Government Student Loan Consolidation: Whos Eligible

All students with federal student loans are eligible for government student loan consolidation. However, some requirements must be met in advance. First, the student must have more than one federal student loan. If he or she only have one now, then consolidation is unnecessary. Second, students must be in good standing with their loans. That means the student must either still be in his or her six-month post-graduate grace period or have made three full monthly payments on time for each of the loans being consolidated.

Both subsidized and unsubsidized student loans can be consolidated. According to the Federal Consolidation Loan Information section of the Carnegie Mellon web site, however, those loans will be consolidated in two separate loans so that lenders can monitor them separately as they are required to do by law. Despite that, the payments for those loans will be combined so the student still only pays one payment per month.

What Are The Pros And Cons Of Student Loan Consolidation

The number one advantage of student loan consolidation is a simplified loan payment. You also have the option to select a longer loan term that can reduce your loan payment. Depending on the loans you have, there may be some downsides to student loan consolidation. Perkins loans, for example, may be forgiven for teachers and other public servants. Consolidating them would eliminate access and enrollment to this loan forgiveness option. Additionally, any grace period or deferment you have with your current loan program also goes away if they are consolidated.

Consolidating Student Loans With Other Debt

Question: Can I consolidate my student loan debt with personal debt such as credit cards and car loans?

Aaron in Virginia

Andrew Pentis, certified student loan counselor at Student Loan Hero, responds

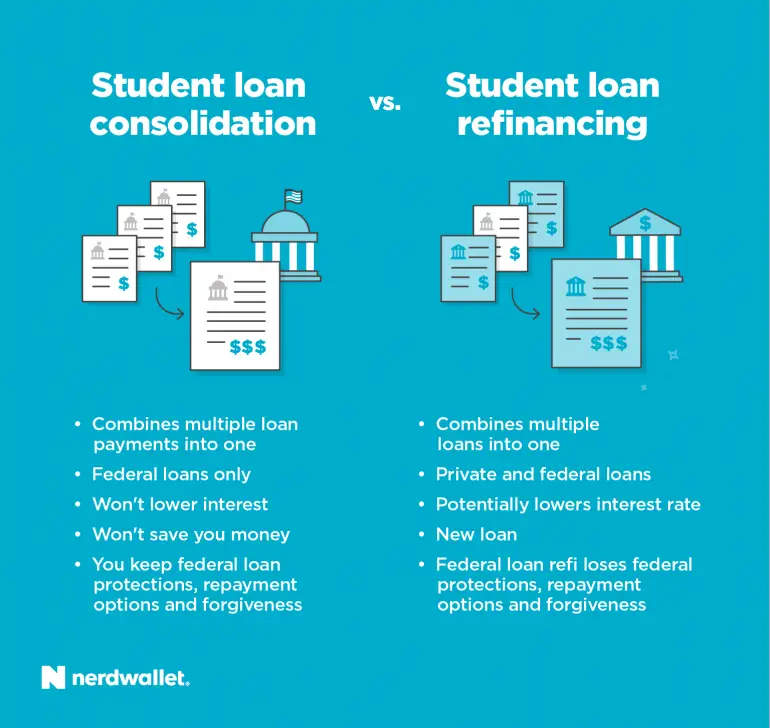

Since you have student loans, youre probably already aware of the benefits of refinancing. You could lower your interest rate, switch lenders, and enjoy a simpler repayment.

Student loan refinancing also allows you to consolidate your debt but only your student loan debt. On the other hand, there is a way to consolidate many different types of debt. Just like student loan refinancing, it requires creating a new loan in your debts place.

Pros of debt consolidation with a personal loan

You can use a personal loan. Apply the amount you borrow to student loans, credit cards, auto repayments, or other debt. Then youd have the simplest possible repayment just one loan with one creditor, instead of a handful of them.

You would shop for a personal loan the same way youd compare other financial products, seeking the best terms from reputable lenders. A strong credit score and a stable income, either from you or a cosigner, can help you qualify for advertised rates.

But just because you can consolidate all your debt via a personal loan doesnt mean you necessarily should. It could make for a significantly more expensive repayment. After all, student loan APRs usually beat those of personal loans.

