financial circumstances of any specific investor and might not be suitable for all investors. Past performance is not indicative of future results. Investing involves risk, including the possible loss of principal.

You May Like: Rtc Bus Driver Salary Las Vegas

Beware The Greenium And Illiquidity

High investor demand for green bonds has created a so-called greenium , and the securities frequently offer a lower yield than similar bonds without the green label. .

Perhaps the clearest example of a sovereign greenium comes from Germany. On September 2, 2020, the German Finance Agency announced that it sold 6.5 billion euros of green Bunds with the same coupon and maturity date as ordinary non-green Bunds issued a few weeks earlier. The green bond priced at one basis point of yield below its vanilla twin, and has maintained a lower yield on the secondary market since, trading as much as seven basis points lower. Two months later, Germany went one better, issuing green and ordinary bonds on the same day that had identical coupons and maturities. This November green bond issue also traded at a greenium.

The popularity of green bonds has led to a tendency to hoard them, reducing liquidity and widening pricing differentials. Those attempting to justify the greenium could argue that green bonds relative scarcity should make it easier to sell them. But that is little comfort to those who wish to rebalance portfolios and need to buy green bonds as well. In some cases, a lack of liquidity also increases trading costs.

A Word Of Caution Before Buying

Bond index funds are useful diversification tools and can beat actively managed funds in the long run. However, they are passively managed, which means the portfolio managers cannot actively buy and sell the holdings.

When interest rates are rising, some investors may be in a bad position because an index fund manager is forced to hold bonds that are falling in price more than similar funds that are actively managed.

Even professional money managers can’t always predict what markets will do. Given that uncertainty, you may find that index funds are your best investment approach.

You May Like: Rtc Las Vegas Jobs

Sovereigns Seek To Address Transparency Hurdles

Green government bonds are often subject to the same spending rules as non-green bonds, which forbid the creation of separate accounts to earmark proceeds for any specific purpose. Elected representatives must also ratify any spending decisions. As a result, governments cannot offer green investors much certainty about how green bond revenues will be spent.

Governments have tried to address this problem in different ways. Poland has changed the law to set up a separate account for green bond inflows. Belgium has made a small legislative adjustment to earmark certain spending against green bond receipts so it cannot be financed again by the same means. Germanys green bond issues are designed to finance pre-existing expenditure.

Reporting Standards Need To Improve

Greater green sovereign issuance should ameliorate these problems. The greenium has dwindled in corporate bond sectors such as utilities, where green issuance is high, and liquidity has improved. For green bonds to go mainstream, however, other challenges need to be addressed. Top of the list are inconsistent reporting standards across different countries.

Standards today are voluntary for all green bonds, and often ad hoc. The use of proceeds reported at issuance can differ from that reported post-issuance, creating a risk that some issuers will overpromise and then fail to meet expectations. Variable reporting and a lack of common terminology and metrics can make it hard to know what the real impact has been, and to compare investments accurately.

Help is on the way. Investment standards for green bonds are being developed at a global and regional level, most prominently the E.U. Green Bond Standard. As these are adopted, the green sovereign market will become more investible and act as a benchmark for green corporate bonds. However, rule makers will need to move carefully. Making it too hard to meet definitions of green could constrain supply, and risk exacerbating pricing and liquidity challenges.

Don’t Miss: Grants For Implants

How We Use Your Personal Data

How we use your information depends on the product and service that you use and your relationship with us. We may use it to:

- Verify your identity, personalize the content you receive, or create and administer your account.

- Provide specific products and services to you, such as portfolio management or data aggregation.

- Develop and improve features of our offerings.

To learn more about how we handle and protect your data, visit our privacy center.

Abundance Of Bond Etf Opportunities

You should decide for yourself whether bond ETFs, bond mutual funds, or individual bonds are right for you. Or a combination of these different types of products might be suitable, depending on your specific investing objectives, risk constraints, and time horizon. Whatever route you choose, a strong case for active bond management can be made in today’s market, given the size and complexity of the bond universe.

If you are interested in exploring bond ETFs, check out the list of the largest bond ETFs by NAV within 6 bond fund categories. Additionally, Fidelity offers 8 other bond ETFs: Fidelity Total Bond ETF , Fidelity Corporate Bond ETF , Fidelity Limited Term Bond ETF , Fidelity High Yield Factor ETF , Fidelity Low Duration Bond Factor ETF ,Fidelity Investment Grade Bond ETF , Fidelity Investment Grade Securitized ETF , Fidelity Preferred Securities & Income ETF , Fidelity Sustainable High Yield ETF , Fidelity Sustainable Core Plus Bond ETF , and Fidelity Sustainable Low Duration Bond ETF .

| Largest bond ETFs by net assets among a variety of categories |

| Broad market bond ETFs |

Any screenshots, charts, or company trading symbols mentioned are provided for illustrative purposes only and should not be considered an offer to sell, a solicitation of an offer to buy, or a recommendation for the security.

