Understanding Treasury Yield And Interest Rates

Most investors care about future interest rates, but none more than bondholders. If you are considering a bond or bond fund investment, you must ask yourself whether you think treasury yield and interest rates will rise in the future. If the answer is yes, you probably want to avoid long-term maturity bonds or at least shorten the average duration of your bond holdings, or plan to weather the ensuing price decline by holding your bonds and collecting the par value when they mature.

Understanding Treasury Yield

Changes In Real Yields

The increase in inflation to 5.0% in May from 4.2% in April has pushed the real yield on 10-year Treasury bonds even lower, to negative 3.5%. The goal of the monetary policy is to facilitate investments by pressuring interest rates lower. A negative real-yield curve and expectations for a growing economy and normal levels of inflation will allow those investments to be paid back in inflation-depreciated dollars.

Changing Yields Over Time

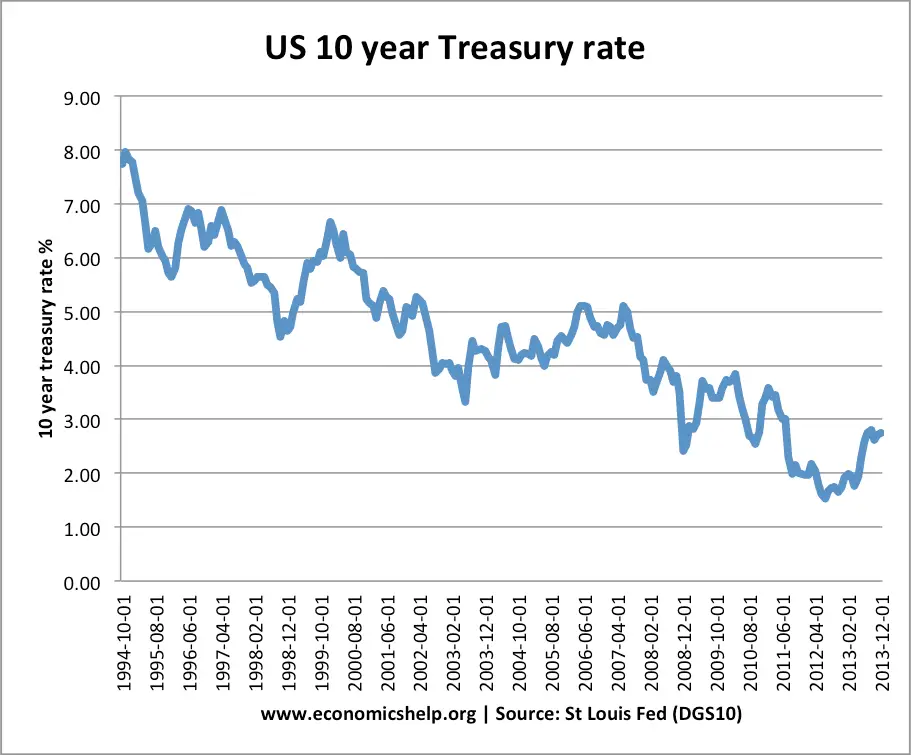

Because 10-year Treasury yields are so closely scrutinized, knowledge of its historical patterns is integral to understanding how today’s yields fare as compared to historical rates. Below is a chart of the yields going back a decade.

While rates do not have a wide dispersion, any change is considered highly significant. Large changes of 100 basis points over time can redefine the economic landscape.

Perhaps the most relevant aspect is in comparing current rates with historical rates, or following the trend to analyze whether near-term rates will rise or fall based on historical patterns. Using the U.S. Treasury website, investors can easily analyze historical 10-year Treasury bond yields.

Recommended Reading: Does The Government Give Free Cell Phones

Types Of Treasury Debt

The U.S. Department of the Treasury issues four types of debt to finance government spending: Treasury bonds, Treasury bills, Treasury notes, and Treasury Inflation-Protected Securities . Each varies by maturity and coupon payments.

Another factor related to the yield is the time to maturity. The longer the Treasury bond’s time to maturity, the higher the rates because investors demand to get paid more the longer their money is tied up. Typically, short-term debt pays lower yields than long-term debt, which is called a normal yield curve. But at times the yield curve can be inverted, with shorter maturities paying higher yields.

What Is A 10

A 10-year Treasury is a bond that guarantees interest plus repayment of the borrowed money in a decade. The 10-year Treasury is just one of a handful of securities issued by the U.S. government. Others include:

Treasury bills, also known as T-bills, are short-term securities, with maturities that range from a few days to 52 weeks. Treasury bills are sold at a discount to their face value, meaning they provide investors with returns by paying them back at the full, not discounted, rate.