Find the right loan to consolidate your debt.

You May Like: Government Jobs Vegas

Potential Advantages To Consolidation

It is important to weigh the pros and cons of consolidation before you submit an application to consolidate. Here are some of the potential advantages to consolidation:

- One servicer, one bill, one payment

- Managing your federal education loan debt with one servicer and one monthly payment may be more convenient than with multiple servicers.

The Difference Between Federal And Private Student Loans

Federal student loans have advantages over private loans. For example, interest on the loan is tax deductable, the loan can sometimes be forgiven for certain types of service, and you can sometimes defer payments on the federal loan if you go back to school.

Private loans dont have these advantages they are really just loans either secured or unsecured, and you have to pay them back just like any other loan.

So, its important to not consolidate federal and private loans together. Consolidate all your federal student loans first, then separately consolidate your private loans. If you were to mix the public and private loans you would have to take out a single private loan that loses all the benefits of the federal loans. Keep government student loan consolidation separate from private loan consolidation.

Also Check: Government Help For Legally Blind

How To Consolidate Federal Loans

Log in to studentloans.gov and click on Complete Consolidation Loan Application and Promissory Note. Youll need to finish the application in one session, so gather the documents listed in the What do I need? section before you start and set aside about 30 minutes to fill it out.

1. Enter which loans you do and do not want to consolidate.

2. Choose a repayment plan. You can either get a repayment timeline based on your loan balance or pick one that ties payments to income. If you pick an income-driven plan, youll fill out an Income-Driven Repayment Plan Request form next.

3. Read the terms before submitting the form online. Continue making student loan payments as usual until your servicer confirms consolidation is complete.

If your loans are in default, consolidation is one of a few methods to get your loans back on track. To consolidate defaulted loans you’ll need to make three full, on-time consecutive monthly payments on the defaulted loan and agree to enroll in an income-driven repayment plan.

If youre considering either federal or private student loan consolidation in order to get a drastically lower loan bill, look further into income-driven repayment instead.

The government offers plans that cut payments to 10% or 15% of discretionary income and offer forgiveness on the remaining balance after 20 or 25 years. You can sign up for free on studentloans.gov.

Federal Direct Consolidation Loan

If you have federal student loans, you have the option to combine all or some of your federal student loans into a federal Direct Loan Consolidation. This option is only available to consolidate federal student loans and not private student loans.

Federal loan consolidation will not lower your interest rate. The fixed interest rate for a Direct Consolidation Loan is the weighted average of the interest rates of the loans being consolidated, rounded up to the nearest one-eighth of a percent. While consolidating your loans may slightly increase your interest rate, it will lock you into a fixed interest rate, so your new payment wont change over time.

If you have federal loans originated under the Federal Family Educational Loan program or the Perkins loan program, you may be able to consolidate those loans into a new Direct Loan to qualify for Public Service Loan Forgiveness .

You can learn more about what type of loan you have through the U.S. Department of Educations Federal Student Aid website. Through this website you can access information about your federal student loans.

Read Also: Semper Fi Auto Repair Las Vegas

What If You Cant Afford Your Monthly Student Loan Payment

Perhaps you were up-to-date on your student loans before the pandemic but your financial situation has changed significantly since the current deferment period started. You may even be facing a student loan payment you can no longer afford and a situation where your loans could be in default in a matter of months.

In that case, you can check into setting up an income driven repayment plan now, if possible, or requesting an extension on forbearance until you believe it will be possible to start making payments, says Simpson. No matter what you do, Simpson says you shouldn’t bury your head in the sand.

Jeff Cimini, Retirement Product Management at Voya Financial, also says individuals can look to their employers for help.

“Many companies today offer support in this area, with some even offering direct payment support for student loan repayment in which employers make direct after-tax contributions to the servicers of their employee’s student loan debt,” says Cimini.

“For those who might be seeking new employment opportunities, or those in the workforce, consider asking your benefits administrator about the options available to you.”

Are Government Debt Consolidation Programs Right For You

Government debt consolidation programs are an excellent option for many people, but not necessarily for everyone. When youre having difficulty making student loan payments, there are many options available to you, and its helpful to talk to a debt consultant who can walk you through different strategies for reducing your debt.