Past performance is no guarantee of future results.

Diversification and asset allocation do not ensure a profit or guarantee against loss.

Don’t Miss: Www.qlinkwireless.com/register

Ltpz Spip And Gtip Are The Best Treasury Etfs For Q1 2022

Treasury exchange-traded funds enable investors to gain exposure to the U.S. government bond market through a stock-like instrument. Unlike individual bonds that are sold by bond brokers, bond ETFs trade on market exchanges. Treasury ETFs offer investors a way to gain passive, and often broad, exposure to U.S. Treasury bonds. They are composed of a basket of Treasury securities, typically with a focus on a particular maturity or range of maturities.

On Dec. 1, 2021, the 10-year Treasury yield was 1.43%, while it was 0.95% on Dec. 2, 2020. Yields have risen, especially since the start of this year, as the economy continues to recover from the impact of the COVID-19 pandemic. The price of Treasury securities and their yield move in opposite directions, so rising yields mean falling prices and vice versa.

Should You Invest In A Total Bond Market Index Fund

Index fund investing benefits from lower fees than buying actively managed mutual funds. Lower costs result in better after-fee returns over the long term. Thats true with fixed income investments as well as equities.

SP Global tracks the relative performance of actively managed funds compared to their respective benchmark across a number of asset classes. Its latest report shows that actively managed funds were more likely to underperform their respective index over one-, three- and five-year periods. Morningstar has reported similar results.

There are at least two important considerations beyond performance that investors should keep in mind. First, the duration of the funds in our list hover around six years. Duration helps us understand how much the value of a fund will rise or fall with interest rates. Generally, for each 1% rise or fall in interest rates, a funds value will rise or fall by a percentage equal to its duration.

Assuming a fund with a six-year duration, an increase in rates of 1% will cause the funds value to decline by about 6%. A decrease of 1% in the prevailing rates will cause the funds value to increase by about 6%. Given the historically low interest rate environment and the recent rise in yields, you need to consider the interest rate risk associated with a total bond index fund.

Don’t Miss: Entry Level Government Jobs Sacramento

How We Make Money

We sell different types of products and services to both investment professionals and individual investors. These products and services are usually sold through license agreements or subscriptions. Our investment management business generates asset-based fees, which are calculated as a percentage of assets under management. We also sell both admissions and sponsorship packages for our investment conferences and advertising on our websites and newsletters.

T Rowe Price Global Multi

Courtesy of T. Rowe Price

- Fund category: World bond USD hedged

- Assets under management: $1.8 billion

- SEC yield: 2.9%

- Expenses: 0.64%

T. Rowe Price Global Multi-Sector Bond Fund makes our cut for one of the best bond funds for 2022 because of its actively managed, “go anywhere” style that provides shareholders with far-reaching opportunities.

When yields are low and the prices for domestic bonds are looking to be under pressure in 2022, active management with broad diversity and the potential for high yields looks attractive. PRSNX pays off on all fronts in this regard, albeit with higher risk from lower credit-quality bonds.

With a 30-day SEC yield of 2.9% and 12-month return of 0.89% through Nov. 30, 2021, PRSNX was well ahead of the iShares Core U.S. Aggregate Bond ETF yield of 1.5% and 12-month return of -1.33%. And 2022 is not likely to look too different from 2021 with regard to low yields and low- to below-zero returns for funds that hold U.S. bonds.

Slightly more than half of PRSNX’s portfolio is invested in foreign debt instruments, with most of the rest in U.S. bonds, and convertible debt making up a tiny remaining sliver. Most of its bonds are government and corporate debt, and mortgage-backed and asset-backed securities.

Included in its top 10 issuers , which make up 33% of the portfolio’s holdings, are Germany, China, Chile and Hungary.

- Fund category: Muni national long

- Assets under management: $19.1 billion

- SEC yield: 1.5%

- Expenses: 0.17%

Recommended Reading: State Jobs In Las Vegas

Structure: Coupon Or No Coupon/discount

Investors in Treasury notes and Treasury bonds receive interest payments, known as coupons, on their investment. The coupon rate is fixed at the time of issuance and is paid every six months.

Other Treasury securities, such as Treasury bills or zero-coupon bonds, do not pay a regular coupon. Instead, they are sold at a discount to their face value investors receive the full face value at maturity. These securities are known as Original Issue Discount bonds, since the difference between the discounted price at issuance and the face value at maturity represents the total interest paid in one lump sum.

What Are Bonds

A bond is a fixed income instrument. When you buy a bond, you’re loaning money to a borrower, which is usually a corporation or a government entity like a municipality, state, or the federal government. You’re promised a specific rate of interest while you own the bond, and the principal must be repaid by the bond’s maturity date. Bonds can be sold after they’re issued, so you don’t have to keep them until they mature.

Also Check: Arkansas Assistance For Single Mothers