Treasury notes, also known as T-notes, are issued with maturities of two, three, five, seven and 10 years. They pay interest every six months and return their face value at maturity.

Treasury bonds, also known as T-bonds, are the longest-term government securities, issued for 20 and 30 years. They pay interest every six months and return their face value at maturity.

Read Also: How Do I Get Free Government Internet

Foreign Us Treasury Holdings Rose In August But At Slower Pace

Foreign holdings of U.S. Treasuries rose for a fifth straight month in August and hit a record high, but the pace of increase slowed, data from the Treasury Department showed on Monday. Gennadiy Goldberg, rates strategist for TD Securities, said the slower rate of increase likely reflected foreign buyers taking stock of less-volatile trading for U.S. debt during August.

Smart Annual Subscribe Now And Get 12 Months Free

Note: Subscription will be auto renewed, you may cancel any time in the future without any questions asked.

- Unlimited access to all content on any device through browser or app.

- Exclusive content, features, opinions and comment – hand-picked by our editors, just for you.

- Pick 5 of your favourite companies. Get a daily email with all the news updates on them.

- Track the industry of your choice with a daily newsletter specific to that industry.

- Stay on top of your investments. Track stock prices in your portfolio.

Don’t Miss: Federal Government Day Care Centers

Why It’s The Most Important

Kimberly Amadeo is an expert on U.S. and world economies and investing, with over 20 years of experience in economic analysis and business strategy. She is the President of the economic website World Money Watch. As a writer for The Balance, Kimberly provides insight on the state of the present-day economy, as well as past events that have had a lasting impact.

The 10-year Treasury note is a loan you make to the U.S. federal government. It’s the only one that matures in a decade. The note is a type of bond, which is the most popular debt instrument in the world. It’s backed by the U.S. “Full Faith and Credit Clause.” Compared to sovereign debt from other countries, there is little risk that the U.S. would default on these obligations.

Citigroup Ceo On Inflation: ‘we’re Probably In For A Bit Of A Brutal Winter’

In a new interview with Yahoo Finance Editor-in-Chief Andy Serwer, Citigroup CEO Jane Fraser weighed in on supply chain disruptions and inflation. She predicts the “extraordinary disclocation” caused by COVID-19 will pass by 2022 but not before we have a “brutal winter.”

Wall Street is looking to extend its October winning streak, with the Dow poised for a fresh record high, against a busy slate of Big Tech earnings later this week.

The bulls have room to run in the U.S. stock market, according to Phil Camporeale, a portfolio manager for the global allocation strategy at JPMorgan Chase & Co.s asset management unit.

Wall Street retreated from fresh record highs Friday as Fed Chair Jerome Powell said the central bank is “on track” to being tapering the pace of its monthly bond purchases.

Leo Grohowski, BNY Mellon Wealth Management CIO, joins Yahoo Finance Live to discuss the outlook on earnings season, the bond market, and inflation.

Wall Street’s earnings-fueled October rally looks set to hit pause Thursday, following an intra-day record for the Dow, as inflation signals continue to flash red.

Also Check: Environmental Social And Corporate Governance Esg

Not Found What You’re Looking For

You can search over a thousand datasets on datahub

Use our data-cli tool designed for data wranglers:

data get https://datahub.io/core/bond-yields-us-10ydata info core/bond-yields-us-10ytree core/bond-yields-us-10y

# Get a list of dataset's resourcescurl -L -s https://datahub.io/core/bond-yields-us-10y/datapackage.json | grep path# Get resourcescurl -L https://datahub.io/core/bond-yields-us-10y/r/0.csvcurl -L https://datahub.io/core/bond-yields-us-10y/r/1.zip

If you are using R here’s how to get the data you want quickly loaded:

install.packageslibraryjson_file < - 'https://datahub.io/core/bond-yields-us-10y/datapackage.json'json_data < - fromJSON, collapse=""))# get list of all resources:print# print all tabular datafor)}

Note: You might need to run the script with root permissions if you are running on Linux machine

Install the Frictionless Data data package library and the pandas itself:

pip install datapackagepip install pandas

Now you can use the datapackage in the Pandas:

import datapackageimport pandas as pddata_url = 'https://datahub.io/core/bond-yields-us-10y/datapackage.json'# to load Data Package into storagepackage = datapackage.Package# to load only tabular dataresources = package.resourcesfor resource in resources:if resource.tabular: data = pd.read_csvprint

For Python, first install the `datapackage` library :

pip install datapackage

To get Data Package into your Python environment, run following code:

Install data.jsmodule using npm:

Etf Transactions By Us Insurers In Q1 2021

No index-linked product details are currently available.