American Consumer Credit Counseling is a nonprofit debt counseling agency providing free credit counseling and low-cost services to consumers nationwide. Our certified and highly trained counselors can explain all the ins and outs of government debt consolidation programs, and help you decide which one is right for you.

Read Also: Government Contractors Charleston Sc

Additional Changes To Pslf Regulations May Be Finalized This Year

While the Biden administration has made many new changes to PSLF through presidential executive action, the Education Department is also in the process of overhauling regulations governing PSLF to more permanently alter the program. Last month, the Department held a negotiated rulemaking session to discuss several proposed changes including automating employment certifications, broadening the definition of a qualifying payment, allowing certain types of deferment and forbearance to count, and expanding the categories of qualifying employment. Rulemaking committee members also discussed making some elements of the Limited PSLF Waiver permanent, such as allowing payments made prior to federal Direct loan consolidation to be counted towards PSLF.

The Departments negotiated rulemaking committee failed to reach a consensus on proposed changes to PSLF during last months session, so it is unclear which changes Department officials will choose to include in new regulations. More information on the final proposed regulations will likely be released later in 2022, with implementation targeted for mid-2023.

The Complete Guide To Federal Direct Student Loan Consolidation

Federal direct consolidation is an essential move for some student loan borrowers and a huge mistake for others.

Federal direct student loan consolidation isnt easy to navigate. Determining whether or not consolidation should be done is a critical step in planning a repayment strategy.

Generally speaking, federal student loan consolidation is most helpful for borrowers trying to address eligibility issues. Some borrowers can use consolidation to qualify for student loan forgiveness or income-driven repayment plans.

Today Ill cover the basics of federal direct consolidation and include a ton of tips on how to get the most out of consolidation.

Also Check: Dental Implant Grants For Seniors

Direct Consolidation Loan Process

Direct consolidation loans are made through the Federal Direct Student Loan Program. The Federal Direct Student Loan Program allows students, as well as parents, to borrow directly from the U.S. Department of Education at participating schools.

Before getting a direct consolidation loan, it is important to consider any benefits associated with the original loans, such as interest rate discounts and rebates. Once the loans are rolled into a new direct consolidated loan, borrowers typically lose those benefits. Additionally, if the new loan increases the repayment period, the borrower may wind up paying more interest.

Federal student loan payments are on hold and interest is waived through Sept. 30, 2021.

The consolidation of federal educational loans is free and the process is fairly simple. Private companies may reach out to borrowers to offer to help with this process for a fee, but they are not affiliated with the Department of Education or its federal loan servicers.

After completing an application, the borrower confirms the loans they are seeking to consolidate, then agrees to repay the new direct consolidation loan. Once this process is complete, the borrower will then have a single monthly payment on the new loan, instead of multiple monthly payments on several loans.

Pros And Cons Of Using Private School Loan Consolidation For Federal Loans

If you have private student loans to repay, private consolidation can be extremely beneficial. You can simplify your bill payment schedule and lower the interest rate on your debt.

The main question is whether you should include federal loans in with a private consolidation plan. Below are some pros and cons of using private student loan consolidation for federal loans. There are more benefits than risks by count, but the downsides carry significant weight. Consider your options carefully!

Also Check: Government Jobs In Sacramento

Government Student Loan Consolidation: Repayment

Loans consolidated through government student loan consolidation must still be repaid. One of the advantages of consolidation, however, is that the repayment period is often extended so students have longer to pay off their loans. That means students will need to make lower monthly payments. Maximum repayment periods for consolidated loans vary from 10 to 30 years depending on how much is owed. The cost of the monthly payments depends on the repayment period, total loan amount, and interest rate.

Students should keep in mind that while a longer repayment period and lower monthly payments can be useful now they will end up paying more in the long run because of the additional accumulated interest.

Complete A Consolidation Loan Application

After gathering the necessary documentation, complete a Direct Consolidation Loan Application and Promissory Note. This free application can be submitted online or in hard copy and includes the following sections:

- Choose Loan & Servicer. The first section of the loan application requires you to select which loans to consolidate and then calculates the new consolidated loan amount and interest rate. This is also where youll request a grace period and choose a loan servicer.