No index-linked product details are currently available.

This list includes investable products traded on certain exchanges currently linked to this selection of indices. While we have tried to include all such products, we do not guarantee the completeness or accuracy of such lists. Please refer to the disclaimers here for more information about S& P Dow Jones Indices’ relationship to such third party product offerings.

Don’t Miss: Government Jobs Bergen County Nj

Growth Concerns Inflation Risks And Interest Rates

Confidence in the recovery has nearly eliminated the perceived risk of economic collapse and deflation. At the same time, guidance from the Federal Reserve consistently calls for low-for-long money market rates.

If all goes to plan, the result will be an economy that can support higher long-term interest rates, while monetary policy pressures short-term bond yields lower. That would create a steep yield curve out to 10 years that would be conducive for bond trading as an alternative to riskier investments in other asset classes.

But there are never straight lines in asset pricing. A recent adjustment in the term premium priced into 10-year Treasury yields, and the decline in expectations for short-term rates over the next 10 years, both reflect a rethinking of the recoverys trajectory.

Prices are increasing, which should be a welcome sign of increased demand and normal economic activity. Inflation expectations have been stable both during the pandemic and as the recovery has taken hold. That reflects both confidence that the monetary authorities will know how to handle inflation pressures should they arise, and the uncertainty regarding the fiscal response to the recession and the speed of the recovery.

MIDDLE MARKET INSIGHT

We anticipate the inflation rate moving higher than 5% this summer until 2020 base-year effects, or the comparisons to the low levels of a year ago, are no longer a factor.

Impact Of Changes In Demand For T

The demand for 10-year Treasury Notes directly affects the interest rates of other debt instruments. As the yield on 10-year T-notes rises during periods of low demand, there will be an increase in interest rates on longer-term debt. Long-term debt that is not backed by the US Treasury must pay a higher rate of interest to compensate investors for the higher risk of default.

You May Like: Government Grants For Wheelchair Vans

The Treasury Yield Curve

In the United States, the Treasury yield curve is the first mover of all domestic interest rates and an influential factor in setting global rates. Interest rates on all other domestic bond categories rise and fall with Treasuries, which are the debt securities issued by the U.S. government. To attract investors, any bond or debt security that contains greater risk than that of a similar Treasury bond must offer a higher yield. For example, the 30-year mortgage rate historically runs 1% to 2% above the yield on 30-year Treasury bonds.

Below is a graph of the actual Treasury yield curve as of January 21, 2021. It is considered normal in shape because it slopes upward with a concave slope, as the borrowing period, or bond maturity, extends into the future:

Consider three elements of this curve. First, it shows nominal interest rates. Inflation will erode the value of future coupon dollars and principalrepayments the real interest rate is the return after deducting inflation. The curve, therefore, combines anticipated inflation and real interest rates.

Second, the Federal Reserve directly manipulates only the short-term interest rate at the very start of the curve. The Fed has three policy tools, but its biggest hammer is the federal funds rate, which is only a one-day, overnight rate. Third, the rest of the curve is determined by supply and demand in an auction process.

Current Benchmark Bond Yields

Selected benchmark bond yields are based on mid-market closing yields of selected Government of Canada bond issues that mature approximately in the indicated terms. The bond issues used are not necessarily the ones with the remaining time to maturity that is the closest to the indicated term and may differ from other sources. The selected 2-, 5-, 10-, or 30-year issues are generally changed when a building benchmark bond is adopted by financial markets as a benchmark, typically after the last auction for that bond. The selected 3-year issue is usually updated at approximately the same time as changes are made to the 2-year, and sometimes with the 5-year. The selected 7-year issue is typically updated at approximately the same time as the 5- or 10-year benchmarks are changed. The current benchmark bond issues and their effective dates, shown in brackets, are as follows.

- 2 year – 2023.11.01, 0.50%

- 3 year – 2024.04.01, 0.25%

- 5 year – 2026.09.01, 1.00%

- 7 year – 2028.06.01, 2.00%

- 10 year – 2031.06.01, 1.50%

- Long – 2051.12.01, 2.00%

Read Also: Government Grants For Elderly Care

Long Rates Tend To Follow Short Rates

Technically, the Treasury yield curve can change in various ways: It can move up or down , become flatter or steeper , or become more or less humped in the middle .

The following chart compares the 10-year Treasury note yield to the two-year Treasury note yield from 1977 to 2016. The spread between the two rates, the 10-year minus the two-year, is a simple measure of steepness:

We can make two observations here. First, the two rates move up and down somewhat together . Therefore, parallel shifts are common. Second, although long rates directionally follow short rates, they tend to lag in magnitude.