- Choose Repayment. Federal student loan repayment options depend on the types of loans youre consolidating and your financial status. This section of the application calculates your estimated monthly payments under several plans using your income, family size and tax status. Finally, youll be asked to choose a repayment plan before moving on to the next section of the application.

Check out this application demo for step-by-step guidance throughout the application process.

Read Also: Qlink Wireless Upload Proof

Am I Eligible For A Direct Consolidation Loan

Determining your eligibility is step three, and there are four primary requirements for taking out a Direct Consolidation Loan:

- You must have at least one existing loan through the Direct or FFEL programs.

- One of your eligible loans must be in either grace or repayment status.

- If you want to include a defaulted loan, you must make acceptable arrangements to repay it with the company currently servicing the loan. Alternately, you must agree to one of these two repayment plans for your Direct Consolidation Loan: Income-Contingent or Income-Based, about which you can find details here.

- Rules for including an existing consolidation loan in a new consolidation are probably the most complex aspect of consolidation. Some FFEL Consolidation Loans may be reconsolidated on their own, but usually you must include a new Direct or FFEL loan in the group to be consolidated.

What Loans Can Be Included In A Direct Consolidation Loan

Heres a list of eligible loans:

- Direct Subsidized and Unsubsidized Loans

- Direct PLUS Loans

and here are the older types of loans that are also included:

- Stafford Loans, both Subsidized and Unsubsidized

- Federal Family Education Loan Program PLUS Loans

- Supplemental Loans for Students , and

- Health Education Assistance Loans.

Even some existing consolidation loans can be consolidated again. Note: A students consolidation cannot include a PLUS loan taken out by a parent to pay for that students education.

Your second step is to estimate what your monthly payment and total loan cost would be if you consolidated those loans, then compare it to the current amounts. The USDOE has set up an online calculator for this purpose. To confirm the results of your calculation, you can contact the USDOE directly to compare your numbers to the consolidation loan terms the Direct Loan Consolidation Center would offer you.

You May Like: Government Grants For Auto Repair Shops

How Do I Consolidate Federal Student Loans

The actual process of federal direct consolidation is very simple.

The Department of Education will process all of the paperwork electronically. They estimate that filling out the form takes about 30 minutes.

One potential headache that borrowers should avoid would be third-party student loan consolidation services. These companies, perhaps more accurately described as scams, advertise a special relationship with the Department of Education. They claim to help borrowers qualify for Income-Driven Repayment Plans and Student Loan Forgiveness. In reality, they function as a middle-man who gets paid and adds no value to the service. In many cases, they end up making errors and making the process even more difficult than necessary.

These companies have gotten so bad that at the top of the Department of Educations Student Loan Consolidation information page, it displays the following:

As long as borrowers stick with the official Department of Education Student Loan Consolidation page and are careful only to consolidate when necessary, the process is relatively simple.

When Should Federal Student Loans Be Consolidated

The classic example of a smart use of federal direct consolidation is Federal Family Education Loan Program loans. Up until 2010, FFELP loans were from private lenders, but the federal government guaranteed them. These loans functioned mostly like federal student loans, but they had a few limitations.

Most notably, FFELP loans are not eligible for Public Service Loan Forgiveness. However, going through federal student loan consolidation transforms FFELP loans into a federally held student loan. As federally held loans, the new loans are eligible for student loan forgiveness.

Borrower Alert: The Department of Education issued a temporary waiver to allow borrowers to count FFEL payments made before consolidation towards PSLF.Some borrowers may even qualify for a large refund if they made over ten years worth of PSLF eligible payments.The deadline to qualify is October 31, 2022.

Another example of a potentially smart use of consolidation is to consolidate Parent PLUS loans. One of the significant issues with Parent PLUS loans is that they are not eligible for an income-driven repayment plan. Likewise, they do not qualify for Public Service Loan Forgiveness. However, by consolidating into a federal direct loan, the Parent PLUS loan can become eligible for the Income-Contingent Repayment Plan and Student Loan Forgiveness.

However, this transformation is not always a smart idea.

You May Like: City Jobs Las Vegas Nevada