More specifically, when short rates rise, the spread between 10-year and two-year yields tends to narrow and when short rates fall, the spread widens . In particular, the increase in rates from 1977 to 1981 was accompanied by a flattening and inversion of the curve the drop in rates from 1990 to 1993 created a steeper curve in the spread, and the marked drop in rates from 2000 to the end of 2003 produced an equally steep curve by historical standards.

What Is The 10

The 10-year Treasury yield is the current rate Treasury notes would pay investors if they bought them today.

Changes in the 10-year Treasury yield tell us a great deal about the economic landscape and global market sentiment, professional investors analyze patterns in 10-year Treasury yields and make predictions about how yields will move over time. Declines in the 10-year Treasury yield generally indicate caution about global economic conditions while gains signal global economic confidence.

At the end of April 2021, the 10-year Treasury note was yielding around 1.65%but back in April 2000, the 10-year yield was 6.23%. Thats a pretty significant decline, and If you look at the chart below, youll see that 10-year Treasury yields have fallen dramatically since 1990.

Lets take a closer look at the 10-year Treasury yield in 2016. On July 5, 2016, the 10-year Treasury yield had fallen to a record low of 1.37% shortly after the conclusion of a referendum in which the citizens of the United Kingdom voted to leave the European Union. This political earthquake rattled markets around the world, which is why the 10-year yield declined.

Meanwhile, when Donald Trump was elected president of the United States in November 2016, the 10-year yield gained considerably, reaching 2.60% by mid December.

You May Like: Government Contractors In Hampton Roads

Why Is The 10

The importance of the 10-year Treasury bond yield goes beyond just understanding the return on investment for the security. The 10-year is used as a proxy for many other important financial matters, such as mortgage rates.

This bond also tends to signal investor confidence. The U.S Treasury sells bonds via auction and yields are set through a bidding process. When confidence is high, prices for the 10-year drop and yields rise. This is because investors feel they can find higher-returning investments elsewhere and do not feel they need to play it safe.

But when confidence is low, bond prices rise and yields fall, as there is more demand for this safe investment. This confidence factor is also felt outside of the U.S. The geopolitical situations of other countries can affect U.S. government bond prices, as the U.S. is seen as safe haven for capital. This can push up prices of U.S. government bonds as demand increases, thus lowering yields.

Us Treasury Yields Slide Again 10

2 min read.

A breakneck rally in US government bonds continued on Thursday, with 10-year Treasury yields falling to their lowest levels since early-2021 as investors sensed cracks in the economic recovery and cooling risks of high inflation

NEW YORK :A breakneck rally in US government bonds continued on Thursday, with 10-year Treasury yields falling to their lowest levels since early-2021 as investors sensed cracks in the economic recovery and cooling risks of high inflation.

Yields were down as much as 7 basis points across the curve, and the 10-year note hit 1.25% before bouncing back above 1.29%, as prices surged yet again, in a sign that investors positioned for higher borrowing costs were reversing course, said Subadra Rajappa, head of US rates strategy, Societe Generale, New York.

Why you must review your mutual fund investment portfolio

In Q1, the market thought the Fed Funds rate would get back to where it was in the previous cycle at 2.38%. The question is why has the market’s expectation of the terminal rate come down so significantly? The primary reason is that the economy looks great. However, it’s the peak and growth is going to be weaker going forward. That ties into the transitory nature of things.

“It’s expected to lead to economic disruptions, lockdowns and so on.” Paul Hickey, Bespoke Investment Group replied in an email.

Read Also: Small Business Requirements For Government Contracts

Stock Picks And Investing Trends From Cnbc Pro:

Arnab Das, global market strategist at Invesco, told CNBC’s “Squawk Box Europe” on Monday that he believed the Fed would go ahead with tapering its asset purchases, though he said that weaker sets of data like the latest jobs report would sow some doubt as to how fast it would do so.

“I think the challenge here for the Fed, and others, is to normalize what has not been a normal economic cycle because of the pandemic and the lockdowns,” Das said.

There are no major economic data releases scheduled for Monday. On international markets, yields on both German and U.K. sovereign bonds were slightly higher on Monday morning.

Instead, investor attention this week will be focused on August’s Job Openings and Labor Turnover Survey, due out on Tuesday. Core inflation data for September and minutes from the Fed’s latest meeting are then set to come out on Wednesday.

Correction: This story has been updated to add that markets were closed Monday due to the Columbus Day holiday.